Get the very best data-driven crypto insights and evaluation each week:

-

Public blockchains and alternate APIs can supply real-time transparency into token possession and buying and selling exercise, serving to policymakers monitor markets and assess dangers because the SEC navigates crypto regulation.

-

Classifying crypto belongings by their financial operate and context of use offers a structured framework to complement conventional safety classifications.

-

Order guide knowledge and liquidity metrics present perception into market effectivity and assist detect manipulation techniques like wash buying and selling, aiding efforts to make sure truthful and clear markets.

The distinct properties of crypto belongings have fueled debate over how they need to be regulated beneath US securities regulation. Beneath earlier regimes, the Securities and Alternate Fee (SEC) has alleged tokens resembling XRP, ADA, SOL, and several other others to be unregistered securities and have sued crypto exchanges and buying and selling platforms for promoting unregistered securities. Some within the crypto trade argue that the SEC has not offered sufficient regulatory readability and was “regulating by enforcement”, as evidenced by enforcement actions towards Coinbase and Kraken, amongst others.

Beneath new management, the SEC is signaling a much less adversarial regulatory method. This shift is supported by two articles printed by SEC Commissioner Hester Peirce in an effort to interact with the group. The primary, titled “The Journey Begins,” explains how the SEC is reconsidering its regulatory method to crypto and describes its plan to determine extra specific rules. The second, titled “There Should Be Someway Out of Right here,” presents a collection of questions to elucidate method the enforcement of those rules.

On this challenge of Coin Metrics’ State of the Community, we’ll handle a few of Commissioner Peirce’s questions and display how on-chain knowledge can make clear regulatory ambiguities.

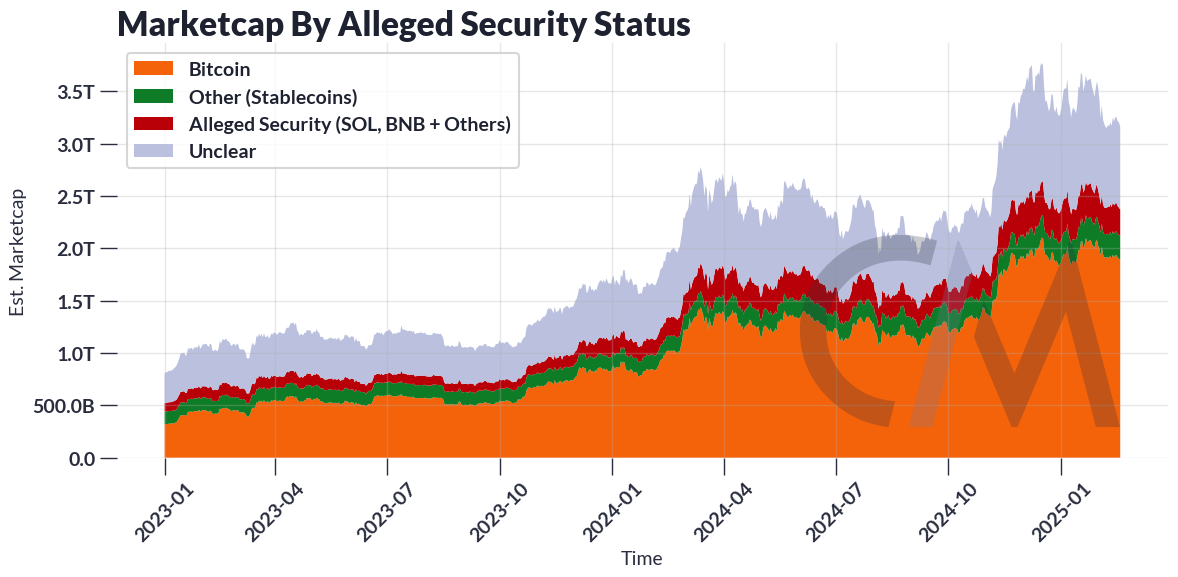

The regulatory classification for crypto belongings has critical implications for a big phase of the market. Of crypto’s roughly $3T market cap, about 25% are belongings whose safety standing is unclear (together with ETH, which earlier SEC chair Gary Gansler notoriously averted classifying explicitly), 8% have been alleged to be securities in earlier SEC lawsuits (consists of SOL, BNB, ADA, and others), with the remaining 7% to be on-chain derivatives together with stablecoins. Word that stablecoins weren’t exempt from being alleged as a safety beneath the earlier regime, as indicated by the SEC’s allegations towards BUSD.

