Get the perfect data-driven crypto insights and evaluation each week:

By: Matías Andrade Cabieses & Tanay Ved

Key Takeaways:

-

The great trade stream metrics launched by Coin Metrics provide a useful instrument for analyzing liquidity, miner involvement, and total provide and steadiness data for the cryptocurrency trade ecosystem.

-

Analyzing the inflows and outflows of Bitcoin (BTC) and Ethereum (ETH) to and from centralized exchanges gives useful insights into investor conduct, market liquidity, and the general well being of the digital asset market.

-

Miner flows to exchanges have seen an uptick this 12 months, with a notable improve from Kraken and Binance, probably on account of miners securing earnings or constructing money reserves in anticipation of the Bitcoin halving occasion.

-

Crypto.com has skilled a major improve in its market share of spot BTC traded quantity, and by analyzing the connection between flows and volumes, buyers and analysts can higher perceive the well being and dynamics of the cryptocurrency market.

-

Specializing in the natural nature of market exercise, by aligning flows and volumes, might help buyers make extra knowledgeable selections and mitigate the dangers related to non-organic or manipulative buying and selling practices.

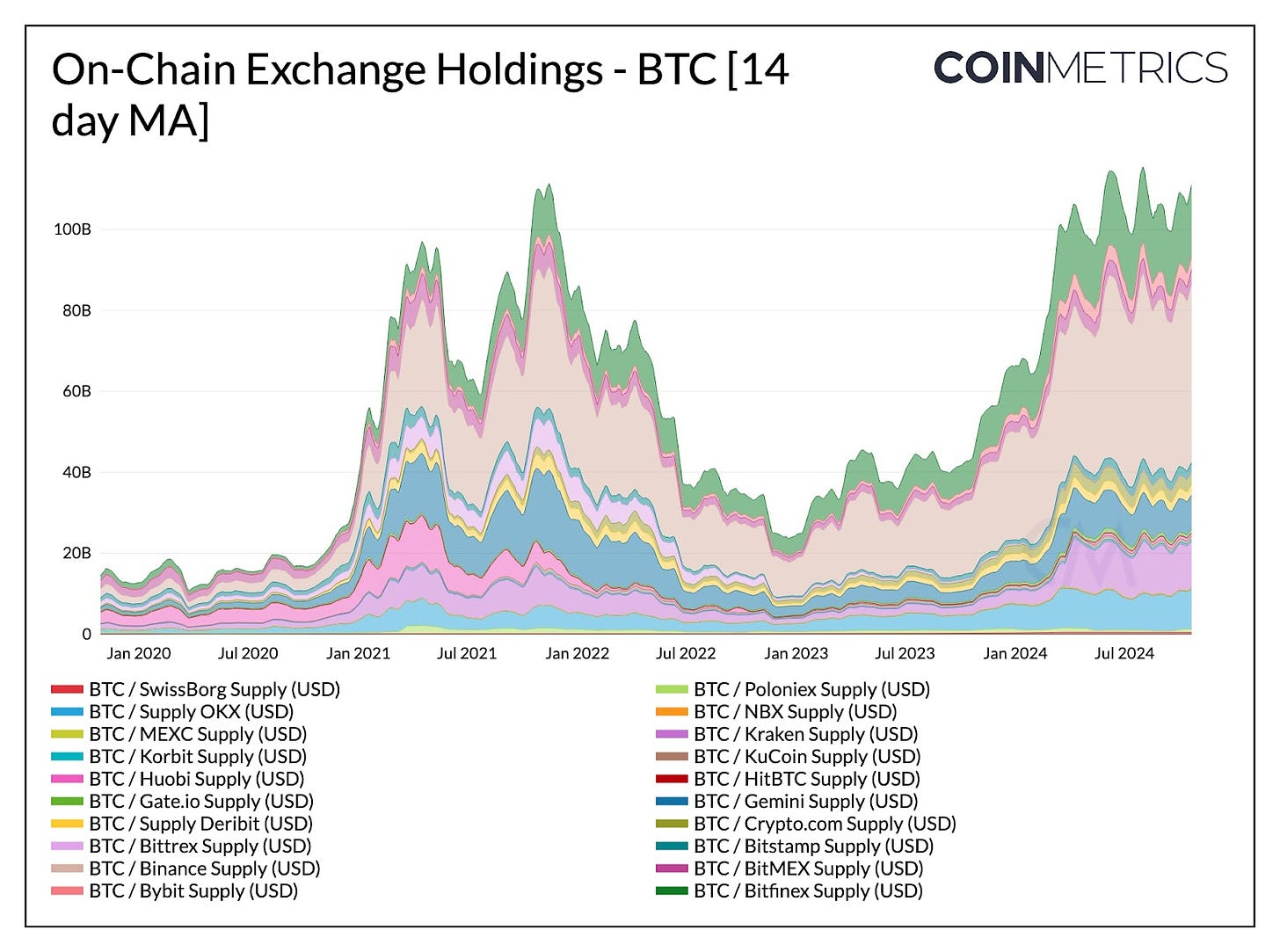

The inflows and outflows of BTC and ETH to and from exchanges provide a window into the broader cryptocurrency ecosystem. By analyzing these trade flows, we will acquire useful insights into investor conduct, market liquidity, and the general well being of the digital asset market. This data will be significantly helpful for merchants, buyers, and market analysts in search of to make knowledgeable selections about exchanges and the broader digital asset market, and determine potential traits or market indicators.

On this week’s situation of Coin Metrics’ State of the Community, we discover our new product that analyzes flows of Bitcoin (BTC) and Ethereum (ETH) to and from centralized exchanges. Understanding the dynamics of those trade flows can present essential insights into the market sentiment, buying and selling exercise, and potential value actions of those digital belongings.

Within the following sections, we focus on the insights that may be gleaned from the evaluation of BTC and ETH trade flows. We discover the historic traits, seasonal patterns, and key occasions which have influenced the actions of those belongings throughout exchanges.

The trade stream metrics launched by Coin Metrics monitor the inflows and outflows to varied cryptocurrency exchanges, together with in/outflows from miners, web balances and in addition the entire provide of belongings held by these exchanges. These metrics cowl exchanges similar to Binance (BNB), Crypto.com (CRO), Deribit (DER), Gate.io (GIO), Huobi (HBT), Kucoin (KCN), Korbit (KOR), MEXC (MXC), NBX, OKX, and Swissborg (SBG) and others, encompassing 20 exchanges in complete.

The precise metrics supplied embody inflows and outflows for every trade, each within the native token and USD, for each BTC and ETH. There are additionally miner influx and outflow metrics, monitoring the motion of funds to and from miners for every trade. The web steadiness metrics present the online place for every trade in each the native token and USD. Moreover, the dataset consists of switch rely metrics, which offer the variety of transfers into and out of every trade. Lastly, the provision metrics element the entire provide of the native token and USD for every trade.

