Get the most effective data-driven crypto insights and evaluation each week:

By: Tanay Ved

-

Pectra, Ethereum’s subsequent main improve, introduces modifications to each the Execution Layer (Prague) and the Consensus Layer (Electra). It’s set to go stay on testnets in February and March, with mainnet activation anticipated in April.

-

The improve introduces key enhancements to staking, Layer-2 scalability and consumer expertise (UX), setting the inspiration for future modifications.

-

Key modifications embrace larger validator stake limits, versatile staking withdrawals, enhancements in account abstraction and elevated blob throughput, contributing to community effectivity and safety.

Almost 29 months after “The Merge”, 22 months after “Shapella” and 11 months after “Dencun”, we strategy Ethereum’s subsequent main improve—the Pectra hard-fork. As the most important proof-of-stake (PoS) blockchain, securing ~$90B in ETH staked, over $135B in stablecoins, and ~$4B in tokenized belongings, Ethereum continues to evolve by means of incremental upgrades.

Pectra is about to be the most important hard-fork in Ethereum’s historical past by way of the variety of Ethereum Enchancment Proposals (EIPs) deliberate for inclusion. Constructing on the inspiration of final yr’s Dencun improve, Pectra introduces options to enhance consumer expertise (UX), validator operations and assist additional scaling of Layer-2’s, suggesting its widespread influence to Ethereum stakeholders. On this week’s problem of Coin Metrics’ State of the Community, we break down Pectra’s key modifications and what they imply for customers, stakeholders, and traders forward of its anticipated mainnet activation in April.

Like earlier Ethereum upgrades, Pectra introduces modifications to each the Execution Layer (EL) and Consensus Layer (CL). Its title displays this twin focus: ‘Prague,’ named after the host metropolis of Devcon 4, represents the execution layer improve, whereas ‘Electra,’ a star within the Lyra constellation, signifies the consensus layer improve.

Pectra was envisioned as an bold improve, initially planning to incorporate as much as 20 Ethereum Enchancment Proposals (EIPs). Nevertheless, as improvement progressed, it was break up into two phases to higher refine and handle its complexity. Now in its ultimate phases, Pectra is about to launch on Ethereum testnets in February and March, adopted by mainnet activation in early April.

Earlier than we dive into particular person EIPs, it is necessary to know the overarching areas Pectra goals to handle, which we’ll bundle into, staking & validator dynamics, consumer expertise (UX) and L2 scaling.

There are three main EIPs that search to enhance the expertise tied to validator operations in Ethereum’s proof of stake (PoS) system:

