As a part of the push to make Synthetix staking nice once more, Synthetix is targeted on deepening liquidity for its native stablecoin, sUSD. A vital a part of this effort is the sUSD/sUSDe Curve pool, which gives LPs a possibility to earn incentivized yield whereas strengthening stablecoin liquidity throughout DeFi.

On this information, we’ll stroll by way of how you can take part and stake your LP tokens for extra rewards.

Why Present Liquidity?

Liquidity is the spine of a stablecoin’s utility. sUSD is designed to energy the Synthetix ecosystem, serving as the first settlement asset throughout Synthetix Alternate and upcoming vaults. By offering liquidity to the sUSD/sUSDe pool on Curve, LPs earn rewards whereas serving to guarantee deep, environment friendly markets for sUSD.

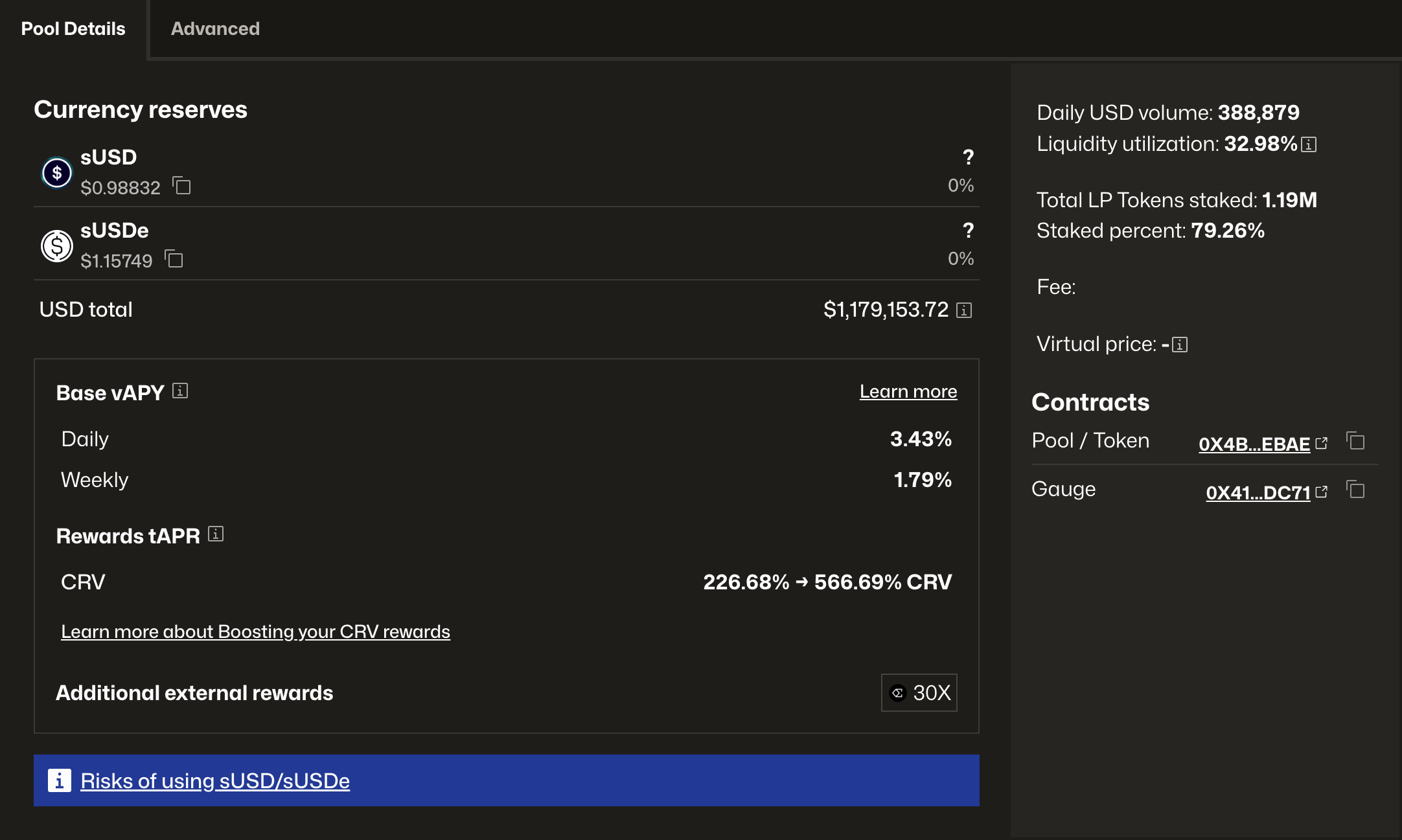

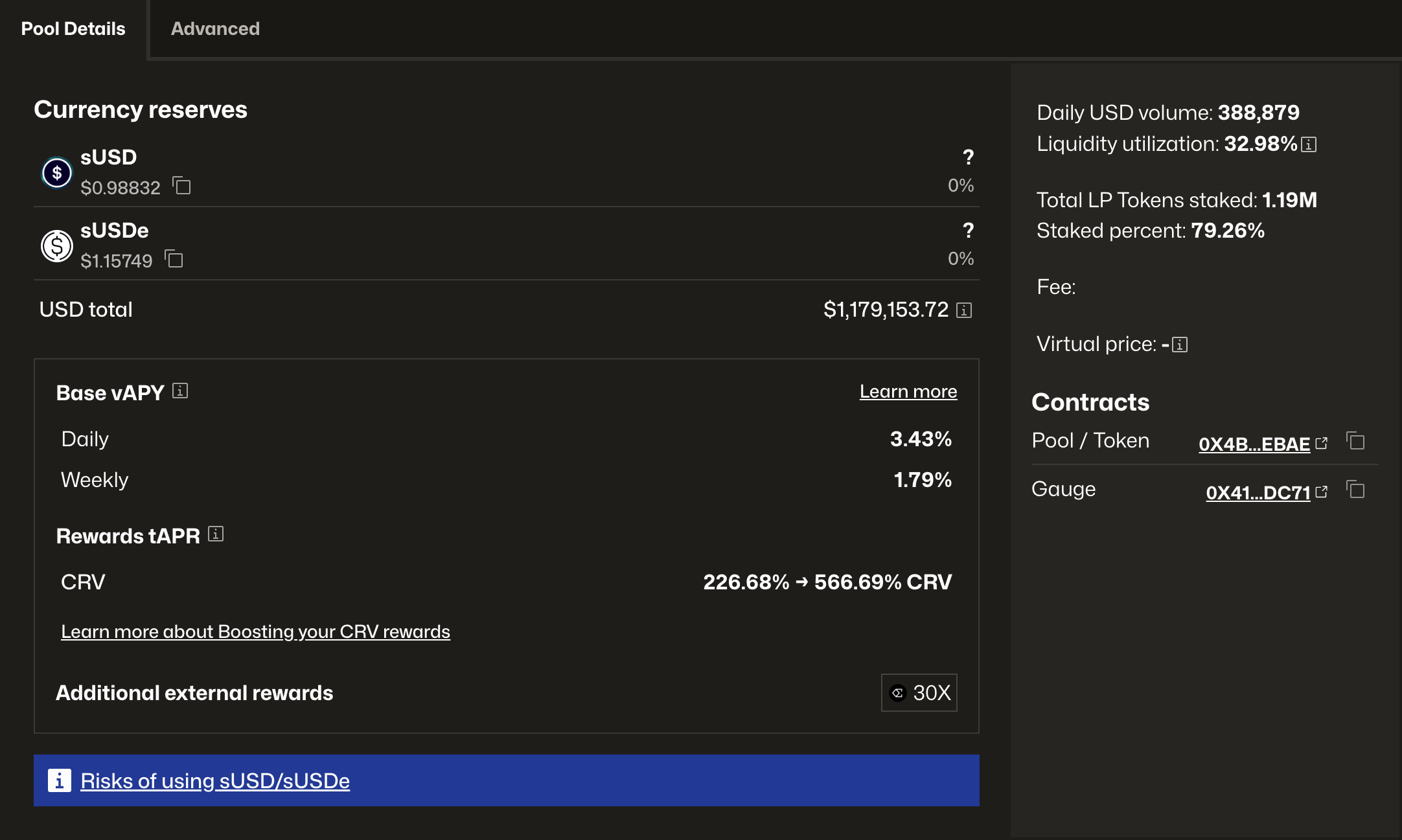

The pool accepts two property:

- sUSD – The stablecoin backing Synthetix’s onchain buying and selling ecosystem.

- sUSDe – A yield-bearing artificial greenback from Ethena (@ethena_labs), which gives passive earnings to holders.

Please Be aware: Because of the yield bearing qualities of sUSDe, market costs above $1 are regular.

Easy methods to Deposit

Step 1: Purchase sUSD or sUSDe

To offer liquidity, you’ll want both sUSD or sUSDe.