Supply: Coin Metrics Community Knowledge Professional

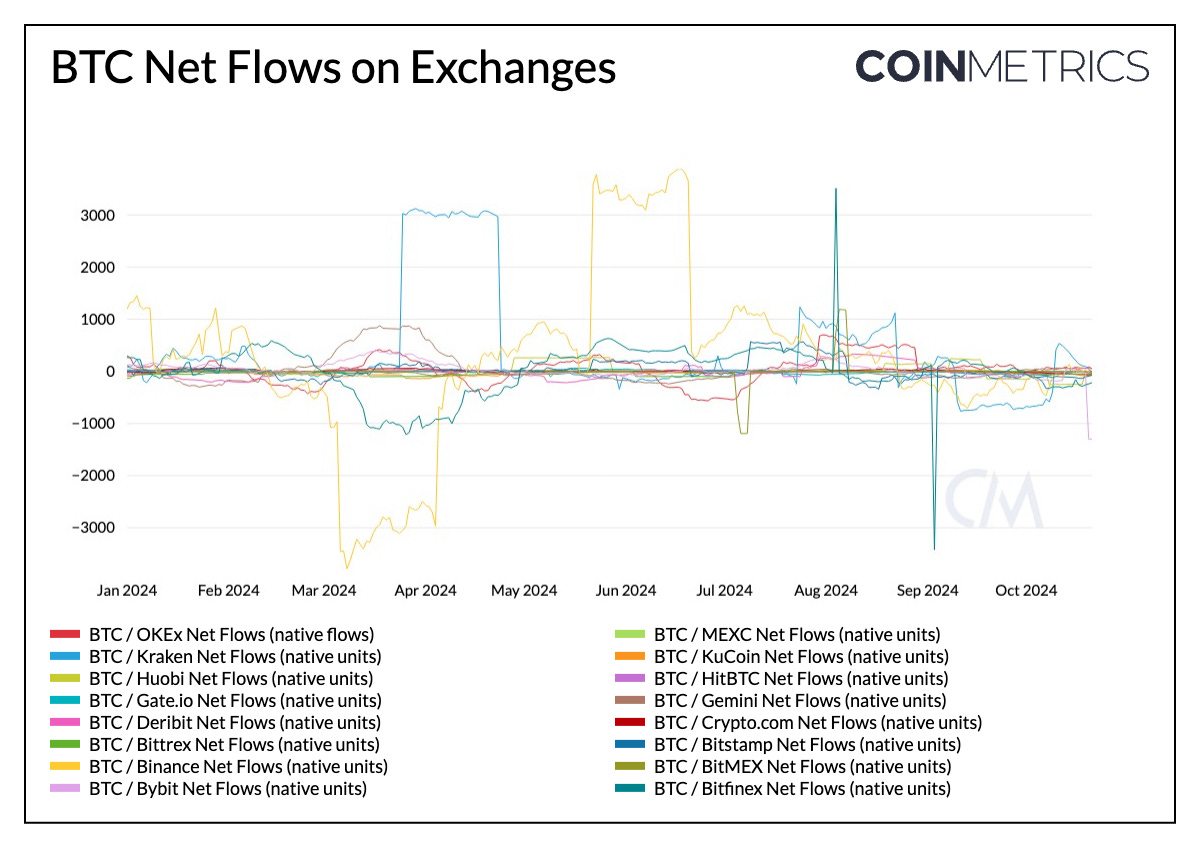

Web stream metrics illustrate the motion patterns of Bitcoin throughout main exchanges, offering a clearer view into market participant conduct. The metrics are significantly useful for monitoring important market occasions similar to Mt. Gox creditor repayments (which have been postponed to October 2025) and notable stream variations seen in intervals just like the March-April Binance actions and August Bitfinex spike, serving to members monitor actions that affect total market dynamics.

