Get the very best data-driven crypto insights and evaluation each week:

By: Tanay Ved

-

Miner revenues have stabilized post-halving, however charges stay low, preserving strain on long-term incentives. Mining operations proceed to adapt, investing in environment friendly {hardware} and tapping into renewable vitality sources.

-

Bitmain ASICs account for a majority of community hashrate, elevating considerations round provide chain dangers and geopolitical disruption.

-

Bitcoin is progressively evolving right into a retailer of worth, although efforts to broaden its transactional utility via Layer-2s and different developments are ongoing.

-

As block rewards decline, sustaining miner incentives over the long run might require higher-value transactions and larger competitors for block area to drive significant charge income.

With virtually one 12 months elapsed since Bitcoin’s 4th halving, miners have endured a interval of stabilization, adapting to diminished block rewards, tighter margins, and shifting operational dynamics. On this difficulty of Coin Metrics’ State of the Community, we offer an replace on the Bitcoin mining panorama, together with miner revenues, change flows, and ASIC distribution. We additionally discover how Bitcoin is getting used at the moment, whether or not as a medium of change or a retailer of worth, and what which means for miner incentives and the community’s long-term sustainability.

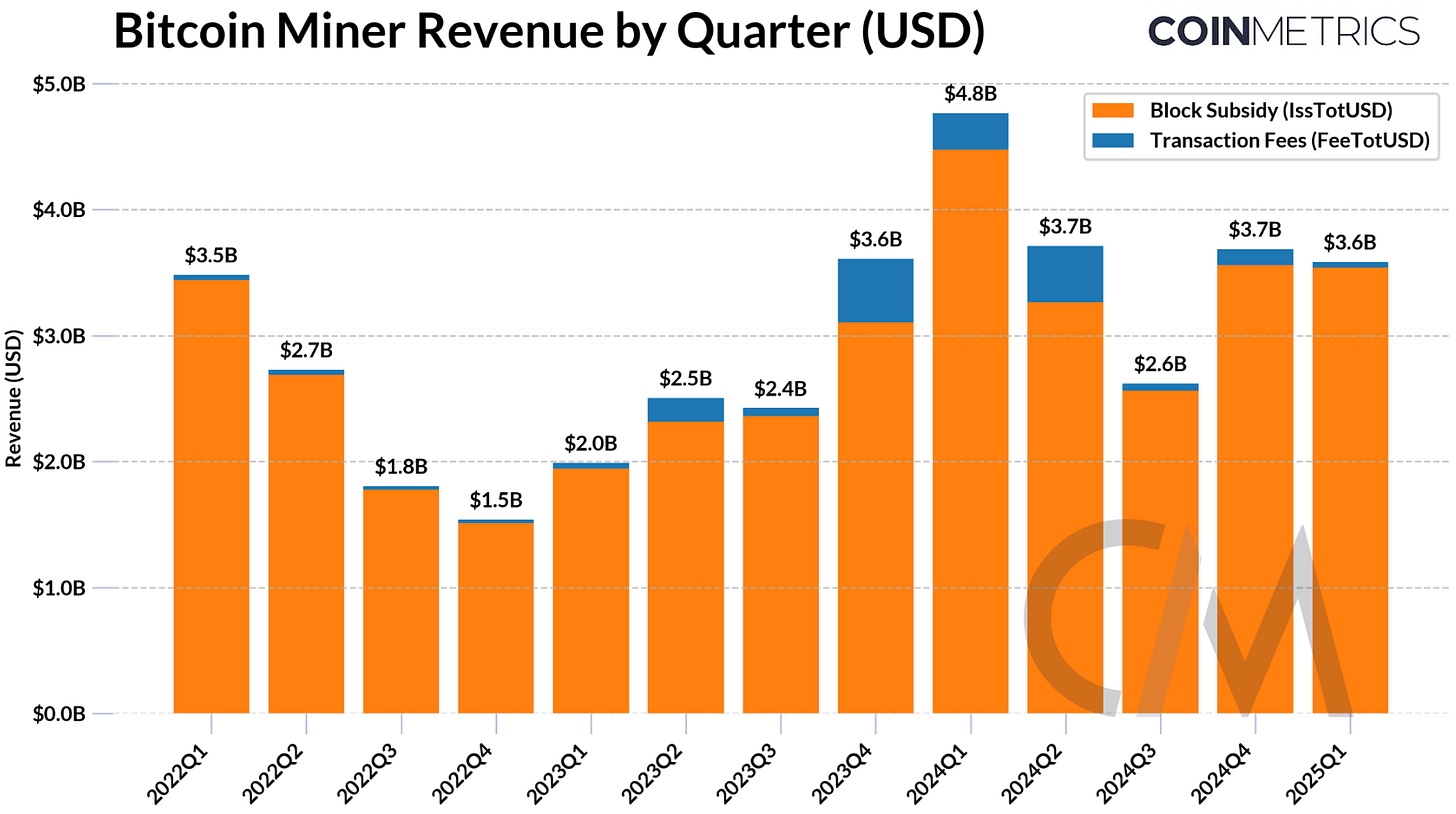

Complete miner income, measuring each whole charges for transactions included in blocks in addition to block rewards from issuance, reached $3.7B in This fall. This represents a 42% improve from Q3 2024, a interval the place miners combatted the results of halved block rewards, a decrease BTC worth, and strain on margins attributable to larger vitality prices and the necessity for extra environment friendly mining {hardware}. Up to now in Q1 2025, miner revenues sit at a wholesome ~$3.6B, with transaction charges accounting for merely 1.33% of whole income, whereas the 30D hashrate has risen to 807 EH/s.

Supply: Coin Metrics Community Information Professional

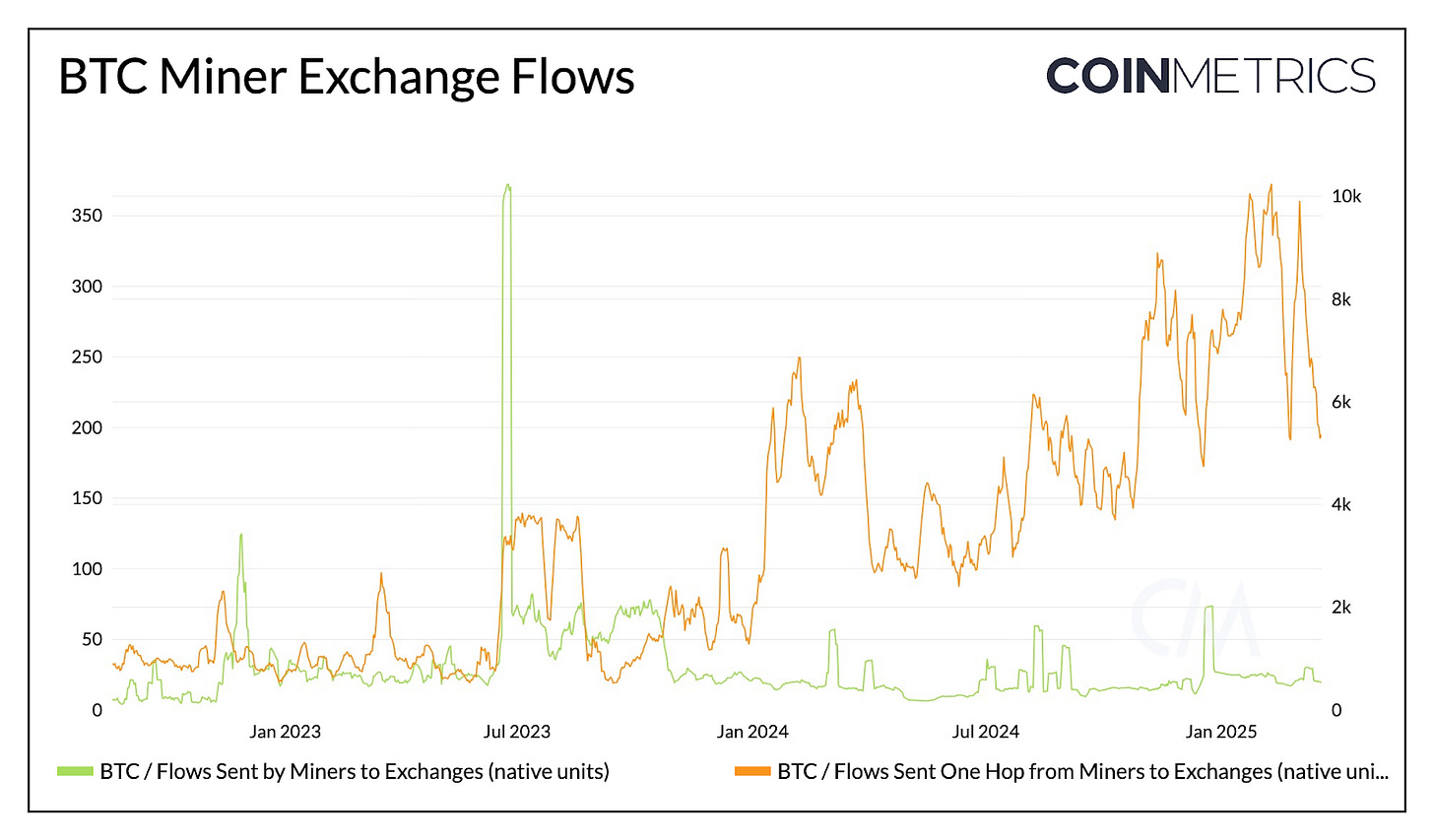

Within the interim, miner habits and technique has continued to evolve in response to tightening margins. Miner flows counsel that direct flows (0-hop) from miners to exchanges have remained comparatively steady with occasional spikes, indicating regular treasury administration and opportunistic promoting by bigger operations. In the meantime, 1-hop flows—BTC despatched to exchanges one step from a mining entity (via middleman addresses)—have steadily elevated, pointing to gradual sell-pressure from smaller mining entities or pool individuals.

Supply: Coin Metrics Community Information Professional

Nicely capitalized miners are in a greater place to face up to diminished incentives. They’re adapting in quite a few methods, corresponding to upgrading to extra vitality environment friendly ASICs, relocating to areas with cheaper and ample renewable vitality assets, corresponding to wind farms in Texas, or in growing areas throughout Africa and Latin America with underutilized assets.

In some circumstances, miners are additionally diversifying into AI data-center internet hosting as a strategy to broaden income and repurpose present infrastructure for prime efficiency computing. For example, Core Scientific dedicated to 200 MW of capability to host CoreWeave’s AI workloads, highlighting how mining operations are evolving to satisfy broader compute calls for whereas in search of improved profitability per terahash.

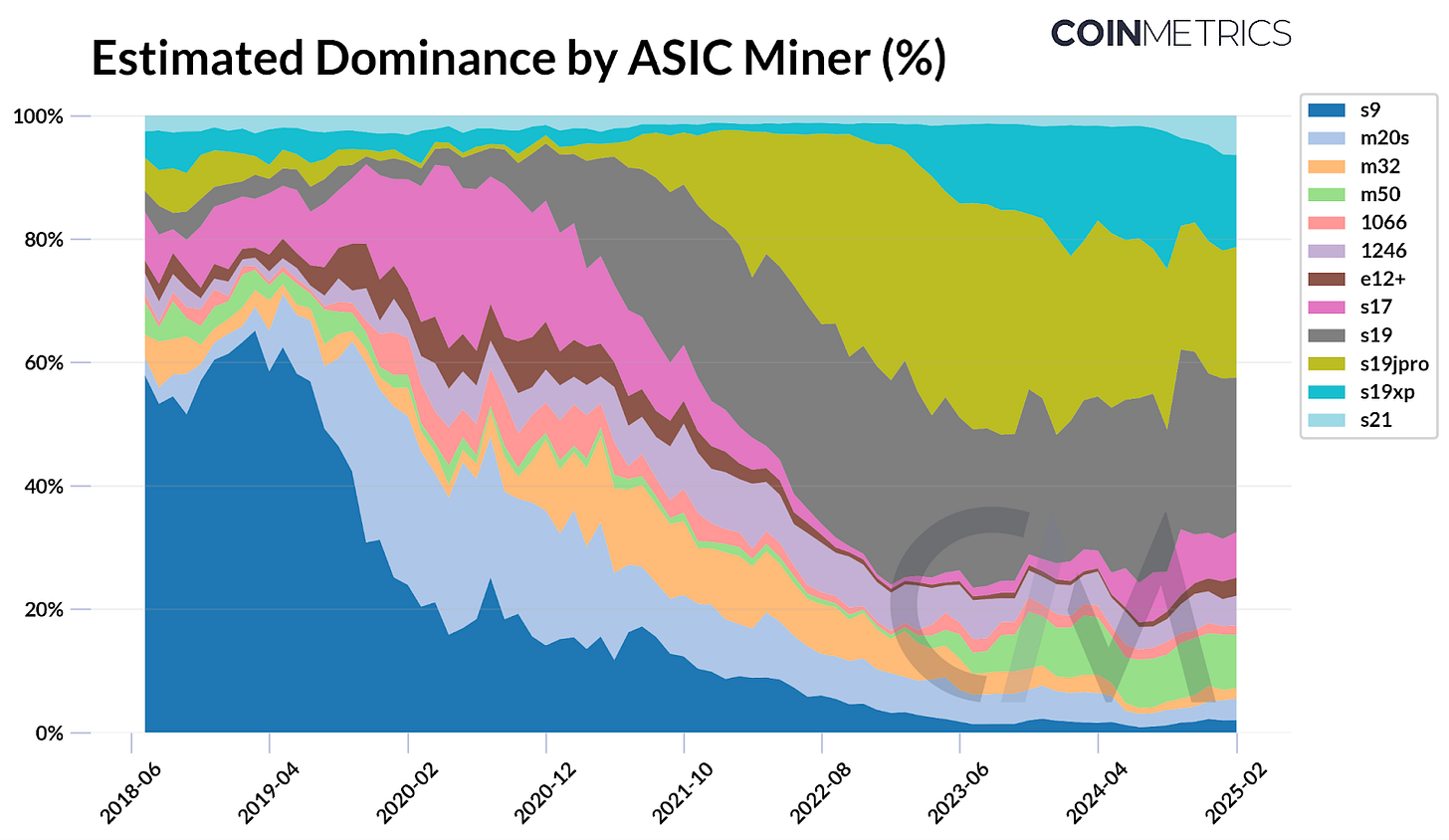

Whereas geographic decentralization and mining pool distribution of hashrate are essential for Bitcoin’s community resilience, the distribution of ASIC {hardware} is one other vital issue to think about. Financial incentives and vitality wants are naturally driving mining operations to diversify geographically, however the geopolitical atmosphere introduces extra complexity to the {hardware} provide chain.

Supply: Sign & The Nonce, MINE-MATCH

Primarily based on nonce patterns linked to real-world ASICs, we estimate that machines manufactured by Bitmain Applied sciences Ltd. (such because the S19, S19j Professional, and S19 XP) at present contribute between 59% and 76% of Bitcoin’s community hashrate. This vary relies on estimates derived from lower-bound, adjusted, and absolutely processed datasets representing totally different ranges of ASIC protection.

With Bitmain accounting for a majority of Bitcoin’s community hashrate, reliance on a single producer, regardless of having distributed provide chains presents a possible danger. Since Bitmain is based totally in China, its dominance highlights how geopolitical dependencies can have an effect on the soundness of mining operations. In early 2025, a number of U.S miners skilled delays in receiving Bitmain shipments attributable to heightened customs scrutiny and new tariffs levied on Chinese language imports. Whereas these delays have different in affect, they spotlight how the geopolitical atmosphere may introduce friction into world mining operations and reshape the present dynamic.

As mining turns into extra aggressive and reliance on transaction charges will increase, understanding how Bitcoin is used at the moment gives useful perception into the sustainability of the community and miner incentives. Whereas its roots lie in being a “peer-to-peer digital money system,” and medium of change, Bitcoin’s utilization is more and more shifting towards that of a world retailer of worth and reserve asset.

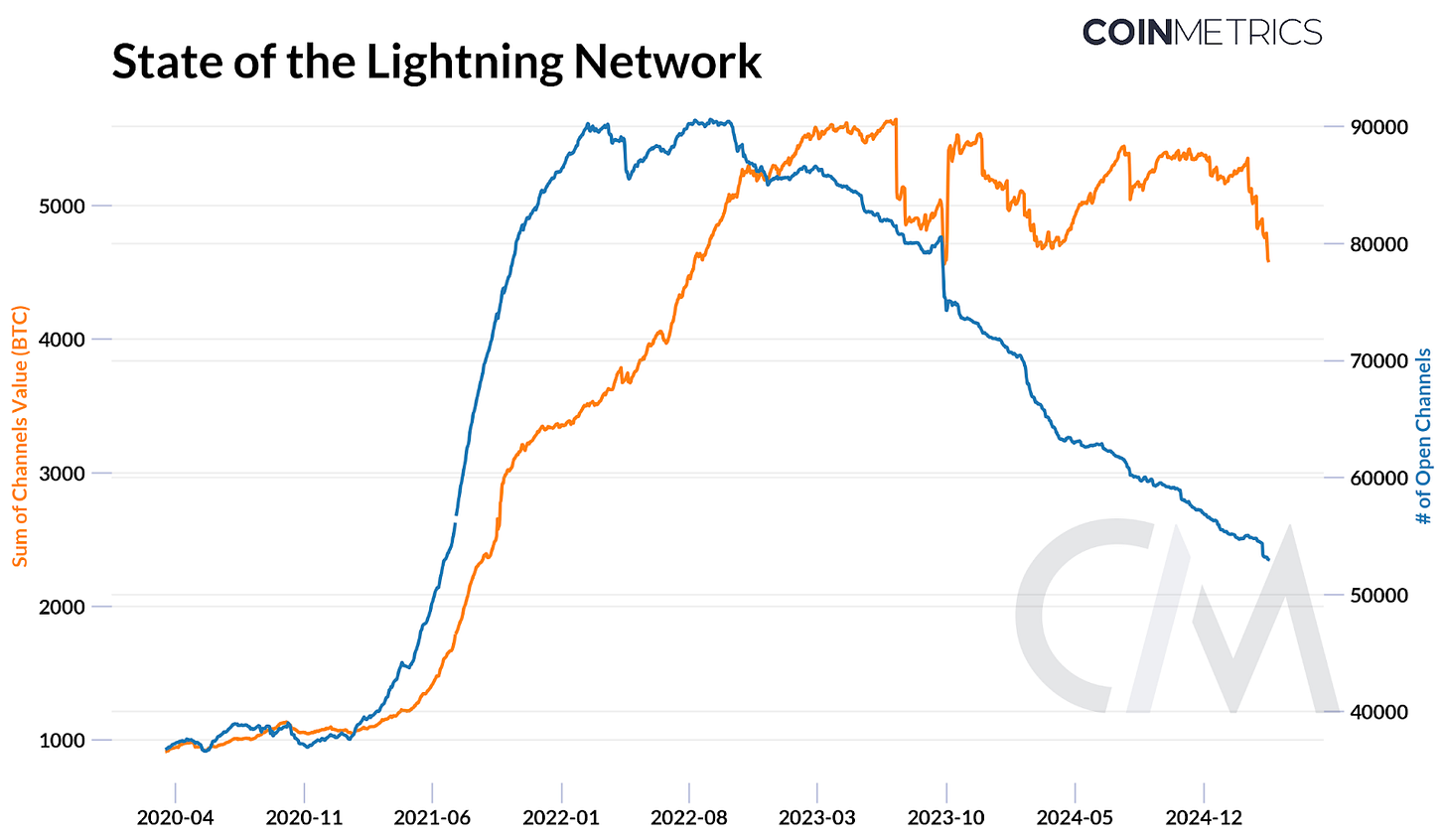

For Bitcoin to perform successfully as a medium of change, limitations round scalability and unpredictable transaction charges prompted the event of second-layer options just like the Lightning Community. The Lightning Community works by creating off-chain cost channels between customers, permitting for near-instant and low-cost transactions that choose the Bitcoin community when channels are closed.

Not too long ago, the variety of open lightning channels has declined to round 52.7K, whereas whole channel worth has remained steady between 4500-5000 BTC. Regardless of fewer seen channels, this means the community has enough capability to deal with the same quantity of worth, probably attributable to improved routing effectivity, channel consolidation and the rising use of personal channels.

Many different Bitcoin rollups and sidechains, corresponding to Stacks, and Botanix are being developed to spice up scalability, transactional exercise and in the end drive larger charge income on Bitcoin. These options purpose to broaden Bitcoin’s utility by enabling good contracts, sooner transactions, and new use circumstances, whereas anchoring to the safety of the bottom layer.

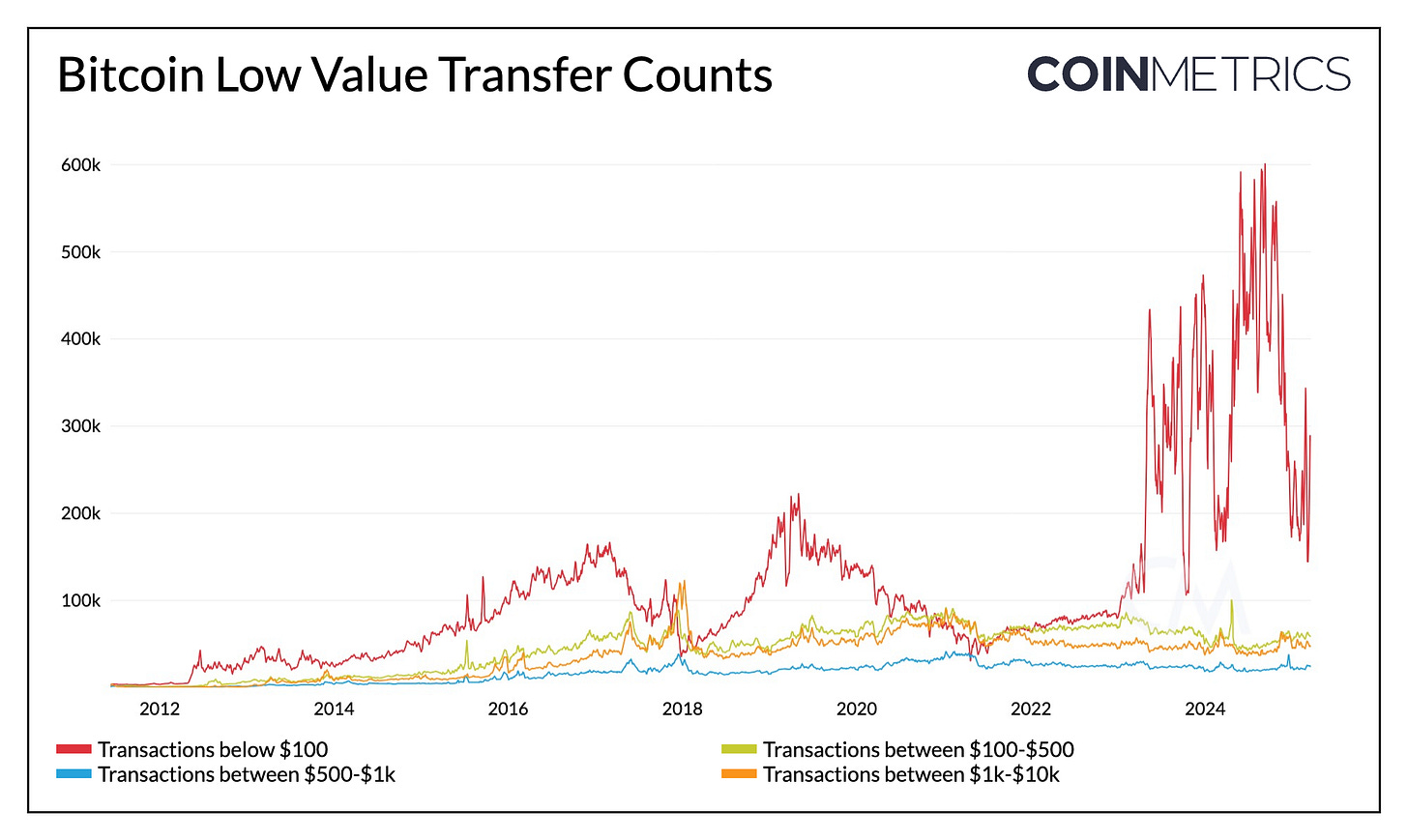

Curiously, the Bitcoin community itself has seen development in decrease worth transactions. Transactions under $100 at present characterize ~60% of Bitcoin’s whole transaction rely, and occasions have additionally represented ~80% throughout elements of 2024. Larger worth transactions (between $100k-$1M) have additionally grown in rely, however account for a smaller portion of exercise than they’ve earlier than.

Supply: Coin Metrics Community Information Professional

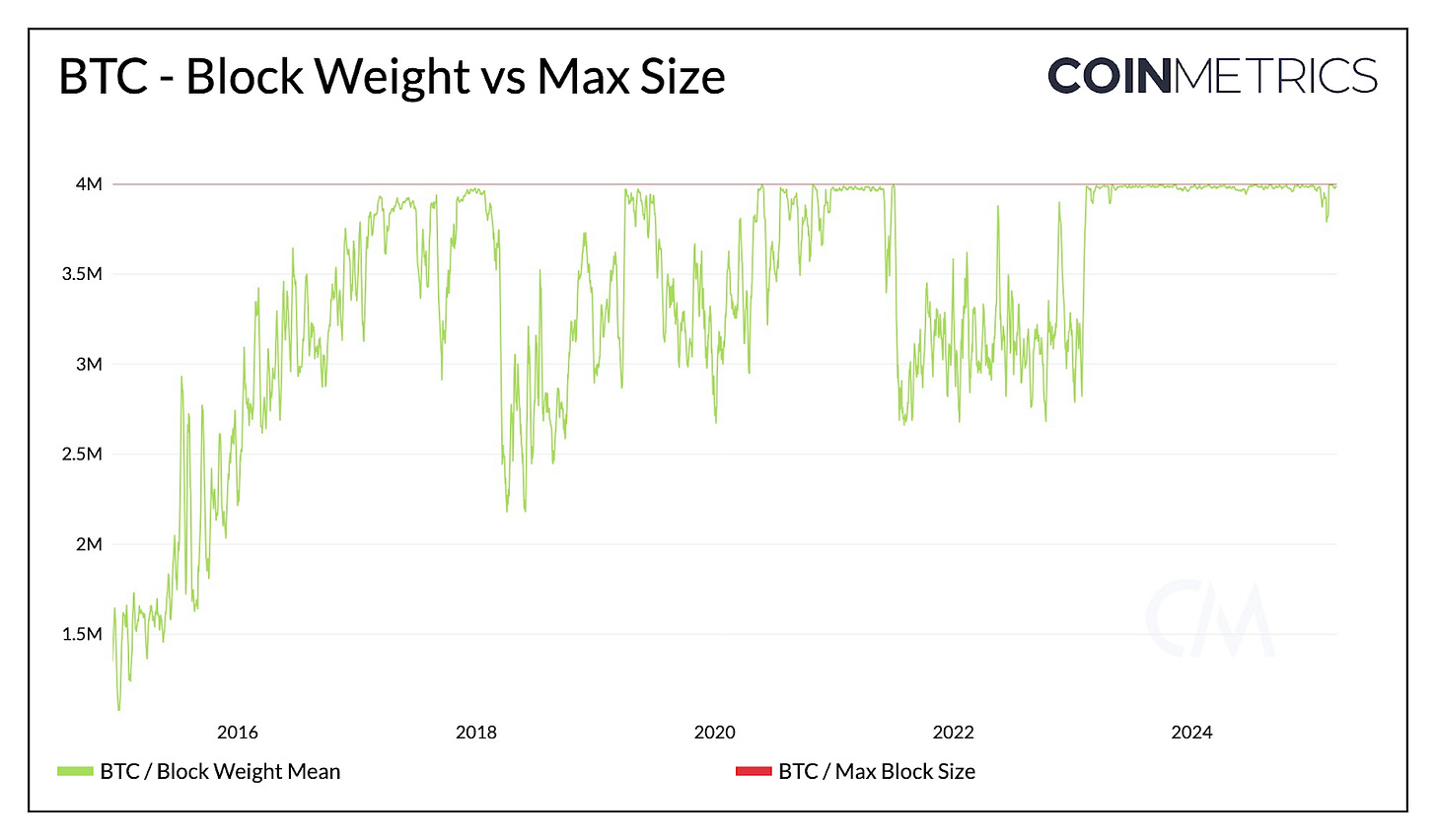

Bitcoin blocks are persistently reaching their most weight restrict of 4 MB, whilst mempool dimension and transactions stay comparatively low. This implies that block area is being crammed primarily by low-value, low-fee transactions, with restricted competitors for inclusion—leading to decrease common and whole charges, except for occasional spikes pushed by demand for Ordinal inscriptions and Runes. Over time, elevated participation from higher-value or extra time-sensitive exercise may assist drive stronger charge income, supporting miner incentives as block rewards decline.

Supply: Coin Metrics Community Information Professional

Whereas a number of efforts to reinforce Bitcoin’s transactional utility and position as a medium of change are underway, Bitcoin is more and more being acknowledged as a “Retailer of Worth”. Its shortage and predictable issuance schedule are key properties which have earned it the title of “digital gold.” This narrative has accelerated lately, with possession shifting towards establishments, public firms, ETFs, and even nation-states, with over 14% of BTC provide held by such entities.

Supply: Coin Metrics Community Information Professional

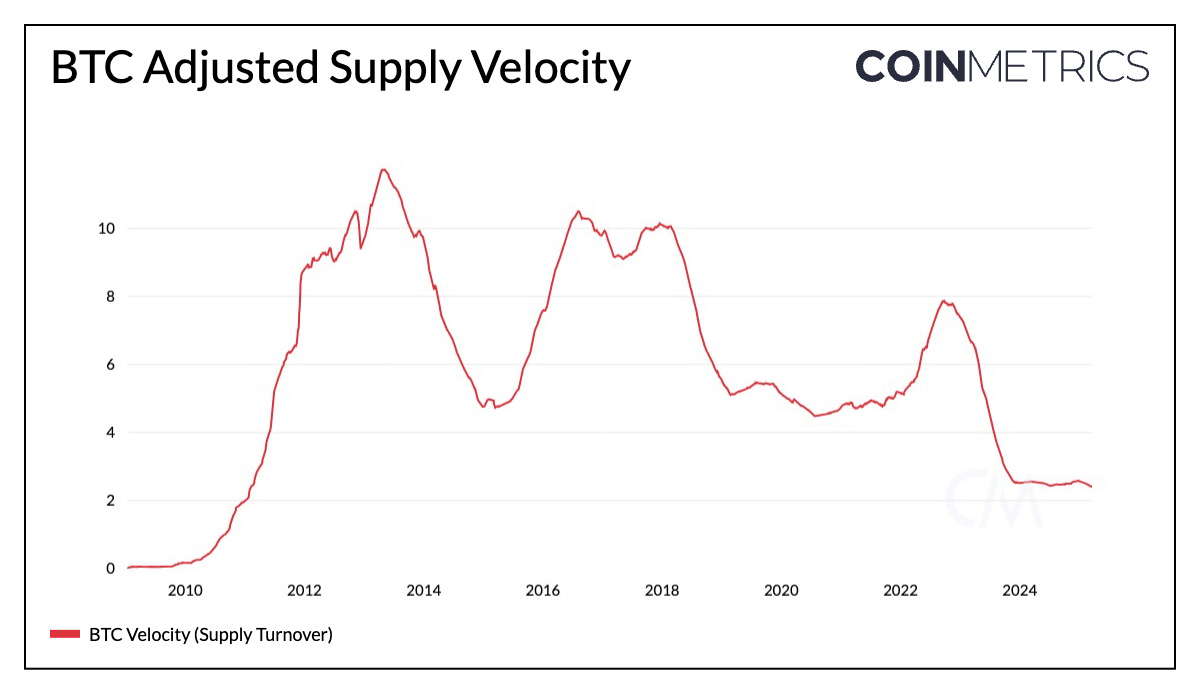

The shift in the direction of long-term holding is supported by on-chain knowledge. Bitcoin’s provide velocity, measuring the ratio of adjusted switch quantity to its present provide (charge of turnover), has declined over time, reinforcing the concept that BTC is more and more held fairly than transacted.

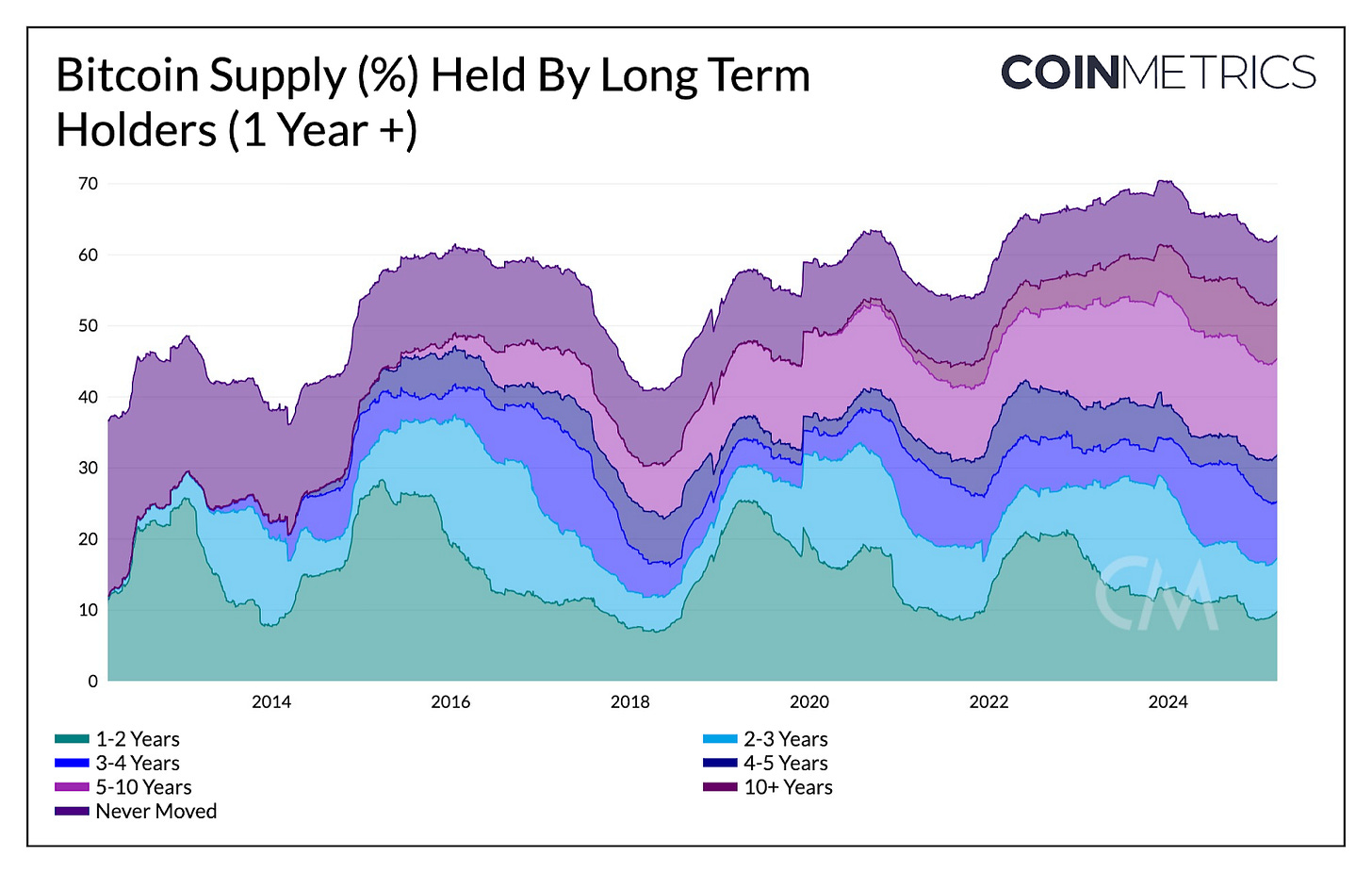

Moreover, Bitcoin provide age bands (“HODL Waves”) will let you see Bitcoin’s evolving provide distribution based mostly on holding time. The share of provide held by long-term holders (1-year or extra) continues to rise, not too long ago reaching ~63%. These tendencies spotlight how Bitcoin’s position is evolving into that of a retailer of worth and reserve asset.

Supply: Coin Metrics Community Information Professional

As Bitcoin miners adapt to the realities of diminished block rewards, adapting via {hardware} upgrades, regional shifts, and strategic diversification, the significance of sustainable charge income continues to develop in significance. On the similar time, Bitcoin’s utilization is evolving: whereas low-value transactions and Layer-2 exercise proceed to develop, long-term holding is more and more dominant, reinforcing its position as a retailer of worth. Balancing these twin narratives can be key to making sure the long-term well being of the community and the financial viability of its safety mannequin.

-

We’re excited to share that Coin Metrics has acquired a grant from dYdX to ship institutional-grade analytics for dYdX v4. Learn the total announcement.

-

Observe Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As at all times, when you’ve got any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier problems with State of the Community right here.