Get the perfect data-driven crypto insights and evaluation each week:

By: Matías Andrade

Key Takeaways:

-

The 2024 Bitcoin halving occasion had a considerable affect on miner profitability, with a pointy drop in BTC-denominated income per terahash (TH/s) of mining energy, although the latest surge in Bitcoin’s value to over $105,000 has partially offset this affect.

-

The efficiency of publicly traded Bitcoin mining shares has exhibited greater volatility in comparison with Bitcoin’s value actions, with firms possessing stronger steadiness sheets and extra environment friendly mining gear, equivalent to Hut8, Bitdeer, and Core Scientific, outperforming their friends.

-

Evaluation of the ASIC distribution on the Bitcoin community reveals a major transition in mining {hardware} dominance, with the present panorama being largely dominated by the S19 collection machines, demonstrating the fast tempo of effectivity enhancements in mining {hardware} as operators repeatedly improve.

-

Going ahead, the power of Bitcoin miners to adapt to the community’s programmed provide changes, optimize operations, and leverage technological developments can be essential to their long-term competitiveness and profitability.

The worldwide bitcoin mining business has change into a fancy and geographically dispersed panorama, with miners consistently searching for out essentially the most favorable situations to energy their energy-intensive operations. In contrast to the idealized imaginative and prescient of a borderless, 24/7 cryptocurrency community, the fact on the bottom is that bitcoin mining exercise is very delicate to components equivalent to regional vitality insurance policies, weather conditions, and even cultural preferences.

On this week’s challenge of State of the Community, we’ll take a deep dive into the shifting patterns and developments shaping the bitcoin mining business around the globe. By way of an in depth evaluation of information on bitcoin’s hash charge and mining problem, we’ll uncover the distribution of mining energy and the way it has advanced over time, profiting from a few of the distinctive insights powered by Coin Metrics information.

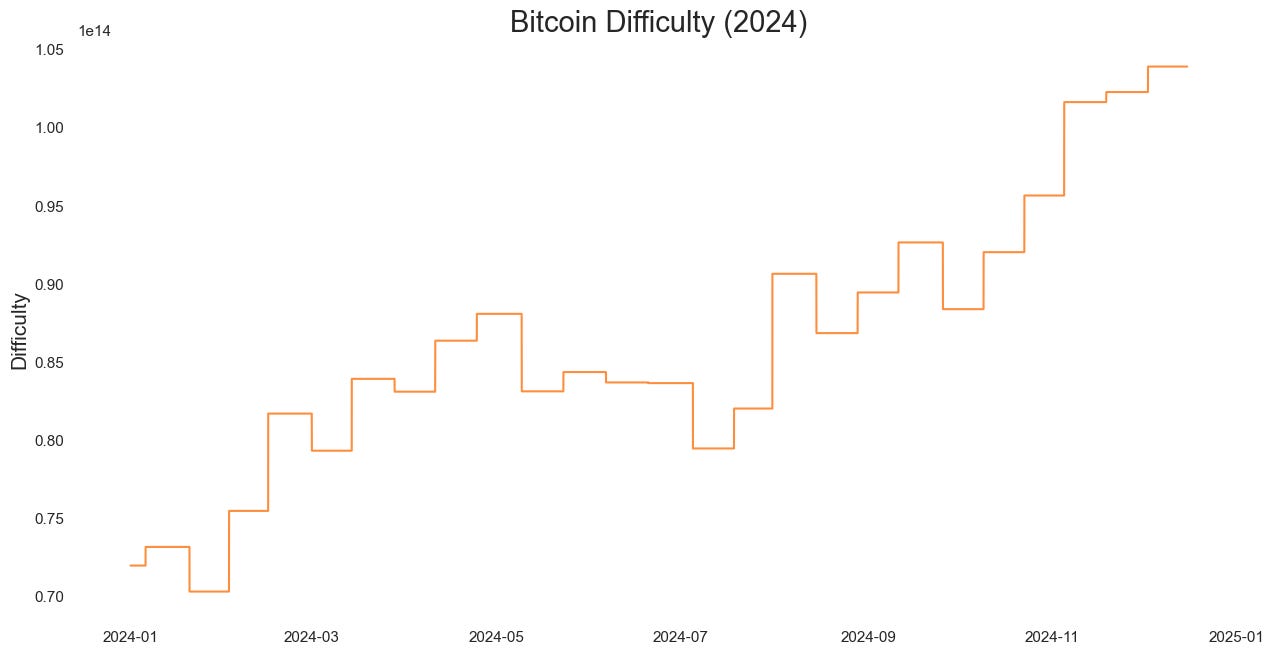

One of the vital vital occasions within the Bitcoin ecosystem is the periodic halving of the block reward, which occurred most just lately on April, 2024. This extremely anticipated occasion, which takes place roughly each 4 years, cuts the reward acquired by Bitcoin miners in half, successfully decreasing the brand new provide of BTC getting into circulation.

