Get the perfect data-driven crypto insights and evaluation each week:

By: Tanay Ved

ETH-focused digital asset treasuries are quickly scaling, with 2.2M ETH (1.8% of provide) gathered in simply two months, making a supply-demand imbalance.

These treasuries are taking an energetic on-chain method, aiming to deploy capital by staking and DeFi to reinforce returns whereas supporting community safety and liquidity.

Whereas nonetheless within the accumulation section, better on-chain participation might strengthen Ethereum’s liquidity and safety but additionally heighten its publicity to company treasury dangers.

Digital asset treasuries (DATs), or public firms that accumulate crypto-assets like BTC or ETH on their company stability sheets, have emerged as a brand new channel for market entry. The 2024 launch of spot ETFs unlocked a wave of demand from traders beforehand unable to carry BTC and ETH by direct custody. Equally, digital asset treasuries present publicity to those property and their ecosystems by publicly traded fairness, with the flexibility to boost and deploy capital strategically.

We beforehand delved into Michael Saylor’s Technique playbook, elevating funds by fairness and convertible debt issuance to amass over 628,000 BTC (2.9% of bitcoin’s provide). A wave of firms all over the world, from Marathon Digital to Japan’s Metaplanet have adopted swimsuit, successfully offering shareholders with amplified or “levered” publicity to BTC. Now, this mannequin is increasing to different ecosystems, with a flurry of entities racing to build up Ether (ETH) of their company treasuries.

Whereas the aim of boosting shareholder publicity to the underlying property stays the identical, ETH treasuries basically differ from their BTC counterparts of their skill to faucet into Ethereum’s staking and DeFi ecosystem. This opens the door to reinforce returns by ETH’s native yield and productive deployment of capital on-chain. On this subject of State of the Community, we study the noticed impacts of ETH digital asset treasuries on Ethereum’s provide dynamics and discover the potential community implications as these giant autos transfer on-chain.

