Get one of the best data-driven crypto insights and evaluation each week:

By: Tanay Ved

-

As Ethereum leans right into a Layer-2-centric scaling mannequin, exercise has more and more migrated to L2s. This has helped scale its ecosystem but in addition diminished mainnet transaction demand, reshaping Ethereum’s financial dynamics.

-

The introduction of blobspace within the Dencun improve made L2 settlement considerably cheaper, enabling worthwhile L2s like Base—which has earned ~$94M in revenue whereas paying simply ~$4.9M to Ethereum. This has reignited debate over whether or not L2s are extractive or symbiotic.

-

ETH’s returns are more and more tied to community fundamentals like charges and burn, suggesting it’s being valued as a revenue-generating asset. As these metrics decline, ETH’s underperformance displays market issues round weakening worth accrual.

-

Upcoming upgrades like Pectra purpose to double blob capability and stimulate demand throughout each L1 and L2, laying the groundwork to revive long-term worth to Ethereum’s ecosystem.

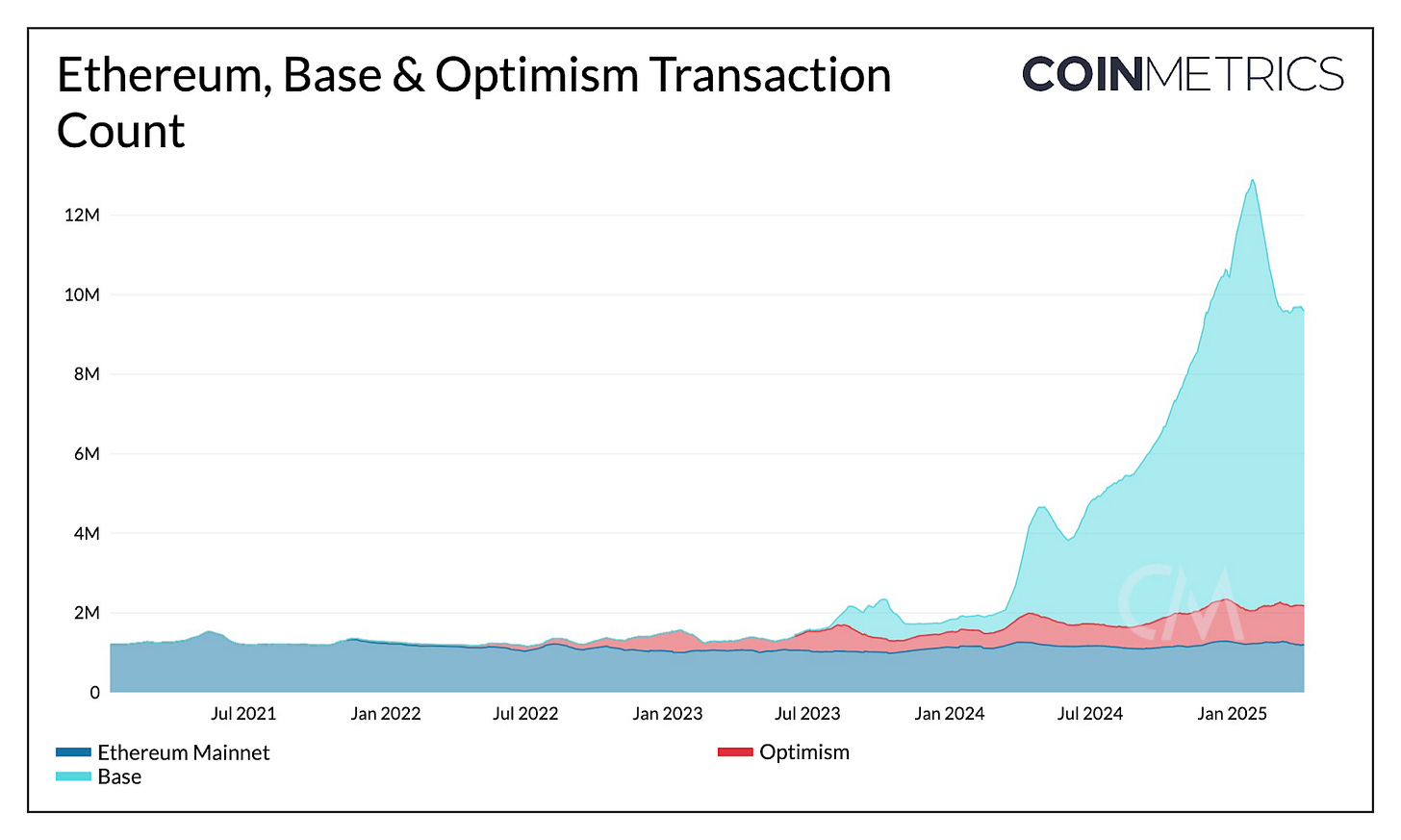

One 12 months for the reason that launch of blobs (type-3 transactions) within the Dencun improve, Ethereum’s transition to a Layer-2 primarily based scaling mannequin is effectively underway. As demand for blockspace grew and the constraints of Ethereum mainnet turned extra pronounced in 2021, the community turned to Layer-2s (L2s) as a technique to scale Ethereum’s ecosystem. Exercise has more and more migrated to L2s like Base, Arbitrum and Optimism, reshaping Ethereum’s financial mannequin and surfacing new questions on ETH’s worth accrual because it continues to underperform.

On this concern of Coin Metrics’ State of the Community, we discover the evolving relationship between Ethereum and its Layer-2 ecosystem, inspecting how L2 utilization and economics are reshaping Ethereum’s on-chain exercise, and the trail to restoring ETHs worth accrual.