As anticipated, the 2024 halving had a major affect on the Bitcoin mining business. Our evaluation of mining problem changes, proven within the chart beneath, reveals a pointy improve within the months main as much as the halving as miners raced to maximise their rewards earlier than the lower.

Supply: Coin Metrics Community Information Professional

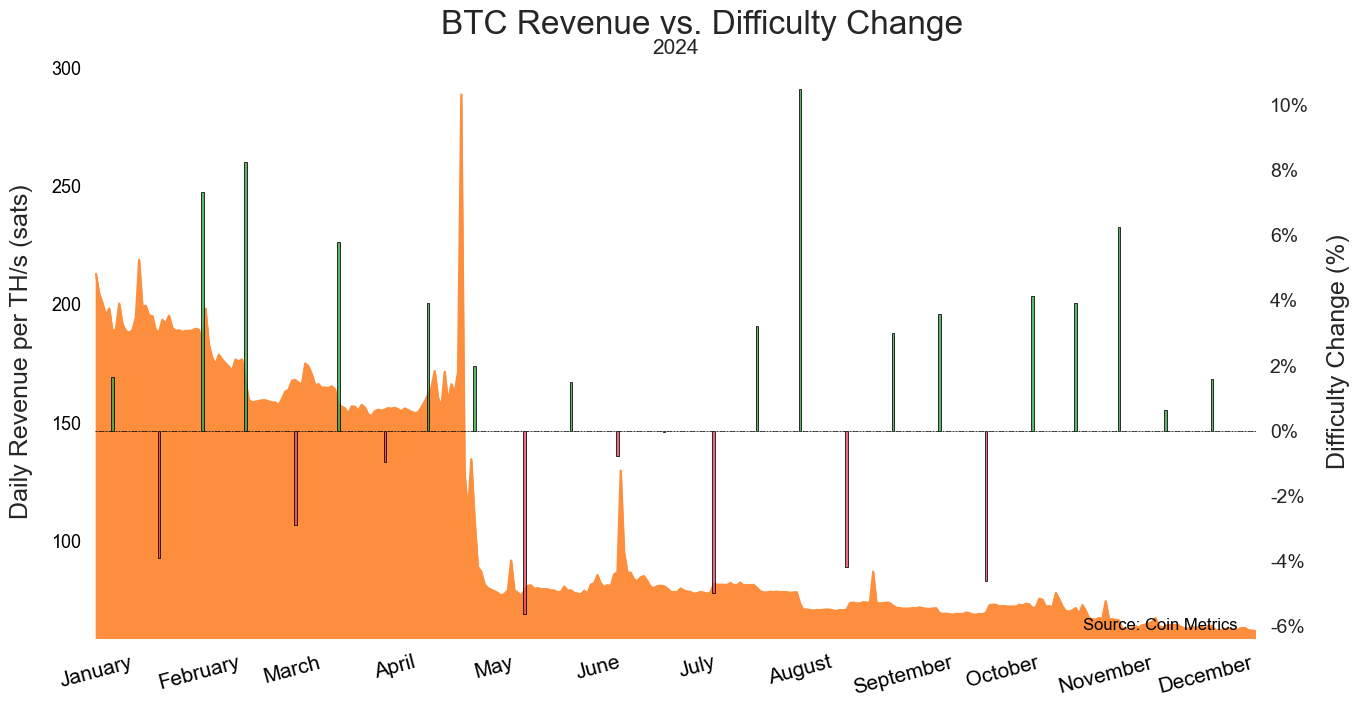

The discount in block rewards has straight impacted the income earned by Bitcoin miners, as illustrated beneath. Our information exhibits a transparent drop in BTC-denominated income per terahash (TH/s) of mining energy instantly following the halving, as miners needed to deal with incomes half the earlier reward for every block they efficiently validated.

