Get one of the best data-driven crypto insights and evaluation each week:

By: Tanay Ved & Matthias Funke

Choices are more and more getting used to handle danger, specific directional views, and gauge market sentiment, making them a robust lens for understanding crypto market dynamics.

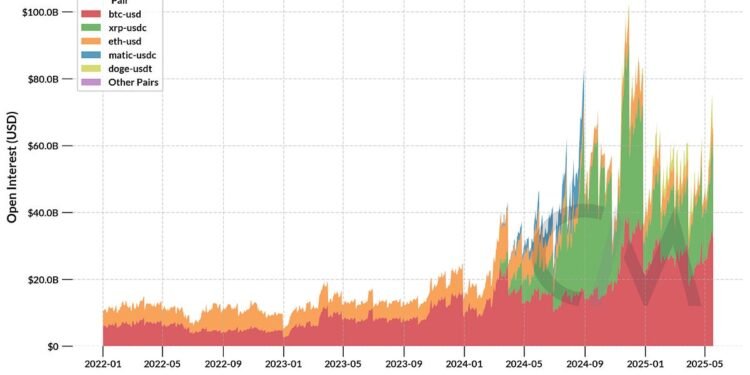

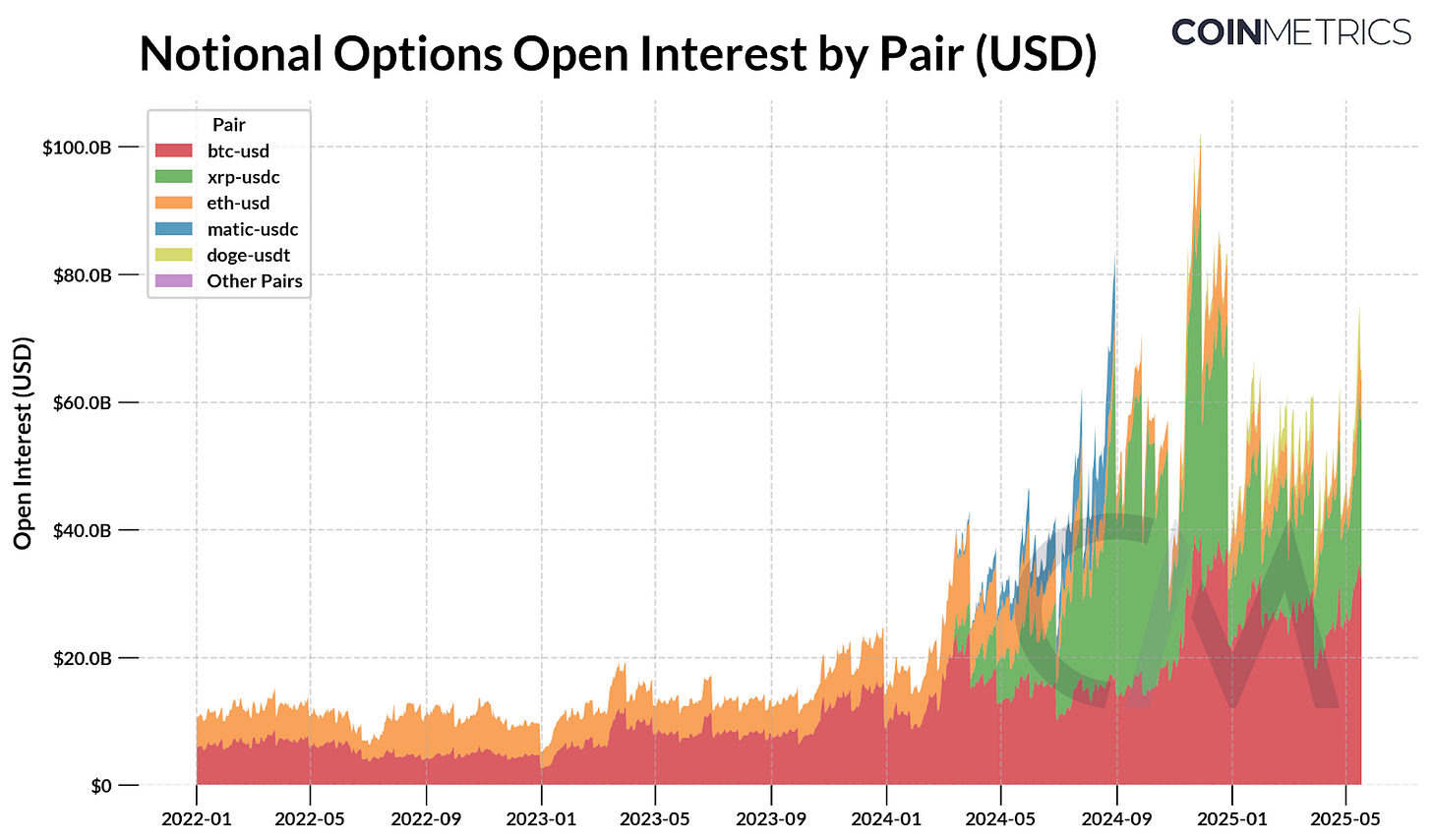

Open curiosity in BTC choices has surged 5x since 2022, reflecting the rising adoption and liquidity in choices markets. Deribit accounts for the overwhelming majority of exercise, whereas BTC-USD, XRP-USDC, ETH-USD, are among the many prime traded pairs throughout exchanges.