Supply: Coin Metrics Community Information Professional

Recall that the SEC has traditionally leaned on the Howey Check to categorise whether or not or not an asset is a safety. The Howey Check consists of the requirement that an “funding contract” exists when there’s the (1) funding of cash (2) in a standard enterprise with a (3) affordable expectation of earnings (4) to be derived from the efforts of others. We’ll take without any consideration the tokens themselves are funding contracts, rendering them eligible for the Howey Check*. For some background on how the Howey Check and subsequent steerage by the SEC can translate into on-chain metrics, try From Orange Groves to Orange Gold.

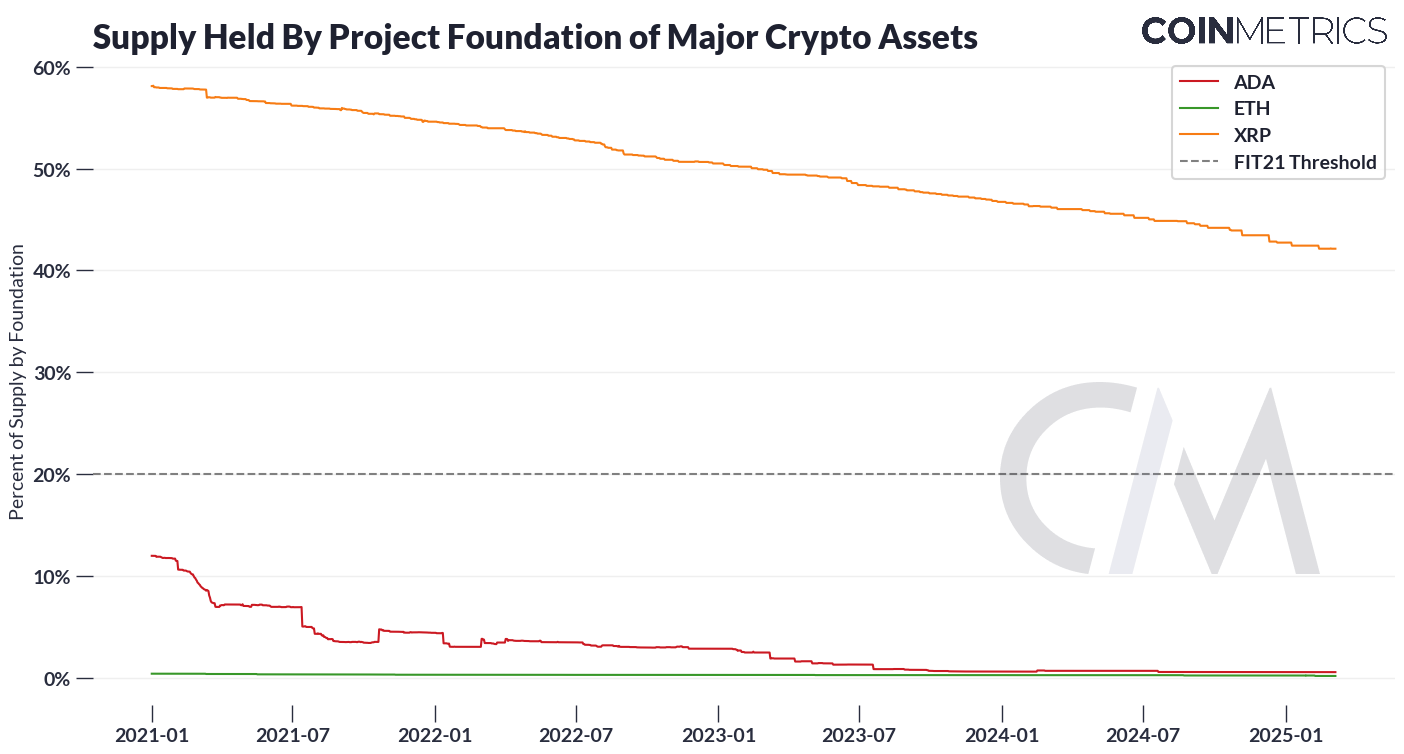

Public blockchains make disclosing the vested curiosity of a standard enterprise doable to do in real-time. If a standard enterprise have been to reveal their addresses, we will monitor the extent of possession they’ve throughout the ecosystem, resembling basis held provide and the circulate of funds throughout completely different entities (e.g. exchanges). By combining this energy with a transparent threshold, such because the 20% from the proposed FIT21 Act, we could arrive at an unambiguous classification of whether or not a token is a safety.

