Get the very best data-driven crypto insights and evaluation each week:

By: Tanay Ved

As we wrap up 2024, a 12 months that stands in stark distinction to the crypto winter of 2022, we’d prefer to pause and reminisce on a momentous 12 months for the crypto business. 2024 was one of the consequential years within the historical past of crypto throughout a number of fronts, beginning with the launch of Bitcoin ETFs and concluding with Bitcoin crossing $100K post- election. On this particular situation of Coin Metrics’ State of the Community, we revisit the key developments that formed the digital belongings business in 2024 by means of a data-driven lens.

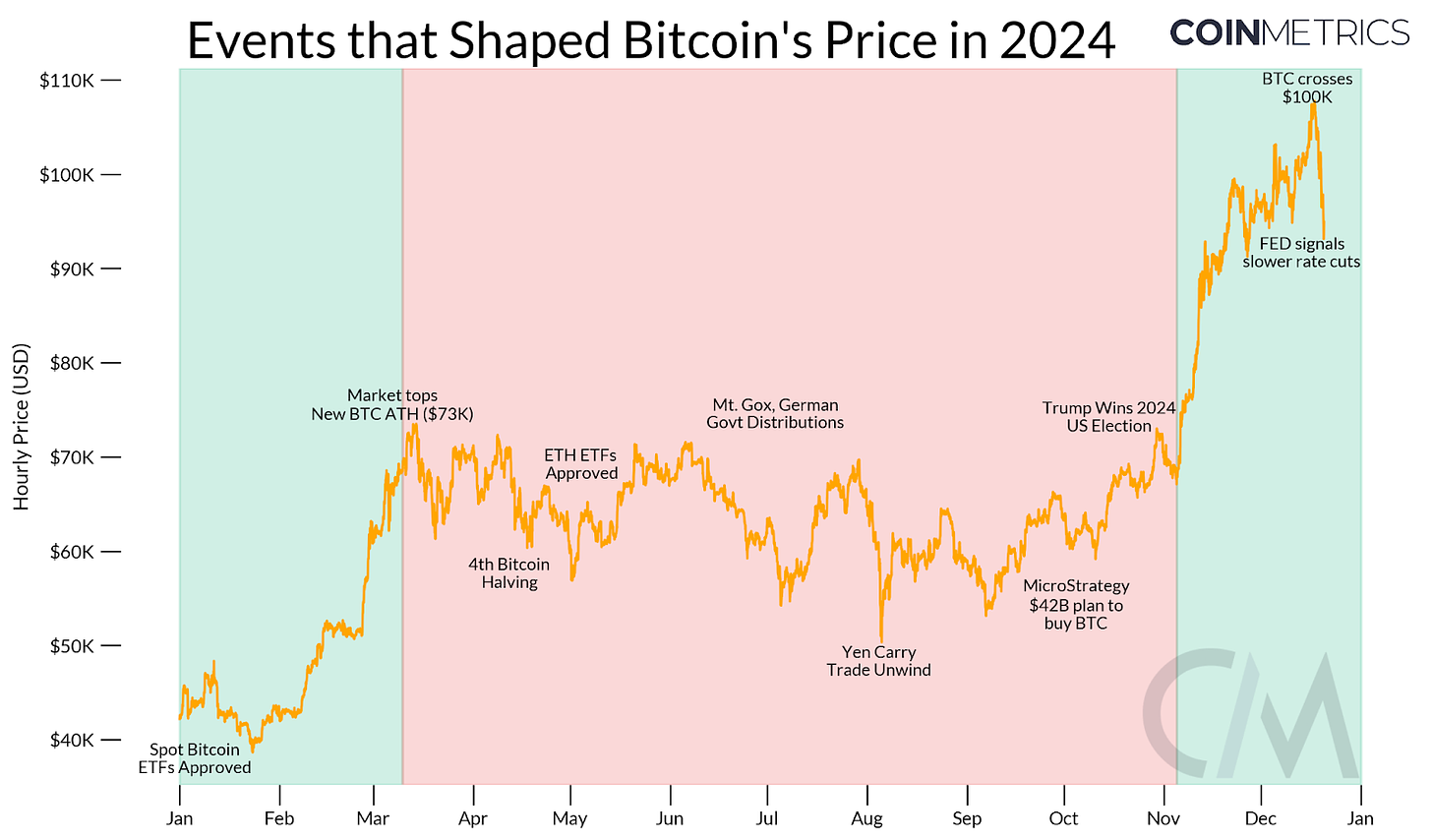

Supply: Coin Metrics Reference Charges, Intraday

Propelled by the explosive success of Bitcoin ETFs in January, the crypto market noticed a powerful section of development in Q1 with Bitcoin hovering to new all-time highs of $73K. What adopted was a quieter interval of consolidation, characterised by subdued catalysts and important provide redistributions from main market individuals. Now, as 2024 attracts to a detailed, optimism has returned, fueled by a pro-crypto U.S. administration and the onset of a rate-cutting cycle.