To scale past the constraints of Ethereum’s Layer-1, specifically restricted throughput and excessive transaction charges during times of rising blockspace demand, Ethereum turned to Layer-2s as supporting infrastructure to develop transaction capability and drive adoption. By processing transactions off-chain, L2s assist Ethereum scale, reaching larger throughput, at decrease prices, whereas additionally retaining its underlying safety.

This technique has taken form with Ethereum now serving as a settlement and information availability layer for a rising set of Optimistic and ZK-rollups. Past general-purpose rollups like Arbitrum and Optimism, exchanges like Coinbase (Base) and companies like Sony (Soneium) are launching their very own Layer-2s, whereas initiatives like MegaETH are constructing rollups optimized for particular high-performance use circumstances.

Supply: Coin Metrics Community Knowledge Professional

Collectively, these L2s are considerably increasing Ethereum’s ecosystem. Optimism is seeing 990K every day transactions whereas Base, Coinbase’s Layer-2 is alone including 7.5M transactions with each at the moment that includes 2.5 second block occasions.

The Dencun improve in March 2024 launched blobspace, dramatically lowering L2 settlement prices and making transactions extra inexpensive. This drew a big quantity of exercise, significantly lower-value transactions, away from mainnet, whereas additionally protecting them from different low-fee chains like Solana or Binance Good Chain. Some property like USDC and cbBTC are actually additionally natively issued on L2s like Optimism and Base, whereas many are being bridged to entry purposes on Layer-2s.

This dynamic has led to many questioning whether or not Layer-2s are web constructive for Ethereum, or whether or not they’re “extractive”. Whereas the reply is nuanced, understanding how Layer-2s function, the affect they’ve had and the place they go from right here might be useful.

