Get the perfect data-driven crypto insights and evaluation each week:

By: Tanay Ved & Matías Andrade Cabieses

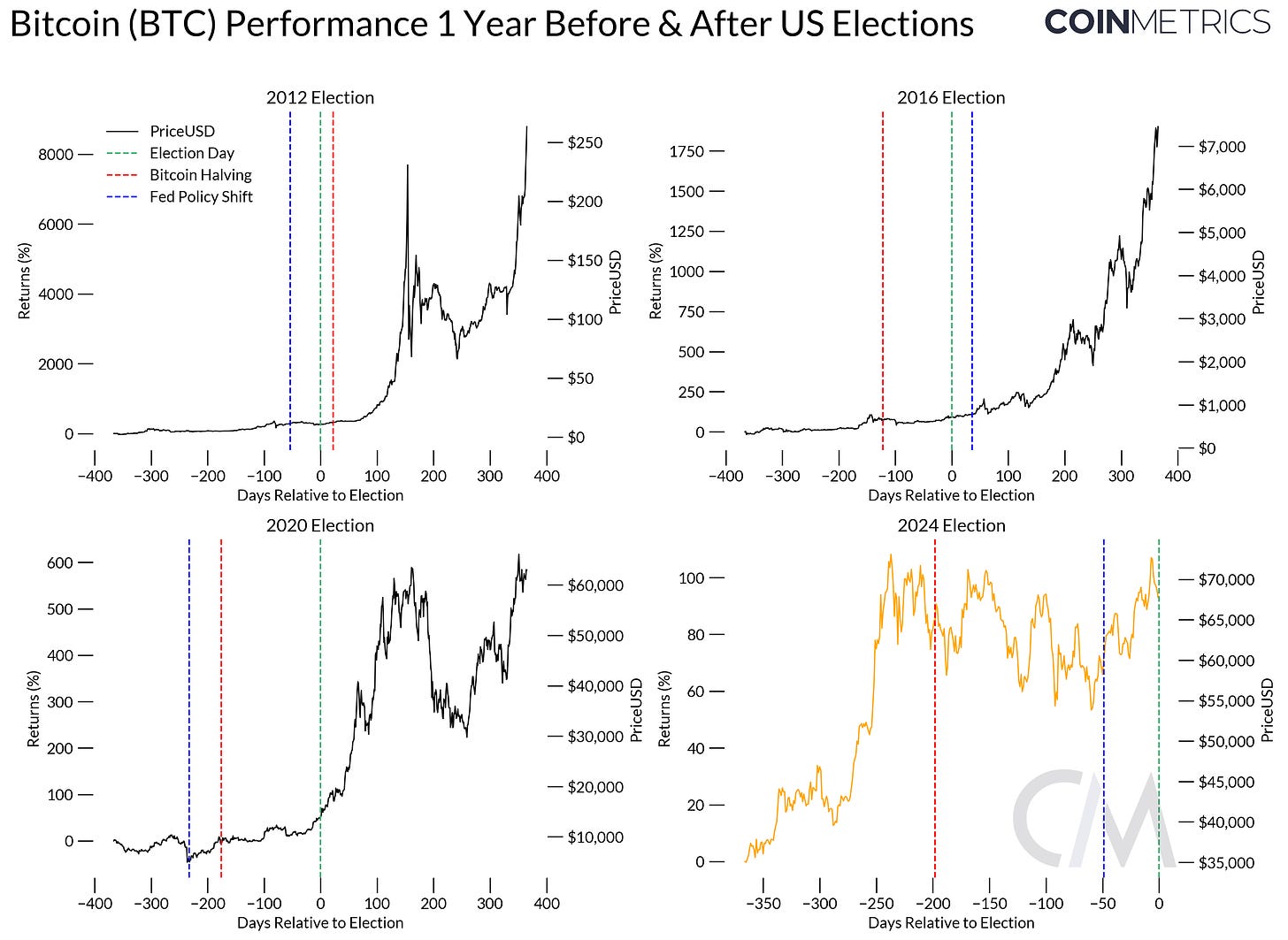

Bitcoin has traditionally seen substantial post-election positive factors, although with diminishing returns every cycle: ~8000% (2012), ~1750% (2016), and ~600% (2020). They’ve usually aligned with Bitcoin halving’s and main Federal Reserve coverage shifts, making a confluence of catalysts that cut back market uncertainty.