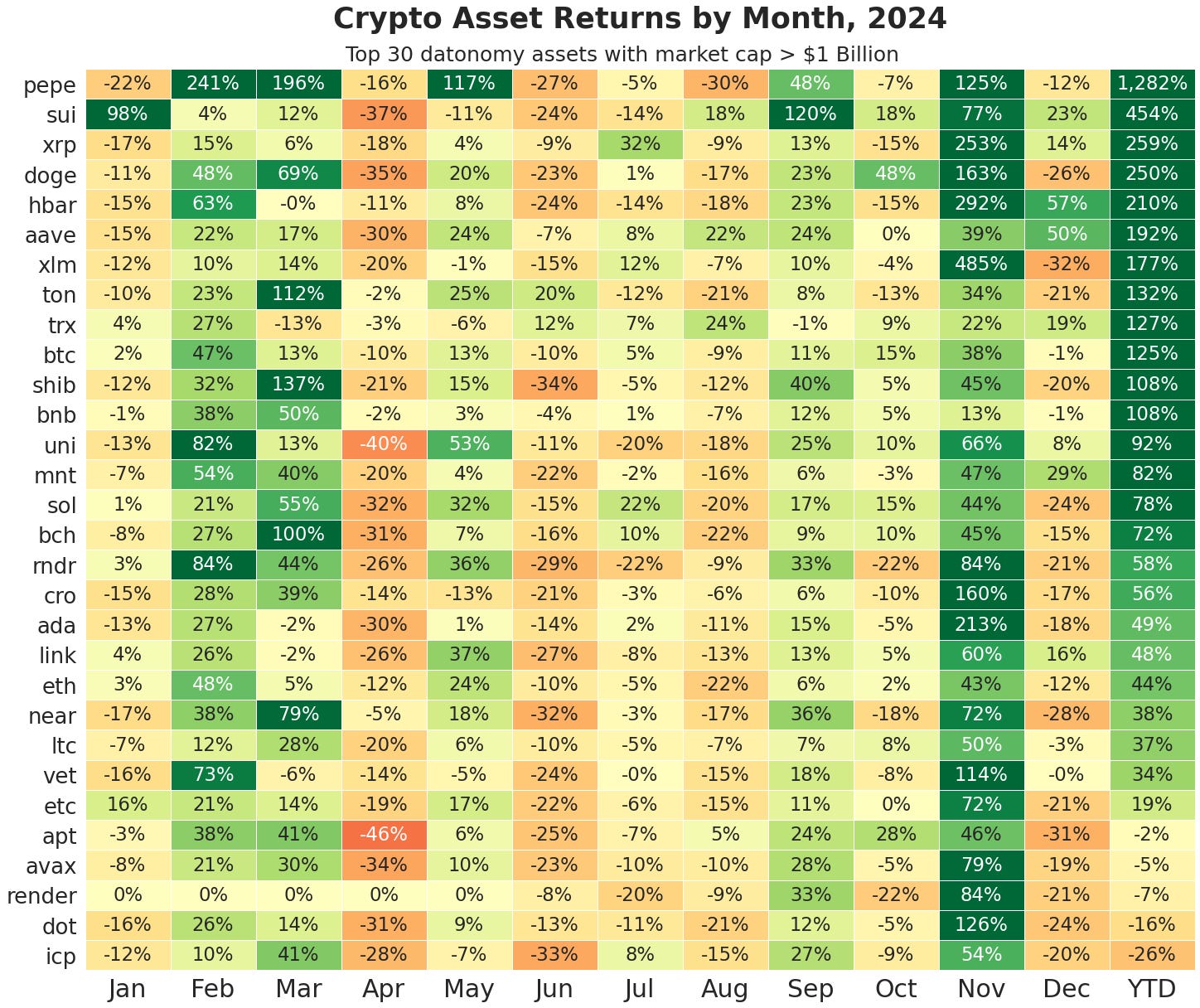

Supply: Coin Metrics Reference Charges, datonomyTM (As of Monday December twenty third)

Bitcoin (BTC) undeniably took middle stage this 12 months, outperforming conventional asset lessons and crypto-assets with a 125% achieve year-to-date. Solana (SOL) led the market a number of instances this cycle, ending the 12 months 78% larger, whereas Ethereum’s (ETH) continued its relative underperformance, rising 44% over the 12 months.

The chart above illustrates the highest 30 cryptoassets within the datonomyTM universe, with a market capitalization of over $1 Billion. Memecoins like DOGE and PEPE captured widespread consideration fueled by retail exuberance, whereas “Dino cash” comparable to Ripple (XRP) and Stellar (XLM) staged an surprising comeback. Different Layer-1s like Sui (SUI) and established blue-chip DeFi protocols like Aave additionally gained traction, reflecting the investor sentiment and thematic rotations that formed the market in 2024.

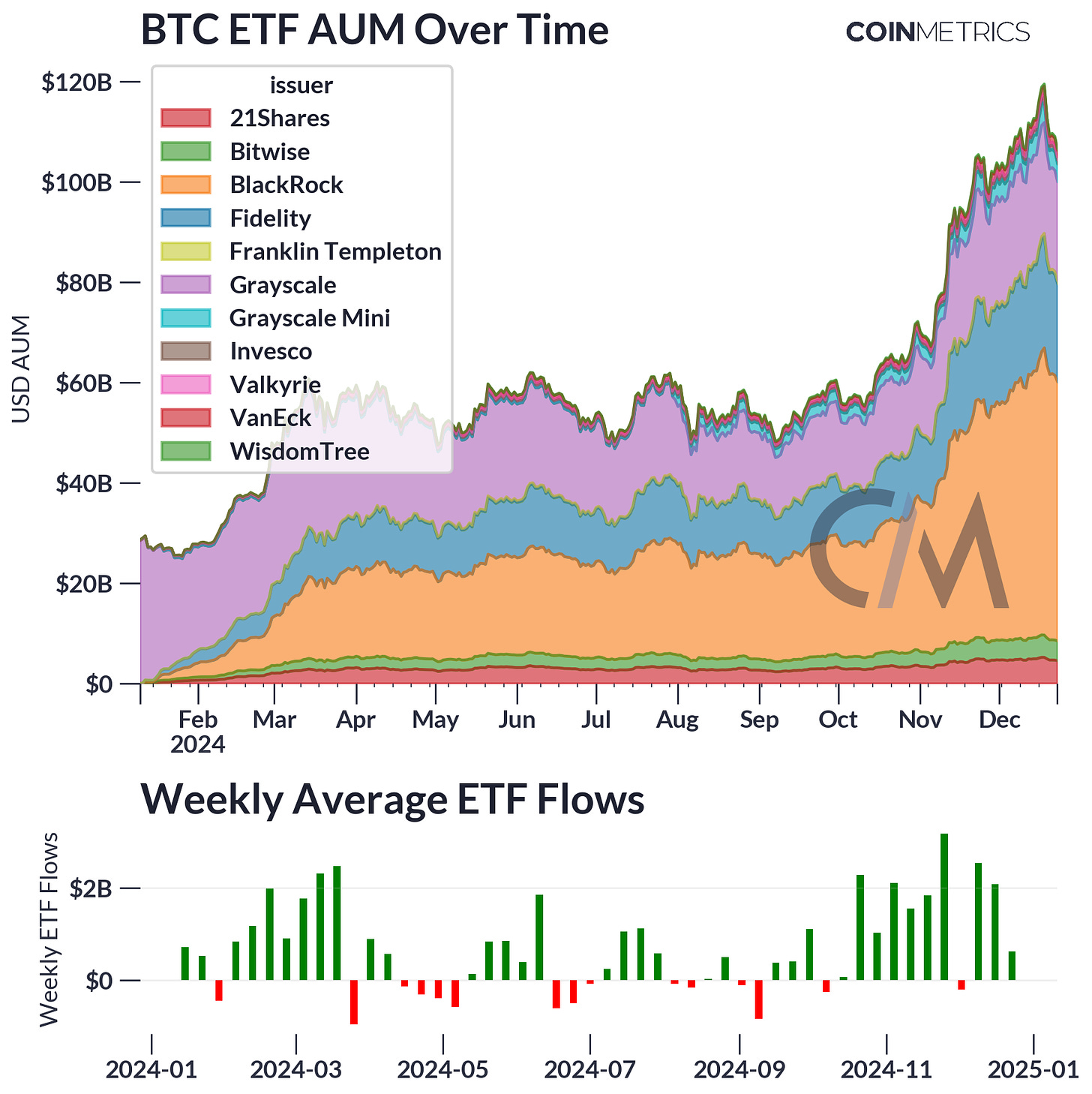

The arrival of spot Bitcoin ETFs ushered in a big wave of adoption and opened the floodgates to Wall Avenue. Property beneath administration (AUM) for the 11 issuers now exceeds $105B, with over 1.2M bitcoin held by the autos. This quantities to five.6% of Bitcoin’s present provide with demand from company stability sheets additional accelerating the tempo at which provide is absorbed. In lower than a 12 months since their launch, spot Bitcoin ETFs have skilled strong flows, cementing their place as essentially the most profitable debut of any ETF class in historical past.

Weekly flows illustrate constant accumulation, with peak weeks exceeding $2B in internet additions, though occasional outflows had been noticed throughout market consolidations in the summertime months.

Supply: Coin Metrics Labs

In parallel to this Bitcoin pushed institutional adoption that pushed the general market larger, memecoins began to draw super mindshare, resulting in an uptrend pushed by excessive ends of the danger spectrum. In early March, spot buying and selling quantity for meme cash hit $13B, because the market capitalization of main meme cash reached $60B.

Supply: Coin Metrics Market Knowledge Feed

Whereas established, large-cap memecoins noticed a lift, a majority of exercise stemmed from an enormous bang of newly launched meme cash on Solana. A platform known as pump.enjoyable turned the epicenter of the memecoin explosion in Q1, facilitating the creation of over 75,000 tokens and pushed energetic wallets on Solana to a then-record excessive of two.06M. Whereas these excessive ranges of exercise didn’t maintain, meme cash made a comeback, with volumes eclipsing $23B in November. New AI-agent platforms like Virtuals on Base have injected contemporary power into this phenomenon.

Supply: Coin Metrics Community Knowledge Professional

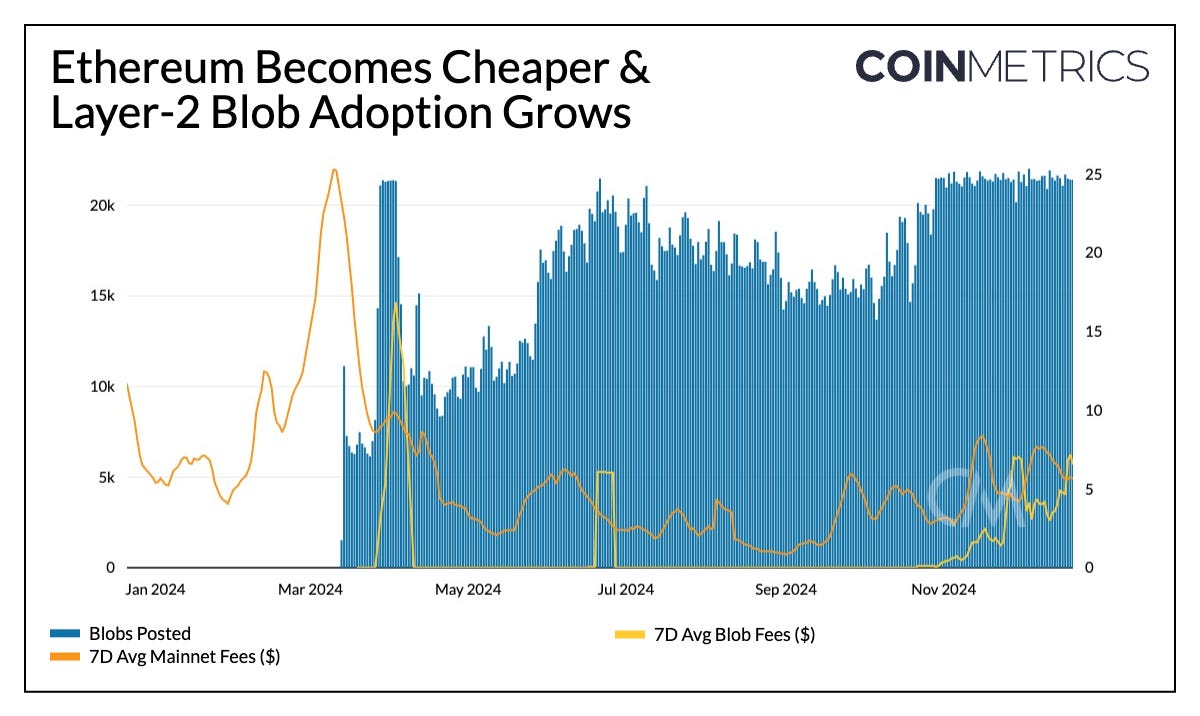

March additionally marked a serious milestone for Ethereum with the deployment of EIP-4844 as a part of the Dencun improve. Quickly after, Ethereum Layer-2 rollups adopted a brand new price marketplace for blob transactions in parallel to mainnet. This laid the inspiration for Ethereum to scale execution with the assistance of Layer-2s like Base, Optimism and Arbitrum whereas decreasing the price of settlement to the Layer-1, making transacting on the community extra reasonably priced. Demand for blobs has been strong, with Ethereum constantly hitting its goal capability of three blobs per block simply seven months after launch.

Whereas this has made the Ethereum ecosystem extra accessible, it has arguably hindered ETH’s worth accrual as a consequence of decreased Layer-1 charges, whereas additionally contributing to a extra fragmented consumer expertise. Nonetheless, there aren’t any indicators of exhaustion within the area, with Layer-2s being spun up by outstanding exchanges in Kraken & Uniswap, Deutsche Financial institution and a multinational conglomerate (Sony), with will increase in blob capability on the horizon.

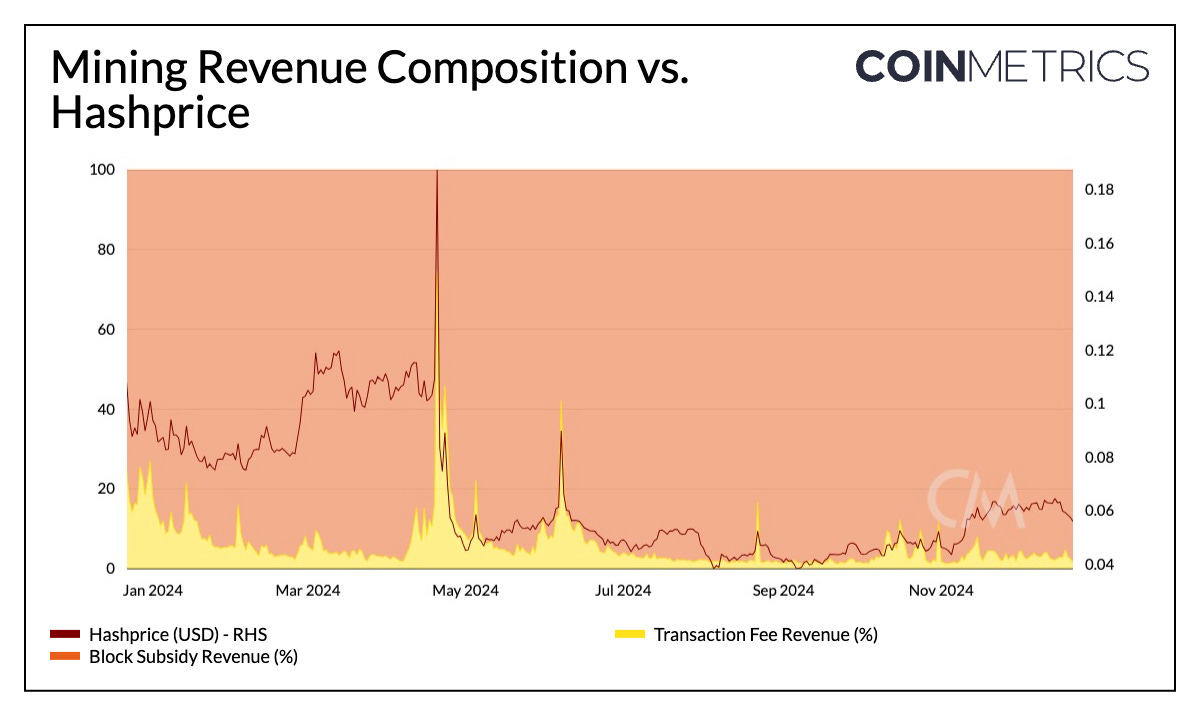

Q2 was characterised by a interval of consolidation, the place the market discovered itself rangebound pushed by an absence of catalysts. In April, Bitcoin underwent its quadrennial halving occasion, decreasing BTC’s each day issuance from 900 to 450 BTC. As is typical with halvings, this offered an inflection level for the mining business, forcing miners to adapt to the diminished block subsidies. The occasion spurred upgrades to extra environment friendly ASIC {hardware}, triggered additional consolidation within the mining sector, and prompted some miners to repurpose their infrastructure for AI information facilities to diversify income streams.

As proven within the chart beneath, transaction charges turned a key element of mining income, partially offsetting declining block subsidies. Regardless of this, the general hashprice (each day USD income per TH/s) remained beneath stress, reflecting miners’ rising reliance on community exercise for sustainability.

Supply: Coin Metrics Community Knowledge Professional

Compounding these challenges had been extra provide pressures. One of the crucial notable was the long-awaited distribution of belongings from the Mt. Gox chapter, which noticed 1000’s of BTC re-enter the market. Equally, the German authorities’s sale of over 50,000 BTC seized in felony investigations added to the promoting stress, exacerbating supply-side dynamics. Regardless of this confluence of gross sales, Bitcoin’s liquidity proved resilient, absorbing the availability with out main disruptions to market stability. Trying forward, promoting pressures could ease as FTX collectors are set to obtain money distributions in 2025 that might re-enter the market.

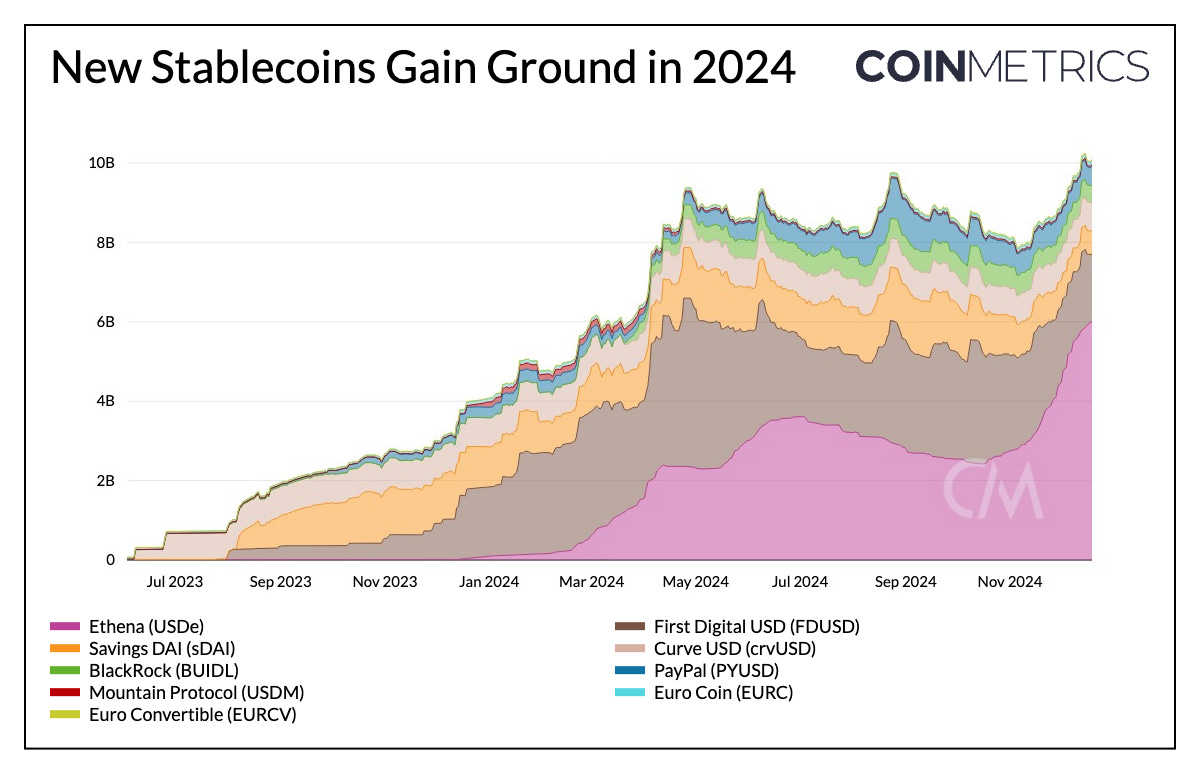

Ubiquitously acknowledged as “crypto’s killer app”, the worldwide significance of stablecoins began permeating past the crypto business. Stablecoins continued to export the greenback world wide, crossing an combination $210B in provide. USDT ($138B) and USDC ($42B) remained the dominant gamers, whereas a majority of stablecoin provide tilted in favor of the Ethereum community, with $122B in stablecoin provide. Altogether, stablecoins facilitated $1.4T in month-to-month (adjusted) switch volumes in November.

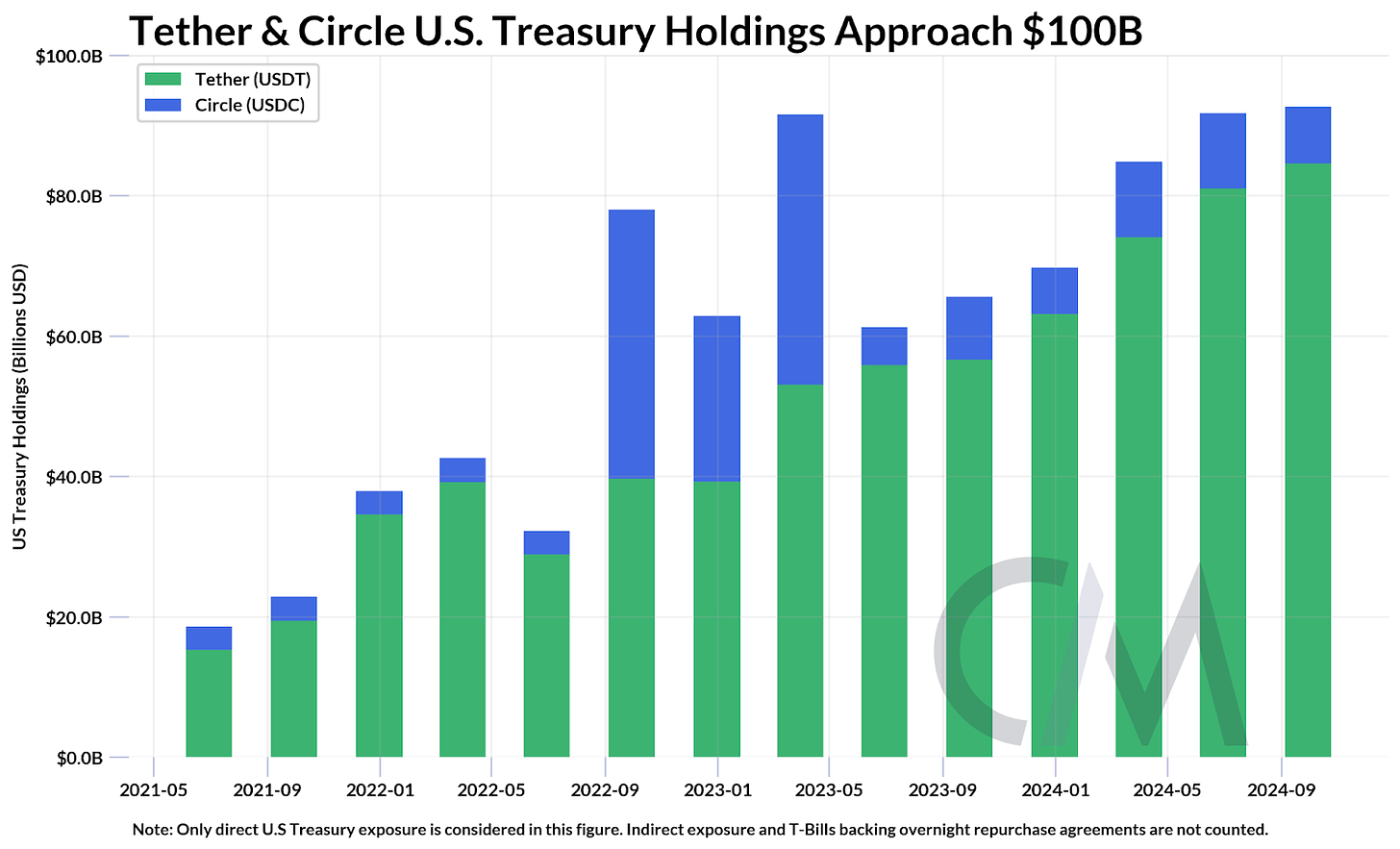

Whereas stablecoins’ position as a medium of trade and retailer of worth in rising economies has been extensively explored, momentum round their utility in funds and monetary companies infrastructure accelerated with Stripe’s acquisition of Bridge. Moreover, with 99% of stablecoins USD-pegged and practically $100B immediately invested in U.S. Treasuries by Tether and Circle, in addition they solidified their place as key autos for preserving greenback dominance on a worldwide scale.

Supply: Tether & Circle Attestations

In parallel, BlackRock entered the tokenization area, launching the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), investing in dollar-equivalent belongings like money and US Treasury payments. BUIDL rapidly reached a provide of 500M, rising the panorama of tokenized securities on public blockchains. The ecosystem expanded in 2024, providing stablecoins with various threat profiles, liquidity, collateral and financial savings mechanisms. Ethena’s USDe stood out, rising from $91M to $6B in market capitalization to grow to be the third-largest stablecoin by leveraging constructive funding charges throughout market uptrends to ship enticing yields to holders. In the meantime, First Digital USD (FDUSD) gained prominence as a supply of liquidity and extensively used quote foreign money on exchanges.

Regulatory concentrate on stablecoins intensified, reflecting their rising significance within the international monetary system. The European Union applied stablecoin-specific necessities beneath the Markets in Crypto-Property (MiCA) regulation, which has begun to reshape the Euro-pegged stablecoin sector.

Supply: Coin Metrics Community Knowledge Professional

The 2024 U.S. presidential election had a profound influence on digital asset markets, propelling BTC above $100K for the primary time. Specialised Cash (together with meme & privateness cash) and Good Contract Platforms in Coin Metrics’ datonomyTM universe had been standout sectors, returning 129% and 84% for the reason that election, respectively.

Supply: Coin Metrics datonomyTM

Main as much as the election, we additionally witnessed the rise of prediction markets like Polymarket, which performed a pivotal position in capturing the collective intelligence for electoral outcomes. At its peak, Polymarket crossed an open curiosity of $450 million. Whereas exercise on the platform has now subsided, it showcased the utility and potential for info markets on public blockchains.

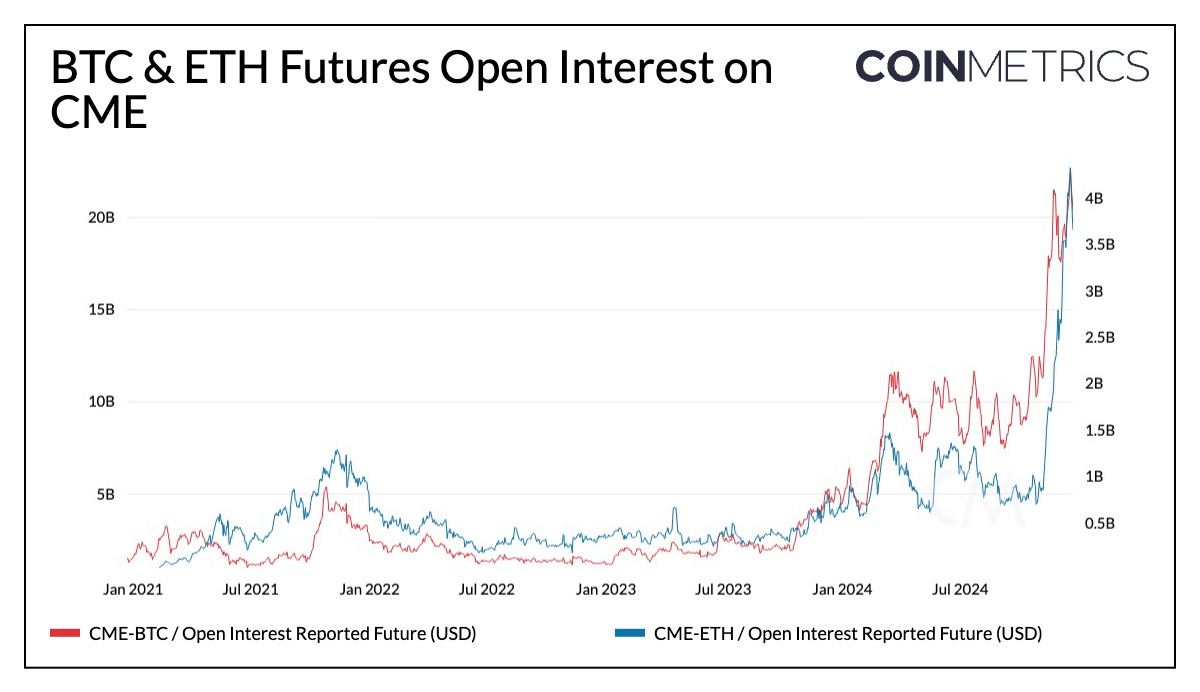

Market optimism surged post-election, fueled by the administration’s pro-crypto stance, a stark departure from the regulatory headwinds of the prior SEC regime. Demand from ETFs and company treasuries bolstered the rally, with MicroStrategy’s holdings reaching 444,262 BTC, funded by its fairness and convertible bond choices. Institutional curiosity hit new highs in derivatives markets, as mirrored in document Bitcoin futures open curiosity of $22.7B on CME out of a complete of $52B+, alongside the launch of options-based ETFs.

Supply: Coin Metrics Market Knowledge Feed

Regardless of this momentum, uncertainties stay concerning the implementation and timeline of crypto-friendly insurance policies. Whereas there are clear indications of a shift in direction of a extra supportive regulatory setting, together with the appointment of crypto advocates to key positions like SEC chair and crypto czar, particular regulatory frameworks stay unclear. Market exuberance has additionally been tempered by revised expectations for rate of interest cuts, leaving individuals cautiously optimistic heading into 2025.

Nonetheless, 2024 leaves us with a powerful basis: the introduction of spot Bitcoin ETFs, acceleration of stablecoin adoption, important strides in on-chain infrastructure and purposes, and a pro-crypto administration taking workplace on the onset of a rate-cutting cycle. As we transition into the following 12 months, keep tuned for our 2025 Crypto Outlook report, the place we’ll discover key themes and developments shaping the 12 months forward.

Discover our weekly State of the Community (SOTN) & State of the Market (SOTM) newsletters on our insights web page. As all the time, in case you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.