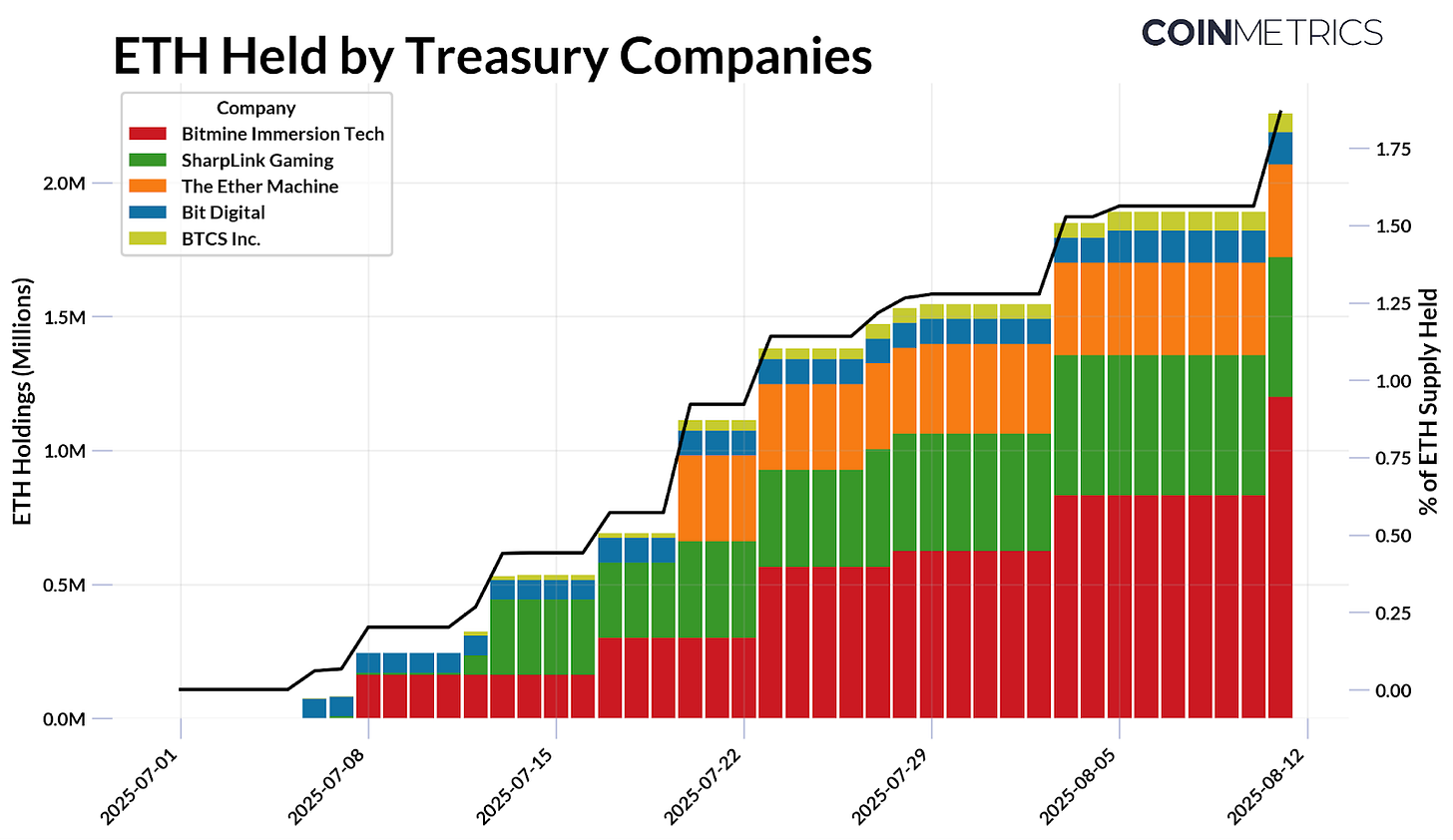

Since simply July of this 12 months, Ethereum digital asset treasuries have gathered 2.2M ETH, representing almost 1.8% ETH’s present provide. There are at the moment 5 main gamers on the block, elevating capital by equity-based fundraising resembling public share choices or Personal Funding in Public Fairness (PIPE) offers to deploy capital and develop the worth of their holdings. As of August eleventh, these entities maintain the next quantities of provide:

BitMine Immersion Applied sciences is at the moment the biggest company holder of ETH. Now at 0.95% of provide, their holdings are quickly climbing in the direction of their said aim of accumulating 5% of ETH’s circulating provide. The race to amass a bigger share of ETH is barely accelerating, particularly as these firms construct reserves at a good value foundation as market situations shift.

Supply: Coin Metrics Community Knowledge Professional & Public Filings (As of August eleventh, 2025)