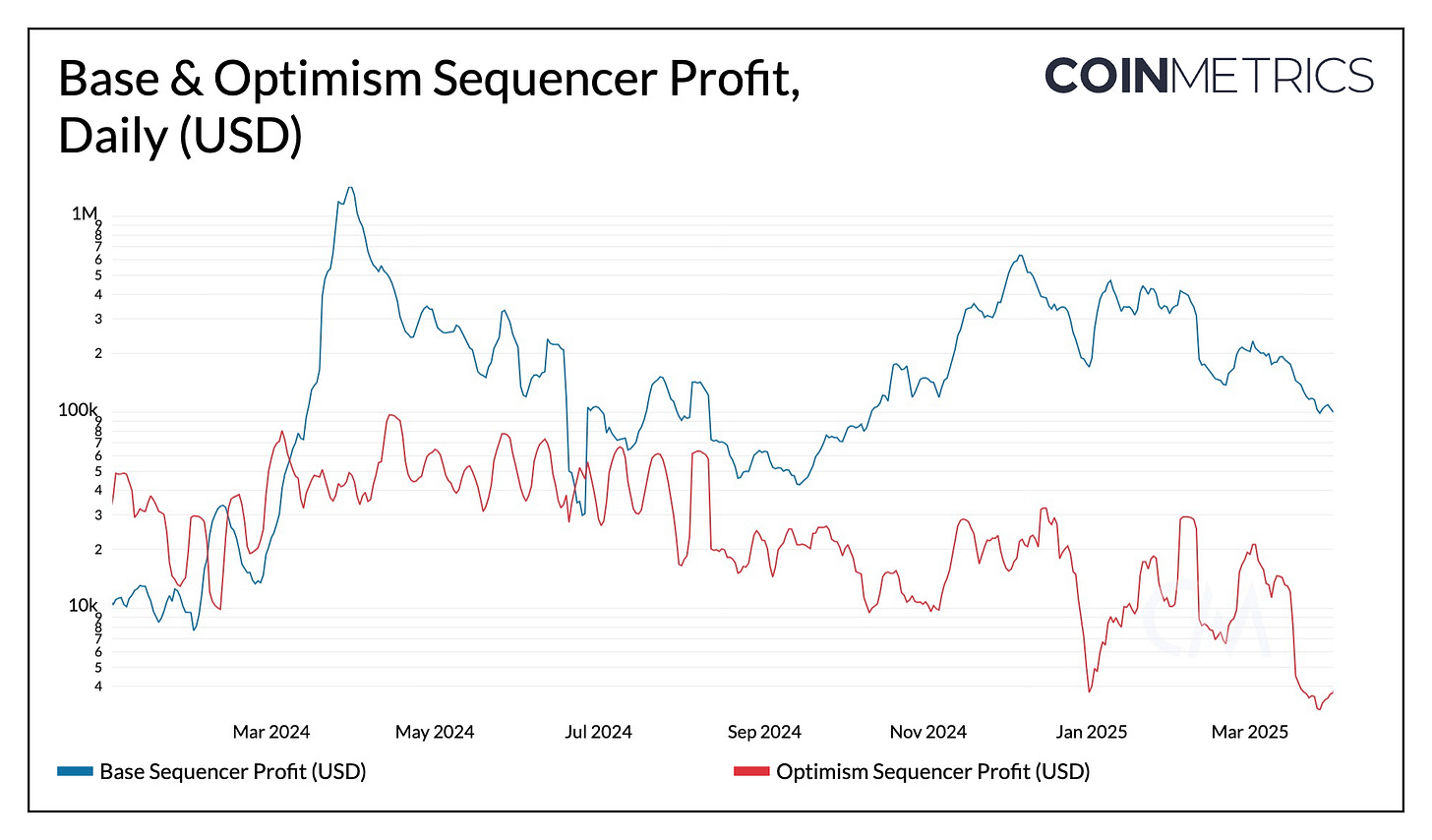

On the heart of each Layer-2 is the sequencer. That is infrastructure (usually operated by a single entity in the present day), that orders and batches person transactions into blocks, and posts compressed transaction information again to Ethereum for settlement and information availability (DA). Layer-2s generate income from the charges customers pay to transact on the community and incur prices when submitting information to Ethereum, primarily by way of blob charges. Profitability lies within the distinction between what L2s earn from customers and what they pay to Ethereum.

