Get the most effective data-driven crypto insights and evaluation each week:

By: Cooper Duschang & The Coin Metrics Group

On this difficulty of Coin Metrics’ State of the Community, we convey you the newest installment in our “Asset Highlight” collection, this time specializing in Solana (SOL). This report dives into the whole lot from Solana’s utilization and adoption to its technical structure, economics, dangers, and funding function. Entry the report right here.

Amid an enormous Layer-1 ecosystem, Solana has emerged as a number one good contract platform, optimizing for top throughput and low transaction charges to help user-friendly and performant purposes. In contrast to Bitcoin and Ethereum, which prioritize decentralization and safety at the price of pace, Solana’s built-in structure allows near-instant settlement, supporting giant volumes of exercise and producing immense quantities of blockchain information.

As soon as entangled within the FTX collapse of 2022, Solana has seen a outstanding restoration, now rating because the 6th largest digital asset with a market capitalization of ~$90B (down from a excessive of $127B). Over the previous 12 months, the chain has seen super development in transaction demand and community exercise, fueled by waves of meme coin hypothesis, together with an increasing DeFi, DePIN and stablecoin ecosystem.

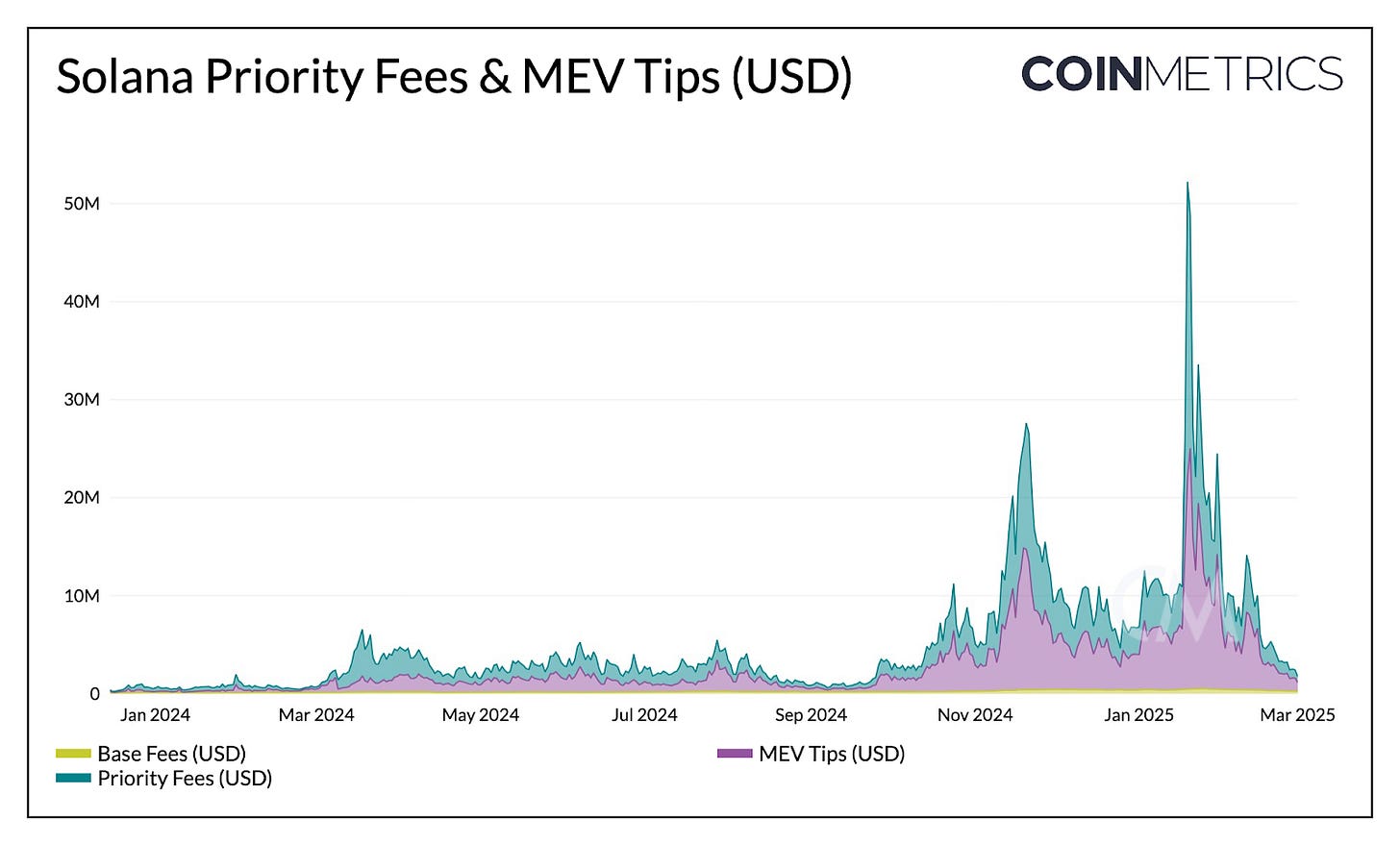

Supply: Coin Metrics Community Knowledge Professional, Solana Payment & MEV Metrics*

(*Measures the demand to transact on Solana, together with whole transaction charges and out of protocol MEV ideas for transaction execution.)

