Get the most effective data-driven crypto insights and evaluation each week:

By: Tanay Ved

Qubic briefly claimed majority management of Monero’s hashrate, triggering a shallow six-block reorganization of the ledger.

Monero’s RandomX algorithm broadened mining entry by way of CPUs, however its decrease hashrate left it susceptible to focus, enabling Qubic’s incentives to realize outsized affect.

The episode reveals how smaller PoW networks with thinner safety budgets and concentrated mining energy may be extra uncovered to disruptions in consensus.

Earlier this month, Monero confronted a significant community safety incident. A Layer-1 blockchain referred to as Qubic claimed management of over half Monero’s hashrate, permitting it to briefly rewrite a part of the community’s transaction historical past. The episode demonstrated how smaller Proof-of-Work (PoW) blockchains may be extra uncovered to disruptions in consensus, elevating questions on mining focus and long-term safety. Whereas the incident was framed as a “stress-test” fairly than an actual double-spend assault, it make clear the significance of distributed mining energy and sustainable incentives for miners to safe PoW networks.

On this problem of State of the Community, we use the Monero episode as a case examine to discover the dangers tied to PoW safety. We clarify what constitutes a 51% assault and chain reorg, revisit previous incidents on networks comparable to Ethereum Basic, and contemplate what this reveals concerning the vulnerabilities that smaller PoW chains may be uncovered to.