Supply: Coin Metrics Community Information Professional

Nonetheless, there are caveats. Some initiatives don’t disclose the quantity of the token’s whole provide that they personal. There are additionally technical challenges that make auditing excessive throughput blockchains, resembling Solana, tough. In Solana’s case, 12.5% of its provide was disclosed to belong to the inspiration at inception, though the sheer dimension of knowledge it produces (~sooner or later of Solana knowledge is the equal to roughly one 12 months of Bitcoin knowledge) make it difficult to audit in real-time.

*That is the premise of the SEC’s “embodiment” concept in previous lawsuits. However it’s nonetheless doable for an asset to be *offered* in a securities providing though the asset itself could or will not be a safety, as was the case on the XRP choice.

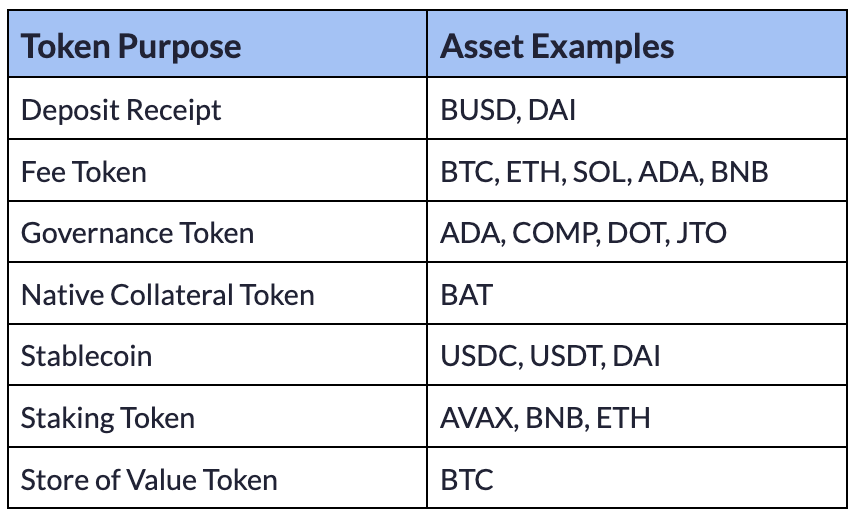

The vary of makes use of for crypto belongings has grown tremendously in dimension and complexity. These features embrace facilitating transaction charges, granting voting rights in on-chain governance or securing a proof-of-stake (PoS) community. To maintain monitor of those developments, we created a classification system for crypto belongings primarily based on their financial context of use. Regulators can use this structured framework as a complement to the Howey Check to raised perceive a token’s utility and the general construction of the crypto trade.

Supply: Coin Metrics Asset Profiles

There are numerous cases the place a single asset serves a number of functions. It’s useful to know a token’s utility within the context of the operations it helps, somewhat than in isolation. A current report by a16z Crypto delves into the excellence between community tokens and firm backed tokens, emphasizing that they derive worth from open vs closed techniques.

For example, ETH and BNB share the aim of being a charge token and staking token. Nonetheless, they need to doubtless be approached in another way as BNB is intrinsically tied to the operations of the Binance ecosystem, together with the alternate and BNB Chain, whereas ETH features as a way to transact on and safe a decentralized community with no central oversight.

Governance tokens additionally introduce a novel dynamic, as tokenholders can vote to increase their very own utility. Within the case of Uniswap, the proposal for turning on the “charge swap”, a mechanism for accruing protocol income to the tokenholders, would danger implicating the UNI token as a safety. This creates a dilemma the place a decentralized group has to weigh the rewards of possession with authorized danger the place the principles aren’t recognized. Clearer rules may present a pathway for these tokens to seize worth in a compliant method.

By leveraging utility-based classifications alongside on-chain knowledge, policymakers can develop a extra tailor-made regulatory framework to evaluate completely different crypto belongings, decide whether or not they fall beneath securities legal guidelines, and facilitate capital formation for decentralized protocols.

One other main focus of the regulatory dialogue revolves across the buying and selling of securities and non-securities in secondary markets and the extent to which regulators can monitor exercise going down on these platforms to take care of truthful, orderly and environment friendly markets.

