Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth has dropped a fraction of a % within the final 24 hours to commerce at $121,310 as of three.45 a.m. EST.

This comes as Twitter co-founder Jack Dorsey’s Sq. introduced the launch of a Bitcoin pockets for retailers in a transfer designed to take Bitcoin funds mainstream and problem bank cards.

JUST IN: Jack Dorsey’s Sq. launched a #Bitcoin pockets answer to allow native companies to simply accept BTC funds with zero charges.

Bullish 🚀 pic.twitter.com/giHUcQTLLr

— Bitcoin Journal (@BitcoinMagazine) October 8, 2025

The pockets, a part of Dorsey’s greater imaginative and prescient for Bitcoin, permits retailers to routinely convert as much as 50% of their each day gross sales into Bitcoin, beginning November 10. For the primary time, small companies can settle for Bitcoin funds and keep away from conventional card community charges, with zero transaction expenses till 2027.

Connecting the ecosystem with @Sq. has been the dream since we launched bitcoin in @CashApp in 2018

Beginning in the present day, all retailers can now seamlessly stack bitcoin behind the scenes from their each day gross sales

Bitcoin Funds Acceptance might be reside for everybody on November 10 pic.twitter.com/mTqbu8wfGG

— Miles 🌞 (@milessuter) October 8, 2025

After that, a 1% price will apply, which continues to be a lot decrease than typical card charges. Dorsey believes the service will assist retailers hedge in opposition to inflation and financial uncertainty, saying, “It should possible enhance in worth. It’s definitely a hedge in opposition to all the things that we’re seeing within the financial system.”

On the identical time, Dorsey is campaigning for US lawmakers to exempt small Bitcoin funds from taxes, a transfer that might enhance on a regular basis crypto adoption and add momentum to Bitcoin’s use as cash.

JUST IN: 🇺🇸 Senator Cynthia Lummis tells Jack Dorsey we have now a invoice prepared for de minimis tax exemptions on Bitcoin

