Get the perfect data-driven crypto insights and evaluation each week:

By: Matías Andrade

Key Takeaways:

-

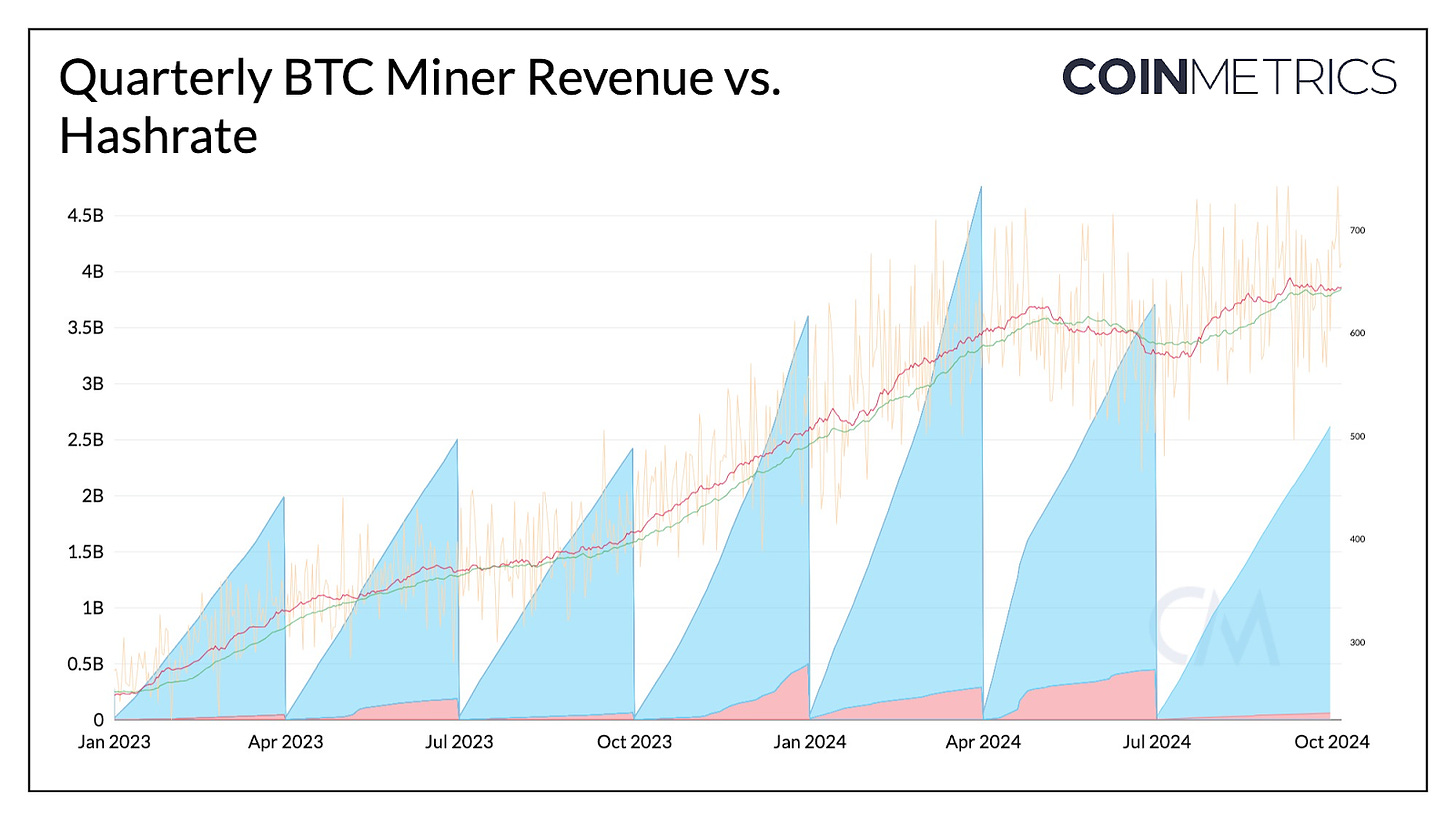

Bitcoin mining revenues declined to $2.5B in Q3 2024, down from $3.7B within the earlier quarter, primarily as a result of April 2024 halving occasion.

-

Transaction charges remained subdued all through Q3, with a short spike across the halving date adopted by persistently low ranges all through Q3, driving miners to contemplate various income sources.

-

Miners are exploring various enterprise fashions, together with renting out rackspace for generative AI and even tokenizing whiskey barrels, to stay aggressive within the altering panorama.

-

Empty blocks proceed to be prevalent, with some mining swimming pools like SpiderPool producing an anomalously-high proportion of empty blocks in comparison with different mining swimming pools.

As we enter Q3 2024, the State of the Community report revisits the Bitcoin mining panorama, persevering with our sequence of quarterly updates on the state of proof-of-work stakeholders. The aftermath of the Bitcoin Halving in April continues to reverberate via the trade, with mining margins going through persistent stress as a result of a comparatively secure BTC value and a subdued price market. Our report delves deeper into every of those components, offering a complete survey of the mining sector’s well being past mere BTC value efficiency.

The third quarter of 2024 has confirmed to be a very difficult interval for Bitcoin miners, with the sector grappling with the lingering results of the April 2024 block reward halving. The discount in block issuance income has put vital stress on mining margins, compounding the woes of an already subdued price market.

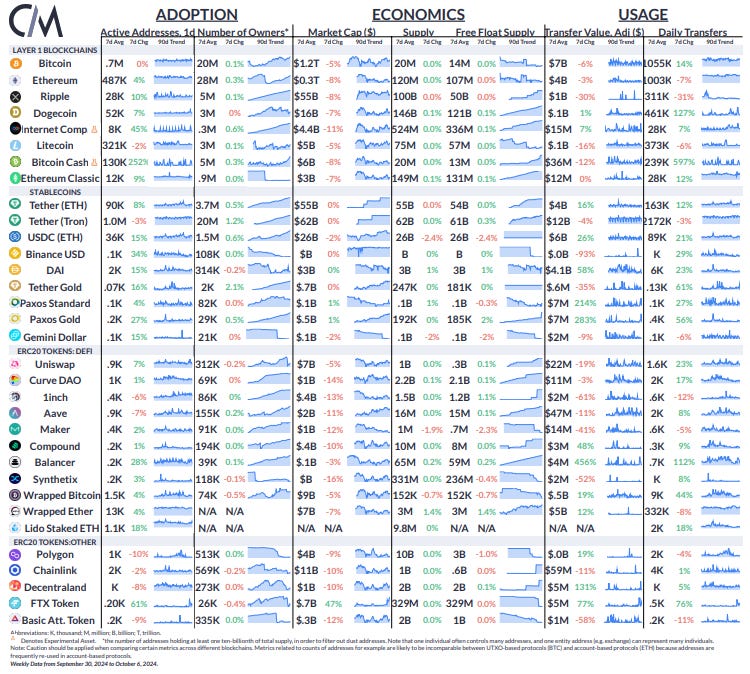

Supply: Coin Metrics Community Knowledge Professional

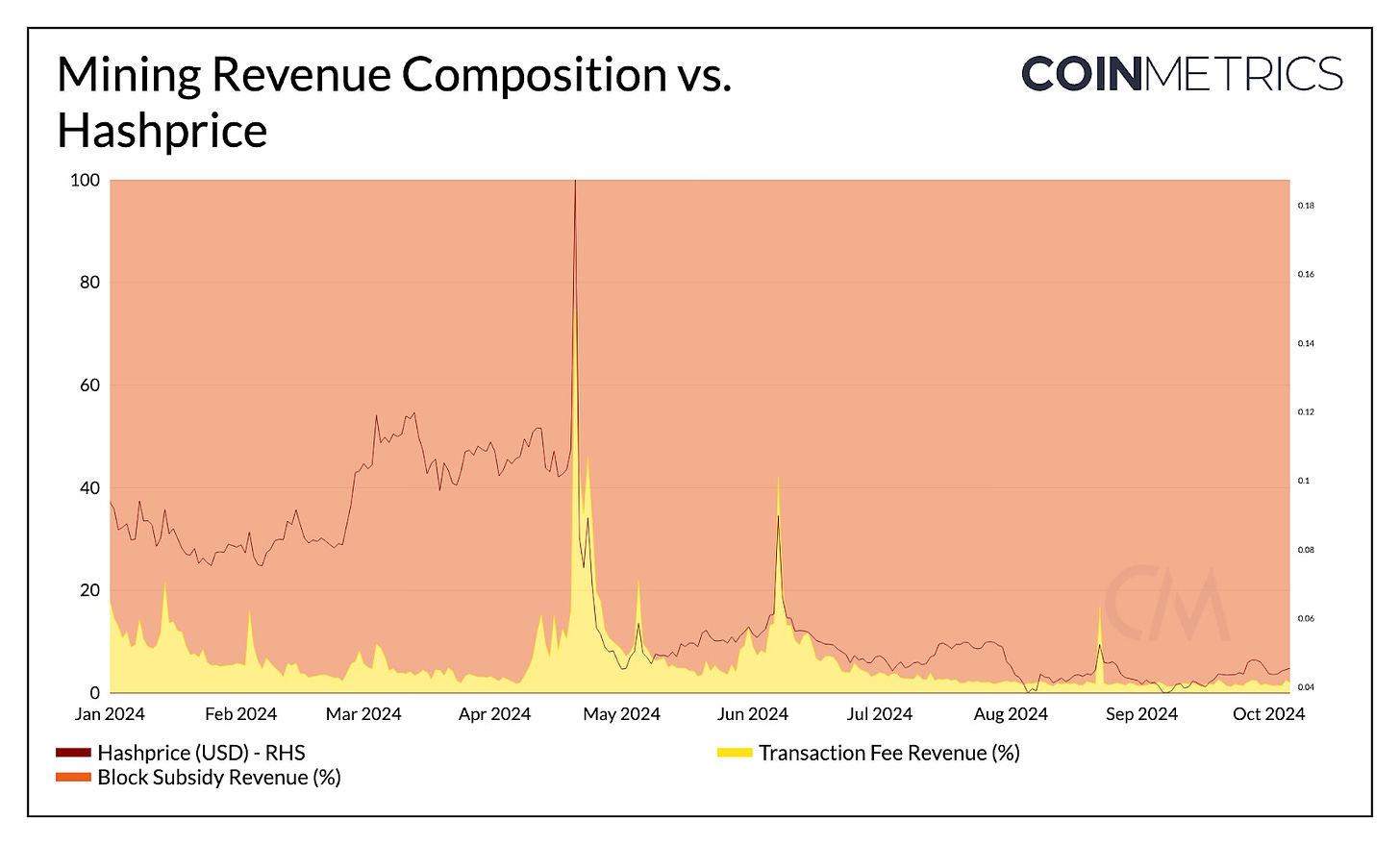

Knowledge from our evaluation signifies that fee-based income, which had beforehand offered a helpful supplementary earnings stream for miners, has remained among the many weakest noticed over the previous a number of quarters. That is evident within the chart under, the place we will see a short spike across the halving date that resulted from the flurry of exercise round attempting to mine helpful halving sats and create inscriptions on this block, whereas subduing nearly fully from July via September.

Supply: Coin Metrics Community Knowledge Professional

This pattern has compelled miners to more and more depend on various income sources, equivalent to transaction acceleration providers and diversification into adjoining infrastructure alternatives—together with renting out rackspace for generative AI or, in a very attention-grabbing case, tokenize whiskey barrels—whereas conserving operations lean and environment friendly.

Regardless of these headwinds, the general mining income image is just not fully bleak. Block rewards, whereas lowered from the pre-halving ranges, have remained comparatively robust, contributing roughly $2.5B in revenues, in comparison with $3.7B final quarter.