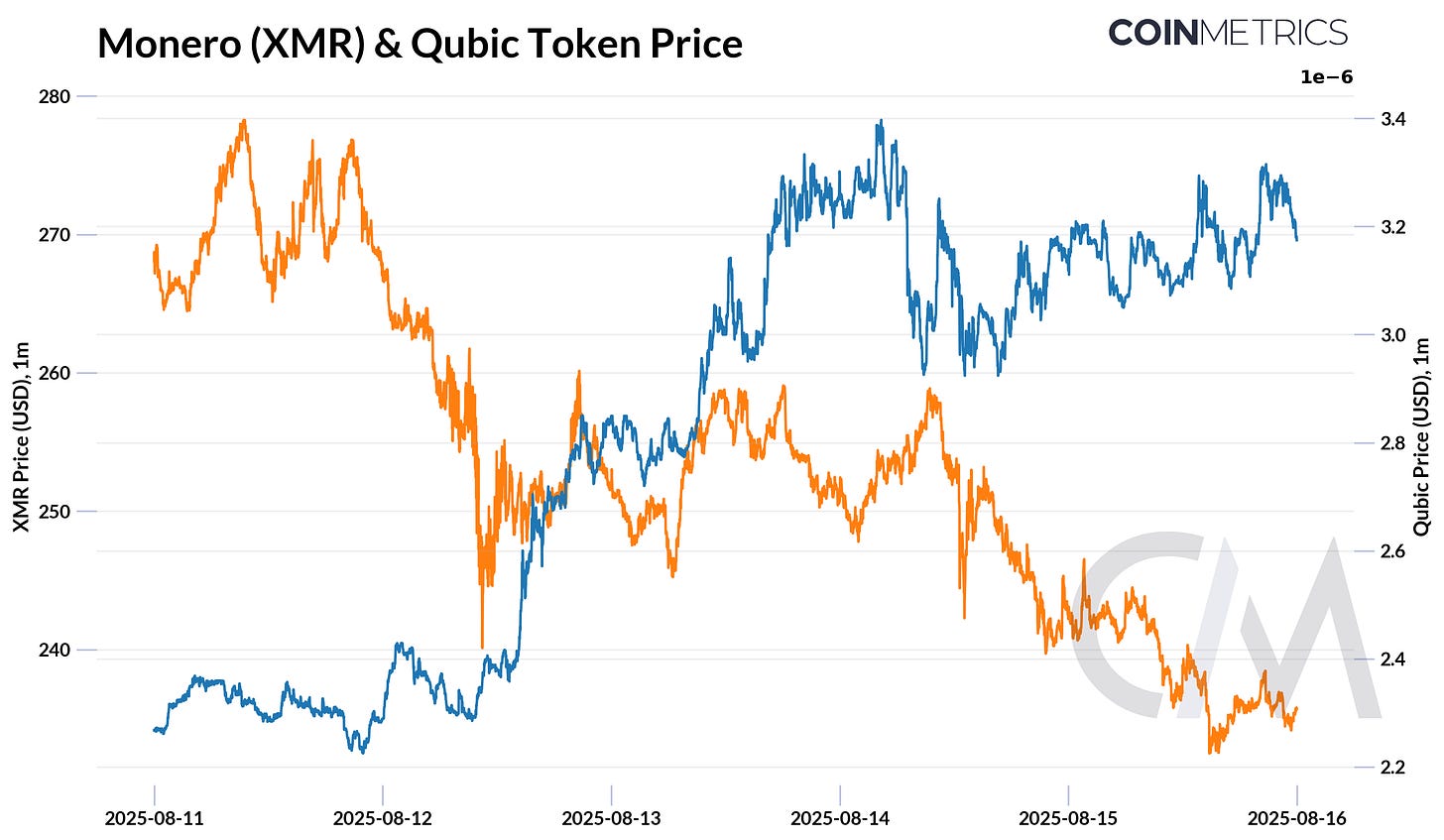

On August twelfth, Qubic claimed it had briefly captured a majority of Monero’s hashrate. In Proof-of-Work (PoW) networks, one of these occasion is usually described as a “51% assault”, which happens when a single actor or group of coordinated entities controls greater than half (>50%) of a community’s mining energy. This majority management permits attackers to govern the community’s consensus, permitting them to re-organize blocks (“reorg”), censor transactions and try double spends, undermining belief within the community.

Like Bitcoin, Monero depends on miners to safe the community by way of PoW consensus, the place members expend computational energy to suggest and validate new blocks. However in contrast to Bitcoin, which makes use of specialised ASIC {hardware} optimized for its SHA-256 mining algorithm, Monero employs RandomX, an algorithm designed to run on general-purpose CPUs. Whereas this lowers the boundaries to mining, it additionally means Monero’s hashrate is much decrease than Bitcoin’s (5.5 GH/s vs. 930 EH/s), leaving the community extra susceptible to focus.

Supply: Coin Metrics Community Knowledge Professional

Qubic’s presence on Monero grew considerably since Could. By means of its “Helpful Proof-of-Work” (UPoW) mannequin, Qubic attracted miners to direct CPU sources towards Monero mining. As an alternative of rewarding miners straight with Monero’s native token XMR, Qubic offered the mined cash in the marketplace, utilizing proceeds to purchase again and burn its personal tokens. These increased rewards drew vital hashrate towards Qubic, boosting their mining profitability whereas heightening fears round community centralization.

Supply: Coin Metrics Reference Charges

This culminated in a shallow six-block reorganization of the Monero ledger, with Qubic mining blocks quicker than the remainder of the community. Whereas a small portion of historical past was briefly rewritten, researchers analyzing the incident discovered no proof of a 51% assault, however fairly an indication of how concentrated incentives can quickly tilt mining rewards.

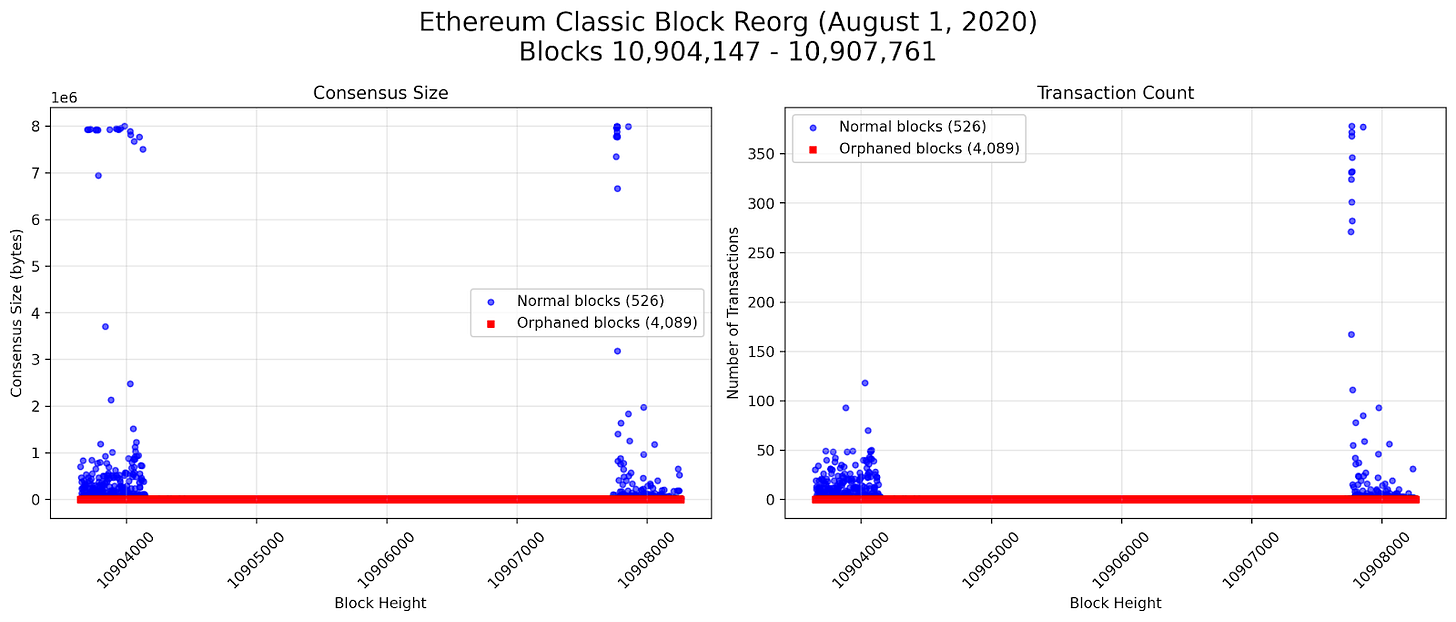

This incident isn’t remoted to Monero alone, as different networks like Bitcoin Gold (2019), Ethereum Basic (2019, 2020) and Bitcoin SV (2021) have confronted comparable occasions. One of many extra extreme occurred in August 2020, when Ethereum Basic went by way of a deep reorganization after a significant mining pool went offline. An attacker privately mined an extended chain after which broadcast it to the community, changing over 4,000 blocks and re-organizing 1000’s of prior transactions.

That is seen in block degree information on Ethereum Basic between blocks10904147 and 10907761. The chart above displays every block’s consensus measurement (in bytes), and the variety of transactions within the block. Through the assault, we see lengthy stretches of purple factors the place consensus measurement drops to zero, which means these blocks had been orphaned when the competing chain took over. The blue factors mark the principle chain that finally prevailed, with the attacker’s chain reorganizing 1000’s of prior blocks.

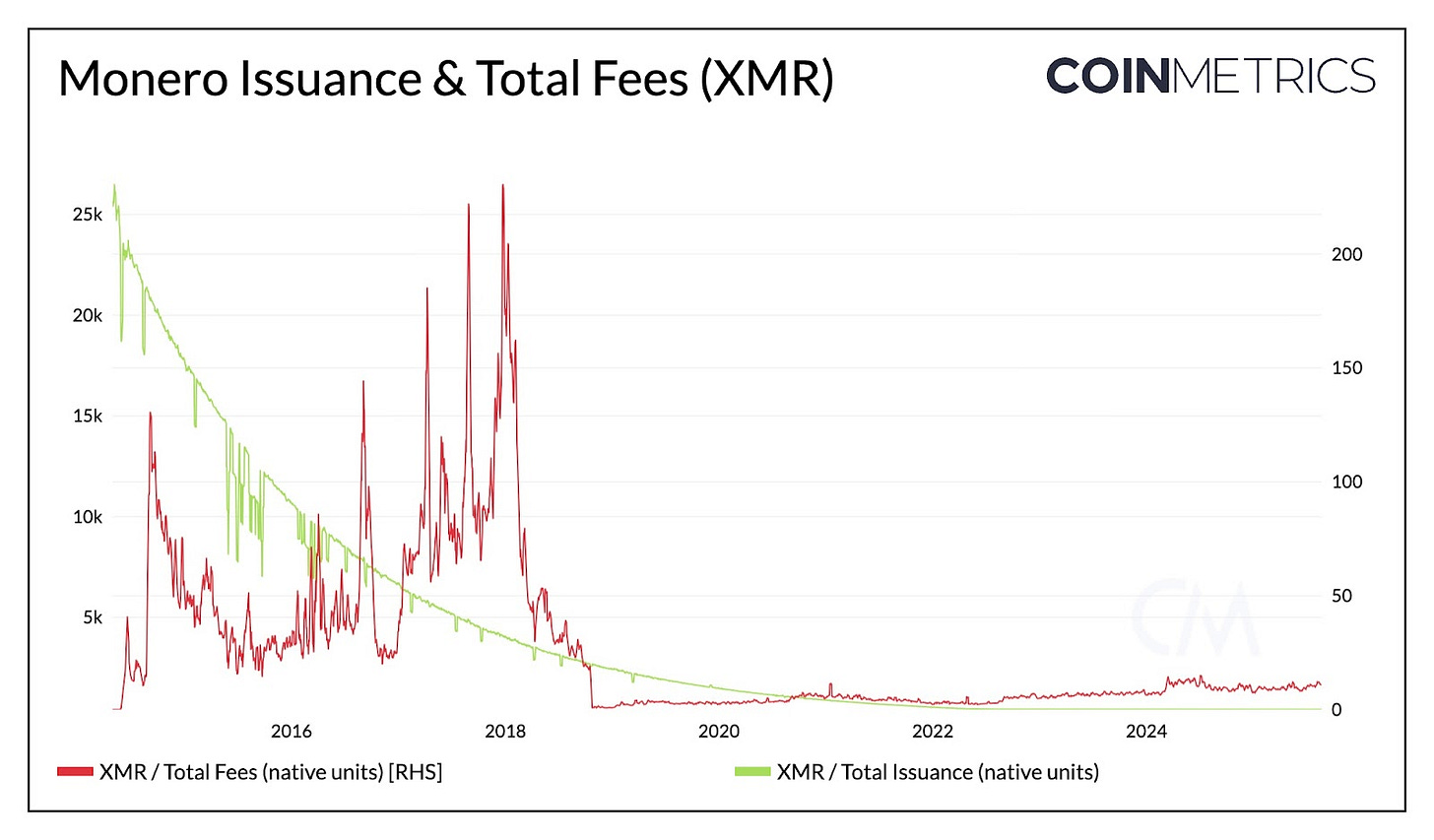

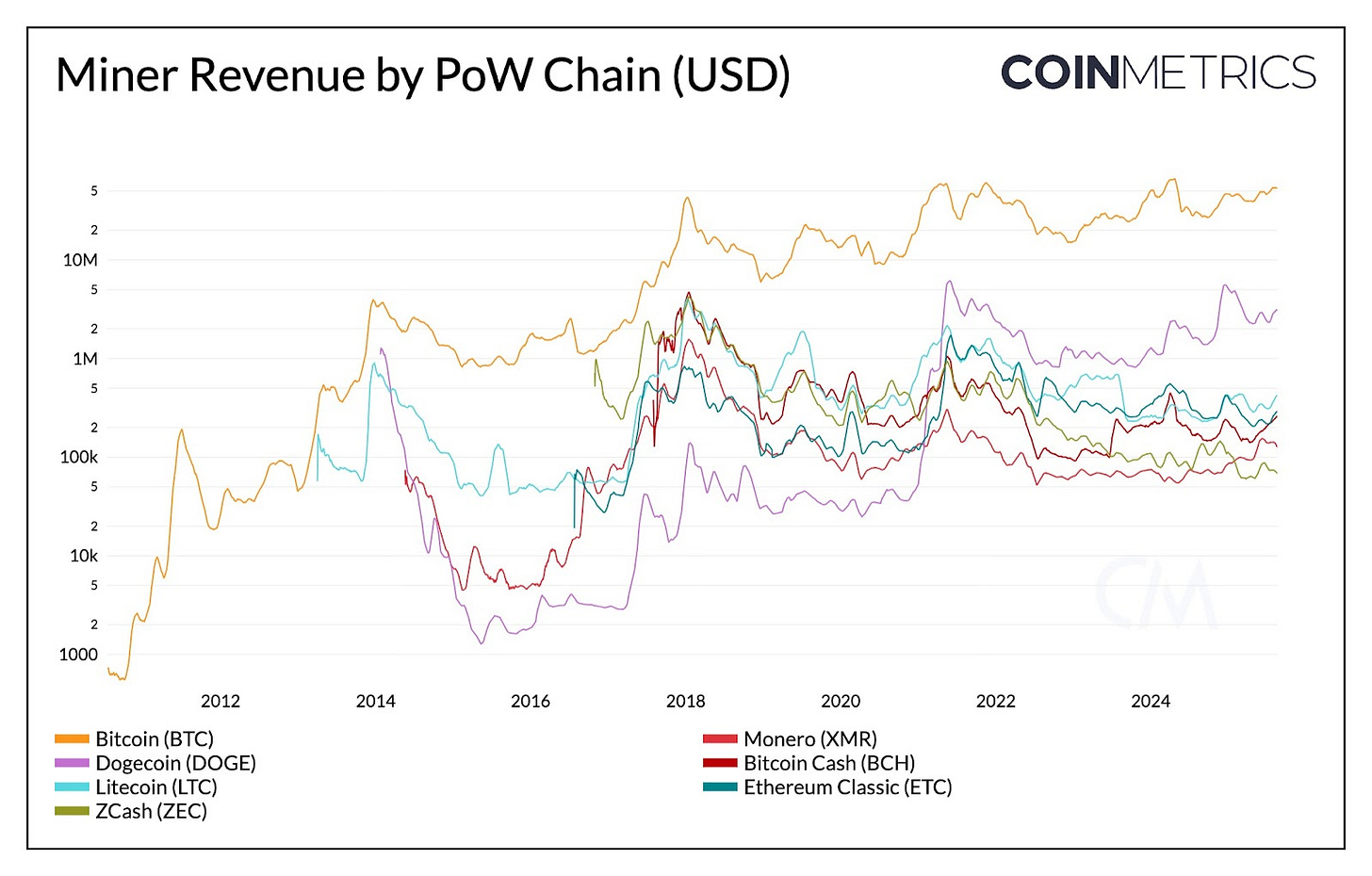

These episodes present how the safety of PoW networks depends upon each the distribution of hashrate and the sustainability of miner incentives. Smaller PoW networks like Monero usually function with a a lot decrease hashrate than Bitcoin, reflecting variations in mining {hardware} and total scale. With much less complete energy securing the chain, it takes fewer sources for a single pool or coordinated actor to achieve majority management, leaving these networks extra vulnerable to disruptions in consensus.

Supply: Coin Metrics Community Knowledge Professional

As Qubic’s incident confirmed, hashrate can centralize round superior incentives. Miners must be sustainably compensated to proceed securing the community. Block rewards on Monero have declined steadily underneath its disinflationary schedule, with the community at the moment issuing ~430 XMR (round $120K at right this moment’s costs) per day. Transaction charges add solely a small complement, at the moment ~9–10 XMR each day. This creates circumstances the place alternate incentive schemes, like Qubic’s uPoW mannequin, can entice sufficient mining energy to quickly tip the steadiness of the community.