Supply: Coin Metrics Community Knowledge Professional

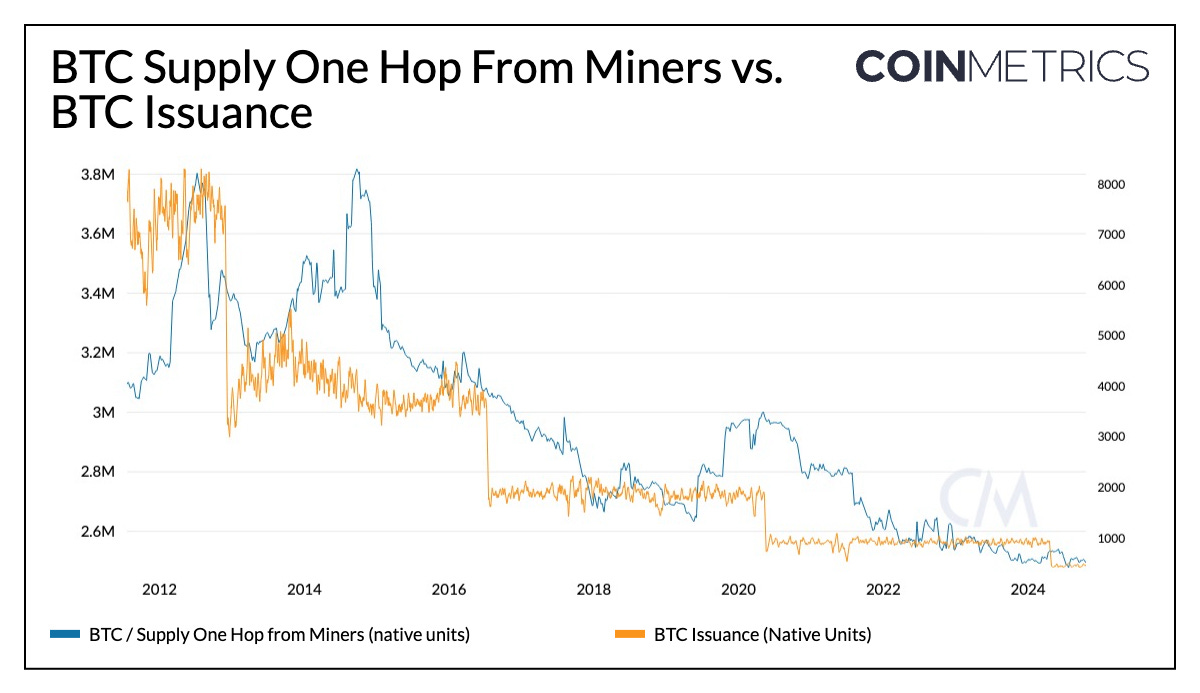

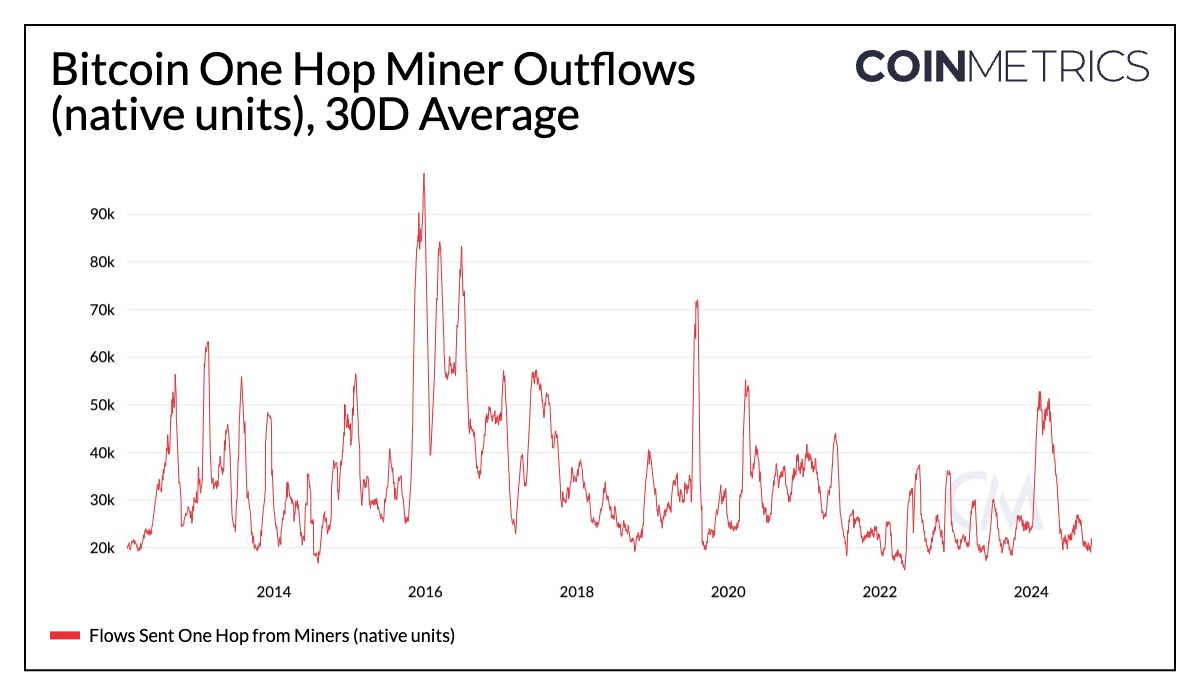

By analyzing flows, we will higher perceive miner conduct close to Bitcoin’s halving cycles—serving to determine intervals of BTC accumulation or distribution. Whereas “0-hop” addresses usually determine mining swimming pools as direct recipients of mining rewards (new BTC issuance and transaction charges), “1-hop” addresses typically characterize particular person miners to whom swimming pools distribute earnings. To dive deeper into the connection between these entities, try “Following Flows V: Pool Cross Pollination”.

Supply: Coin Metrics Community Knowledge Professional

Due to this fact, exercise of 1-hop addresses might help gauge miner sentiment and their affect on market provide and demand. With BTC’s block subsidy halving and issuance discount roughly each 4 years, there’s a long run decline in BTC provide held 1-hop from miners, presently at 2.5M BTC. This means that miners are retaining much less of their newly mined cash and probably distributing them on account of financial pressures or for operational methods with every halving.

Supply: Coin Metrics Community Knowledge Professional

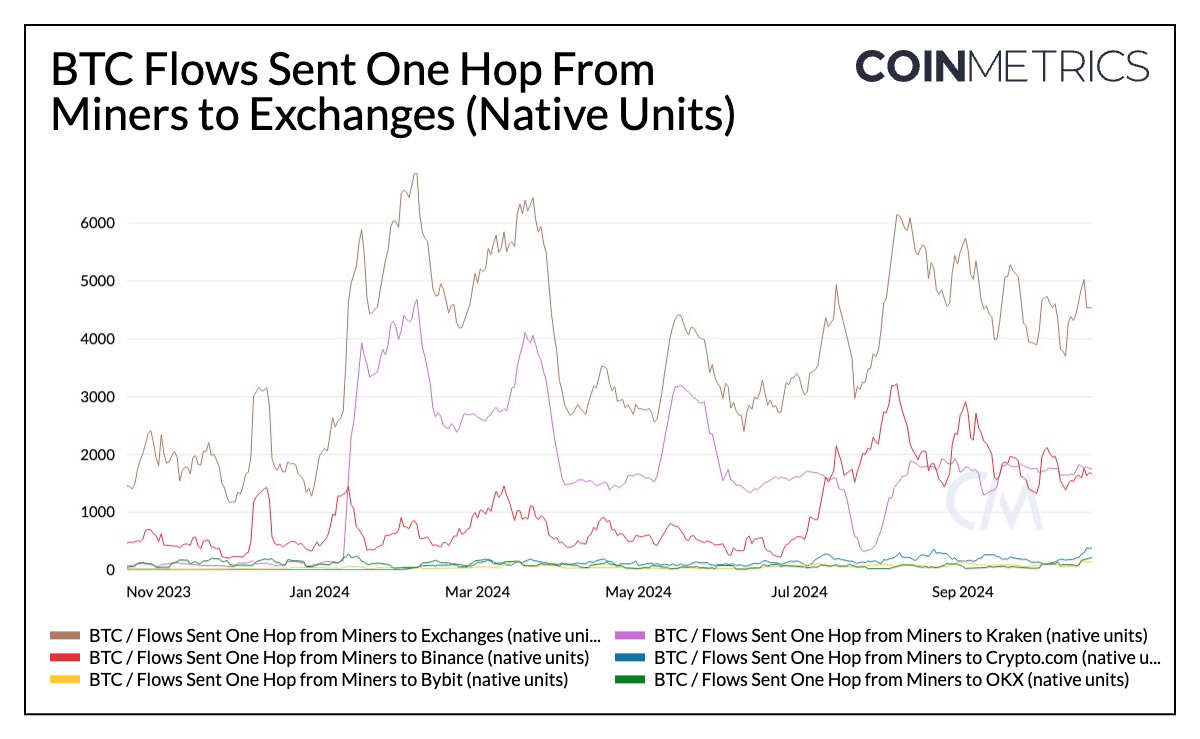

Consequently, BTC complete flows despatched 1-hop from miners and to exchanges have seen an uptick this 12 months, with a excessive of 59K and 6.8K respectively. Apparently, the rise happens 2-3 months earlier than and after the halving, as miners could also be securing earnings or constructing money reserves in anticipation of slashed revenues or step by step realizing the total financial affect of the halving. A notable improve stems from Kraken, representing over 85% of inflows in February in addition to Binance, accounting for a excessive of~3200 BTC (a 60% share of inflows) in early August.

