At 0xArc, we have to have each piece of information, on each chain, at each time limit (previous, current and to-be-future). In consequence, our knowledge warehouses are a whole lot of terabytes in measurement. To get this knowledge we’ve made billions of RPC calls and proceed to make a whole lot of tens of millions per 30 days throughout many blockchain networks. Sadly, we discovered, on common, RPC calls to nodes work roughly ~80% of the time relying on situations with 10x variances in pricing! This text shares a few of our findings and can hopefully be helpful to the remainder of the neighborhood.

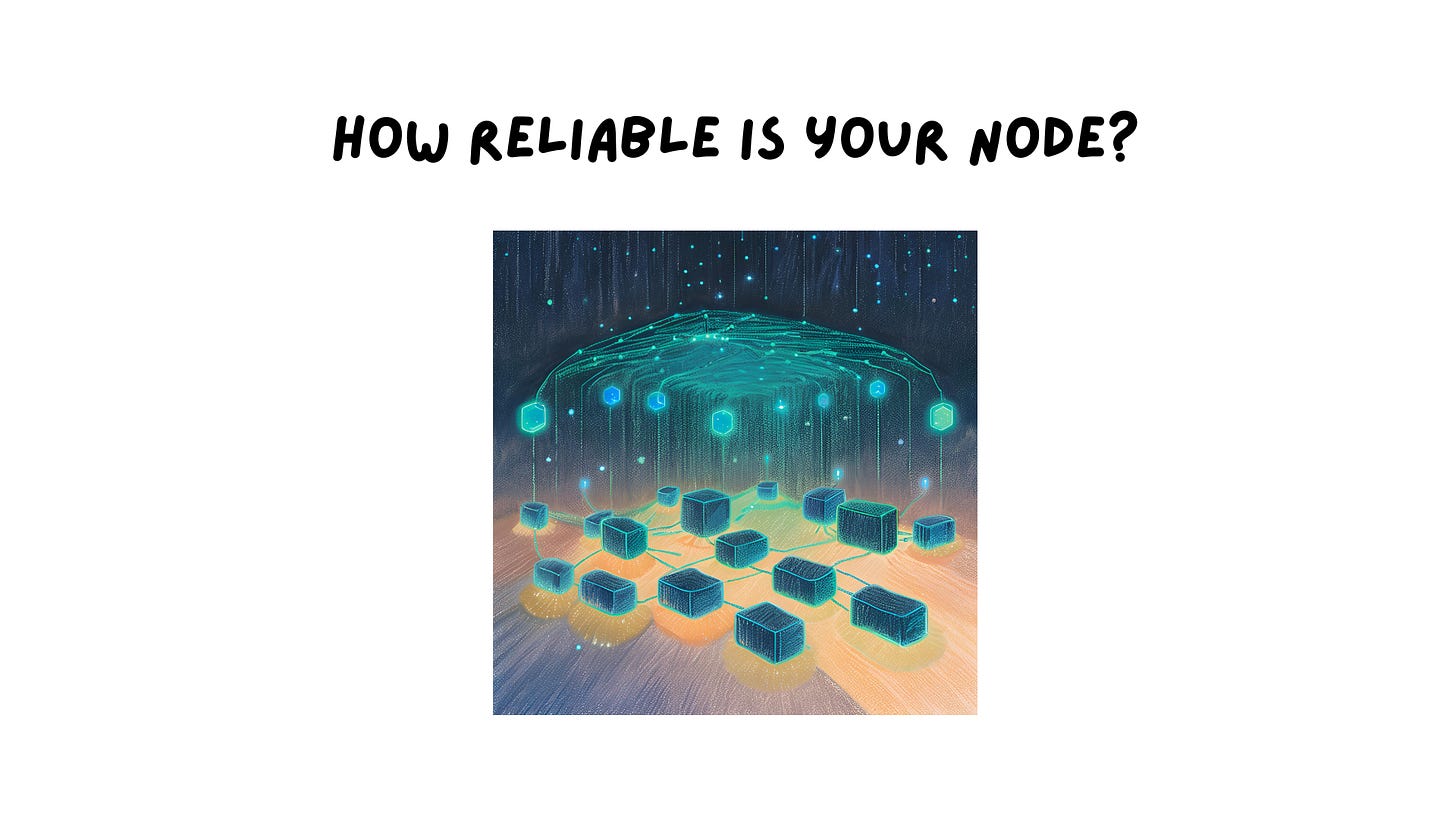

Earlier than we discuss numbers it’s necessary to know how the node trade works in crypto so we are able to correctly perceive what we’re discussing. Whereas it’d be nice if everybody ran their very own nodes and we adopted excellent rules of decentralisation, the truth is that operating a node is complicated and requires experience. Subsequently we delegate this duty to a node supplier. This diagram is predicated on how the industrial node trade works in 2024 in crypto.

At a excessive stage, you’ve full or archive nodes which can be run on a selected kind of node implementation (geth/reth/erigon). These nodes are hosted by a supplier corresponding to Alchemy or Quicknode for each blockchain community they help. You because the RPC shopper entry all of this on the finish of the road.

Whenever you deconstruct this chain of logic, you’ve 4 major dimensions that can enormously influence efficiency:

The chain you’re making RPC requests to: every chain’s community of nodes behave in a different way and have differing exercise ranges.

The strategy you’re calling: this can rely if you happen to’re making full or archive node calls and the node consumer implementation.

The supplier that you simply’re utilizing: the entity that hosts the nodes so that you can entry.

Whenever you name the node: node efficiency varies throughout the entire above dimensions over time, it isn’t fixed.

Having the ability to instrument and perceive this knowledge may be very difficult. Nonetheless, at 0xArc that is our job as we make billions of RPC calls and thoroughly monitor the efficiency of every thing we contact. Efficiency, reliability and price are paramount to us. We all know when a series is down or when a RPC supplier is down earlier than most market contributors. Right here is the context of the info we’ll taking a look at on this article:

With a view to correctly perceive what’s taking place with over 1b+ rows of information, we’re going to must slice and cube it throughout many dimensions. Fortunately, we all know what these are by way of the factors I made above.

The remainder of the article will present distinctive situations of how efficiency can differ throughout every of those dimensions in an unpredictable means.

Suppose you’re constructing a cross-chain utility that depends on interfacing with varied networks. Your node’s efficiency will differ considerably based mostly on the chain you’re calling and the time you’re calling it.