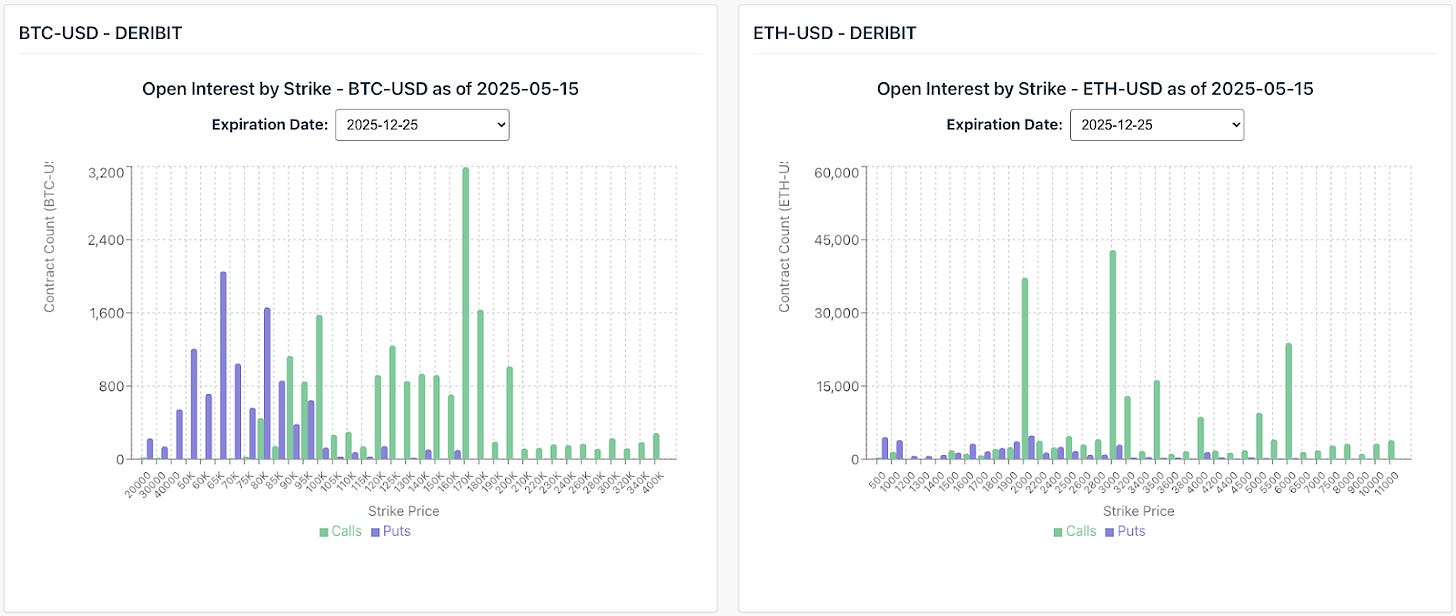

Positioning for Deribit’s choices contracts within the medium-term (expiring 12/25) reveals a bullish tilt in BTC, with open curiosity concentrated between $90K–$180K. ETH positioning is extra dispersed throughout strike costs, reflecting much less consensus on its future course.

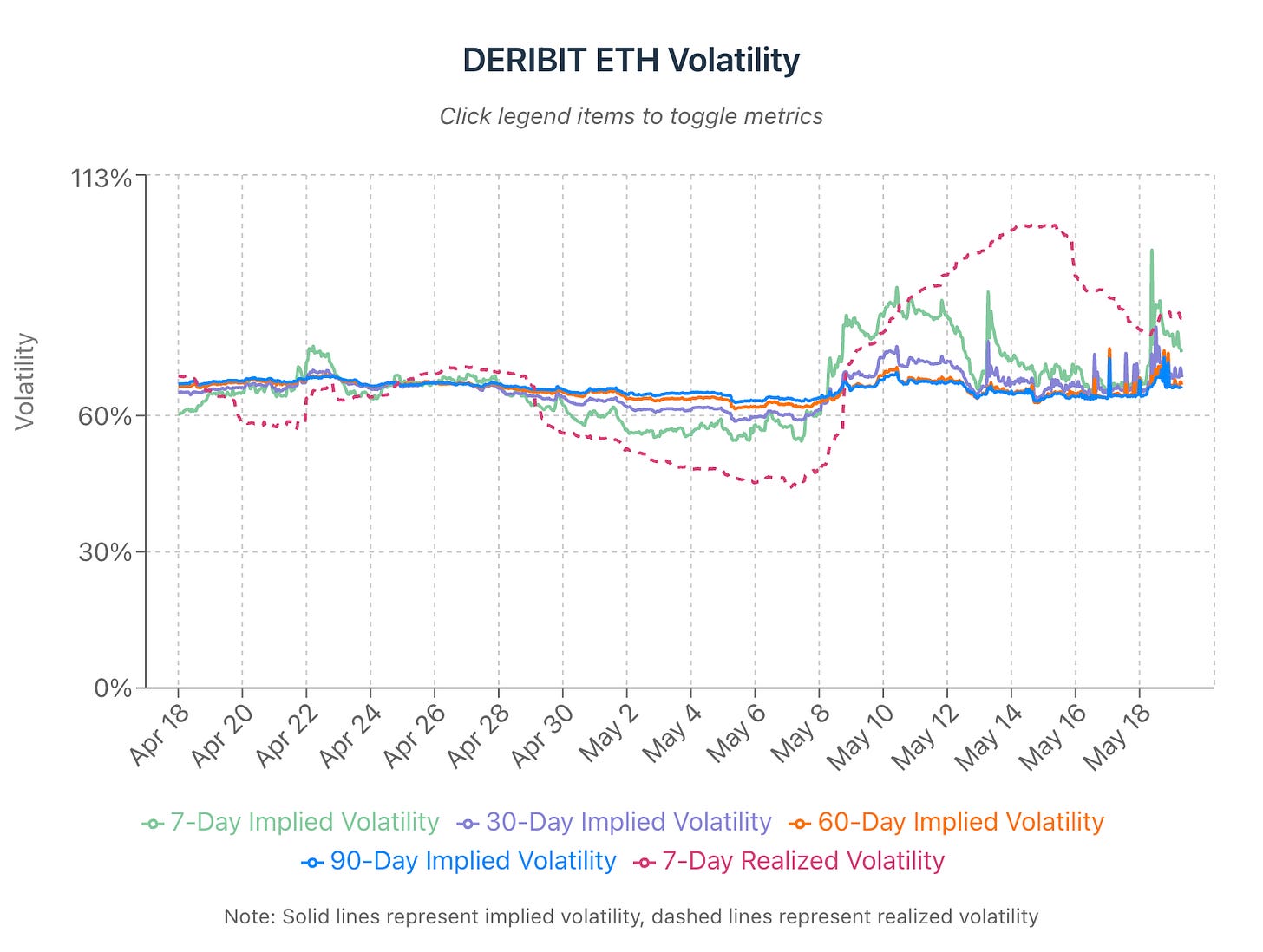

Brief-term implied volatility for each BTC and ETH has just lately risen, reflecting rising expectations of near-term worth swings.

Choices are rapidly turning into a core a part of crypto’s market construction, complementing the extra established spot and futures markets. They provide contributors one other device of their arsenal to hedge danger, specific directional views and interpret market sentiment. In late 2024, the SEC authorized choices buying and selling on spot Bitcoin ETFs, and Coinbase just lately acquired Deribit, catalysts that collectively reveal the evolution of choices in crypto. As liquidity in these markets deepens, choices information gives a priceless lens into how merchants are positioned, and what the market collectively expects.

On this problem of Coin Metrics’ State of the Community, we study crypto market dynamics via the lens of choices information, exploring traits in open curiosity and quantity, and what they reveal about positioning, volatility expectations and broader shifts in market sentiment.

Choices are a sort of derivatives contract which give the proprietor the fitting, however not the duty to buy (name) or promote (put) the underlying asset at a pre-determined worth (strike worth) by a set expiration date. Like different derivatives, their worth is derived from the value of the underlying asset, on this case, crypto-assets like BTC and ETH.

Choices are a robust device for managing danger, hedging in opposition to draw back strikes, or expressing directional views via hypothesis. Due to how they’re priced and traded, choices additionally provide a singular lens into the market’s collective expectations for future worth motion and volatility.

There’s two fundamental varieties of choices that serve completely different strategic functions:

Name Choices: Give the holder the fitting to purchase the underlying asset on the strike worth. Merchants typically use calls to specific bullish views, betting that the asset’s worth will rise above the strike worth by expiration.

Put Choices: Give the holder the fitting to promote the asset on the strike worth. Places are generally used to hedge in opposition to draw back danger or speculate on worth declines.

Every choices contract is outlined by just a few key traits that decide its worth and conduct:

Strike Value: The worth at which the dealer should purchase or promote the asset.

Expiration Date: The date by which the choice expires, or have to be exercised.

Premium: Value paid by the client of an choices contract.

The premium, or market worth, of an possibility fluctuates always primarily based on the value of the underlying asset, time until expiration, and broader market circumstances akin to volatility.

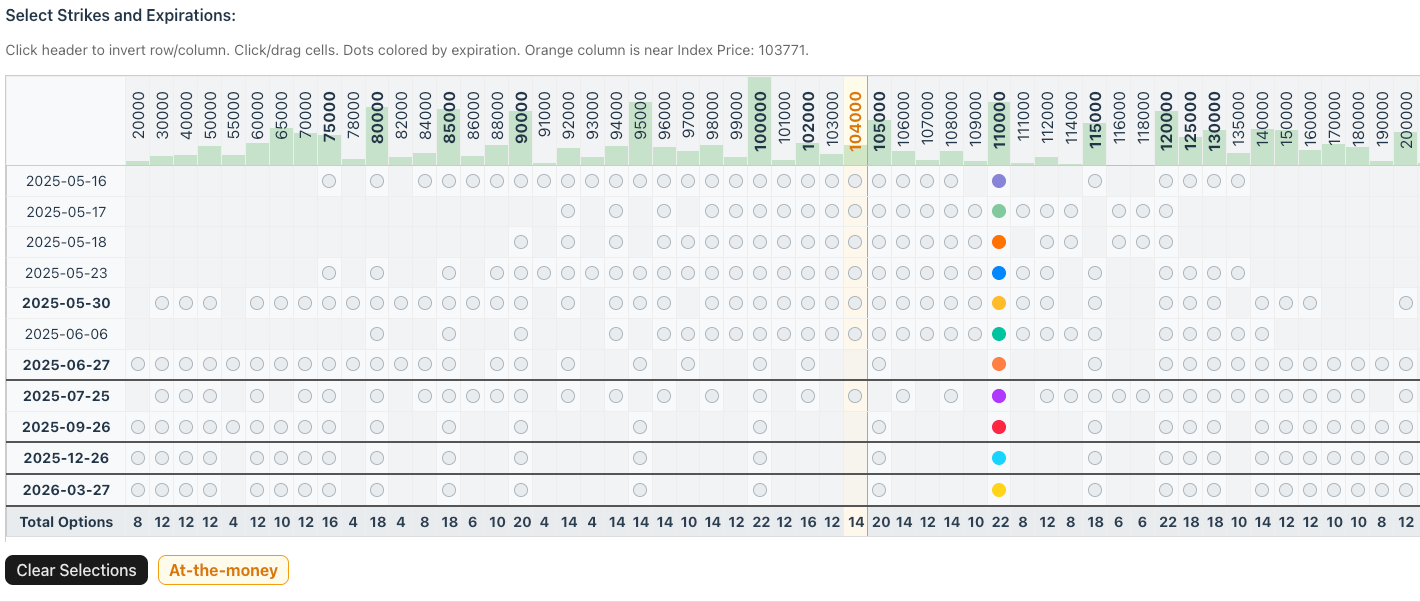

As an illustrative instance, we are able to take into account the matrix beneath that visualizes the connection between strike worth and expiration date for BTC-USD choices on Derbit. Every dot represents an lively choices contract (with coloured dots indicating chosen contracts), organized by strike worth on the horizontal axis and expiration date on the vertical axis, extending out until March 2026.

Supply: Coin Metrics Market Knowledge Feed & CM Labs

Inexperienced bars alongside the highest spotlight strike costs with the very best open curiosity, indicating ranges the place market contributors are most concentrated. This grid might help us construct an instinct for the way choices markets are structured, the place curiosity is most clustered and the way an possibility’s worth can shift primarily based on these components.

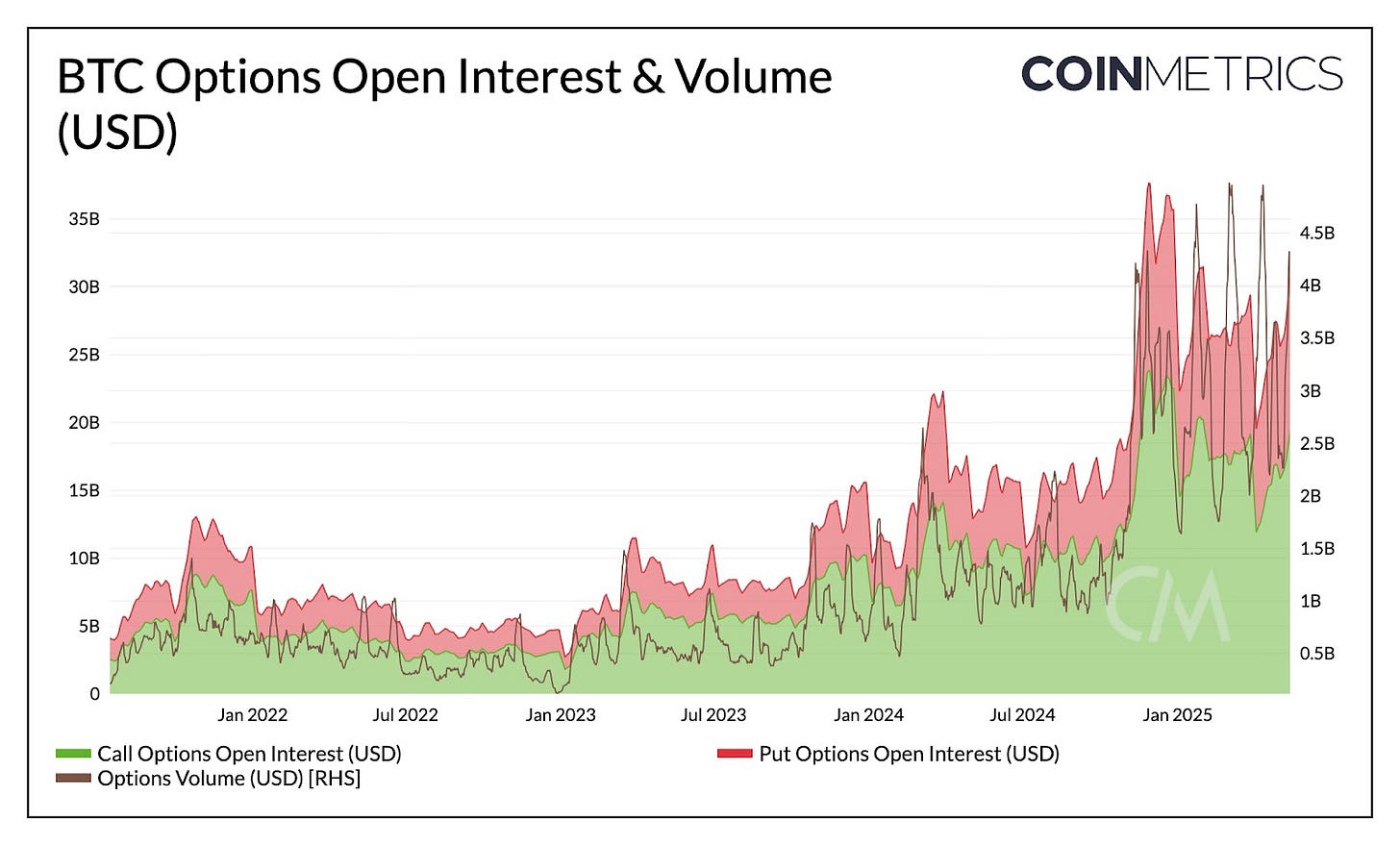

Open curiosity is without doubt one of the foundational metrics in choices markets. It refers back to the whole variety of excellent (unsettled) choices contracts and is a priceless indicator of market participation and liquidity. This may be measured in contract depend, market worth, or in notional USD phrases. Alongside it, choices quantity displays the market worth or notional worth of contracts traded over a given interval, capturing how actively contributors are participating with the market.

Supply: Coin Metrics Market Knowledge Professional

Bitcoin (BTC) name and put open curiosity has grown considerably since early 2022, climbing from round $5B to over $30B in 2025. This development in choices adoption has accelerated in current months as markets expertise a lift in optimism and volatility after the U.S. elections. Choices quantity has additionally risen, albeit seeing bursts of exercise since January.

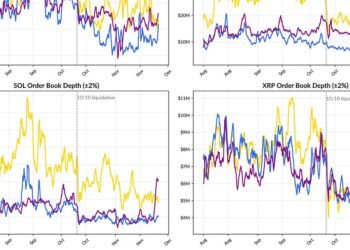

Within the chart beneath, we see notional open curiosity damaged down by buying and selling pairs throughout choices exchanges. BTC-USD continues to carry the biggest share of notional open curiosity, reflecting its liquidity and maturity. Apparently, open curiosity for XRP-USDC has grown considerably, surpassing ETH-USD since mid 2024 as ETH noticed a relative decline in choices demand. Past the majors, pairs like MATIC-USDC and DOGE-USDT have additionally seen intervals of speculative curiosity.

Supply: Coin Metrics Market Knowledge Professional

The lion’s share of exercise takes place on Deribit, an offshore trade just lately acquired by Coinbase. Deribit accounts for over $60B in whole open curiosity, far forward of rivals like Binance and OKX, which every see round $4–$5B. Within the U.S., the CME gives entry to choices on regulated futures contracts for Bitcoin and Ethereum. Whereas these contracts differ structurally from spot-based choices traded on Deribit, they signify a rising phase of institutional crypto derivatives exercise.

Bringing these ideas collectively, we are able to use choices positioning to grasp the place the market expects costs to maneuver. The time to expiry might attraction to completely different contributors with shorter dated contracts sometimes attracting speculators and tactical merchants whereas longer-dated choices typically utilized by traders expressing broader market views.

The chart beneath reveals BTC and ETH open curiosity by strike worth for contracts expiring on December 25th 2025 on Deribit, providing a snapshot into how contributors are positioning for long-term outcomes. For BTC, there’s a sturdy focus of name choices between the $90K and $180K, with a pointy spike on the $170K degree. This implies a bullish bias and that merchants are positioning for the potential of a rally into the year-end. Put choices are largely clustered within the $60K–$80K vary, possible representing draw back hedges.

Supply: Coin Metrics Market Knowledge Feed

However, ETH’s open curiosity is extra dispersed throughout a wider vary of strike costs, with clusters round $2K, $3K, $6K. Whereas this means some bullish positioning, it additionally suggests much less consensus round ETH’s future trajectory. Apparently, ETH has extra open contracts than BTC, however its whole USD open curiosity is far decrease. This is because of ETH’s smaller contract measurement and lower cost, making it extra accessible to retail merchants, whereas BTC tends to signify bigger notional publicity.

These insights from choices markets may also be paired with funding charges from perpetual futures to construct a extra full view of market positioning. Funding charges mirror real-time sentiment and leverage in derivatives markets. Whereas aggregated futures funding charges for BTC & ETH have been damaging in elements of 2025, suggesting extra bearishness, they’ve began to flip constructive, aligning with a number of the bullish sentiment noticed in choices markets.

Implied volatility (IV) represents the market’s view of how considerably the value of the underlying asset might fluctuate sooner or later. Much like worth, implied volatility is a property of choices contracts and adjustments primarily based on demand and market circumstances.

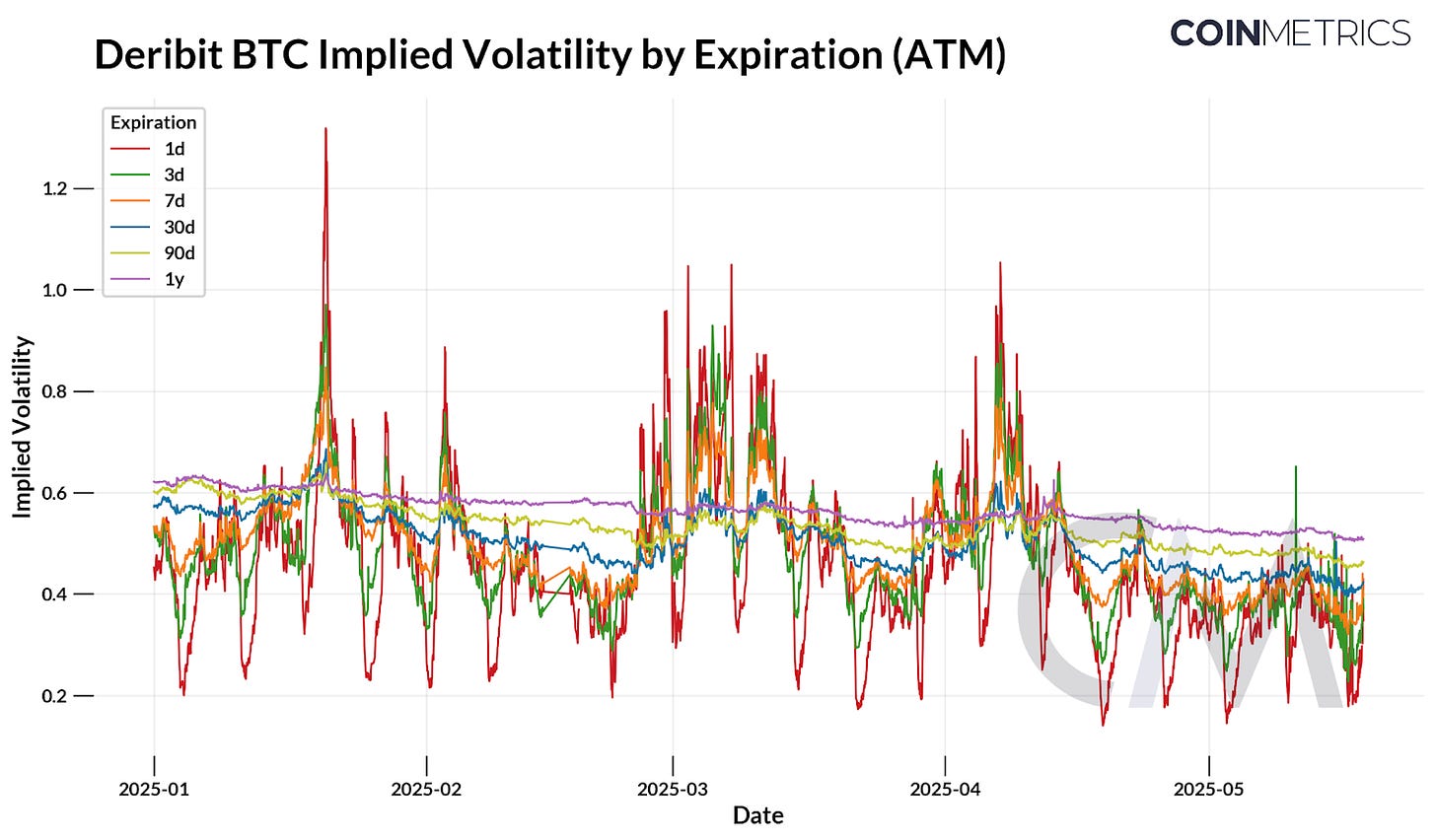

The chart beneath reveals how BTC implied volatility has developed throughout completely different maturities for at-the-money (ATM) choices on Deribit. An possibility is alleged to be ATM when its strike worth is equal, or near, the present market worth of the underlying asset. These choices are sometimes probably the most delicate to adjustments in worth, making them significantly informative when gauging the market’s consensus expectations.

Supply: Coin Metrics Market Knowledge Professional, Implied Volatility

Shorter-dated expiries like 1D and 3D are much more reactive to market swings, with pronounced spikes during times of uncertainty in current months. Longer-dated expiries (30D, 90D and 1y), then again, stay extra steady and mirror broader expectations of future volatility quite than rapid sentiment.

To enrich this, the chart beneath reveals ETH’s implied and realized volatility on Deribit over the previous month, at a 1 hour frequency to seize short-term adjustments. ETH’s 7-day implied volatility rose considerably on Could seventh, coinciding with its 30% rally and likewise spiked to 96% on Could 18th. Realized volatility adopted these strikes as markets reacted to short-term expectations.

Supply: Coin Metrics Market Knowledge Professional

As compared, BTC’s short-term implied volatility has remained comparatively decrease but additionally picked up on Could 18th, as BTC posted its highest-ever weekly shut at $106.9K.

With crypto gaining maturity, choices have gotten an vital cornerstone of the market’s infrastructure, providing a well-recognized toolkit on this novel, rising asset class. On this problem, we explored how information on open curiosity, strike distributions and implied volatility can make clear positioning, sentiment, and future expectations. Whereas we centered on these metrics, instruments like choices Greeks and volatility surfaces may present deeper perception into how choices react to cost, time, and volatility. As adoption grows, choices information will grow to be an more and more vital information to understanding and navigating crypto markets.

Final week, we launched a Sector Evaluation Report on Stablecoins. For a deep-dive into the stablecoin sector, learn the report right here.

Observe Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As at all times, in case you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier problems with State of the Community right here.