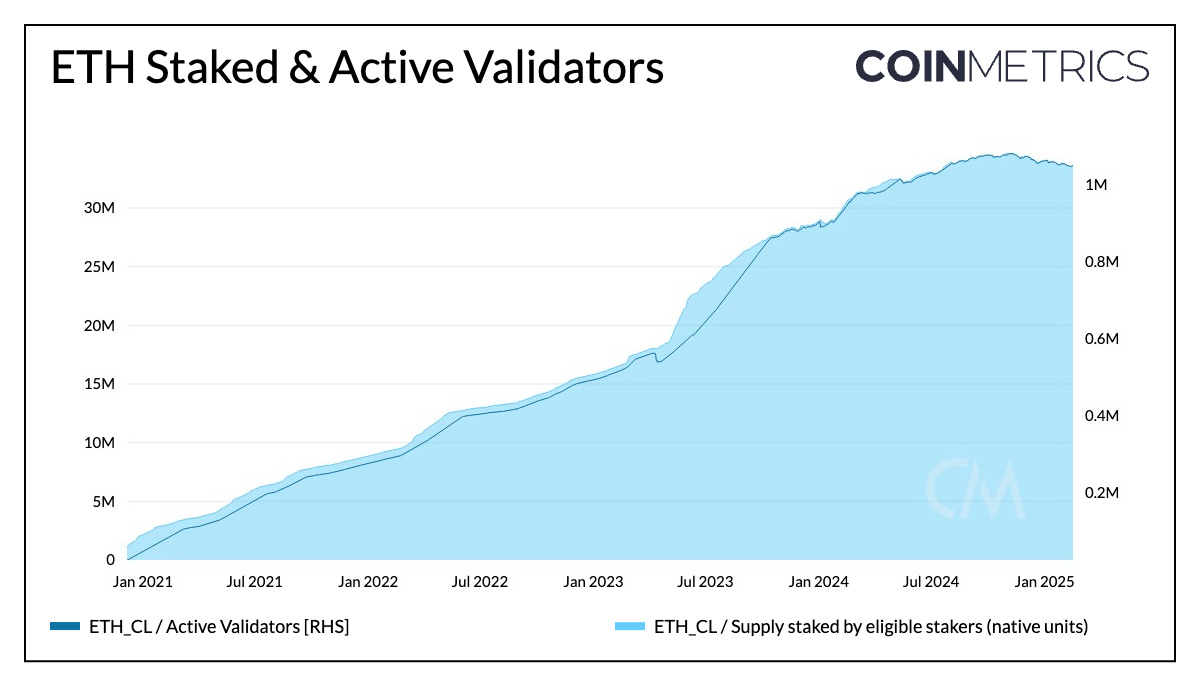

Ethereum’s present staking design limits a validator’s efficient stability to 32 ETH, which means solo stakers should stake in fastened increments of 32 ETH, which is the utmost a single validator can stake. Any rewards earned past this restrict don’t contribute to their lively stake. EIP-7251 raises this most efficient stability (MaxEB)to 2048 ETH, which means {that a} single validator can now stake between 32 and 2048 ETH. That is anticipated to:

-

Enhance staking flexibility: Stakers can now compound rewards over their total stability reasonably than being restricted to multiples of 32 ETH. For instance, a validator with 33 ETH can have all 33 ETH counted towards rewards, enhancing capital effectivity and suppleness in staking operations.

-

Decrease validator rely: Ethereum presently has 1.05M lively validators on the consensus layer. This EIP will enable bigger operators to consolidate their validators, which is anticipated to decrease validator rely and alleviate community overhead from a big validator set.

-

Scale back community load: Whereas a excessive validator rely strengthens decentralization, it additionally will increase bandwidth and computational calls for. Elevating the MaxEB permits a extra environment friendly validator set, lowering peer-to-peer communication overhead.

Supply: Coin Metrics Community Knowledge Professional

This EIP expands validator capabilities and enhances the EIP above. EIP-7002 permits validators to provoke exits and partial withdrawals instantly by means of their execution layer (0x01) withdrawal credentials. Validators have two keys: the lively key for performing validator duties and a withdrawal key for accessing and managing staked funds. Beforehand, solely the primary key may set off an exit. Now, withdrawal credential addresses may provoke exits, permitting for bigger withdrawals and lowering reliance on node operators. This variation enhances validator management over funds and permits absolutely trustless staking swimming pools, enhancing safety and decentralization.

EIP-6110 streamlines validator onboarding by enhancing how deposits are processed between Ethereum’s Execution Layer (EL) and Consensus Layer (CL). At present, when a brand new validator deposits on the execution layer (EL), it should look forward to the consensus layer (CL) to acknowledge and course of it earlier than activation, resulting in delays. EIP-6110 permits the EL to instantly talk validator deposits to the CL, eradicating the necessity for an extra verification course of and lowering the activation delay from round ~9 hours to ~13 minutes.

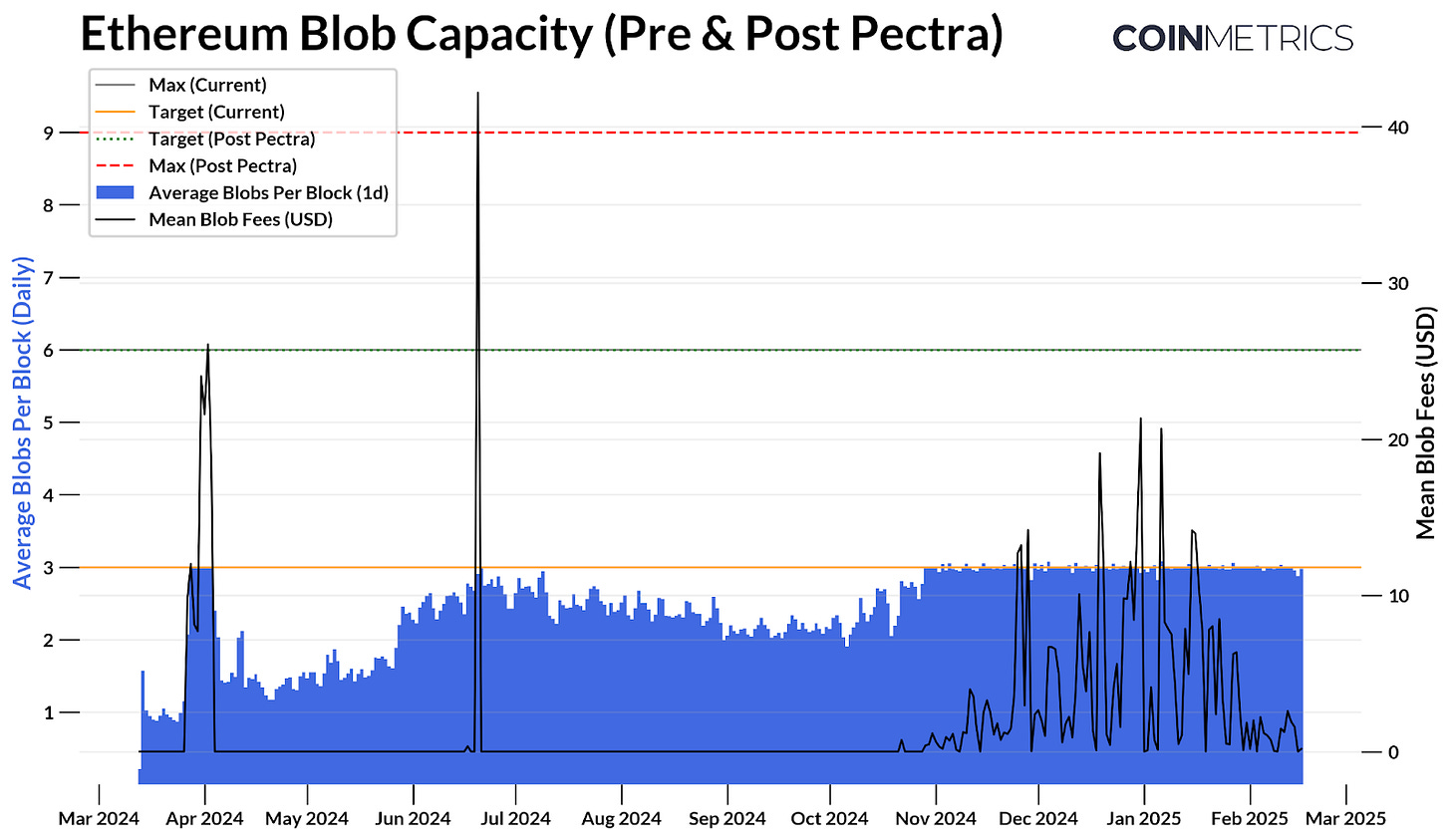

Past validator enhancements, Pectra additionally brings key modifications to Ethereum’s knowledge availability and scaling. The Dencun improve final yr launched blobs as a brand new environment friendly approach of storing knowledge from Layer-2 rollups. Blobs are actually broadly adopted throughout Ethereum L2s, with a mean of 21,000 blobs posted each day. Nevertheless, blob utilization has constantly hit capability, rising charges and limiting throughput.

Supply: Coin Metrics Community Knowledge Professional, Blob Metrics

The community presently targets a mean of three blobs per block and a most of 6. EIP-7691 will improve the goal to six and most to 9, rising the capability for storing knowledge and subsequently rising throughput and scalability. Knowledge storage prices will scale back, leading to cheaper blob charges for Ethereum L2s and thus transaction charges for finish customers.

EIP-7623: Improve calldata price, is one other EIP that enhances blob adoption. Earlier than the introduction of blobs, L2s used calldata to retailer knowledge on Ethereum, which they nonetheless use occasionally as it may be more cost effective. By elevating prices for calldata, this modification can incentivize L2s to solely make the most of blobspace, making rollup transactions much more environment friendly.

EIP-7702 is a largely anticipated change because it brings Ethereum nearer in the direction of account abstraction. It’s anticipated to vastly enhance consumer expertise (UX) and pockets performance by permitting externally owned accounts (EOAs), or consumer wallets, to quickly perform as good contract wallets. This permits them to execute logic much like good contracts, offering larger flexibility for customers, and programmability for wallets and apps.