Supply: Coin Metrics Community Information Professional

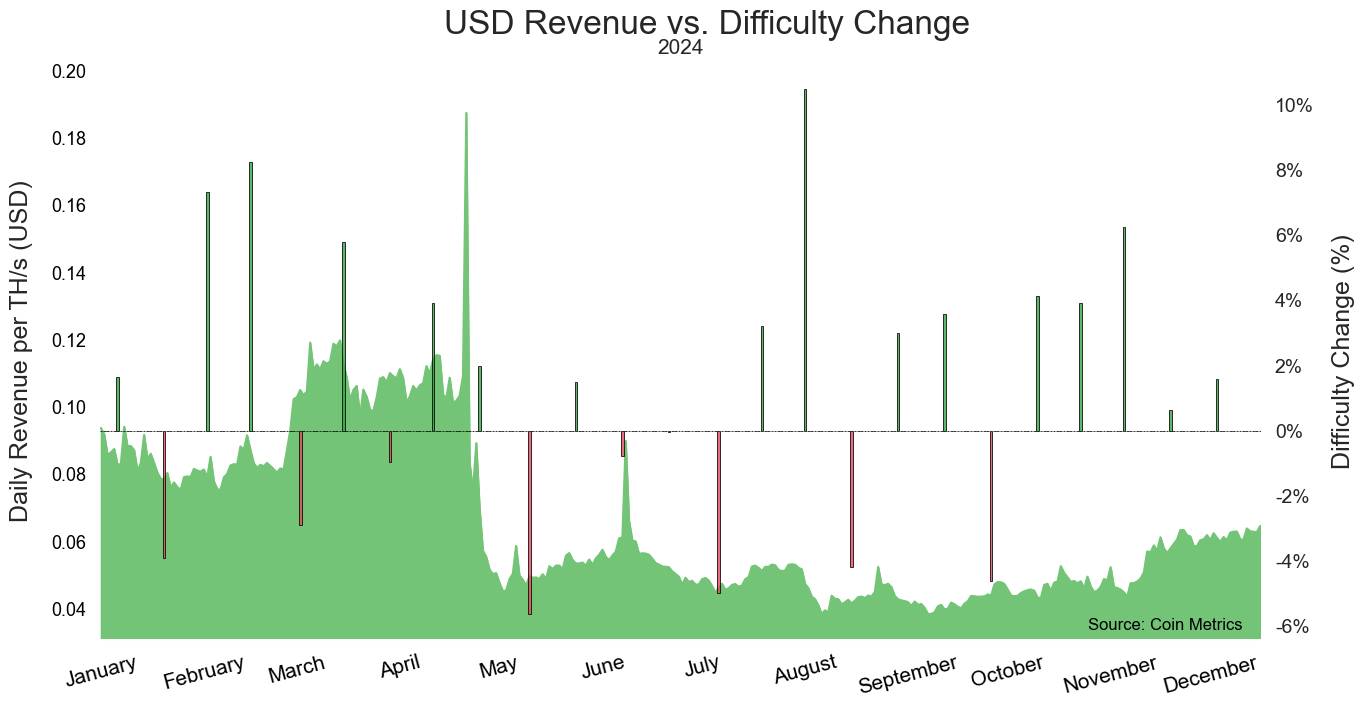

Whereas the BTC-denominated income declined, the latest rally in Bitcoin’s value to over $107,000 has partially offset the affect, as proven beneath. The USD income per TH/s of mining energy has recovered considerably, although it stays beneath the pre-halving ranges, as miners face the problem of sustaining profitability with decreased block rewards.

Supply: Coin Metrics Community Information Professional

These developments spotlight the resilience and flexibility required of Bitcoin miners within the face of the community’s programmed provide changes. Because the business continues to evolve, miners might want to optimize their operations, search out essentially the most cost-effective vitality sources, and leverage technological developments to stay aggressive within the ever-changing panorama of cryptocurrency mining.

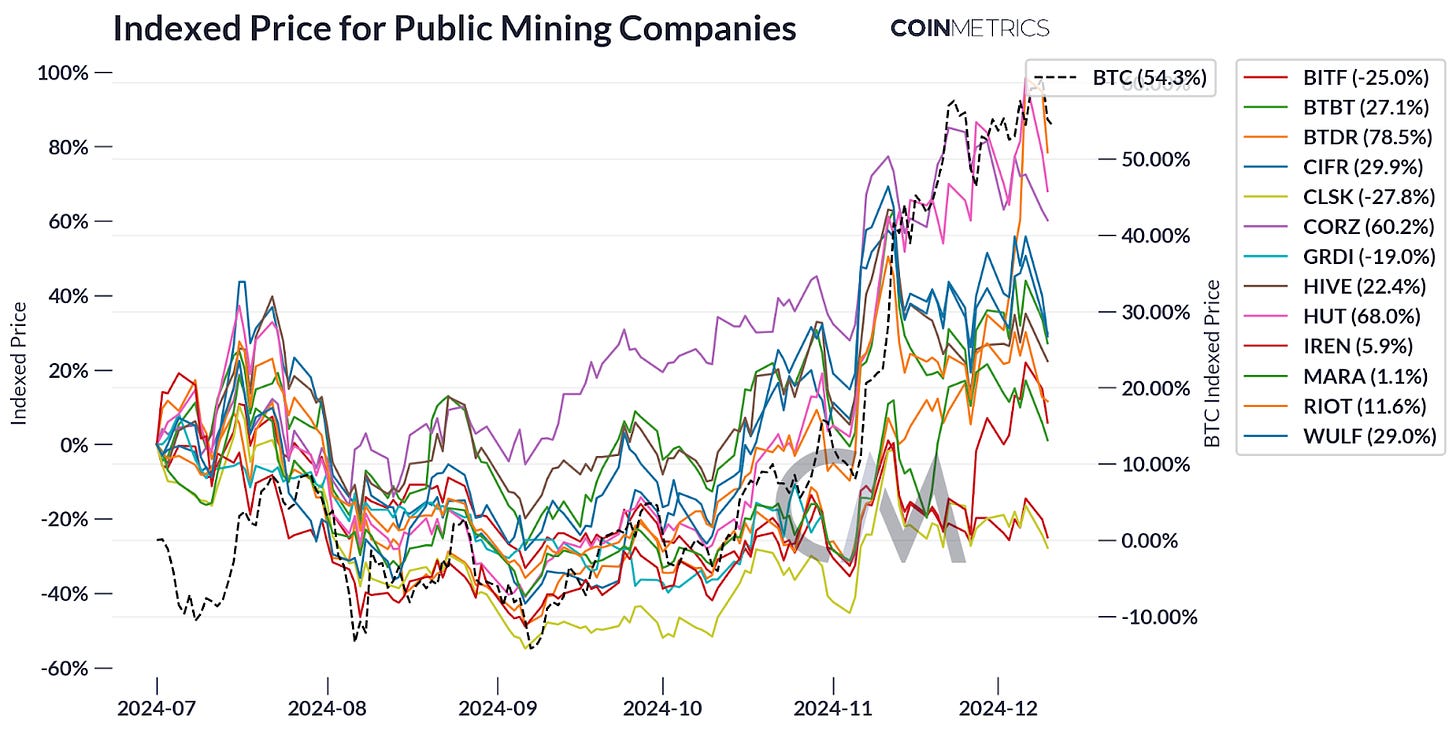

The efficiency of publicly traded Bitcoin mining shares has proven robust correlation with Bitcoin’s value actions, however with notably greater volatility. As Bitcoin has reached new all-time highs in 2024, mining firms have skilled vital value appreciation, although their trajectories have different primarily based on components like operational effectivity, debt ranges, and mining capability.

Key mining firms like Marathon Digital Holdings (MARA), Riot Platforms (RIOT), and CleanSpark (CLSK) have seen their inventory costs surge a number of hundred p.c from their 2023 lows. Nonetheless, this appreciation hasn’t been uniform throughout the sector. Firms with stronger steadiness sheets and newer, extra environment friendly mining gear have usually outperformed their friends. Since July 2024, as seen within the chart beneath, the best earners have been Hut8, Bitdeer, and Core Scientific, appreciating 68%, 78.5% and 60.2% respectively.

