Think about being a enterprise and working a promotion the place you supply folks $3 of worth for each $1 they spend. Oh, and there’s completely no situations on who can declare this supply. Your grandma, the homeless dude down the street, a effectively paid govt, or a traditional center class individual are all eligible for this supply.

What do you assume goes to occur? Properly, the individuals who want the cash essentially the most and are least more likely to be repeat prospects will likely be coming in droves to swipe you clear till you run out of cash or stock to maintain this supply.

The excellent news is that the true world doesn’t work this manner as free markets guarantee enterprise like that die shortly.

The unhealthy information is that crypto companies do work this manner and the free markets proceed to advertise their bankroll.

The above situation is strictly what Arbitrum roughly did, besides with $85m and ended up with a $60m loss within the course of. Let’s dig into what precisely the scheme was, the way it was structured, and what we are able to be taught from this all.

Arbitrum DAO structured this in a approach the place sure verticals and their respective apps would obtain ARB tokens to incentivise on their platform. In the end the thought is that by incentivising utilization of those platforms, Arbitrum as a community would obtain extra charges and the top protocols would profit as effectively. Seems one celebration received right here and the opposite one much less so (I’m positive you already know who the loser is right here).

The evaluation is fairly prime quality with the sophistication round measurement and provides props to the Blockwork crew for clearly laying out why, what, and the way round their strategy.

You possibly can learn/study the outcomes your self right here: https://discussion board.arbitrum.basis/t/ardc-research-deliverables/23438/9

At a excessive degree, you’ll be able to break this marketing campaign into two excessive degree elements:

-

Create a benchmark to grasp what % of the incentives may be attributed to the spend versus baseline. They name this a “Artificial Management” methodology with some fancy math. This doesn’t matter an excessive amount of aside from no matter our closing numbers are we have to regulate them down as a result of not all the things may be attributed to this single effort. You possibly can learn extra about it within the unique discussion board submit.

-

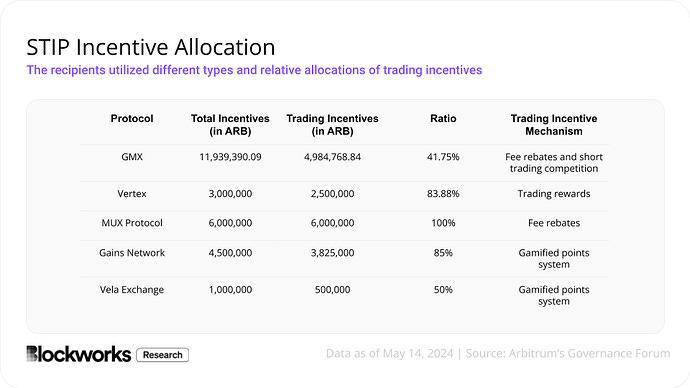

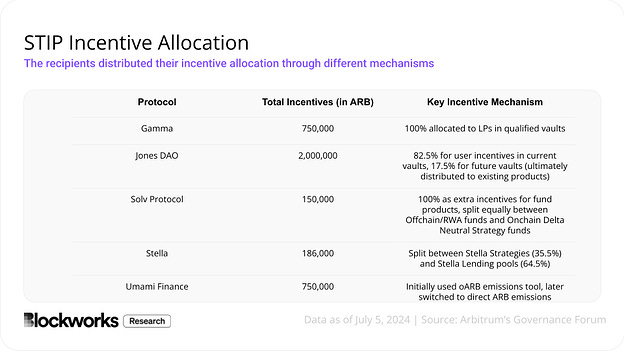

Incentivise the top customers of apps in several verticals on Arbitrum by giving them ARB tokens to juice their metrics. Three verticals have been chosen (perps, DEXs, liquidity aggregators). Every app was given methods to greatest spend the inducement.

I did discover some attention-grabbing excerpts that I believed I’d embody in right here in your personal judgement:

-

“Many protocols missed a number of bi-weekly studies or didn’t submit them in any respect. Round 35% of all STIP recipients didn’t submit a closing report.”

-

“It was rare that protocols rigorously justified why they need to be allotted a specific amount of incentives when making use of for the STIP. Moderately, the ultimate allocations have been usually a results of back-and-forth between protocols and the group, usually leading to an allocation primarily based on one thing akin to “we really feel like this ask is just too large/small”.

Anywayyyyysss, shifting on. I’ve included screenshots for the completely different classes, how a lot was spent, and the mechanism (no methodology screenshot for the DEXs however principally they only incentivised liquidity). The important thing factor to recollect right here is that 1 ARB is kind of $1. So sure, these are tens of millions of {dollars} being distributed.

I need to break up the outcomes into two elements right here as a result of there are two issues that this experiment aimed to grasp.

-

The impression of those incentives on the apps

-

The impression of those incentives for sequencer income

We’re going to start out our evaluation with the primary as a result of that paints a barely happier story. Properly if we predict from first ideas, if somebody provides you free cash to run promotions for your small business, what do you assume will occur? Properly, usually enterprise will enhance — for some time. That’s what we noticed throughout the board with this experiment.

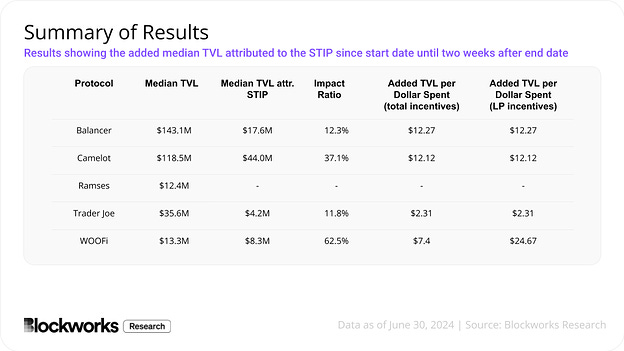

Beginning off with the Spot DEXs, their outcomes appear fairly respectable on the floor:

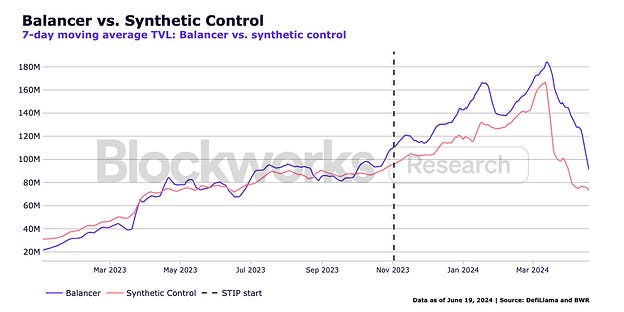

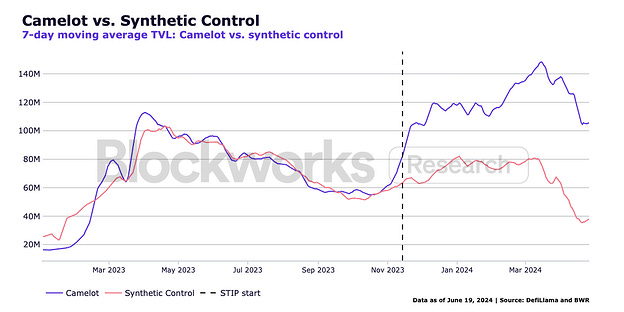

So principally what we’re seeing right here is that anyplace from $2 to $24 was earned in TVL for each greenback spent which sounds good. Nonetheless, we have to ask the true query right here — how a lot of that was retained? That is the place it turns into a bit tough. Balancer’s TVL principally dropped after the rewards ran out, as evident by means of this chart:

Nonetheless, Camelot, however, really managed to retain this TVL! I’m undecided why these two protocols differed of their retention but when I used to be to take a guess it’d be the best way they ran their incentive program and the kinds of customers they attracted for the marketing campaign itself. That is one thing I’ve bookmarked and can analyse myself in a future article.

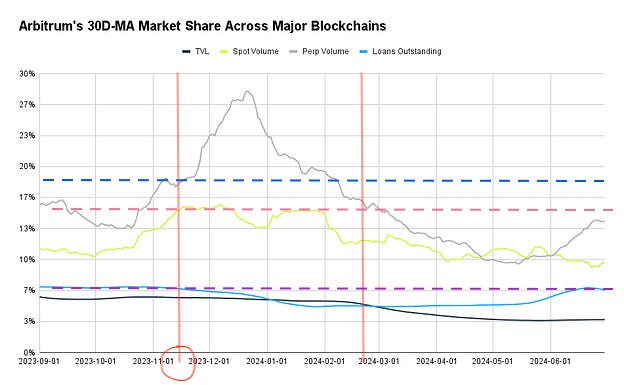

Now that you simply perceive among the micro nuances, lets zoom out and perceive how efficient this was for the apps and the three top-line classes that matter (spot quantity, perp quantity, and loans). I current to you our key chart. I needed to annotate on high of it to assist it make sense of all of it so stick with me as I clarify it.

-

I drew two pink vertical traces to mark the beginning of this system and the top of this system. This can assist us perceive the timeframe we’re coping with right here.

-

I then drew a number of horizontal traces to grasp the completely different metrics and visualise how this system impacted these metrics over the course of its lifetime.

-

The primary blue line principally reveals that TVL spiked massively (no shock) however then principally dropped to beneath the place this system first started indicating nearly none of it was sticky!

-

The second line is spot volumes. I need to pause right here and point out that not like TVL which is provide facet and prices nothing, spot quantity represents demand. As we are able to see demand was fixed at greatest however was really decrease by the point this system ended!

-

The third line is loans excellent which can be demand driver and noticed no change. Whereas no lending protocols have been incentivised I do discover it as one other robust metric of demand. This really dropped all through this system!

-

So what can we conclude from the entire above? Properly principally Arbitrum spent $85m on all these different companies to juice their provide facet metrics (which clearly labored) however was rendered ineffective as there was no corresponding demand to absorb that TVL and tighter liquidity. In essence, you may say all of that cash was lit on fireplace and given to mercenary farmers. Not less than sure protocols have increased TVL and the next token value making some folks richer within the course of 😇

Talking of demand facet metrics, absolutely all this exercise was good for the chain and led to increased revenues from all these transactions — proper?!

Properly, not precisely.

Really, no, in no way.

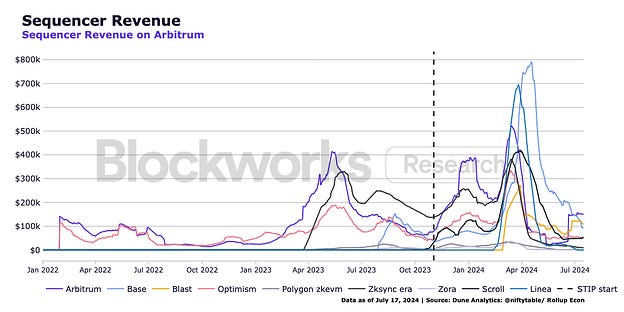

So right here’s the chart of sequencer revenues from Jan 2022 to July 2024. The large spike close to April is when crypto began to go up massively and the Artificial Management helps us account for this.

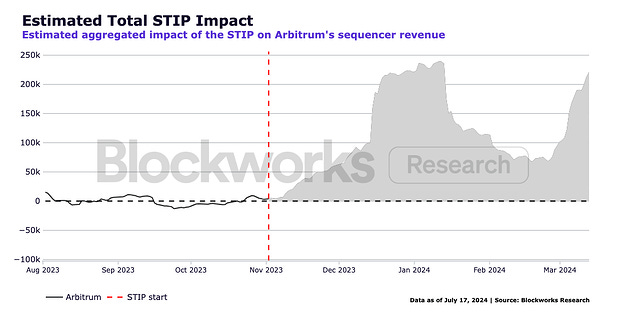

On the floor we are able to see income went up, hitting as excessive as $400k per day for sure months. Right here’s a clearer chart that reveals the impression only for Arbitrum and taking into consideration the Artificial Management:

So what’s the realm underneath the curve? $15.2m. Should you take away the Artificial Management you get a complete of $35.1m in sequencer income in whole. We’re nonetheless removed from god right here given $85m was spent!

To summarise the entire above:

-

Arbitrum determined to spend $85m to incentivise exercise on its community to spice up marketshare and income

-

They did this by giving free tokens to apps/protocols that might distribute them to their finish customers

-

Upon evaluation, all of those free tokens got to produce facet drivers and nearly no change was proven on the demand facet

-

Wanting even deeper, the sequencer income from all this exercise was $60m lower than the quantity spent

What’s my takeaway from this? The primary is provide facet incentives are nearly as good as burning cash and shouldn’t be executed until you could have a supply-side drawback (often not although, demand is the wrestle).

The second, which is the premise round what I touched upon initially of the article was: in the event you give cash out to randos with out discernment of who they’re and the place they arrive from, you’ll get what you pay for — which to make clear, is 💩. Protocols that proceed to dump cash to customers with out perceive who they’re, what their intents are will finish because the enterprise described initially of this text.

Lets think about that this incentive scheme discerned who these tokens got to through a pockets’s permission-less id and had standards reminiscent of:

-

Does this consumer really use DEXs or is it a model new pockets?

-

What’s the net-worth of this pockets and are they a probably useful pockets to accumulate?

-

How a lot has this pockets spent on charges? Are they stick on the platforms they use?

-

Is that this handle at the moment utilizing all of the issues which have upcoming tokens? They in all probability scent like a farmer.

What do you assume the top end result can be?

I imagine that the work that my crew and I are doing at 0xArc will resolve these points. We nonetheless have some key elements to construct however in the event you’re eager about studying extra be happy to succeed in out.