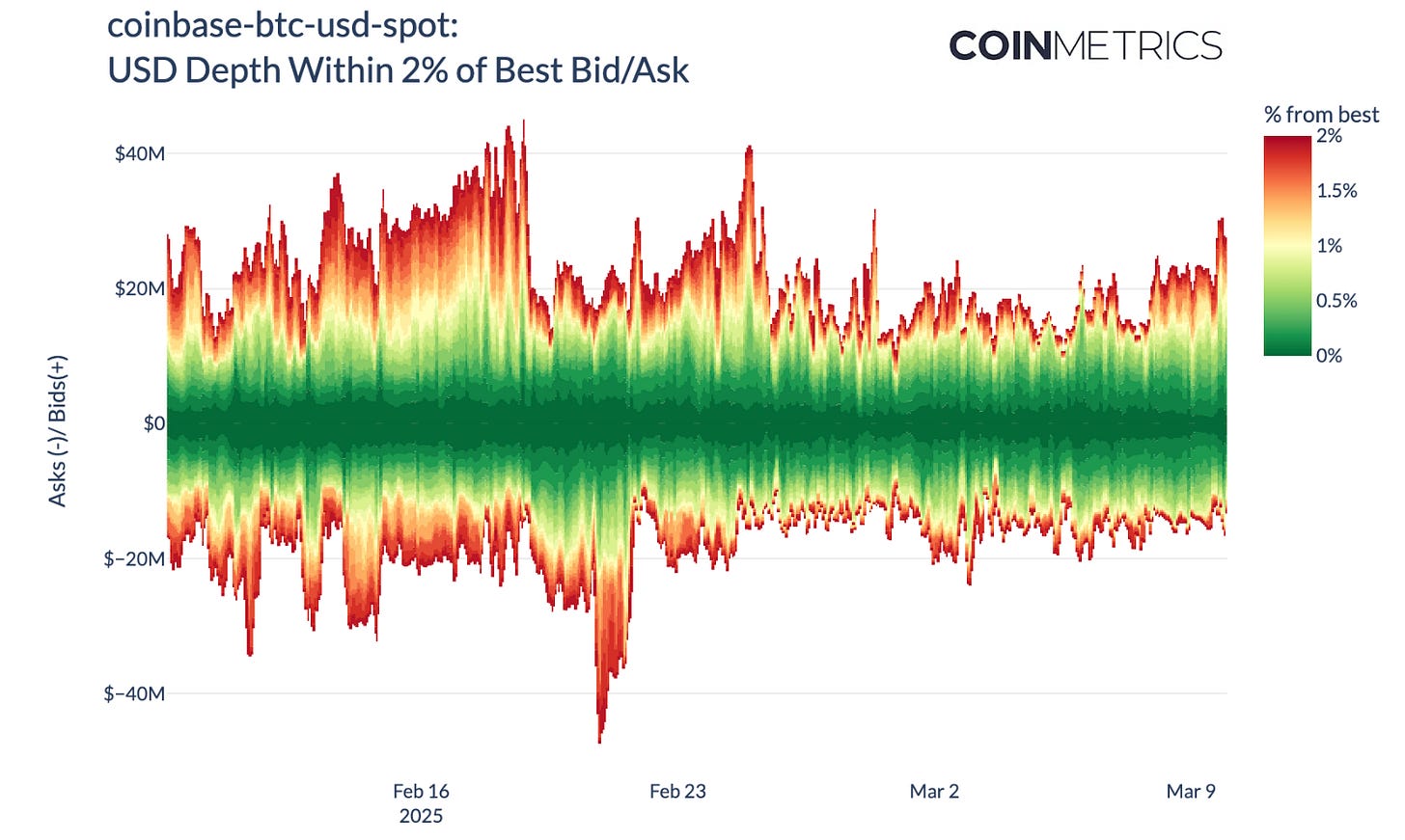

Crypto markets function with an inherent diploma of transparency on account of exchanges resembling Binance or Coinbase exposing their buying and selling knowledge by way of API and the power to leverage on-chain alternate knowledge from public blockchain ledgers . We connect with real-time feeds of a number of exchanges, seize the state of the orderbook at any given time (orderbook snapshots), and mixture them to type the premise for important liquidity metrics, resembling bid-ask spreads, slippage and order guide depth. Exposing knowledge in these varieties permits us to know how liquidity is distributed, how effectively trades are executed, how markets reply to giant shifts in provide and demand, and the execution throughout “off-chain” and “on-chain” buying and selling venues.

