Get the perfect data-driven crypto insights and evaluation each week:

By: Tanay Ved & Matías Andrade Cabieses

-

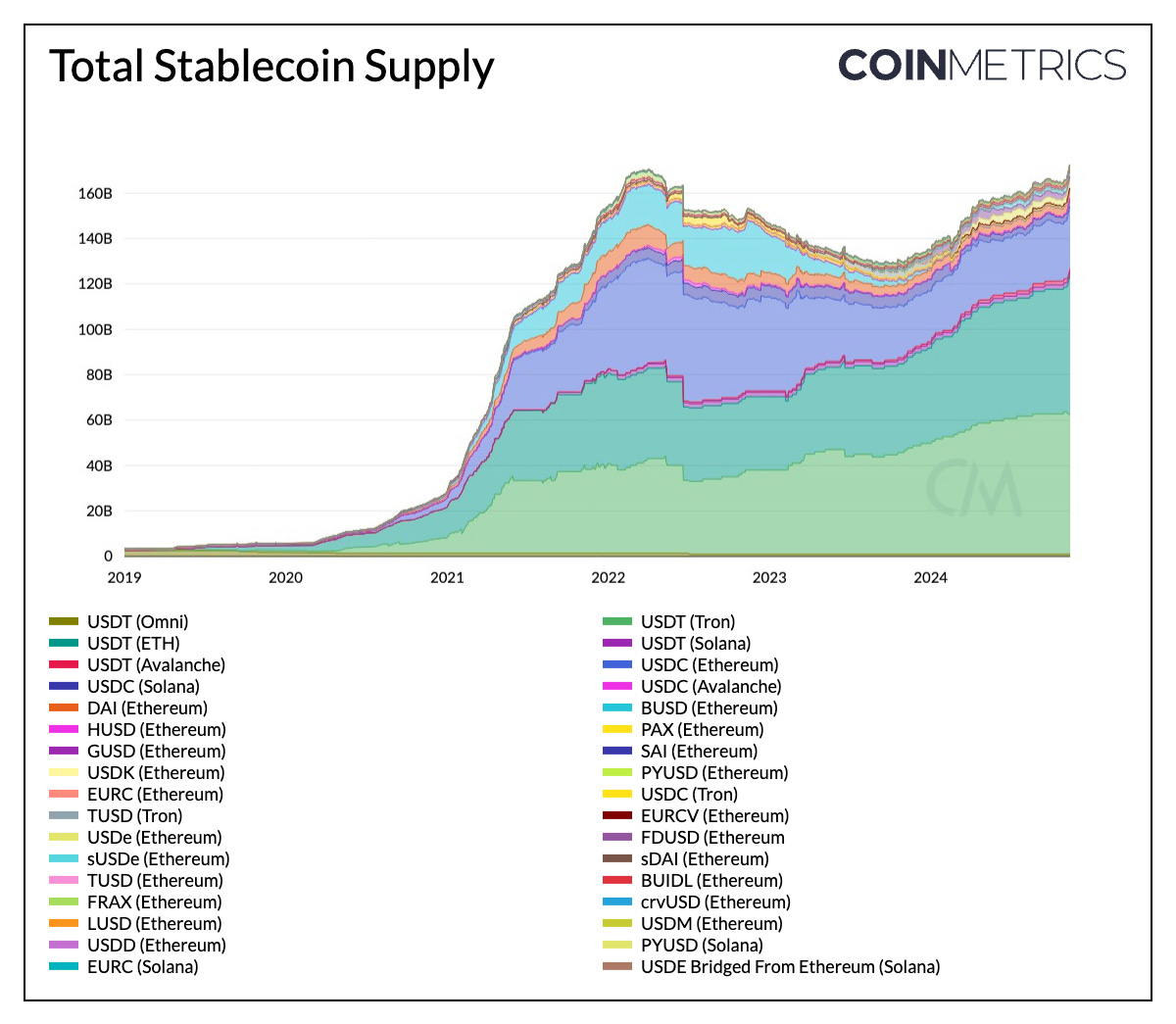

The combination provide of stablecoins issued has expanded to $189B, with Tether’s USDT represents $125B (66% of whole provide), whereas stablecoins issued on Ethereum account for $104B, or (55% of whole provide).

-

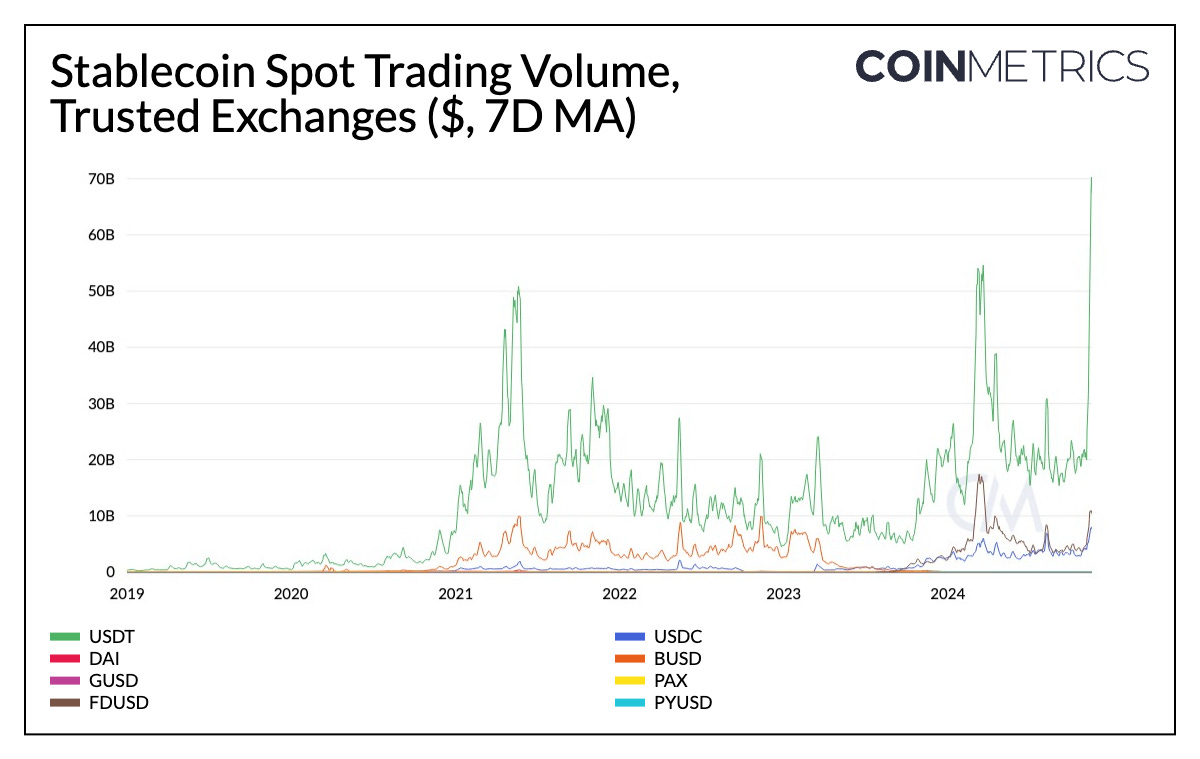

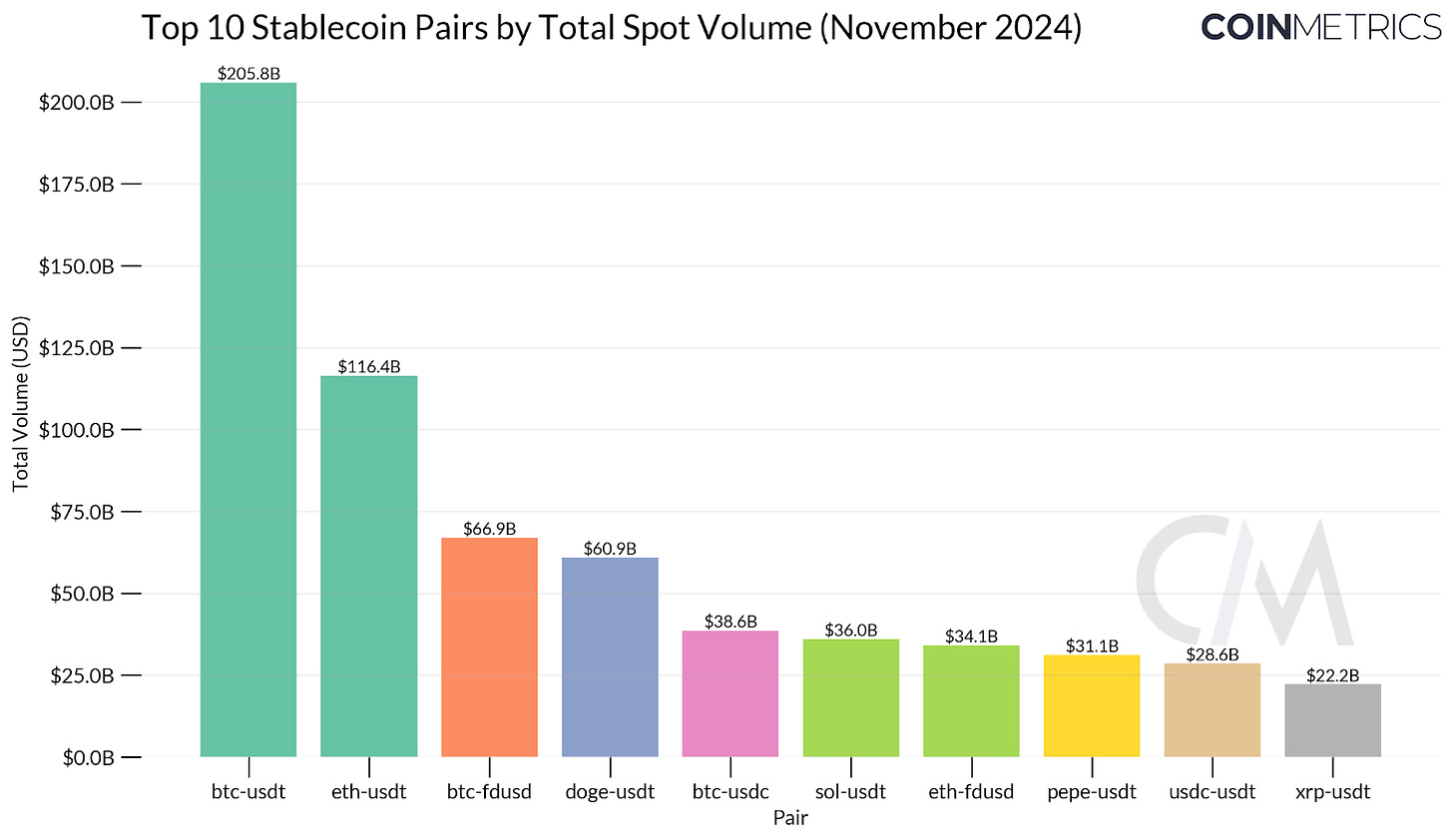

Past serving as a retailer of worth, stablecoins are essential as a medium of trade in bull-markets. Stablecoin denominated buying and selling volumes throughout main exchanges surged to $120B post-election, with prime buying and selling pairs together with BTC, ETH, SOL & memecoins.