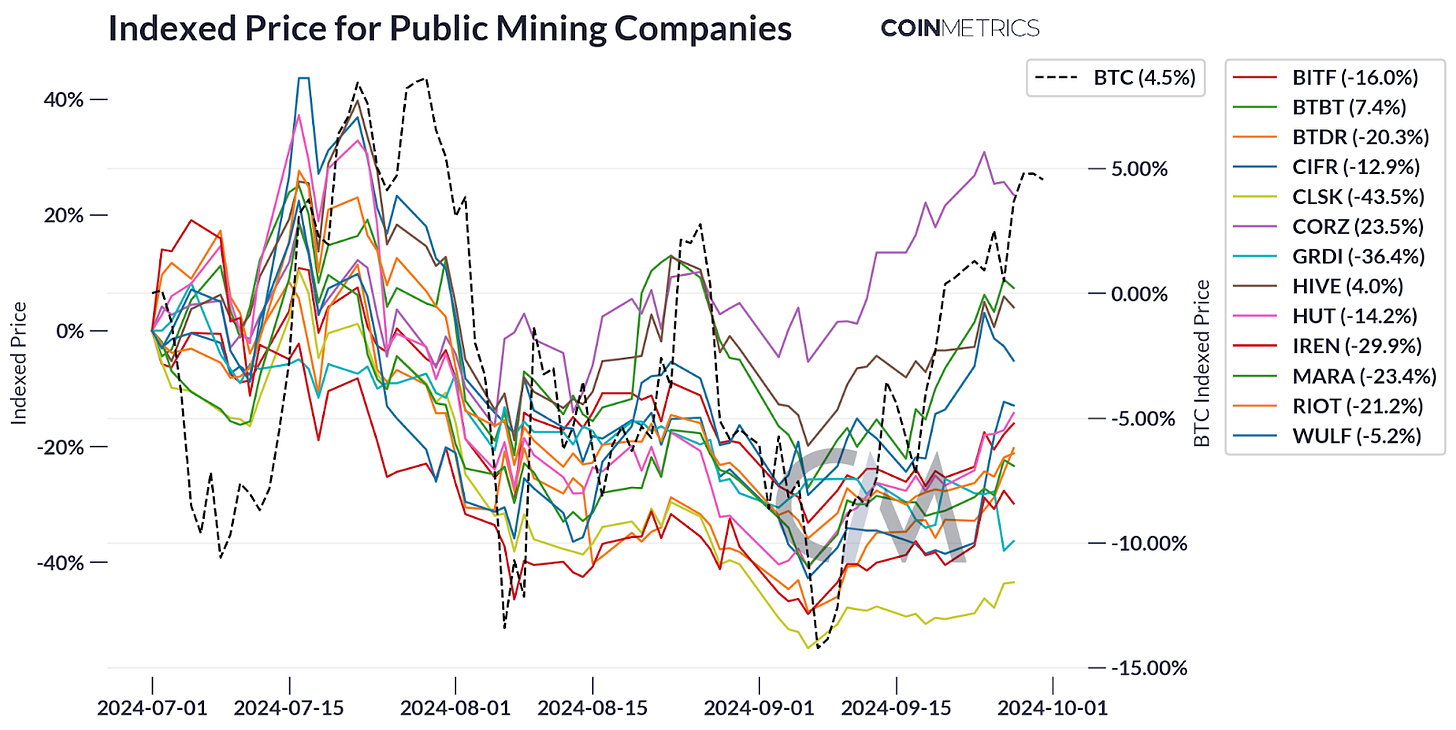

Supply: Coin Metrics Reference Charges & Yahoo Finance

In response to those challenges, many mining operators are pivoting their enterprise fashions, diversifying past pure-play mining. We’re seeing a pattern of miners reinventing themselves as generalized infrastructure suppliers, actively pursuing internet hosting contracts for power-hungry AI purposes. This strategic shift displays the trade’s adaptability within the face of adjusting market dynamics.

Concurrently, the relentless march of technological progress continues unabated within the chip effectivity enviornment. These developments are forcing miners to confront a essential determination: whether or not to stick with growing old ASIC {hardware} or undertake complete fleet upgrades. The selection between these choices might considerably affect particular person miners’ competitiveness and profitability within the coming quarters.

One fascinating facet about Bitcoin mining operations is the phenomenon of the empty block. One can contemplate empty blocks to be considerably counterintuitive, since a miner that succeeds in mining an empty block is forfeiting any revenues that would come from charges which are paid by customers that want to embody their transaction within the block. So, why does this occur?

First, we have now to know that bitcoin mining is a really aggressive trade. No bitcoin miner value its salt goes to depart income on the desk except they’ve superb causes to take action. What’s value contemplating right here is the usage of block templates within the technique of mining blocks. A block template is used to optimize transactions in a block as to maximise income. One of many issues is that making a block template can take time, so one of many theories behind these empty blocks is that these are blocks which are mined quickly one after one other—since mining bitcoin is a random course of, typically miners are sure to “get fortunate” and occur to create a brand new block quickly after the earlier one was discovered and distributed.

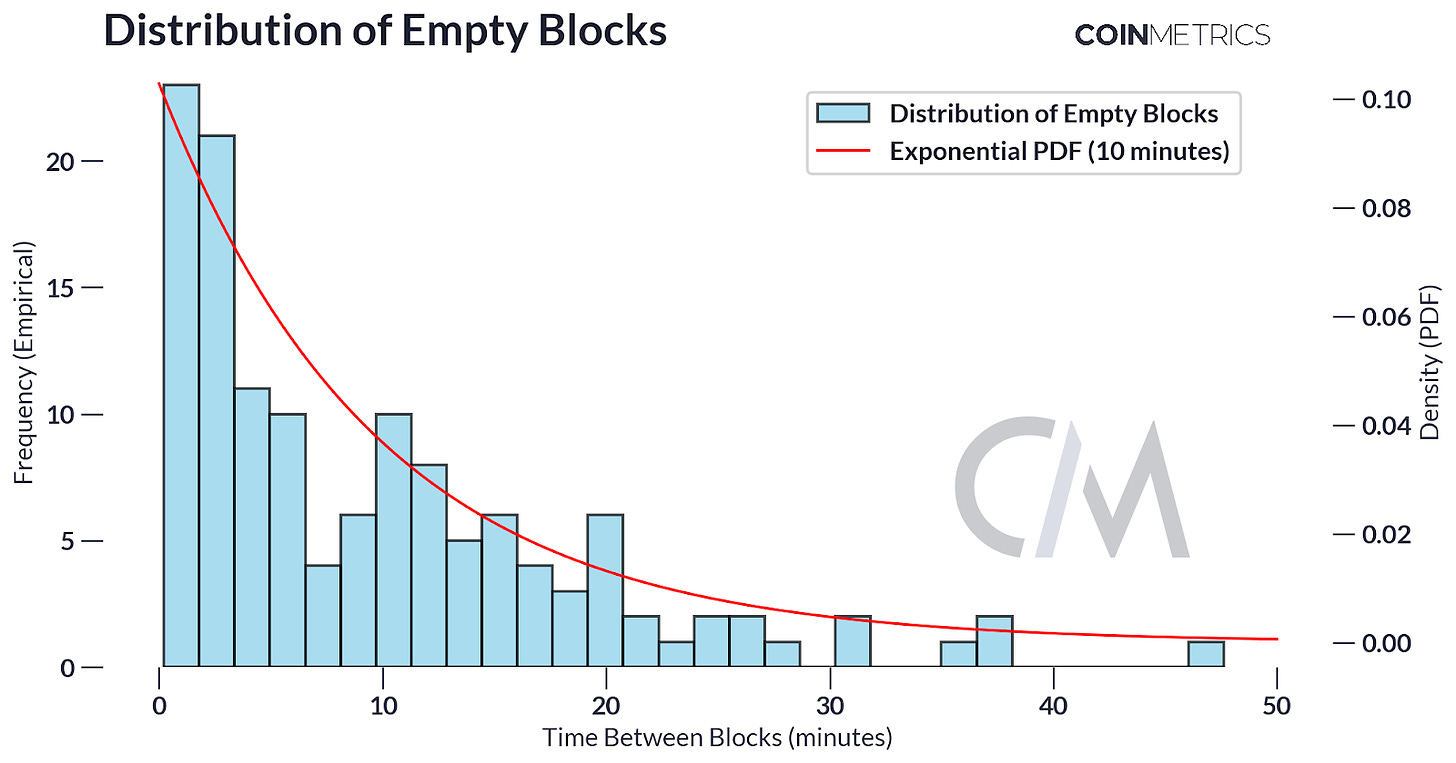

Nonetheless, if we check out the distribution of Bitcoin block occasions in 2024, we discover that it’s fairly just like the exponential distribution—simply as we might count on, provided that the time between blocks might be modeled as a Poisson course of with a imply time between blocks of roughly 10 minutes—with empty blocks being registered at the same time as excessive as 47 minutes. Right here we’re utilizing Coin Metrics’ database consensus_time, which avoids the problems that come from miners inaccuracy in self-reported block occasions.

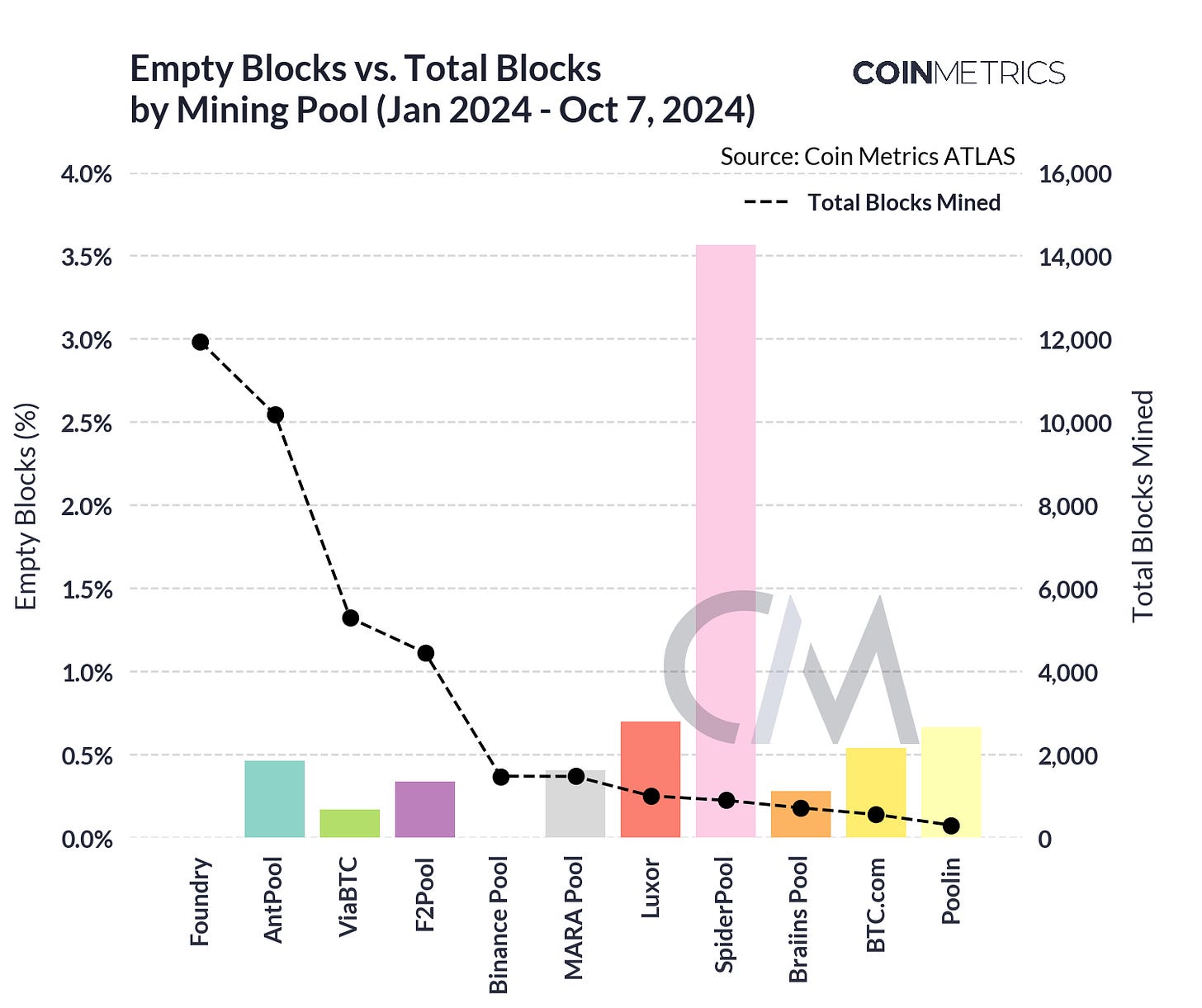

This makes us doubt that the explanation these blocks are empty is usually because miners don’t have time to substitute a block template as we hypothesized earlier. Certainly, if we glance deeper and try which swimming pools are literally producing these empty blocks we start to see a sample, with some swimming pools like Foundry and Binance Pool exhibiting zero empty blocks within the chosen time interval, whereas others (with SpiderPool most evident) have a comparatively giant variety of empty blocks.

So how can we clarify this? There are numerous theories, however one which appears to clarify this whereas permitting the truth that swimming pools search to maximise their income (and thus embody transactions with suggestions, if potential) is that if swimming pools simply mined a block, it’s of their curiosity to start work on a block with out template in order to start out as quickly as potential after broadcasting the earlier answer. It’s because blocks take round 15 seconds to propagate all through the bitcoin community, which ought to give the pool that final issued a block a head begin on discovering the subsequent block.

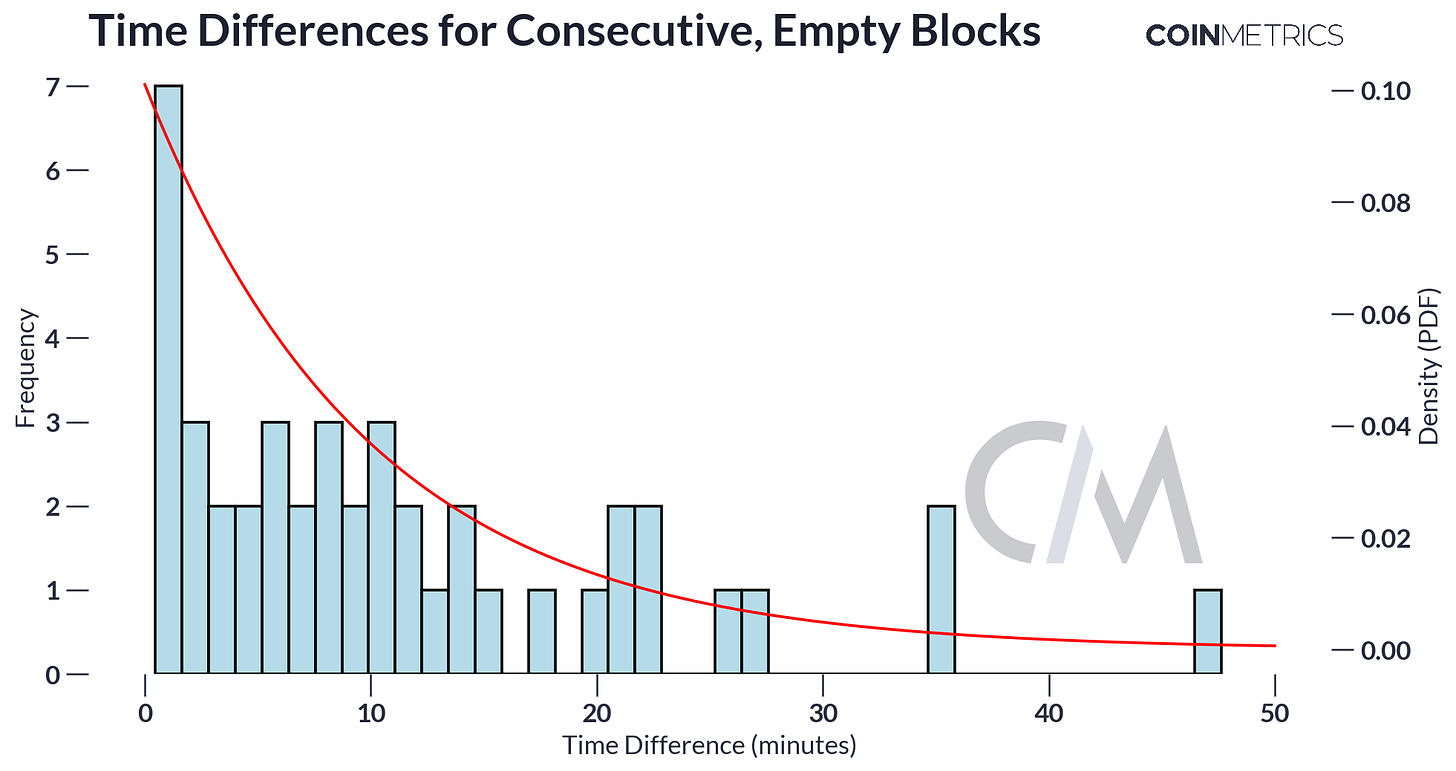

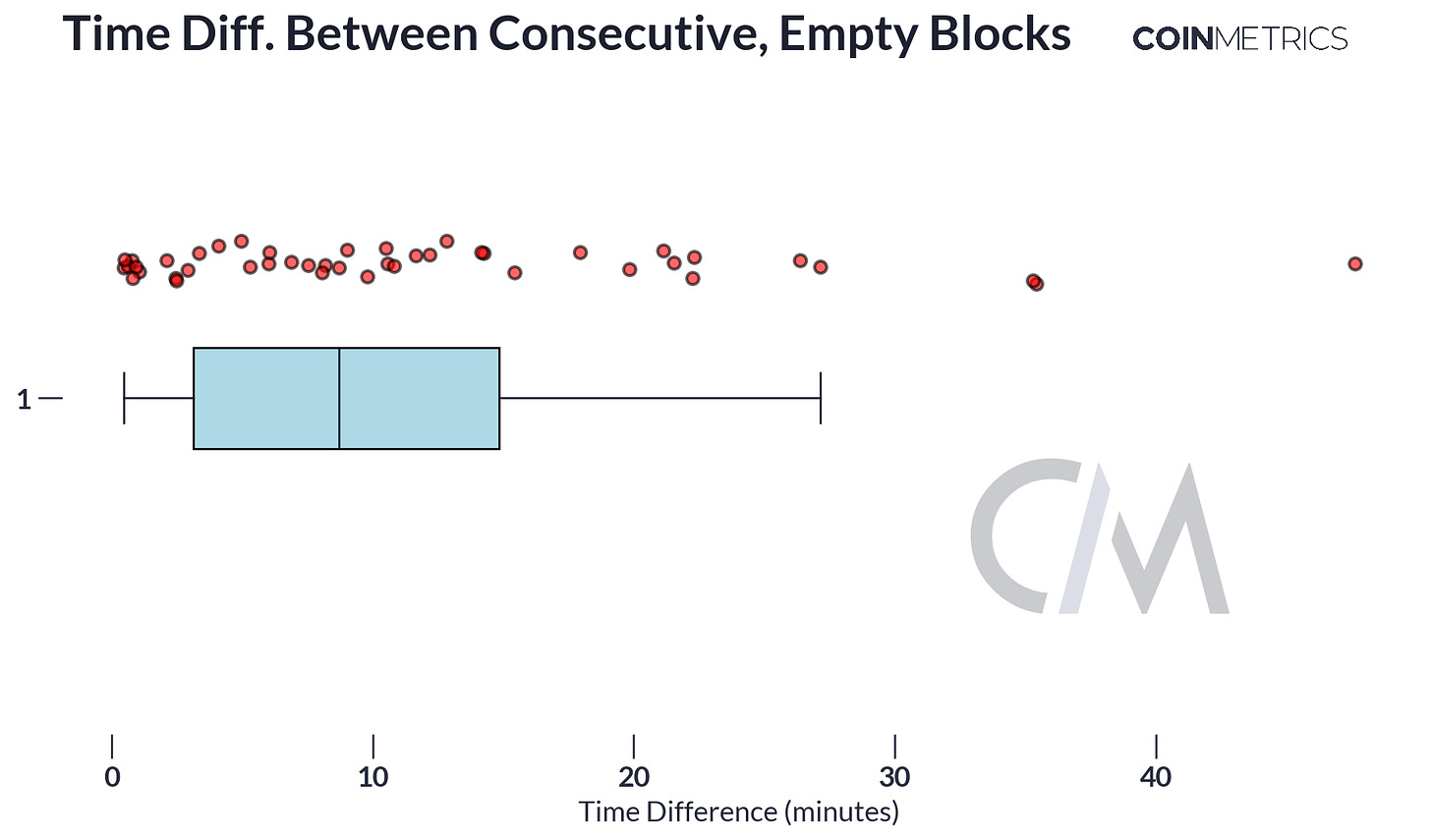

To check that idea, we will check out the time interval between consecutive blocks (that’s, blocks consecutively mined by the identical pool) and evaluate it towards the theoretical distribution of block occasions to see if a larger proportion of consecutive, empty blocks are broadcast sooner than anticipated, this time increasing the info set to look again beginning on 2022.

Taking a look at these charts, these are usually not the outcomes we might count on if miners had been ignoring transactions solely in the course of the first few seconds, since this distribution is kind of just like the anticipated distribution with the central tendency round 10 minutes, with a substantial variety of such blocks noticed past 10 minutes. This appears to contradict the speculation that miners usually tend to produce empty blocks within the first few seconds after mining a block. It is essential to notice that this chart relies on an expanded dataset that goes again to 2022 and contains 44 blocks, since there are solely 8 consecutive, empty blocks mined in 2024. Nonetheless, additional analysis can be essential to make any definitive statements in regards to the patterns of consecutive empty block mining.

The Q3 2024 Bitcoin mining panorama displays an trade in transition, grappling with the aftermath of the April halving. Miners face vital challenges, together with lowered block rewards and persistently low transaction charges. In response, many are diversifying their operations, exploring various income streams, and reassessing their {hardware} methods.

The phenomenon of empty blocks continues to puzzle analysts, with notable disparities amongst mining swimming pools. This pattern, together with the continued debate over optimum mining methods, underscores the advanced dynamics at play within the Bitcoin ecosystem.

Because the trade evolves, miners are demonstrating resilience and adaptableness. Their pivot in direction of changing into generalized infrastructure suppliers and their exploration of novel enterprise fashions sign a sector that’s actively reinventing itself within the face of adjusting market situations. The approaching quarters will possible see additional improvements as miners try to keep up profitability and relevance in an more and more aggressive panorama.

Supply: Coin Metrics Community Knowledge Professional

The market capitalization of Bitcoin (BTC) and Ethereum (ETH) slid by 5% and eight% respectively over the previous week, amid fears of escalating tensions within the middle-east. FTX token rose by 47% in market cap with the bankrupt trade’s remaining $16B in belongings to be redistributed to collectors within the close to future.

This week’s updates from the Coin Metrics group:

-

We expanded market information help for the Curve decentralized trade (DEX).

-

Comply with Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As at all times, when you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution is just not permitted with out consent. This article doesn’t represent funding recommendation and is for informational functions solely and you shouldn’t make an funding determination on the premise of this info. The publication is offered “as is” and Coin Metrics won’t be accountable for any loss or harm ensuing from info obtained from the publication.