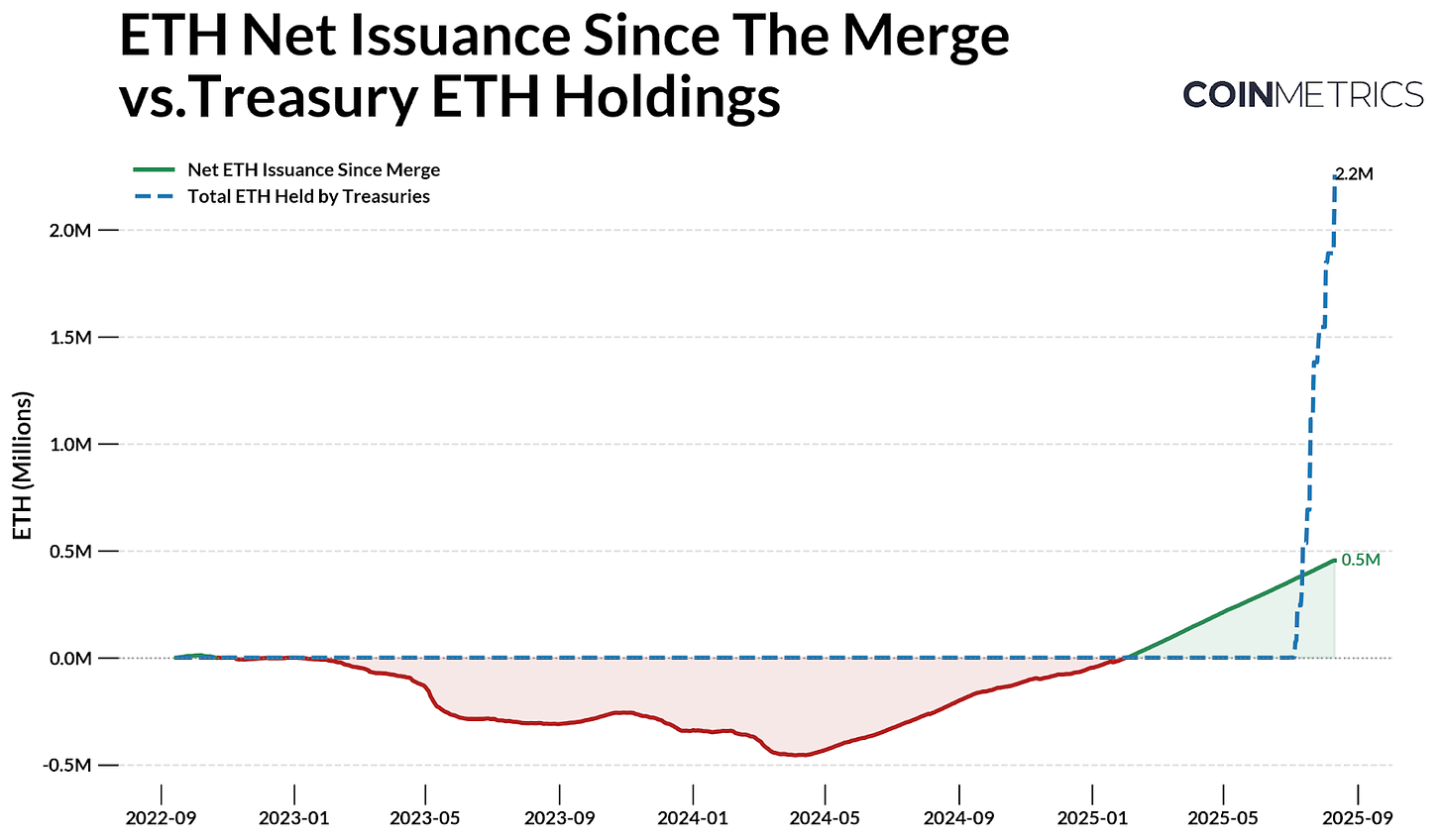

This pattern can also be putting when seen alongside Ethereum’s issuance dynamics. With Ethereum’s provide ruled by proof-of-stake (PoS), the place new ETH is issued to validators and a portion of transaction charges is burned, web issuance can swing between unfavorable (deflationary) and constructive (inflationary).

Since “The Merge” in September 2022, a complete of two.44M ETH has been issued, whereas 1.98M ETH has been burnt, leading to a web provide progress of 454.3K ETH. Since July, ETH treasury firms have collectively gathered 2.2M ETH, far exceeding web new issuance over the identical interval. Whereas Bitcoin’s capped provide and halving schedule straight cut back new issuance over time, Ethereum’s provide is dynamic and at the moment inflationary. This makes the dimensions and tempo of current demand much more notable provided that ETH’s market cap is roughly 4.5x smaller than BTC’s.

Supply: Coin Metrics Community Knowledge Professional & Public Filings

This demand-supply imbalance is much more pronounced when factoring inflows into Ether ETFs, which have additionally accelerated in current months. Mixed collectively, these autos are steadily absorbing extra of Ethereum’s 107.2M free float provide (accessible provide out there), on high of the 29% of ETH staked on the consensus layer and eight.9% held in different good contracts. Consequently, sustained accumulation from treasuries and ETFs might amplify worth sensitivity to new demand.

Whereas most ETH treasuries are nonetheless within the accumulation section, a portion of their capital could finally discover its approach on-chain. By tapping into Ethereum’s staking and DeFi infrastructure, these companies intention to reinforce risk-adjusted returns and make productive use of their holdings – a distinction to the extra passive method taken by Bitcoin treasuries. This shift is already underway, with SharpLink Gaming staking a majority of its holdings, BTCS Inc. utilizing Rocket Pool to drive income, and others like The Ether Machine and ETHZilla getting ready for extra energetic on-chain administration.

