Enacting a Bitcoin treasury technique modifications greater than reserve composition. It redefines capital technique, danger posture, and market positioning—particularly for corporations making ready for public markets.

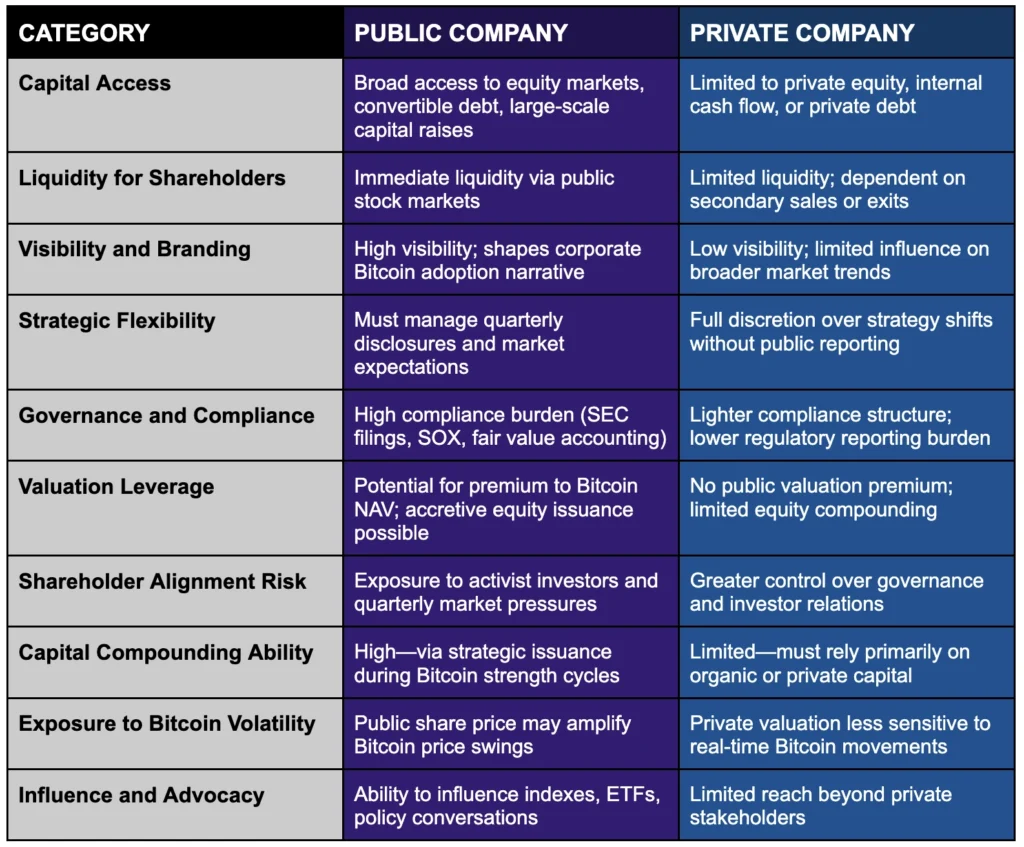

For pre-IPO corporations contemplating or constructing a Bitcoin treasury technique, the choice between remaining personal or transitioning to public life will not be merely regulatory. It’s a strategic alternative that impacts capital entry, shareholder alignment, treasury scalability, and long-term competitiveness.

Understanding the variations between private and non-private Bitcoin treasury methods is crucial for corporations positioning themselves for the subsequent stage of development.

Strategic Benefits of Being a Public Bitcoin Treasury Firm

Entry to Public Capital Markets

Public corporations have a decisive edge in capital formation. By fairness choices, convertible debt, and different monetary devices, public corporations can effectively increase vital funds—capital that may be deployed to scale Bitcoin reserves with out closely burdening operations or present fairness constructions.

Liquidity for Shareholders and Stakeholders

A public itemizing supplies liquidity alternatives for founders, staff, and early traders. Liquidity strengthens expertise recruitment and retention by providing a transparent monetization path—an essential consideration for rising corporations competing for prime expertise.

