Get the very best data-driven crypto insights and evaluation each week:

By: Tanay Ved

-

Stablecoin flows have turned constructive, pushing whole provide above 160B in direction of record-highs. This implies enhancing market liquidity and elevated capital obtainable for deployment within the crypto ecosystem.

-

The stablecoin panorama continues to broaden in range, use circumstances, and danger profiles, from fiat-collateralized and crypto-backed to interest-bearing and protocol-native stablecoins.

-

With stablecoin collateral more and more composed of U.S greenback equivalents and real-world property (RWAs), adjustments within the rate of interest setting might influence profitability and attractiveness of varied stablecoins.

On this concern of Coin Metrics’ State of the Community, we discover the varied stablecoin panorama, specializing in peg mechanisms, approaches to collateral composition, and sources of yield amid a altering interest-rate setting.

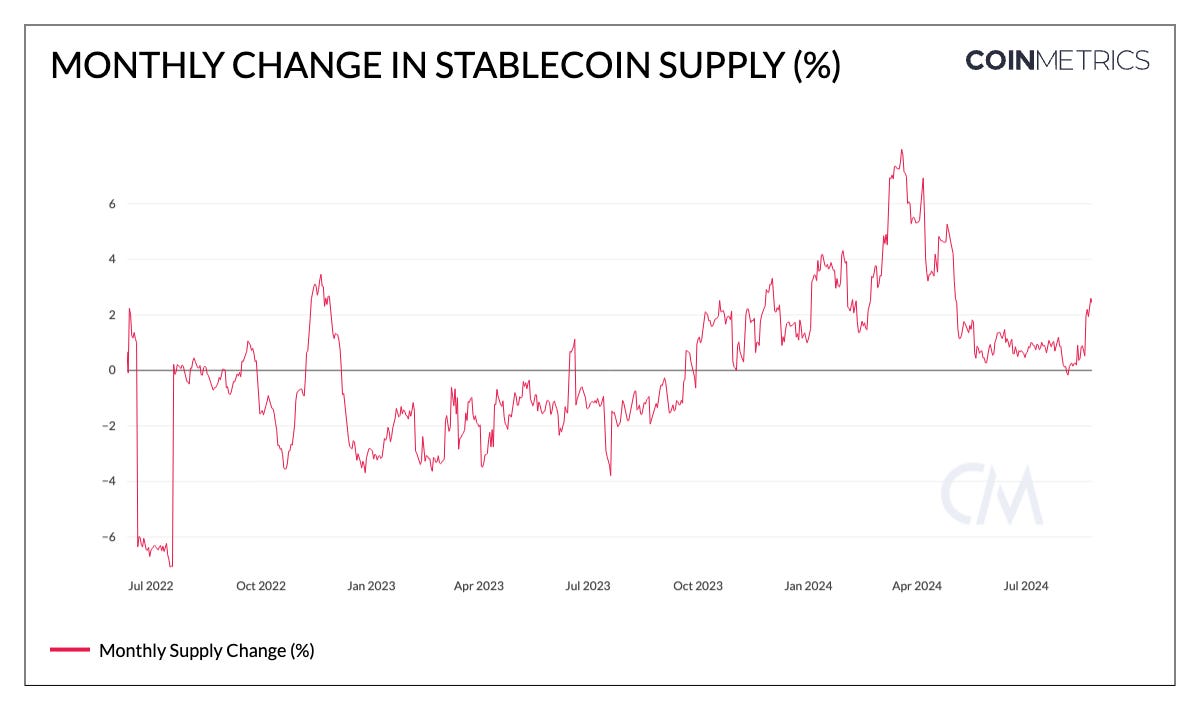

After a interval of consolidation in Q2, combination stablecoin provide has trended constructive in August—suggesting an setting with elevated liquidity and potential for capital flows into the ecosystem. That is mirrored within the chart under, illustrating the month-to-month change in stablecoin provide.

Supply: Coin Metrics Community Information Professional

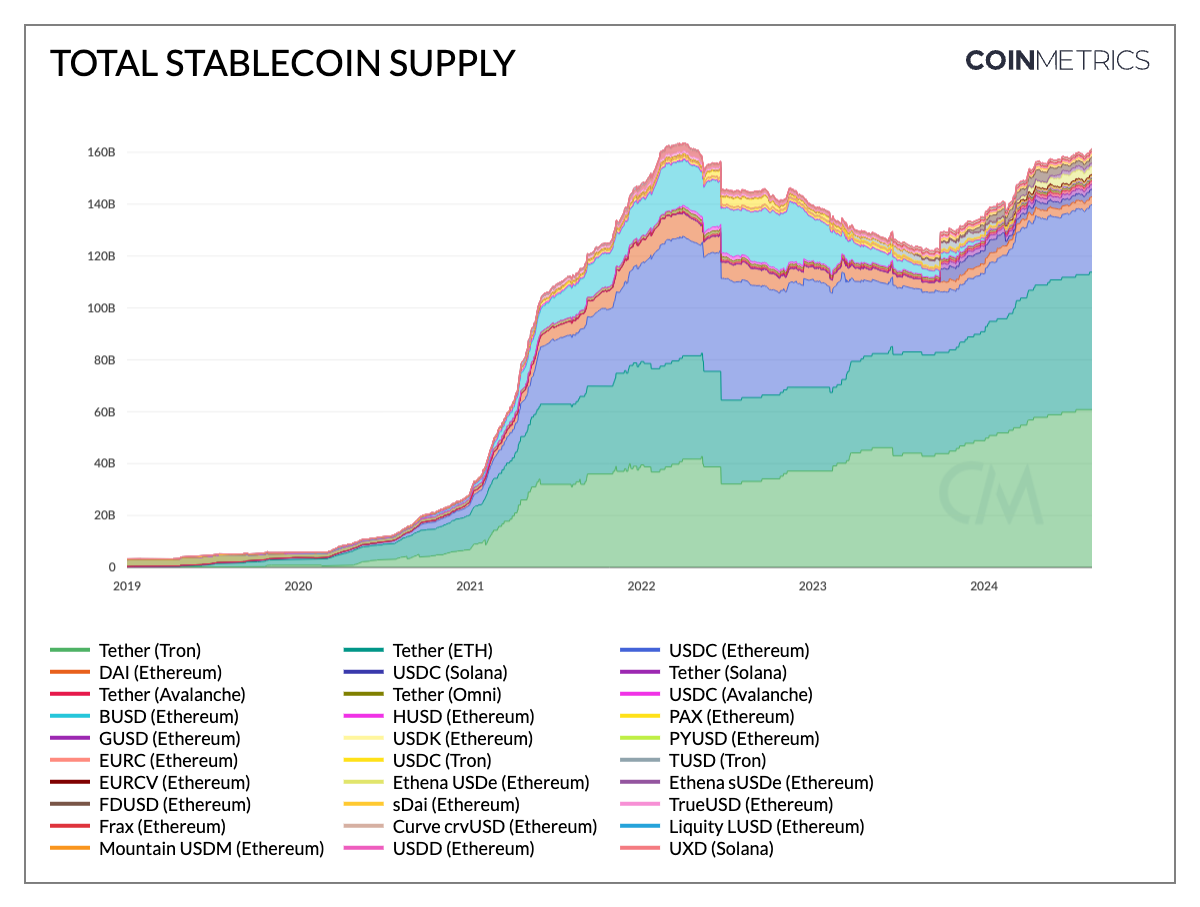

Because of this, close to 161B, the mixture provide of stablecoins is as soon as once more approaching record-highs. Tether mantains a market share larger than 70%, with USDT on Ethereum (+28%) and Tron (+26%) rising over the 12 months to a complete provide of $119B throughout networks together with Solana and Avalanche. In the meantime, Circle’s USDC provide has grown to ~$34B because it proliferates throughout Solana and Ethereum layer-2’s like Base. Whereas DAI has trended decrease in direction of $3.1B, the tokenized model of DAI deposited into Maker’s Dai Financial savings Price, sDAI (financial savings DAI), has grown to $1.34B.

Newer stablecoin entrants have additionally gained traction: First Digital USD (FDUSD) on Ethereum grew by 56% in August to succeed in $3.07B, whereas Ethena’s USDe ($2.96B) and sUSDe ($1.16B) hit a mixed whole of $4.12B. Notably, PayPal’s PYUSD has seen speedy development on Solana, surpassing its Ethereum provide of $364M to succeed in a $1B whole.

Supply: Coin Metrics Community Information Professional

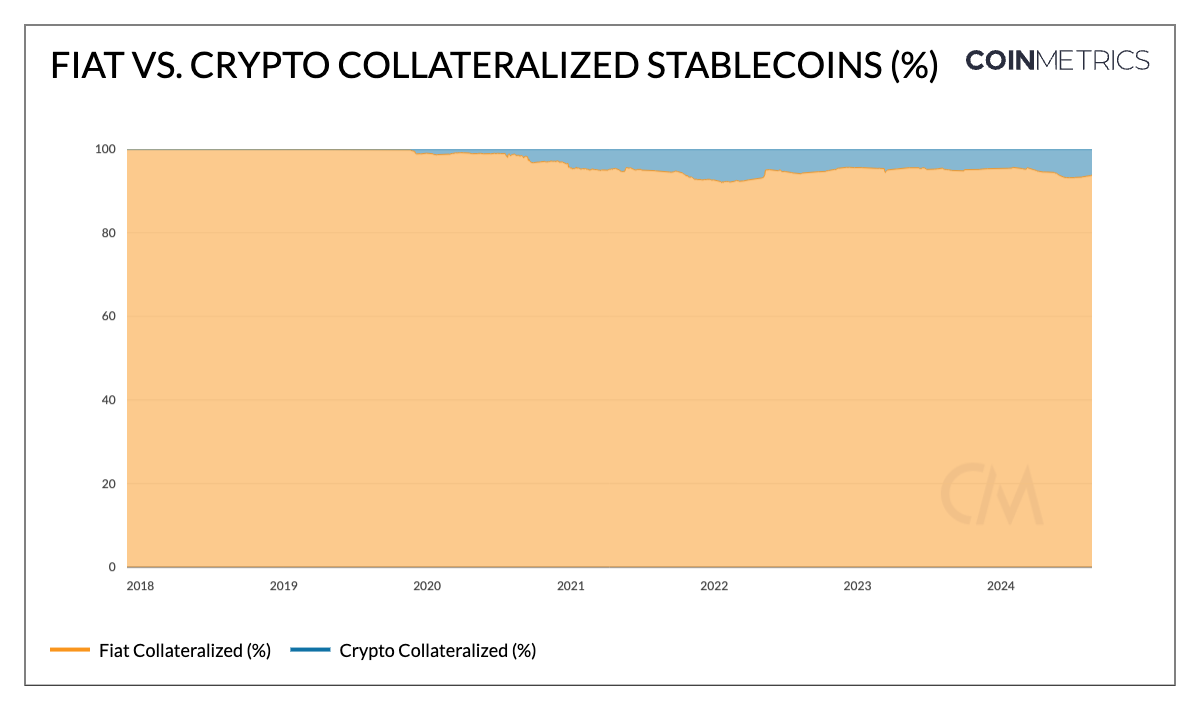

To enhance utility as a retailer of worth, a wide range of asset composition or collateralization approaches have arisen within the stablecoin ecosystem, influencing the chance profile, operational traits and regulatory outlook of those merchandise. Greater than 90% of excellent stablecoin provide consists of these collateralized by fiat currencies, corresponding to Circle’s USDC, Tether’s USDT and PayPal’s PYUSD, backed by the US Greenback and cash-equivalents property, tying their stability to the standard monetary system.

Others, like MakerDAO’s DAI and sDAI, present an alternative choice to conventional items of account, backed by a portfolio of crypto-assets and real-world property (RWAs) like non-public credit score loans or treasuries. 45% of Dai is backed by crypto-assets, whereas 40% is collateralized by RWAs.

Supply: Coin Metrics Community Information Professional

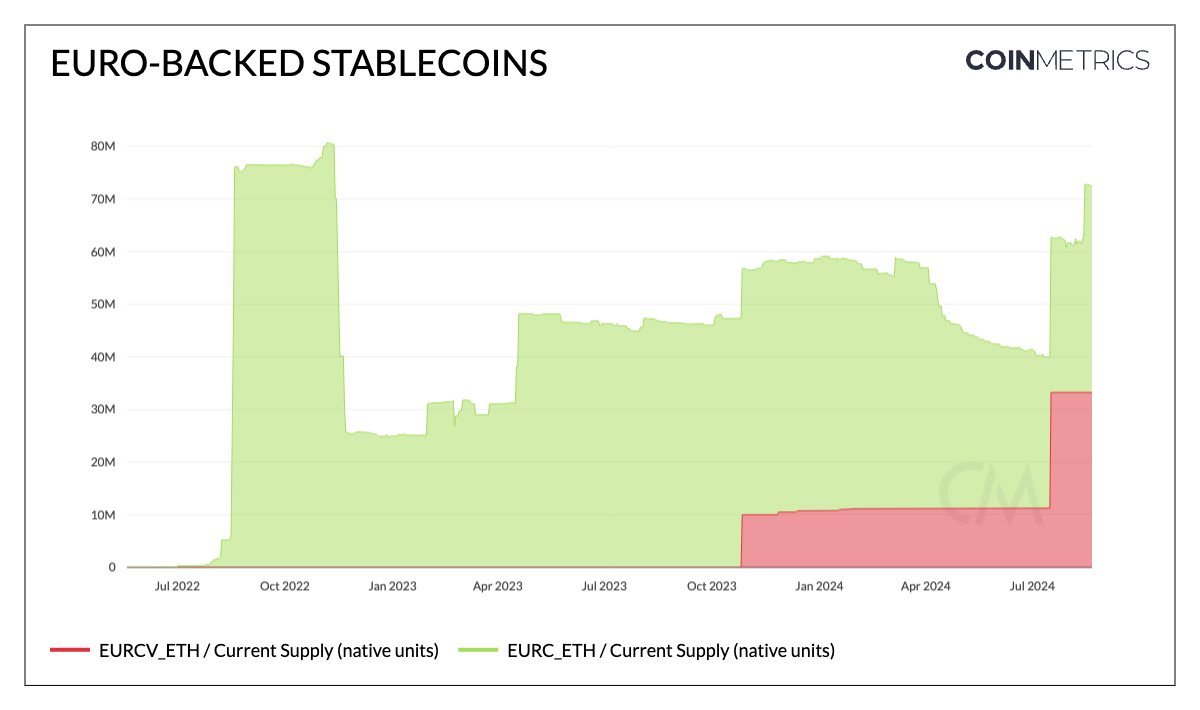

On account of the US Greenback’s standing as the worldwide reserve forex and ubiquitous demand in rising markets, the availability of USD-pegged stablecoins far exceeds different items of account. Nonetheless, not all stablecoins are pegged to the U.S. greenback. With the European Union’s progress on regulating digital property by Markets in Cryptoassets (MiCA) Rules, Euro-backed stablecoins have seen a lift in adoption. With a present provide of ~40M, Circle’s EURC is the one Euro-pegged stablecoin compliant to MiCA rules. As extra establishments deploy different pegged property corresponding to Société Générale’s EURCV wholesale stablecoin, different pegs might allow foreign exchange markets to broaden leveraging on-chain infrastructure.

As totally different jurisdictions develop their regulatory frameworks for digital property, stablecoins pegged to native currencies can facilitate transactions for people and companies inside and throughout regional economies, whereas complying with regulatory necessities.

Supply: Coin Metrics Community Information Professional

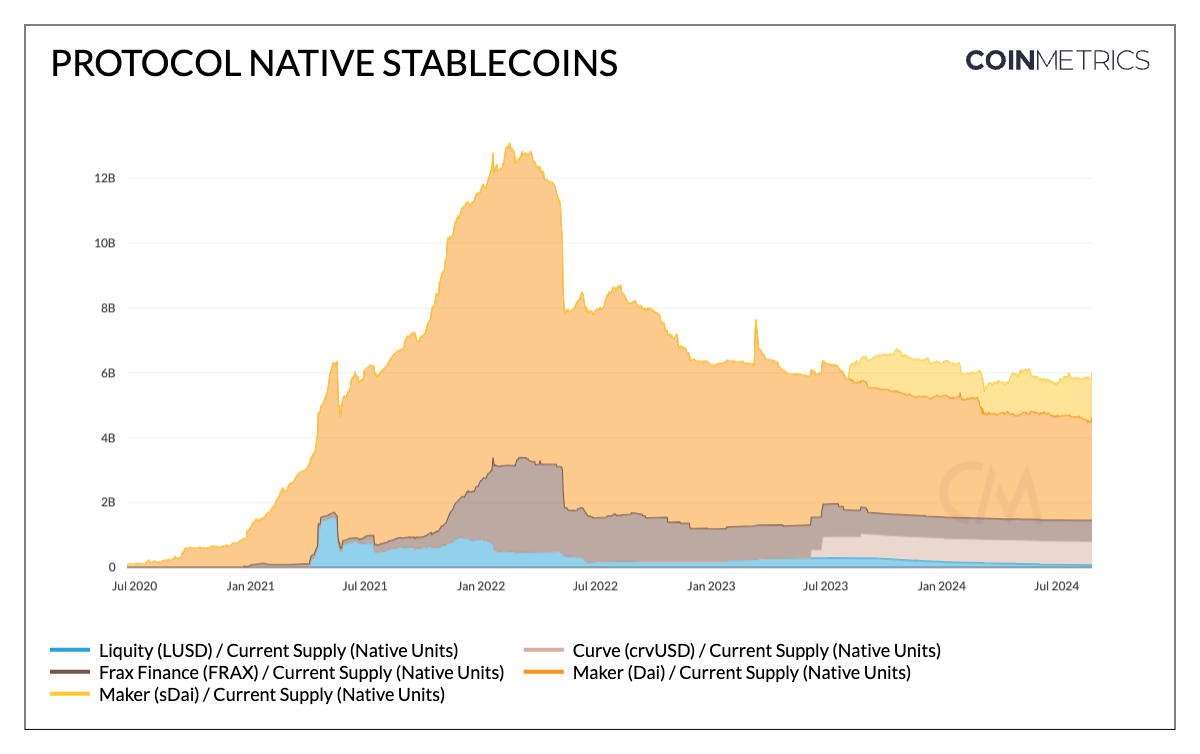

Stablecoins have grow to be synergistic to the enterprise fashions and performance of decentralized finance (DeFi) protocols. Following Maker’s success with DAI, many DeFi protocols have launched their very own native stablecoins tailor-made to their ecosystems. Cash market protocols like Aave (GHO), DEXs like Curve Finance (crvUSD) and collateralized-debt protocols (CDPs) like Maker & SparkLend (DAI) and Liquity (LUSD) characteristic native stablecoins, with mechanisms for sustaining worth stability and aiding operations inside their respective ecosystems.

They facilitate a variety of monetary companies like funds, borrowing, buying and selling, liquidity provision and yield methods. A good portion of conventional stablecoin provide additionally resides in Ethereum sensible contracts: 27% of USDC, 20% of USDT, and notably, over 50% of PYUSD —serving as steady collateral on lending protocols and quote pairs on decentralized exchanges (DEXs). Moreover, with the proliferation of tokenized treasuries and real-world property (RWAs) like BlackRock’s BUIDL and Mountain Protocols USDM, DeFi protocols are starting to include conventional monetary property into their ecosystems, bridging the hole between DeFi and TradFi.

Supply: Coin Metrics Community Information Professional

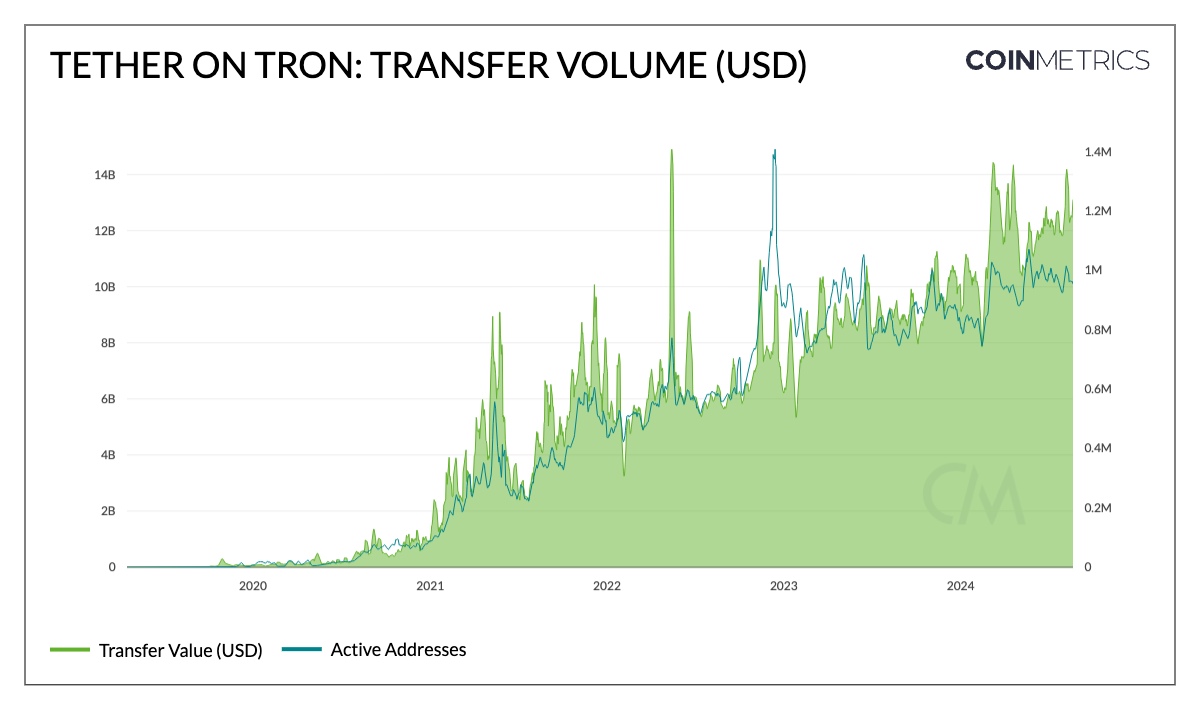

Tether (USDT) on the Tron community is a main instance of a stablecoin that has established a product-market match. It has displayed sturdy adoption and utilization as a medium of trade and retailer of worth throughout a variety of metrics. Not solely does it boast the most important present provide of 118B with ~61B on Tron and ~53B on Ethereum (along with Solana & Avalanche), however information the best switch volumes and counts relative to different stablecoins. Tether’s (adjusted) switch quantity on Tron is nearing a report $14B, with near 1M energetic addresses.

This utilization is propelled by a mixture of Tron’s low transaction charges, enabling decrease worth funds and remittances with low median switch sizes and USDTs deep liquidity throughout exchanges, facilitating transactional actions as a quote-asset. Due to this fact, it offers the means to guard financial savings, search financial stability and democratizes entry to banking infrastructure, enabling peer-to-peer transactions of varied functions—particularly in rising markets.

Supply: Coin Metrics Community Information Professional

Low charges on networks like Solana and Ethereum layer-2s, mixed with the distribution of companies like Coinbase and simpler onboarding by smart-wallets or level of sale techniques, provide a possibility for stablecoins to ascertain a robust base throughout these networks and across the globe.

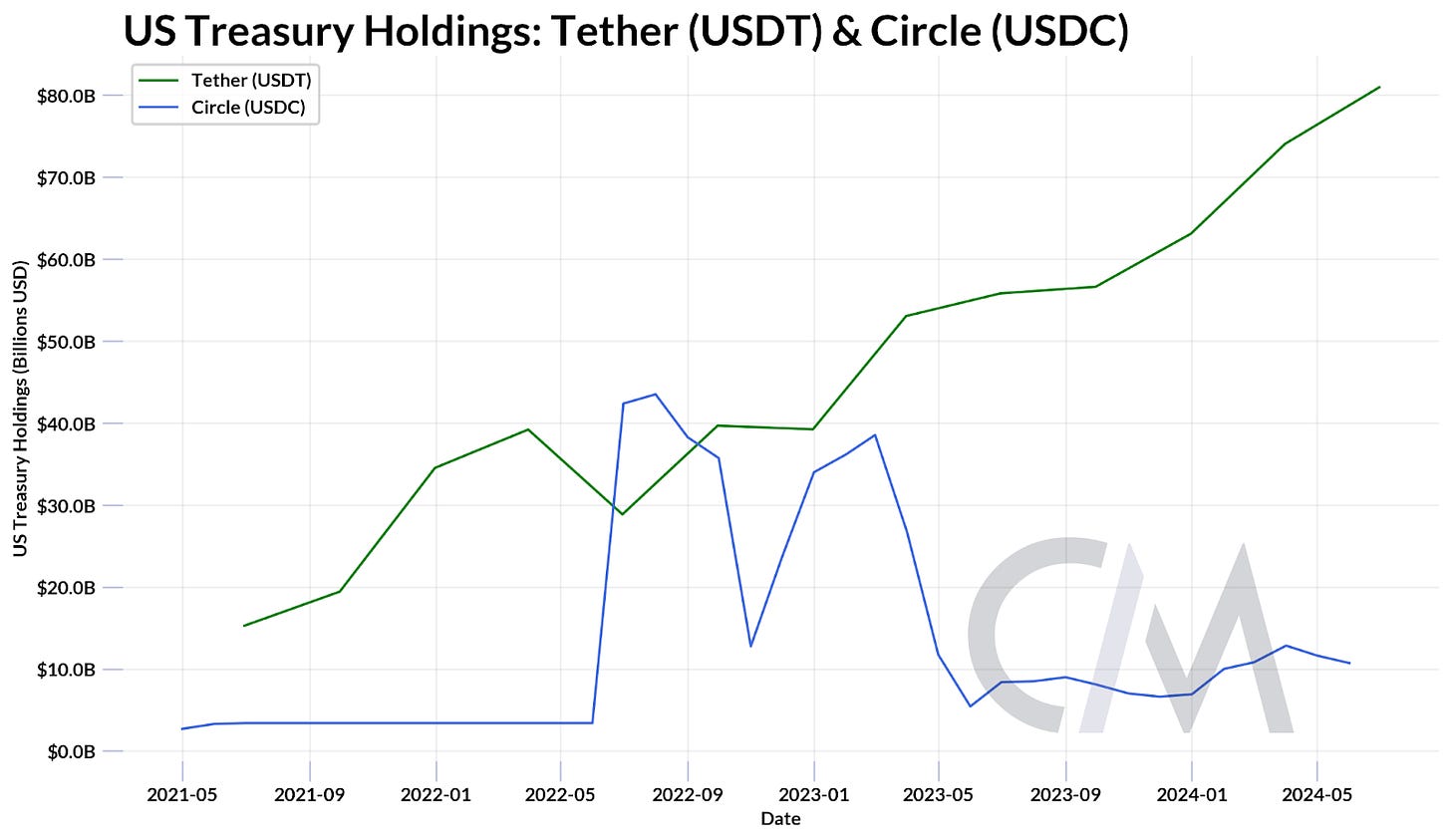

Stablecoins are primarily collateralized by U.S {Dollars} or equivalents like money or treasury payments. Most conventional stablecoins (e.g., USDT, USDC, PYUSD) retain curiosity earned on their collateral moderately than passing it to token-holders. Tether’s Q2 attestation exemplifies this, reporting $5.4B in earnings partly from direct and oblique possession of U.S. Treasury holdings, which reached a brand new excessive of $97.6B. This introduced their publicity to treasuries above Germany, the United Arab Emirates, and Australia—rating 18th out of nations holding U.S debt.

Supply: Tether & Circle Attestations

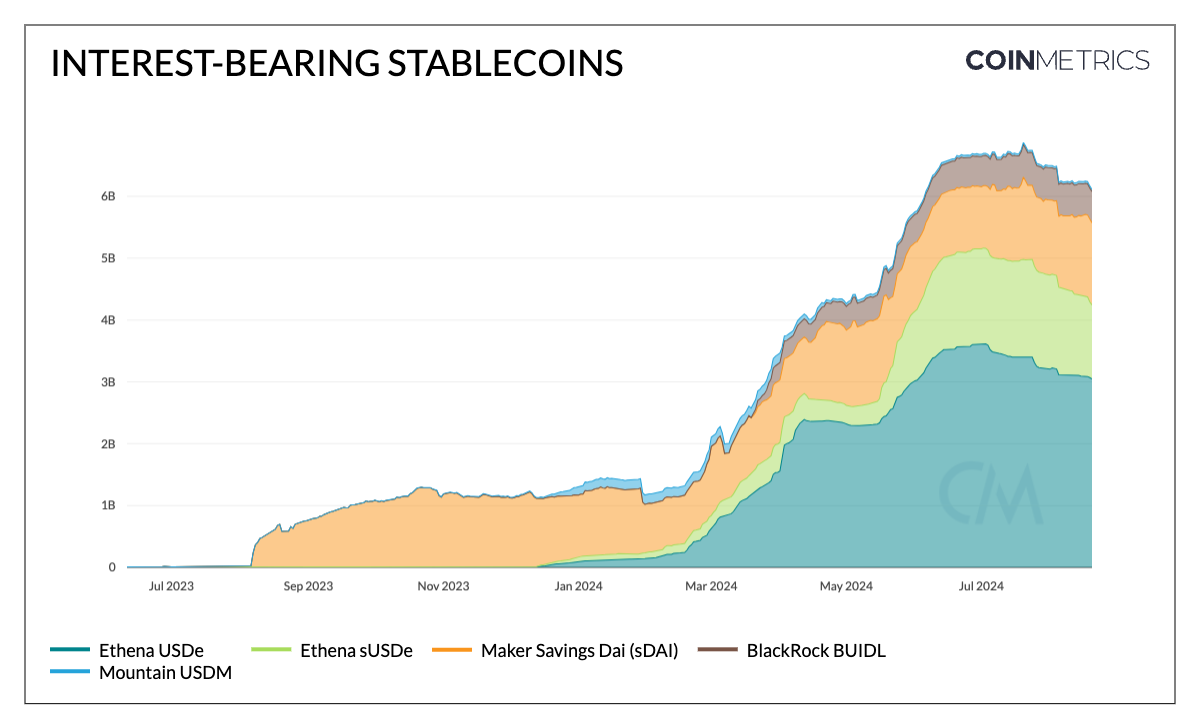

Nonetheless, the post-2021 rise in federal funds and world rates of interest launched a possibility value for pure U.S. greenback publicity. This sparked the emergence of interest-bearing stablecoins, collateralized by short-term U.S. treasury payments, cash market devices, and different real-world property (RWAs), which handed yield to holders.

Mountain Protocol’s USDM, as an example, derives its yield from a reserve composition of treasury payments, accruing curiosity by a rebasing mechanism. Maker protocol’s financial savings DAI (sDAI), takes one other strategy, accumulating curiosity from DAI deposited within the DAI Financial savings Price (DSR). This yield originates from a basket of real-world property (RWAs), crypto-assets, and extra reserves backing DAI, carried out by an ERC-4626 vault normal. These merchandise basically operate as crypto financial savings accounts.

The combination of RWAs with public blockchains has additionally paved the best way for institutional-grade choices like BlackRock’s BUIDL, a tokenized cash market fund issued by Securitize that makes use of a USDC redemption fund to supply a steady, 24/7 offramp into stablecoins. Whereas tokenized treasury merchandise depend on such off-chain sources of yield, others like Ethena’s USDe generates yield by a foundation commerce involving delta-neutral hedging (lengthy place in staked ETH or different collateral and a corresponding quick place in perpetual futures contracts.)

Supply: Coin Metrics Community Information Professional

Nonetheless, Federal Reserve Chair Jerome Powell’s suggestion of rate of interest cuts on the 2024 Jackson Gap symposium raises questions on stablecoins in a low interest-rate setting. Whereas fiat collateralized stablecoin issuers might even see lowered profitability as a result of interest-rate sensitivity of their enterprise fashions and yield-bearing stablecoins would possibly lose a few of their attraction as a result of diminishing returns, a risk-on setting might deliver new capital inflows to the crypto ecosystem. This inflow, pushed by traders searching for to capitalize on decrease borrowing prices and better asset valuations, might probably offset these results by elevated demand for stablecoins as a medium of trade.

The latest development in stablecoin provide, pushing in direction of new highs, indicators growing liquidity and capital availability within the crypto ecosystem. Because the panorama continues to evolve, we’re witnessing stablecoins optimizing for various use circumstances and danger profiles with numerous collateralization strategies from RWAs to crypto-assets and modern approaches just like the tokenized foundation commerce. As we glance forward, navigating regulatory hurdles and a low interest-rate setting introduces each alternatives and challenges, probably reshaping enterprise fashions, consumer preferences and the general aggressive panorama of this burgeoning sector.

This week’s updates from the Coin Metrics workforce:

As at all times, if in case you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.