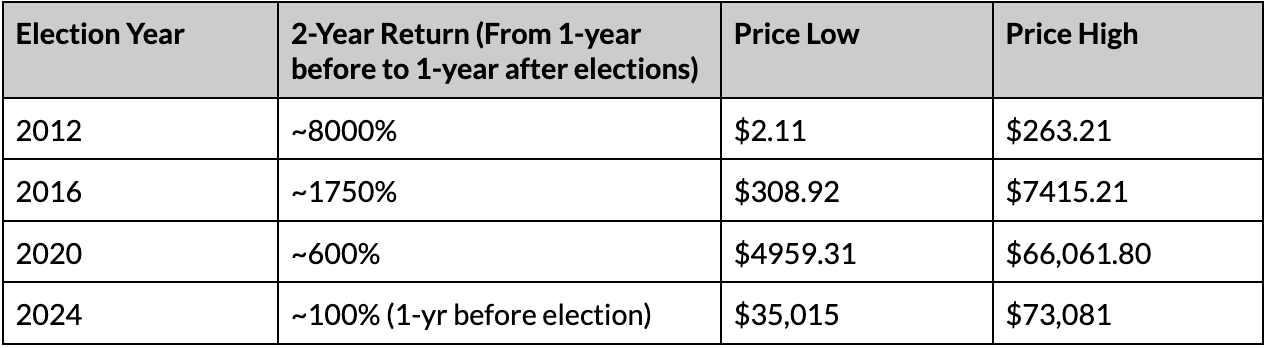

Bitcoin’s realized volatility has traditionally elevated round U.S. elections, usually remaining elevated for about 30 days post-election.

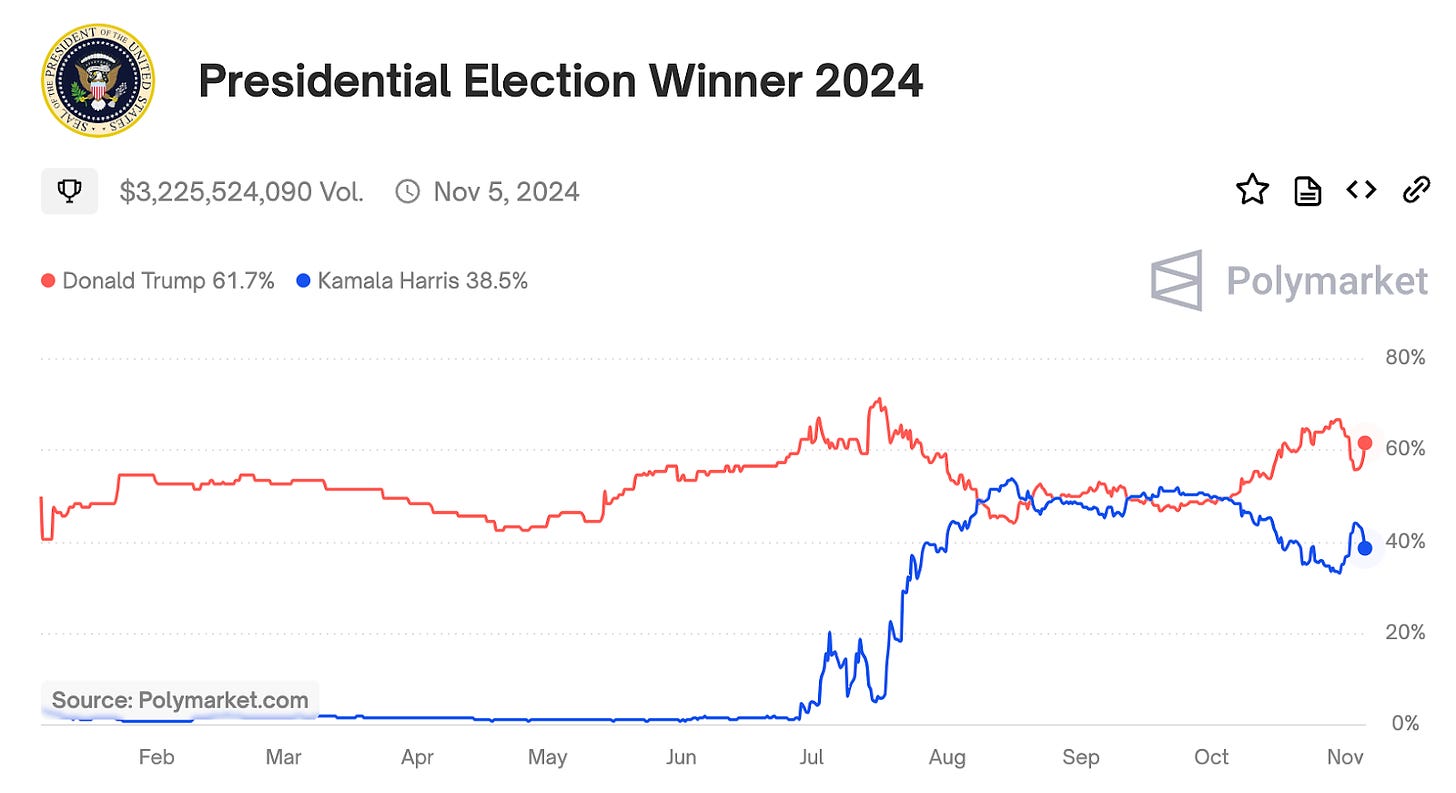

Polymarket odds for the 2024 race have seen dramatic swings: from a fair break up in October, to a 34% Trump lead, and most just lately to 62% Trump vs 38% Harris. Buying and selling patterns counsel important worldwide participation, with peak buying and selling volumes occurring between 01:00-04:00 ET.

