Be part of Our Telegram channel to remain updated on breaking information protection

The Ethereum worth has jumped 2% within the final 24 hours to commerce at $3,543 as of 4:00 a.m. EST with each day buying and selling quantity up 18.93% at $39.53 billion.

Ethereum has taken middle stage in crypto information after its co-founder, Vitalik Buterin, along with different Ethereum leaders, launched a “Trustless Manifesto” earlier right this moment. The open letter urges builders and builders to prioritize decentralization because the undertaking grows.

1/ In the present day, The Account Abstraction Group & @VitalikButerin are publishing one thing we’ve talked about for years however by no means wrote down clearly sufficient:

The Trustless Manifesto.

And we’re placing it the place it belongs: onchain.

trustlessmanifesto.eth → https://t.co/VtabFPp5Eo

— Ethereum Basis (@ethereumfndn) November 13, 2025

Buterin’s assertion comes at a vital time, when each technical progress and institutional adoption of the Ethereum blockchain are surging. Within the manifesto, Buterin stated that trustlessness is not only a characteristic, however the very essence of Ethereum. The message is obvious: initiatives and protocols constructed on Ethereum shouldn’t sacrifice these core values simply to draw extra customers or simplify operations.

The letter was additionally signed by Ethereum Basis researchers and different key contributors. ETH’s neighborhood has taken this name severely, particularly after a current cloud outage confirmed the pitfalls of centralized operations.

AWS has gone down 3-4 occasions within the final month.

Each time, the identical factor occurs: a whole bunch of apps, video games, exchanges, dashboards, even inside instruments.. all go darkish collectively.

That’s not a bug, that’s how centralised cloud works.

One platform. Shared management aircraft.

A number of core…

— Gaurav_IO (@Gaurav_ionet) November 8, 2025

When an Amazon Internet Companies (AWS) incident introduced components of the community down, some layer 2 chains suffered, revealing how simple comfort can develop into a weak point. Buterin’s manifesto underlines that each shortcut or central level may ultimately flip right into a choke level, threatening the permissionless nature of Ethereum.

On-Chain Indicators Supporting The ETH Value

On-chain exercise for Ethereum is at present peaking.

Based on trade trackers, November 2025 has introduced report highs in main community metrics. Day by day transactions, energetic wallets, and sensible contract calls are all at all-time highs, pushed by robust development in decentralized finance (DeFi), NFTs, and layer 2 adoption.

