Get the most effective data-driven crypto insights and evaluation each week:

By: Matías Andrade, Tanay Ved, Cooper Duschang

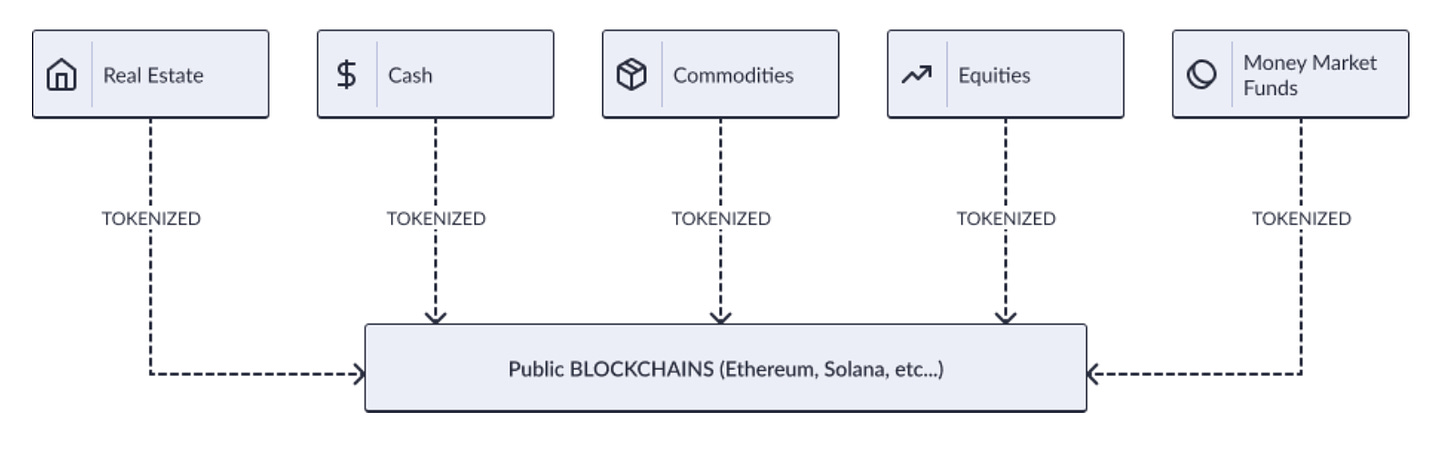

Actual-world asset (RWA) tokenization represents a major step ahead within the evolution of economic markets, bridging the hole between conventional finance and the world of digital property. Whereas blockchains and cryptocurrencies have garnered important consideration for his or her potential to revolutionize varied elements of the monetary system, skeptics have usually identified that many digital property lack intrinsic worth or connection to real-world financial actions. Tokenization of RWAs addresses this concern by making a tangible hyperlink between on-chain infrastructure and off-chain property, unlocking new efficiencies and alternatives in how we handle and commerce these beneficial property. Whereas nonetheless in its early phases, we’ve seen an acceleration in curiosity, with main monetary establishments and crypto-native protocols coming into the house in tandem.

Supply: Coin Metrics RWA Report

In our newly launched report, we discover the emergence of the real-world asset tokenization sector, analyzing the present panorama, sectors and networks gaining adoption, regulatory implications and market alternatives.

Bridging Conventional Finance and Digital Property: Actual-world asset (RWA) tokenization represents a major step within the convergence of conventional finance and digital property bringing a wide selection of property equivalent to fiat currencies, authorities securities, personal credit score, and commodities onto blockchain infrastructure.

Elevated Liquidity and Accessibility: Tokenizing real-world property can drastically enhance liquidity and decrease obstacles to entry. Via fractional possession, 24/7 markets, and international accessibility, blockchains democratize entry to beforehand illiquid and unique asset lessons.

Community Adoption: Ethereum at the moment stands because the dominant blockchain for RWA tokenization, dwelling to main tasks like BlackRock’s BUIDL. Networks like Solana and Stellar are additionally gaining traction, every providing distinctive benefits for several types of RWA merchandise.

Regulatory Panorama: The regulatory surroundings is evolving, with key developments just like the EU’s Markets in Crypto-Property (MiCA) regulation and the SEC’s Workers Accounting Bulletin No. 121 (SAB 121) shaping the way forward for RWA tokenization throughout the globe.

Institutional Involvement: Main monetary establishments, together with BlackRock and Franklin Templeton, are coming into the house, signaling rising mainstream acceptance of tokenized RWAs.

DeFi Integration: The mixing of RWAs into decentralized finance (DeFi) is on the rise, with protocols equivalent to MakerDAO and Aave integrating with tokenization tasks like BUIDL. This convergence opens up new income streams and alternatives for TradFi and DeFi stakeholders.

