Key Takeaways

- Teucrium is launching the primary leveraged ETF linked to XRP within the US, buying and selling below the ticker XXRP.

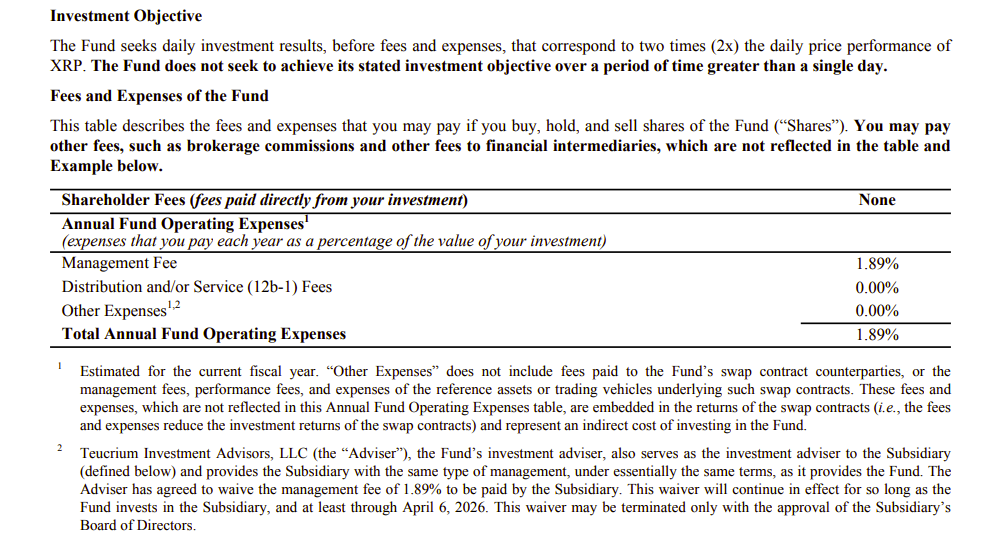

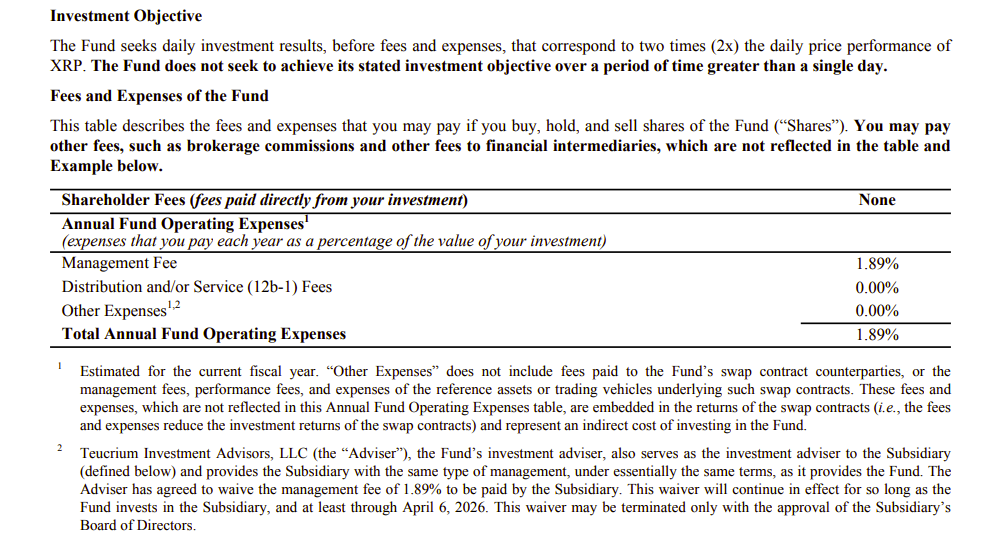

- The ETF goals to ship twice the each day return of XRP and has a 1.85% expense ratio.

Share this text

Teucrium Funding Advisors is about to launch the first-ever leveraged exchange-traded fund linked to XRP, the fourth-largest crypto asset by market cap, Bloomberg reported Monday.

The fund, known as the Teucrium 2x Lengthy Every day XRP ETF, will commerce on NYSE Arca below the ticker XXRP. The trade has licensed its approval of the itemizing and registration of the fund.

The ETF goals to supply buyers a leveraged solution to wager on the each day value actions of XRP. The fund seeks to ship returns which might be double the each day return of XRP by the usage of swap agreements.

The XXRP ETF will cost a administration payment of 1.89%, in accordance with its prospectus.

To find out the worth of XRP for the swap agreements, the fund will reference a number of benchmarks, together with the CME CF XRP-Greenback Reference Price, the CME CF XRP-Greenback Actual Time Index, and spot XRP ETFs.

Nonetheless, since there are not any US-listed spot XRP ETFs appropriate for the fund’s funding or as a reference asset, the XXRP ETF will initially base its XRP swaps on a number of XRP ETPs listed on European exchanges. These embody 21Shares XRP ETP, Bitwise Bodily XRP ETP, Virtune XRP ETP, WisdomTree Bodily XRP ETP, and CoinShares Bodily XRP ETP.

Teucrium Funding Advisors, presently managing $311 million in property, focuses on offering ETFs targeted on different investments, reminiscent of agricultural commodities and different area of interest markets.

Previous to the XXRP fund, Teucrium had already launched a Bitcoin futures ETF, known as the Teucrium Bitcoin Futures Fund. The product launched in April 2022 after being accredited by the SEC below the Securities Act of 1933.

In response to its prospectus, Teucrium can be searching for to launch a brief model of the Teucrium 2x Lengthy Every day XRP ETF, dubbed the Teucrium 2x Quick Every day XRP ETF. The leveraged inverse ETF would enable buyers to doubtlessly revenue from each day declines within the value of XRP.

In response to Sal Gilbertie, founder and CEO of Teucrium ETFs, the choice to launch the leveraged XRP ETF presently was influenced by engaging low costs.

He additionally famous that there was appreciable investor demand for XRP, which he expects could be heightened by the fund’s leverage.

XRP was buying and selling at $1.9 at press time, up 1% within the final 24 hours, in accordance with CoinGecko.

The launch comes because the years-long authorized battle between the SEC and Ripple Labs, the corporate behind XRP, approaches the ultimate line, as confirmed by Ripple CEO Brad Garlinghouse final month.

Garlinghouse, talking in a latest interview with Bloomberg, mentioned that he anticipates the launch of a number of XRP ETFs within the US through the second half of 2025.

The favorable settlement with the SEC instantly boosted market optimism, pushing the percentages of XRP ETF approval to 86% and growing XRP’s worth by 14%.

Within the US, a number of asset managers—together with Bitwise, Canary Capital, 21Shares, WisdomTree, CoinShares, Grayscale, and Franklin Templeton—have already submitted filings to the SEC for their very own XRP ETFs.

ProShares and Volatility Shares are additionally searching for a regulatory nod for XRP-linked funding merchandise.

In response to Nate Geraci, President of The ETF Retailer, the end result of the go well with may immediate main gamers like BlackRock and Constancy to contemplate becoming a member of the XRP ETF race.

Share this text