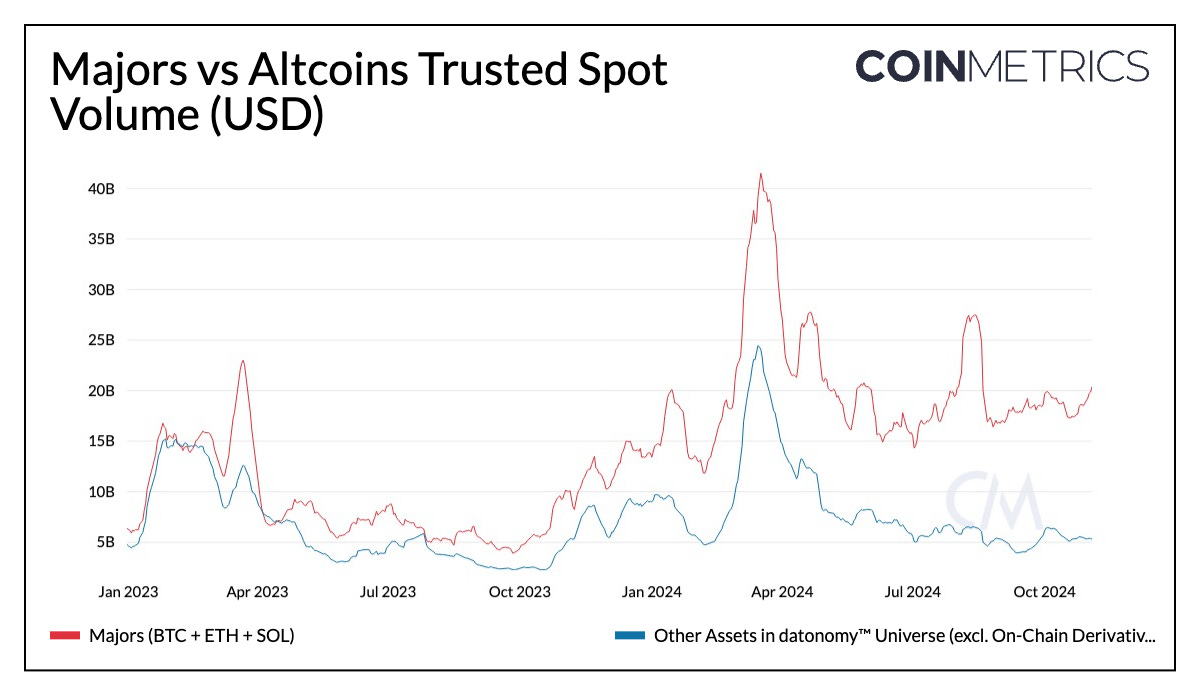

As we head into the elections, trusted spot volumes for majors (BTC, ETH, SOL) are double their latest common at $19.7B, whereas Bitcoin futures open curiosity has reached near-record ranges of $34B.

As anticipation builds across the 2024 U.S. Presidential election, international markets are poised for potential outcomes, with important implications for digital property and dynamics of the crypto ecosystem. A number of political developments have unfolded main as much as the election, with prediction markets like Polymarket taking part in an more and more influential position in forecasting sentiment alongside typical polls. For a deeper understanding of how prediction markets and Polymarket work, see our latest SOTN problem, “Polymarket and the Energy of Collective Intelligence.” Now, as election outcomes draw close to, crypto markets have regained momentum, with Bitcoin (BTC) pushing previous $70,000, inside touching distance of its all-time excessive. As we glance forward, the election’s consequence is prone to additional form crypto’s coverage panorama and affect market sentiment within the months to come back.

On this problem of Coin Metrics’ State of the Community, we analyze Bitcoin’s (BTC) historic efficiency round prior elections, dive into market actions and study Polymarket knowledge pushed by 2024 elections.

With potential outcomes for digital property on prime of thoughts for market contributors, we are able to look again to BTC’s efficiency throughout previous elections to grasp whether or not they’ve had any noticeable affect or impression.

Supply: Coin Metrics Reference Charges

Above, we are able to see the returns for BTC a 12 months earlier than and after the final 3 U.S. presidential elections, alongside the present 2024 election (highlighted in orange). Notably, bitcoin halvings, main Federal Reserve coverage shifts and presidential elections have all usually occurred carefully inside this timeframe, previous a significant worth rally. Whereas returns have diminished over every cycle, BTC has traditionally skilled important worth appreciation round 100 days post-election, because the cyclical discount of BTC issuance, financial coverage shifts, and election outcomes cut back market uncertainty and increase sentiment.

Whereas the constructive consequence of those occasions is clear, these developments additionally mirror Bitcoin’s development as a part of broader market cycles, that are additionally influenced by international financial coverage and increasing cash provide. BTC’s efficiency round election cycles might align with these structural elements quite than indicate a direct relationship.

Supply: Coin Metrics Market Knowledge Feed

As we strategy every election, volatility tends to extend as market contributors course of new data and regulate their positions in anticipation of election outcomes. The chart above exhibits realized volatility over a 7-day interval, which has usually risen main into earlier elections (2016 and 2020) and remained elevated round 30 days after. Whereas volatility forward of the 2024 election has remained comparatively subdued, it’s seemingly we’ll see a rise within the coming days.

For the reason that starting of October, Donald Trump and Kamala Harris’ odds to win the presidential election on Polymarket have widened considerably from ~50% every to a spot of ~34% in favor of Trump. Nonetheless, within the final week this divergence has reversed, with Harris’ chance of profitable the election reaching 46%, narrowing the hole between the candidates. An identical shift in odds can also be mirrored on Kalshi, a U.S. regulated prediction market alongside some different forecasts.

