Get the perfect data-driven crypto insights and evaluation each week:

By: Tanay Ved

-

Crypto markets have been weighed down by macroeconomic headwinds and industry-specific challenges, leading to renewed volatility.

-

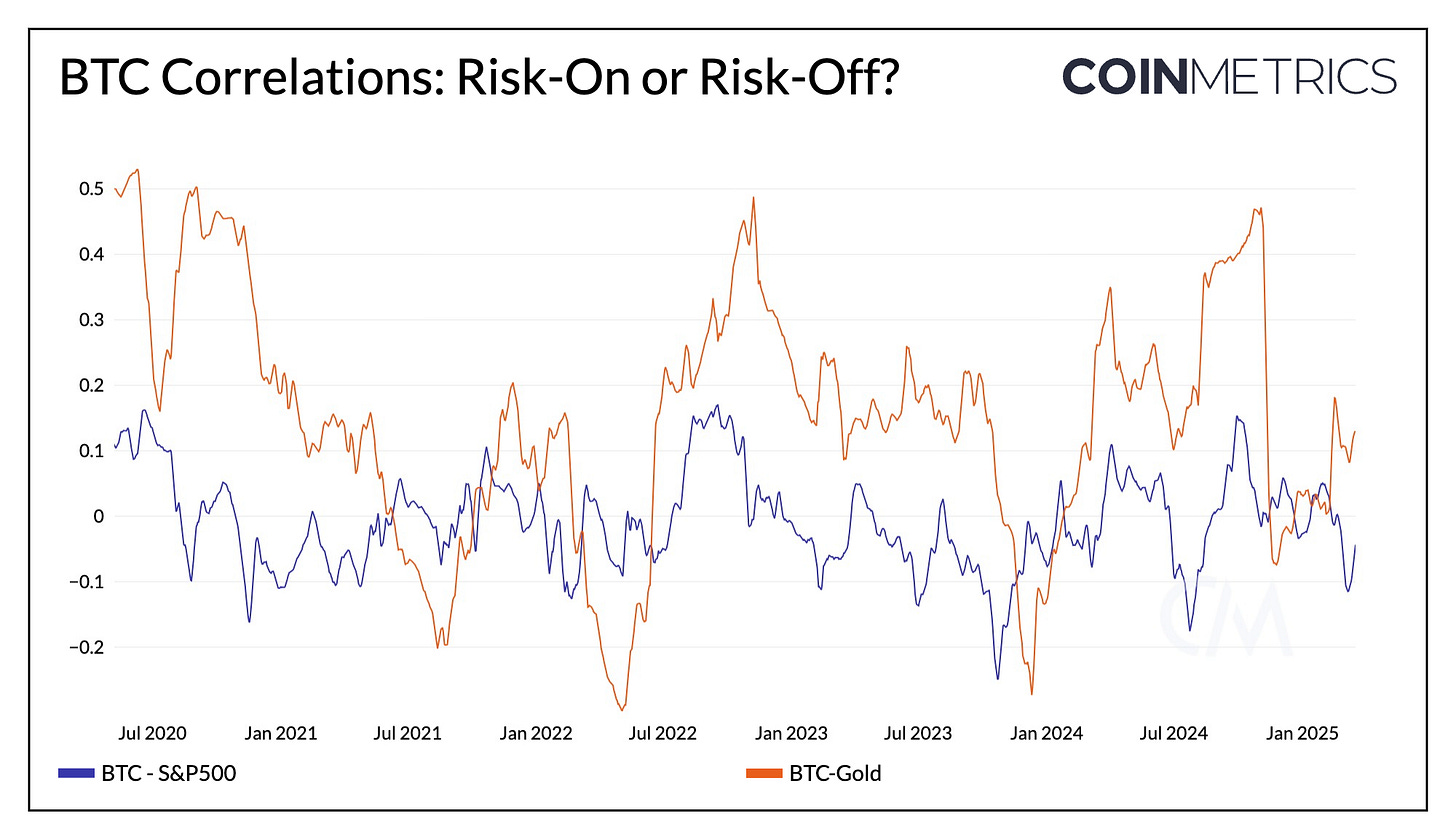

Bitcoin stays largely uncorrelated to conventional belongings like Gold and the S&P 500, underscoring its distinctive positioning within the present macro setting.