Visibility and Market Management

Public corporations command higher visibility with institutional traders, sovereign wealth funds, and strategic companions. They’re positioned to steer the narrative round company Bitcoin adoption somewhat than merely taking part in it.

Potential Premium to Bitcoin Holdings

In favorable market environments, public Bitcoin treasury corporations have traditionally traded at premiums relative to the online worth of their Bitcoin holdings. This dynamic permits for accretive fairness issuance, compounding shareholder worth and Bitcoin reserves concurrently.

Affect in Capital Markets and Coverage Arenas

Public Bitcoin corporations acquire entry to indexes, ETFs, analyst protection, and broader capital markets affect—accelerating adoption not solely inside their very own partitions however throughout the whole company panorama.

Managing Commerce-Offs in Public Markets for Bitcoin Treasury Technique

Regulatory and Compliance Necessities

Going public introduces SEC reporting (10-Qs, 10-Ks, 8-Ks), Sarbanes-Oxley compliance, truthful worth Bitcoin accounting, and governance enhancements. These necessities enhance operational complexity but in addition professionalize treasury operations for long-term scale.

Quick-Time period Market Pressures

Public corporations should handle quarterly disclosures, market volatility, and investor communications—notably when Bitcoin’s pure value cycles diverge from broader market traits.

Dilution Danger

Strategic fairness issuance have to be fastidiously managed to keep away from diluting shareholder worth. Nonetheless, with disciplined execution, corporations can leverage market demand to boost Bitcoin accumulation per share.

Publicity to Activist Buyers

Public visibility can appeal to activist strain, notably if Bitcoin technique execution is misaligned with shareholder expectations. Ready governance constructions are key to navigating this dynamic.

Strategic Constraints of Remaining Non-public

Restricted Capital Entry

Scaling Bitcoin reserves to a major strategic stage usually requires entry to public capital. Non-public fundraising avenues, whereas viable for early development, can limit the power to maneuver opportunistically or at scale.

Diminished Liquidity for Stakeholders

Non-public shareholders face restricted liquidity pathways absent a sale or personal secondary market transactions. This may sluggish expertise recruitment and scale back strategic flexibility throughout Bitcoin market cycles.

Decrease Visibility and Market Affect

Non-public Bitcoin treasury corporations function with much less visibility, making it tougher to affect institutional adoption traits, appeal to strategic partnerships, or advocate for Bitcoin’s function in company finance at scale.

Why Public Alignment Helps Bitcoin Treasury Scale

For corporations dedicated to a Bitcoin treasury technique, public market entry is greater than a funding mechanism.

It’s a pressure multiplier that permits:

- Strategic compounding of Bitcoin reserves by way of fairness market dynamics

- Attraction of Bitcoin-aligned institutional shareholders

- Lengthy-term positioning as a pacesetter within the rising company Bitcoin financial system

- Enhanced flexibility to navigate future macroeconomic and capital market shifts

Bitcoin is a long-duration, scarce, non-sovereign asset. Public corporations are finest positioned to align their capital technique, governance construction, and shareholder base to match that point horizon.

Non-public corporations could accumulate Bitcoin efficiently.

However public corporations have the power to scale, sign management, and institutionalize Bitcoin adoption throughout world markets.

Conclusion: Constructing Bitcoin Treasury Technique for Life in Public Markets

For pre-IPO corporations already making ready for the general public stage, Bitcoin treasury technique must be a part of the capital technique dialog as we speak—not after IPO.

Public corporations have the instruments to:

- Increase capital at scale

- Compound Bitcoin reserves accretively

- Form company adoption narratives

- Strengthen resilience by way of financial neutrality

Remaining personal affords near-term flexibility.

However working as a public firm unlocks strategic levers that non-public constructions can not replicate.

For corporations considering long-term about steadiness sheet resilience, Bitcoin accumulation, and institutional positioning, the crucial is obvious:

Construct Bitcoin treasury technique with public market alignment in thoughts. Put together not simply to take part—however to steer.

Disclaimer: This content material was written on behalf of Bitcoin For Companies. This text is meant solely for informational functions and shouldn’t be interpreted as an invite or solicitation to accumulate, buy, or subscribe for securities.