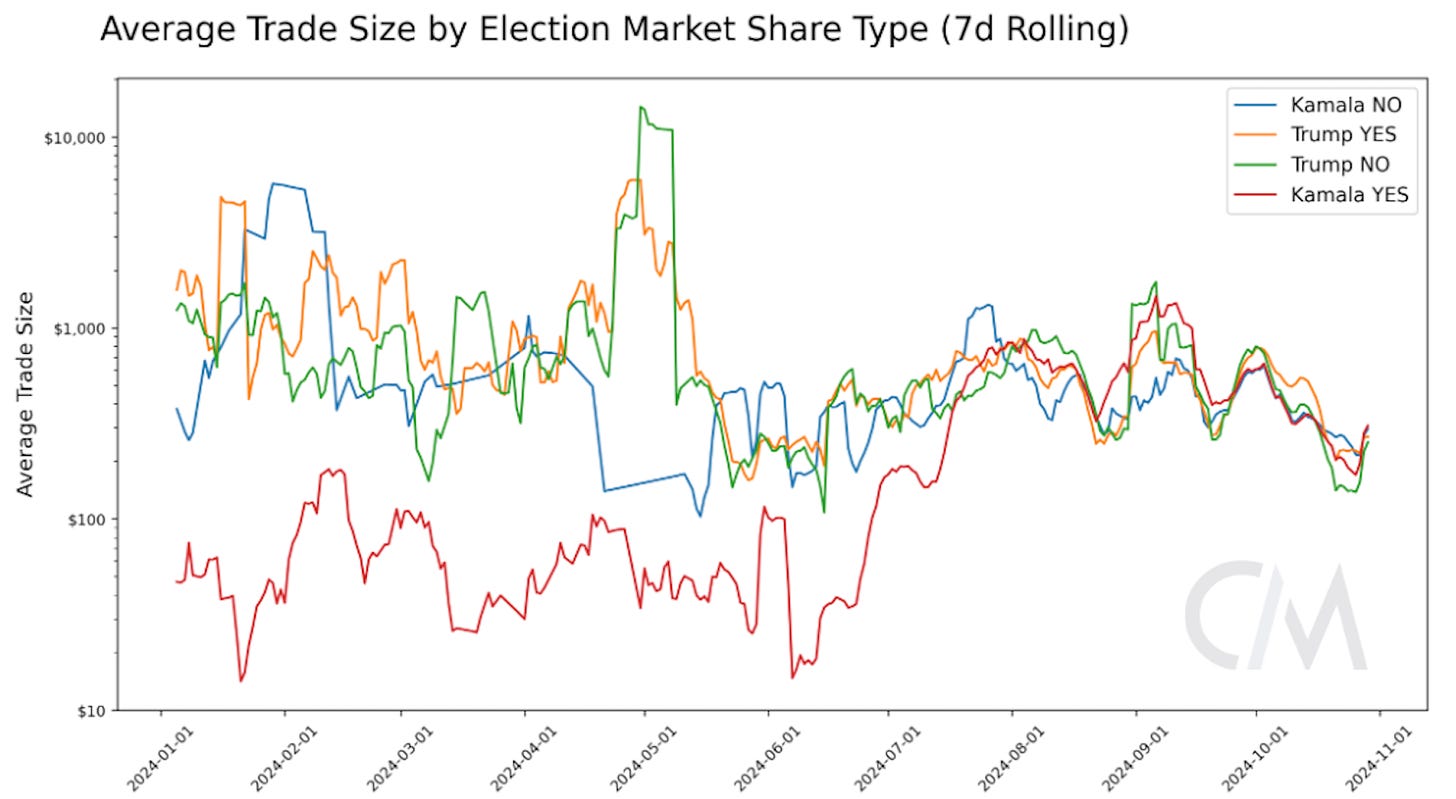

To grasp how Polymarket customers have influenced candidates odds over the 12 months, we are able to study patterns in common commerce sizes throughout completely different shares. The chart under, exhibiting the 7-day rolling common guess dimension reveals notable patterns in buying and selling conduct throughout election outcomes. Over the whole interval, “Trump YES” and “Trump NO” shares exhibit greater common commerce sizes, ($971 and $955 respectively) with spikes on some events suggesting a shift in sentiment pushed by exterior occasions or the affect of bigger, concentrated bets. Alternatively, “Kamala YES” and “Kamala NO” positions typically have decrease commerce sizes ($274 and $622 respectively) with a divergence within the early interval. As we transfer nearer to the election, commerce sizes have converged throughout shares resulting in a extra steady market surroundings.

