Following a pointy multi-week selloff that dragged Bitcoin from above $100,000 to under $80,000, the latest worth bounce has merchants debating whether or not the Bitcoin bull market is really again on monitor or if that is merely a bear market rally earlier than the subsequent macro leg larger.

Bitcoin’s Native Backside or Bull Market Pause?

Bitcoin’s newest correction was deep sufficient to rattle confidence, however shallow sufficient to take care of macro development construction. Worth appears to have set a neighborhood backside between $76K–$77K, and several other dependable metrics are starting to solidify the native lows and level in direction of additional upside.

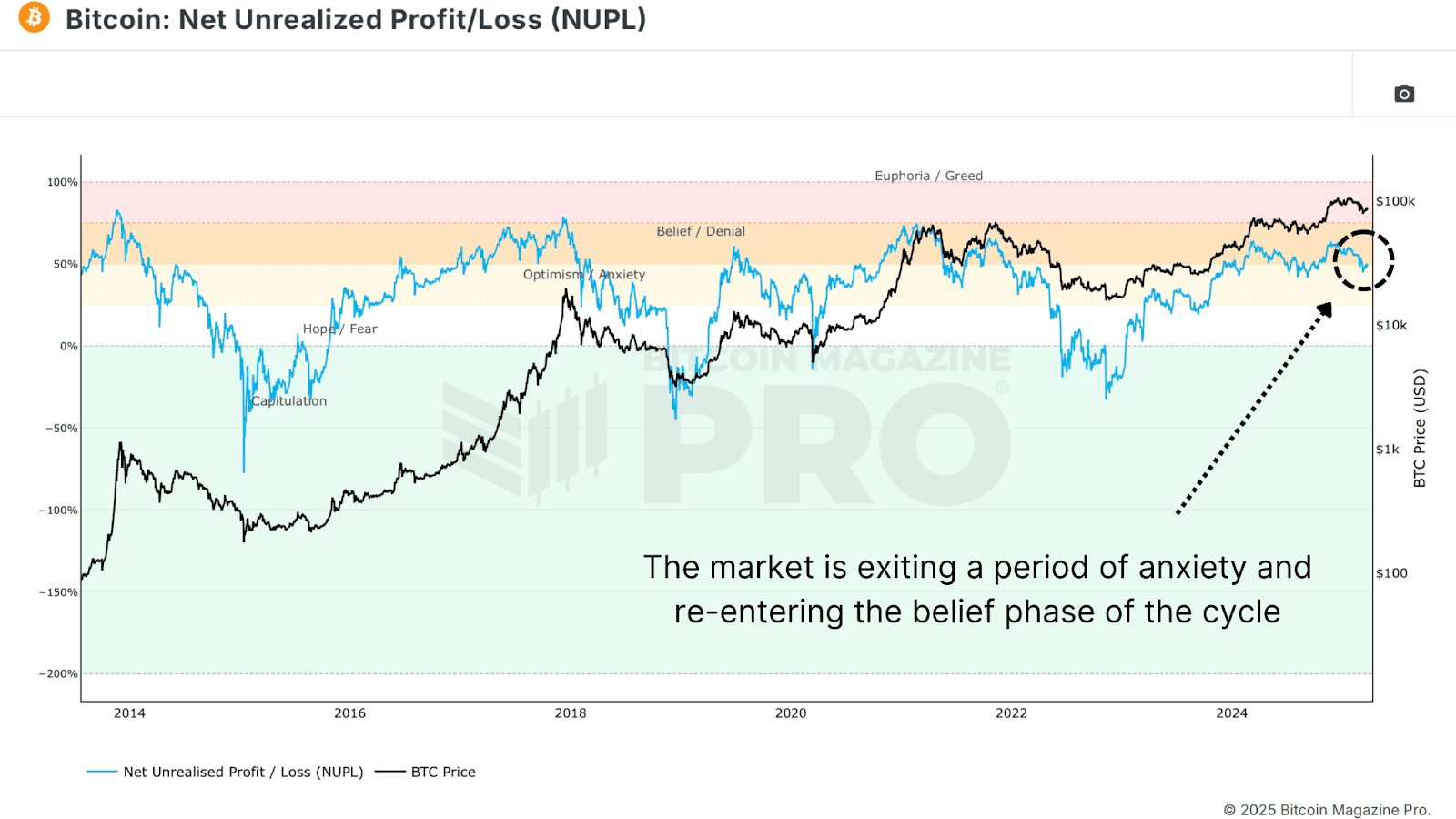

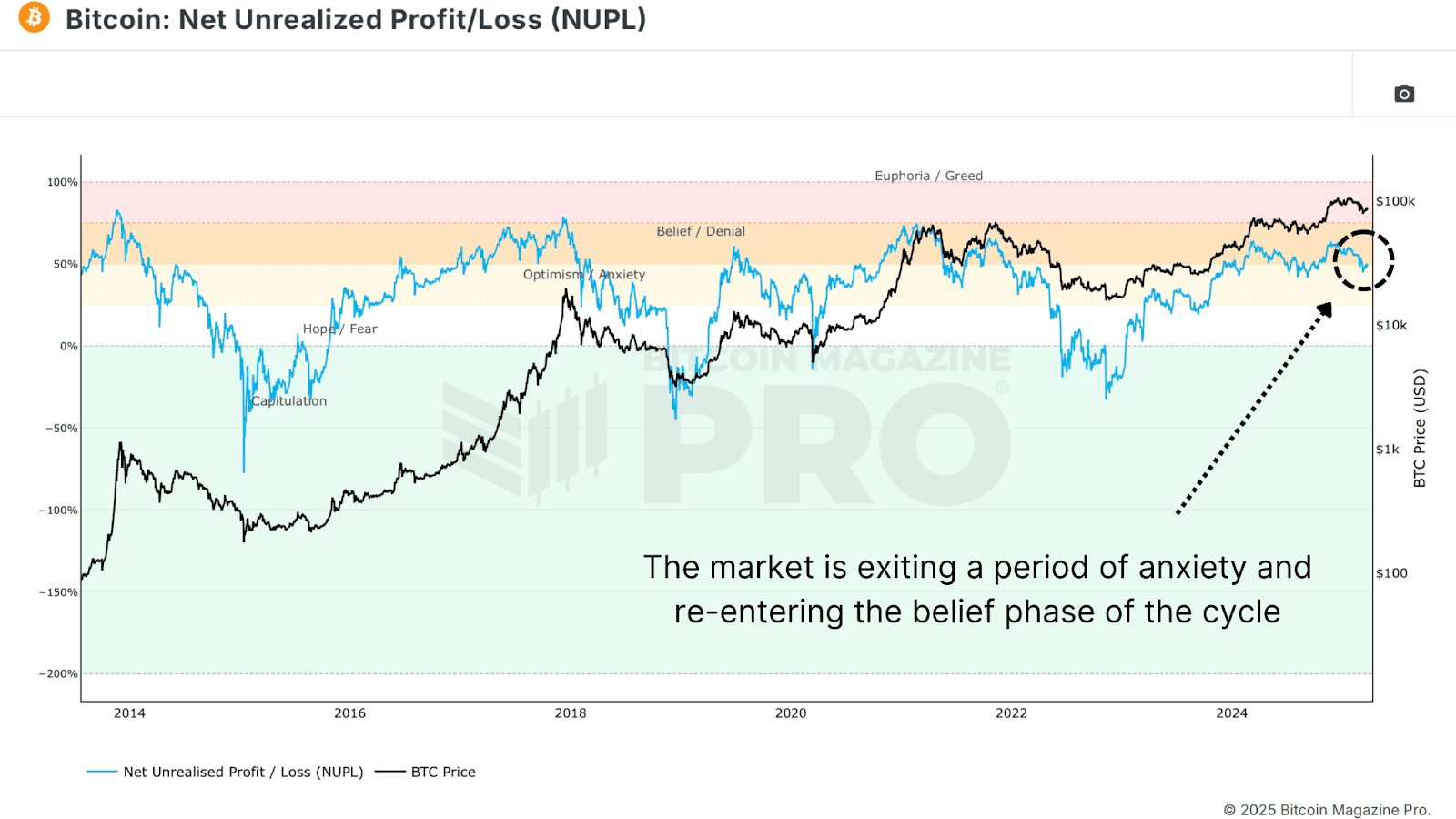

The Web Unrealized Revenue and Loss (NUPL) is without doubt one of the most dependable sentiment gauges throughout Bitcoin cycles. As worth fell, NUPL dropped into “Anxiousness” territory, however following the rebound, NUPL has now reclaimed the “Perception” zone, a essential sentiment transition traditionally seen at macro larger lows.

The Worth Days Destroyed (VDD) A number of weighs BTC spending by each coin age and transaction measurement, and compares the information to a earlier yearly common, giving perception into long run holder habits. Present readings have reset to low ranges, suggesting that giant, aged cash should not being moved. This can be a clear sign of conviction from sensible cash. Related dynamics preceded main worth rallies in each the 2016/17 and 2020/21 bull cycles.

Bitcoin Lengthy-Time period Holders Increase Bull Market

We’re additionally now seeing the Lengthy Time period Holder Provide starting to climb. After profit-taking above $100K, long-term individuals are actually re-accumulating at decrease ranges. Traditionally, these phases of accumulation have set the inspiration for provide squeezes and subsequent parabolic worth motion.

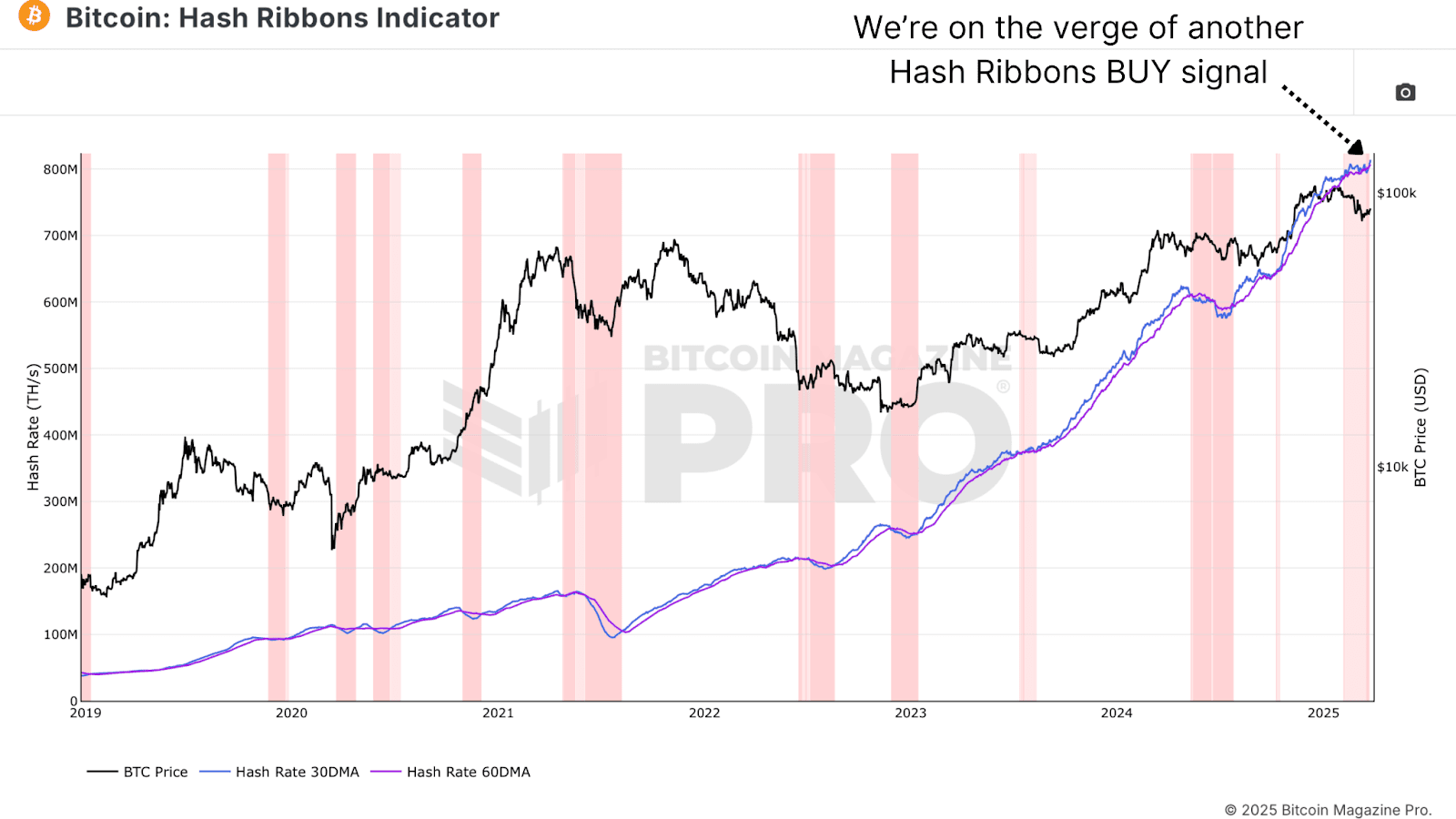

Bitcoin Hash Ribbons Sign Bull Market Cross

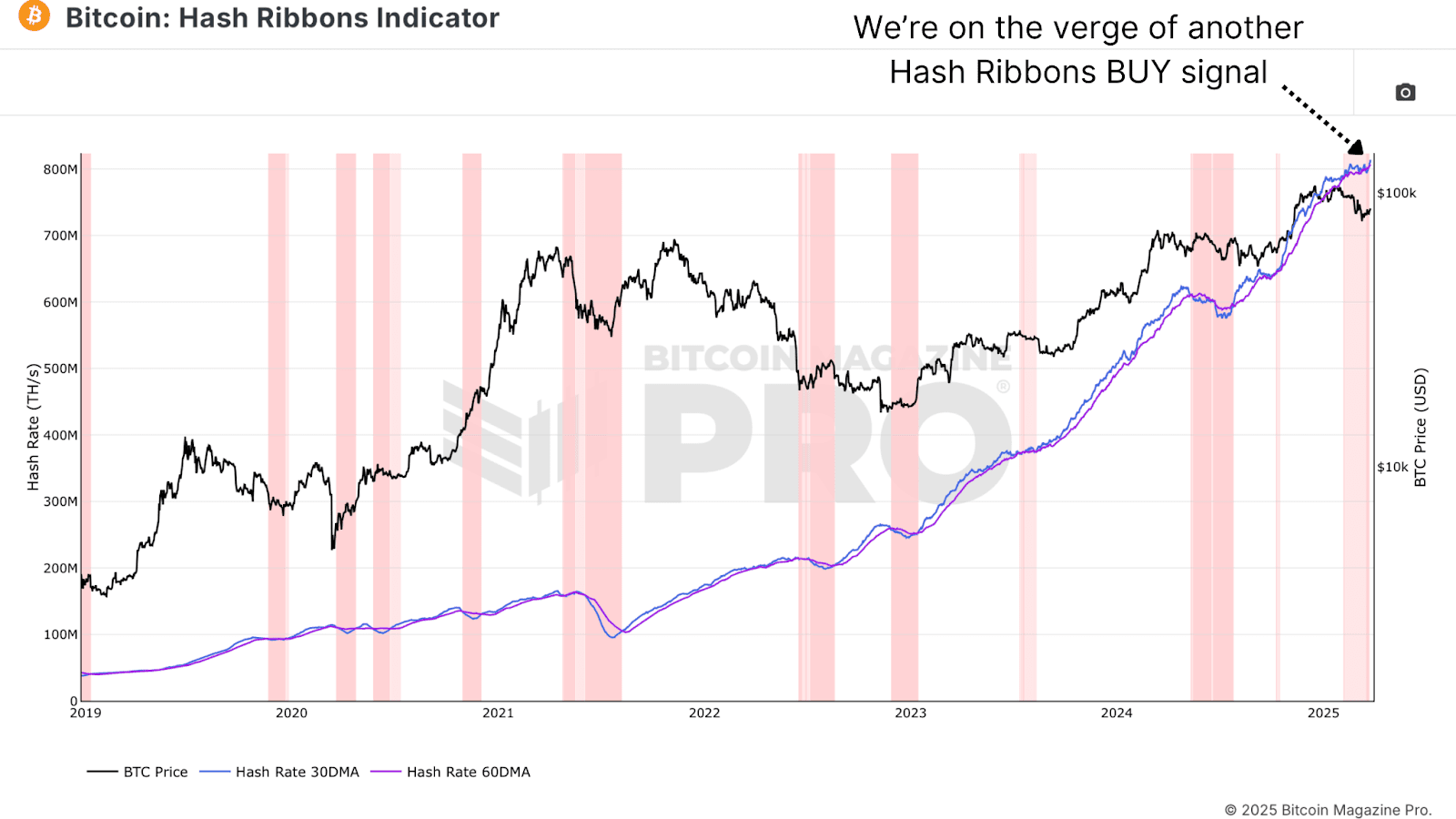

The Hash Ribbons Indicator has simply accomplished a bullish crossover, the place the short-term hash charge development strikes above the longer-term common. This sign has traditionally aligned with bottoms and development reversals. On condition that miner habits tends to mirror profitability expectations, this cross suggests miners are actually assured in larger costs forward.

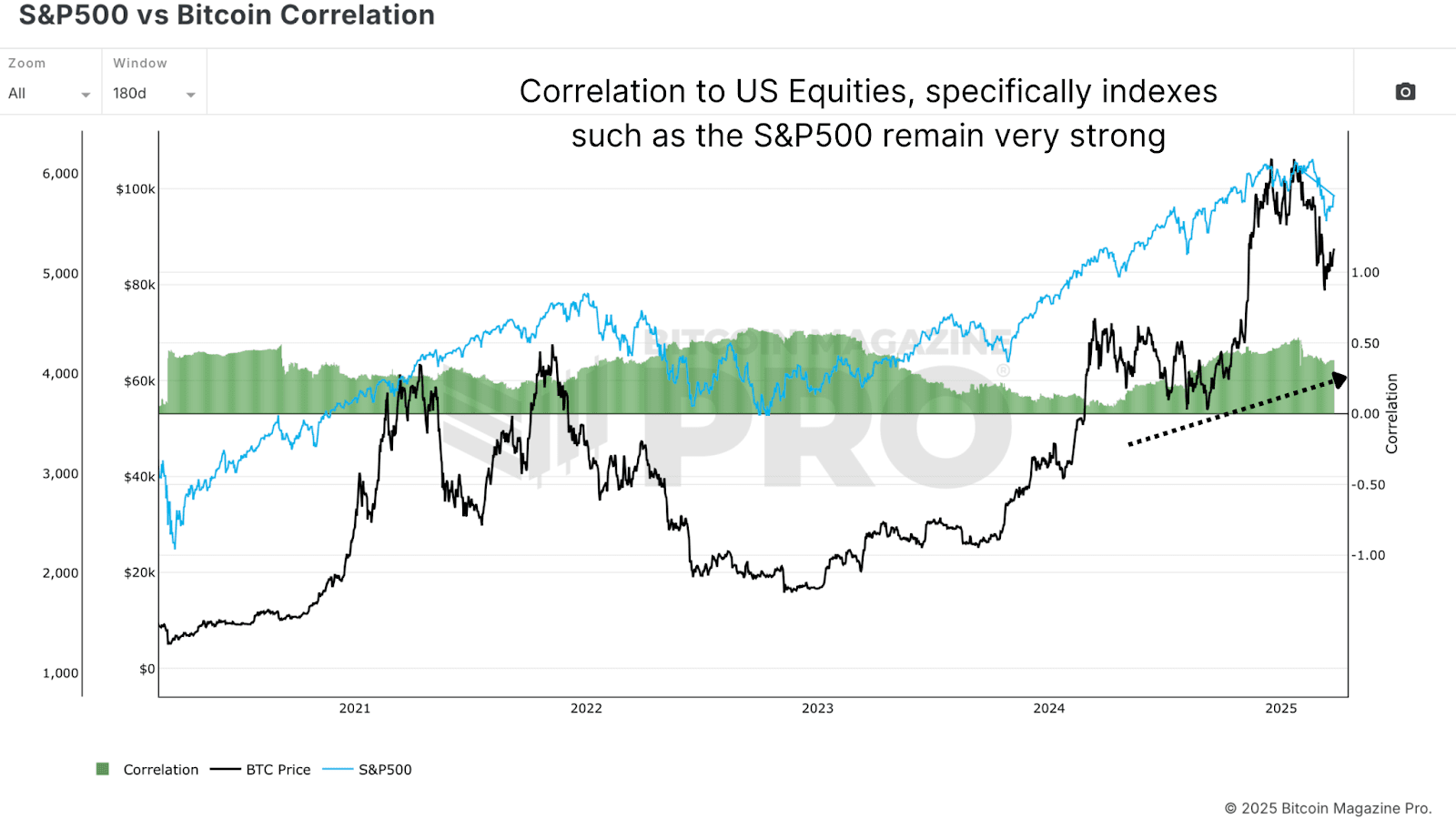

Bitcoin Bull Market Tied to Shares

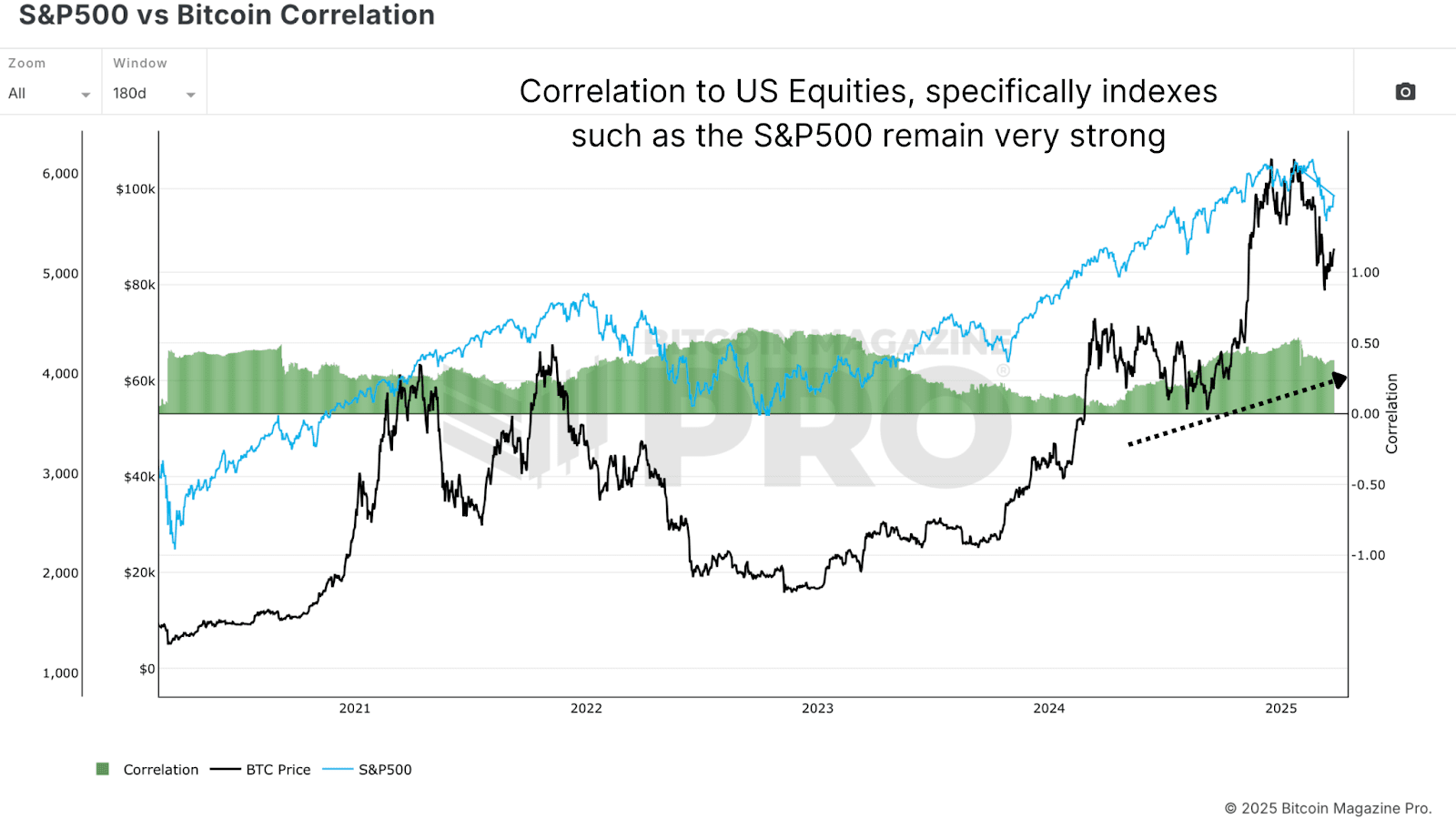

Regardless of bullish on-chain knowledge, Bitcoin stays intently tied to macro liquidity traits and fairness markets, significantly the S&P 500. So long as that correlation holds, BTC might be partially on the mercy of worldwide financial coverage, danger sentiment, and liquidity flows. Whereas charge lower expectations have helped danger property bounce, any sharp reversal might trigger renewed choppiness for Bitcoin.

Bitcoin Bull Market Outlook

From a data-driven perspective, Bitcoin appears more and more well-positioned for a sustained continuation of its bull cycle. On-chain metrics paint a compelling image of resilience for the Bitcoin bull market. The Web Unrealized Revenue and Loss (NUPL) has shifted from “Anxiousness” in the course of the dip to the “Perception” zone after the rebound—a transition usually seen at macro larger lows. Equally, the Worth Days Destroyed (VDD) A number of has reset to ranges signaling conviction amongst long-term holders, echoing patterns earlier than Bitcoin’s rallies in 2016/17 and 2020/21. These metrics level to structural power, bolstered by long-term holders aggressively accumulating provide under $80,000.

Additional supporting this, the Hash Ribbons indicator’s latest bullish crossover displays rising miner confidence in Bitcoin’s profitability, a dependable signal of development reversals traditionally. This accumulation part suggests the Bitcoin bull market could also be gearing up for a provide squeeze, a dynamic that has fueled parabolic strikes earlier than. The information collectively highlights resilience, not weak point, as long-term holders seize the dip as a possibility. But, this power hinges on extra than simply on-chain indicators—exterior components will play a essential position in what comes subsequent.

Nevertheless, macro circumstances nonetheless warrant warning, because the Bitcoin bull market doesn’t function in isolation. Bull markets take time to construct momentum, usually needing regular accumulation and favorable circumstances to ignite the subsequent leg larger. Whereas the native backside between $76K–$77K appears to carry, the trail ahead gained’t doubtless function vertical candles of peak euphoria but. Bitcoin’s tie to the S&P 500 and world liquidity traits means volatility might emerge from shifts in financial coverage or danger sentiment.

For instance, whereas charge lower expectations have lifted danger property, an abrupt reversal—maybe from inflation spikes or geopolitical shocks—might take a look at Bitcoin’s stability. Thus, even with on-chain knowledge signaling a strong setup, the subsequent part of the Bitcoin bull market will doubtless unfold in measured steps. Merchants anticipating a return to six-figure costs will want endurance because the market builds its basis.

In the event you’re fascinated with extra in-depth evaluation and real-time knowledge, think about testing Bitcoin Journal Professional for invaluable insights into the Bitcoin market.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your personal analysis earlier than making any funding choices.

Following a pointy multi-week selloff that dragged Bitcoin from above $100,000 to under $80,000, the latest worth bounce has merchants debating whether or not the Bitcoin bull market is really again on monitor or if that is merely a bear market rally earlier than the subsequent macro leg larger.

Bitcoin’s Native Backside or Bull Market Pause?

Bitcoin’s newest correction was deep sufficient to rattle confidence, however shallow sufficient to take care of macro development construction. Worth appears to have set a neighborhood backside between $76K–$77K, and several other dependable metrics are starting to solidify the native lows and level in direction of additional upside.

The Web Unrealized Revenue and Loss (NUPL) is without doubt one of the most dependable sentiment gauges throughout Bitcoin cycles. As worth fell, NUPL dropped into “Anxiousness” territory, however following the rebound, NUPL has now reclaimed the “Perception” zone, a essential sentiment transition traditionally seen at macro larger lows.

The Worth Days Destroyed (VDD) A number of weighs BTC spending by each coin age and transaction measurement, and compares the information to a earlier yearly common, giving perception into long run holder habits. Present readings have reset to low ranges, suggesting that giant, aged cash should not being moved. This can be a clear sign of conviction from sensible cash. Related dynamics preceded main worth rallies in each the 2016/17 and 2020/21 bull cycles.

Bitcoin Lengthy-Time period Holders Increase Bull Market

We’re additionally now seeing the Lengthy Time period Holder Provide starting to climb. After profit-taking above $100K, long-term individuals are actually re-accumulating at decrease ranges. Traditionally, these phases of accumulation have set the inspiration for provide squeezes and subsequent parabolic worth motion.

Bitcoin Hash Ribbons Sign Bull Market Cross

The Hash Ribbons Indicator has simply accomplished a bullish crossover, the place the short-term hash charge development strikes above the longer-term common. This sign has traditionally aligned with bottoms and development reversals. On condition that miner habits tends to mirror profitability expectations, this cross suggests miners are actually assured in larger costs forward.

Bitcoin Bull Market Tied to Shares

Regardless of bullish on-chain knowledge, Bitcoin stays intently tied to macro liquidity traits and fairness markets, significantly the S&P 500. So long as that correlation holds, BTC might be partially on the mercy of worldwide financial coverage, danger sentiment, and liquidity flows. Whereas charge lower expectations have helped danger property bounce, any sharp reversal might trigger renewed choppiness for Bitcoin.

Bitcoin Bull Market Outlook

From a data-driven perspective, Bitcoin appears more and more well-positioned for a sustained continuation of its bull cycle. On-chain metrics paint a compelling image of resilience for the Bitcoin bull market. The Web Unrealized Revenue and Loss (NUPL) has shifted from “Anxiousness” in the course of the dip to the “Perception” zone after the rebound—a transition usually seen at macro larger lows. Equally, the Worth Days Destroyed (VDD) A number of has reset to ranges signaling conviction amongst long-term holders, echoing patterns earlier than Bitcoin’s rallies in 2016/17 and 2020/21. These metrics level to structural power, bolstered by long-term holders aggressively accumulating provide under $80,000.

Additional supporting this, the Hash Ribbons indicator’s latest bullish crossover displays rising miner confidence in Bitcoin’s profitability, a dependable signal of development reversals traditionally. This accumulation part suggests the Bitcoin bull market could also be gearing up for a provide squeeze, a dynamic that has fueled parabolic strikes earlier than. The information collectively highlights resilience, not weak point, as long-term holders seize the dip as a possibility. But, this power hinges on extra than simply on-chain indicators—exterior components will play a essential position in what comes subsequent.

Nevertheless, macro circumstances nonetheless warrant warning, because the Bitcoin bull market doesn’t function in isolation. Bull markets take time to construct momentum, usually needing regular accumulation and favorable circumstances to ignite the subsequent leg larger. Whereas the native backside between $76K–$77K appears to carry, the trail ahead gained’t doubtless function vertical candles of peak euphoria but. Bitcoin’s tie to the S&P 500 and world liquidity traits means volatility might emerge from shifts in financial coverage or danger sentiment.

For instance, whereas charge lower expectations have lifted danger property, an abrupt reversal—maybe from inflation spikes or geopolitical shocks—might take a look at Bitcoin’s stability. Thus, even with on-chain knowledge signaling a strong setup, the subsequent part of the Bitcoin bull market will doubtless unfold in measured steps. Merchants anticipating a return to six-figure costs will want endurance because the market builds its basis.

In the event you’re fascinated with extra in-depth evaluation and real-time knowledge, think about testing Bitcoin Journal Professional for invaluable insights into the Bitcoin market.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your personal analysis earlier than making any funding choices.