-

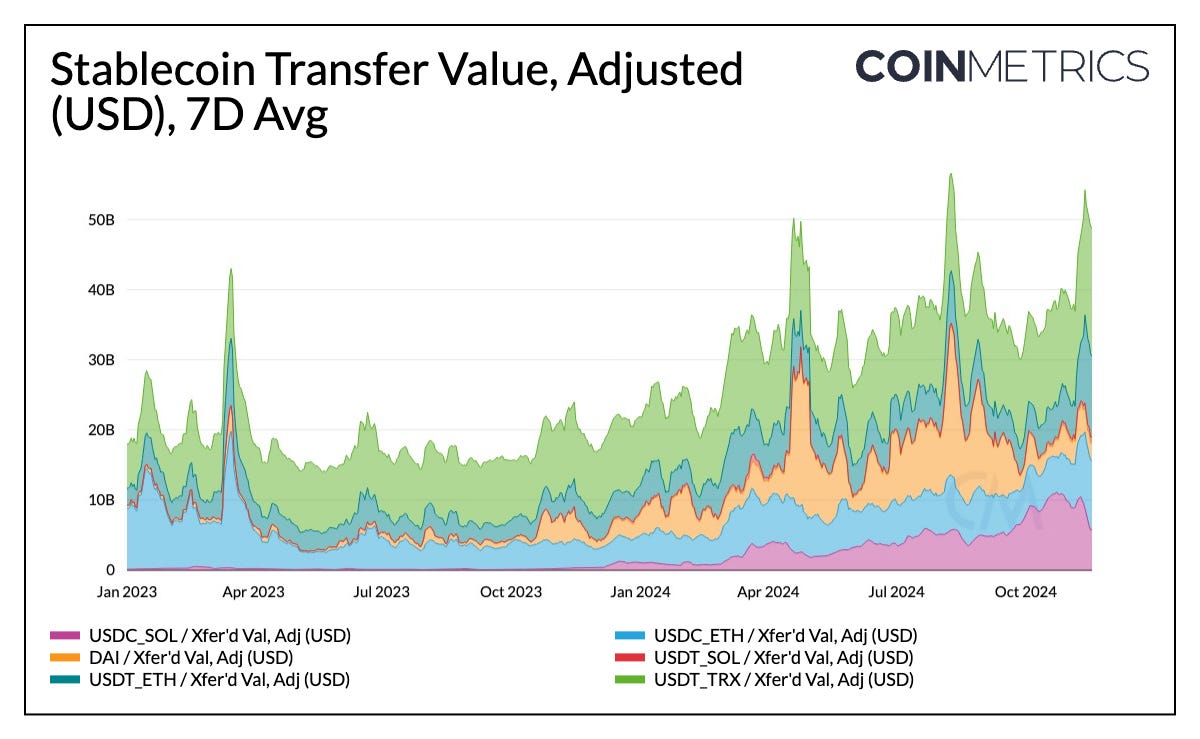

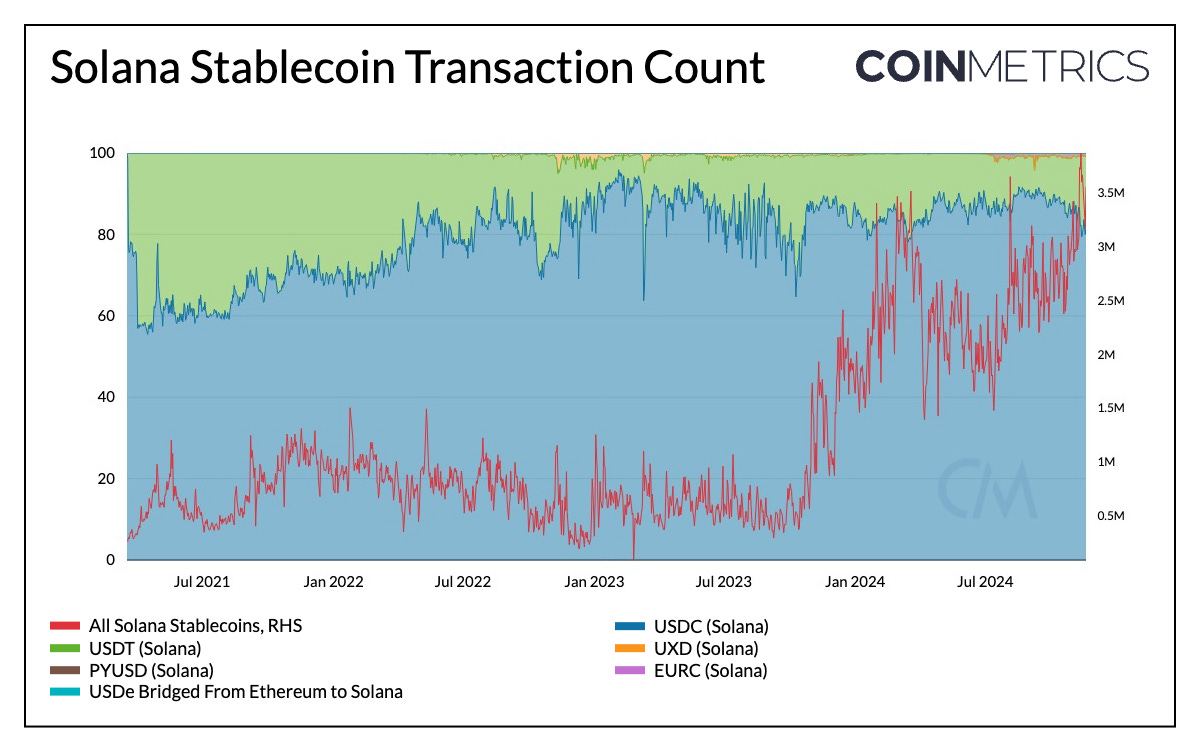

On-chain exercise trended larger as adjusted stablecoin switch volumes (USD) crossed $50B in November. Solana stablecoins hit an all-time excessive in stablecoin transactions, pushed by USDC utilization.

-

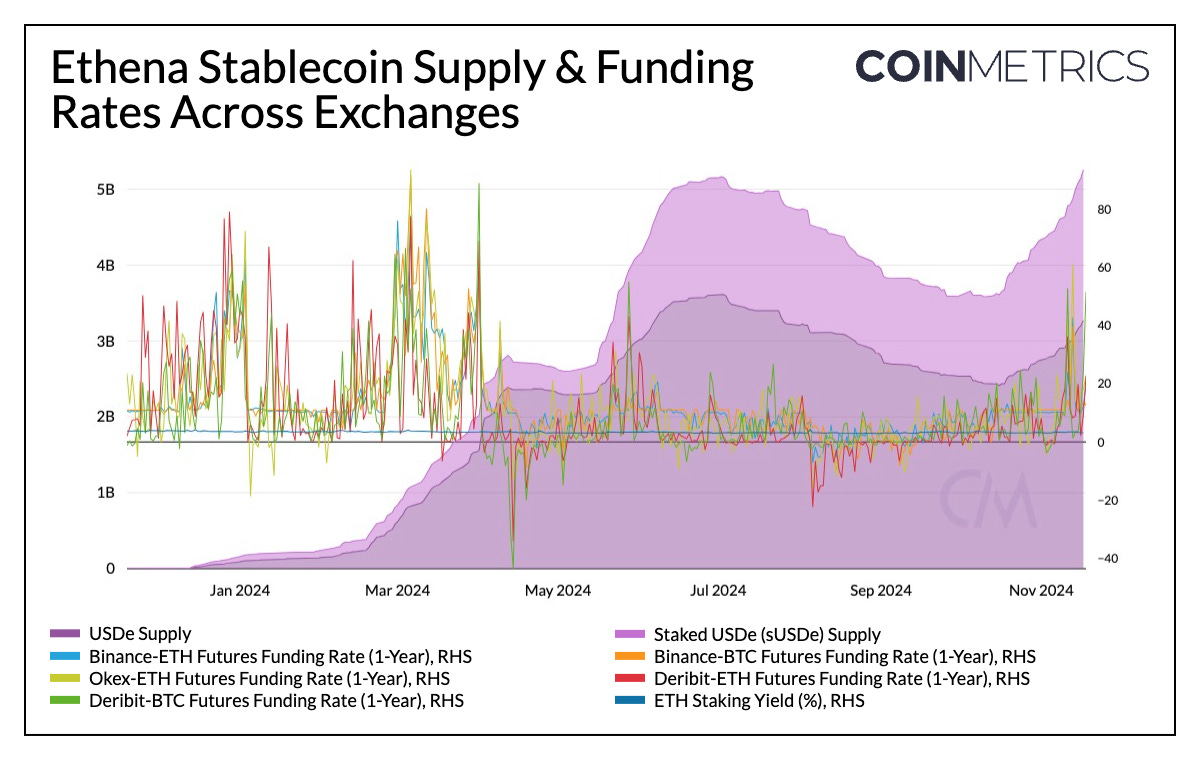

Ethena’s USDe and staked USDe (sUSDe) noticed speedy development since Q3, fueled by bullish market circumstances and rising funding charges, showcasing the evolving yield-driven dynamics of stablecoins.

Because the crypto market enters a bullish part, stablecoins have resumed their ascent, with over $189B in stablecoins issued. This inflow suggests an surroundings with rising liquidity, as customers place themselves to capitalize on appreciating costs and rising alternatives within the on-chain ecosystem. Mergers and acquisitions within the crypto house have heated up, additional boosting the sector’s momentum with Stripe’s acquisition of Bridge—a stablecoin funds platform—for $1.1B in October, and Coinbase’s acquisition of Utopia Labs. Stablecoins proceed to be a central theme throughout the monetary panorama, promising to be the spine of FinTech, funds and the worldwide monetary system.

On this week’s situation of Coin Metrics’ State of the Community, we take a data-driven dive into the stablecoin sector, exploring its pivotal position as a medium of trade in bull markets and analyze on-chain adoption throughout key metrics.

The stablecoin panorama continues to develop in depth and breadth. Following the exceptional profitability of incumbents like Tether, there was no scarcity of conventional monetary and crypto-native issuers, leading to a relentless inflow of stablecoins getting into the market. On the similar time, stablecoins are establishing a wider footprint cross-chain, particularly as various Layer–1 and Layer–2 ecosystems mature. In consequence, Coin Metrics’ stablecoin protection has expanded to over 35 stablecoins and counting.

Supply: Coin Metrics Community Knowledge Professional

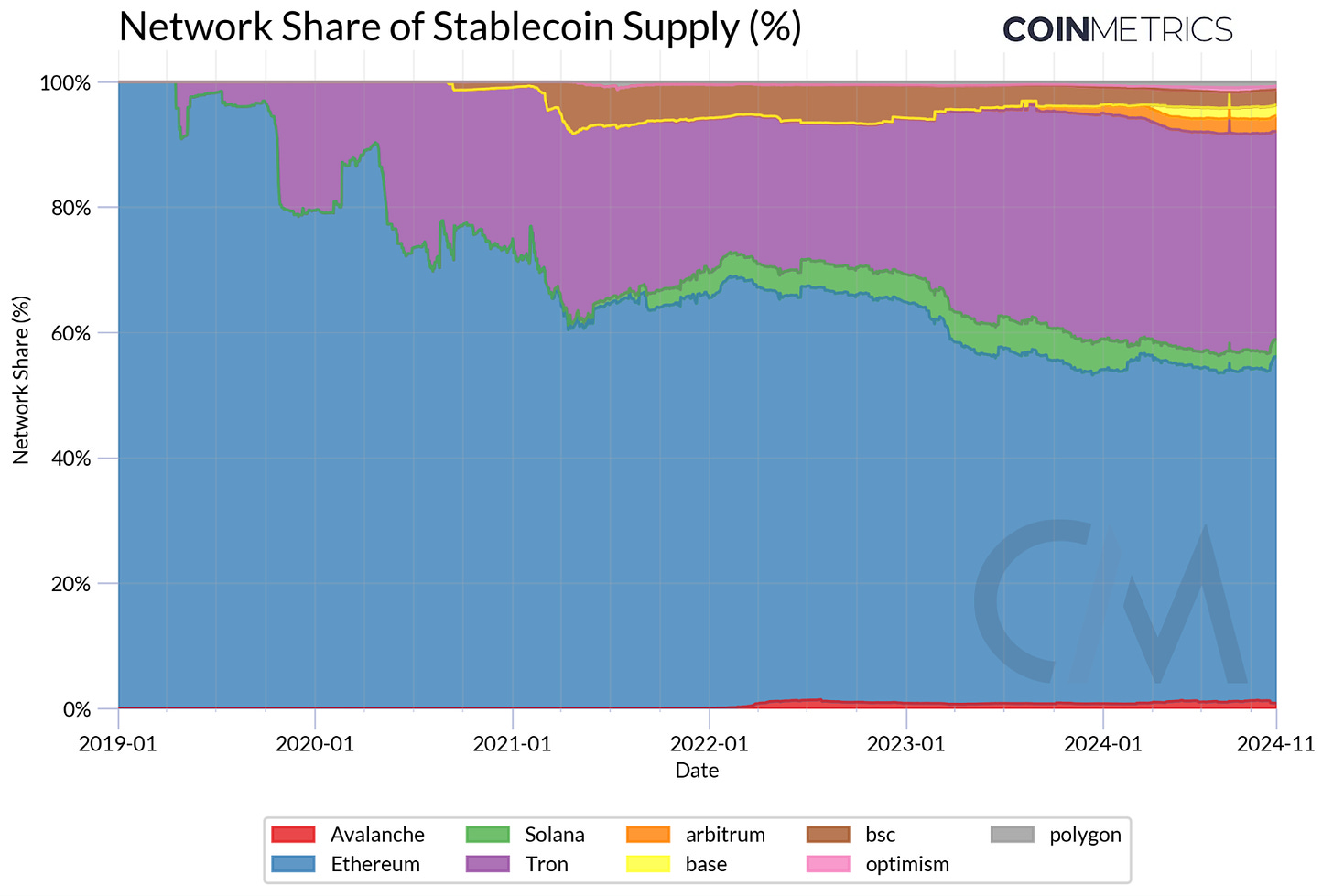

With a complete provide of $125B, Tether’s USDT continues to take care of the lion’s share of stablecoins issued with a 66% market share. Circle’s USDC is second to observe, with $36B in whole provide and a 19% market share. When it comes to networks, Ethereum is the biggest blockchain by stablecoins issued, dwelling to $104B (55%) of whole stablecoin provide. Tron continues to take care of a considerable 33% in community share of stablecoin provide, pushed primarily by USDT. Solana and Ethereum Layer-2 networks (Arbitrum, Base, Optimism) collectively characterize ~7.5% of the entire stablecoin provide, reflecting their rising however nonetheless rising stablecoin ecosystem.

Supply: Coin Metrics Community Knowledge Professional & Coin Metrics Labs

As considered one of its earliest use-cases, stablecoins have provably garnered utility of their position as a medium of trade, each in bull and bear markets. In an upwards trending market, stablecoins are a bridge by way of which customers can achieve publicity to different tokens within the ecosystem, serving as a supply of liquidity important to facilitate on-chain and buying and selling exercise. In market downtrends or during times of volatility, in addition they function a retailer of worth or technique of financial savings, enabling customers to retailer wealth or earn yield from on-chain and off-chain sources. This makes stablecoins important below varied market circumstances, geographies and time-zones.

Supply: Coin Metrics Market Knowledge Feed

With the crypto market’s rise post-election, stablecoin denominated buying and selling volumes throughout exchanges crossed $120B as buying and selling exercise ramped up. Of this whole, Tether’s USDT accounted for ~80% or $95B in spot volumes recorded on November 12th. First Digital USD (FDUSD) additionally gained vital traction, spiking to $16 billion in day by day spot volumes (~17% of the entire), whereas Circle’s USDC reached $11 billion, marking its highest weekly common spot quantity so far.

