This subject of Dose of DeFi is dropped at you by:

No must open up 5 tabs to make an knowledgeable commerce. Oku has superior analytics, restrict orders, and TradingView charts, multi function place for the very best DEX expertise. Web site & Twitter

DeFi lenders got here out of the market carnage of 2022 bruised however nonetheless functioning (which couldn’t be mentioned for his or her CeFi brethren). Simply as crypto markets have been crashing and demand for leverage was plummeting, the Fed added to DeFi lenders’ ache through its most aggressive rate-hiking marketing campaign ever, sapping demand for the modest yields in DeFi. After which in March 2023, the autumn of SVB and the depegging of USDC threatened to push all lending protocols underwater.

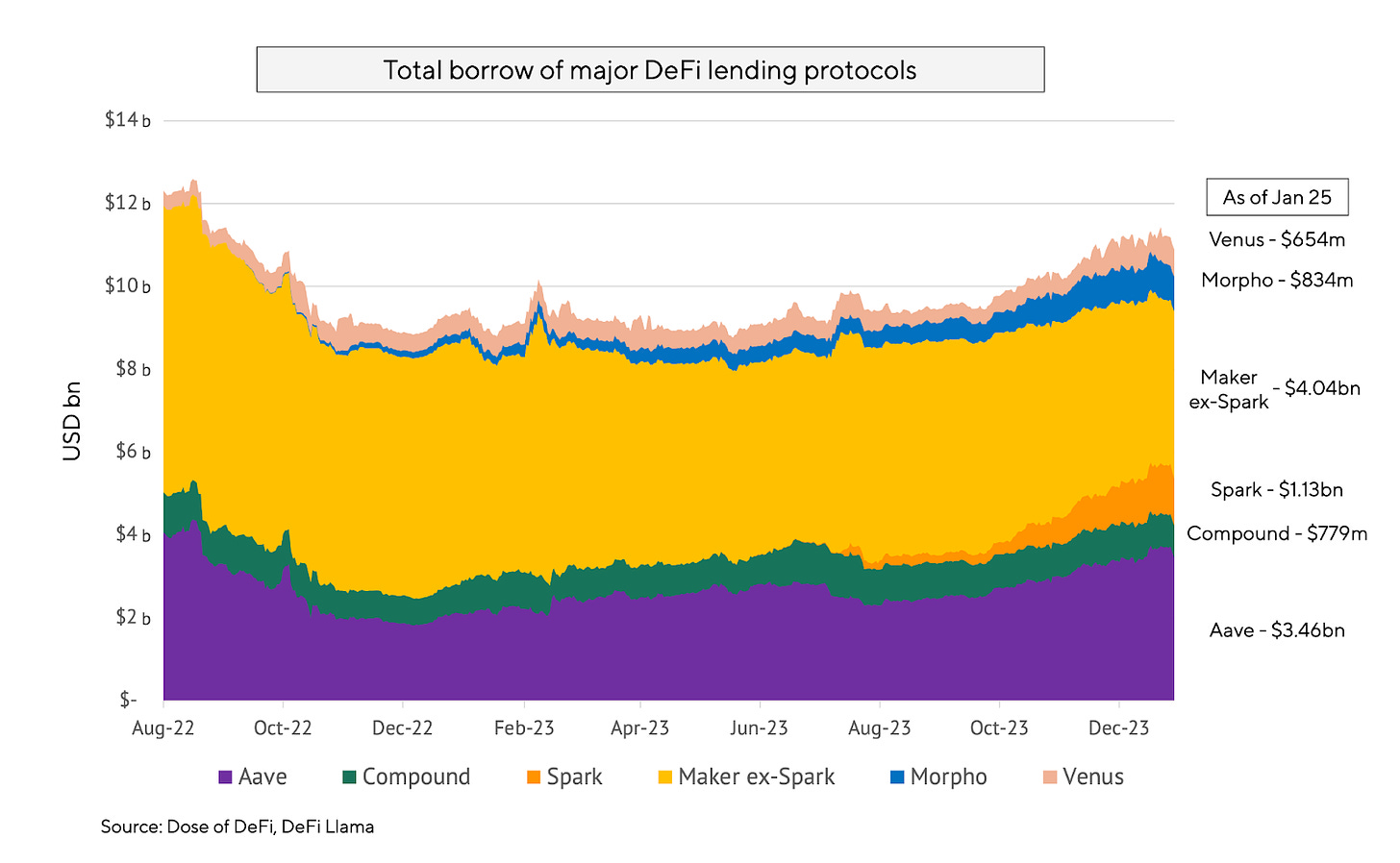

A yr later and that worry has disappeared; DeFi lenders are flourishing. On-chain charges now look extra like these in TradFi (because of some nudging from Maker), and an entire new crop of modern merchandise have broadened collateral base and diversified the danger choices – one thing that’s actually set to proceed.