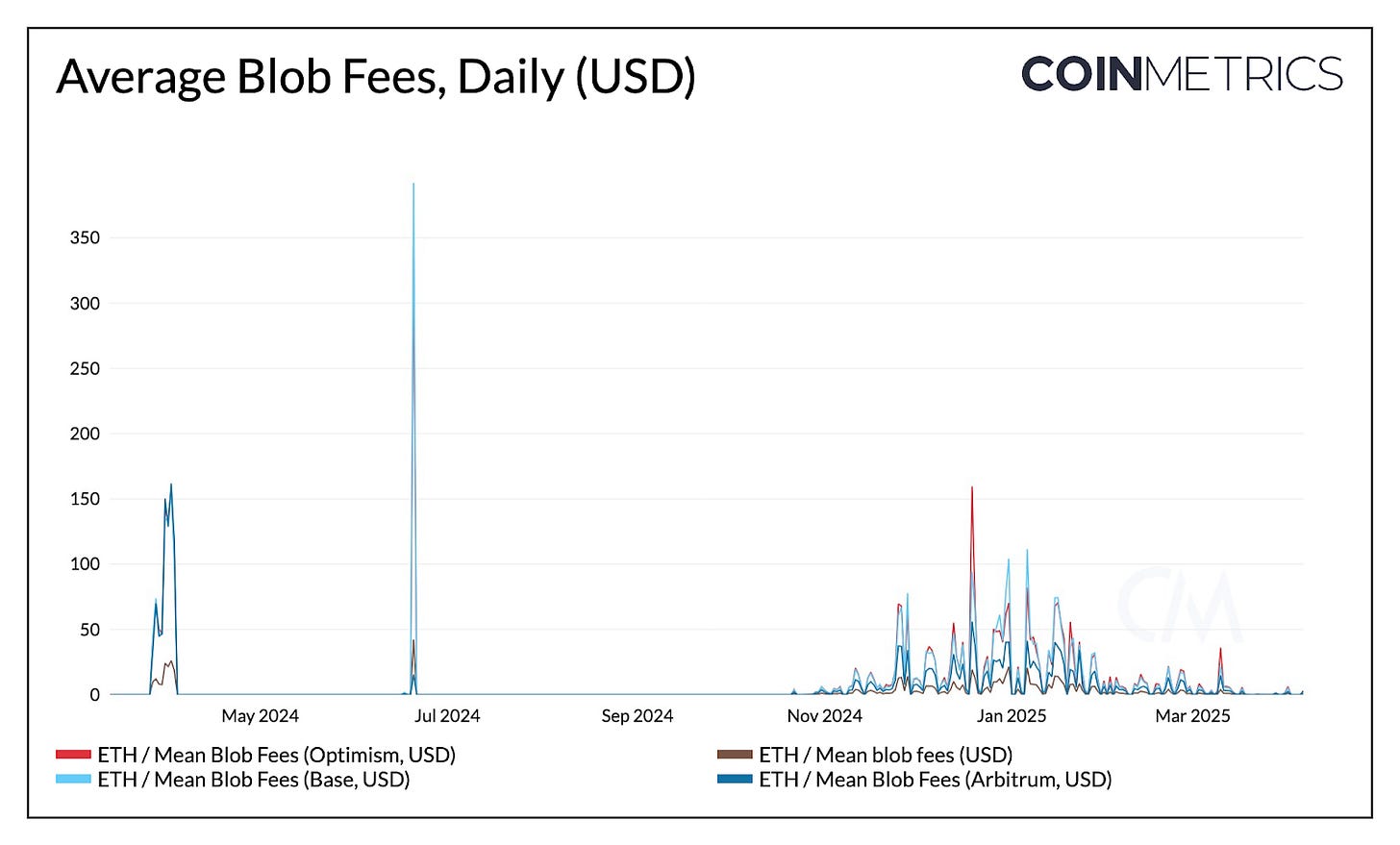

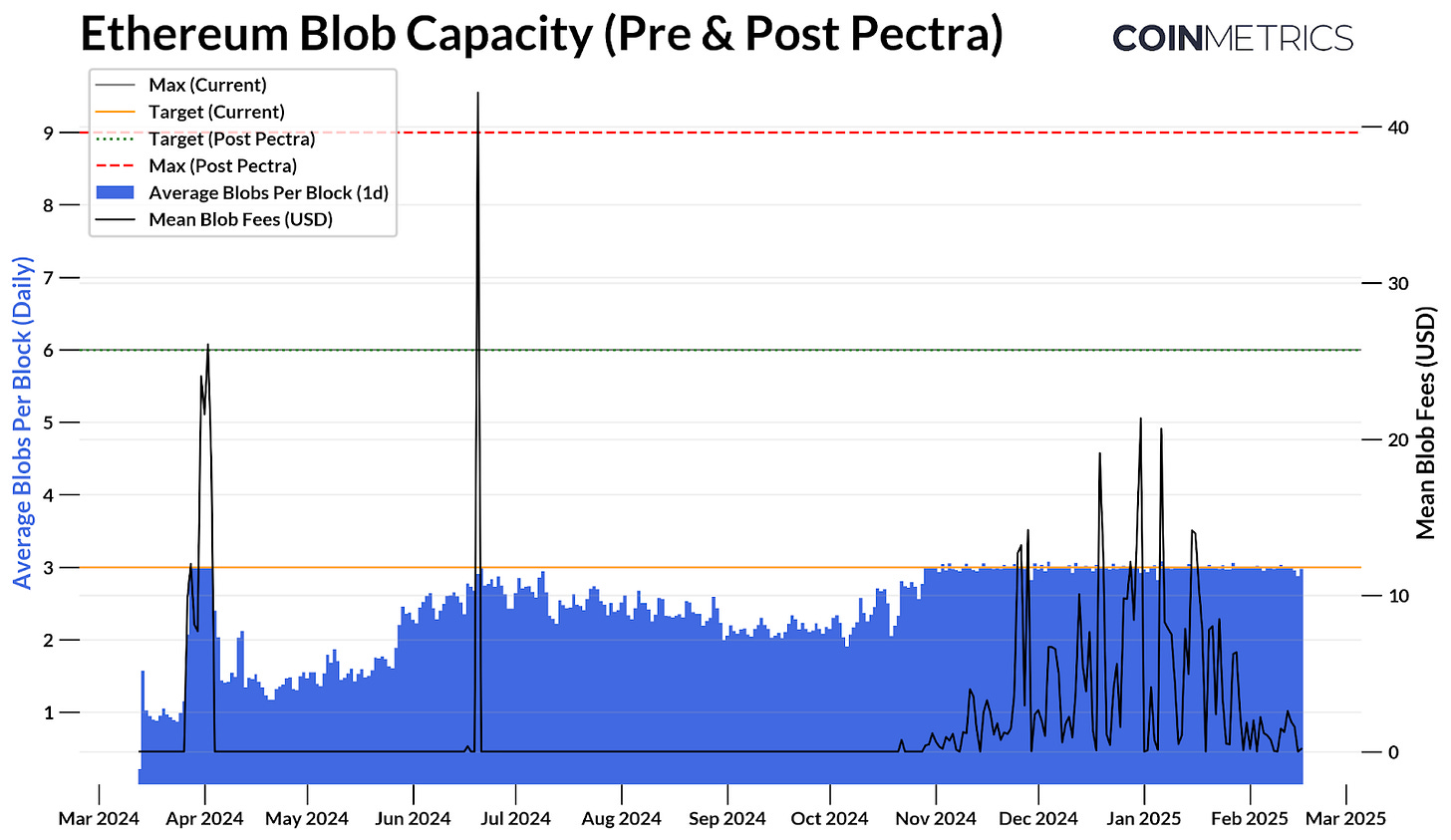

For the reason that adoption of blob transactions launched in EIP-4844, Layer-2 settlement prices have dropped considerably. Blobs supply a extra environment friendly and scalable type of information storage, with common prices usually underneath $1—rising solely during times when utilization exceeds the goal capability of three blobs per block, which will increase the blob base charge.

Spikes in demand from occasions like onrush of “blobscriptions” or the LayerZero airdrop briefly drove blob charges larger. Nevertheless, from November to March, blobs have persistently hit goal capability, with charge will increase pushed by natural utilization.

