Get one of the best data-driven crypto insights and evaluation each week:

By: Tanay Ved

-

MicroStrategy operates as a Bitcoin treasury firm and a leveraged proxy to Bitcoin, amplifying BTC’s worth actions each on the upside and draw back.

-

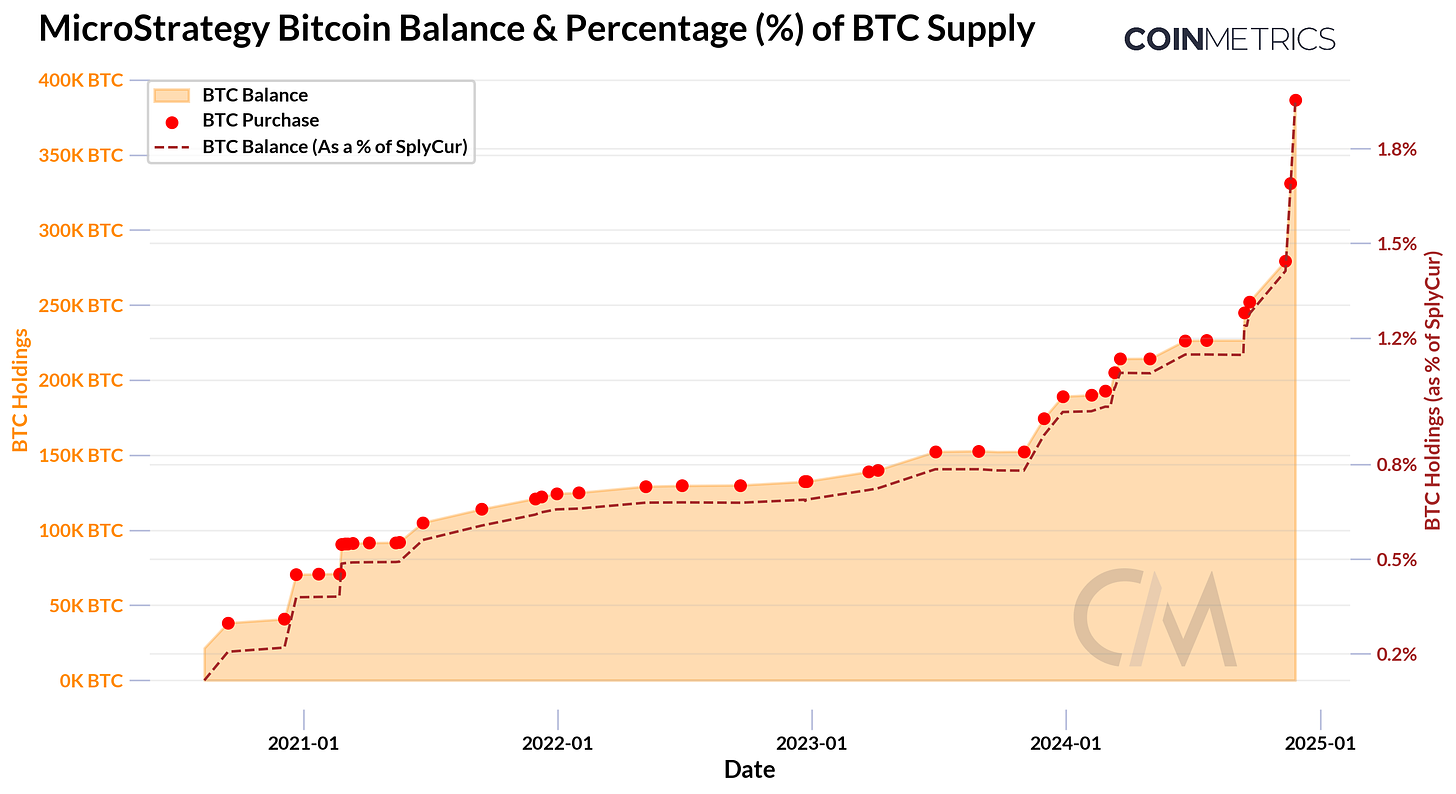

The corporate now holds 386,700 BTC (valued at ~$36B), representing 1.9% of Bitcoin’s present provide—making them the most important company holder of BTC globally.

-

MicroStrategy funds its Bitcoin acquisitions via convertible bonds, capitalizing on low borrowing prices and elevated fairness premiums throughout bull markets to develop its BTC holdings.

Bitcoin’s post-election momentum has pushed it towards the $100K mark for the primary time in its 15-year historical past. Whereas a lot of its provide stays self-custodied, Bitcoin’s rising maturity has unlocked extra accessible funding avenues, together with “crypto equities”—publicly traded shares that present publicity or a proxy to Bitcoin and different digital property through conventional brokerage accounts. These vary from Bitcoin miners like Marathon Digital (MARA) to full-stack operators like Coinbase (COIN) and MicroStrategy (MSTR), the most important company holder of Bitcoin with 386,700 BTC in its treasury. The launch of spot Bitcoin (BTC) and Ether (ETH) ETFs this yr has additional broadened institutional entry.

On this week’s problem of Coin Metrics’ State of the Community, we analyze MicroStrategy’s efficiency, its Bitcoin holdings, and its function as a leveraged proxy throughout the crypto equities panorama, exploring its acquisition technique and the dangers and rewards of its strategy.

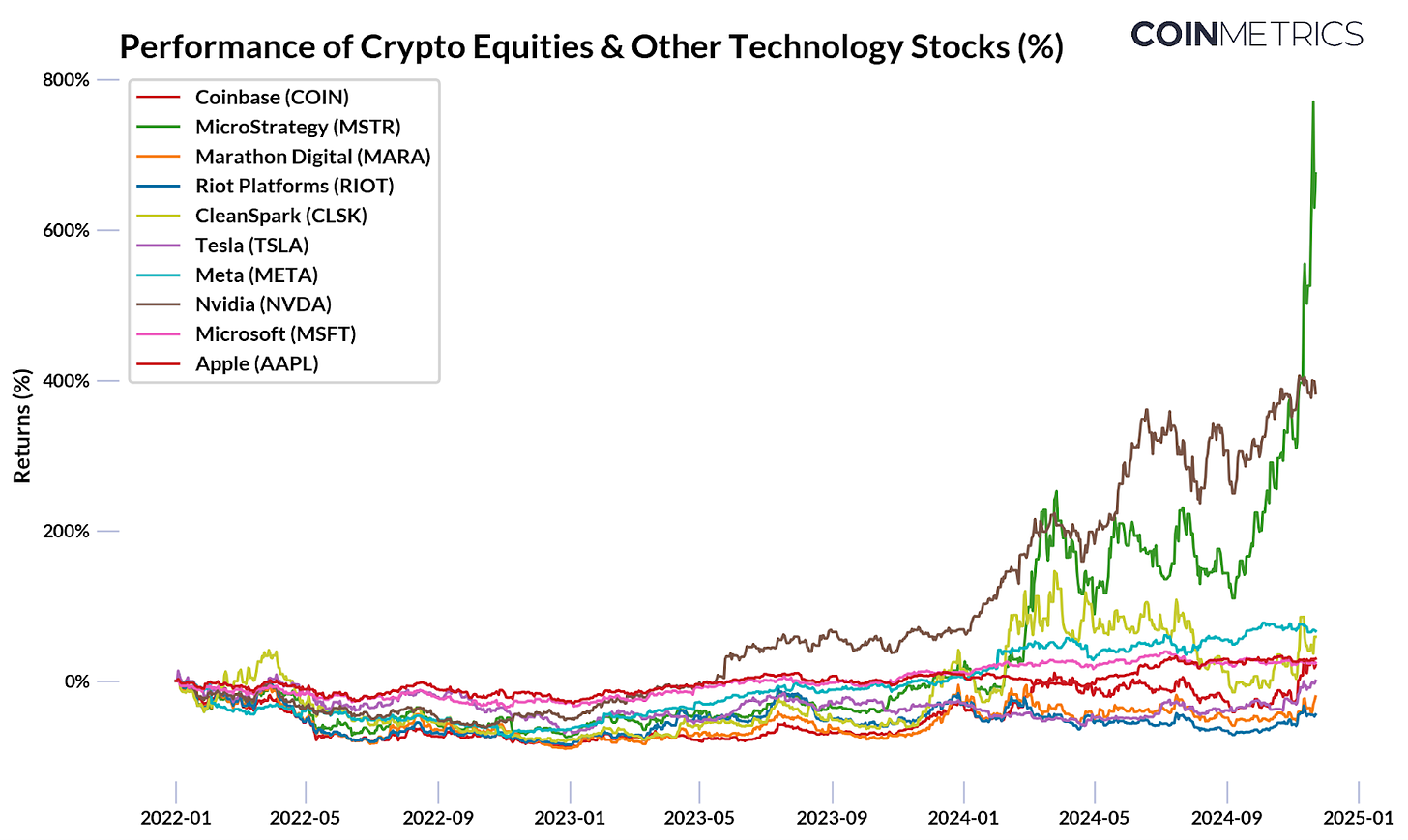

Whereas MSTR will not be part of the S&P 500 index, it has delivered returns exceeding 700% since 2022 and 488% year-to-date, surpassing the efficiency of shares throughout the S&P 500. Its efficiency far outpaces main crypto equities and know-how shares like Coinbase (COIN) or Nvidia (NVDA), pushed by its distinctive function as a “Bitcoin treasury firm”. Subsequently, the technique behind its efficiency warrants a better look.

Supply: Google Finance

Some could also be stunned to study that MicroStrategy was based in 1989 as an enterprise software program firm specializing in enterprise intelligence. Nevertheless, in August 2020, co-founder and then-CEO Michael Saylor made a daring pivot, adopting Bitcoin as the corporate’s major reserve asset as a part of a “new capital allocation technique.” This reworked MicroStrategy right into a Bitcoin accumulation machine. 4 years later, it has grow to be the only largest company holder of Bitcoin, with 386,700 BTC (valued at ~$36B) and a market cap of ~$90B. MicroStrategy’s bitcoin holdings far outpace different company treasuries, holding 12x greater than miners like Marathon Digital (MARA) and 34x greater than Tesla (TSLA).