Whereas DeFi buying and selling collectively struggles to supply a product extra aggressive than CeFi, DeFi lending has already surpassed CeFi and presents extra potential to develop into mainstream markets with increased yields. Due to increased charges, DeFi lending protocols are seeing an explosion of on-chain income that will likely be reinvested again into enlargement into new markets. We don’t anticipate a bull market sugar excessive, however relatively a shift away from the DeFi of the zero rate of interest atmosphere towards a brand new interval of upper income and broader attraction.

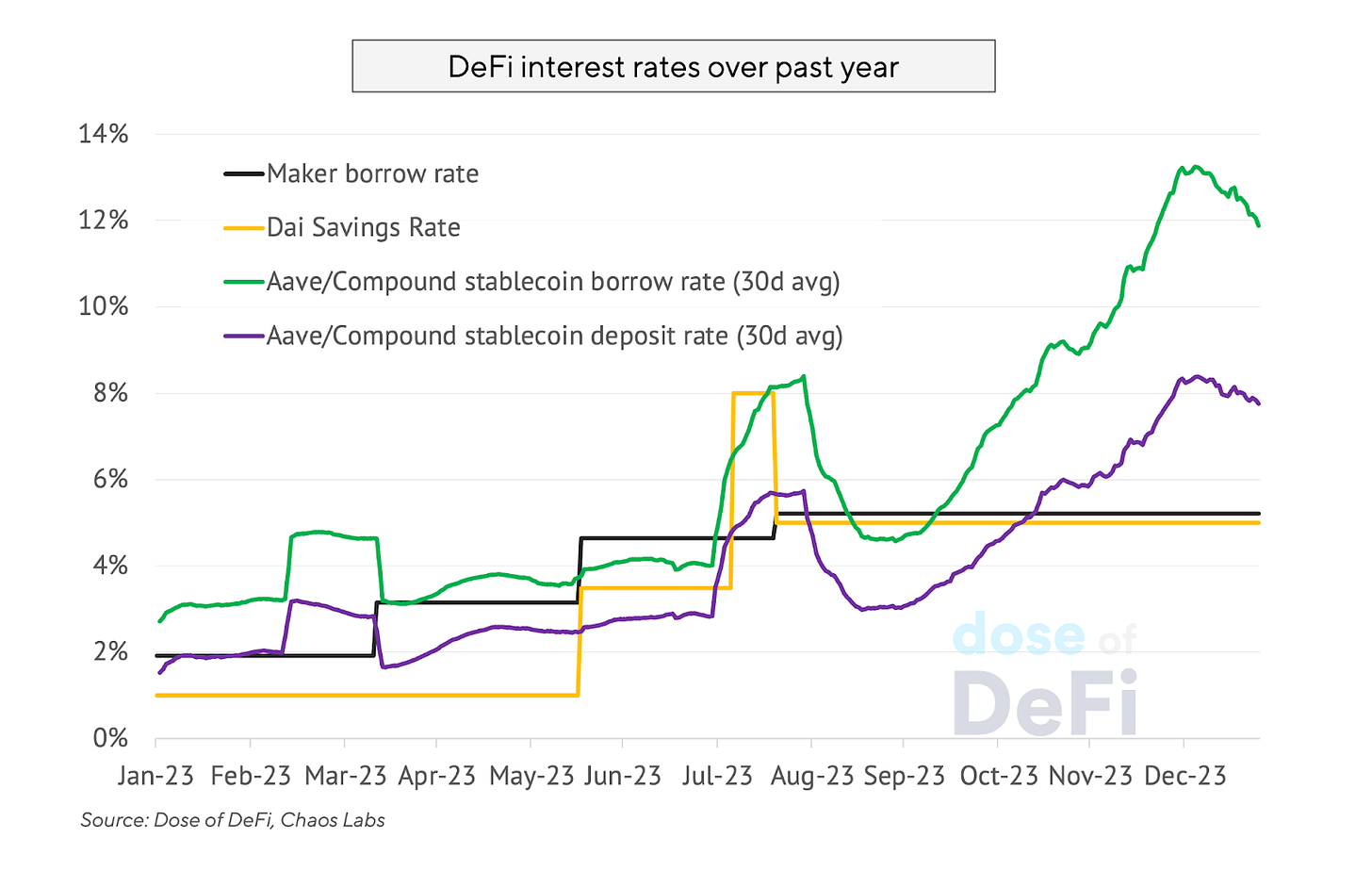

Charges climbed steadily all through 2023, pushed by two forces: the elevated demand for leverage as markets heated up, and real-world yield coming on-chain. MakerDAO led the cost with increased charges when it voted to extend the borrowing charge for its vaults within the spring, regardless that demand for borrowing was tepid. Not like Compound and Aave – the place rates of interest are set by market demand – Maker has full management over what rate of interest it points for Dai loans.

Maker was not elevating charges simply to stay it to debtors. Larger lending charges allowed it to boost the Dai Financial savings Fee, first to three.33%, and later to five% (the place it stays for now).

The expansion of actual World property (RWA) in MakerDAO introduced increased TradFi charges to DeFi and drastically lowered their stablecoin publicity. Dai was generally derisively mocked as “wrapped USDC”, however that is now not the case. Firstly of 2023, 63% of Dai was backed by USDC or one other stablecoin. Quick ahead to at present, and that quantity is 12%. It has been changed by real-world property (primarily T-bills), that are yielding 5%+. This entails a number of off-chain complexity swapping USDC within the Peg Stability Module for T-bills and dripping funds again to the protocol in Dai, nevertheless it scales higher than crypto collateral.

All through 2023, Maker has maintained its lead within the ETH lending market forward of Aave. In 2021, Aave benefited from an aggressive collateral onboarding technique. This performed out effectively for them within the transition to staked ETH, and their early mover benefit enabled them to lock within the liquidity community results. It has extra staked ETH than Maker. Staked ETH represents 59% of Aave’s ETH-based collateral, in contrast with 42% for Maker. Compound missed out on the staked ETH market, however stays a aggressive second place (behind Aave) in WBTC.

