Prometheum, a agency that has garnered consideration for its first-of-its-kind license to function in crypto-based securities, finds itself at a crossroads. The agency has positioned itself throughout the regulatory framework established by the US Securities and Alternate Fee (SEC) underneath its chair, which has taken a troublesome stance on crypto classifications.

Nevertheless, with management adjustments on the horizon, as SEC Chair Gary Gensler introduced his departure and pro-crypto Donald Trump prepares to take workplace in 2025, the regulatory atmosphere and the potential shift within the classification of those tokens may problem the agency’s operations.

Prometheum Faces Uncertainty As SEC’s Gensler Resigns

Prometheum has touted the SEC’s current guidelines as “useful,” leveraging them to safe a Particular Objective Dealer Vendor license. This standing permits the agency to function as a platform for buying and selling digital securities, a distinct segment market inside which it has marketed itself.

In 2023, the corporate notably testified earlier than the US Congress – with a Democratic majority – on digital belongings, marking a major milestone regardless of its relative anonymity throughout the broader crypto neighborhood.

Nevertheless, Fortune experiences that the anticipated resignation of Gensler, coupled with the election of Trump, presents a double-edged sword for Prometheum.

The incoming Trump administration is anticipated to undertake a extra lenient strategy towards cryptocurrencies, probably redefining the classification of many tokens that Gensler has deemed “securities.”

The report alleges that this shift may undermine Prometheum’s enterprise mannequin. Its mannequin hinges on the premise that many cryptocurrencies are categorised as securities, permitting it to supply the mandatory authorized infrastructure for buying and selling these belongings.

The political panorama provides additional complexity. Prometheum has confronted scrutiny and criticism from some lawmakers, notably Republicans, who’ve questioned its ties to China—an allegation the agency has repeatedly denied.

Co-CEO Eyes Growth Past Crypto

In response to Fortune’s inquiries about Prometheum’s prospects, Aaron Kaplan, the corporate’s co-CEO, expressed optimism. He believes that the Trump administration will catalyze change out there, resulting in the issuance of trillions of securities primarily based on blockchain know-how.

Kaplan emphasised that Prometheum just isn’t restricted to crypto and has the potential to increase into numerous asset courses, together with equities, debt, and exchange-traded funds, all facilitated by blockchain know-how.

Regardless of the optimism, skepticism stays. Trade critics similar to Matt Walsh of Fortress Island Ventures and a political commentator have questioned Prometheum’s influence, citing an absence of proof that its platform is getting used for “real-world buying and selling.”

But, Kaplan acknowledged the agency remains to be within the “very early phases” of its growth, asserting that Prometheum is engaged in ongoing discussions with monetary establishments to broaden its attain.

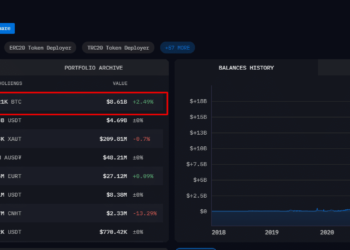

Featured picture from DALL-E, chart from TradingView.com

Prometheum, a agency that has garnered consideration for its first-of-its-kind license to function in crypto-based securities, finds itself at a crossroads. The agency has positioned itself throughout the regulatory framework established by the US Securities and Alternate Fee (SEC) underneath its chair, which has taken a troublesome stance on crypto classifications.

Nevertheless, with management adjustments on the horizon, as SEC Chair Gary Gensler introduced his departure and pro-crypto Donald Trump prepares to take workplace in 2025, the regulatory atmosphere and the potential shift within the classification of those tokens may problem the agency’s operations.

Prometheum Faces Uncertainty As SEC’s Gensler Resigns

Prometheum has touted the SEC’s current guidelines as “useful,” leveraging them to safe a Particular Objective Dealer Vendor license. This standing permits the agency to function as a platform for buying and selling digital securities, a distinct segment market inside which it has marketed itself.

In 2023, the corporate notably testified earlier than the US Congress – with a Democratic majority – on digital belongings, marking a major milestone regardless of its relative anonymity throughout the broader crypto neighborhood.

Nevertheless, Fortune experiences that the anticipated resignation of Gensler, coupled with the election of Trump, presents a double-edged sword for Prometheum.

The incoming Trump administration is anticipated to undertake a extra lenient strategy towards cryptocurrencies, probably redefining the classification of many tokens that Gensler has deemed “securities.”

The report alleges that this shift may undermine Prometheum’s enterprise mannequin. Its mannequin hinges on the premise that many cryptocurrencies are categorised as securities, permitting it to supply the mandatory authorized infrastructure for buying and selling these belongings.

The political panorama provides additional complexity. Prometheum has confronted scrutiny and criticism from some lawmakers, notably Republicans, who’ve questioned its ties to China—an allegation the agency has repeatedly denied.

Co-CEO Eyes Growth Past Crypto

In response to Fortune’s inquiries about Prometheum’s prospects, Aaron Kaplan, the corporate’s co-CEO, expressed optimism. He believes that the Trump administration will catalyze change out there, resulting in the issuance of trillions of securities primarily based on blockchain know-how.

Kaplan emphasised that Prometheum just isn’t restricted to crypto and has the potential to increase into numerous asset courses, together with equities, debt, and exchange-traded funds, all facilitated by blockchain know-how.

Regardless of the optimism, skepticism stays. Trade critics similar to Matt Walsh of Fortress Island Ventures and a political commentator have questioned Prometheum’s influence, citing an absence of proof that its platform is getting used for “real-world buying and selling.”

But, Kaplan acknowledged the agency remains to be within the “very early phases” of its growth, asserting that Prometheum is engaged in ongoing discussions with monetary establishments to broaden its attain.

Featured picture from DALL-E, chart from TradingView.com