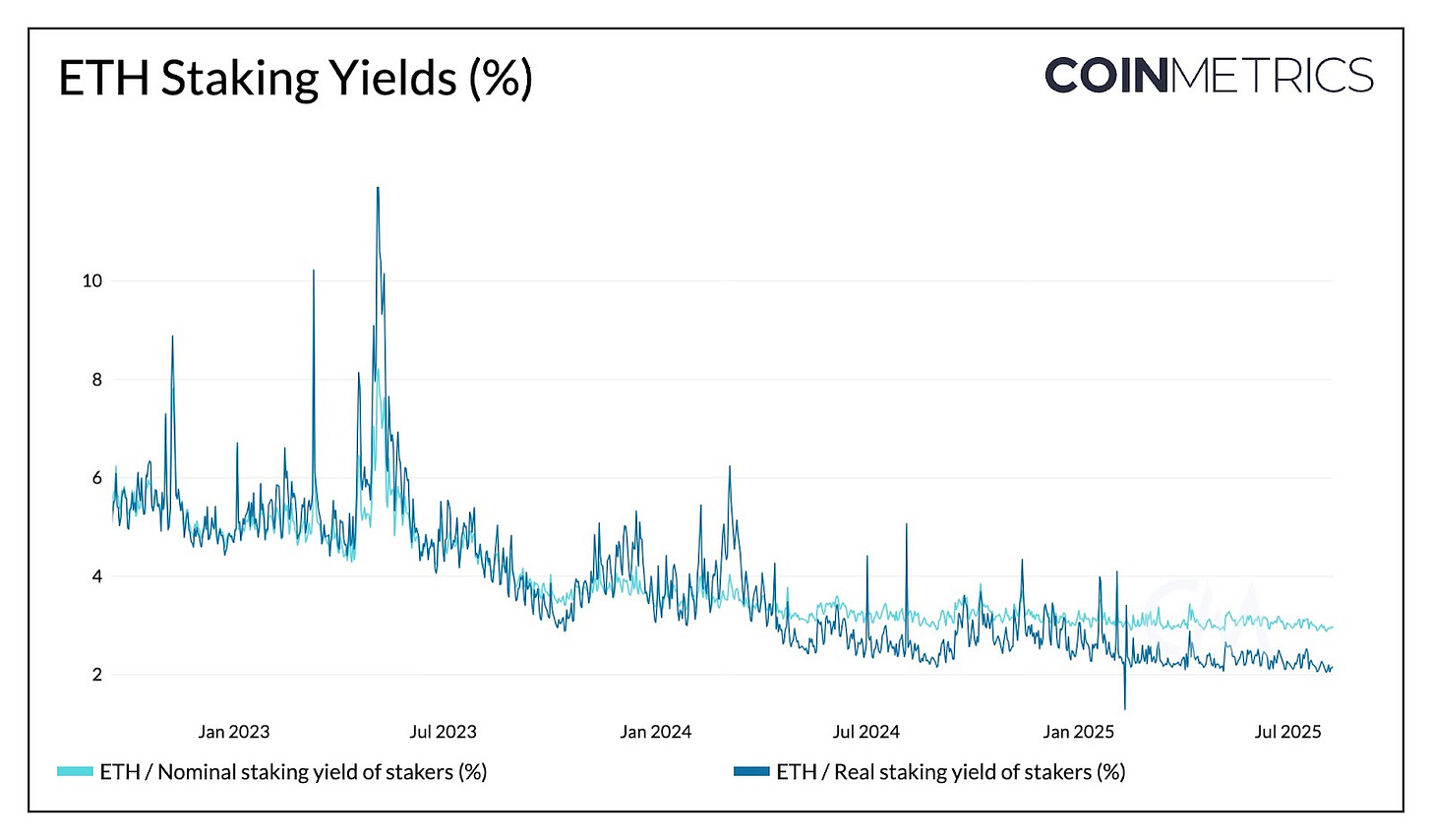

Supply: Coin Metrics Community Knowledge Professional

Ethereum at the moment provides 2.95% nominal and a couple of.15% actual (inflation-adjusted) yield by staking rewards for securing the community. This could present treasury firms with a gradual stream of revenue along with the value appreciation of the underlying asset. For instance, if 30% of the two.2M ETH held by treasury firms at present had been staked on the present ~3% nominal yield and a $4K ETH worth, it might generate roughly $79M in annual revenue. Whereas an inflow of staking might compress yields, the impact could be modest since Ethereum’s reward charge decays regularly as the full quantity staked will increase.

Company treasuries are approaching this by two methods: by operating their very own validators or using liquid staking protocols. The latter, which was clarified by the SEC to not be thought of securities, permits companies to stake with third social gathering suppliers like Lido, Coinbase or RocketPool, whereas receiving a “liquid” receipt token in return.