Enacting a Bitcoin treasury technique modifications greater than reserve composition. It redefines capital technique, danger posture, and market positioning—particularly for corporations making ready for public markets.

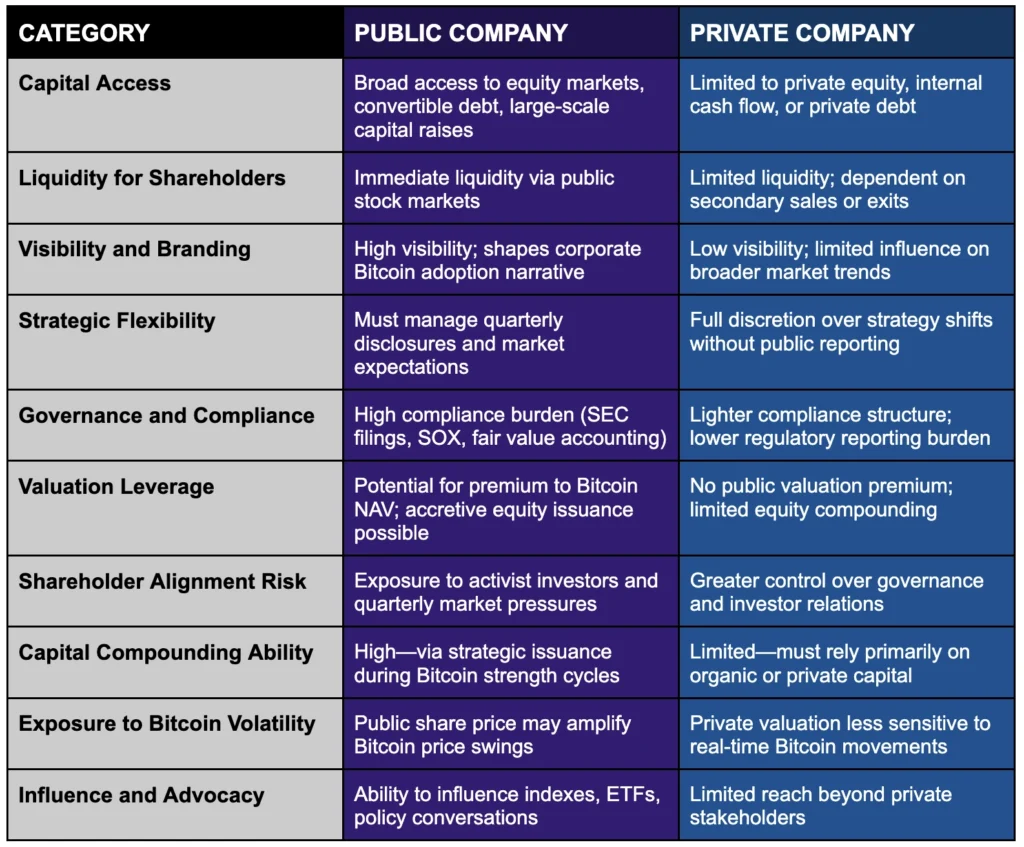

For pre-IPO corporations contemplating or constructing a Bitcoin treasury technique, the choice between remaining personal or transitioning to public life will not be merely regulatory. It’s a strategic alternative that impacts capital entry, shareholder alignment, treasury scalability, and long-term competitiveness.

Understanding the variations between private and non-private Bitcoin treasury methods is crucial for corporations positioning themselves for the subsequent stage of development.

Strategic Benefits of Being a Public Bitcoin Treasury Firm

Entry to Public Capital Markets

Public corporations have a decisive edge in capital formation. By fairness choices, convertible debt, and different monetary devices, public corporations can effectively increase vital funds—capital that may be deployed to scale Bitcoin reserves with out closely burdening operations or present fairness constructions.

Liquidity for Shareholders and Stakeholders

A public itemizing supplies liquidity alternatives for founders, staff, and early traders. Liquidity strengthens expertise recruitment and retention by providing a transparent monetization path—an essential consideration for rising corporations competing for prime expertise.