Supply: Coin Metrics Market Information Feed & Yahoo Finance

A number of components are driving this value motion. Mining firms have excessive mounted prices when it comes to gear and electrical energy, that means that will increase in Bitcoin’s value can result in larger enhancements in profitability. This explains why mining shares typically exhibit larger volatility than Bitcoin itself, which appreciated in worth by 54.3% throughout the identical interval.

The Bitcoin halving occasion is impacting valuations as traders value in each the discount in mining rewards and the historic sample of value appreciation following earlier halvings. Lastly, many miners held onto their mined Bitcoin in the course of the crypto winter, basically working as leveraged performs on Bitcoin’s value. As Bitcoin’s worth has elevated, these holdings have considerably appreciated, strengthening their monetary positions.

It’s essential to notice that these shares face distinctive dangers past Bitcoin’s value actions. Vitality prices, gear obsolescence, and regulatory issues can considerably affect their efficiency. Moreover, competitors within the mining house continues to accentuate, doubtlessly pressuring margins even in a rising Bitcoin value surroundings, which might result in M&A exercise and consolidation within the mining business.

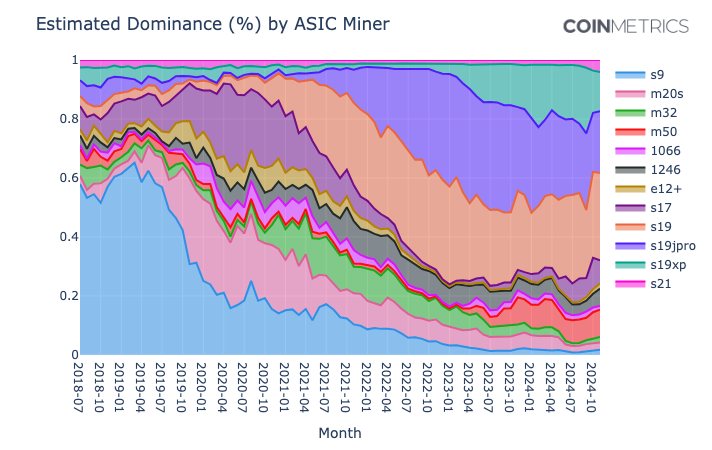

Bitcoin mining {hardware} evolution could be tracked by way of evaluation of nonce patterns in mined blocks, offering perception into the technological development and safety traits of the community. Every ASIC producer implements distinct approaches to nonce scanning, creating identifiable signatures that permit researchers to find out which machines are possible chargeable for mining particular blocks. This system, pioneered and refined by Coin Metrics, has change into an important software for understanding the composition of Bitcoin’s mining ecosystem.

Supply: Coin Metrics’ MINE-MATCH

The info reveals a number of vital transitions in mining {hardware} dominance over the previous six years. Antminer S9s, which dominated till 2019-2020, have been virtually fully phased out because the community underwent a serious technological improve cycle. The present panorama is dominated by the S19 collection machines, together with the XP, JPro, and normal variations, which collectively symbolize the vast majority of community hashrate. This transition demonstrates the fast tempo of effectivity enhancements in mining {hardware}, as operators repeatedly improve to take care of competitiveness in an more and more industrial mining panorama.

The affect of the 2024 halving occasion, which decreased miner rewards by 50%, has had a major impact on the profitability and operations of Bitcoin miners globally. Whereas the drop in BTC-denominated income per terahash of mining energy was speedy, the latest surge in Bitcoin’s value has helped offset a few of the destructive affect, permitting miners to take care of a level of profitability. Nonetheless, the business continues to face challenges in adapting to the community’s programmed provide changes.

Because the Bitcoin ecosystem continues to evolve, the mining business might want to reveal resilience, adaptability, and a eager eye for optimizing operations to remain forward of the curve.