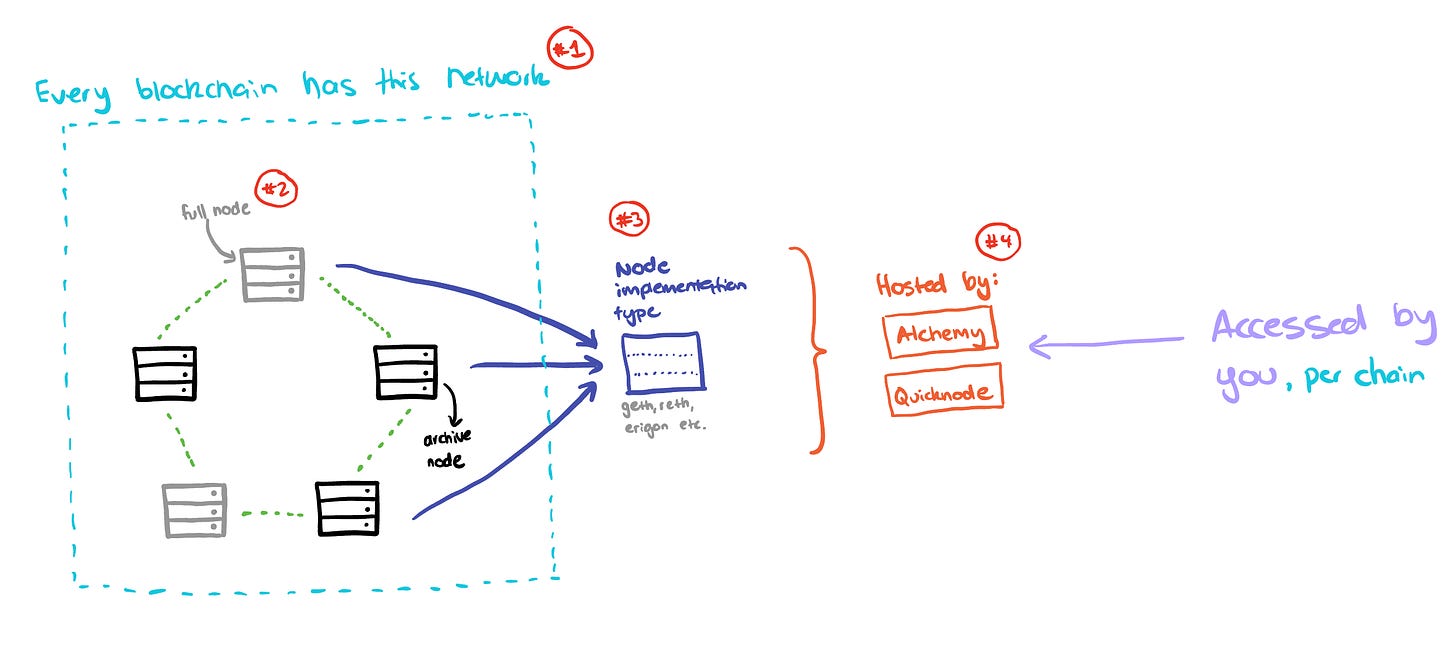

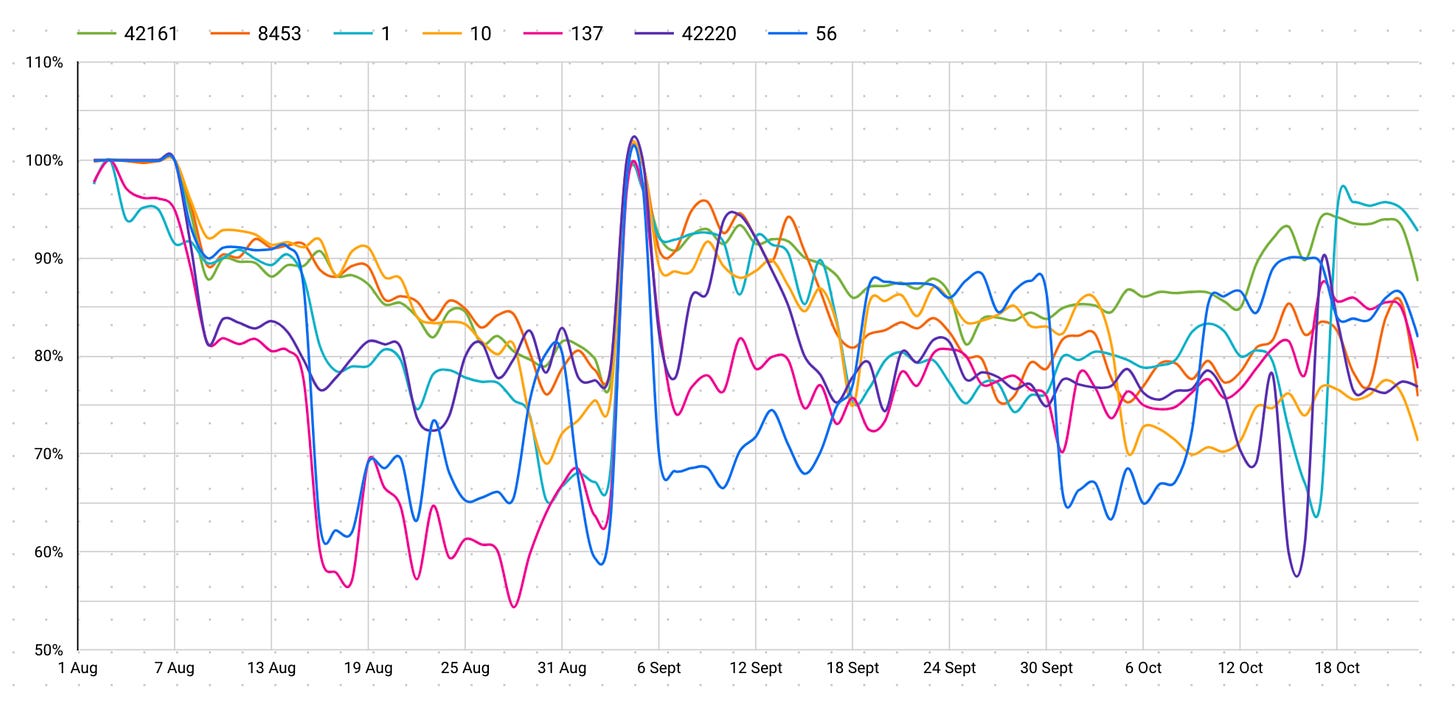

This primary graph is displaying what the common success fee for every chain per day was aggregated throughout all suppliers and strategies. As you may see from the chart beneath, the common success fee you get from chains varies considerably nearly each month. We’re unsure why this can be the case however we are able to see that Polygon calls had been profitable on common 60% of the time in August however then have spiked as much as 80%+ in more moderen weeks.

A key caveat of this knowledge when evaluating it isn’t: “Polygon is a foul chain and RPC calls solely succeed 70% of the time on common”. That is the blended common success fee throughout all chains, all suppliers, all strategies over a ~2.5 month interval. As we dig into any of those dimensions the info adjustments considerably.

