Get the very best data-driven crypto insights and evaluation each week:

By: Tanay Ved

-

We estimate Coinbase to report ~$2B in complete income for This fall 2024, a 65% enhance QoQ and 109% YoY, pushed by a rebound in transaction income and regular development in subscriptions & providers.

-

Buying and selling volumes surged to ~$430B—the very best since This fall 2021—fueled by renewed market optimism post-U.S. election, whereas USDC provide grew 23%, seemingly boosting Coinbase’s stablecoin income.

-

Base generated 8,047 ETH ($26.36M) in sequencer income and seven,417 ETH ($24.18M) in revenue, sustaining robust profitability as low settlement prices on Ethereum sustained excessive margins.

Coinbase International Inc. (COIN) is about to report its This fall 2024 earnings outcomes on February 13th . As the one publicly traded main cryptocurrency alternate listed on the U.S. inventory market— and an more and more diversified blockchain enterprise— its monetary efficiency can be carefully watched by each crypto market contributors and Wall Road alike. This fall formed as much as be a bullish quarter, fueled partially by Donald Trump’s election victory, which helped drive renewed optimism within the house. Traders will now be desirous to see how Coinbase capitalizes on this momentum, particularly as an easing regulatory atmosphere and anticipated development in crypto IPO’s promise to deliver competitors from different distinguished gamers within the business.

On this problem of Coin Metrics’ State of the Community, we preview Coinbase’s This fall 2024 earnings utilizing a mix of Coin Metrics’ suite of market knowledge and on-chain knowledge alongside publicly out there info.

Going into the earnings outcomes, analysts count on Coinabase to report $1.59B in complete income, ~$300M increased than its Q3 2024 income of $1.2B and anticipate an earnings per share (EPS) of $1.13. Whereas this initiatives quarterly income development for the corporate, we consider Coinbase will exceed these expectations pushed by a mix of development in transaction revenues and subscription and providers income, the 2 core segments of their income combine.

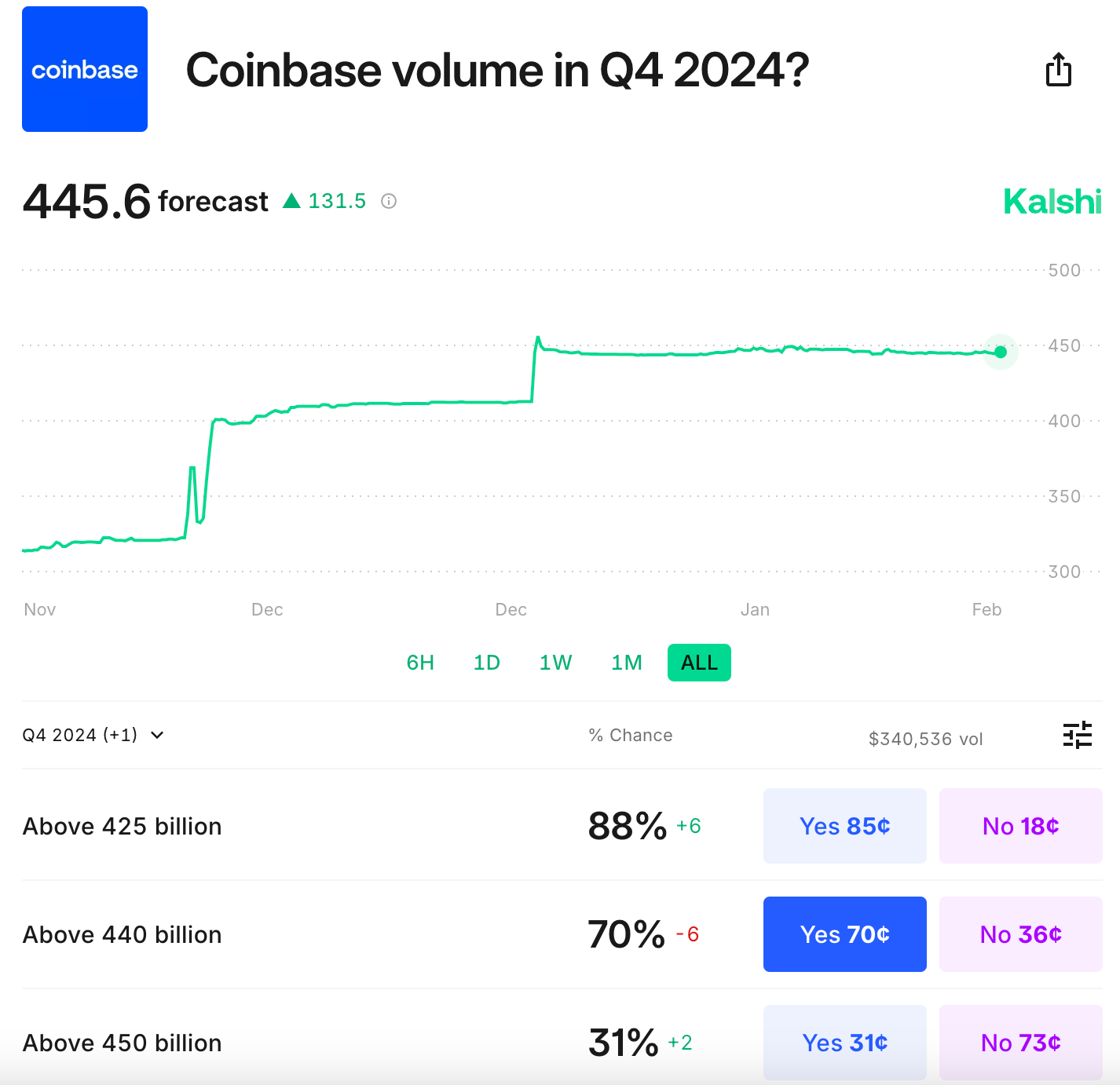

Taking a look at prediction markets like Kalshi, contributors are forecasting $445B in complete buying and selling quantity over the quarter with a 70% chance. This represents a 140% enhance from Q3.

Coinbase’s transaction income consists of earnings earned from client and institutional buying and selling, in addition to their Layer-2 Base and funds associated income, which was reclassified from client to “Different transaction income” in Q1 2024.

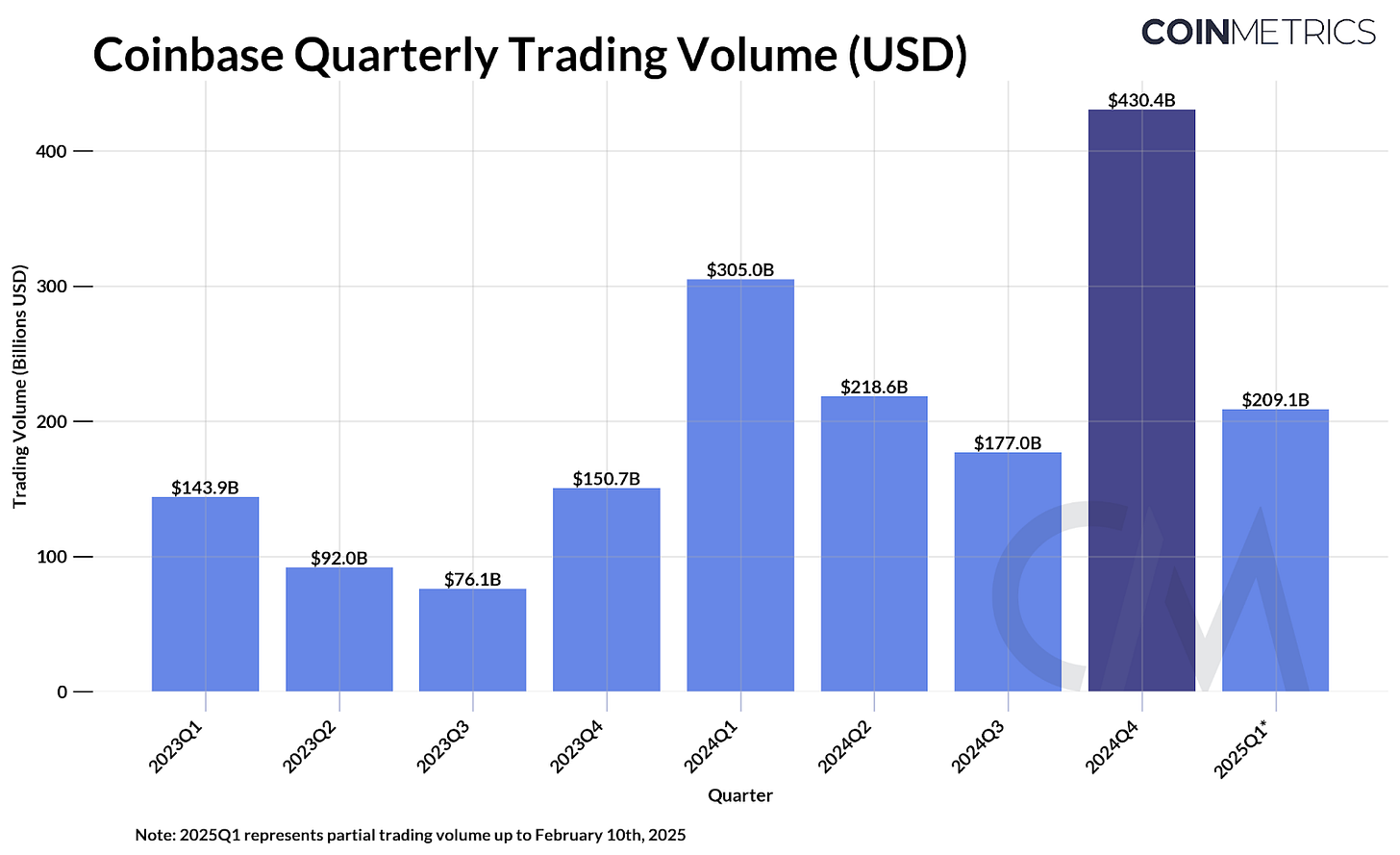

With Coinbase’s every day buying and selling quantity resampled to the previous eight quarters, This fall 2024 stands out as the very best quarterly buying and selling quantity (~$430.4B) since This fall 2021. Donald Trump’s U.S. election in November has fueled considerably increased buying and selling exercise on the alternate. This enhance ought to stem from each client and institutional cohorts, supported by enhancing sentiment, heightened crypto volatility, and regulatory momentum below a crypto-friendly administration, all of that are anticipated to spice up retail and institutional participation in crypto markets and operations.

Supply: Coin Metrics Market Information Feed

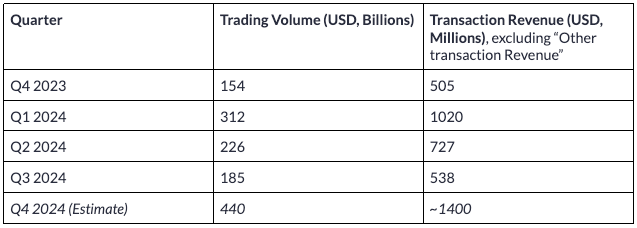

Primarily based on a quarterly buying and selling quantity of $440B, we estimate Coinbase’s This fall 2024 transaction income at ~$1.4B, reflecting a 175% YoY enhance. That is pushed by:

-

Shopper buying and selling contributing ~$1.3B, based mostly on 20% of complete buying and selling quantity and a 1.5% take fee assumption.

-

Institutional buying and selling producing ~$102M, based mostly on 80% of complete buying and selling quantity and a 0.03% take fee assumption.

If materialized, This fall 2024 Transaction Income would eclipse Coinbase’s complete income in Q3 2024 of $1.2B. Having accomplished just one month of the quarter, Q1 2025 additionally factors to a powerful begin, reversing the development of suppressed transaction income in current quarters.

Supply: Coin Metrics Market Information Feed & Coinbase Q3 2024 Shareholder Letter

We are able to additionally dive deeper to grasp the markets and belongings that compose buying and selling volumes on Coinbase’s alternate. Using Coin Metrics’ candles knowledge, we are able to see the highest stablecoin (or fiat) and non-stablecoin markets by buying and selling quantity over the quarter. Amongst stablecoin-fiat markets, USDT-USD led with $49.4B in quantity, suggesting Tether’s robust demand as a key on/off-ramp for USD. In the meantime, USDC-EUR ranked fourth with $2B, reflecting its rising adoption in euro-based markets, seemingly supported by regulatory readability from MiCA compliance. BTC, ETH, XRP and DOGE noticed excessive demand, whereas ETH-BTC was probably the most traded non-stablecoin market, at $1.6B for the quarter.

Supply: Coin Metrics Market Information Feed

Since November, Coinbase has steadily eased on its measured strategy to alternate listings, including memecoins like PEPE and dogwifhat (WIF) which may proceed to assist client buying and selling volumes.

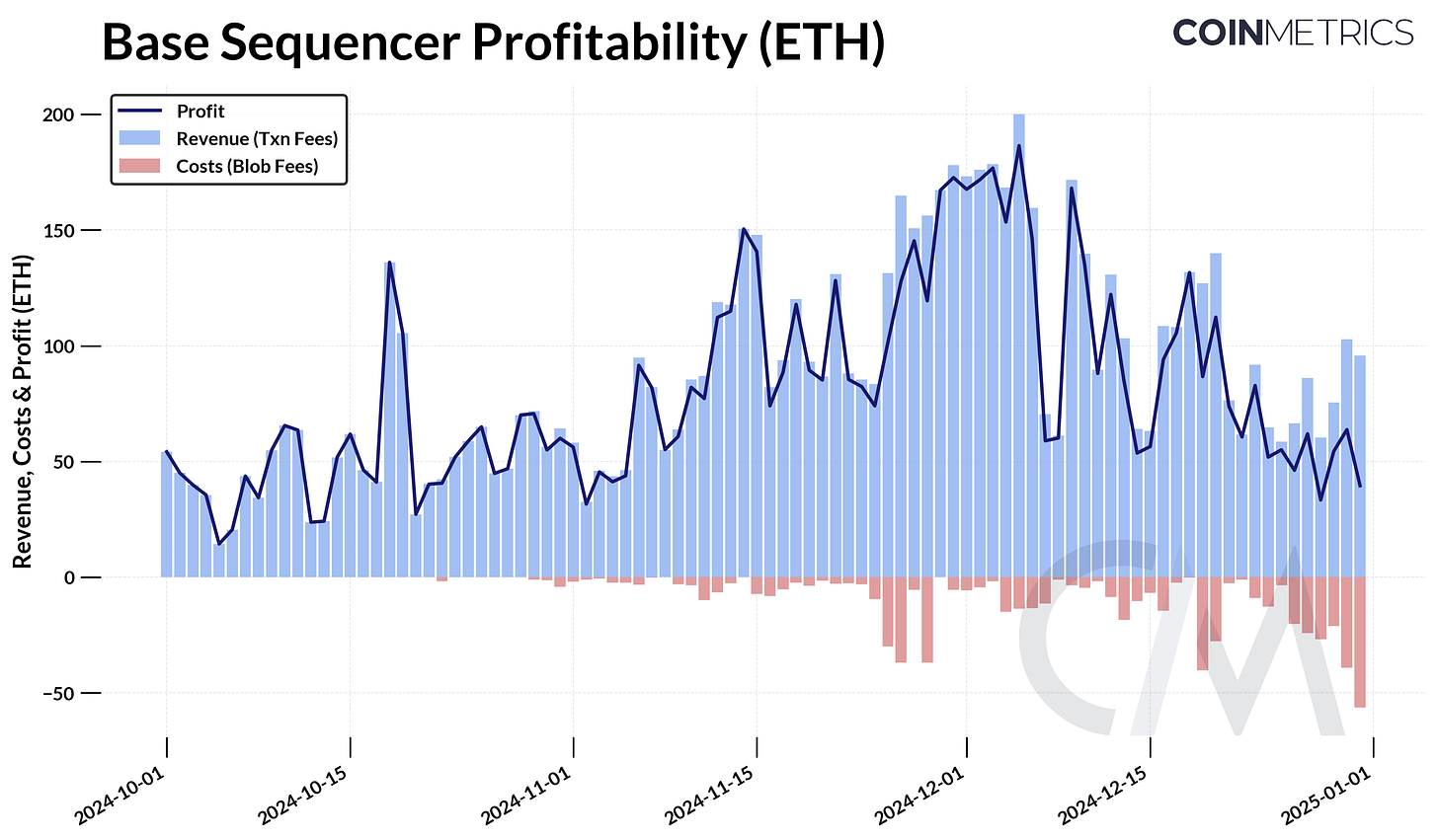

Base is Coinbase’s optimistic rollup, an Ethereum Layer-2 constructed on Optimism’s OP stack which is an more and more vital a part of Coinbase’s on-chain footprint. Base exemplifies that working a Layer-2 on the Ethereum community is a worthwhile enterprise mannequin, reinforcing why companies like Kraken, Sony, and Deutsche Financial institution are coming into the house. As the only sequencer, Coinbase earns income from transaction charges for ordering and processing transactions on Base, whereas incurring prices within the type of blob charges paid to Ethereum Layer-1 for settlement.

Supply: Coin Metrics Community Information Professional, Coin Metrics Labs

Over This fall 2024, Base generated 8,047 ETH ($26.36M) in complete income, with 630 ETH ($2.18M) in blob price prices, leading to 7,417 ETH ($24.18M) in revenue. For many of the quarter, revenue margins remained between 80-100%, however declined to ~45% by late December as settlement prices (blob charges) elevated. This fall seems to be a powerful quarter for Base, pushed by sustained demand for Layer-2 transactions and a broader surge in on-chain exercise, reinforcing its function as a number one L2 on Ethereum.

Over current quarters, Coinbase’s income from subscriptions and providers—which incorporates blockchain rewards from their staking enterprise, stablecoin income from Circle’s USDC and custody income from U.S. spot ETFs—has accounted for ~30%-50% of web income. In a previous evaluation of Coinbase, we discovered how the corporate shows a rising, however various correlation to variables like stablecoin provide or staked balances. In Q3, this section represented $556M in income, with the bulk coming from stablecoin and blockchain rewards.

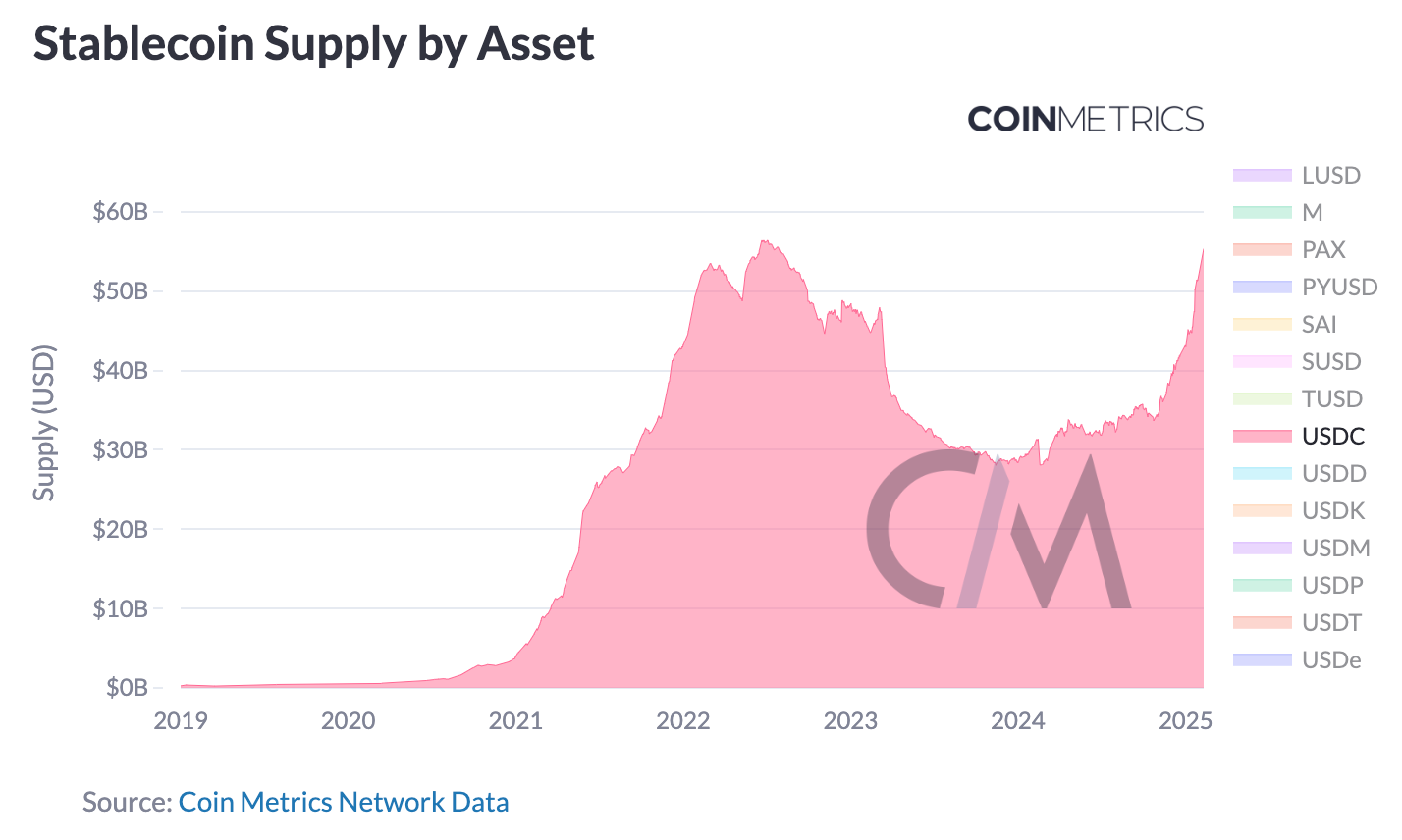

Coinbase earns income from the USDC stablecoin primarily by curiosity earnings on reserves through a revenue-sharing settlement with Circle. In This fall 2024, USDC provide grew 23% to 43.2B and now stands close to 55B, seemingly boosting Coinbase’s platform balances. As they proceed to combine USDC, customers globally can earn ~4.5% APY on holdings or borrow USDC towards Bitcoin increasing its utility.

Nevertheless, decrease treasury yields in comparison with prior quarters might restrict the income impression of USDC’s provide development. Primarily based on these components, we estimate stablecoin income at ~$250M, a modest enhance from prior quarters.

Supply: Coin Metrics Stablecoin Dashboard

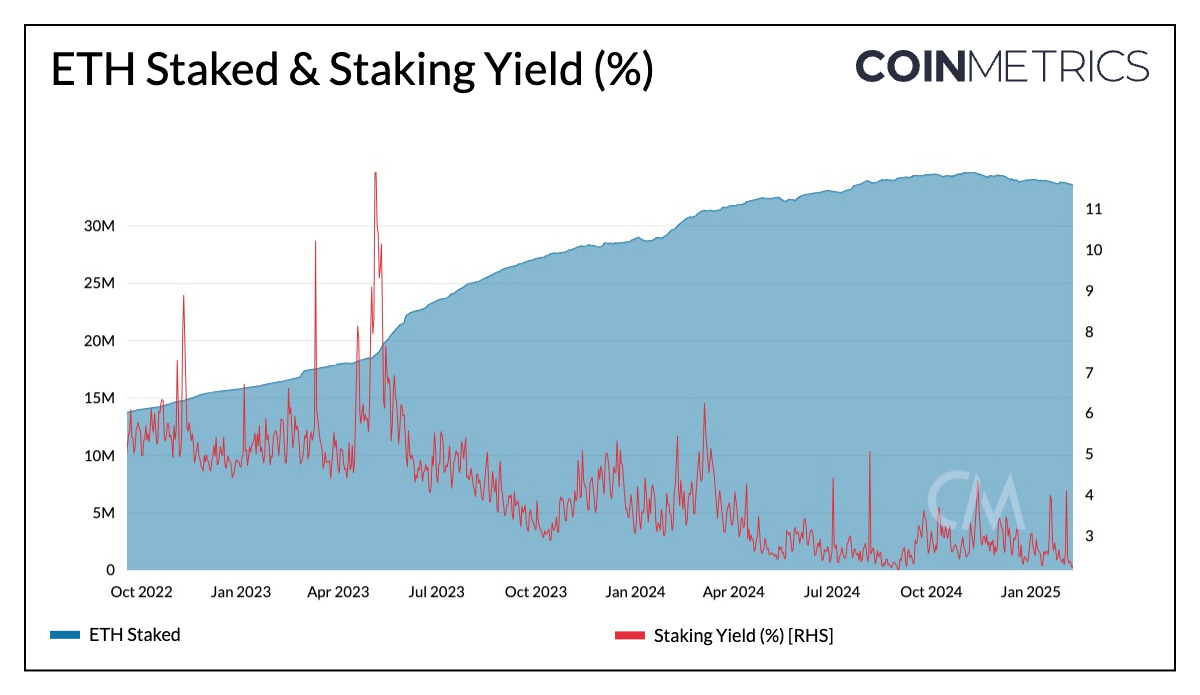

Blockchain rewards have been the second-largest income supply in Coinbase’s Subscriptions and Providers section, producing $154 million in Q3 2024. Though ETH and SOL staking balances remained comparatively flat quarter-over-quarter, increased common asset costs seemingly drove a average enhance in USD-denominated income.

Supply: Coin Metrics Community Information Professional

With custody balances exceeding 1.1M BTC and extra income as the first custodian of spot Bitcoin and Ether ETFs, custodial price income is predicted to rise above $35M. Coinbase additionally stands to achieve from the adoption of FASB accounting guidelines, which permit public firms to report crypto holdings at truthful worth, probably boosting earnings amid rising asset costs.

Past custody, Coinbase continues to increase its product suite with belongings like cbBTC, a tokenized model of Bitcoin usable in Ethereum and Solana purposes, Bitcoin lending by Morpho, and enhancements to Coinbase Pockets, strengthening its function as an infrastructure layer within the crypto ecosystem. Together with company curiosity and different earnings, we estimate Subscription and Providers income to come back in at ~$570-600M.

Coinbase is firing on all cylinders and seems well-positioned to increase its market management. With transaction income rebounding and subscriptions & providers income remaining robust, we estimate Coinbase will report ~$2B in income—a 65% quarterly rise and 109% YoY enhance. COIN shares presently commerce at ~$280 and present a average correlation to the NASDAQ. As transaction revenues enhance, Coinbase’s robust distribution, increasing stablecoin footprint, and Base’s dominance place it for long-term development and deeper integration throughout the crypto ecosystem. As Coinbase matures with its numerous income streams, it continues to blur the traces between a financial institution, brokerage, and funds firm, reinforcing its function in bringing the world on-chain.

Supply: Coin Metrics Community Information Professional

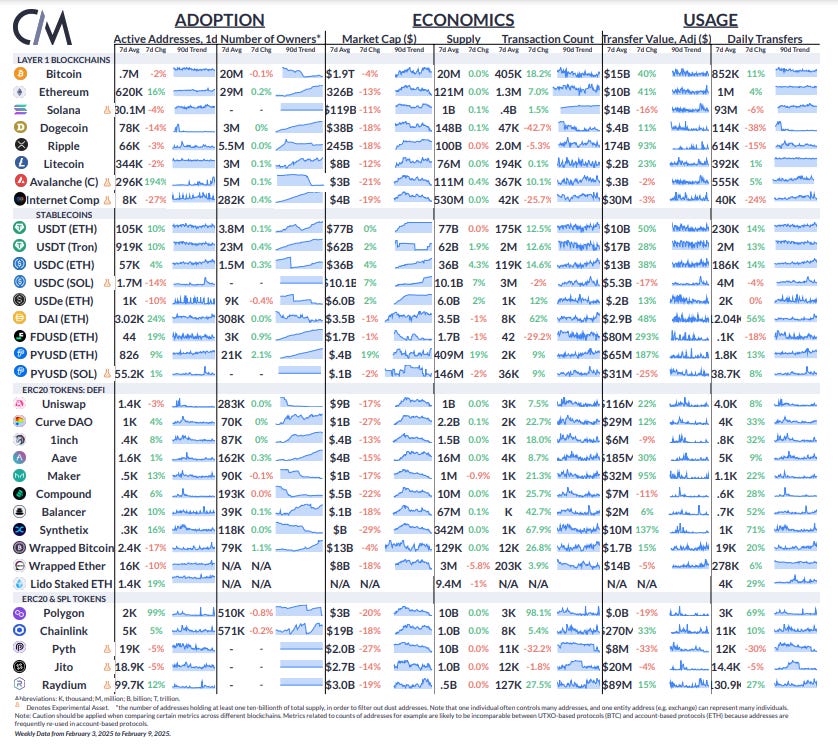

Ethereum’s lively addresses elevated by 16%, whereas Avalanche C-chain noticed a 194% development over the previous week. Adjusted switch worth for USDT grew by 50% on Ethereum and 28% on Tron, whereas USDC on Ethereum rose by 38% by the identical measure.

-

Comply with Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As all the time, you probably have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.