Since writing my final put up I’ve had just a few individuals attain out round what particularly I’m investing in and the place. Whereas I don’t intend to be changing this text right into a full inventory choosing e-newsletter, I did need to share the thematics and the way I take into consideration these picks from a logical stand level.

Let’s get into it.

My psychological fashions for fascinated about the place worth lies when investing or constructing is thru dependency chains. Who will depend on what, by how a lot and what does it take to interrupt that dependency? I’ve used the identical lens to consider my Machine Financial system investments.

First up, we have now to assemble our macro thesis and that’s the truth that humanity goes to want much more compute. I’ve outlined why on this put up and advocate studying it in the event you haven’t already.

For this compute, the core of all this lies across the GPU as a proxy to AI and accelerated computing workloads.

NVIDIA has all of the mindshare nevertheless we have now to recollect they merely design the chips, not manufacture them. Subsequently we have now to ask the next questions:

Who’s making these chips?

What different elements do you could make these chips run?

The place do you supply the land, energy and labour to tie all of it collectively?

Are there any downstream dependencies that can go parabolic as all the pieces on this provide chain reconfigures?

That are firms are required to harness the total energy of this compute?

By asking these questions we will kind a transparent image of which subsectors and corporations to pay attention capital round and naturally, guess measurement accordingly.

That is the obvious and direct play, however mainly all these information facilities are going to want energy to have the ability to come on-line. When you concentrate on information heart energy there’s what’s know as Behind the Meter (BTM) and Entrance of Meter (FOM) energy. FOM energy means that you’re connecting on to the grid which implies that the facility is delivered on to you. BTM means it’s important to work out energy your self aka onsite energy era.

To spend money on vitality relative to information facilities it’s important to work out how a lot publicity you’re attending to information heart demand versus regular electrical energy demand. Corporations that specialize in offering BTM energy to information facilities might be tied nearer to information heart development whereas FOM energy you’ll be able to have diluted returns as a result of their companies are already extraordinarily giant (electrical energy grids).

An instance of every that I like is:

Entrance of Meter: Constellation Power. They function a broad portfolio of producing property comparable to nuclear, hydroelectric, wind, photo voltaic, pure gasoline, and so forth. Their inventory has carried out extremely nicely over the previous few years which reveals a correlation to AI tendencies.

Behind the Meter: Bloom Power. This firm produces Solide Oxide Gasoline Cells (SOFC) that are able to changing pure gasoline into electrical energy on the scale of working a knowledge heart. Whereas the inventory has run up tremendously, the earnings and development are nothing in need of spectacular.

I’m in no way an vitality professional, nevertheless I discover this framework worthwhile to consider what vitality bets to make when fascinated about it in relation to information facilities. Their are many different performs out there however this could function a conceptual framework on this class not less than.

I’ve referred to as this class Semiconductor Producers and never Semiconductors as I’ve a separate class for reminiscence which I’ll elaborate on additional. This class can have many rabbit-holes however to maintain it pretty excessive degree, this class represents all the pieces round the way you make chips that energy the AI recreation. Two names that most individuals would have heard of are:

Nonetheless, there are different performs right here that you may change your perspective with.

GOOG: Sure, you learn that appropriately. Google again in 2014 invested of their TPU (Tensor Processing Models) after realising their NVDA invoice was going to be very excessive. That funding is now paying off and so they have are literally one other NVDA, one which the market doesn’t absolutely respect simply but.

NVTS: It is a extra smaller play however showcases what is feasible. Navitas creates energy transformers primarily based on GaN (Gallium Nitride) and SiC (Silicon Carbide) that lets you step down giant currents to ones wanted by particular person elements. That is important for the reason that newer era of GPUs and so forth are drawing more and more extra energy.

A notable point out I need to make right here is IShares MSCI Korea ETF! This ETF is accessible to US traders and is made up of two firms which are vital to the way forward for semiconductors: Samsung and SK Hynix. I received’t go in an excessive amount of element right here however right here’s a chart of its historic efficiency. It’s a must to do not forget that the semiconductor trade is dominated in Asia, not the West!

Okay so that is one in every of my favorite classes and doubtless has essentially the most upside nonetheless baked into it. Whereas compute has scaled through GPUs, one part that has lagged behind is reminiscence. The speed of progress between compute and reminiscence may be showcased within the chart beneath:

To spotlight the significance of reminiscence, you could perceive how GPUs and AI fashions work. As soon as a GPU has carried out some quantity of labor that it then must construct on later however must be entry in a short time, it must retailer it in reminiscence! There are a lot of layers to reminiscence:

RAM (closest to the processor)

Flash (assume NVMe SSD drives)

HDD (classical exhausting drives)

This complete sector is mainly constrained and blowing up massively with the rise of AI fashions. Now what’s below appreciated right here is the truth that with regards to RAM you could have two sorts to pay attention to:

Since September, DRAM costs have exploded and there’s a large reminiscence scarcity. Nonetheless, what makes this much more fascinating is there are solely 3 firms on the earth that may produce HBM (SK, Samsung, Micron). The experience to take action requires a long time of compounding that’s unimaginable to breed even in just a few years. Exterior of HBM, Flash and HDD firms are doing extraordinarily nicely. Right here’s the chart of Western Digital (sure the one which makes exhausting drives you could have most likely bought)…

I may go on and on about reminiscence however I could save this for an additional article if there’s curiosity!

Keep in mind how I talked about Entrance of Meter earlier on this article and the way this can be very exhausting to get linked to the grid (as much as 5 years at this level)? Nicely turns on the market’s a category of firms which have pre-existing energy and know run excessive efficiency computer systems — BTC miners! They realised their benefit and have pivoted to operating AI information facilities as an alternative. Now this panorama is extra complicated since you could have a enterprise that was geared to do one factor, now pivoting to do one thing else. Whereas there are lots of on this class I’ll discuss one that’s frequent amongst most traders.

IREN: Initially from Australia, they pivoted their 100% sustainable Bitcoin enterprise to AI information heart play. They at present have 3 GW of energy secured which is the equal of three full scale Nuclear reactors.

I believe what it’s important to perceive on this class is how a lot buying energy do these firms have relative to the individuals who hire their infrastructure? If energy actually is the constraint then these firms will do exceptionally nicely. If energy is an affordable commodity that anybody can get (little proof in the direction of this), then count on to be bearish.

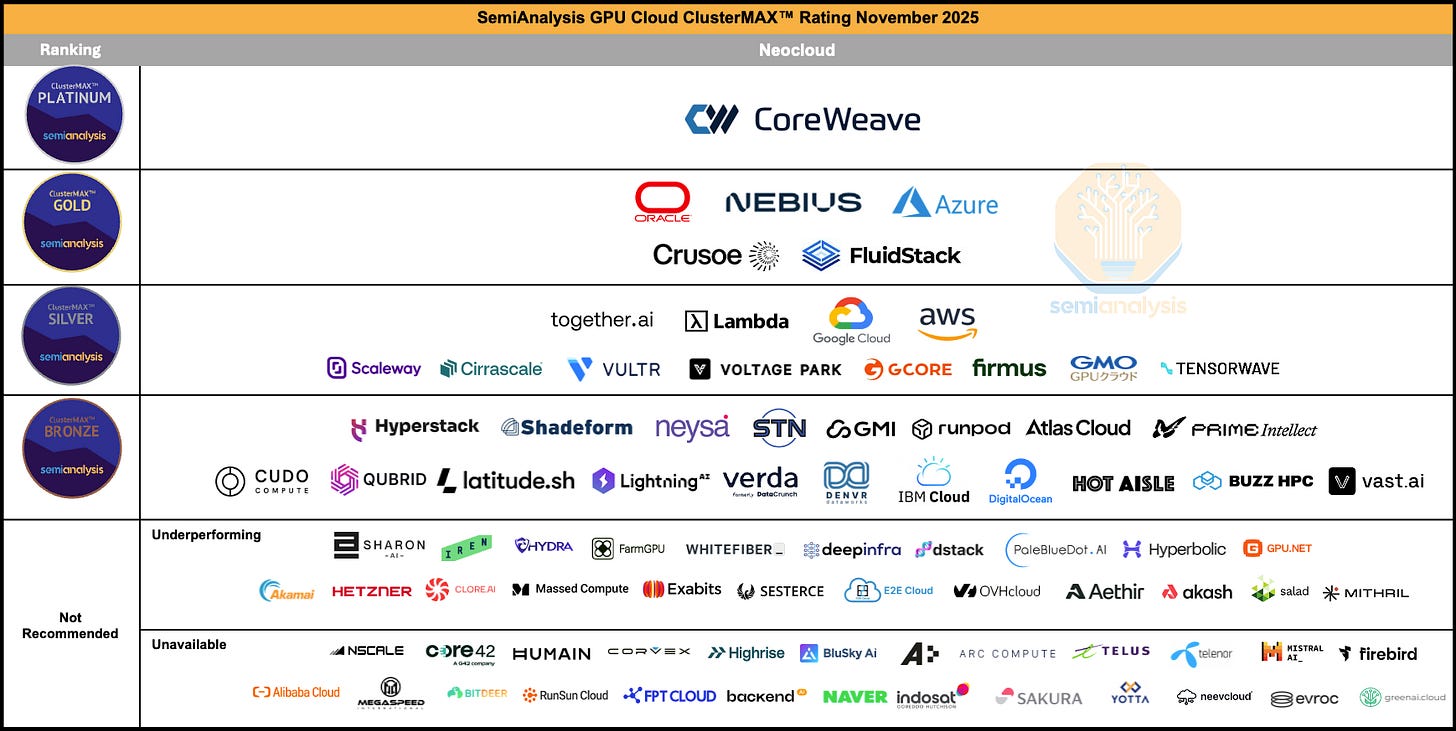

Final however not least is the precise information heart firms! These are most likely the toughest to cause about as it’s important to perceive:

What their contracted demand truly is and for the way lengthy?

What their prices are like? Have they got entry to energy or will they pay a premium for it?

What’s their financing base at present and transferring ahead?

Most of the AI bears discuss these variables and so they could possibly be proper about sure features! Nonetheless, the very fact is that the demand for AI will not be going to decelerate and constructing a knowledge heart is tough! If it was simple, then the hyperscalers would do it themselves. Whereas I do assume the issues are legitimate to some extent, individuals are overly bearish at this second on these firms. For example my level I’ll discuss two totally different companies:

Coreweave. The darling of the trade but in addition extremely levered. The credit score market is pricing the possibility of them defaulting to be excessive. Nonetheless, on the identical time they’re among the finest cloud internet hosting platforms!

Nebius. It’s the identical individuals from Yandex and Clickhouse (two each insanely spectacular Russian primarily based firms). They’re going for grow to be a full stack AI cloud enterprise and have the chops to take action. Their software program background provides them a formidable edge that different Neoclouds received’t be capable to rival so simply.

I’m not going to enter tons of element into each of those however I do need to spotlight the truth that these companies should be evaluated on their very own deserves. Regardless, constructing information facilities will not be simple and anybody who thinks this stuff are going to 0 is delusional.

There’s a class of firms that I couldn’t precisely work out model however are straight associated to this entire construct out which are price mentioning.

VRT: Vertiv Holdings. With a view to run these GPUs, you want liquid cooling. Vertiv is the chief on this class.

APLD: Utilized Digital is within the development enterprise of theses precise information facilities. They’ve $11b of contracted income with a market cap of $6b.

CRDO: They make particular connectivity cables that each information heart must run. They will help about 100GB/s by way of their Energetic Electrical Cable technoloy.

CAT: Caterpillar, the development firm with the yellow branding! They’ve generators which are driving development in a subset of their enterprise that’s quickly rising. An fascinating twist for a multi hundred billion greenback market cap firm!

Whereas I do personal most of the shares listed on this article, it serves to intention as an illustrative instance of how I take into consideration investing within the machine financial system and what the varied sub-sectors are. I’ve rotated a good portion of my net-worth from crypto into these names because the CAGR of AI-adjacent names goes to be 40% until not less than 2030. I nonetheless retain sure holdings in crypto (BTC, SOL, ETH) and a full-time enterprise (RouteMesh) nevertheless from an investing perspective, I consider my capital may be put to work more durable within the machine financial system (of which crypto is a subset).

I’m additionally very desirous about robotics and can begin writing extra about it as I get deeper into {hardware}. How does all of this tie collectively? I’m not absolutely certain however curiosity is a key private worth for me and after I’m drawn in the direction of one thing I don’t query it, I simply continue to learn 🙂