This is identical chart however for a 17 day interval and filtered by a single supplier. As you may see the graph is so much smoother and varies from the general combination.

If we see a single supplier doing nicely, what stops us from doubling down on them on a regular basis? The following part addresses that query with extra nuance.

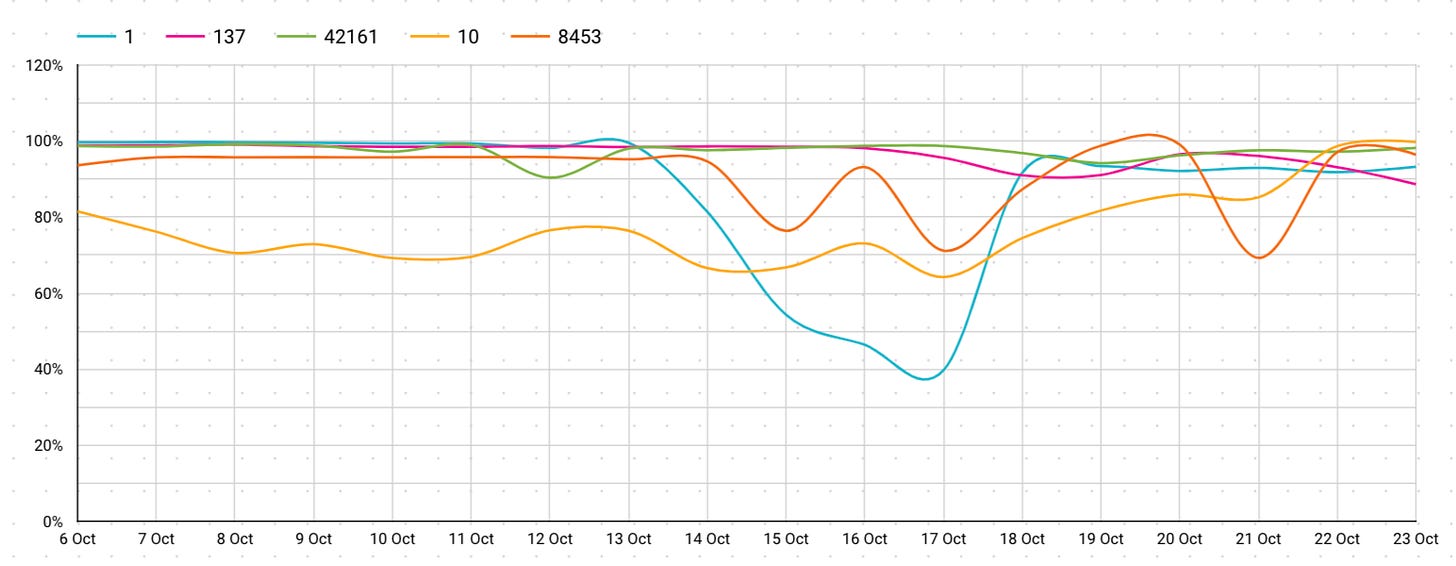

This subsequent graph I simplified as a result of I wished to keep away from having too many traces. Every of those represents a serious RPC supplier community and their success fee aggregated throughout all chains and strategies. As you may see from the chart beneath, the orange supplier is likely one of the most dependable relative to the others and the distinction is kind of staggering!