Supply: Coin Metrics Labs

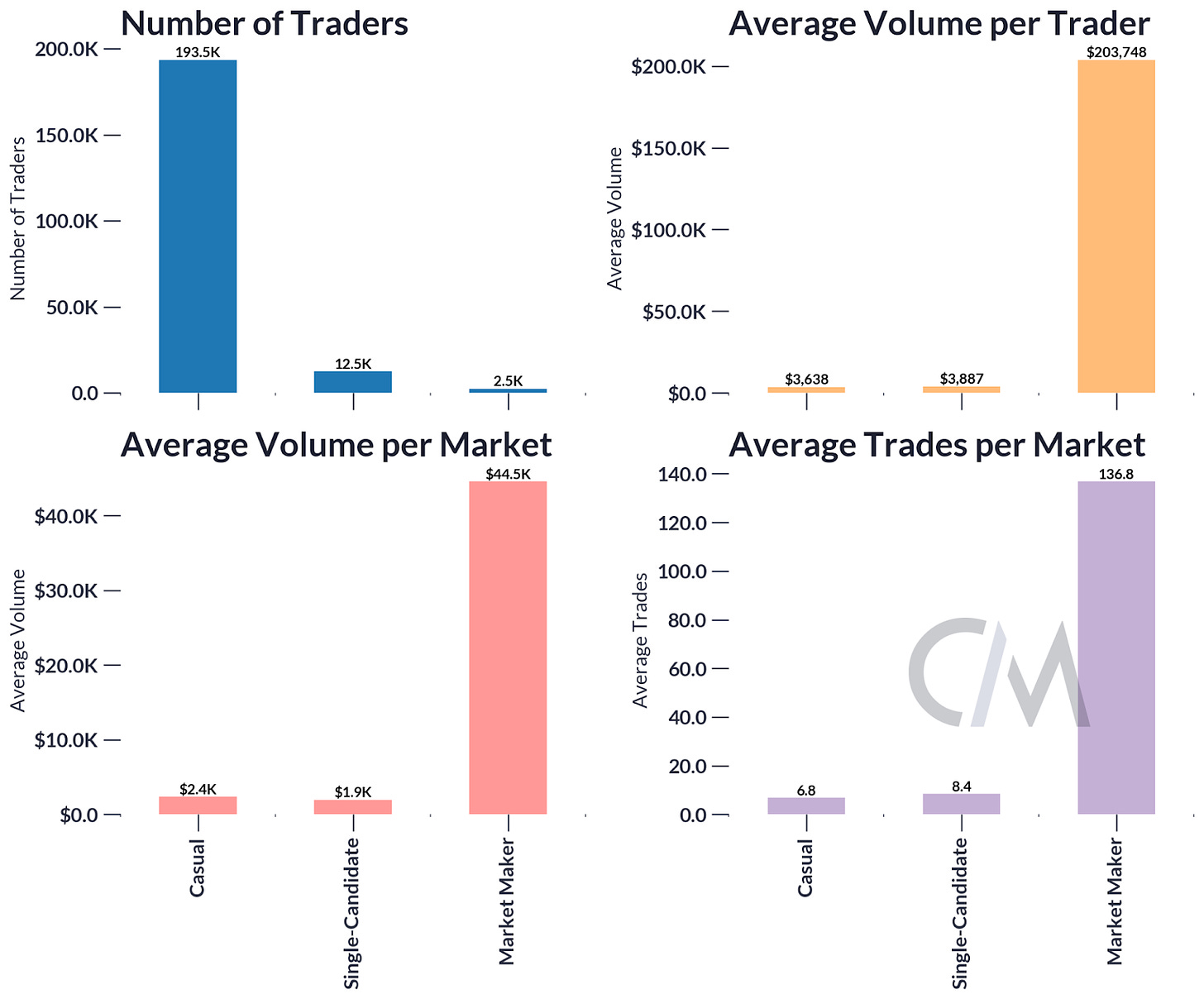

We will additional analyze the dealer exercise throughout Polymarket for the 2024 election. We will break down the bets made in Polymarket utilizing the straightforward heuristic that if merchants have traded greater than 50 instances and in favor or towards two candidates they’re categorized as market makers, isolating merchants that guess solely in favor of a single candidate, and informal merchants who make up the remainder of the exercise on Polymarket. Whereas market makers make up a small proportion of the entire proportion of merchants on Polymarket, they drive a big proportion of trades and quantity on the platform.

Supply: Coin Metrics Labs

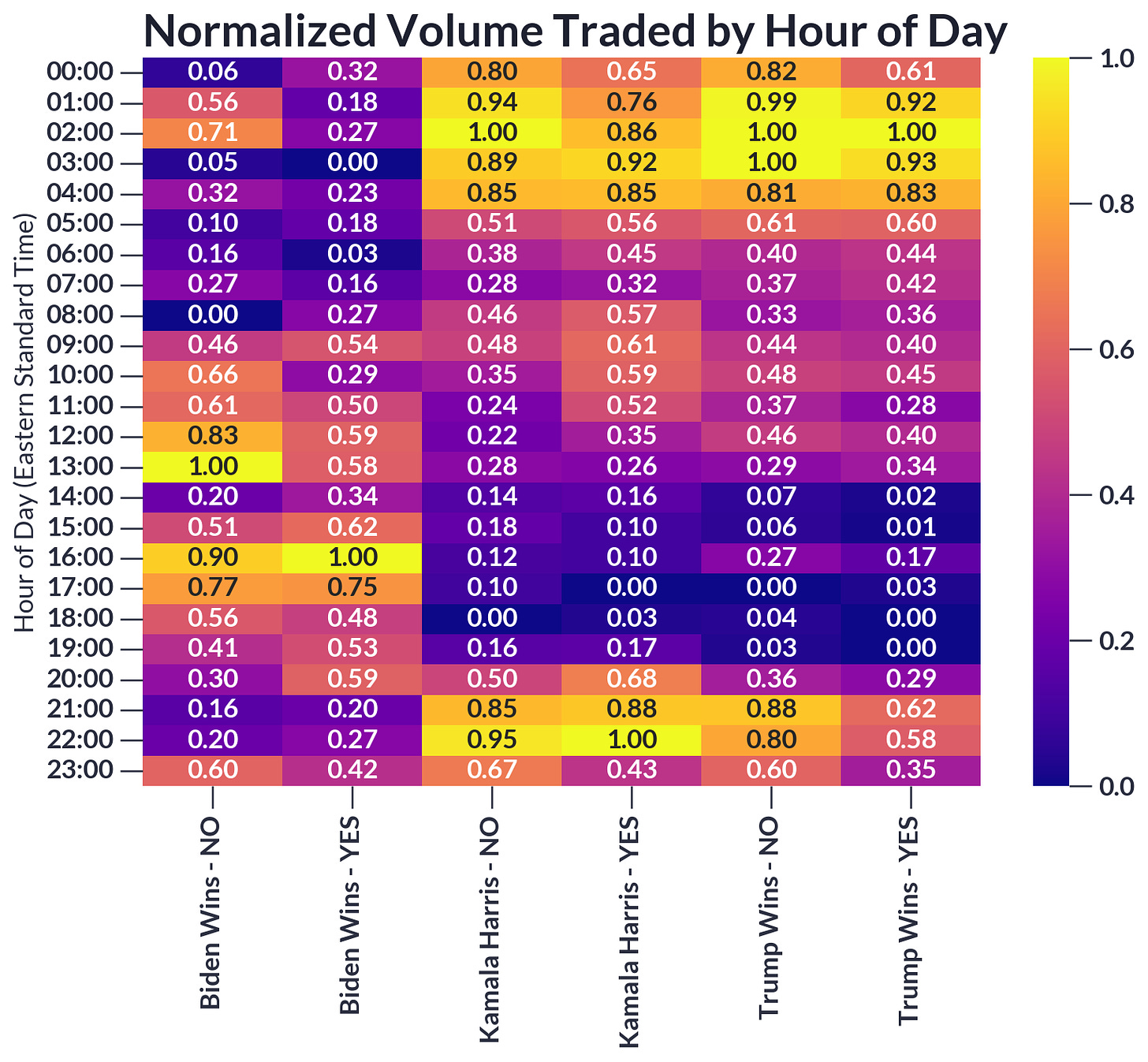

One of many questions on Polymarket buying and selling for the election is predicated on the truth that Individuals should not allowed to take part on these markets. We will begin by trying on the normalized quantity traded by hour throughout completely different prediction market contracts associated to Biden, Harris, and Trump, the place there is a clear sample suggesting that a lot of the buying and selling exercise happens outdoors typical US buying and selling hours.

Supply: Coin Metrics Labs

Whereas we do see some quantity in the course of the US market hours for the Biden Wins market, the very best buying and selling volumes are persistently noticed throughout what could be in a single day hours within the US, particularly between 01:00-04:00 ET contemplating that the Biden Wins markets have a lot decrease total quantity in comparison with Trump Wins and Kamala Wins markets. This timing aligns extra with European and Asian buying and selling hours. Nonetheless, provided that US political information influences buying and selling patterns, as evidenced by some important buying and selling exercise throughout US daytime hours, this sample means that worldwide merchants are actively monitoring and reacting to US political developments. The truth that the vast majority of buying and selling quantity happens outdoors US hours whereas nonetheless sustaining important exercise throughout US instances suggests a worldwide buying and selling group that is closely influenced by, however not based in, the USA.

A lot has been mentioned in regards to the outlook for various sectors of the digital asset market and the way election outcomes might form their trajectory. Segmenting the market into majors (BTC, ETH, & SOL) and altcoins throughout the datonomy™ universe (excluding on-chain derivatives like stablecoins) reveals a notable divergence in trusted 14-day spot buying and selling volumes. Majors at the moment account for $19.7B in buying and selling quantity, in comparison with $5.4B for altcoins. Whereas buying and selling volumes for majors are ~2x greater than previous averages, total ranges stay comparatively subdued, awaiting election outcomes and potential coverage modifications to verify a directional pattern.

Supply: Coin Metrics Market Knowledge Feed & datonomy™

Whereas a Trump victory has been thought to be helpful to BTC and a wider cohort of crypto-assets because of his proposed initiatives round Bitcoin and involvement in initiatives like World Liberty Monetary—a DeFi borrowing & lending protocol, it stays to be seen how numerous sectors reply to both consequence. Going into elections, a number of metrics might function indicators for shifts in market sentiment. The ETH/BTC ratio sits at 0.035, approaching April 2021 ranges whereas the SOL/ETH ratio is close to an all time excessive of 0.07. Hypothesis has heightened, with BTC futures open curiosity close to record-highs ($34B). Consequently, implied volatility is predicted to grind greater, reflecting market anticipation.

Because the U.S. election approaches, anticipation is constructing amongst international market contributors and the crypto ecosystem alike. Whereas election outcomes might steer the short-term course of digital property, the business stays on path for sustained, long-term development as market uncertainty fades. As we’ve seen by previous cycles, Bitcoin has proven resilience by a number of elections, reinforcing its standing as an apolitical macro asset. Because the broader crypto ecosystem continues to mature, we are able to count on higher funding participation and deeper on-chain adoption to form its evolution over time.

This week’s updates from the Coin Metrics workforce:

We expanded our protection of the Solana ecosystem, including full knowledge historical past and metrics for a number of SPL tokens. Discover extra particulars right here.

Comply with Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As all the time, you probably have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.