Howdy! Welcome to a different year-end take a look at the world of DeFi. As in 2020, 2021, and 2022, we’ve collated under the highest memes of the yr for 2023, together with 5 charts that assist clarify the yr. It’s been a yr with out euphoria, but enthusiasm emerged throughout a number of key areas. Narrative improvement is essential to success in crypto and DeFi; the memes under are meant to focus on how components of the trade have tried to construct momentum round concepts, issues, or funding alternatives. The charts are snapshots of an trade that now has years of market cycles and aggressive battles underneath its belt, however remains to be creating new market buildings and primitives.

This difficulty of Dose of DeFi is delivered to you by:

Oku makes DEX buying and selling seamless throughout the highest EVM chains. Attempt it now with 0% charges and superior analytics. Web site & Twitter

The primary on-chain AMM Bancor launched in 2017. This was adopted by Uniswap in 2018, and shortly after, impermanent loss was coined to explain the chance of LPing in an AMM with sharp (or actually any) value actions. Tim Roughgarden of Columbia and a16z crypto reframed the issue and rebranded impermanent loss to loss versus rebalancing (LVR). Eliminating impermanent loss appeared like an impossibility, however decreasing LVR looks like a “difficult however well-defined drawback”, within the phrases of Dan Robinson. New analysis additionally emerged this yr from Max Resnick on the Particular Mechanism Group that illustrated the CEX-DEX arbitrage, which some say is liable for 85-90% of all MEV earnings.

Minimizing LVR has now turn out to be a modus operandi for all DEX designers. Uniswap unveiled its v4, with its core idea of hooks giving LPs – or extra precisely, new DEX designers – extra instruments to cope with LVR. This has not but launched however its code is public. Ambient Finance has an identical idea however launched on-chain with out the catchy hook descriptor. It has dynamic charges and hopes to scale back poisonous move. Sorella Labs has but to launch its Angstrom challenge, however it goals to use a gated liquidity layer constructed on Uni v4, with the power to public sale off the proper to commerce with LPs. That is just like the design that CoW Swap has researched. All focus is now on decreasing LVR and incentivizing searchers to work on behalf of LPs.

Be taught extra:

-

Ending LP’s dropping sport: Exploring the Loss-Versus-Rebalancing (LVR) Drawback and its Options [0xKeyu/Fenbushi].

-

Will MEV mitigation destroy on-chain liquidity? [Dose of DeFi]

-

Uniswap v4 and Ambient Finance: Contemporary hope for passive LPs [Dose of DeFi]

Ethereum is an advanced net of competing concepts and pursuits. There’s the Ethereum Basis (EF) and the social layer, after which there’s utility builders and customers. Changing into aligned with all of those stakeholders has turn out to be a little bit of a joke in 2023.

On one hand, you’ve different chains competing with one another to point out how dedicated they’re to Ethereum, like Polygon funding Ethereum core devs to point out its zkevm is aligned with Ethereum. However, some folks say they’re “unaligned” with Ethereum as a result of they disagree with the technical route the protocol has taken. This group is crucial of PBS and the MEV ruling class it has spurred. Some need sooner block instances, whereas others are annoyed with the solo-stakers obsession.

Discover additional: Ethereum, to be, or to not be (aligned)? [Abdelhamid Bakhta/Starknet].

At a macro stage, 2023 was outlined by rate of interest hikes at report tempo. This wreaked havoc at regional banks and finally blew up Silicon Valley Financial institution and tarnished the sterling repute of the DeFi’s Blue Knight (USDC). It was becoming that in the course of the frantic weekend earlier than the FDIC introduced that SVB depositors could be made complete, USDC was thought-about the broader market value for an SVB restoration.

USDC is the most well-liked stablecoin in DeFi lending protocols, so its depegging may have created dangerous debt from mispriced collateral. On Compound, USDC was hardcoded to $1.00, so there was no danger of dangerous debt. Since then, Compound launched v3, which solely makes use of USDC as its borrowing stablecoin and doesn’t as collateral. Aave, in the meantime, skilled the most important scare in the course of the USDC depeg. USDC didn’t drop under $0.85 and thus threaten the massive mainnet markets, however Aave v3 with effectivity mode (E-Mode) noticed some losses. Maker engulfed an additional $2 billion in USDC, leaving it much more depending on the stablecoin. The occasion left such a bitter style that it’s pushing Dai to maneuver away from the US greenback alongside a path specified by the Endgame by Maker founder Rune Christensen. It has additionally onboarded different RWAs to considerably lower the reliance on USDC.

Return: Harm management: DeFi lenders and the USDC depeg [Dose of DeFi]

Once you first hear “intents” in a severe crypto dialog, you most likely marvel why there must be a phrase for it. However then you definately see how the phrase has been used as a self-descriptor for a swath of latest “intent-based protocols”. Might these exist with out first the creation of the intents meme? Was CoW Swap an intent-based protocol when it launched earlier than the meme was popularized? Put in your tin foil hats everybody.

In actuality, the shift in person conduct from one the place an execution path is outlined to at least one the place an finish purpose is signaled is delicate however essential, and necessitates a phrase to explain the brand new design area. Wanting forward, utility builders will construct for an intents world, however there’s nonetheless lots of debate on how these intents might be solved. Entrance-ends and functions are the place MEV is leaked, so that they might want to give you options to manage their MEV provide chain.

Background: Intent-based architectures and their dangers [Quintus Kilbourn & Georgios Konstantopoulos/Flashbots & Paradigm]

Restaking is a type of concepts that’s so intuitive, you marvel the way it was not considered earlier than. Put merely, a restaking protocol permits ETH validators to generate further yield by operating different computational duties, reminiscent of an oracle. Sreeram Kannan theorized the concept that grew to become Eigenlayer on the College of Washington in 2021, however it was this yr that the thought really broke by means of to the mainstream Ethereum dialog. Eigenlayer raised $50m in March. Its testnet launched in April and it went reside on the mainnet in June, supporting stETH and rETH. Already, $400 million has been staked on EigenLayer, reaching the cap for stage 1 of the mainnet launch, regardless that there isn’t a express yield promised.

Restaking modifications Ethereum in two key methods. First, it gives a reputable different to initiatives flirting with the app chain mannequin of Cosmos. Cosmos’ attraction is the power to simply bootstrap a small validator set that does extra than simply consensus, however truly runs logic on behalf of the appliance. dYdX has already proven the technical benefits on this strategy with their v4. The rising recognition of coprocessors can even be a key use case for restaking.

Second, it introduces extra leverage to Ethereum. That is what Vitalik is speaking about when he wrote about not “overloading Ethereum’s consensus”. The identical belongings are being rehypothecated to safe increasingly more financial exercise. Vitalik’s concern is how a downstream drawback for a closely restaked protocol may threaten Ethereum’s credible neutrality.

Restaking opens up the design area for trustless compute however it additionally introduces extra layers of danger that should be monitored.

Dig deeper:

-

Restaking and shared safety – the way forward for blockchain infrastructure [Felix Lutsch/Chorus One]

-

After Shapella, a brand new daybreak for ETH yield merchandise [Dose of DeFi]

-

Restaking Alignment with Vitalik, Sreeram, Tim Beiko, Justin Drake, Dankrad & Jessy [Bankless]