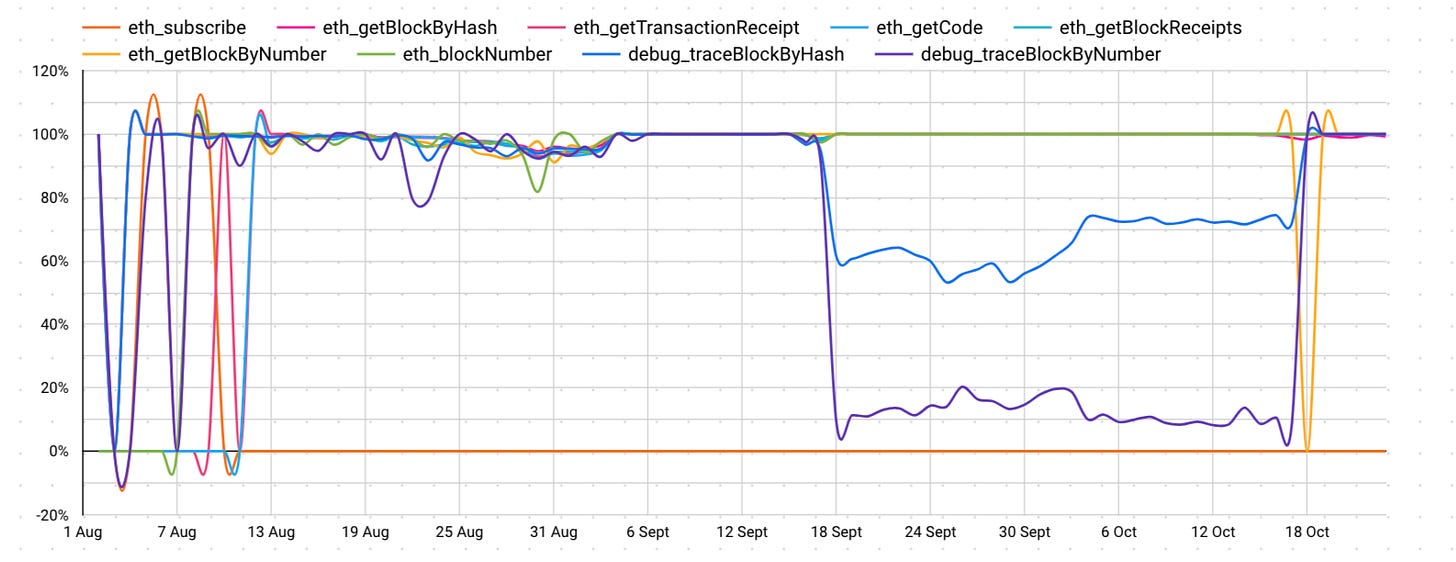

As soon as once more, the apparent would possibly simply be “use orange supplier” as a result of it performs nicely. Sadly, that doesn’t actually work both. After we take a look at orange supplier’s efficiency for simply Ethereum, the archive node strategies can have dramatic drops in efficiency. As you may see for nearly one month, archive nodes carried out terribly on what was meant to be “the perfect supplier” in our above instance.

So if we’re after the perfect efficiency for sure strategies, we have to look nearer.