Supply: Coin Metrics Community Knowledge Professional

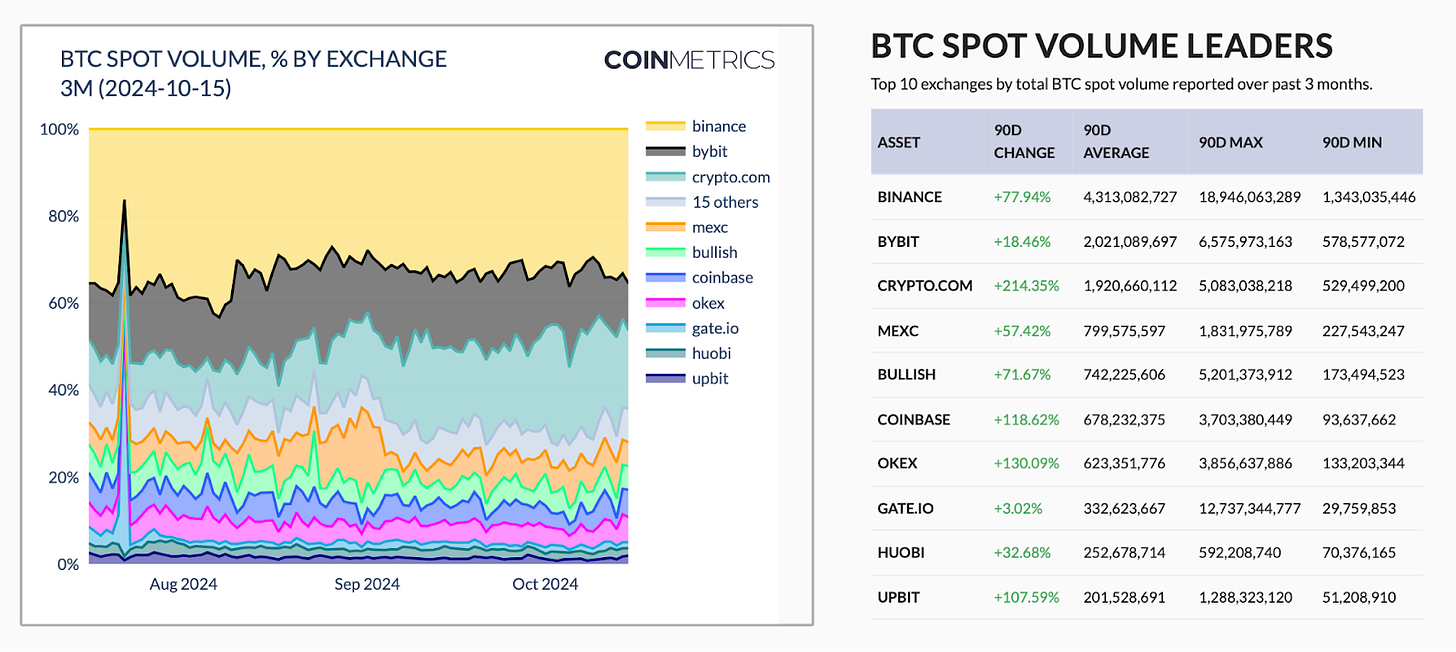

A current development in trade dominance has been happening over the previous couple of months, with Crypto.com rising their market share of spot BTC traded quantity fairly considerably, by over 200% over the past 90 days, this now places it on the highest 3 BTC spot quantity leaders tracked by Coin Metrics.