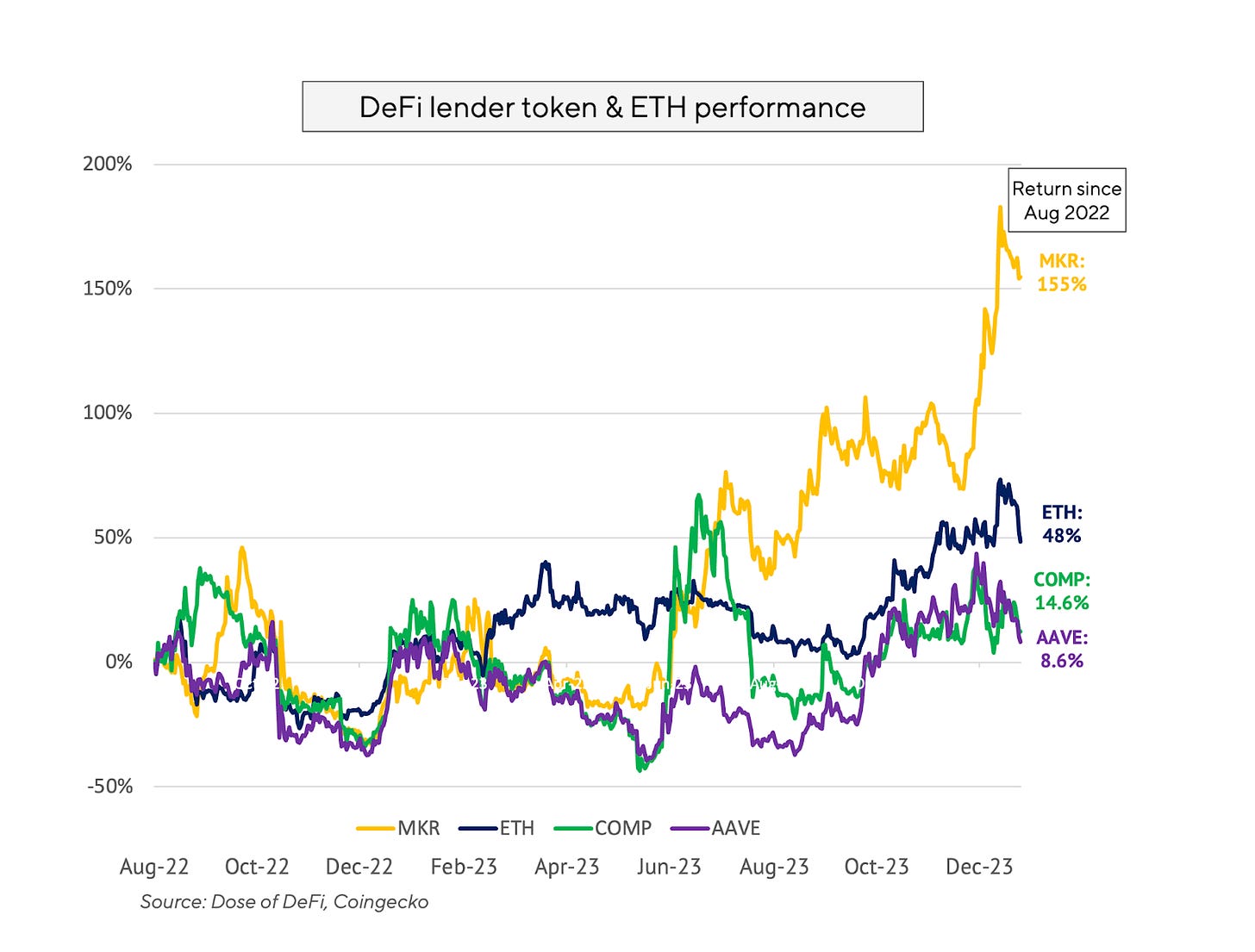

MKR has led in token efficiency. Its standout development, nevertheless, occurred over the previous few months, on increased revenues from RWAs and hypothesis about adjustments within the Endgame (extra on that later).

The shut aggressive dynamics between Maker, Aave, and Compound (and different smaller gamers) has helped drive a wave of continued innovation and new product releases in lending. This entails each new and previous gamers alike. Probably the most thrilling current developments are as follows:

-

Morpho launched in August 2022, and now has a few totally different merchandise. The Optimizer is a P2P lending protocol constructed on high of Compound and Aave. It matches up lenders and debtors straight and falls again on Compound or Aave. Simply this month, Morpho launched Morpho Blue, a protocol with a really skinny layer of governance and off-chain dependencies. As an alternative of counting on core protocol governance to handle lending dangers. Morpho Blue is permissionless on the base layer, however lending swimming pools could be curated by DeFi service suppliers like Block Analitica, Steakhouse, or B. Protocol. It additionally presents increased loan-to-value (LTV) ratios because of enhanced capital effectivity.

-

Ajna simply launched this month. It’s much more governance-minimized than Morpho and likewise boasts a non-oracle design, in addition to with the ability to settle for any ERC20 or NFT as collateral. It makes use of an inside order ebook for lending positions, that means customers units a market worth for what their collateral might resolve for. Ajna could possibly be regarded as an “interest-bearing restrict order on the borrowed asset”. It’s not very normie pleasant, however its flexibility implies that others may construct primitives on high of Ajna to make it simpler to entry for much less refined customers.

-

GHO & crvUSD are new stablecoins from Aave and Curve respectively. GHO stays small (market cap: $35m) and has struggled with peg administration. It’s nonetheless early days although, and given Aave’s place within the lending market, it might take its time increase an ecosystem round GHO. Presumably, Aave is involved in replicating the RWA mannequin that Maker has pioneered. That’s not the case for crvUSD. Its strategic benefit is that it makes LPing on Curve extra enticing, and there’s some reflexivity to it as a stablecoin hub. Its key innovation its gradual liquidations. They only introduced further lending plans this week with code already up on github.

-

Spark is a fork of Aave v3 that was launched as a subDAO of MakerDAO. It’s plugged into Maker core by means of the Direct Deposit Module (D3M). Not like Compound v2 or Aave, the Maker Protocol will not be a cash market and doesn’t lend out collateral (it makes use of the CDP mannequin). Spark is a means of providing this product whereas nonetheless linked to Maker’s stability sheet. Spark’s Dai borrow charge is ready by MakerDAO governance (at present 5.53%). It presents the very best borrowing charges as a result of it’s not depending on its provide of Dai deposits. It will probably merely mint new Dai. Spark is only the start of some main adjustments to MakerDAO that revolve across the bold Endgame plan. For instance, Spark will likely be one in all a number of “subDAOs” that may borrow on Maker’s stability sheet. These subDAOs may have new tokens to be farmed out, beginning this yr. Maker can be getting an entire rebrand and a brand new token. The farming and rebrand ought to deliver a lot wanted consideration to DeFi.

Moreover, lending protocols have seen vital development in deposits and borrowing on their L2 deployments. Token emissions are a giant purpose for this, however the property are more likely to keep after incentives as rates of interest on L2s are additionally comparatively aggressive with Ethereum. L2s and low-cost chains are essential for DeFi lenders’ enlargement, because it’s the one means they will transfer in the direction of a extra mass retail investor base.

In DeFi, market dynamics are extra fluid in lending, and success appears extra depending on catching the most recent wave of investor choice. Compound’s early success was because of COMP farming, which kicked off a wave of copycats. Aave pulled forward as a result of it cornered the LST market.

Wanting forward, lending protocols will subsequent be battling to draw the upcoming onslaught of restaked ETH tokens anticipated to hit the market with the launch of Eigenlayer. We mentioned the “ETF-ization of ETH yield” final yr and since then, a number of tasks akin to Rio, Renzo, and Swell, have already introduced plans to launch new types of tokenized restaked ETH. This will likely be trickier than staked ETH, the place there are totally different tokens for a similar yield (ETH rewards from the Ethereum protocol). With restaked LSTs, there will likely be scores of various kinds of yield with totally different danger concerns. The market will seemingly be extra splintered than vanilla staked ETH, the place Lido has 70%+ market share. Most attention-grabbing will likely be to see how conducive lending protocols are to highly-leveraged recursive borrowing, provided that the asset costs of the restaked LSTs will likely be extremely correlated, even when their danger will not be.

Yield is a robust motivator for traders. For the crypto-curious, DeFi’s excessive charges could be simple to put in writing off as coming from “pretend governance tokens”. However yield can be pure, as demonstrated by the attraction of 5% danger free in TradFi final yr. DeFi lenders could possibly be the important thing to onboarding extra informal DeFi customers if they will supply sustainable yield. A major quantity of capital might circulation from CeFi crypto customers alone, if yields are enticing.

Probably the most promising facet of DeFi lenders is that they’re creating wealth. MakerDAO might attain $200m in income this yr, with bills beneath $30m. Aave, in the meantime, may even see $35m in yearly income, whereas Compound might surpass $15m. These are going to the DAOs and could be reinvested into development and protocol improvement. Allocating that capital to entities which might be aligned on a technique and mission would require efficient and environment friendly governance. Lending protocols have professionalized their danger administration by means of service suppliers like Gauntlet, Block Analitica, and Chaos Labs, however they’ll want to increase this focus to different governance areas going ahead. Lending protocols are advanced and require coordination, however the previous couple of years have confirmed that the mannequin really can scale and be a sustainable enterprise mannequin.

-

Bloxroute product to assist validators navigate consensus timing video games Hyperlink

-

What it takes to be a block builder Hyperlink

-

Flash market making MEV protocol Aori launches on Arbitrum Hyperlink

-

Paypal participates in CRV bribe governance for its stablecoin Hyperlink

-

Khlani Community goals to be decentralized solver infrastructure layer Hyperlink

-

Orderflow.artwork Hyperlink

-

Optimism RetroPGF Spherical 3 recipients Hyperlink

-

Synthetix launches v3 perpetuals on Base Hyperlink

That’s it! Suggestions appreciated. Simply hit reply. Written in Nashville, the place I’m nonetheless recovering from our massive snow final week.

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov and Monetary Content material Lab. I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO. All content material is for informational functions and isn’t supposed as funding recommendation.