Visibility and Market Management

Public corporations command higher visibility with institutional traders, sovereign wealth funds, and strategic companions. They’re positioned to steer the narrative round company Bitcoin adoption somewhat than merely taking part in it.

Potential Premium to Bitcoin Holdings

In favorable market environments, public Bitcoin treasury corporations have traditionally traded at premiums relative to the online worth of their Bitcoin holdings. This dynamic permits for accretive fairness issuance, compounding shareholder worth and Bitcoin reserves concurrently.

Affect in Capital Markets and Coverage Arenas

Public Bitcoin corporations acquire entry to indexes, ETFs, analyst protection, and broader capital markets affect—accelerating adoption not solely inside their very own partitions however throughout the whole company panorama.

Managing Commerce-Offs in Public Markets for Bitcoin Treasury Technique

Regulatory and Compliance Necessities

Going public introduces SEC reporting (10-Qs, 10-Ks, 8-Ks), Sarbanes-Oxley compliance, truthful worth Bitcoin accounting, and governance enhancements. These necessities enhance operational complexity but in addition professionalize treasury operations for long-term scale.

Quick-Time period Market Pressures

Public corporations should handle quarterly disclosures, market volatility, and investor communications—notably when Bitcoin’s pure value cycles diverge from broader market traits.

Dilution Danger

Strategic fairness issuance have to be fastidiously managed to keep away from diluting shareholder worth. Nonetheless, with disciplined execution, corporations can leverage market demand to boost Bitcoin accumulation per share.

Publicity to Activist Buyers

Public visibility can appeal to activist strain, notably if Bitcoin technique execution is misaligned with shareholder expectations. Ready governance constructions are key to navigating this dynamic.

Strategic Constraints of Remaining Non-public

Restricted Capital Entry

Scaling Bitcoin reserves to a major strategic stage usually requires entry to public capital. Non-public fundraising avenues, whereas viable for early development, can limit the power to maneuver opportunistically or at scale.

Diminished Liquidity for Stakeholders

Non-public shareholders face restricted liquidity pathways absent a sale or personal secondary market transactions. This may sluggish expertise recruitment and scale back strategic flexibility throughout Bitcoin market cycles.

Decrease Visibility and Market Affect

Non-public Bitcoin treasury corporations function with much less visibility, making it tougher to affect institutional adoption traits, appeal to strategic partnerships, or advocate for Bitcoin’s function in company finance at scale.

Why Public Alignment Helps Bitcoin Treasury Scale

For corporations dedicated to a Bitcoin treasury technique, public market entry is greater than a funding mechanism.

It’s a pressure multiplier that permits:

- Strategic compounding of Bitcoin reserves by way of fairness market dynamics

- Attraction of Bitcoin-aligned institutional shareholders

- Lengthy-term positioning as a pacesetter within the rising company Bitcoin financial system

- Enhanced flexibility to navigate future macroeconomic and capital market shifts

Bitcoin is a long-duration, scarce, non-sovereign asset. Public corporations are finest positioned to align their capital technique, governance construction, and shareholder base to match that point horizon.

Non-public corporations could accumulate Bitcoin efficiently.

However public corporations have the power to scale, sign management, and institutionalize Bitcoin adoption throughout world markets.

Conclusion: Constructing Bitcoin Treasury Technique for Life in Public Markets

For pre-IPO corporations already making ready for the general public stage, Bitcoin treasury technique must be a part of the capital technique dialog as we speak—not after IPO.

Public corporations have the instruments to:

- Increase capital at scale

- Compound Bitcoin reserves accretively

- Form company adoption narratives

- Strengthen resilience by way of financial neutrality

Remaining personal affords near-term flexibility.

However working as a public firm unlocks strategic levers that non-public constructions can not replicate.

For corporations considering long-term about steadiness sheet resilience, Bitcoin accumulation, and institutional positioning, the crucial is obvious:

Construct Bitcoin treasury technique with public market alignment in thoughts. Put together not simply to take part—however to steer.

Disclaimer: This content material was written on behalf of Bitcoin For Companies. This text is meant solely for informational functions and shouldn’t be interpreted as an invite or solicitation to accumulate, buy, or subscribe for securities.