Supply: Coin Metrics Community Information Professional

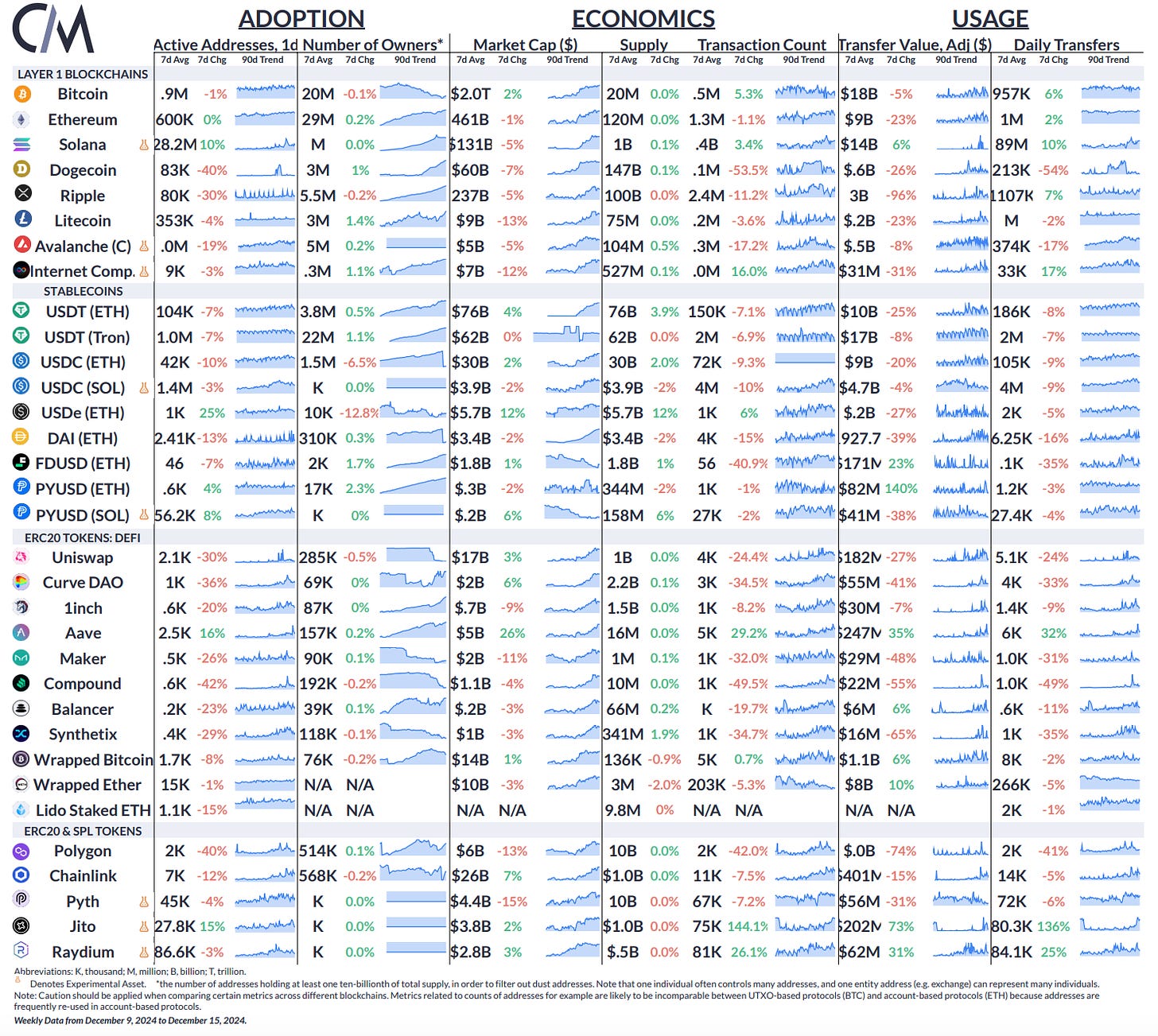

Over the previous week, Ethena launched USDtb, a brand new stablecoin backed by BlackRock’s BUIDL fund. USDe continued its ascent, with a 12% improve in market cap on Ethrereum to $5.7B. The market valuation of Aave (AAVE) and Chainlink (LINK) grew by 26% and seven% respectively, on the again of purchases from Donald Trump’s World Liberty Monetary (WFLI). Transaction counts for Jito (JTO) and Raydium (RAY) on Solana elevated by 73% and 31% respectively.

This week’s updates from the Coin Metrics staff:

-

Comply with Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.

As at all times, you probably have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market information.

If you would like to get State of the Community in your inbox, please subscribe right here. You may see earlier problems with State of the Community right here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution just isn’t permitted with out consent. This text doesn’t represent funding recommendation and is for informational functions solely and you shouldn’t make an funding determination on the premise of this info. The publication is offered “as is” and Coin Metrics won’t be accountable for any loss or injury ensuing from info obtained from the publication.