Supply: Coin Metrics Community Knowledge Professional

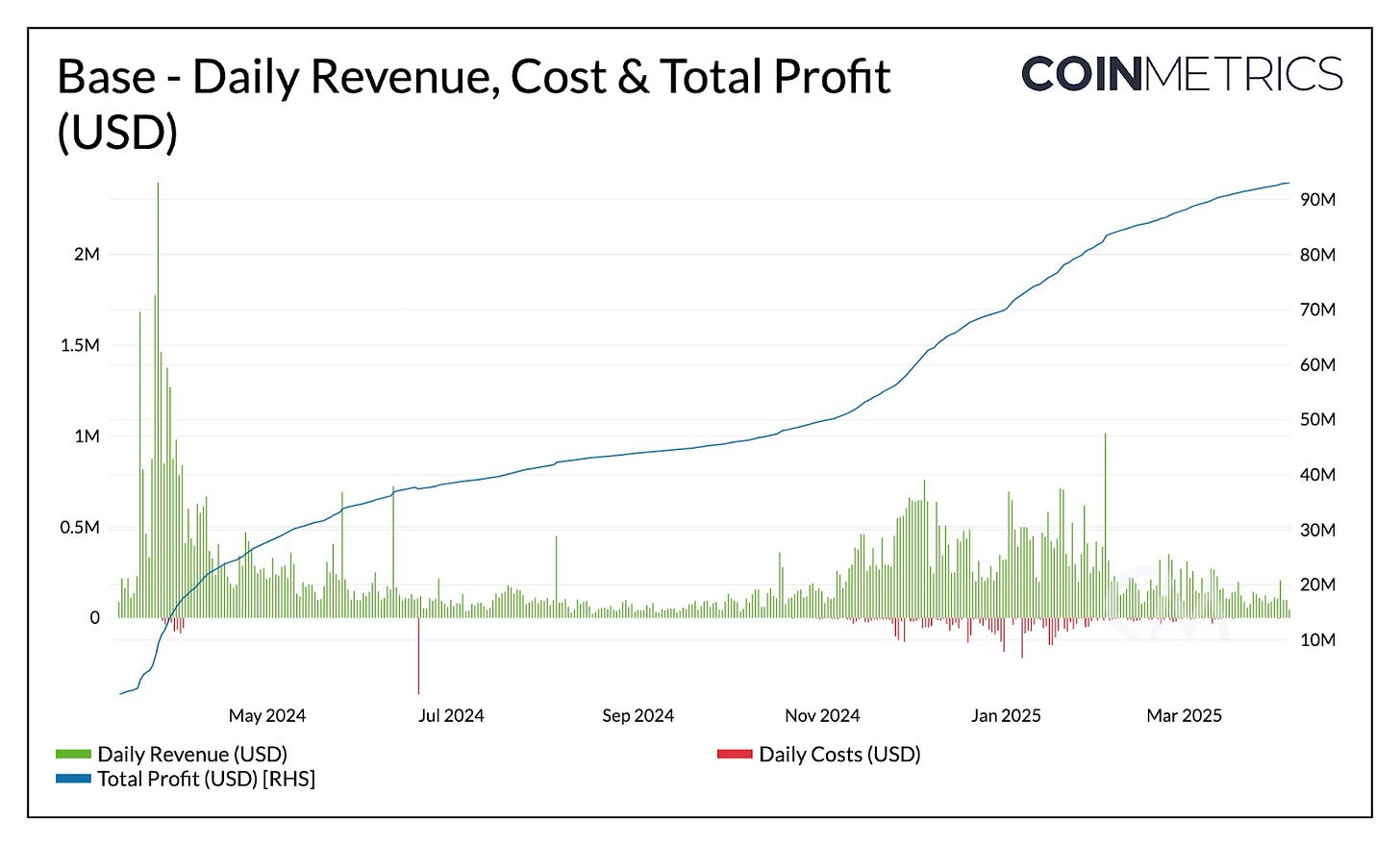

Because of these low prices, mixed with the truth that many Layer-2s function “Stage 0” rollups with a single sequencer, L2s might be fairly a worthwhile enterprise mannequin. Taking Base for example, a rollup that has seen probably the most person demand to date, earned a complete of ~$98M in revenues from person transaction charges (together with base and precedence charges), whereas paying solely ~$4.9M to the Ethereum base layer, leading to a complete estimated revenue of $94M for the reason that Dencun improve in March 2024 (not accounting for Base’s income share with the Optimism Collective).

Supply: Coin Metrics Community Knowledge Professional

Whereas Base leads on this regard, a number of different L2s like Optimism and Arbitrum function at wholesome margins, balancing blockspace demand with cost-optimization methods. This highlights how Layer-2s, with low working prices and rising person exercise, have gotten a viable and scalable enterprise mannequin, additional incentivizing L2 progress and adoption inside Ethereum’s ecosystem.