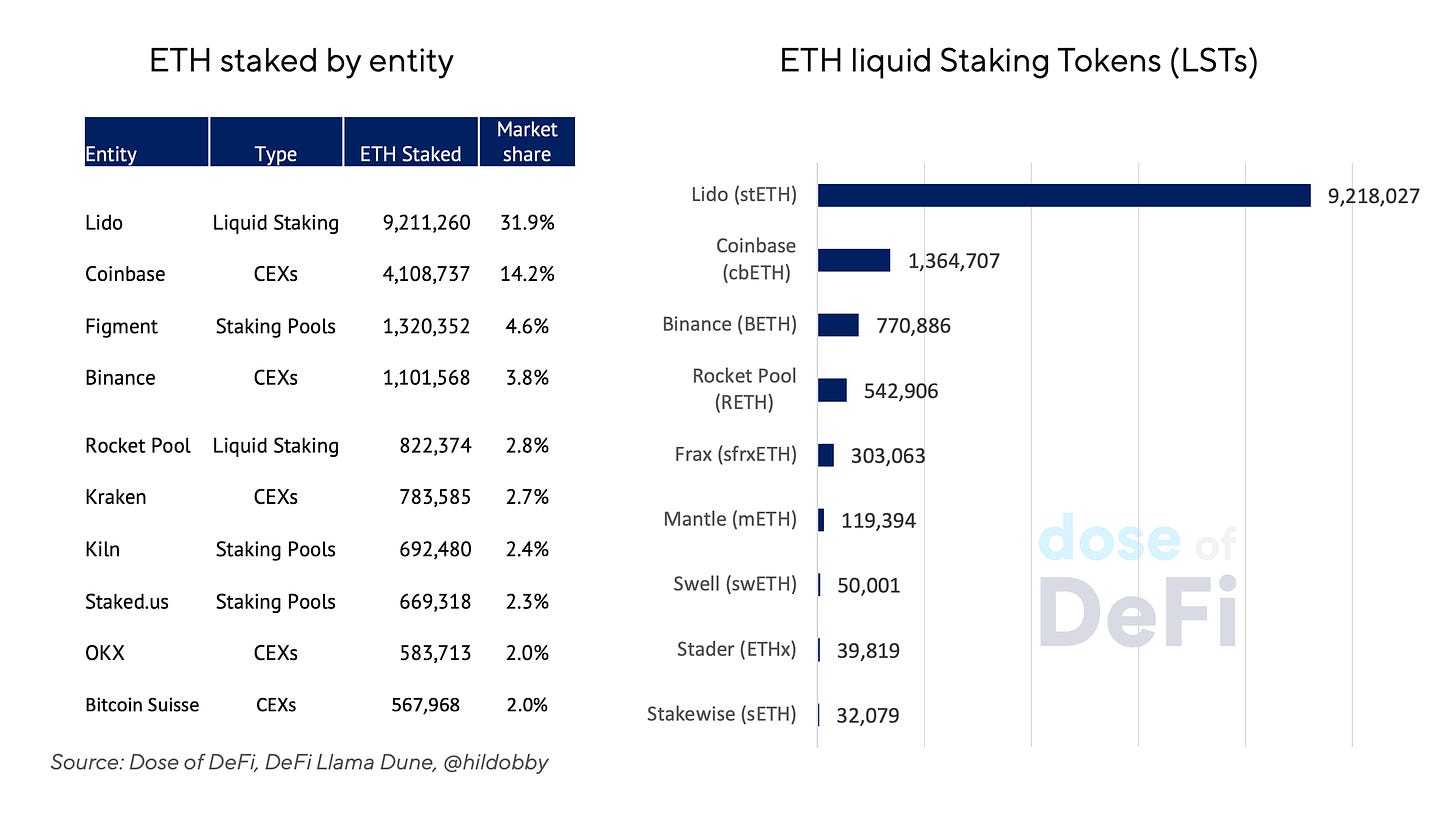

Lido has turn out to be maybe crucial protocol in DeFi after it cornered the market on liquid staking tokens (LST’s) in 2022. There was appreciable anxiousness on the ability that Lido has. It has maintained a giant lead on the LST market with over 75% market share, and a substantial lead within the total ETH stake market hovering round ~30%. Many within the ETH neighborhood see conserving Lido under the 33% threshold as key to sustaining Ethereum’s decentralization, so it’s notable that it didn’t considerably improve its market share, though the general quantity of ETH staked elevated by 80% this yr with ~23% of all ETH staked.

What are the downsides of Lido’s dominance? In their very own phrases: “Crucial concern might be the validator/operator whitelist. If Lido continues to realize market share, there’s a danger that LDO holders would be capable of successfully decide the vast majority of the Ethereum validator set. Governance may then shepherd Lido’s operators into working collectively to use multi-block MEV, execute worthwhile re-orgs, and/or censor sure transactions.” In February, Lido introduced their v2, meant to decentralize the node operator record.

Nevertheless, amidst these dangers, Lido offers a buffer in opposition to KYC-ed exchanges dominating the Ethereum validator set (Coinbase is catching up with 15% share). We anticipate intense discussions in regards to the platform’s impression within the coming years.

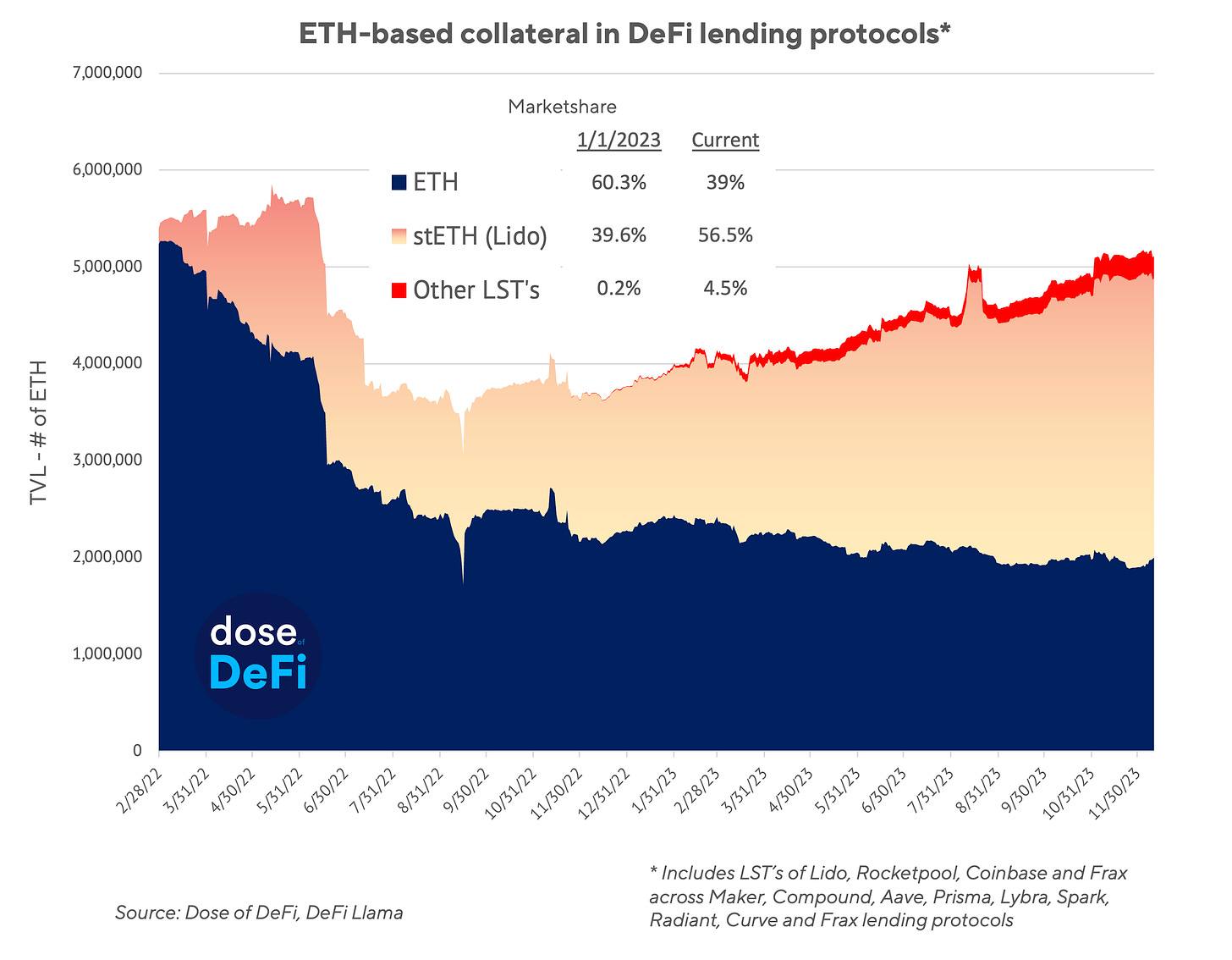

DeFi lending protocols didn’t unveil new protocol designs like their DEX brethren. As an alternative, they had been centered on diversifying diversifying its collateral base. Essentially the most important change of the yr was the shift from ETH as the first supply of collateral to LSTs, particularly Lido’s stETH, which now accounts for a staggering 56% of collateral in main DeFi lending platforms. This explains Lido’s rise and reinforces its dominance, as its liquidity in DeFi merely makes it extra helpful than different LST’s.

Elsewhere in lending, Actual World Property (RWAs) elevated dramatically, most notably at MakerDAO. Up till USDC’s depeg, nearly 50% of Dai was backed by USDC. Maker onboarded nearly $2.5bn in RWA collateral within the type of US Treasury payments, facilitated by BlockTower and Monetalis Clydesdale, which has decreased its reliance on centralized stablecoins to simply underneath 9%. Maker additionally launched Spark, one other lending protocol that forked Aave v3, which skilled fast development over the second half of the yr.