Supply: Coin Metrics State of the Market

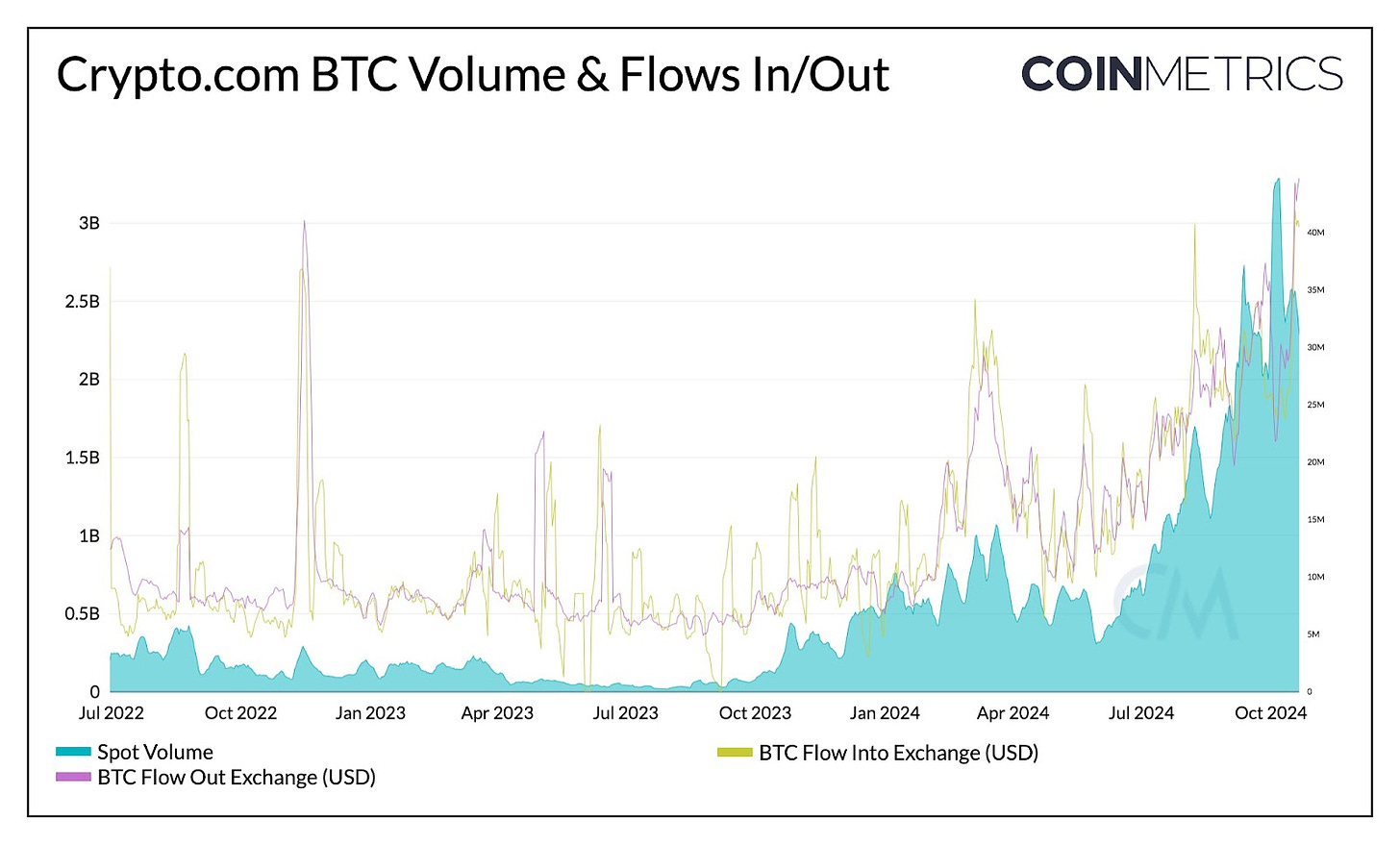

One of many methods we will use the brand new stream metrics is to validate whether or not the exercise happening in an trade is natural. By evaluating the spot BTC volumes traded (in USD) and the BTC flows (equally priced in BTC), we will acquire useful insights into the character of the market exercise.

Flows, which characterize the online motion of BTC out and in of an trade, are immediately aligned with the underlying buying and selling volumes. If the flows are consistent with the volumes, it means that the exercise is natural, which means that the trades are pushed by real market demand and never by synthetic or manipulative practices. Conversely, if the flows and volumes are misaligned, it may point out the presence of non-organic exercise, similar to wash buying and selling or different types of market manipulation.

Supply: Coin Metrics Market Knowledge Feed & Community Knowledge Professional

By analyzing the connection between flows and volumes, buyers and analysts can higher perceive the well being and dynamics of the cryptocurrency market. This data will be significantly helpful when assessing the reliability of value actions and buying and selling exercise, because it helps to differentiate between real market exercise and probably synthetic or manipulated conduct. By specializing in the natural nature of the market, buyers could make extra knowledgeable selections and mitigate the dangers related to non-organic exercise.

The evaluation of Bitcoin and Ethereum trade flows metrics supplied by Coin Metrics affords a robust instrument for buyers, merchants, and market analysts to achieve essential insights into the cryptocurrency ecosystem. By understanding the dynamics of inflows and outflows, miner behaviors, and the connection between buying and selling volumes and natural market exercise, stakeholders could make extra knowledgeable selections and higher navigate the complexities of the digital asset market. The great knowledge and metrics introduced on this report illustrate the worth of data-driven evaluation within the quickly evolving cryptocurrency panorama, empowering market members to determine traits, mitigate dangers, and capitalize on rising alternatives.

Supply: Coin Metrics Community Knowledge Professional

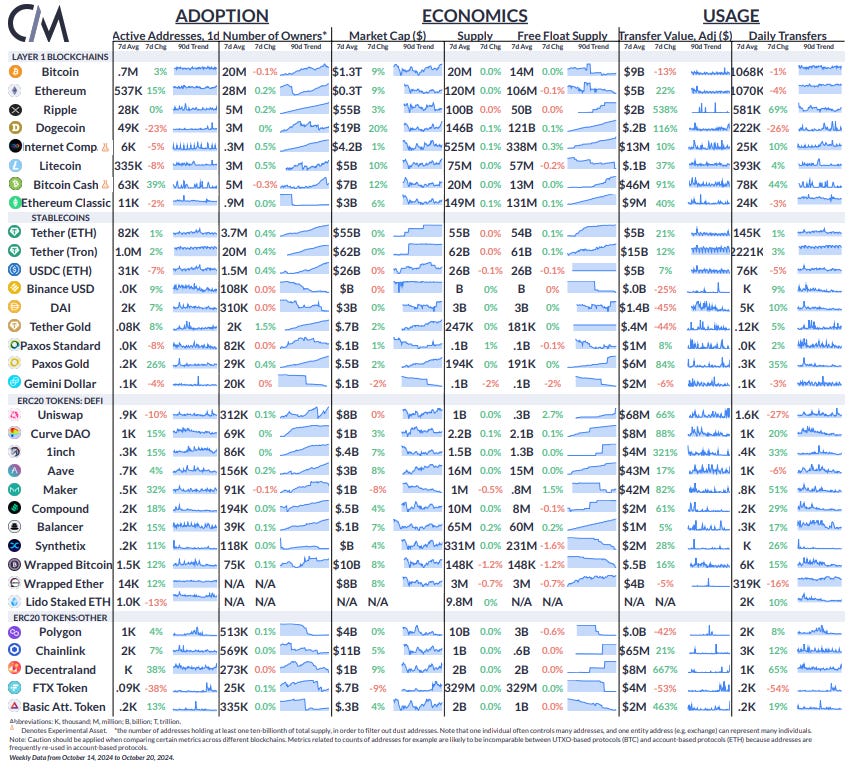

The market capitalization of Bitcoin and Ethereum noticed a 9% improve over the previous week, as Bitcoin rallied in direction of $70K for the primary time since July. Ethereum’s every day lively addresses rose by 15%, whereas a number of different ERC-20’s skilled heightened exercise amid robust market momentum.

This week’s updates from the Coin Metrics workforce:

As all the time, you probably have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.