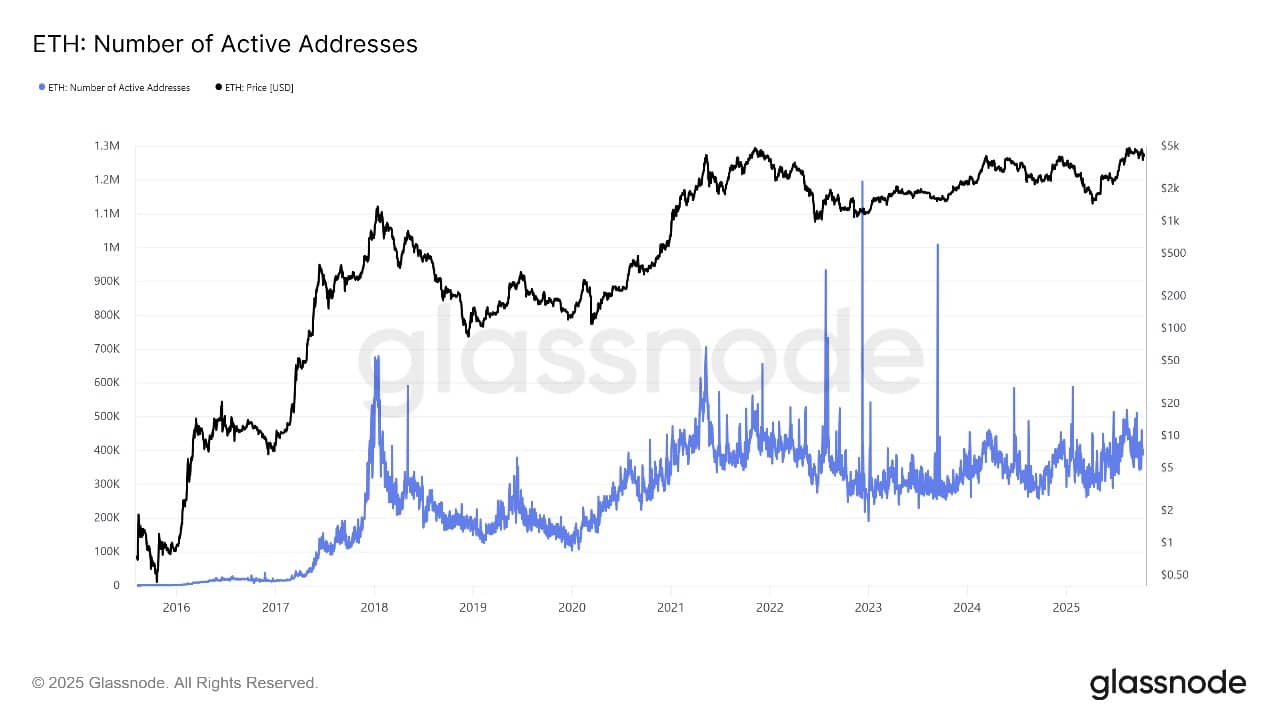

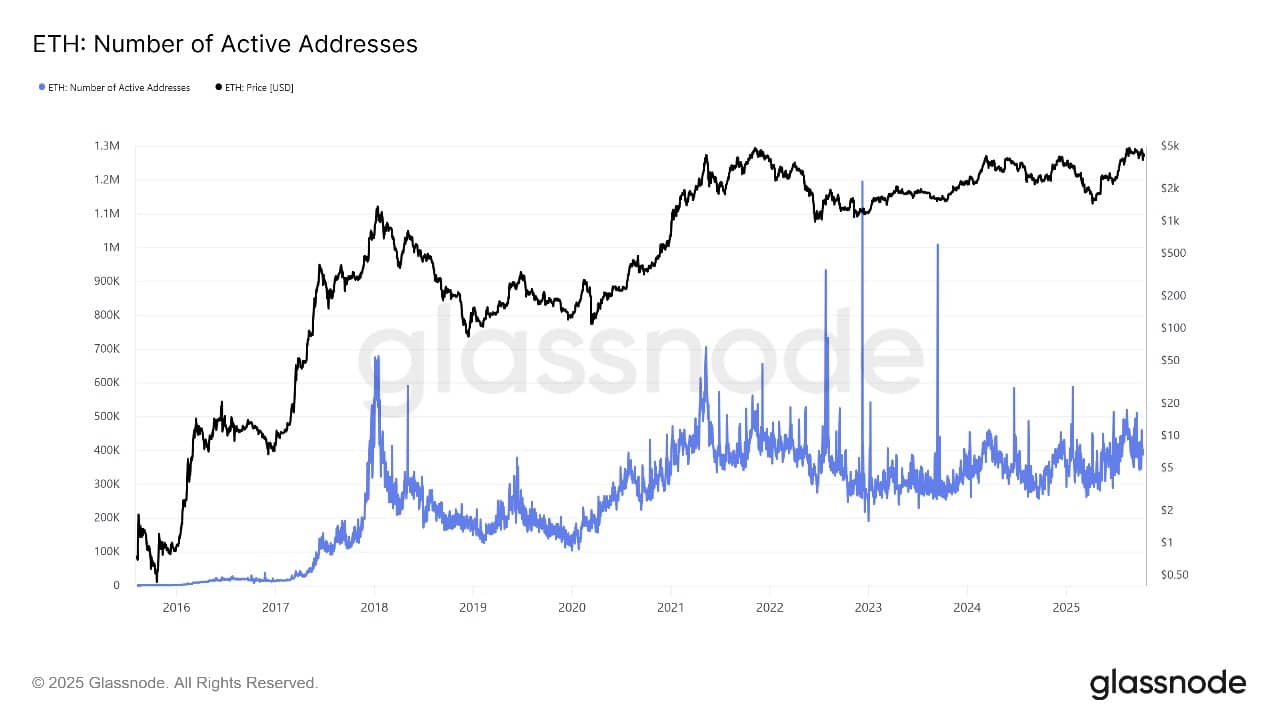

Variety of energetic ETH pockets addresses Supply: Glassnode

The variety of wallets shifting ETH off exchanges has additionally elevated. This factors to robust holding exercise and rising confidence in ETH’s future.

Giant holders should not promoting both, suggesting accumulation continues. Every dip within the ETH worth has been met by an increase in on-chain transfers to personal wallets and staking contracts, which takes provide off the market and helps regular the value.

Ethereum’s builders stay energetic as nicely. Updates on scaling and privateness enhancements have saved neighborhood sentiment robust, even with giant traders eyeing short-term income. The general on-chain story helps a bullish outlook, particularly if the bullish metrics proceed into the 12 months’s finish.

ETH Value Technical Evaluation

Wanting on the each day chart for ETH/USD, the value is displaying indicators of stability and restoration.

ETH is buying and selling at $3,529, nicely above the necessary 200-day Easy Shifting Common (SMA) at $3,449. This long-term trendline acts as a key assist degree, defending in opposition to sharper drops.

In the meantime, the 50-day SMA sits at $3,950, now appearing as a resistance degree that ETH should conquer to sign extra upside.

ETHUSD Evaluation Supply: Tradingview

Just lately, ETH bounced up from the $3,450 space, marking the 200-day SMA as a assist flooring. The worth can be inside a bigger upward channel, with consumers repeatedly stepping in when ETH falls close to the decrease channel boundary, as proven within the chart.

Technical indicators provide a blended however bettering image: The Relative Energy Index (RSI) is at present at 43.79, which suggests ETH is neither overbought nor oversold. There’s room for a transfer increased if new consumers step in.

The MACD (Shifting Common Convergence Divergence) is attempting to show constructive, at present at 2.74. This means that bullish momentum is constructing, however not but that robust.

Ethereum Value Eyes Breakout Above $3,950

In the meantime, the Chaikin Cash Stream (CMF) is barely destructive at -0.11, indicating impartial stress from giant consumers and sellers.

If ETH can push above the 50-day SMA ($3,950), the following resistance is discovered close to $4,100–$4,240. A each day shut above this band might spark a transfer to the prior highs at $4,950.

Nonetheless, if ETH fails to interrupt above $3,950 quickly, it may dip again to check assist on the 200-day SMA ($3,450) and even the $3,165 degree marked by the Fibonacci retracement.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection