Key Takeaways

- RAY token surged 28% after Raydium introduced its LaunchLab platform to compete with Pump.enjoyable.

- The meme coin sector has been declining, with market cap dropping considerably since its peak.

Share this text

RAY, Raydium’s utility and governance token, surged round 28%, rising from $1.6 to $2 on Tuesday following studies that the agency is rolling out its personal meme coin launchpad that might problem Pump.enjoyable, the go-to platform for meme token debuts.

In response to Blockworks, Raydium’s meme coin manufacturing unit, known as LaunchLab, will keep an identical bonding curve as Pump.enjoyable however will differentiate by permitting third-party consumer interfaces to set charges.

Plus, the platform will help a number of quote tokens and hyperlink with Raydium’s liquidity supplier locker for perpetual swap price safety.

The event of LaunchLab surfaced lower than a month after Pump.enjoyable reportedly examined its personal AMM, a transfer that signaled its intention to tug away from Raydium.

This might massively influence Raydium, which has derived substantial income from Pump.enjoyable’s token swimming pools.

Rumors of Pump.enjoyable’s AMM characteristic triggered a 30% drop in RAY’s worth, CoinMarketCap knowledge reveals.

This decline intensified because the crypto market skilled a widespread correction shortly thereafter, fueled by escalating tariff tensions and a deteriorating macroeconomic setting.

Prior to now month, RAY has plummeted by round 60%.

Declining curiosity in meme cash

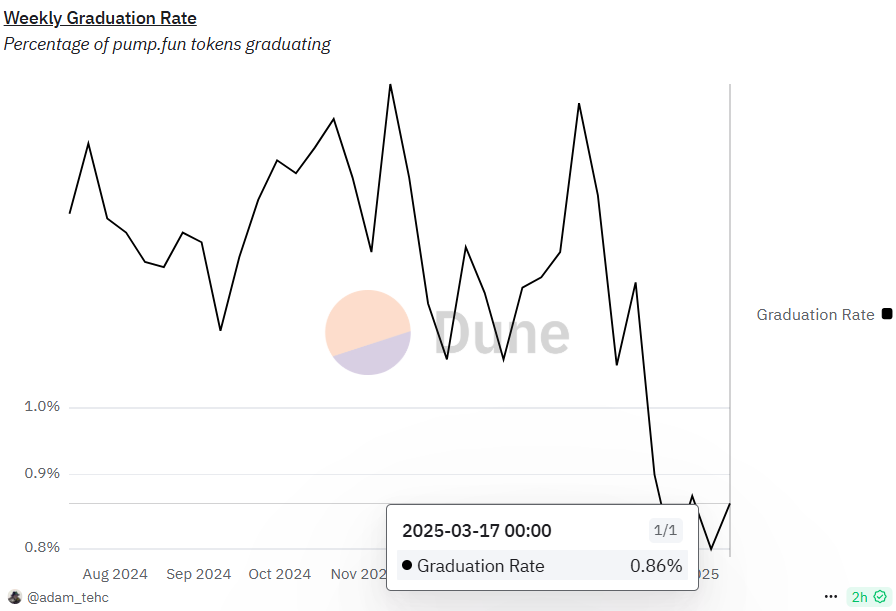

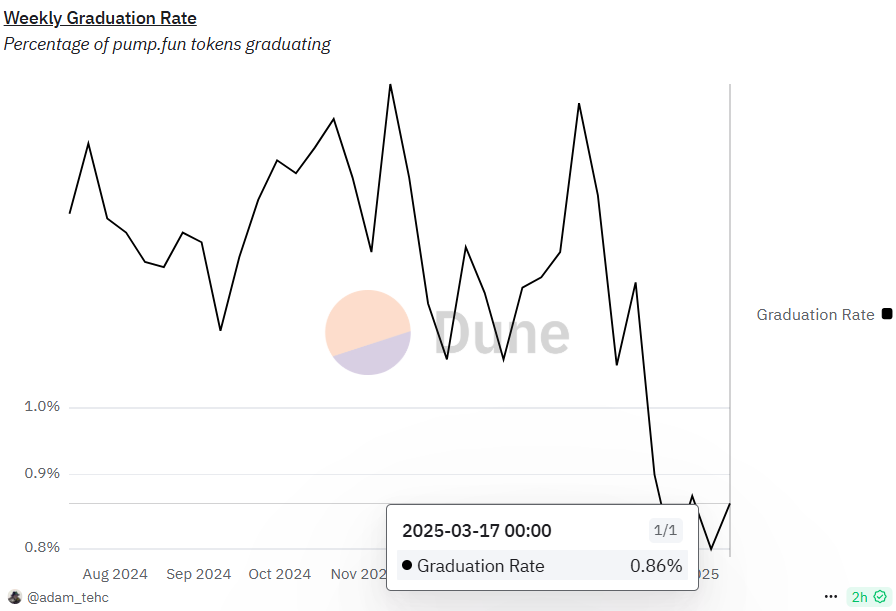

Pump.enjoyable’s commencement fee, which refers back to the share of tokens that efficiently transition from the incubation section to full tradability on a Solana DEX, has been under 1% since February 17, based on Dune Analytics.

Traditionally, the very best commencement fee was 1.67% in November 2024, however even then, absolutely the variety of profitable tokens was important because of the giant quantity of launches.

The present low commencement fee displays declining investor curiosity in meme cash, generally perceived as high-risk investments.

In response to CoinMarketCap knowledge, the meme coin sector’s market cap is down round 65% from its peak on December 9 final yr.

Regardless of short-lived optimism forward of Trump’s inauguration, nearly all of meme tokens had been in a massacre post-inauguration date.

And regardless of slight enhancements in liquidity, the general crypto market, together with Bitcoin, stays underneath stress with no main restoration in sight for meme cash.

That being stated, whereas Raydium’s established presence may present a aggressive edge, the debut of its meme coin launchpad might face preliminary hurdles.

Commenting on Raydium’s transfer, Ceteris, Head of Analysis at Delphi Digital, stated that Raydium will probably encounter a elementary situation of consumer engagement.

Whereas Raydium gives the underlying liquidity infrastructure, platforms like Pump.enjoyable and aggregators corresponding to Jupiter successfully management the consumer interface and expertise, based on the analyst.

“Pump.enjoyable owns the consumer, Raydium is simply back-end infra. Even when customers go to commerce after bonding they go to Jupiter. [Most probably] don’t even notice they’re Raydium swimming pools,” Ceteris stated. “A lot tougher to personal the consumer than to create a vanilla AMM.”

Story Protocol’s Jongwon Park added, “the truth is, crypto UX will get higher if you summary away 10s of AMMs. Merchandise are king, and liquidity in AMM follows merchandise.”

Share this text