Supply: Coin Metrics Market Information Feed, Orderbook knowledge

Sustaining a 24/7/365 connection to those exchanges pose many challenges, as we documented in our API High quality rating in our Trusted Alternate Framework. Not all alternate APIs are created equally: outages nonetheless occur and knowledge uncovered by way of API could be incomplete. Regulatory businesses or some other events interested by monitoring the market should steadiness between connecting to exchanges immediately or outsourcing this to organizations who’ve already constructed the infrastructure to plug into these APIs.

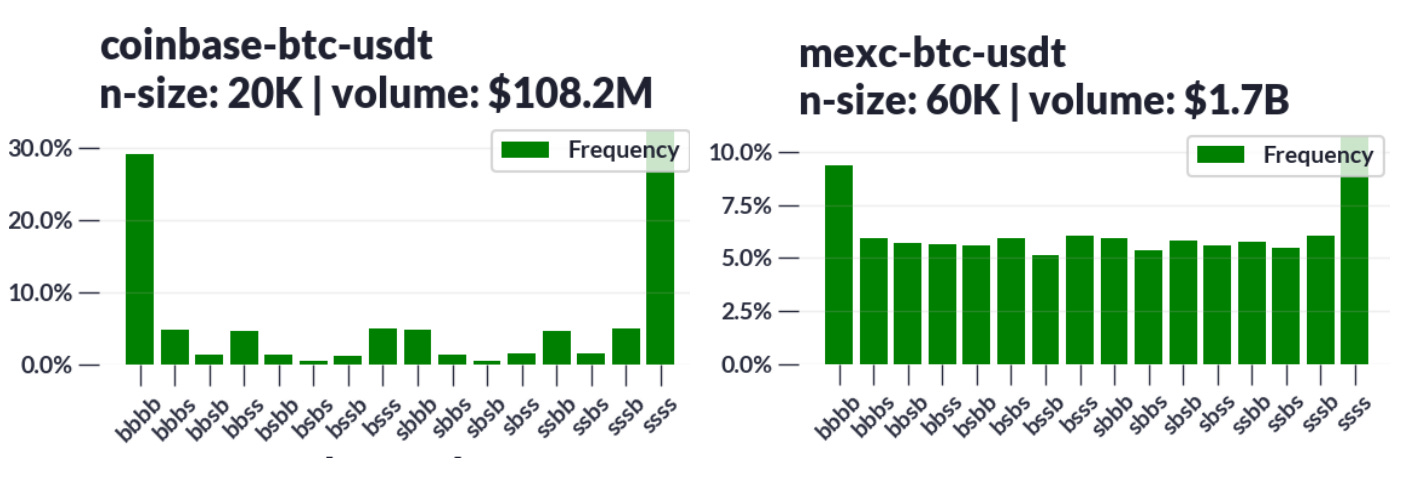

Orderbook knowledge can even supply visibility into types of market manipulation and irregular buying and selling behaviour. For example, we will establish commerce permutations that deviate from natural market exercise and are related to wash-trading.

In well-behaved markets (coinbase-btc-usdt), commerce sequences are likely to function consecutive purchase and promote orders, reflecting pure shifts in market provide and demand. In distinction, markets exhibiting indicators of wash buying and selling typically show an unnaturally uniform distribution of orders, suggesting inflated market exercise somewhat than real market-driven buying and selling (mexc-btc-usdt).

Supply: Coin Metrics Trusted Alternate Framework 2.2

This technique could be prolonged to much less liquid markets, the place there’s extra incentive to inflate market exercise.

At its core, the spirit behind securities regulation is to smoothen the knowledge asymmetry between privileged events and the general public. Crypto’s ingrained cypherpunk values of free-market, permissionless innovation typically appear at odds with the SEC’s mission to guard traders, keep truthful, orderly, and environment friendly markets, and facilitate capital formation. However, these two wouldn’t have to be in battle as a result of each know-how and regulation enforcement finally exist to serve the individuals.

At Coin Metrics, we’ve got over 6 years of expertise in learning blockchain knowledge and perceive its immense potential to advertise transparency. We’ve additionally grow to be intimately conscious from amassing knowledge throughout a number of protocols that not all crypto initiatives adhere to standardized or complete disclosures. Information can play an integral position in surfacing the numerous unhealthy actors that disrupt the mission of constructing a extra interoperable monetary system. Whereas this report solely addresses a fraction of the questions on the SECs agenda, we welcome the Crypto Job Power to leverage on-chain knowledge to develop clear, considerate rules that can foster a thriving crypto trade.