Supply: Coin Metrics Community Knowledge Professional

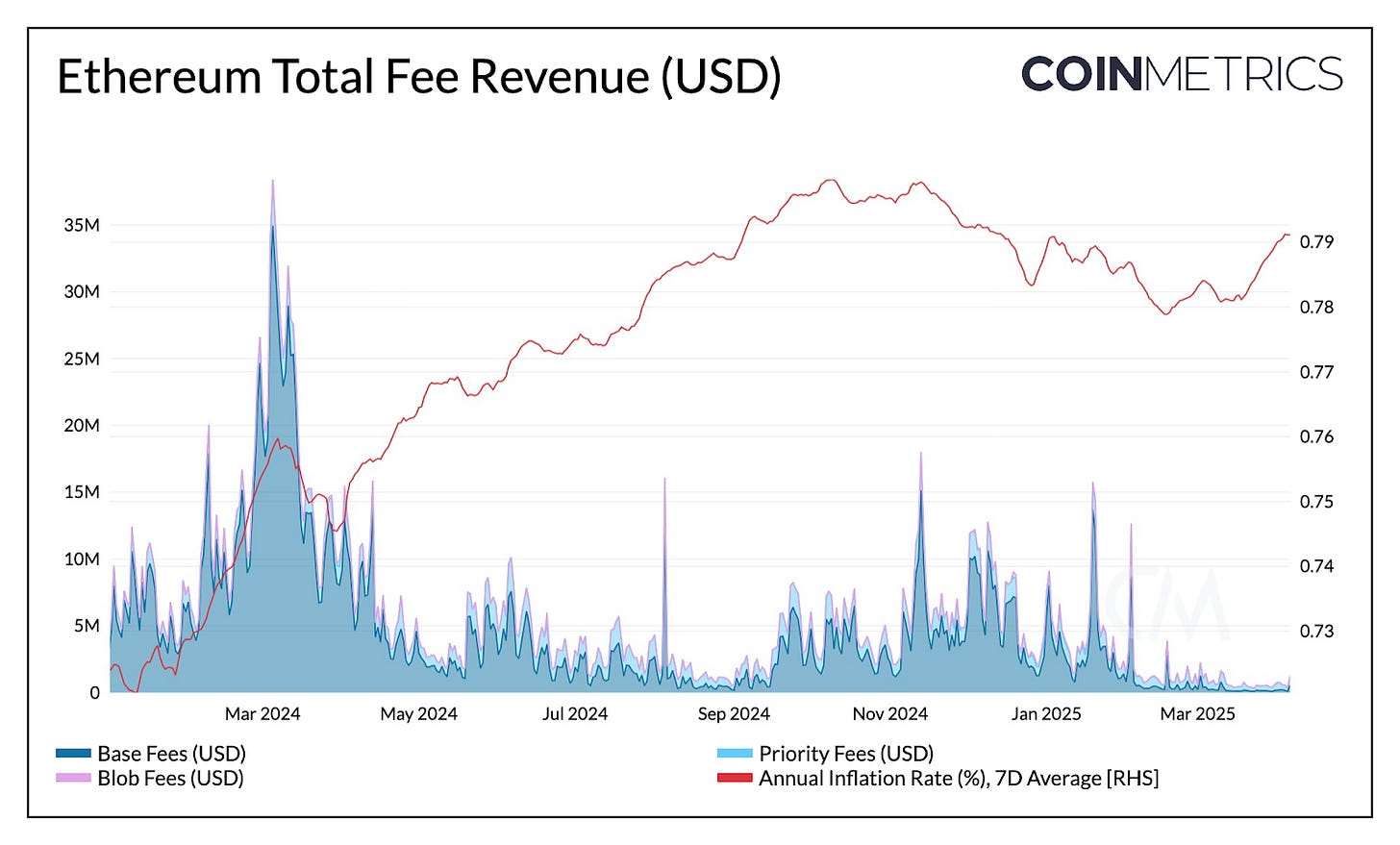

As Layer-2s thrive, Ethereum’s core economics have seen a number of unintended penalties. With transaction exercise shifting to L2s, blockspace demand on mainnet has declined. Complete Layer-1 charges, (together with base charges, precedence charges, and blob charges), have fallen from over ~$30M on the time of the Dencun improve to round ~$500K in the present day. In consequence, ETH burn has slowed to report lows (~100 ETH per day), pushing Ethereum’s annualized inflation price to +0.78%.

Supply: Coin Metrics Community Knowledge Professional

This shift has reignited debate across the position that Layer-2s play. Some argue they’re “extractive,” capturing a disproportionate share of financial worth whereas paying again solely a fraction to Ethereum by way of blob charges. Others view them as symbiotic, rising Ethereum’s community results and utility.

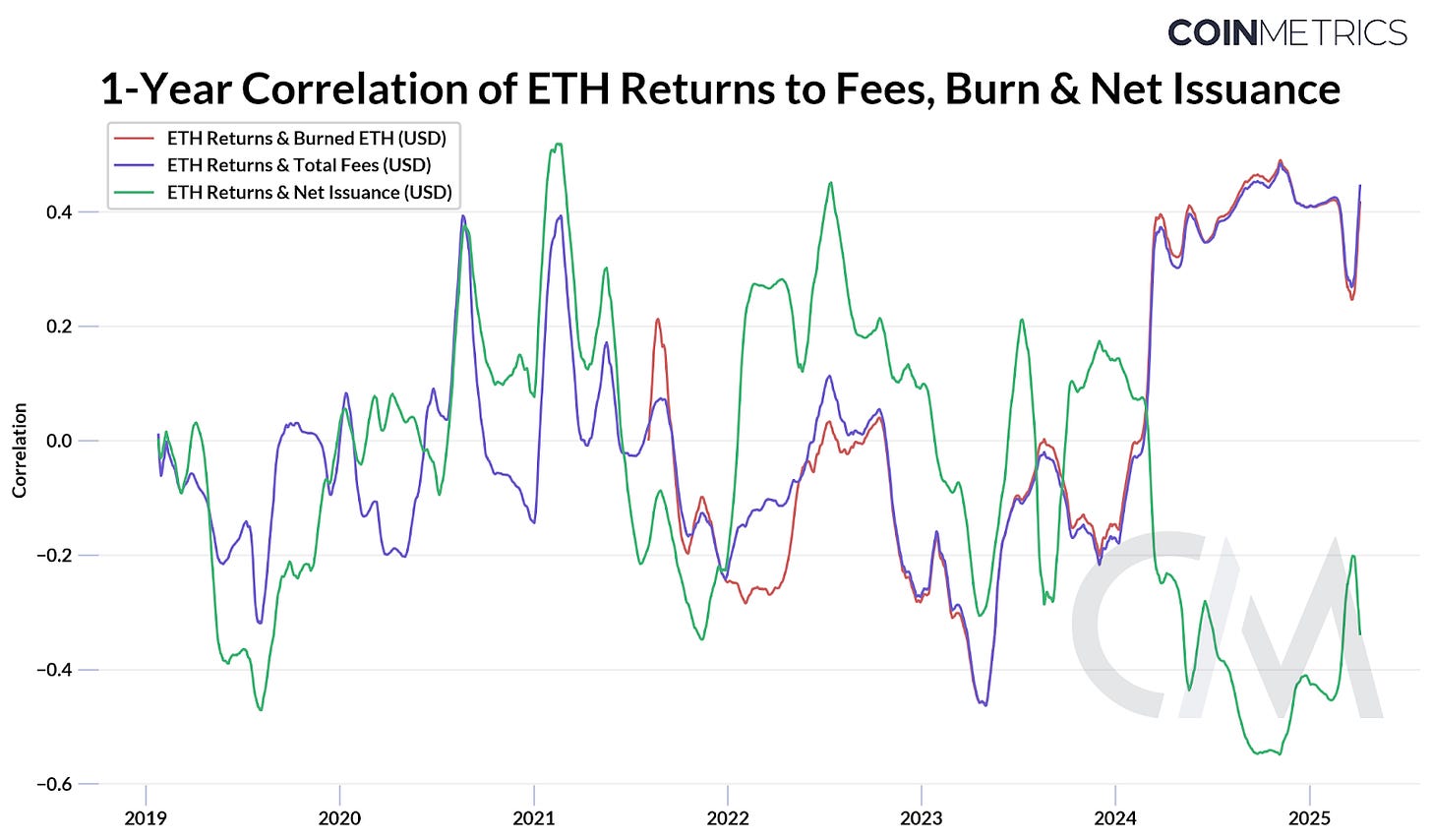

As ETH’s value reaches a 2-year low, questions round worth accrual have turn into extra urgent. The 1-year correlation of ETH returns to community metrics like whole charges and burned ETH has strengthened (+0.4) since 2023, whereas its correlation to web issuance has turned destructive. This means that ETH is more and more being priced on its charge income.

Supply: Coin Metrics Community Knowledge Professional & Reference Charges

As mainnet charges and burn charges decline, and web issuance rises, traders look like discounting ETH’s valuation, reflecting issues about weakening worth accrual.

This sample reveals the reflexive nature of Ethereum’s economics. As community utilization rises, so do charges and burn, supporting ETH’s value and vice versa. Whereas this doesn’t imply ETH’s worth accrual is basically damaged, it reveals the market is very delicate to blockspace demand (charges & burn). As Ethereum continues its Layer-2 transition, ETH’s valuation could replicate decrease mainnet exercise within the quick time period. Nevertheless, it may regain momentum by way of the identical reflexive dynamics, particularly if worth accrual turns into higher aligned throughout layers.

Ethereum’s upcoming Pectra improve, now scheduled for Could seventh, will mark step one in a broader effort to increase blob capability. It would elevate the goal from 3 to six blobs per block and the utmost to 9 blobs, serving to cut back blob charges and make Layer-2 settlement much more scalable. Future upgrades like Fusaka are anticipated to proceed this trajectory, aiming to unlock higher mixture transaction demand throughout L2s and in the end drive larger blob utilization and charge income for Ethereum.

Supply: Coin Metrics Community Knowledge Professional

Nevertheless, this gained’t be straightforward because it’d require L2 transaction volumes to develop by a number of orders of magnitude, which could take longer to play out with future protocol upgrades. Due to this fact the important thing to restoring Ethereum’s worth disconnect doubtlessly lies in stimulating each L1 and L2 demand:

-

Scaling Layer-2s: Rising L2 capability and utilization to drive larger mixture blob charges.

-

Reinvigorating & Scaling Layer-1: Concurrently scaling L1, and attracting high-value use circumstances like stablecoins, tokenization, and DeFi to revive mainnet exercise and charge accrual.

Ethereum builders and Vitalik himself acknowledged the necessity to scale Ethereum’s Layer-1, even in an L2-centric future. This effort has begun with a current fuel restrict improve from 30M to 36M, with additional upgrades deliberate for the Ethereum Digital Machine (EVM) and cross L1-L2 interoperability. Whereas many different approaches, corresponding to native or based-rollups, or potential adjustments to blob charge pricing are being explored, this stays the broad path for Ethereum’s improvement.

As Ethereum’s modular roadmap unfolds, its relationship with Layer-2s will stay central to each community scalability and ETH’s long-term worth. Whereas short-term rising pains are evident, the groundwork is being laid for a extra sustainable and scalable financial mannequin. As Ethereum positions for broad adoption, it should cope with balancing the complexity of ongoing protocol upgrades, whereas scaling the ecosystem and restoring worth accrual. With over $230B in stablecoins and a rising share of tokenized property, Ethereum stays well-positioned to capitalize on renewed demand and real-world adoption.

Monitor Ethereum’s L2 economics and blob utilization in our dashboard!

As all the time, you probably have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You possibly can see earlier problems with State of the Community right here.