Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth surged 4% prior to now 24 hours to commerce at $91,393 as of two:41 a.m. EST on buying and selling quantity that rose 14% to $75.7 billion.

BTC rebounded over the past day, climbing above $91,000 as rising expectations of a US Federal Reserve fee reduce drove a wave of renewed investor curiosity.

Markets now worth in roughly an 85% probability of a quarter-point discount in December, a pointy bounce from a measly 44% probability every week in the past, based on information from CME FedWatch.

Rates of interest are too excessive.

The Fed ought to reduce 50 foundation factors in December.

— Anthony Pompliano 🌪 (@APompliano) November 26, 2025

If a fee reduce happens, decrease charges may raise “threat property” reminiscent of Bitcoin by rising liquidity and boosting urge for food for higher-yielding property.

In the meantime, as the biggest crypto by market capitalization recovered, a crypto pockets related to SpaceX moved 1,163 BTC valued at round $105 million to a brand new pockets, based on Arkham Intelligence information.

Nevertheless, it stays unclear whether or not SpaceX moved the cash for custody functions or with the intent to promote them.

Bitcoin lastly broke out of a fragile $81,000-$89,000 zone, a zone that highlighted the market’s lack of liquidity and demand.

Can the restoration be sustained and Bitcoin’s worth rise even increased?

Bitcoin Value Poised For A Sustained Restoration

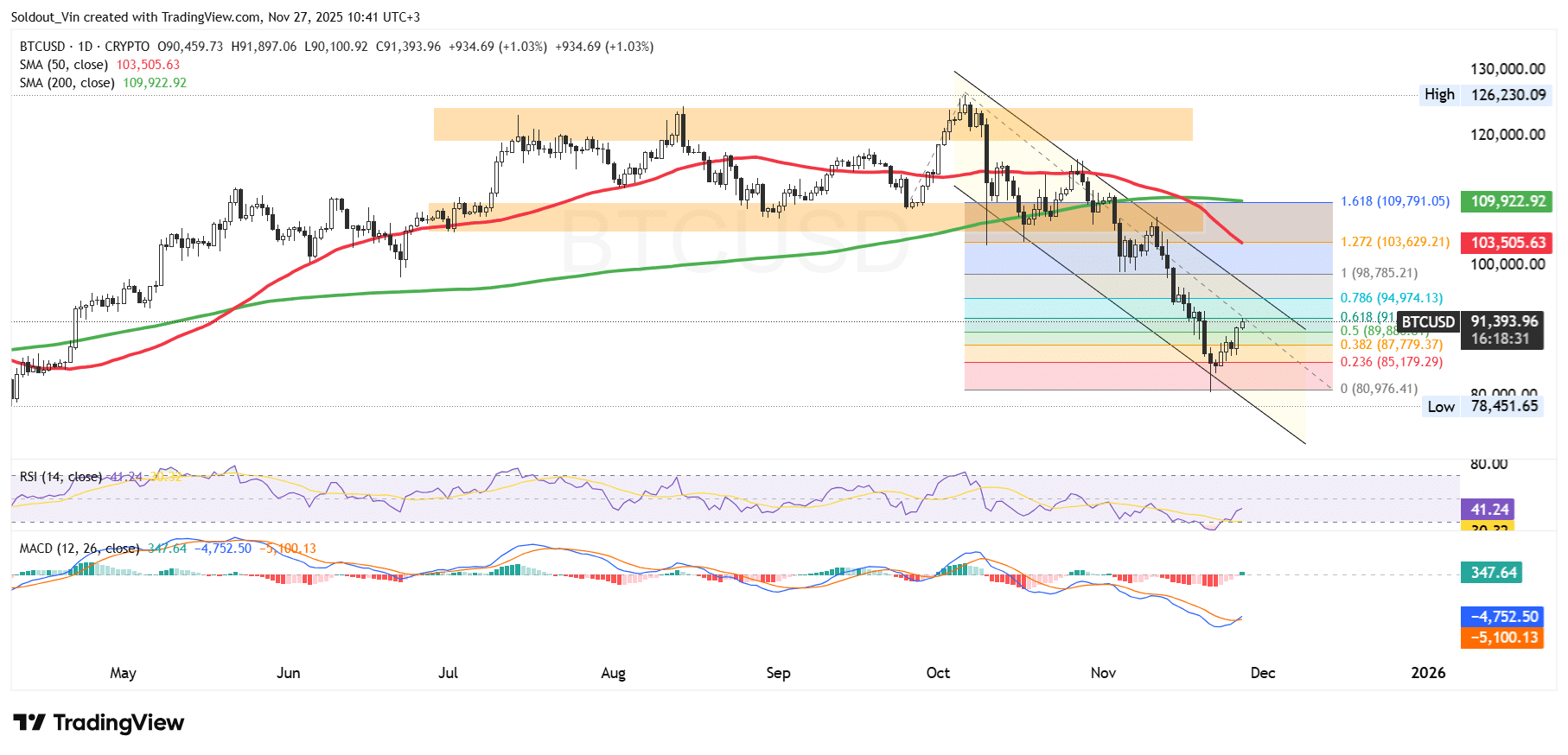

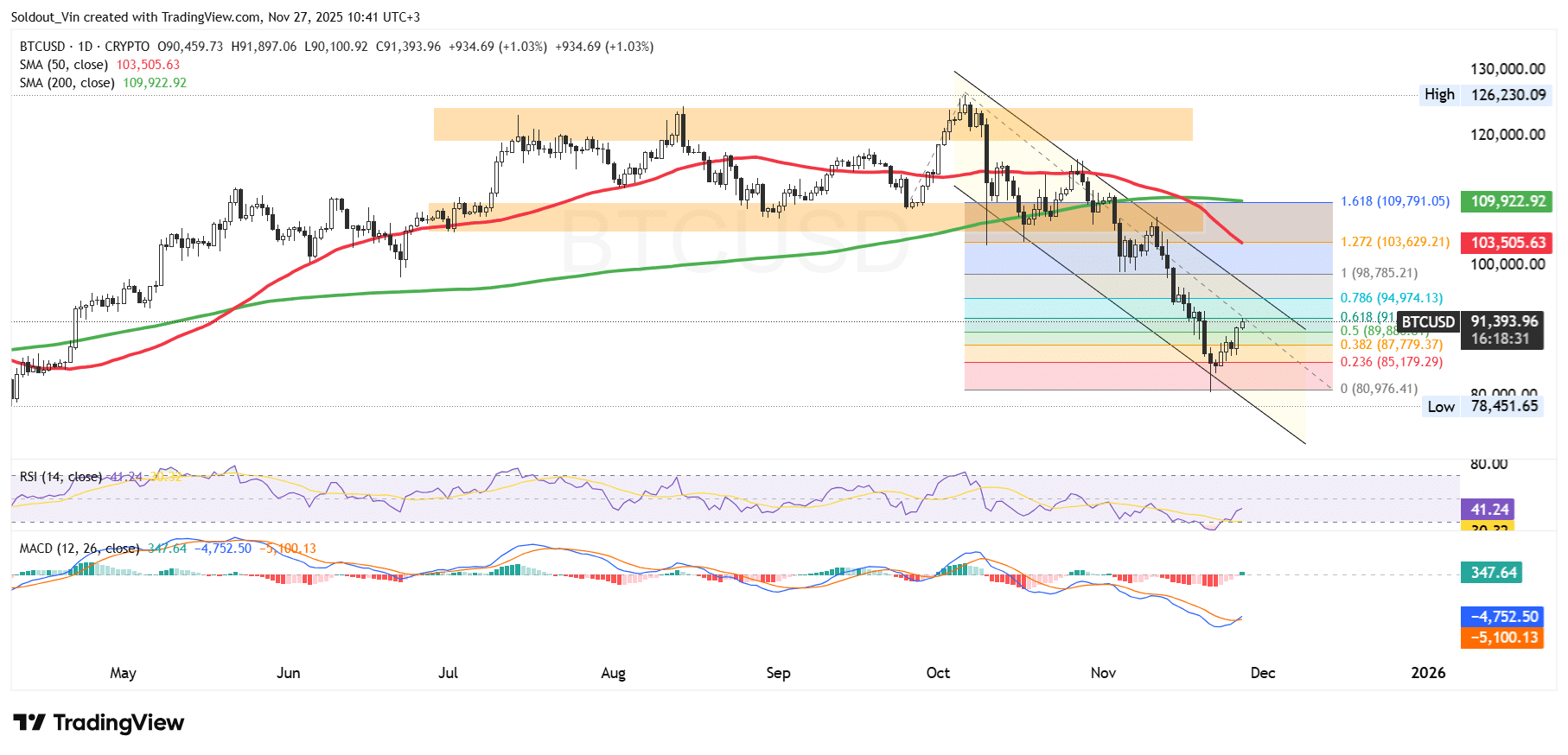

After a sustained surge from Might, the BTC worth was rejected above the $123,000 zone, forcing it to commerce sideways between this stage and the $107,400 assist.

Nevertheless, the Bitcoin worth couldn’t maintain that stage, main the bears to push the crypto right into a well-defined falling channel, with BTC crossing key Fibonacci assist ranges. BTC is now surging towards the 0.5 Fibonacci ($89,880) and the 0.618 Fibonacci ($91,982) ranges.

The sustained bearish pattern has pushed BTC’s worth under each the 50-day and 200-day Easy Transferring Averages (SMAs), suggesting the bearish pattern stays in place.

In the meantime, on the every day chart, the Relative Energy Index (RSI) is recovering from oversold territory, at present at 41, suggesting patrons are taking again management.

The Transferring Common Convergence Divergence (MACD) additionally helps the restoration try, because the blue MACD line has crossed above the orange sign line. With inexperienced bars now forming on the histogram, BTC is at present using constructive momentum.

BTC Value Prediction

In accordance with the BTC/USD chart evaluation, the Bitcoin worth is trying a short-term rebound after touching the decrease Fibonacci zone close to the 0.236–0.382 ranges, which frequently act as response factors throughout corrective phases.

If momentum continues to enhance, the subsequent key resistance for BTC lies across the 0.5 and 0.618 Fibonacci retracements at $89,800–$91,800, the place sellers are more likely to re-enter.

A profitable breakout from the descending channel may open the trail towards the $95,000–$98,500 zone, which falls inside the 0.786 Fib stage and a previous consolidation area.

Nevertheless, if the Bitcoin worth fails to carry above current lows, a retest of the $80,000–$82,000 assist vary turns into potential, because it aligns with the Fib backside and former liquidity ranges.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection