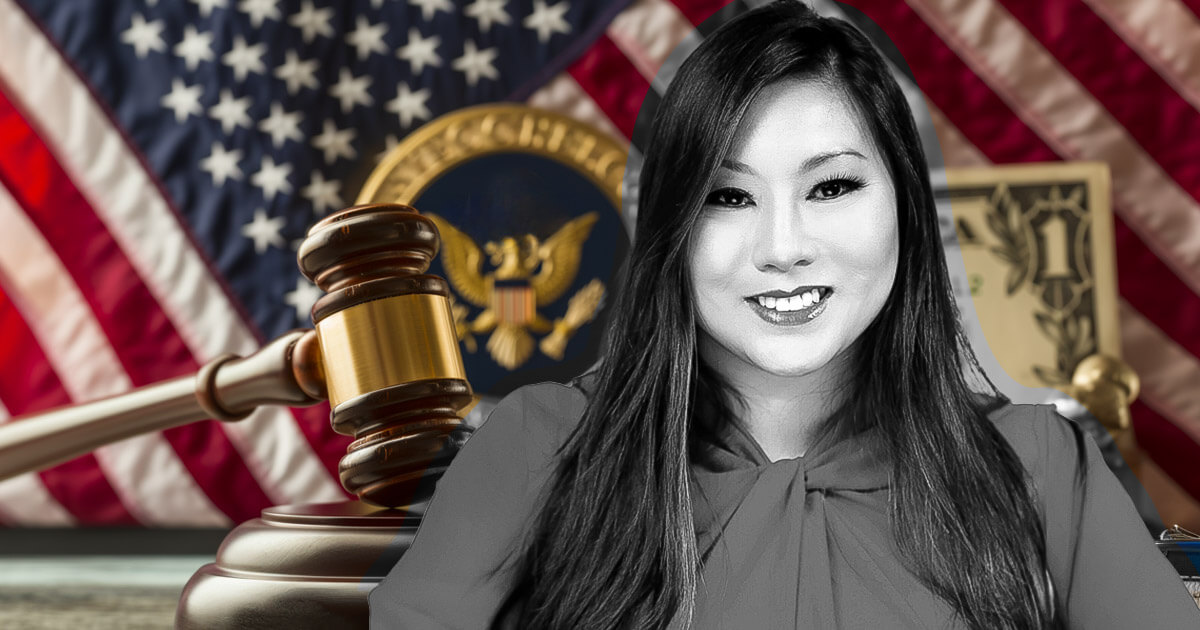

President Donald Trump has reportedly chosen Caroline Pham, a junior commissioner on the Commodity Futures Buying and selling Fee (CFTC), to function the company’s performing chair, Bloomberg Information reported on Jan. 20, citing sources acquainted with the matter.

In keeping with the information outlet’s sources, the CFTC’s 5 commissioners voted on Monday to verify Pham as performing chair because the appointment wasn’t formally introduced. Historically, the fee helps the incoming administration’s nominee for the performing position.

Pham was appointed as a commissioner by former President Joe Biden in 2021 and has emerged as a distinguished advocate for regulatory readability within the US crypto trade.

Throughout her tenure, she has championed revolutionary frameworks similar to “regulatory sandboxes,” which permit firms to check their services and products underneath shut supervision with out the burden of full compliance.

In September 2023, throughout a speech at a suppose tank Cato Institute occasion, Pham proposed a government-led pilot program to foster the event of compliant digital asset markets and tokenization.

She envisions this system as a collaborative effort involving regulators and trade stakeholders to ascertain tips for threat administration, transparency, and fraud prevention.

In consequence, Pham said that this system would increase liquidity and competitors whereas addressing dangers and stopping fraud within the crypto market.

Furthermore, the reported new CFTC performing chair commented that the US dangers falling behind worldwide counterparts who’re advancing strategic and long-term crypto insurance policies.

Nominations for everlasting position

Whereas Pham is about to imagine the position of performing chair, the seek for a everlasting CFTC chair continues, based on the report.

Different contenders embody Summer time Mersinger, the CFTC’s senior Republican member, and Brian Quintenz, a former commissioner now spearheading coverage for Andreessen Horowitz’s crypto arm, a16z Crypto. Each nominees are pro-crypto and had been reportedly the “odds-on front-runners” for the position.

Whoever is finally appointed to the everlasting chair will face mounting stress to navigate the intersection of conventional monetary markets and the more and more influential digital asset sector.

The Monetary Innovation and Expertise for the twenty first Century Act, at the moment up for a ground vote, might grant the CFTC expanded authority over digital commodities markets, together with exchanges.