-

Solana’s scalability and efficiency benefits, comparable to its 400ms (0.4 seconds) block instances and parallel transaction execution.

-

Solana’s payment construction, staking dynamics, and up to date tokenomic adjustments, such because the adoption of SIMD-0096 which boosts validator incentives.

-

The expansion of stablecoins and institutional adoption, with main gamers like PayPal and USDC leveraging its infrastructure.

-

Solana’s evolving funding case and function in portfolio diversification as we strategy a possible Solana (SOL) ETF.

-

The function of meme cash in driving retail engagement, and the way they’ve helped onboard new customers into the ecosystem.

-

Key market dangers and challenges, together with validator prices, MEV extraction and whale pushed volatility.

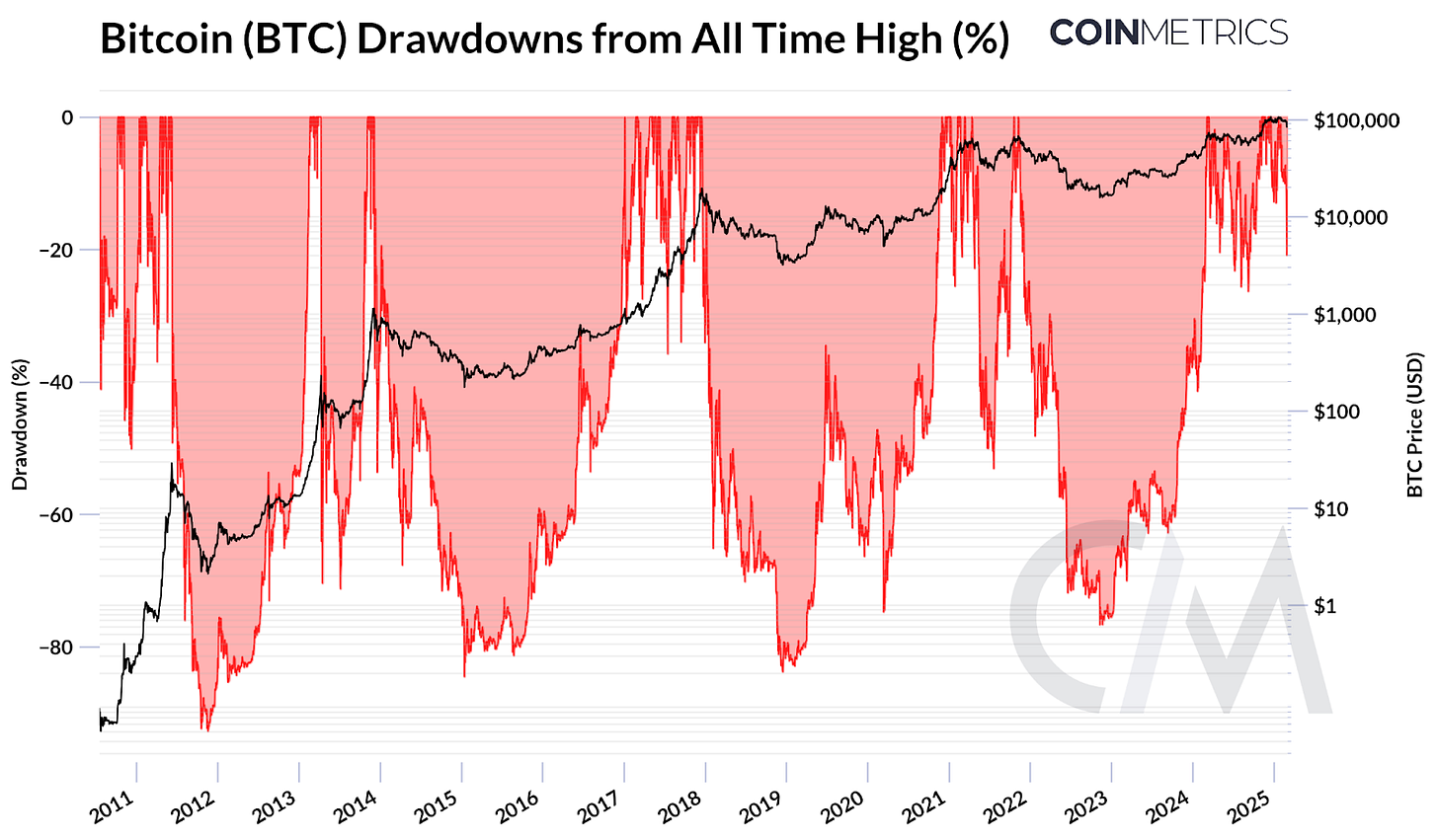

Crypto markets face renewed volatility, attribute of patterns seen in earlier market cycles. Whereas markets have been comparatively resilient after Bybit’s hack, Bitcoin (BTC) skilled a >20% drawdown, falling to ~$78K on February 28th. Whereas this correction could have unsettled some buyers, it isn’t unusual to see pullbacks of this magnitude throughout bull markets. In 2017, when BTC ran up from ~$9000 to ~$19,000, it confronted a number of drawdowns larger than 25%, which additionally occurred in 2021, throughout its rise to $60,000.

