Be part of Our Telegram channel to remain updated on breaking information protection

Metaplanet plans to boost $135 million to develop its Bitcoin holdings, doubling down on the asset even after it plunged 33% from an all-time excessive on Oct. 6.

The Japan-based Bitcoin treasury agency mentioned in a Nov. 20 announcement that it plans to situation 23.6 million Class B shares priced at 900 yen ($5.71) every, bringing the overall increase to 21.249 billion yen.

The providing shall be executed by way of a third-party allotment to abroad buyers relying on whether or not the plan receives approval from a shareholder assembly on Dec. 22.

The announcement got here as Bitcoin headed for its worst month-to-month efficiency since June 2022, following the collapse of Do Kwon’s TerraUSD stablecoin. BTC has plummeted greater than 10% prior to now 24 hours to commerce at $81,956.25 as of 6:07 a.m. EST, CoinMarketCap exhibits.

Metaplanet Providing Comes With 4.9% Dividend

The brand new providing, which the corporate is asking “MERCURY,” will provide holders a 4.9% mounted annual dividend and provides them the precise to transform their most popular shares into frequent inventory at a conversion value of $6.34.

Immediately we introduced MERCURY, our new Class B perpetual most popular fairness. 4.9% mounted dividend. ¥1,000 conversion value. A brand new step in scaling Metaplanet’s Bitcoin treasury technique. pic.twitter.com/UtnHA2lPRE

— Simon Gerovich (@gerovich) November 20, 2025

The corporate will retain a market-price name choice that may be exercised if Metaplanet’s inventory trades greater than 130% above the liquidation desire for 20 consecutive buying and selling days. The shares may even include no voting energy, however will carry redemption rights beneath particular occasions.

Metaplanet Inventory Slides

Metaplanet shares have plunged greater than 61% prior to now six months and tumbled 7% in the course of the previous 24 hours.

Its mNAV (a number of Internet Asset Worth), which is its market cap divided by the worth of the Bitcoin it holds, has dropped beneath 1 to face at 0.98 as of 5:37 a.m. EST.

Metaplanet share value (Supply: Google Finance)

Metaplanet is the fourth-largest company Bitcoin holder globally with 30,823 BTC on its steadiness sheet. At present costs, the greenback worth of those holdings equates to $2.55 billion, in line with knowledge from Bitcoin Treasuries.

The agency bought its Bitcoin holdings at a median value of $108,036, leading to an unrealized loss for the corporate of greater than 23%.

MSCI Might Quickly Axe Metaplanet

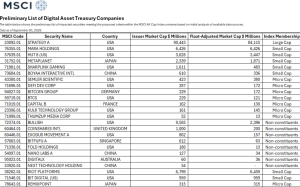

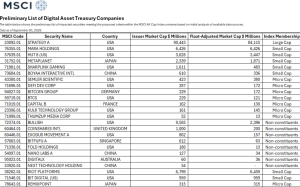

Metaplanet could quickly face extra issues after information that MSCI is consulting with the funding neighborhood on whether or not to exclude from its indexes corporations with greater than 50% of crypto belongings.

A preliminary record launched by MSCI exhibits 38 crypto firms could also be excluded.

Preliminary record of firms that is perhaps excluded (MSCI)

MSCI mentioned that some digital asset treasury firms could also be extra just like funding funds that aren’t eligible for inclusion in its indexes.

The Odds that MSCI excludes such corporations are ”solidly in favor of it,” Charlie Sherry, head of finance at BTC Markets, informed CoinTelegraph. It ”solely places adjustments like this into session after they’re already leaning that approach,”

JPMorgan estimates that if the MSCI excluded Michael Saylor’s Technique, and different index suppliers did the identical, it might face a $12 billion hit as passive buyers that observe the indexes rebalance their portfolios.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection