Get one of the best data-driven crypto insights and evaluation each week:

By: Tanay Ved, Victor Ramirez

-

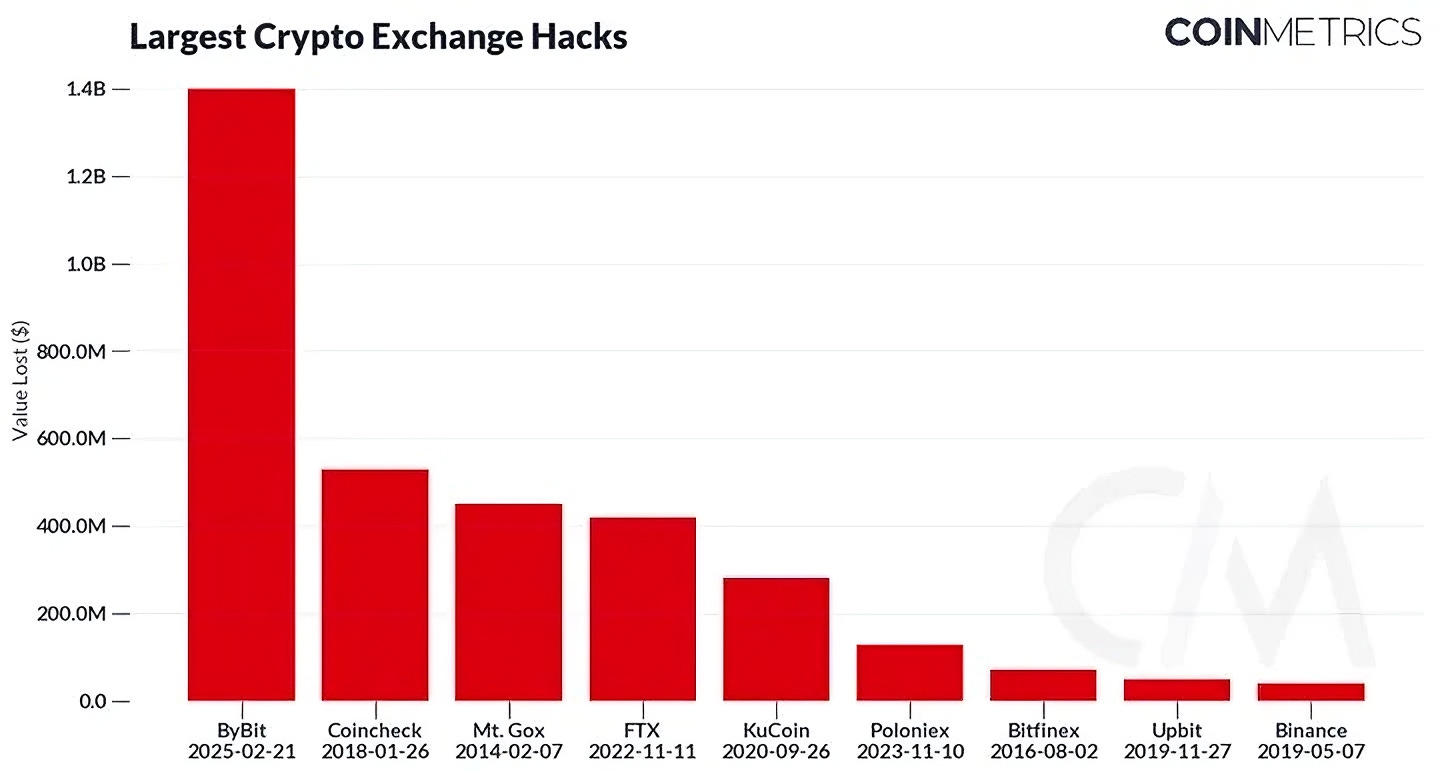

Bybit, a distinguished crypto change, fell sufferer to the biggest hack in crypto historical past, draining $1.5B in ETH from its chilly pockets.

-

Whereas hackers stay in possession of stolen property, dispersing 401,346 ETH throughout a number of accounts, Bybit has replenished $1.2B of its deficit, bringing ETH reserves to 380,000 ETH.

-

The market fallout was largely contained, leading to comparatively small and transient value dislocations in comparison with earlier incidents.

Over the previous 300 problems with State of the Community, we’ve seen many headlines shift, narratives evolve, new tasks emerge and fade, and quite a few consequential occasions that shook the crypto trade. Since our founding, Coin Metrics has operated underneath OPEN values: Open, Pioneering, Elucidating, Impartial. We write State of the Community with a goal that displays our values: to elucidate the advanced world of public blockchains, to be a pioneer within the frontier of crypto markets, and to stay editorially impartial to keep up the integrity of our analysis. Our purpose is to make SOTN a constant supply of unbiased, timeless and well timed data-driven insights that assist observers, traders and shoppers navigate crypto markets and on-chain exercise to make knowledgeable selections.

In a merciless twist of irony, as we had been mulling what concern #300 can be about and reflecting on the timeless topics all through crypto’s historical past, we skilled an oft-repeated disaster within the trade: The Bybit change was sufferer to what’s now the biggest change hack in historical past. For this particular three hundredth concern, we’ll flip our consideration to the Bybit change hack, using on-chain knowledge to research change reserves, fund flows and contextualize its market affect.

In a stunning flip of occasions, Bybit, one of many largest crypto exchanges, was hacked for roughly $1.5B in ETH. This incident ranks among the many largest crypto hacks of all time, eclipsing even the notorious Mt.Gox collapse and FTX implosion. Whereas broader contagion has been contained, inspecting the sequence of occasions and its on-chain footprints can present worthwhile context on the hack and its market affect.

Whereas notable hacks of the previous (which we examined again in SOTN #35), stem from a spread of safety vulnerabilities, Bybit’s assault occurred throughout a routine switch of ETH from the platform’s multi-signature chilly pockets to a scorching pockets, amid customary operational procedures for centralized exchanges managing person funds (for a deeper dive into change operations and pockets varieties, see SOTN #184). Shortly after, Bybit CEO Ben Zhou, confirmed the hack and appeared on livestream to reassure customers of the change’s monetary stability and its potential to fulfill withdrawal requests.

The assault focused signers of the Bybit chilly pockets by “masking” the person interface of a Secure pockets (pockets supplier utilized by Bybit) and altering the underlying good contract code. This tricked signers into approving a malicious transaction, granting attackers full entry to Bybit’s Ethereum chilly pockets.

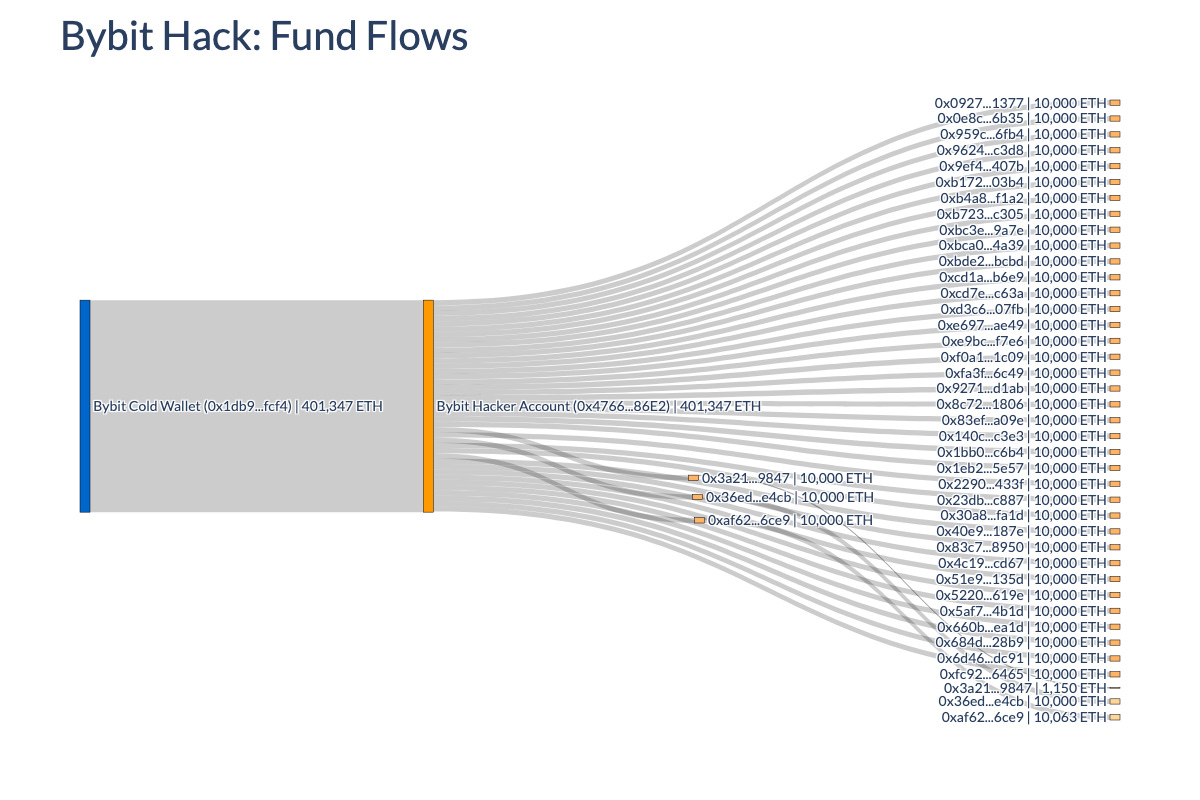

Supply: Coin Metrics ATLAS & Deal with Tagging

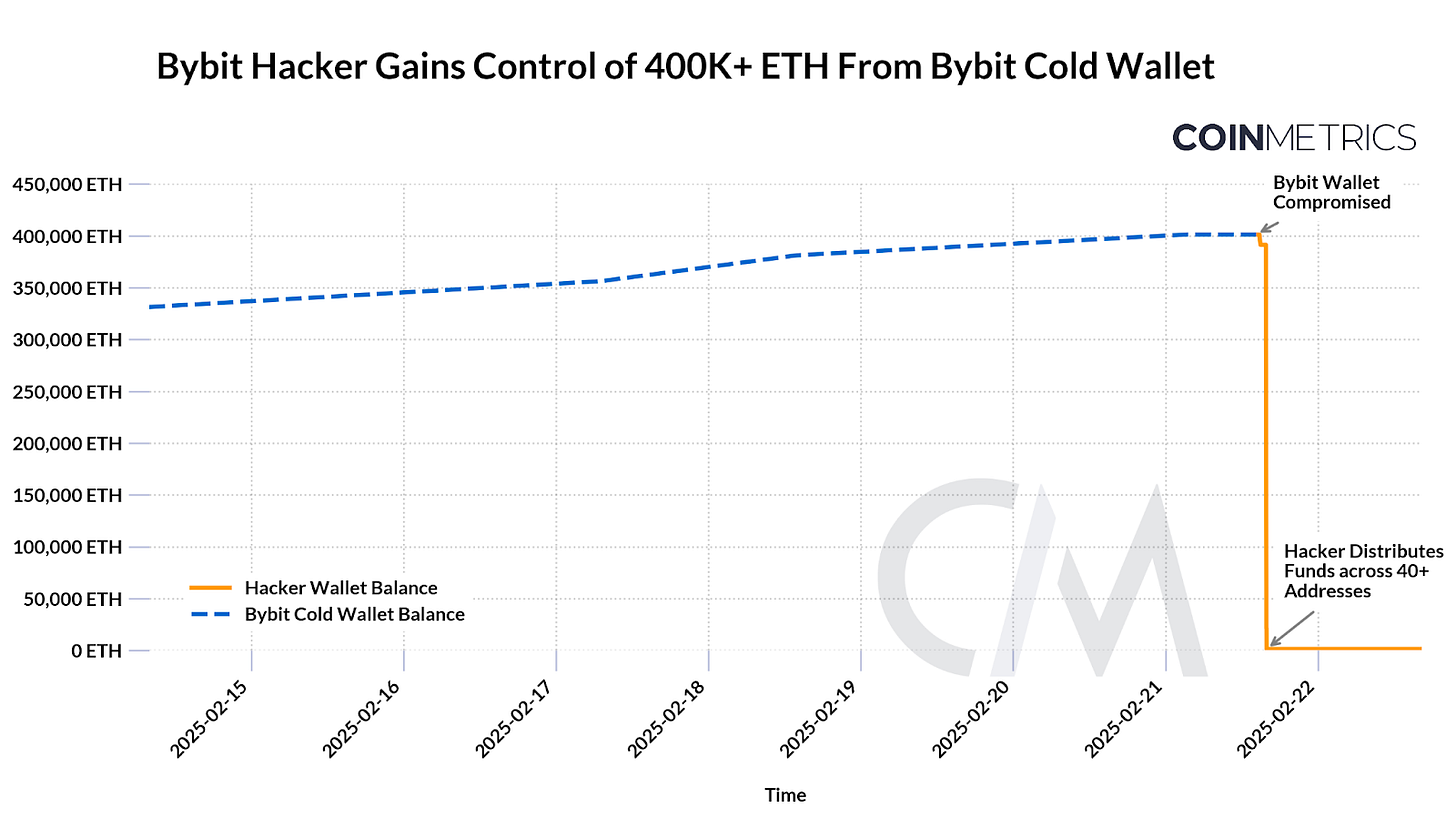

By 2:16 pm UTC, shortly after the attacker’s account was created, the hacker had gained management of 401,346 ETH (valued at $1.1B), draining the Bybit chilly pockets of its funds. The entity’s stolen property additionally reportedly embody Ethereum staking derivatives like stETH, bringing the whole to $1.5B.

Whereas exchanges like Bybit function as off-chain as centralized entities, on-chain knowledge permits you to monitor change wallets, counterparties and fund actions in actual time. Coin Metrics tags the customarily advanced operations construction of change wallets, permitting us to comply with the motion of funds, from the change to the hackers pockets and past.

Supply: Coin Metrics ATLAS & Deal with Tagging

As seen within the diagram above, 401,347 ETH flowed into the hackers account (0x47…) from Bybit’s chilly pockets (0x1d…) after which funds had been distributed throughout 40+ accounts with a number of debits of 10,000 ETH every. Whereas the perpetrator nonetheless stays in charge of the property, a portion of funds are being moved to decentralized exchanges (DEXs) and bridged to different networks like Solana to swap into native property that can not be frozen in absence of a government.