- sUSD will be obtained by swapping on any main DEX aggregator, reminiscent of Llamaswap.

- sUSDe will be acquired by staking USDe on Ethena or buying straight on a DEX aggregator reminiscent of Llamaswap.

Curve permits depositors to decide on any quantity of every token to deposit, however LPs might earn constructive slippage from offering the secure which balances the pool.

Step 2: Add Liquidity

Liquidity suppliers can deposit sUSD, sUSDe, or each into the sUSD/sUSDe Curve pool and obtain LP tokens representing their share of the pool.

By including liquidity, you earn by facilitating swaps between sUSD and sUSDe, supporting deeper liquidity for Synthetix’s ecosystem.

Step 3: Stake Your LP Tokens

After depositing, LP tokens will be staked on Curve within the Rewards Gauge to earn CRV rewards.

Present yield is proven within the pool particulars. The pool’s tAPR could also be boosted with locked CRV, or veCRV, however all LPs will earn tAPR. Be taught Extra About Curve’s Rewards.

Dangers of LPing

Offering liquidity in DeFi comes with dangers, together with sensible contract vulnerabilities and impermanent loss. LPs ought to consider dangers earlier than depositing. Be taught Extra About Curve Pool Dangers

Keep Linked

The sUSD/sUSDe pool is a core a part of strengthening Synthetix’s stablecoin and providing LPs a possibility to take part within the Synthetix ecosystem. To comply with extra information from Synthetix, be part of the neighborhood.

Be a part of the dialog: discord.gg/synthetix

Subscribe to TG: https://t.me/+v80TVt0BJN80Y2Yx

Observe us on X: x.com/synthetix_io

As a part of the push to make Synthetix staking nice once more, Synthetix is targeted on deepening liquidity for its native stablecoin, sUSD. A vital a part of this effort is the sUSD/sUSDe Curve pool, which gives LPs a possibility to earn incentivized yield whereas strengthening stablecoin liquidity throughout DeFi.

On this information, we’ll stroll by way of how you can take part and stake your LP tokens for extra rewards.

Why Present Liquidity?

Liquidity is the spine of a stablecoin’s utility. sUSD is designed to energy the Synthetix ecosystem, serving as the first settlement asset throughout Synthetix Alternate and upcoming vaults. By offering liquidity to the sUSD/sUSDe pool on Curve, LPs earn rewards whereas serving to guarantee deep, environment friendly markets for sUSD.

The pool accepts two property:

- sUSD – The stablecoin backing Synthetix’s onchain buying and selling ecosystem.

- sUSDe – A yield-bearing artificial greenback from Ethena (@ethena_labs), which gives passive earnings to holders.

Please Be aware: Because of the yield bearing qualities of sUSDe, market costs above $1 are regular.

Easy methods to Deposit

Step 1: Purchase sUSD or sUSDe

To offer liquidity, you’ll want both sUSD or sUSDe.

- sUSD will be obtained by swapping on any main DEX aggregator, reminiscent of Llamaswap.

- sUSDe will be acquired by staking USDe on Ethena or buying straight on a DEX aggregator reminiscent of Llamaswap.

Curve permits depositors to decide on any quantity of every token to deposit, however LPs might earn constructive slippage from offering the secure which balances the pool.

Step 2: Add Liquidity

Liquidity suppliers can deposit sUSD, sUSDe, or each into the sUSD/sUSDe Curve pool and obtain LP tokens representing their share of the pool.

By including liquidity, you earn by facilitating swaps between sUSD and sUSDe, supporting deeper liquidity for Synthetix’s ecosystem.

Step 3: Stake Your LP Tokens

After depositing, LP tokens will be staked on Curve within the Rewards Gauge to earn CRV rewards.

Present yield is proven within the pool particulars. The pool’s tAPR could also be boosted with locked CRV, or veCRV, however all LPs will earn tAPR. Be taught Extra About Curve’s Rewards.

Dangers of LPing

Offering liquidity in DeFi comes with dangers, together with sensible contract vulnerabilities and impermanent loss. LPs ought to consider dangers earlier than depositing. Be taught Extra About Curve Pool Dangers

Keep Linked

The sUSD/sUSDe pool is a core a part of strengthening Synthetix’s stablecoin and providing LPs a possibility to take part within the Synthetix ecosystem. To comply with extra information from Synthetix, be part of the neighborhood.

Be a part of the dialog: discord.gg/synthetix

Subscribe to TG: https://t.me/+v80TVt0BJN80Y2Yx

Observe us on X: x.com/synthetix_io