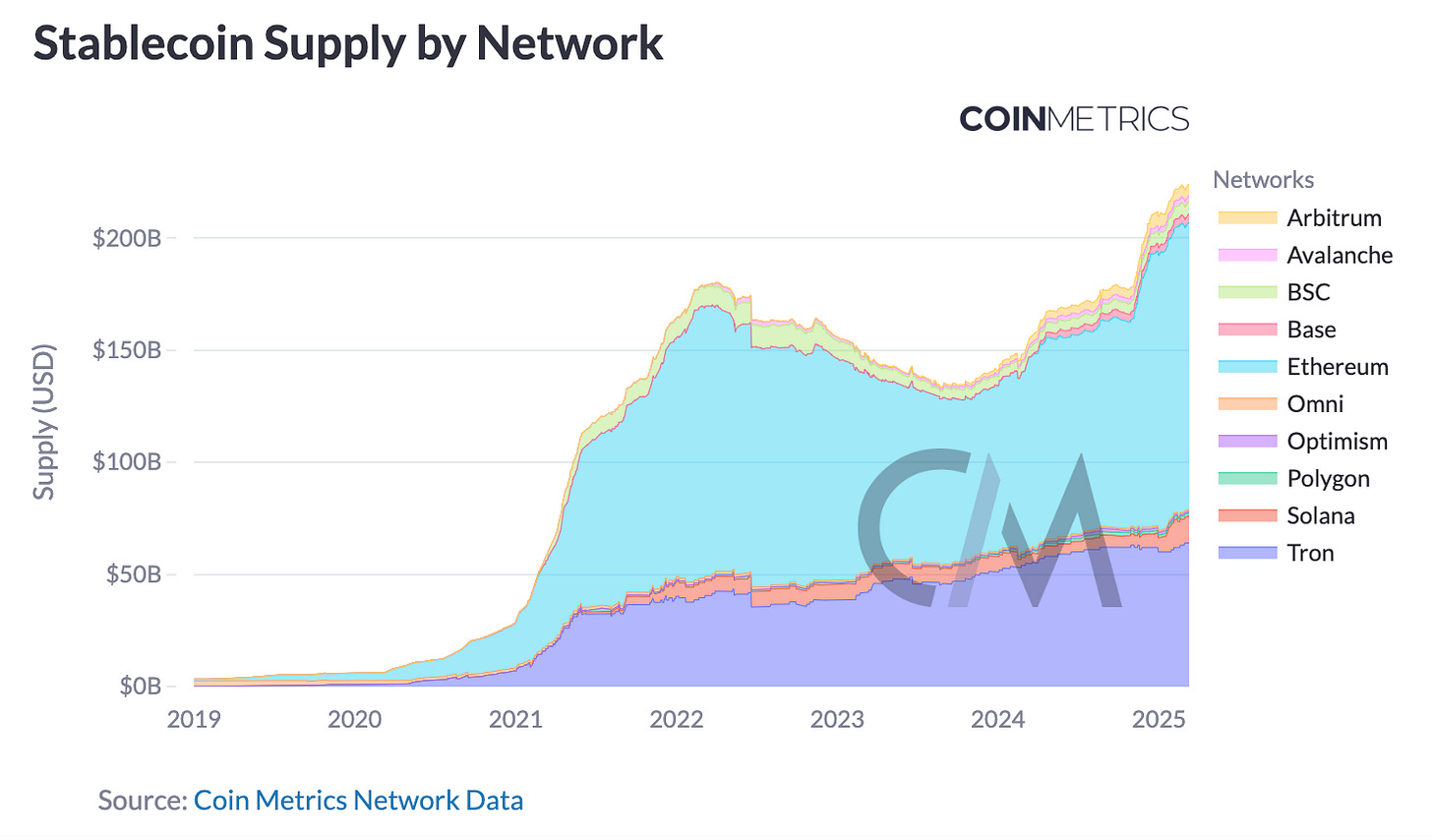

Supply: stablecoins.coinmetrics.io

As markets cool off, mixture stablecoin provide has stabilized round $223B. Ethereum and Tron maintain 85% of whole provide, whereas Solana and Base have expanded to $11.8B and $3.6B, respectively.

-

Comply with Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As at all times, when you’ve got any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier problems with State of the Community right here.