Supply: Coin Metrics Reference Charges

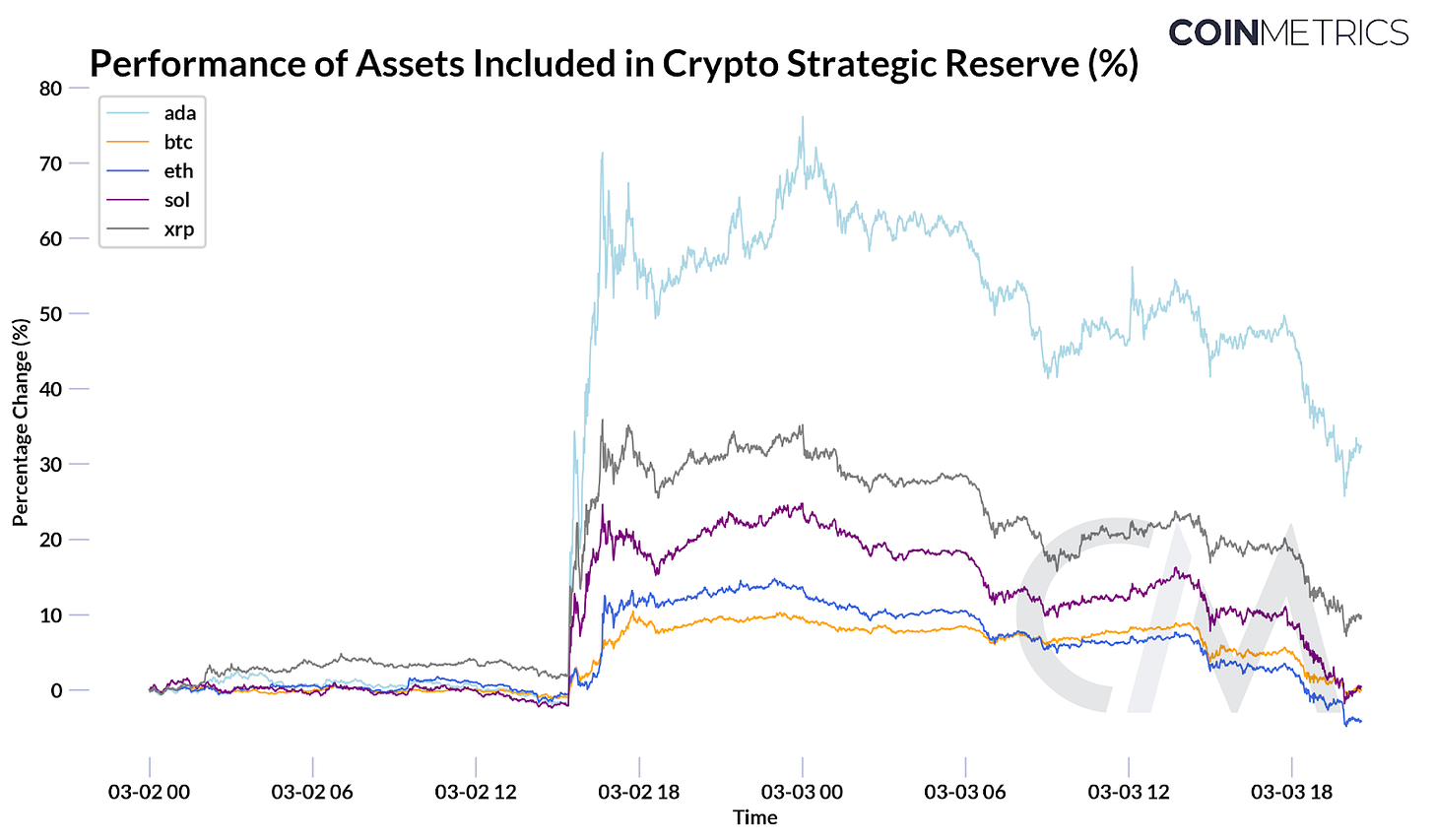

The drop was short-lived, as Trump introduced his intent to “transfer ahead” with establishing a “Crypto Strategic Reserve” together with Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Ripple (XRP) and Cardano (ADA). Whereas the sudden weekend announcement fueled a quick rally, costs have since retraced, with BTC, ETH & SOL returning to pre-announcement ranges.

No particulars have been offered on the rationale or choice standards for these belongings, including to uncertainty across the reserve’s goal. The market’s preliminary euphoria, adopted by skepticism, suggests cautious sentiment as buyers search a reversal in weak spot.

Supply: Coin Metrics Reference Charges (1 minute frequency)

-

We’re excited to introduce Community Profiles and improved Asset Profiles information, providing a clearer view into basic community and asset properties.

-

Comply with Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As all the time, when you’ve got any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.