After Pectra, customers and builders can leverage EIP-7702 to:

-

Bundle transactions: batch a number of transactions or consumer operations right into a single transaction. (e.g., approving and swapping tokens in a single transaction).

-

Transact with out fuel: permitting account X to pay for a transaction on behalf of account Y, or “paymaster contracts” to cowl fuel charges for customers.

-

Conditional or sponsored transactions: Implement spending controls, automated actions, or sponsored transactions primarily based on set situations.

Whereas we lined essentially the most impactful modifications in Pectra, a number of different EIPs additionally contribute to community enhancements. These embrace EIP-2513, EIP-2935, EIP-7549, EIP-7865, and EIP-7840, all centered on optimizing effectivity and lowering useful resource consumption throughout the community.

But once more, Ethereum is getting ready for a significant improve—this time with a file variety of EIPs. Pectra goals to boost Ethereum’s most urgent priorities, together with the transition towards account abstraction, improved validator operations, larger community effectivity, and incremental scaling of Layer-2 blob utilization. On the similar time, as Vitalik Buterin highlighted in a latest weblog put up, Ethereum continues to scale Layer-1 regardless of its rollup-centric roadmap. With the latest fuel restrict improve to 36 million, additional expansions are anticipated to spice up censorship resistance, throughput, and scalability.

Whereas Pectra’s modifications are primarily technical, many might surprise how they may influence ETH’s valuation. Traditionally, ETH has seen measurable shifts in worth round prior upgrades, however market sentiment—each inside crypto and in broader monetary markets—typically performs a bigger position than direct modifications to Ethereum’s economics. Nonetheless, Pectra is poised to advance Ethereum’s adoption, and as we transfer past this improve, we’ll revisit its influence on key community metrics, ecosystem stakeholders, and ETH as an asset.

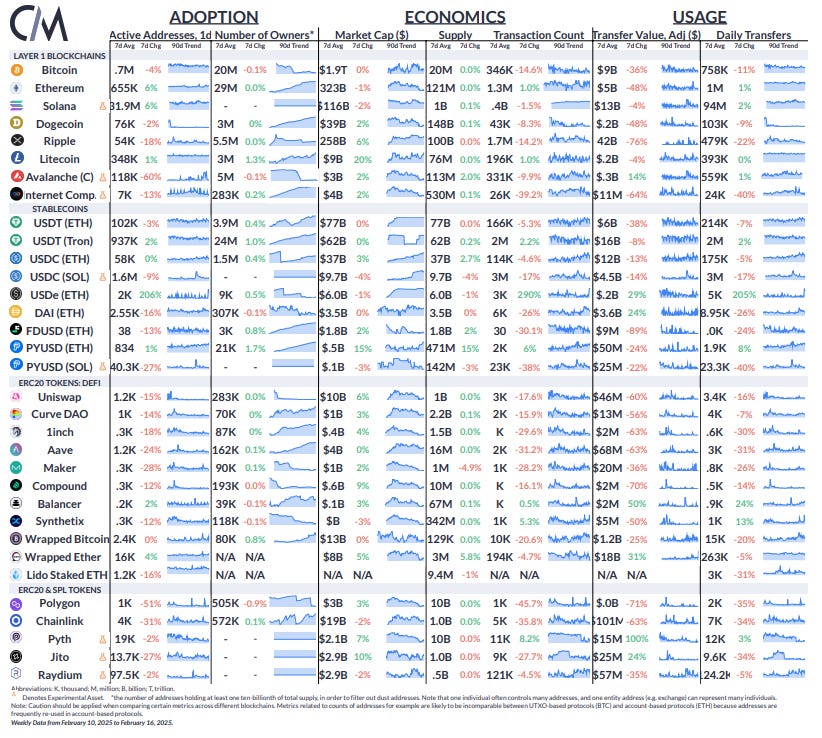

Supply: Coin Metrics Community Knowledge Professional

Bitcoin lively addresses decreased by 4%, whereas Ethereum and Solana lively addresses rose by 6% over the previous week. USDC on Ethereum noticed its market cap develop by 2.7% to 37B, whereas PayPal USD on Ethereum grew by 15% in market capitalization to a file 498M.

-

Comply with Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As at all times, in case you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier problems with State of the Community right here.