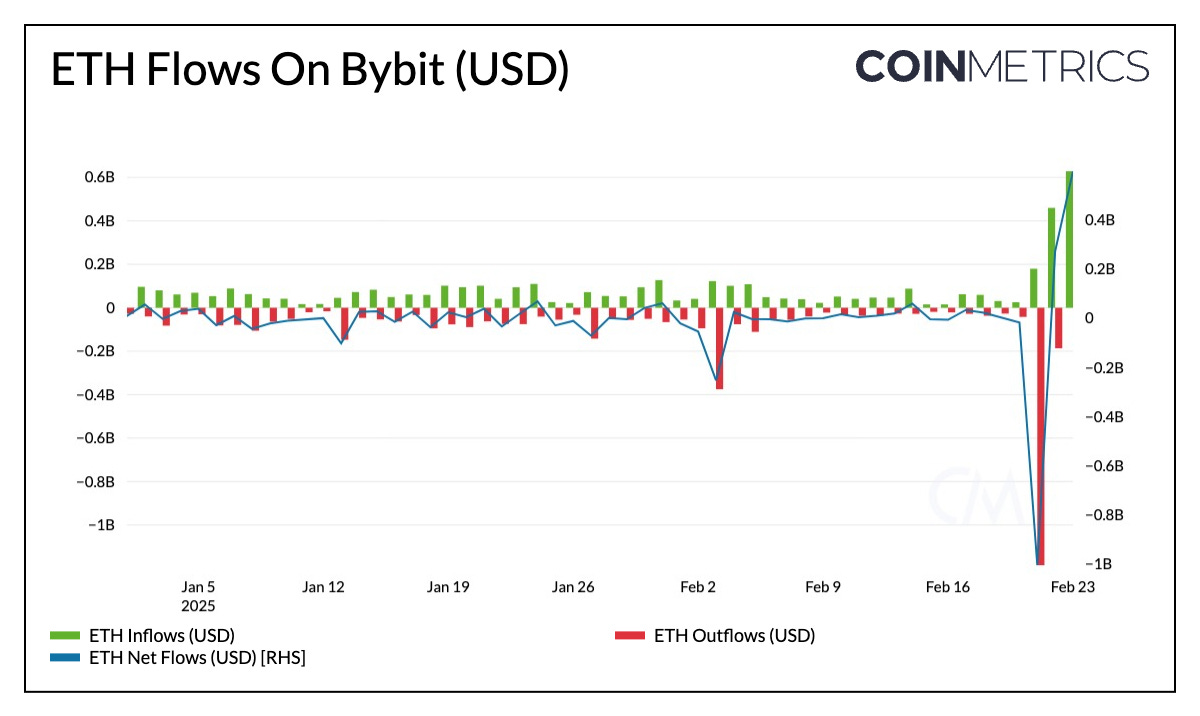

Supply: Coin Metrics Community Knowledge Professional, Change Movement Metrics

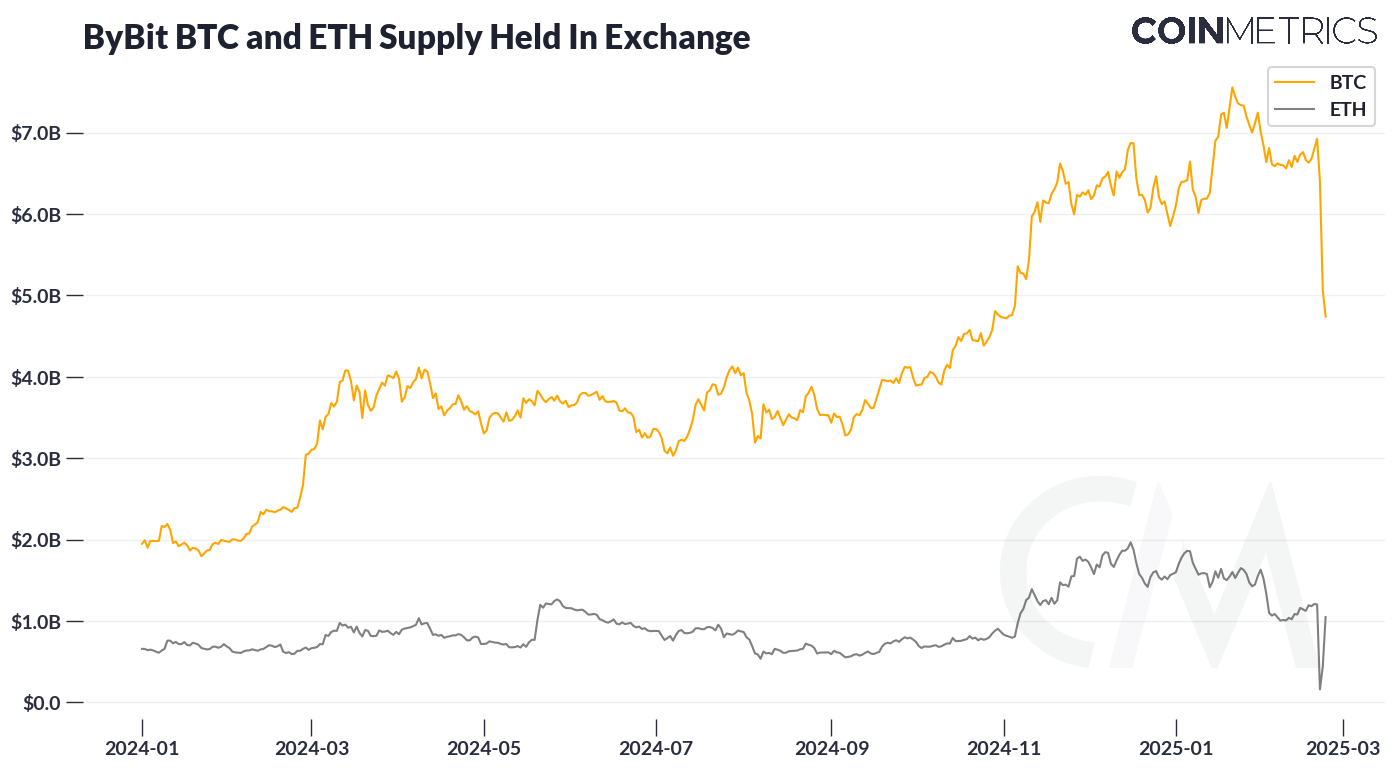

From the angle of the change, we are able to see the ~$1.2B in ETH outflows from Bybit because the incident unfolded on February 21st. This introduced the whole provide of ETH on Bybit from 438,000 to 60,000 ETH by the tip of the day. As information of the hack pervaded, Bybit’s change provide of BTC additionally fell by 21,000 BTC (as of Feb twenty third) with person demand for withdrawals ramping up.

Nevertheless, as seen with the following inflows, Bybit has managed to replenish $1.2B in deficits, by a mixture of securing loans, making OTC transactions and incoming person deposits. This was confirmed by a proof of reserves audit carried out by Hacken, verifying that each one main property together with the likes of ETH preserve a 100%+ collateralization ratio. As of February 24th, Bybit’s reserves stand at 380,000 ETH.

Supply: Coin Metrics Community Knowledge Professional, Change Provide Metrics

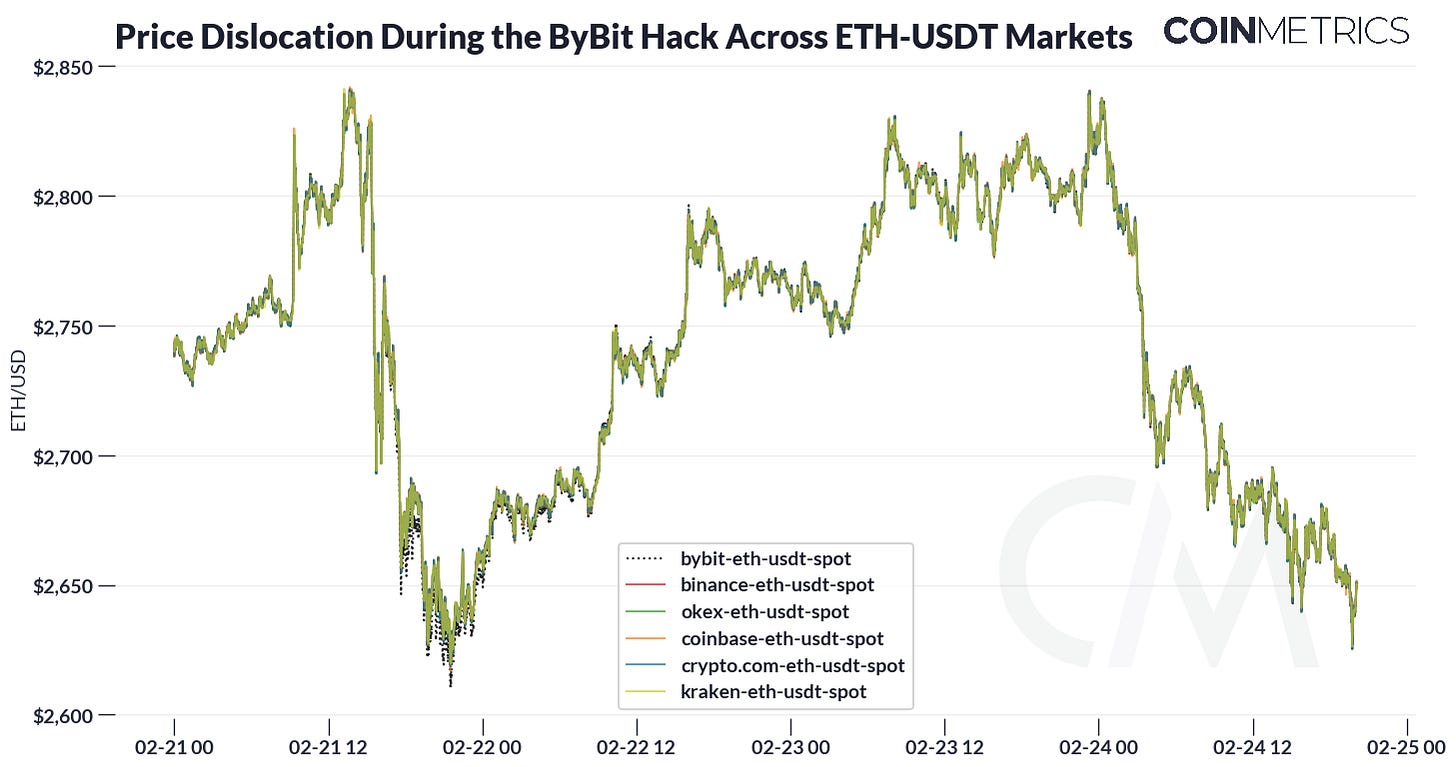

The Bybit hack left an aftershock on markets. Shortly after the hack was introduced, ETH had dipped sharply from $2,850 to $2,600 and Bybit’s ETH-USDT market traded at a slight low cost for just a few hours towards different notable markets. The hole between Bybit and different markets closed over the weekend and on early Sunday, ETH had even reclaimed its value degree from earlier than the hack.

We’ve written concerning the market affect from earlier hacks in SOTN #35, and the affect from this hack appeared far more muted than in years previous. The market has matured to the place it will possibly deal with shocks of this magnitude with out skipping a beat, not to mention being an existential threat to an change or the trade at massive.

Supply: Coin Metrics Reference Charges

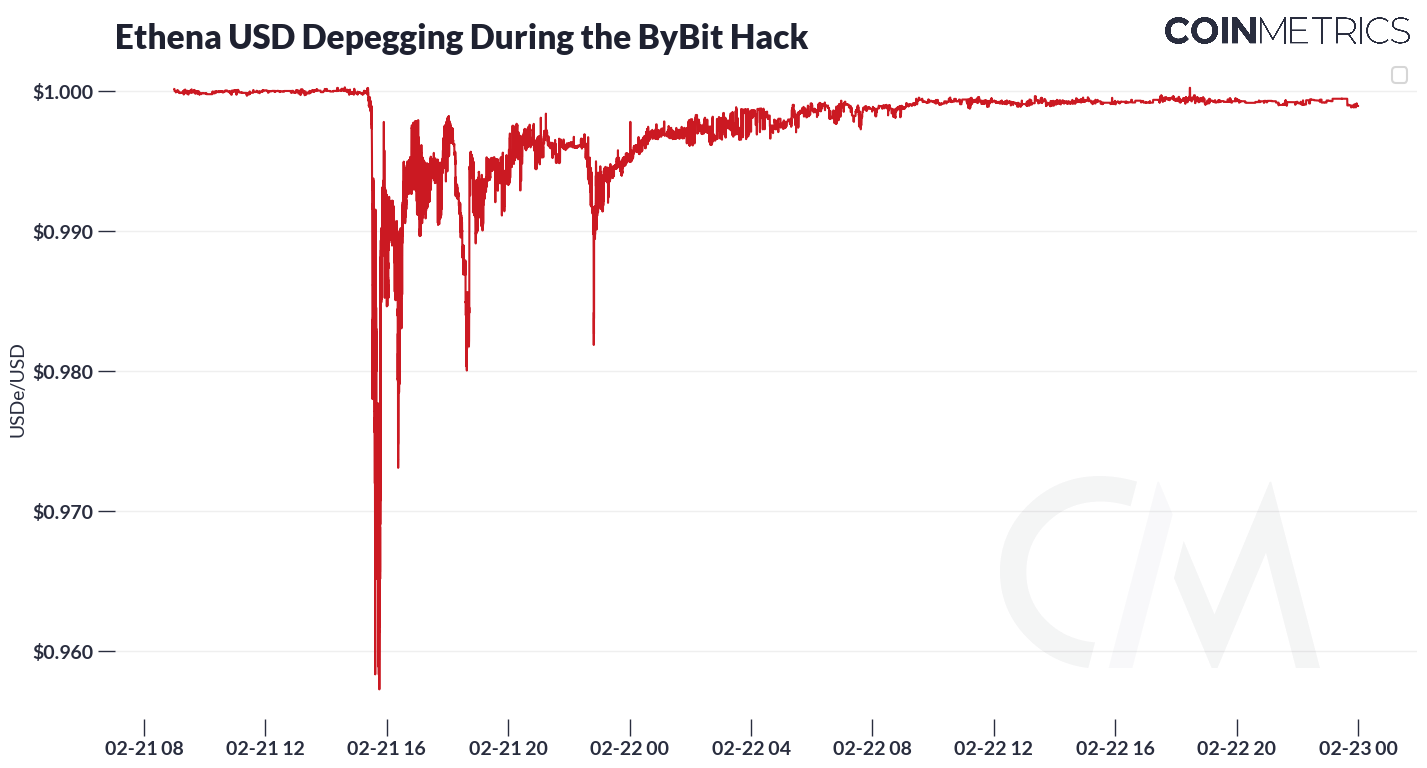

Whereas a majority of stablecoins maintained their pegs, one other notable contagion was a short depegging of Ethena USD (USDe). USDe dipped under $0.96 however began to get well the next day.

Ethena does depend on exchanges corresponding to Bybit to execute hedging methods to keep up its peg, however importantly, Ethena USD shops the property backing its stablecoin in institutional-grade custodians and not inside Bybit (or any change). Solely the margin required for hedging brief positions is deposited on exchanges like Bybit. The majority of the collateral stays off-exchange and is insulated from Bybit’s direct dangers.

(For a deeper dive on the impact Bybit had on Ethena USD, see this thread)

To place this in perspective, we are able to draw some comparisons to the Silicon Valley Financial institution (SVB) disaster resulting in USDC’s de-peg nearly two years in the past in March 2023*. USDC depegged for just a few days and dipped to $0.88 due to issues about Circle’s reserves being custodied on SVB.

Coincidentally (and importantly), each incidents occurred on a Friday. Whereas USDC holders had been weak from the gears of conventional finance coming to a halt exterior of enterprise hours, the second order results from the Bybit hack available in the market self-corrected throughout the weekend. General, the contagion remained largely contained. The group got here collectively to make sure that funds had been protected and ByBit was capable of meet its buyer obligations.

Whereas Ethena USD was insulated from change dangers, USDe (and different stablecoins) should not immune from custodial dangers. An change hack story is just not full with out a cautionary story on custodial threat, so we’ll finish with this evergreen notice: not your keys, not your cash.

*After all, the 2 occasions should not solely comparable: one was a financial institution run that resulted in a fraction of a stablecoin reserve being locked, whereas the opposite was a lack of funds straight from theft. The relative magnitudes of crypto property “misplaced” on this case are comparable. $3.3B out of $40B USDC was locked in Circle’s SVB account, whereas Bybit includes 15% of USDe ‘backing’, or 15% of ~$6B ~ $900M.

The Bybit hack was one other take a look at towards the resilience of the crypto trade. In years previous, this is able to be existential to not simply an change, however the market as an entire. Miraculously, the group pulled collectively to trace the funds flowing to the hacker on-chain, establish the malicious actor, validate the solvency of a custodian in real-time, and mitigate the injury that would consequence from this disaster. The speed and effectivity with which this was achieved wouldn’t be potential with out public instruments, knowledge, and a tradition of transparency.

The trade will now must reckon with a goal on its again from hostile state actors and regulators. Whereas the injury inside the ecosystem appears principally contained, this incident will increase nationwide safety issues as crypto grows more and more built-in with the broader worldwide monetary system. Will probably be as much as the trade to handle these professional issues and show the worth of permissionless structure.

Thanks to our loyal readers of SOTN in your time and a focus all these years and to previous contributors (you understand who you might be). Right here’s to hoping that we’ve solely coated the start of crypto’s story.

-

We just lately launched Coinbase change flows metrics to our Community Knowledge Professional product, permitting customers to trace BTC & ETH flows for some of the important crypto exchanges.

-

Observe Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As all the time, in case you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You possibly can see earlier problems with State of the Community right here.