Supply: Coin Metrics Community Knowledge Professional & BitBo Treasuries

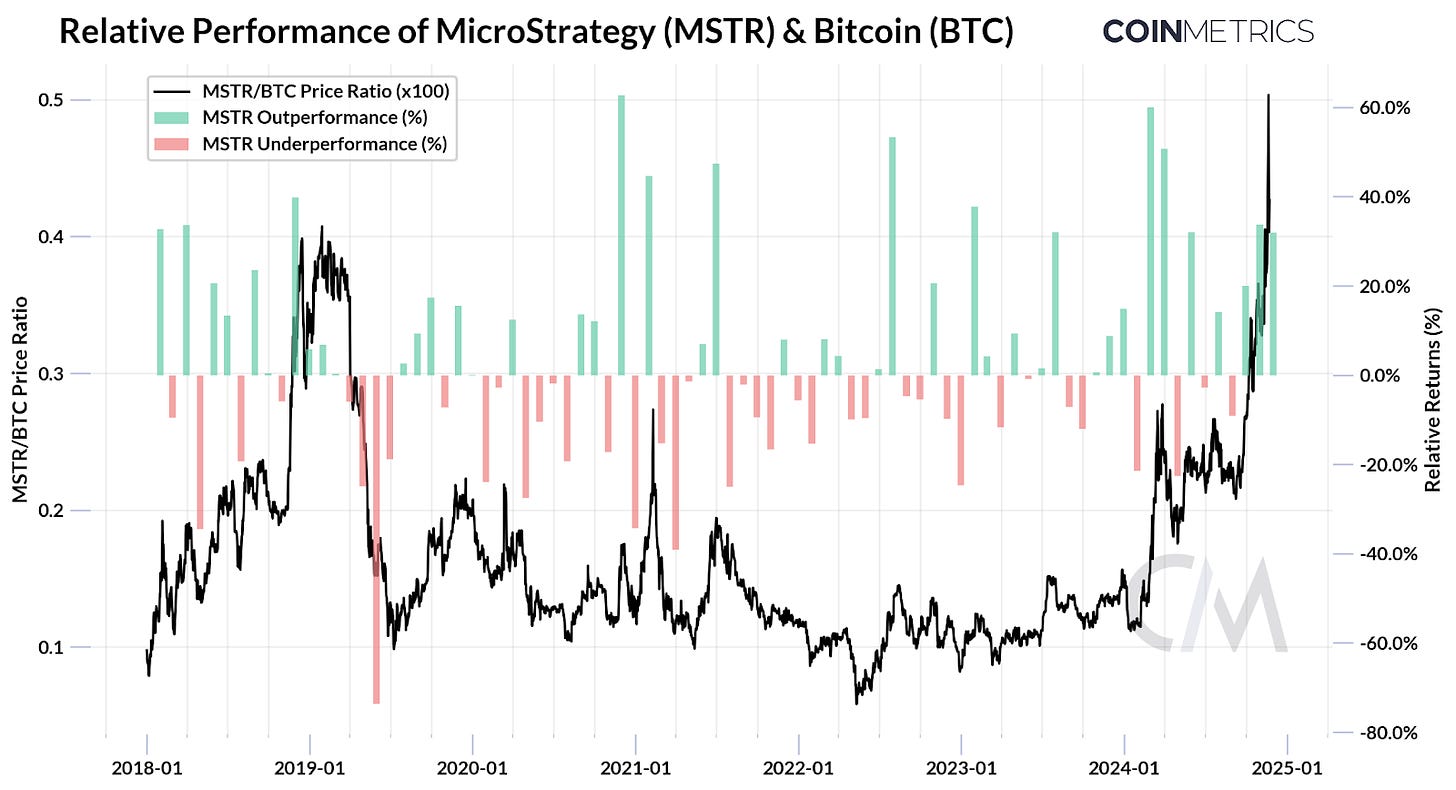

With their most up-to-date buy of 55,500 BTC on November 24th, MicroStrategy now holds 386,700 BTC at a mean price foundation of $56,761, representing ~1.9% of Bitcoin’s present provide. Solely Bitcoin spot ETFs surpass this, collectively holding ~5.3% of the availability—thrice greater than MicroStrategy. This technique has successfully reworked MicroStrategy right into a Bitcoin funding automobile, serving as a leveraged play on Bitcoin. Michael Saylor has himself described the corporate as a “treasury operation securitizing Bitcoin, providing 1.5x to 2x leveraged fairness.” As proven within the chart beneath, MicroStrategy’s efficiency relative to Bitcoin displays this strategy, amplifying features throughout rallies and losses throughout downturns.

Supply: Coin Metrics Reference Charges & Google Finance

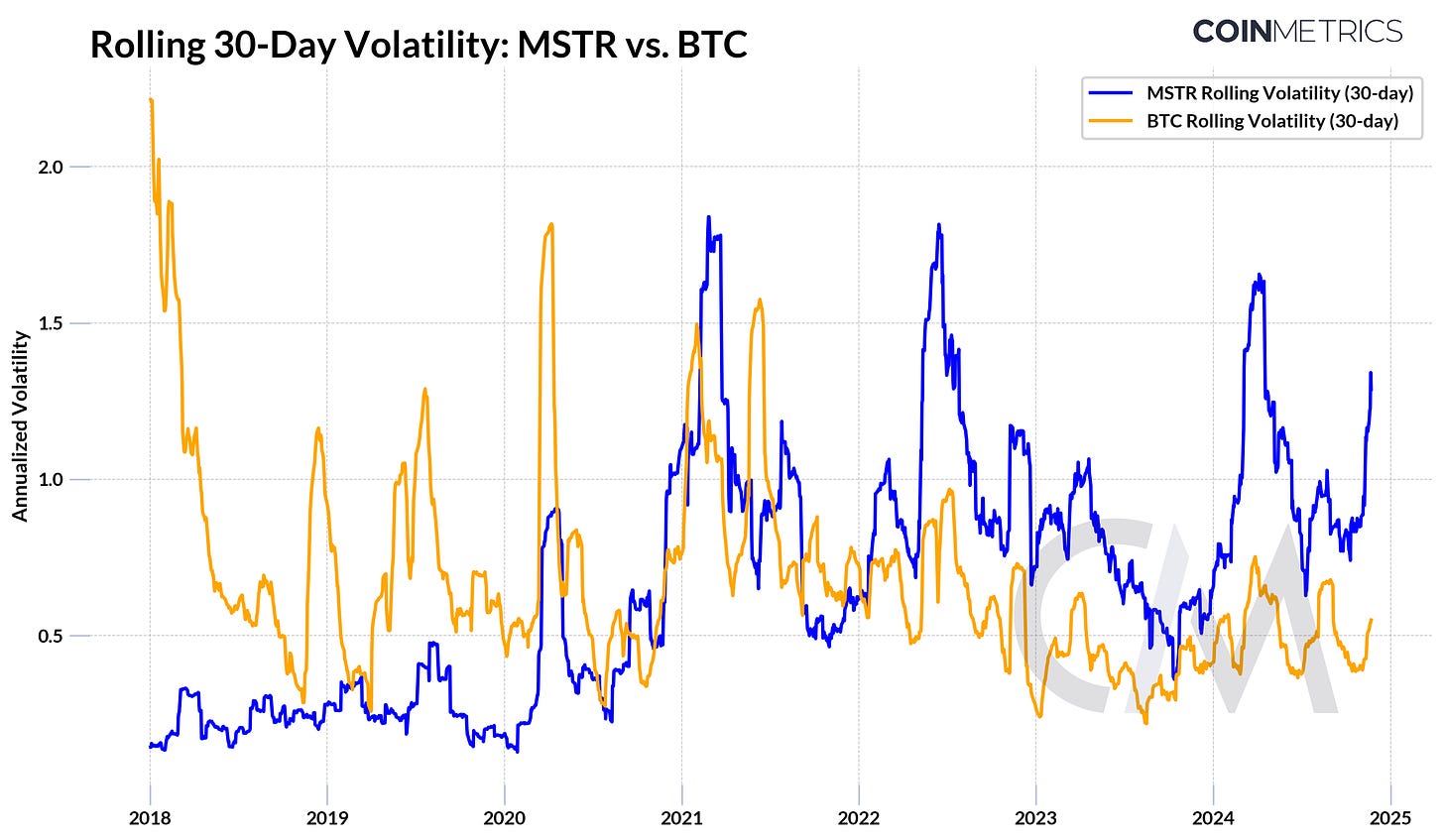

This leveraged strategy inherently drives greater volatility for MSTR in comparison with BTC, usually amplifying BTC’s worth actions by 1.5x to 2x. Past its Bitcoin publicity, MicroStrategy’s inventory worth can be influenced by broader fairness market tendencies and investor sentiment towards Bitcoin, making it a high-risk, high-reward proxy for the asset’s efficiency.

Supply: Coin Metrics Market Knowledge Feed & Google Finance

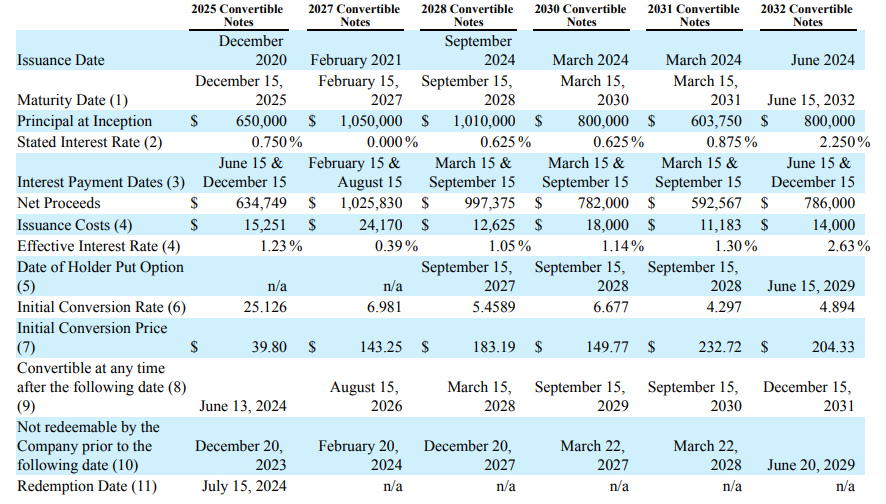

How is MicroStrategy capable of fund its huge Bitcoin purchases? The cornerstone of its technique lies in borrowing cash to purchase bitcoin by issuing convertible bonds. These are a sort of fixed-income instrument that act as a hybrid between debt and fairness, which could be transformed right into a set variety of the corporate’s shares at a future date and predetermined worth.

By providing these convertible notes in fixed-income markets or on to institutional traders, MicroStrategy has been capable of elevate money to scale its Bitcoin holdings quickly, usually with remarkably low borrowing prices. These bonds are enticing to traders as a result of they provide the potential for fairness conversion at a better worth than the issuance worth, successfully functioning as a name choice with demand additional amplified in bull markets MicroStrategy’s rising Bitcoin treasury. This creates a reflexive loop: greater BTC costs drive a better premium on MSTR shares, enabling the corporate to problem extra debt or fairness, which funds further BTC purchases. These purchases add to purchasing strain, additional lifting Bitcoin costs—and the cycle continues, reinforcing itself in a bull market.

Supply: Microstrategy Q3 2024 Earnings

The desk above highlights MicroStrategy’s excellent convertible notes, which mature between 2025 and 2032. Additionally they not too long ago raised $3B via one other convertible bond providing due in 2029 with a 0% rate of interest and 55% conversion premium , bringing its whole excellent debt to over $7.2B.

Whereas their technique has to date introduced large success, one query stays: “What may go improper? Is that this one other bubble ready to burst?” With MicroStrategy’s market capitalization close to ~$90B and their Bitcoin holdings valued at ~$37.6B, the corporate now trades at a big premium of ~2.5x (250%) to its web asset worth (NAV). In different phrases, MicroStrategy’s shares are priced at 2.5 instances the worth of their underlying Bitcoin treasury. This steep valuation premium has drawn scrutiny from market individuals, elevating questions on how lengthy it may possibly stay elevated and the potential penalties if it have been to break down or flip unfavourable.

Contributors are additionally trying to benefit from the premium on MSTR fairness by shorting MSTR inventory and shopping for BTC as a hedge. The inventory has attracted ~11% in brief curiosity, decreasing from ~16% in October as some quick positions are closed out. To evaluate the danger of MicroStrategy probably liquidating a part of its bitcoin holdings and the implications of a declining MSTR/BTC worth and NAV premium, turning to the well being of its legacy software program enterprise could present a greater thought of its means to service these ranges of debt.

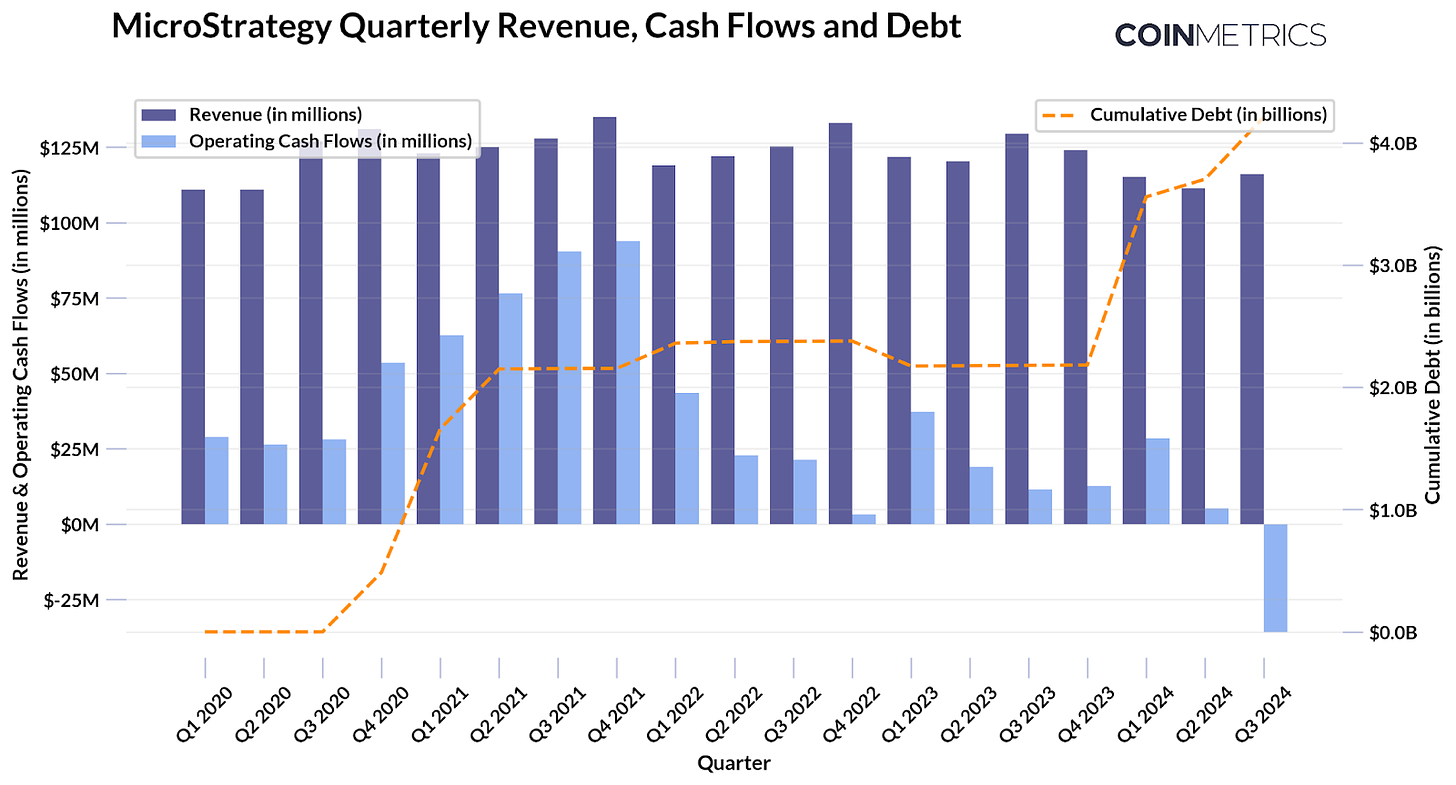

Supply: MicroStrategy Quarterly Earnings as of Q3 2024

Whereas quarterly revenues for the legacy enterprise have been comparatively regular since 2020, working money flows present a declining pattern. In the meantime, cumulative debt has grown considerably since 2020 reaching $7.2B, pushed by the issuance of convertible notes to fund Bitcoin acquisitions, dashing up throughout bullish market situations. This displays the corporate’s reliance on Bitcoin’s appreciation to take care of monetary stability. Regardless of this, the comparatively low curiosity prices on these bonds are seemingly serviceable by the software program enterprise. If bondholders convert their notes into fairness at greater share costs upon maturity, a lot of the debt would resolve with out requiring money compensation. Nevertheless, if market situations deteriorate and the premium on MicroStrategy’s shares erodes, the corporate could must discover different methods to satisfy its obligations

MicroStrategy’s daring strategy highlights Bitcoin’s potential as a company reserve asset. By leveraging its massive Bitcoin chest, the corporate has amplified its market efficiency, establishing itself as a novel proxy to BTC. Nevertheless, this technique carries inherent dangers tied to Bitcoin’s worth volatility and the sustainability of fairness premiums, warranting nearer consideration as market situations evolve. MicroStrategy’s mannequin may encourage broader adoption—not solely amongst firms however probably on the sovereign degree, additional cementing Bitcoin’s function as a retailer of worth and superior reserve asset.

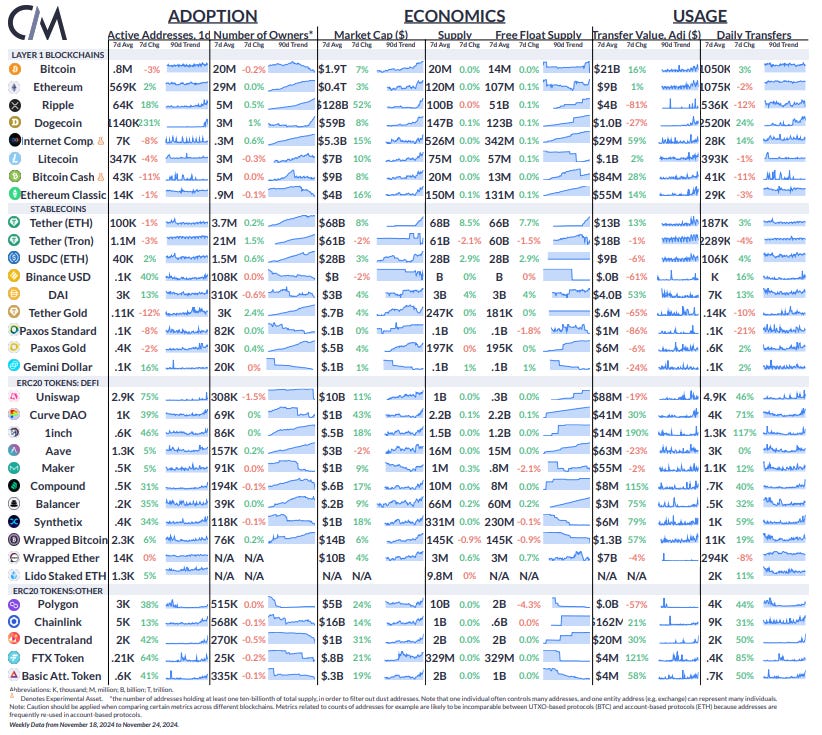

Supply: Coin Metrics Community Knowledge Professional

Over the previous week, Ripple’s (XRP) market capitalization grew by 52%, reaching $128B. Day by day lively addresses for Dogecoin (DOGE) rose by 231%, whereas exercise elevated throughout the board for a number of ERC-20 tokens.

This week’s updates from the Coin Metrics workforce:

-

Remember to try our new Ethereum Overview report, diving into ETH’s historic funding efficiency, adoption, provide dynamics and extra.

-

Comply with Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As all the time, in case you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.