Supply: Coin Metrics Market Knowledge Feed

We will additional drill down into particular stablecoins and crypto-assets that drove exercise in November. Giant-cap belongings like BTC, ETH, and SOL, alongside memecoins like DOGE and PEPE, function prominently among the many prime 10 pairs by buying and selling quantity throughout exchanges. Whereas the dominance of majors is unsurprising, the affect of memecoins suggests heightened retail participation as BTC establishes new value highs. Consequently, the “Specialised Cash” sector in datonomy™, which consists of meme cash, privateness cash, and remittance cash, emerged because the top-performing sector, delivering 63% returns over the previous 30 days.

Whereas stablecoins play an influential position as a medium of trade and supply of liquidity on exchanges, they’re additionally elementary to non-trading use circumstances, equivalent to facilitating transactions and settling financial worth on-chain. Stablecoins function a perfect instrument for client and B2B funds, remittances, saving wealth, or to hunt financial stability and entry to monetary infrastructure, particularly in rising markets.

With the assistance of some on-chain metrics, we are able to higher perceive how stablecoin pushed financial exercise has advanced over time, and the extent to which they affect utilization on totally different public blockchains.

Supply: Coin Metrics Community Knowledge Professional

The weekly adjusted switch quantity involving transfers of native models between distinct stablecoin addresses exceeded $50B in November. Of this, $18.2 billion (38%) originated from USDT on Tron, and $12.3 billion (23%) from USDT on Ethereum, each setting document highs for transaction quantity. USDC on Ethereum and Solana additionally demonstrated larger traction, with a rising pattern in switch volumes.

Supply: Coin Metrics Community Knowledge Professional

Notably, stablecoin transactions on Solana hit an all-time excessive of three.86M in November. USDC continues to be the stablecoin of selection on Solana, representing 83% of all stablecoin associated transactions on the community. Because of Solana’s low transaction charges, USDC on the community has a median switch dimension of $20, in comparison with $1,400 on Ethereum. This contributes to Solana’s larger transaction depend, with 3.86M stablecoin transactions in November, considerably larger than Ethereum’s 230K transactions regardless of Ethereum’s deeper stablecoin liquidity.

There are a number of different metrics we are able to leverage to know stablecoin exercise on-chain, together with the provision held by sensible contracts and externally owned accounts (EOAs), stablecoin velocity (turnover), lively addresses, the variety of addresses holding greater than a certain amount of stablecoins, and provide distribution. These metrics will be explored additional by way of this stablecoin dashboard created with our charting instrument.

One other avenue that drives demand for stablecoins is the supply of yield, which might function a type of passive revenue or threat administration in each bull and bear markets. To compete on adoption with giants like Tether & Circle, a number of stablecoin issuers incentivize stablecoin development by passing on curiosity to holders, enhancing their retailer of worth properties. This spans varied approaches and threat profiles, from passing a portion of yield generated on off-chain real-world belongings (RWAs) equivalent to US Treasuries or on-chain collateral belongings like staked ETH or in some circumstances, income generated from operations tied to on-chain protocols (within the case of protocol issued stablecoins).

Ethena has introduced a comparatively new method to yield era for its artificial greenback—USDe, dubbed the “Web Bond.” It combines hedging methods on centralized exchanges with staking rewards to generate yield whereas sustaining peg stability. Crypto-assets are used as collateral (BTC, ETH), to open quick positions in perpetual futures markets, aiming to profit from optimistic funding charges. Together with the funding and foundation unfold, Ethena passes on the yield from ETH staking rewards within the type of a interest-bearing token—sUSDe.

Supply: Coin Metrics Community Knowledge Professional

Notably, there’s a shut relationship between USDe provide and ETH funding charges throughout exchanges. The availability of USDe and staked USDe (sUSDe) has grown in environments with optimistic funding charges and declined or stagnated when funding charges turned adverse. Curiously, Ethena lately introduced plans to launch USTb, a brand new stablecoin collateralized by BlackRock’s tokenized US Treasury fund, BUIDL. This stablecoin is meant to operate as a backing asset to USDe, serving to handle threat during times of market volatility that end in weak funding charges. Because the stablecoin that has grown essentially the most since Q3, Ethena is well-positioned to capitalize from rising funding charges.

Stablecoins stay a cornerstone of the digital asset ecosystem, driving liquidity, facilitating funds, enabling on-chain financial exercise, and serving as a instrument for financial savings and wealth preservation. Primarily based on a number of metrics, stablecoins proceed to show development in adoption and utilization, proving their widespread demand and utility. s stablecoins achieve traction, regulatory readability in areas like reserve transparency and issuance requirements will drive innovation throughout the ecosystem and gasoline the expansion of stablecoin-related companies. With optimistic regulatory efforts advancing within the U.S. and globally, the stage is about for the subsequent part of stablecoin development, probably rewiring the monetary ecosystem.

Supply: Coin Metrics Community Knowledge Professional

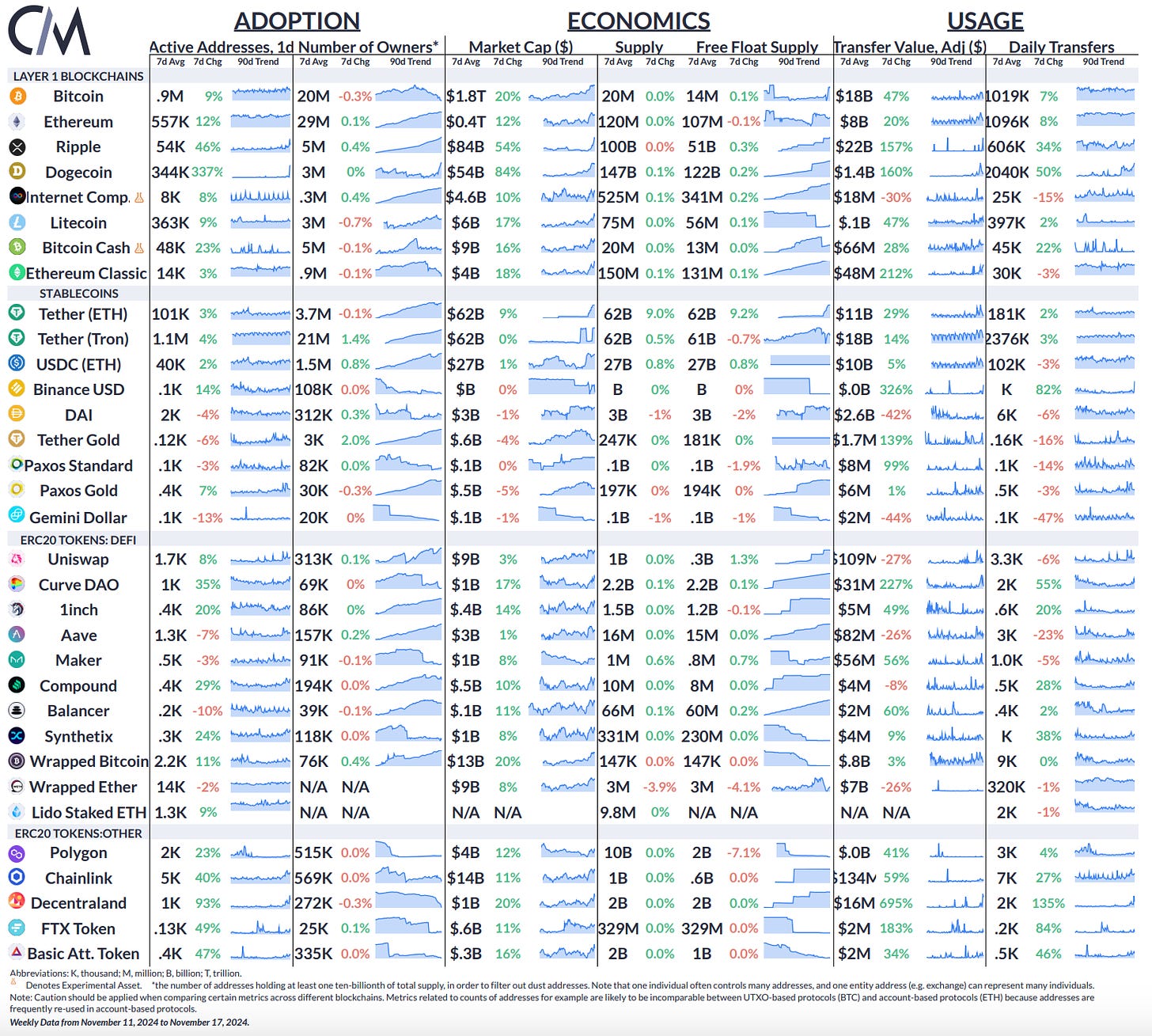

Submit-election market momentum continued over the previous week, with the market cap of Bitcoin and Ethereum rising by 20% and 12%, respectively. Energetic addresses for Dogecoin surged by 337%, whereas its market cap rose by 84% to $54B.

This week’s updates from the Coin Metrics staff:

-

Comply with Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As at all times, when you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.