Tax-free Bitcoin funds quickly 😎 pic.twitter.com/VSvULFqAEe

— Bitcoin Archive (@BTC_Archive) October 9, 2025

Bitcoin Worth Outlook: On-Chain Traits and Tax

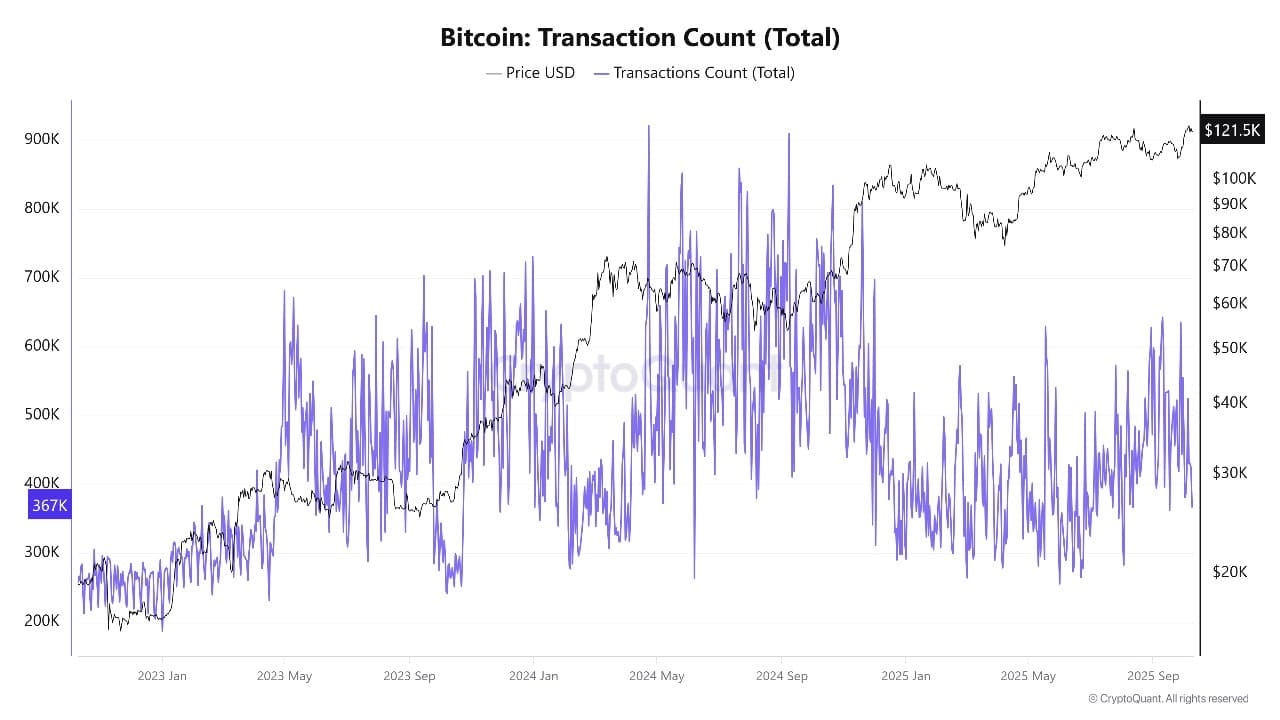

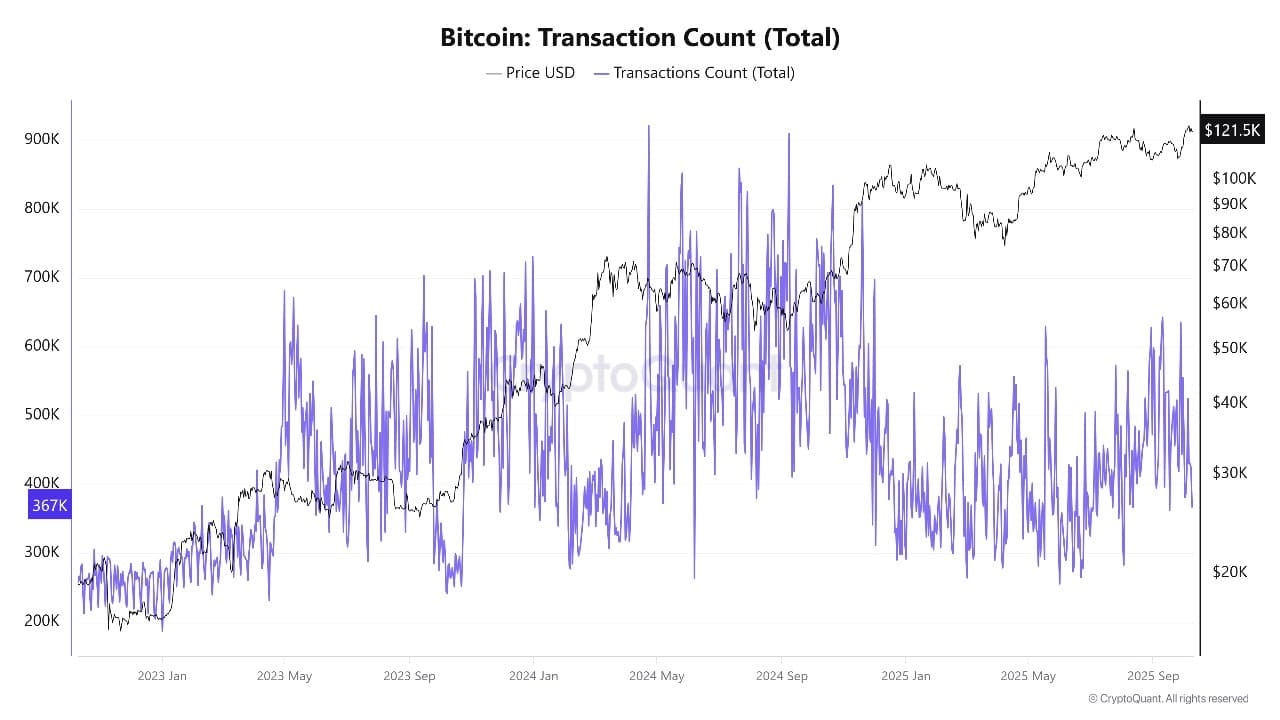

Dorsey’s Bitcoin pockets service might enhance demand amongst retailers, as extra companies begin changing each day earnings into Bitcoin. This pattern is already being watched intently on the blockchain. Analysts say the variety of Bitcoin addresses and transaction counts reveals extra actual exercise, with long-term holders rising their positions.

Bitcoin Transaction Rely Supply: CryptoQuant

However there’s one other issue at play: tax guidelines. The U. Treasury lately introduced new interim steerage which will exempt some paper income on digital property from the 15% company minimal tax.

That is excellent news for corporations holding massive quantities of Bitcoin, however for bizarre customers, the principle problem is avoiding tax points from small, on a regular basis crypto purchases.

Dorsey’s push for a de minimis exemption has gained assist from politicians and the crypto neighborhood. If handed, this might take away a giant hurdle for spending Bitcoin at shops and should draw much more customers into utilizing crypto for funds.

Elevated retail and on-chain exercise typically alerts wholesome demand, however profit-taking might sluggish momentum within the quick run.

Bitcoin Worth Evaluation: Key Help and Resistance Ranges

Trying on the BTCUSD 4-hour worth chart, Bitcoin is holding above the important thing assist at $119,320, slightly below the present worth of $121,273. This assist zone sits close to current lows and is watched intently by merchants.

BTCUSD Evaluation Supply: Tradingview

If Bitcoin falls beneath this space, the subsequent main helps are at $117,040 and $115,251, as proven by Fibonacci retracement ranges and prior consolidation on the chart.

The 50-period Easy Shifting Common (SMA) is at $122,298, whereas the 200-period SMA is at $115,936. Bitcoin is buying and selling near its short-term shifting common, suggesting indecision. The 200-period SMA, situated properly beneath the value, acts as a longer-term cushion in opposition to additional declines.

On the upside, preliminary resistance is seen at $125,903, with a significant excessive at $126,272.

Technical indicators present Bitcoin is cooling off after its current surge. The Relative Power Index (RSI) is at 45.49, that means the coin is neither overbought nor oversold, which might sign room for extra consolidation earlier than the subsequent massive transfer.

The MACD indicator is barely unfavorable, indicating slowing momentum and a attainable threat of additional short-term dips.

Bitcoin Worth Holds Above 119k Help

If Bitcoin stays above the $119,320 assist and patrons step in after current information, the value might rebound towards $122,220 and better resistance close to $126,000 within the subsequent few weeks. Nevertheless, if sellers push beneath $119,000, Bitcoin might retest deeper helps round $117,000 and $115,000 earlier than bulls return.

If Block’s new pockets beneficial properties traction with retailers and lawmakers assist simpler tax guidelines for crypto, the coin worth might stabilise and get better quickly.

Merchants might be watching key worth ranges, the tempo of service provider adoption, and new alerts from Washington. All might affect whether or not the subsequent transfer is up or down for Bitcoin in October.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection