Get the perfect data-driven crypto insights and evaluation each week:

By: Uriel Morone

-

Bittensor is a decentralized community that incentivizes customers to unravel AI duties by rewarding the perfect performers.

-

Precog makes use of Bittensor’s infrastructure to create a market for crypto worth predictions, the place forecasters compete for rewards.

Earlier this month, Coin Metrics shared information in regards to the launch of Precog, a cutting-edge subnet constructed on the Bittensor community. Inbuilt collaboration with Yuma, a subsidiary of DCG, Precog goals to rework the panorama of cryptoasset worth forecasting via decentralized machine studying and collaborative innovation. On this problem of Coin Metrics’ State of the Community, we’ll dive into what Bittensor is, how its subnets work, and why Coin Metrics is worked up to carry our information to the Bittensor ecosystem.

Bittensor is a platform which makes use of blockchain know-how to create decentralized networks tasked with fixing a variety of clever duties. Conventional information sharing strategies depend on centralized platforms, however with Bittensor new strategies and varieties of evaluation are potential that are distributed and immune to manipulation and censorship, whereas retaining excessive throughput and accuracy.

$TAO tokenomics resemble that of Bitcoin. Solely 21 million will ever be minted, however the emission schedule lasts 140 years, so the token worth is kind of inflationary (present worth of 1 $TAO token is round $600). The token had a good launch with no VCs, no buyers, no premine, and Bittensor isn’t an organization. The founders personal lower than 1% of the full token provide.

By leveraging the ability of decentralized networks and machine studying algorithms, Bittensor empowers customers to share and monetize their information in a trustless and autonomous method. It makes use of a blockchain to coordinate rewards to customers offering the perfect intelligence. This blockchain tracks the balances of customers throughout many alternative subnets; that are networks designed to reward customers for fixing arbitrary duties like AI pure language solutions, graph optimization, protein folding, and market information prediction. These customers can take part permissionlessly by paying a registration price, incentivizing the perfect concepts from the broader neighborhood to supply their options to those duties.

Coin Metrics is proud to combine our Group information, which has been out there as a core worth since our founding, into a brand new subnet referred to as Precog which is able to enable customers with the perfect market data to show it whereas incomes incentives for forecasting future worth actions.

The aim of a subnet is to coordinate a number of brokers to unravel an assigned process independently, determine the perfect answer in response to public uniform guidelines, and finally floor information associated to that process. As talked about, the duty could be extraordinarily versatile. For instance, in our Precog subnet the duty revolves round forecasting the value of BTC. The top outcomes are two forecasts: the precise BTC worth one hour sooner or later and the max and min values that the value is anticipated to maneuver throughout that hour. These forecasts are modeled on the discretion of contributors and those who carry out greatest will obtain probably the most incentive to provide future forecasts.

The next are just a few examples to offer a way of the number of challenges the subnet paradigm can tackle: There are subnet purposes devoted to responding to AI prompts (each picture era and pure language textual content), GPU Computing rental, sports activities betting, and extra.

What they share in widespread is the duties are achieved by impartial brokers utilizing their very own options. In some circumstances the brokers are competing to supply the perfect mannequin, in others they’re competing to supply the most cost effective sources. Nonetheless, in all circumstances the Bittensor construction allows a various set of options to a single drawback and promotes probably the most profitable.

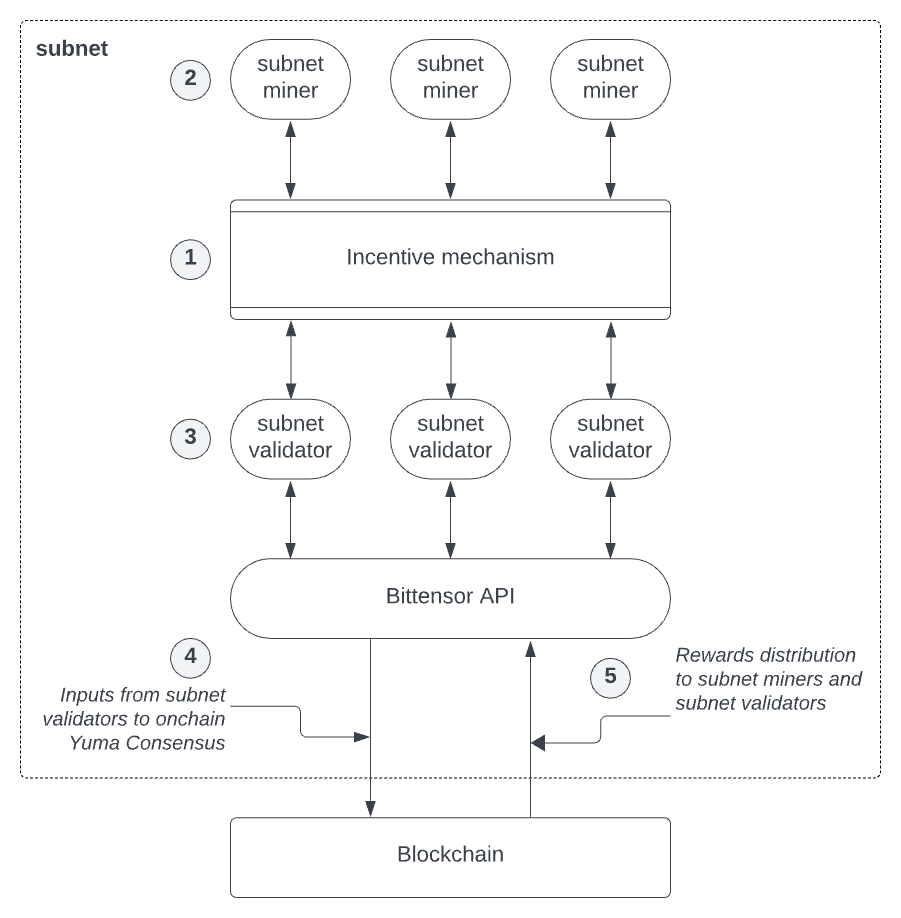

Supply: Bittensor Documentation – Understanding Subnets

A subnet is a community consisting of three varieties of brokers. When you are possible used to the idea of Miners and Validators in numerous blockchain protocols, Bittensor makes use of these phrases in another way. In Bittensor, Miners and Validators don’t safe the blockchain, they carry out duties inside every subnet and their scores are written to the blockchain.

Whereas these phrases could have similarities to their utilization in different contexts, it’s best to initially perceive Subnet Miners and Subnet Validators solely based mostly on their definitions beneath. The three varieties of agent on a subnet:

-

Subnet Miner – A consumer which receives a request to carry out a process and shares the outcomes of that process again. Within the Precog Subnet this can be forecasted worth of BTC worth and the interval it is going to commerce between one hour sooner or later

-

Subnet Validator – A consumer which points the requests to Miners and later ranks the efficiency of the Miners’ response from best-to-worst. Within the Precog Subnet, Validators will examine costs forecasted one hour in the past to the Coin Metrics reference charge throughout that very same window and determine the miners which carry out the perfect.

-

Subnet Proprietor – The consumer which registered the subnet, controls the hyperparameters, and controls the code which Validators run to determine the perfect Miners and attain consensus.

To align everybody’s incentives Bittensor makes use of the next system for emissions: Validators will rank Miner’s responses to their request in response to an incentive mechanism pre-determined by the Subnet Proprietor. This mechanism can evolve over time because the proprietor updates the subnet. The Miners will obtain “weight” from the Validators in response to how they’ve been ranked, which in flip will decide their share of the TAO token emissions.

Validators additionally act autonomously, however they’re judged in response to the Yuma Consensus algorithm. There are just a few parts which incorporate outcomes over time, however broadly talking Validators can be scored extremely based mostly on how intently the weights they assign to Miners are in consensus with the weights assigned by the opposite Validators. On this manner Validators can act autonomously and the rating of Miners could be decentralized however all are incentivized to advertise Miners that greatest fulfill the duty of the subnet, as a result of that’s how the opposite Validators are anticipated to rank.

The Precog Subnet will deal with market information predictions, powered by Coin Metrics’s highly effective Group API. Miners can be tasked with two outputs:

-

The value of Bitcoin 1-hour from the prediction time (Level Forecast)

-

A worth vary equal to the min and max worth of the value in the course of the 1-hour following prediction time (Interval Forecast)

These outputs are generated by the Miners each 5 minutes and evaluated by Validators an hour later. The main focus is to make use of the decentralized construction of Bittensor to provide refined, simply digestible, and relevant information factors about future worth forecasts at increased time decision than what is feasible in conventional exchanges.

Conventional derivatives markets present some perception into market perception of future worth actions, however the uncooked information consists of a ladder of contracts at completely different strike costs, expiration dates, and guidelines. Quantitative Analysts and mathematical fashions are required to rework the information on a derivatives market into significant possibilities of future worth.

The Precog Subnet in distinction isn’t a market in any respect, it focuses particularly on producing helpful intelligence. The duty of processing market information to reply “whats the probably worth” is offloaded to the Miners, who can resolve the issue utilizing the strategies they discover only. For information shoppers, the output of the subnet are two actionable information factors that may be utilized with minimal post-processing: What’s the value going to be? and the way a lot will it differ?

We have now loads of concepts on methods to make the most of the information output by the subnet and lengthen what we will do as soon as the neighborhood is established. We’re at the moment within the technique of growing a dashboard so the general public can view how forecast efficiency evolves over time. Keep updated with the most recent developments at:

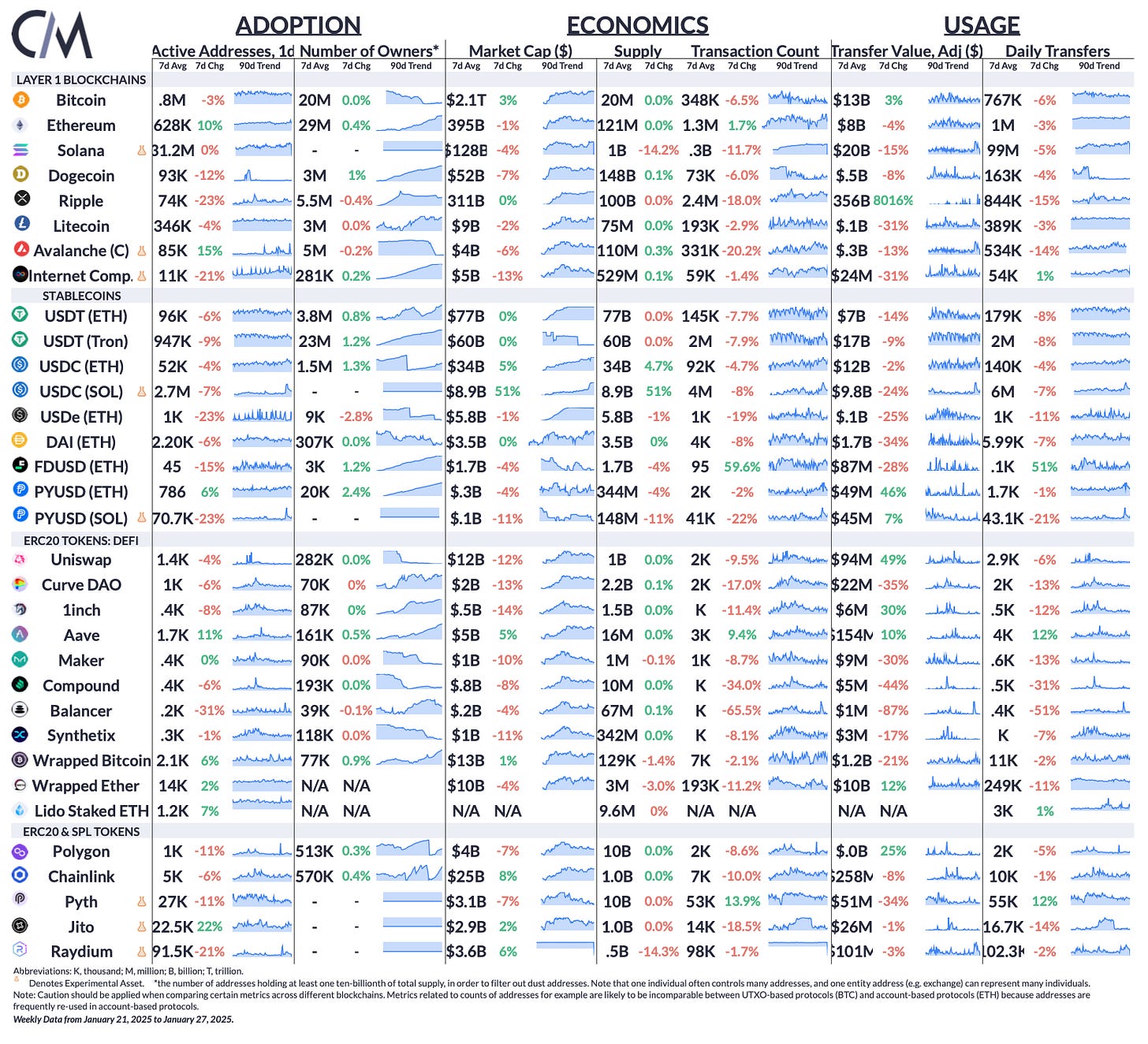

Supply: Coin Metrics Community Knowledge Professional

Over the previous week, Ethereum and Avalanche C-chain noticed day by day energetic addresses rise by 10% and 15% respectively, whereas Bitcoin’s declined by 3%. On Solana, USDC provide surged 51% to 9B, as Trump-related memecoins drove heightened exercise and an inflow of liquidity, pushing Solana’s complete stablecoin market cap above $10B for the primary time.

-

Comply with Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As all the time, in case you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You possibly can see earlier problems with State of the Community right here.