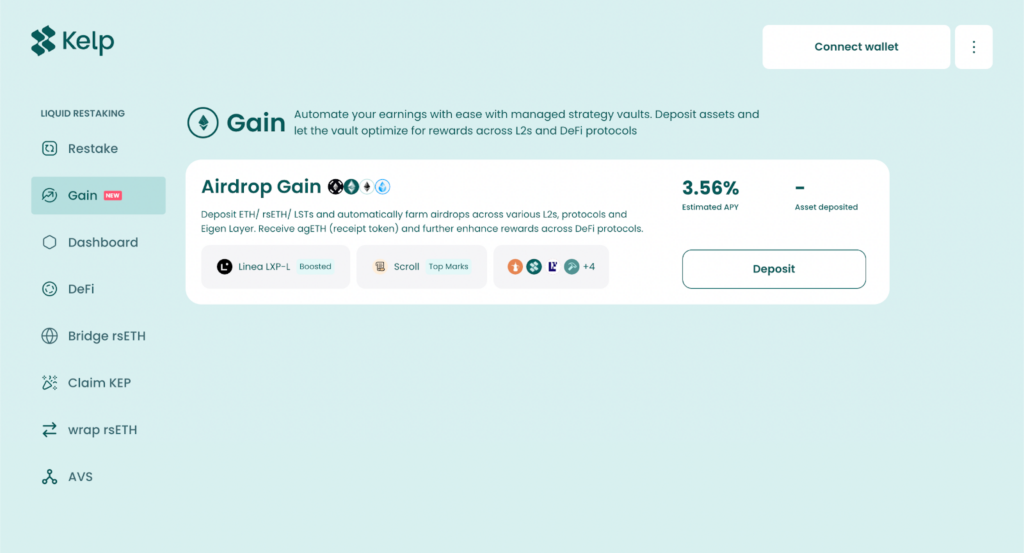

Restaking protocol Kelp has simply launched “Acquire” – an automatic optimizer for yield farming and airdrop factors participation throughout Layer 2 networks.

Acquire supplies customers with a hands-free method to earn extra returns on chosen liquid staking tokens (LSTs) and its liquid restaking token (LRT), rsETH, by means of specialised vaults.

How Does Acquire Work?

Acquire customers deposit supported property corresponding to rsETH into its vaults, which deploys these property throughout partnered L2 networks for optimized yield farming and factors earnings.

These factors are sometimes redeemable for an eventual airdrop of tokens when the respective platform launches a governance token.

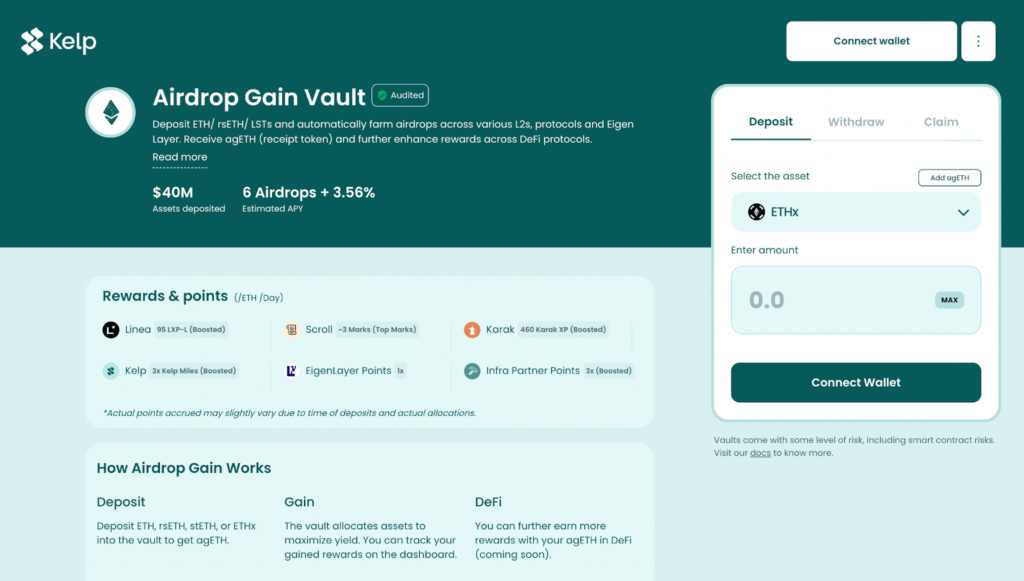

One of many key options of Acquire is that it points depositors with a liquid token, agETH, which represents a declare on their share of deposits inside the vaults. agETH can be utilized inside the wider DeFi ecosystem to additional improve returns.

Customers can withdraw their funds from the vaults at any time, or just promote their agETH on the open market to exit their place.

Flagship Vault

Acquire’s flagship vault is its Airdrop Acquire Vault, which permits customers to take part in a number of L2 airdrops by means of a single, diversified technique.

Customers can deposit ETH, stETH, ETHx, and rsETH and obtain agETH, a liquid reward-accruing token that can be utilized inside the DeFi ecosystem.

To start, the Airdrop Acquire Vault is allocating 45% of deposits to Linea, 35% to Scroll, and 20% to Karak methods. The vault will take a 2% share of rewards earned by customers.

Robust Partnerships

Kelp hasn’t constructed Acquire alone, as an alternative partnering with a number of business gamers for every facet of the product.

These companions embrace:

- August (beforehand Fractal Clearing): Supplies the underlying infrastructure.

- Tulipa Capital: Administration of Acquire vault methods to maximise returns for customers.

- LayerZero: Supporting interoperability throughout L2 networks.

The platform additionally integrates with DeFi companions corresponding to Pendle, Balancer, and Uniswap, permitting customers to leverage agETH in varied yield methods.

Conclusion

Acquire makes it straightforward for anybody to take part in exercise throughout varied rising layer 2 networks, incomes factors and boosting their possibilities of receiving future airdrops on these platforms.

This could all be completed whereas incomes staking rewards on ETH, in addition to EigenLayer Factors and Kelp Miles on rsETH.

About Kelp

Kelp is a liquid restaking protocol with over $700 million in complete worth locked (TVL). It permits customers to maximise their staking rewards by restaking ETH, stETH, and ETHx on EigenLayer, with consumer stakes represented as rsETH – a liquid restaking token that can be utilized all through the DeFi ecosystem.

rsETH integrates with varied different DeFi platforms to supply liquidity pooling choices for extra rewards and accessible swaps.