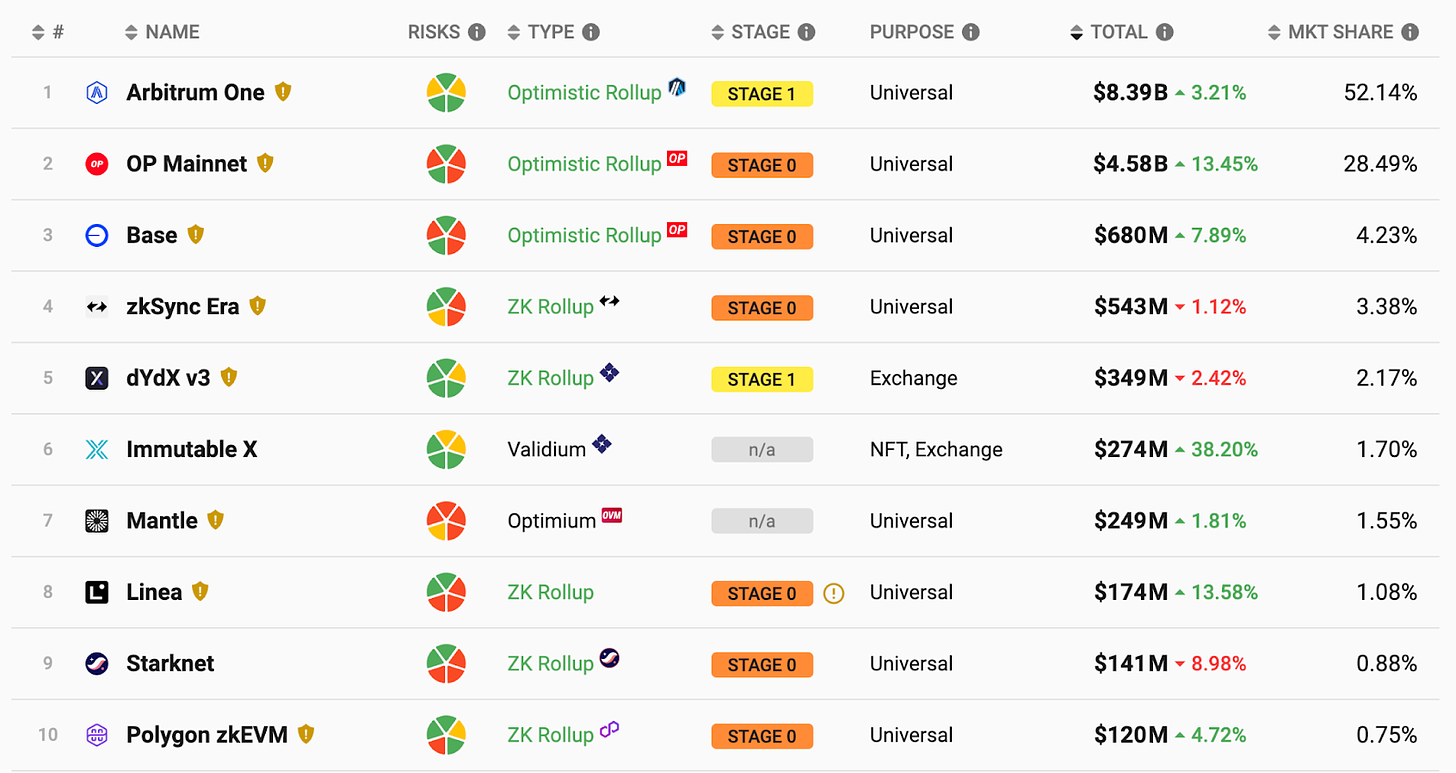

In 2023, rollups emerged as a pivotal power within the trade. From the sooner discussions to the proliferation of various rollup options, the sector skilled a big surge. Complete worth locked (TVL) has proven constant development, fostering wholesome competitors amongst ecosystems. Customers now have the autonomy to go for chains providing decrease transaction prices, that are already under Ethereum’s charges (although nonetheless not reaching excellent ranges). Nevertheless, because the person base expands, transaction batching will scale back prices.

What pursuits us most is the variety within the rollup providing (see chart). Optimistic rollups at the moment dominate. Arbitrum (after launching an airdrop in 2023) is main in TVL, with Optimism following. Nevertheless, the latter is rising horizontally – Coinbase’s Base chain is utilizing Optimism Stack and is part of its Superchain. Regardless that Vitalik predicts the eventual triumph of the ZK expertise, ZK-based zkSync, Scroll and Starknet are but to realize important traction (and but to launch tokens).

Stablecoins have endured the bear market fairly effectively, with whole worth slowly lowering from $140 billion on the peak of the bull market to $130 billion at current, considerably lower than the 40% decline within the whole crypto market cap. Regardless of this, USDT has maintained its management place, witnessing development in each absolute worth (from $65 billion to $90 billion) and in market share (from 48% to 70%). In the meantime, USDC backed by Circle seemed to be making all the proper strikes, from nearer collaboration with regulators, to increasing onto extra chains and growing a top-tier bridge. But its market share declined from 31% to 19% in 2023. The USDC depeg is the almost certainly offender for the decline. Tether’s USDT has firmly established itself inside exchanges and is gaining momentum in South-East Asia and Latin America. Does USDT’s “up solely” efficiency present us that the stablecoin market finally favors a winner-takes-all state of affairs?

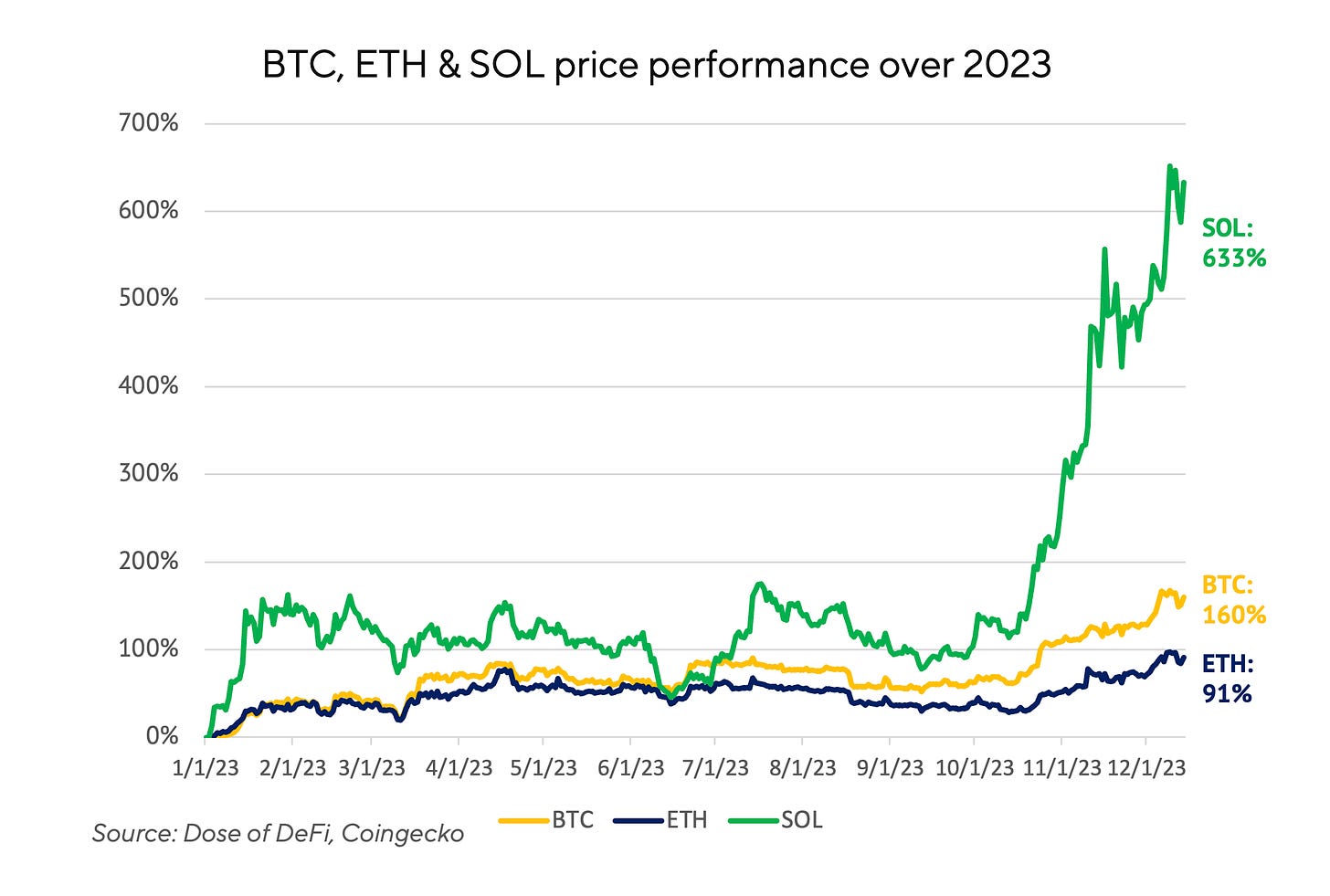

Evaluating costs on the finish of the yr is at all times an train within the arbitrary however it’s nonetheless enjoyable none the much less, particularly evaluating how the cash are doing on the finish of 2023 in comparison with 2022. Who is aware of if that is the start of a sustained bull market, however it’s clearly put some animal spirits again into the trade.

The cash have all gone up, however not on the identical tempo. Solana is on an absolute tear, particularly during the last two months, paying homage to how ETH outperformed BTC in 2021. Extra not too long ago, Solana is beginning to see some uptick in DeFi exercise. BTC, in the meantime, has reminded us to respect the orange coin. It has such a novel place within the public psyche. It appears some normies have reclaimed the narrative from the maximalists and there’s now stuff truly being constructed on Bitcoin.

ETH, in the meantime, has lagged behind. It has lengthy been the middle of DeFi, so we’re clearly biased in the direction of it. Two issues dangle over the ETH narrative: incapability to scale and MEV extraction. These are solely issues for Ethereum, as a result of it’s the one blockchain with sufficient exercise to create these issues within the first place. A military of researchers and builders are attempting to unravel these issues now. What’s clear is whether or not it’s a multichain world or a modular one, there might be not be one chain to win all of them.

That’s it! Suggestions appreciated. Simply hit reply. Written in Nashville, the place I’m totally embracing the vacation season. Might I be one of many first to say, “Comfortable New Yr!”

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov and Monetary Content material Lab. All content material is for informational functions and isn’t meant as funding recommendation.