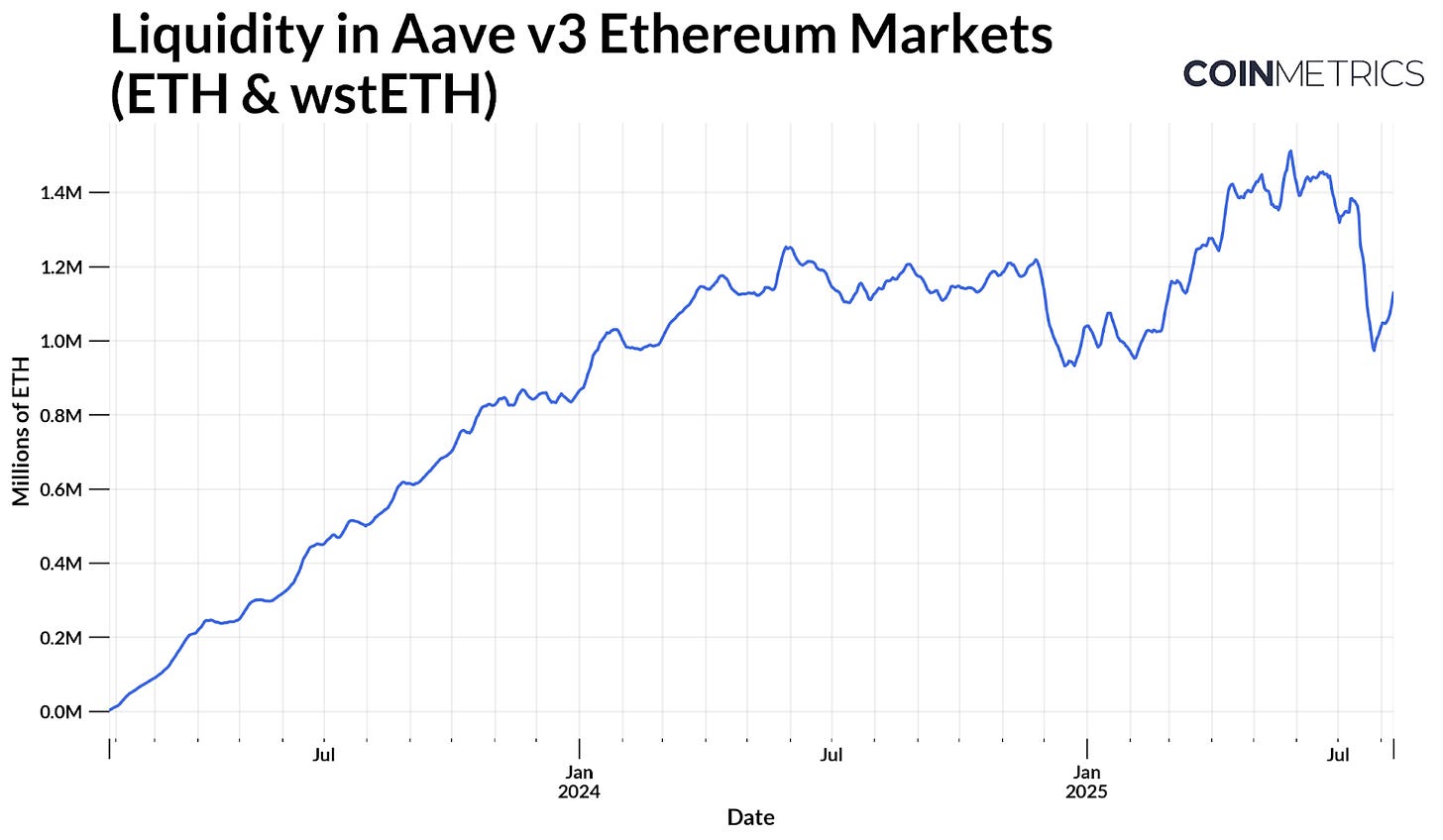

Whereas carrying extra danger, these tokens resembling Lido’s stETH are broadly utilized in DeFi for collateralized borrowing or to achieve extra yield over the benchmark staking APY in a capital environment friendly method. Taking Aave v3 for instance, ETH and liquid staking tokens like wrapped stETH kind a deep pool of obtainable liquidity (the quantity of property provided that stay accessible to borrow). This has grown to round 1.1M ETH, and treasuries might additional strengthen it, compounding yield whereas enhancing market liquidity.

Supply: Coin Metrics Community Knowledge Professional

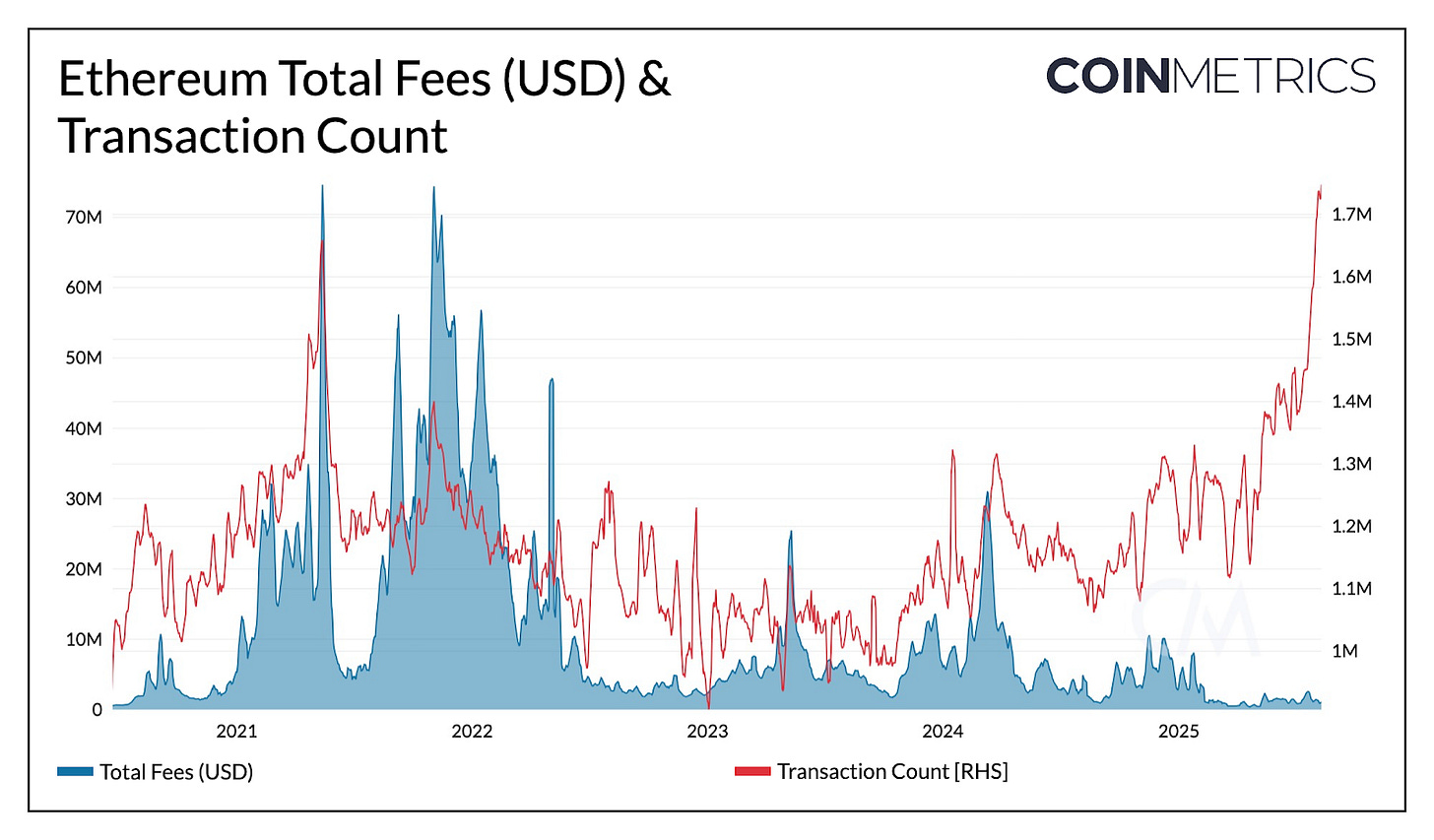

Regardless of Ethereum now exceeding file transaction counts on mainnet (1.7-1.9M per day), complete charges stay close to multi-year lows as current fuel restrict will increase and blob capability expansions have eased congestion and offloaded exercise to L2s. If the capital from treasury firms strikes on-chain at scale, excessive worth transactions on Ethereum L1 might enhance combination blockspace demand and price income, doubtlessly making a constructive suggestions loop between treasury exercise, liquidity, and on-chain utilization.

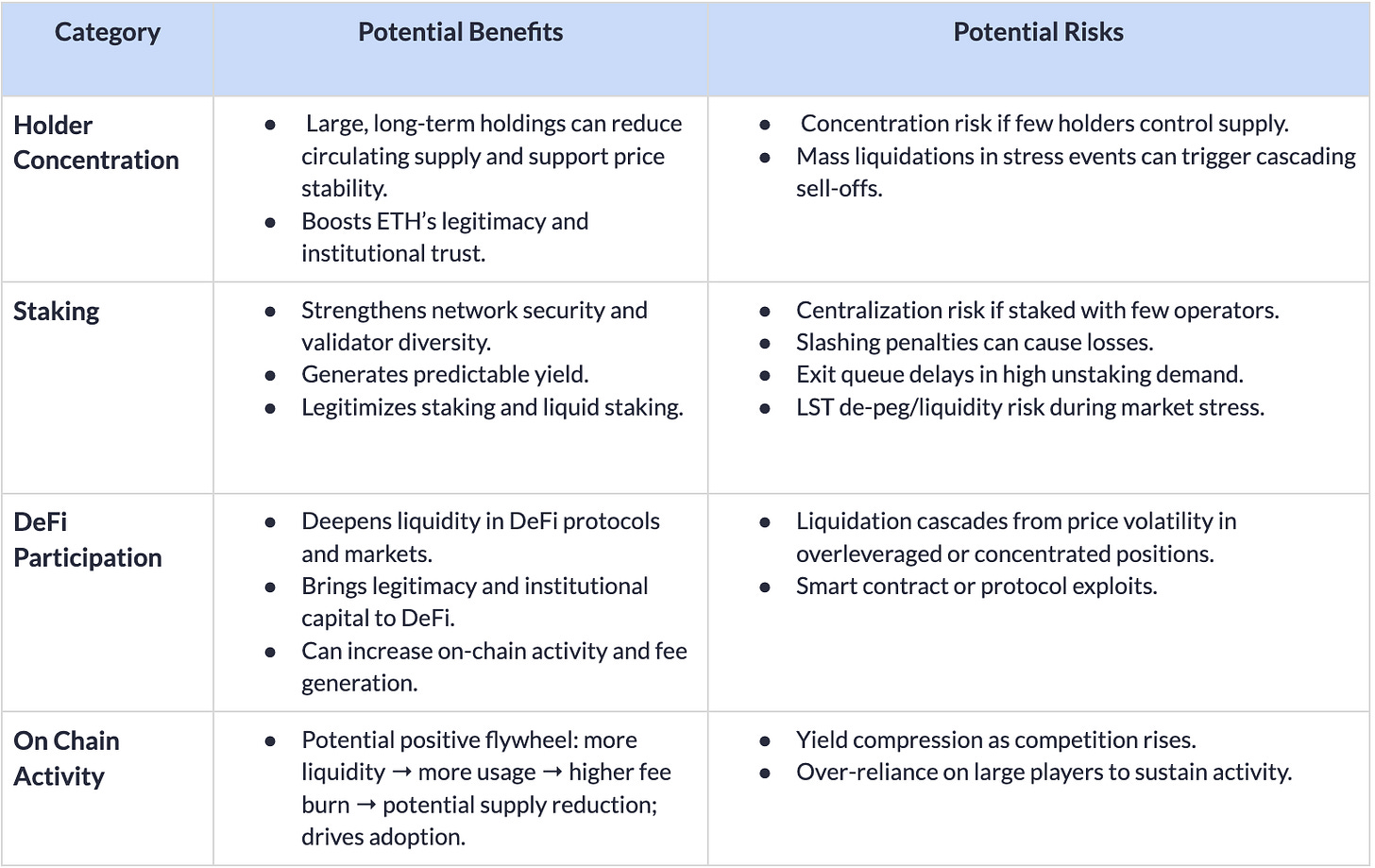

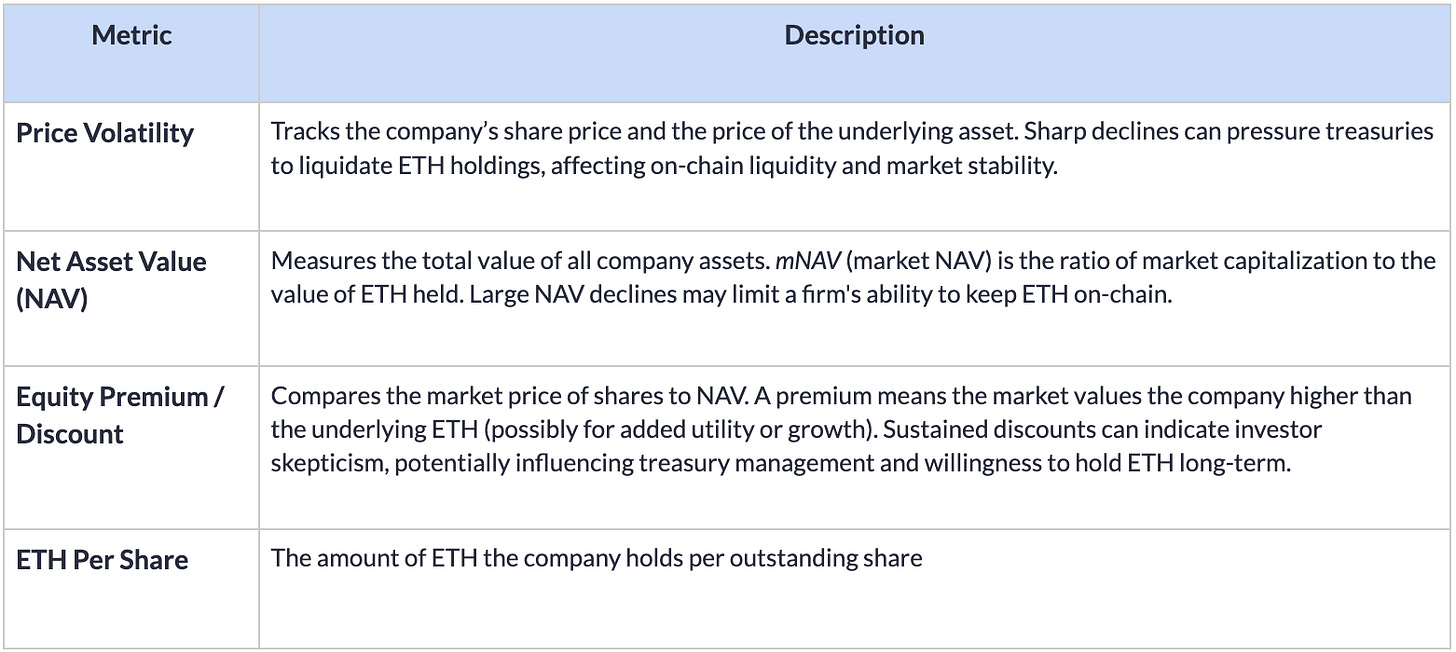

As publicly listed ETH treasuries increase their on-chain footprint, their monetary efficiency more and more carries implications for Ethereum’s long-term community well being, linking off-chain company outcomes to potential on-chain results. Massive, long-term holdings can cut back circulating provide, enhance legitimacy, and deepen on-chain liquidity, however focus, leverage, and operational dangers imply that outcomes on the company stage might spill over into the community.

Whereas these are network-level concerns, company treasuries themselves are topic to market forces and investor sentiment. A powerful stability sheet and sustained investor confidence can enable treasuries to increase holdings, and improve participation. Conversely, sharp drops in underlying worth, tightening liquidity, or extreme leverage can result in ETH gross sales or decreased on-chain exercise.

By monitoring each the network-level implications and the monetary well being of those firms, market members can higher anticipate how company treasury conduct would possibly have an effect on Ethereum’s provide dynamics and its community well being at giant.

The speedy emergence of company ETH treasuries is portraying Ethereum’s attraction as each a reserve asset and a supply of on-chain yield. Their rising presence might deepen liquidity and strengthen community exercise, but additionally carries dangers tied to leverage, financing, and strong capital administration. Off-chain pressures, from fairness efficiency to debt obligations, might shortly ripple on-chain as they turn out to be extra intertwined. Monitoring each stability sheet well being and on-chain exercise shall be key to understanding the influence of those autos as they develop bigger.

This week’s updates from the Coin Metrics staff:

Comply with Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As at all times, you probably have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier problems with State of the Community right here.