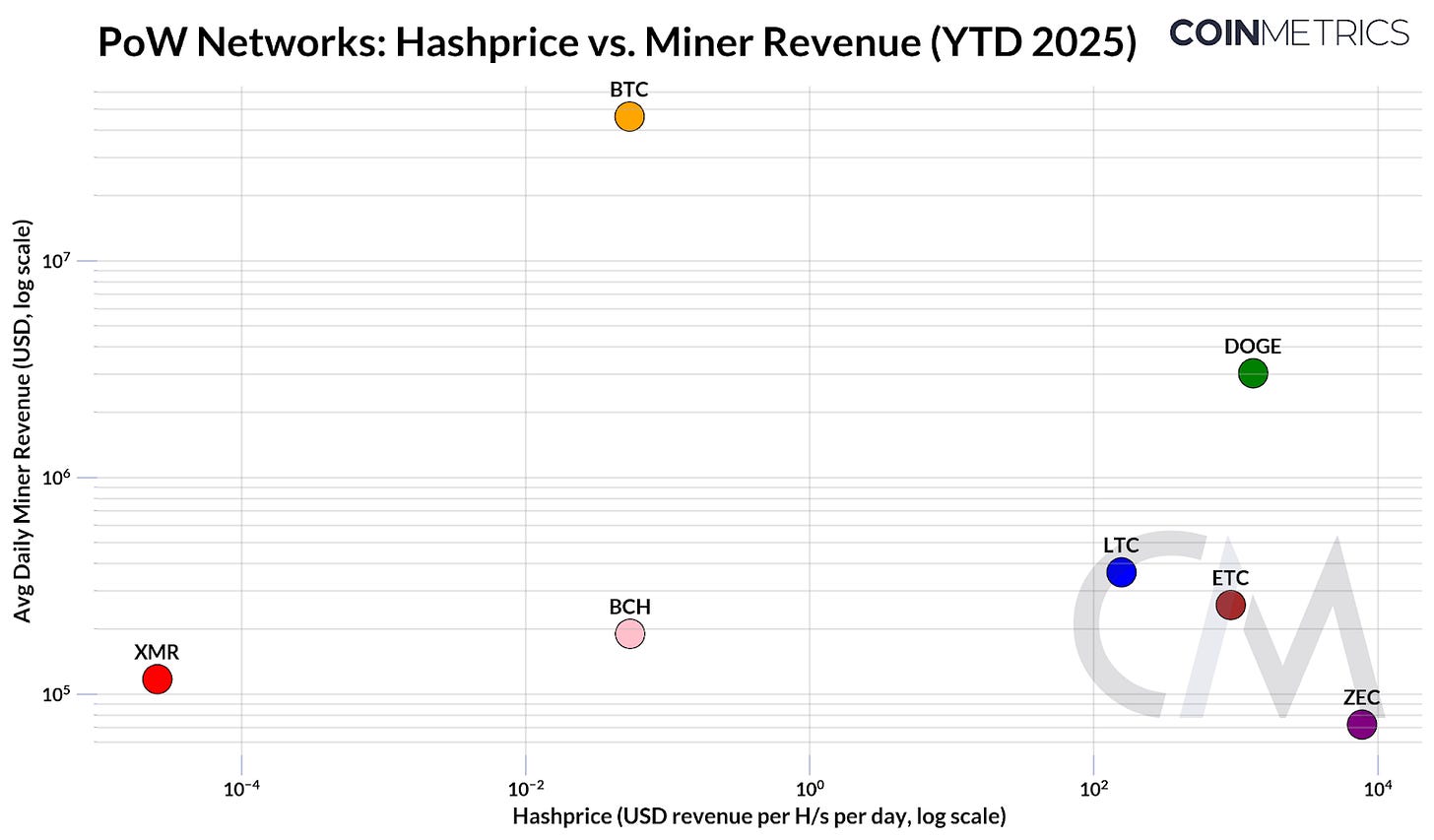

The chart under places this dynamic right into a broader context, displaying hashprice (the income a miner earns per unit of hashrate, i.e. per hash per second per day) in opposition to common each day miner income throughout main PoW networks. Bitcoin sits in a category of its personal, whereas mid-sized chains comparable to Monero, Litecoin, and ZCash cluster with thinner safety budgets.

Supply: Coin Metrics Community Knowledge Professional

In contrast, Bitcoin’s a lot bigger income base helps maintain each the distribution of ASIC {hardware} and the diversification of mining swimming pools. Whereas questions stay round transaction charge dynamics and pool focus, the dimensions of Bitcoin’s hashrate and capital necessities makes coordinated assaults much more pricey.

That is bolstered in analysis comparable to Breaking BFT, which finds {that a} 51% assault on Bitcoin is economically infeasible given the dimensions of capital funding in ASIC {hardware} and the electrical energy prices required to maintain such an assault.

Supply: Coin Metrics Community Knowledge Professional

Monero’s incident with Qubic was not a full-fledged 51% assault, nevertheless it served as a stress check for proof-of-work safety. It reveals how miner incentives, and concentrated mining energy can depart smaller PoW blockchains uncovered to disruptions in consensus, finally risking belief within the community. Previous episodes on networks like Ethereum Basic present that these dangers are usually not hypothetical, however recurring challenges.

Bitcoin’s scale stays a key differentiator, with the boundaries to assault being far better than on smaller networks. However questions over its long-term safety mannequin stay, significantly as block rewards proceed to say no and transaction charges turn into a extra essential a part of the safety funds. In the end, the Qubic episode underscores that PoW safety rests on each sustainable incentives and broad distribution of hashrate, and that incidents like these may be catalysts for networks to strengthen their resilience.

This week’s updates from the Coin Metrics staff:

Observe Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As all the time, if in case you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You possibly can see earlier problems with State of the Community right here.