Challenges and Alternatives: Whereas the tokenization of RWAs gives important benefits—equivalent to enhanced liquidity, transparency, and effectivity—challenges stay, together with regulatory uncertainty and the necessity for strong infrastructure. Nevertheless, with rising institutional curiosity, regulatory readability, and improvement in crypto infrastructure, RWAs are poised to reshape how a wide selection of property are managed within the digital age.

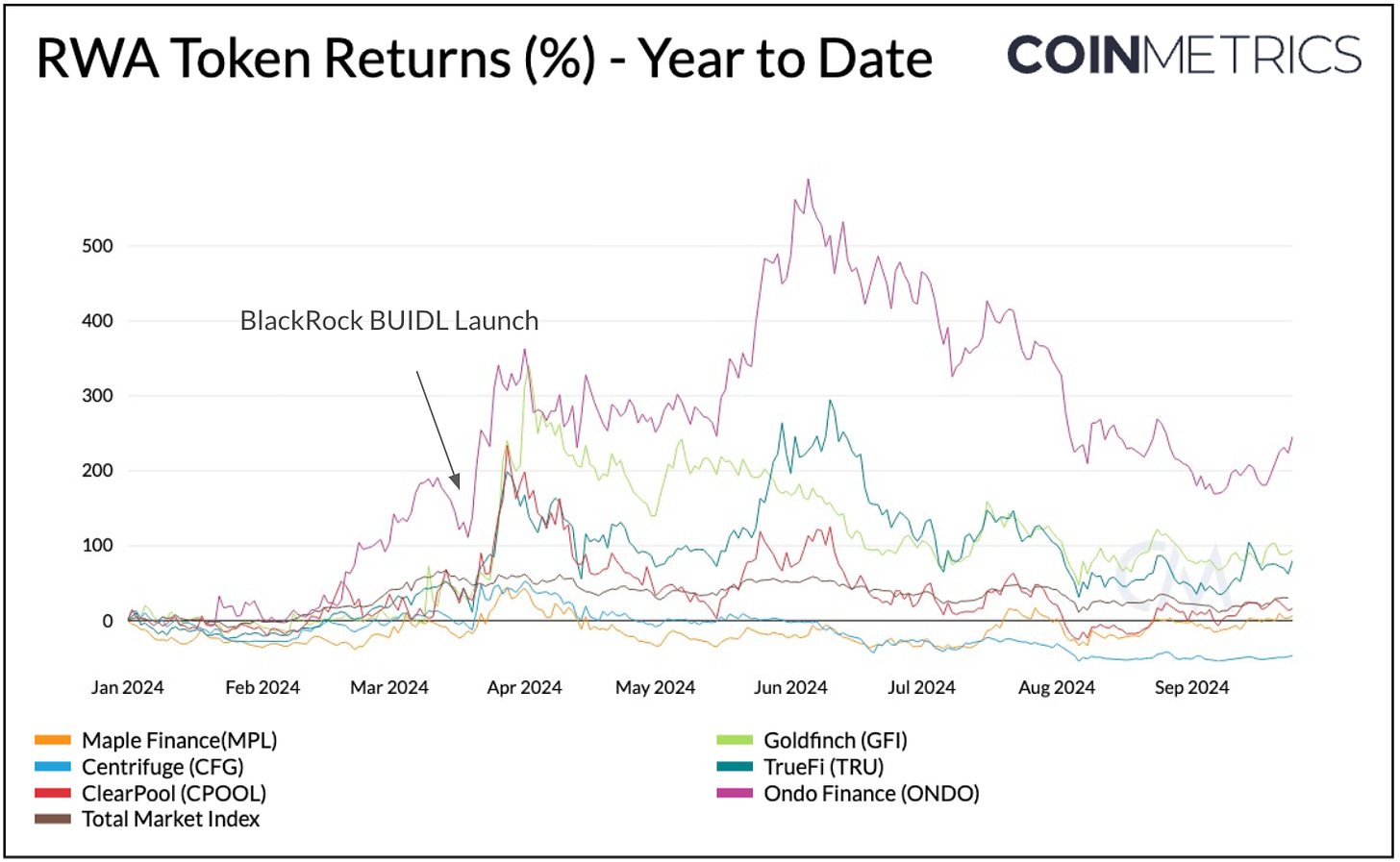

Supply: Coin Metrics Reference Charges

The chart above illustrates the efficiency of choose Actual World Asset (RWA) undertaking related tokens benchmarked in opposition to the efficiency of the full market index. Returns for these tokens are more likely to be influenced by a wide range of elements, together with total market circumstances, catalysts like the doorway of BlackRock and different giant monetary establishments into the tokenization house and underlying fundamentals of those merchandise. To study extra in regards to the RWA & Tokenization panorama, you should definitely take a look at our report.

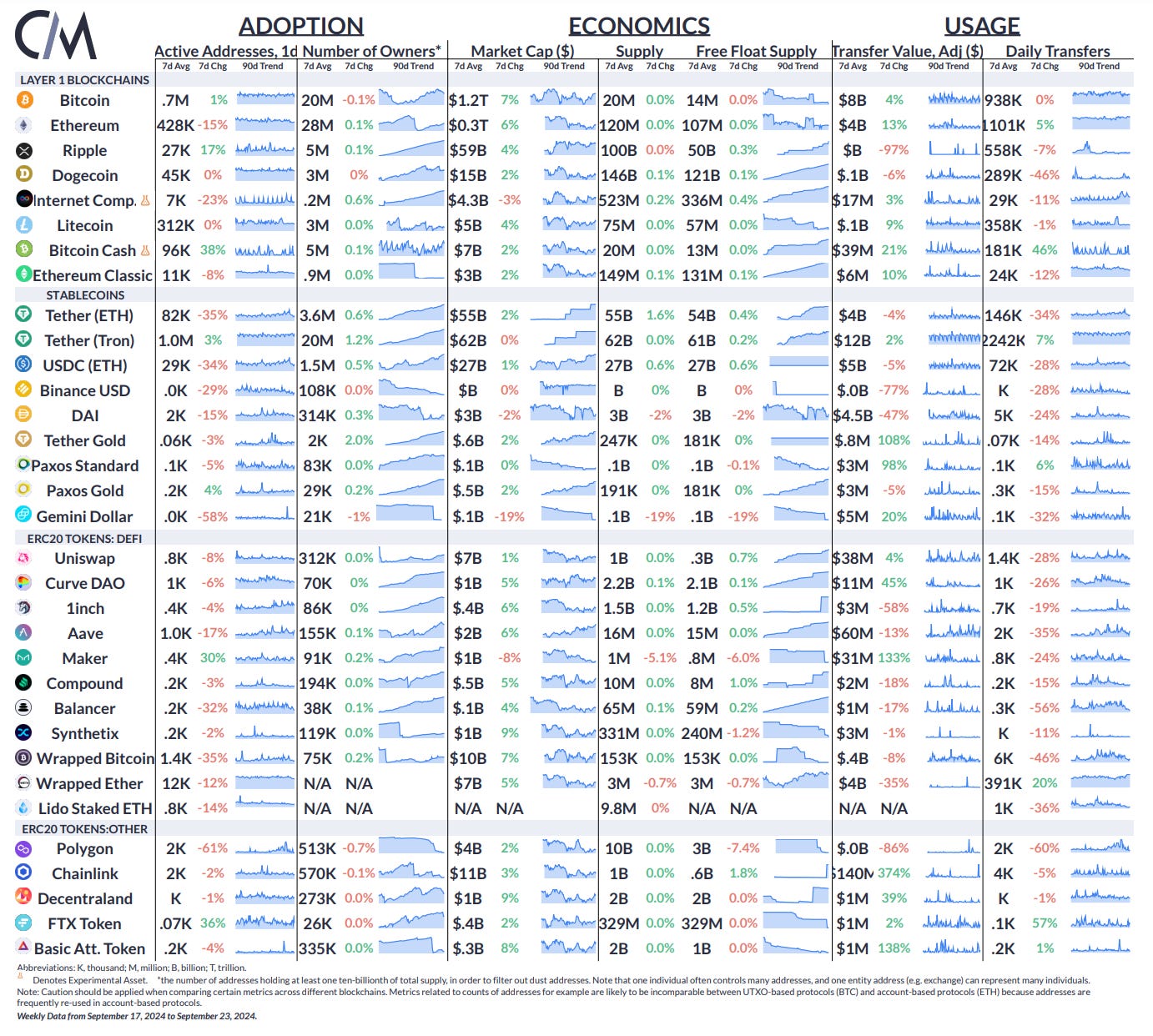

Supply: Coin Metrics Community Information Professional

The market cap of Bitcoin and Ethereum rose by 7% and 6% over the week, respectively, on the again of a 0.5 bps charge minimize from the Federal Reserve. The (adjusted) switch worth of MakerDAO’s MKR token elevated by 133% amid its rebrand to Sky, with its governance token (MKR) and stablecoin (DAI) being changed by SKY and USDS.

This week’s updates from the Coin Metrics group:

Comply with Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As all the time, when you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.