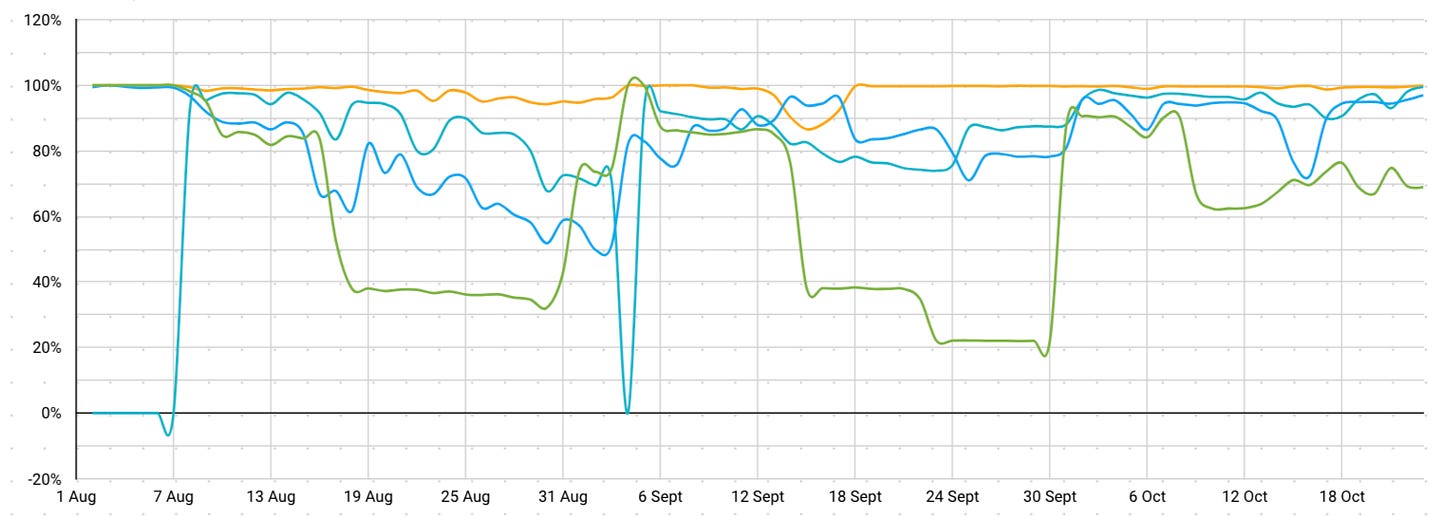

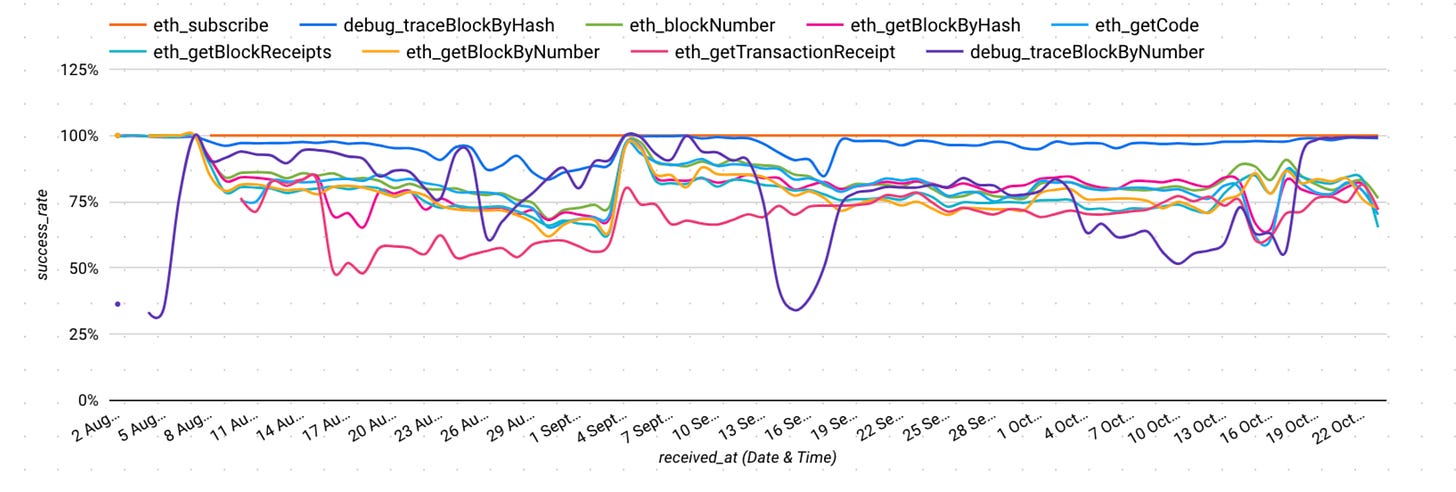

Our closing chart beneath reveals how success throughout varied strategies adjustments significantly month-to-month. Relying on if you happen to’re making calls to full nodes versus archive nodes, your efficiency will differ considerably. We noticed this briefly in an remoted instance with the only supplier on a series above, however now now we have a extra zoomed out view.

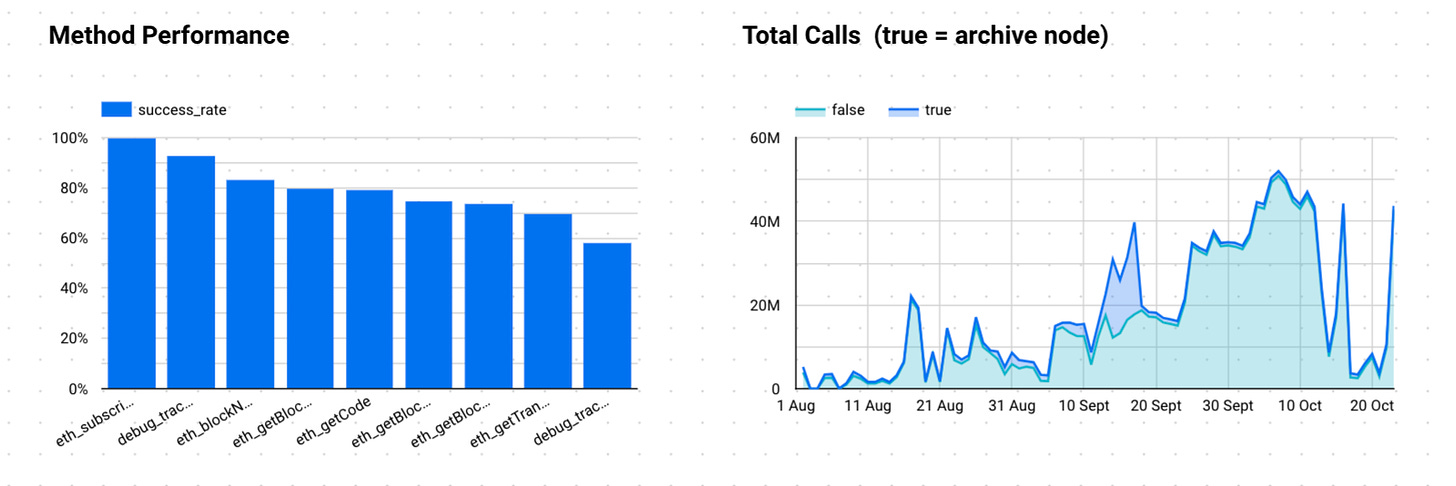

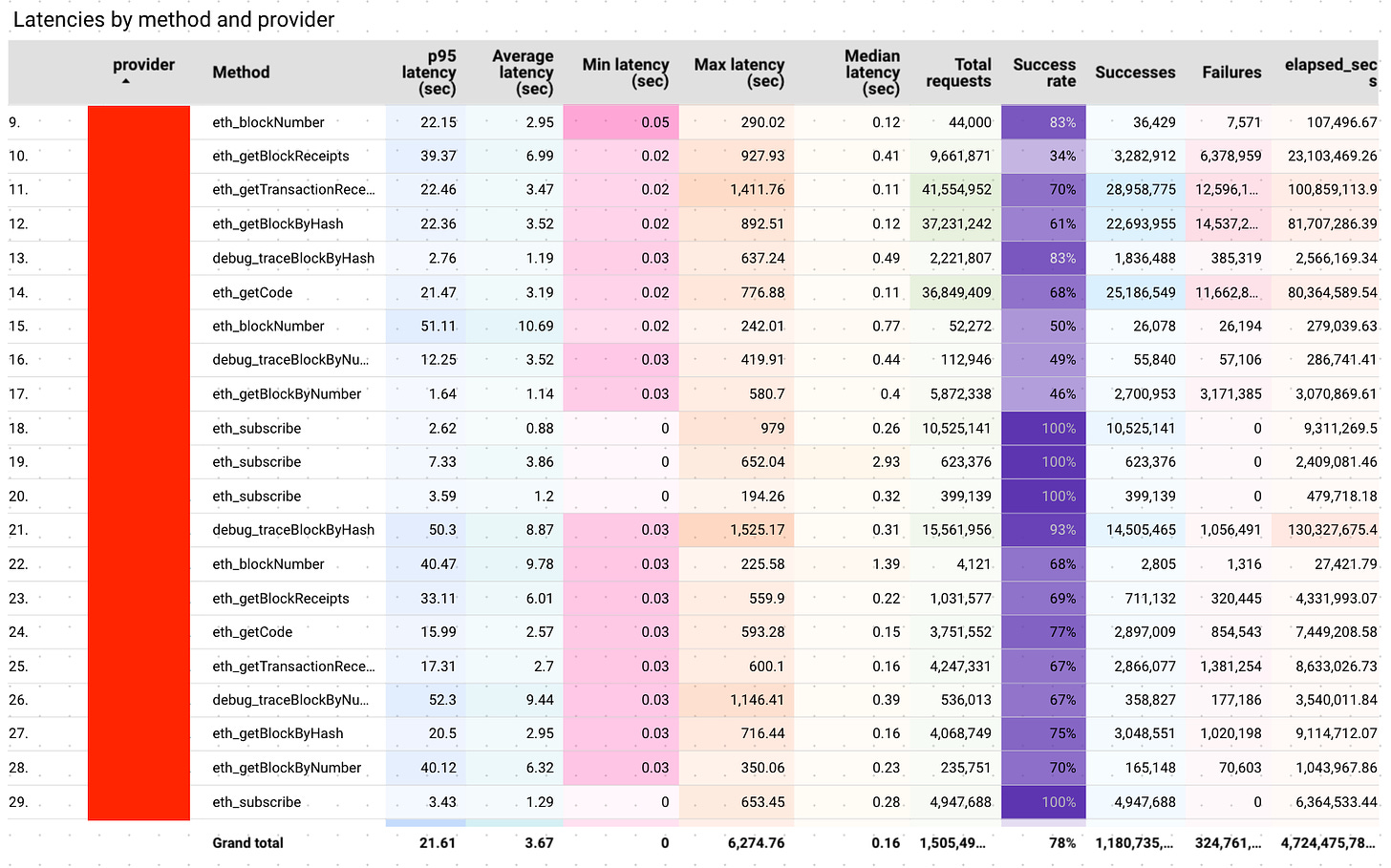

If we common out this knowledge, we get the beneath breakdown of common success fee per methodology with the accompanying areas chart displaying a breakdown of archive versus non-archive node calls. Whenever you put it like this, you realise simply how unreliable nodes may be whenever you’re wanting throughout many dimensions. Many instances, node suppliers use shiny advertising numbers on restricted time frames to market their efficiency. It isn’t till you hammer them at scale do you see the actual metrics.

So what’s one of the simplest ways to pick a node? One line of argument to this complexity could also be to simply use the orange supplier in our above instance, nevertheless when their techniques begin failing and experiencing massive drop offs, your downstream techniques will fail due to them.

One technique to keep away from that is by having fall-back suppliers in your system. Nonetheless, these fall-back suppliers require handbook upkeep and add to latency by way of sub-optimal routing. Ideally you wish to have knowledge on how all these routes carry out in a dynamic, clever means — reasonably than static if/else clauses in your code base.

To make issues much more difficult, pricing for each supplier adjustments on a per chain and methodology foundation. These variations be be as a lot as 10 instances the fee per methodology/chain. Out of the blue a 10-20% distinction in efficiency finally ends up costing you much more! Every supplier needs to lock you right into a yearly plan or a month-to-month quota which has further prices. Virtually no supplier is pure utilization based mostly which suggests you’re pressured to take a guess on a single one — with none knowledge! What’s a “easy service” on the outset, really has nice variance in efficiency when inspected intently.

For those who’re paying for RPCs or eager about your infrastructure’s reliability, let’s discover tips on how to maximize efficiency throughout chains and suppliers. Attain out to speak about our findings or to see how we can assist.

At the moment paying for RPCs and wish to be taught extra about tips on how to enhance your reliability

Are a RPC supplier and wish to know the way your nodes carry out

Interested by signing as much as a RPC service and would really like some recommendation

Attain out to me instantly from this electronic mail or by emailing me at ok@0xarc.io so we are able to setup a while to speak.