-

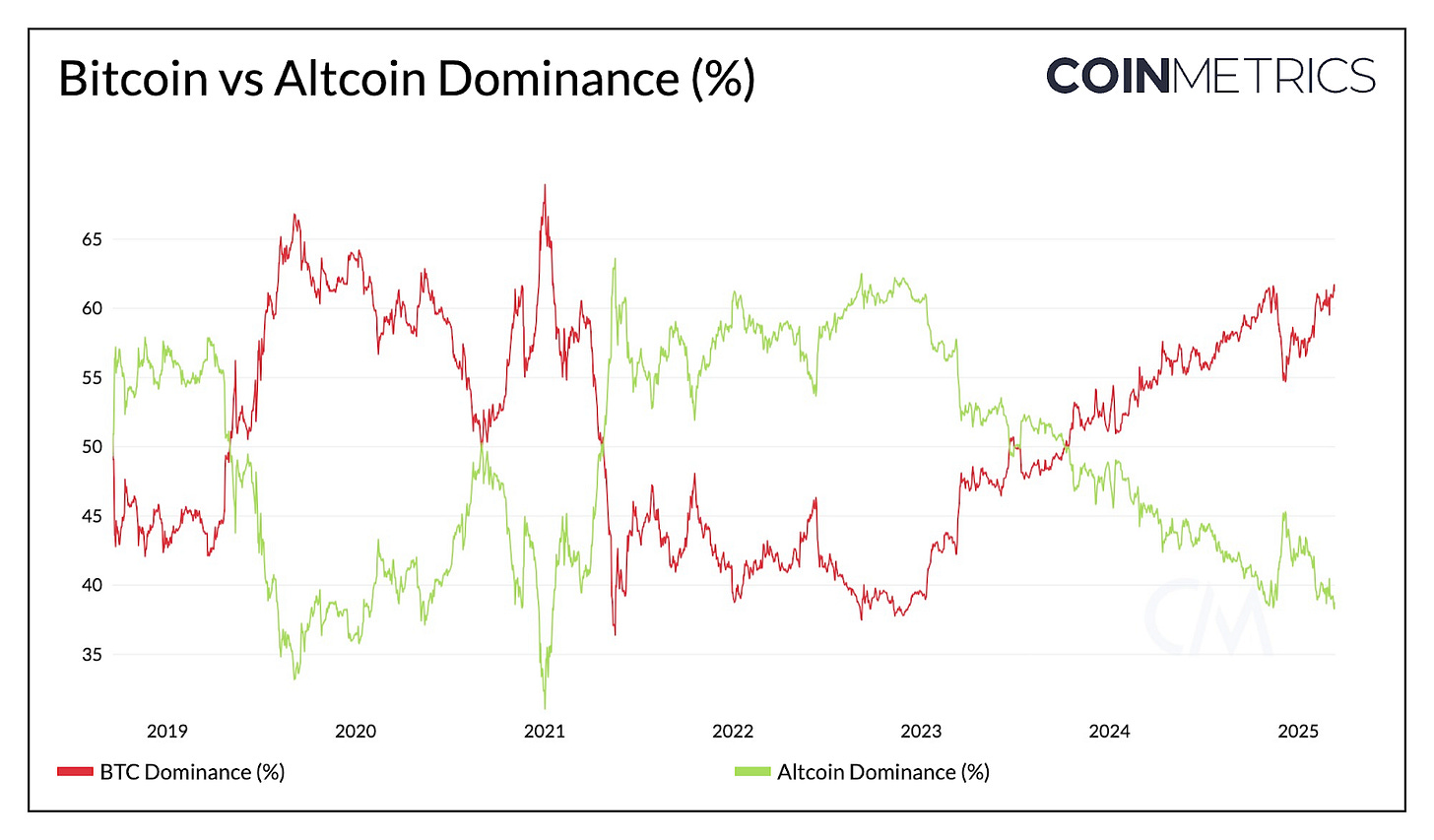

Bitcoin’s dominance continues to rise, reinforcing a market construction more and more pushed by institutional capital whereas retail participation stays subdued.

-

Market situations stay unsure, however bettering macro dynamics, regulatory readability, and shifting capital flows may create a robust basis for long-term market development.

Hit by waves of volatility and uncertainty, the digital asset market finds itself caught within the crosscurrents of macro-economic pressures and crypto-specific forces. Simply weeks in the past, BTC was consolidating close to $100K, with market members optimistic about one other part of development below a extra supportive administration and structural catalysts. Now, as BTC hovers round $80K, sentiment has visibly shifted. Speculative exercise has cooled, occasions like Bybit’s hack have added to the unease and threat urge for food has weakened amid financial uncertainty. But, optimistic developments proceed unabated, together with the institution of a US Strategic Bitcoin Reserve and a constructive shift within the regulatory strategy in direction of the {industry}.

On this situation of Coin Metrics’ State of the Community, we assess the drivers behind current weak point in crypto markets and the place we stand within the broader market cycle, analyzing each macroeconomic and crypto-specific forces shaping the highway forward.

The broader inventory market and crypto-assets alike have skilled a turbulent few months, erasing their post-election good points. The first driver of this volatility has been intensifying macroeconomic pressures, within the type of Trump’s aggressive commerce insurance policies, retaliatory measures from main US buying and selling companions and escalating geopolitical tensions—all of which have created an setting of uncertainty, weighing on inflation expectations and financial development.

Regardless of seemingly optimistic developments, together with the institution of a Bitcoin Strategic Reserve forward of the inaugural White Home Crypto Summit, the SEC dropping high-profile lawsuits and rising institutional momentum, macroeconomic headwinds and up to date industry-specific challenges have stored digital asset markets below stress.

Supply: Coin Metrics Method Builder

Within the present unsure market setting, gold has surged past $3000 as buyers flock to the premier safe-haven asset. In the meantime, the S&P 500 and Nasdaq Composite have declined 3.8% and eight.2% year-to-date, respectively, as threat urge for food fades. Bitcoin, nonetheless, appears caught between these two forces. Whereas typically seen as “digital gold” and a hedge towards inflation or market instability, BTC is but to determine a significant correlation with Gold. As an alternative, its 90D correlation with each the S&P 500 and Gold stays weak (~0), suggesting its uncorrelated nature and ambiguous function within the present market regime.

Regardless of the bigger macro forces at play, dynamics intrinsic to crypto-assets proceed to form the market in distinctive methods. In typical style, Bitcoin (BTC) stays the first market driver and a barometer for market-wide threat urge for food. Bitcoin dominance, measuring its market cap relative to the overall crypto market, has steadily climbed from 37% in November 2022 to 61% at present. Whereas that is attribute of previous cycles, structural shifts just like the introduction of spot Bitcoin ETFs and demand from company holders like Micro(Technique) have amplified this Bitcoin-driven market construction.

Supply: Coin Metrics Community Knowledge Professional

In distinction, altcoin dominance has trended in direction of 39%. Whereas traditionally, a decline in bitcoin dominance has preceded capital rotation into altcoins, signaling the onset of “altcoin season”, a reversal within the present pattern stays elusive. This prolonged weak point in altcoins seemingly displays the widening divide between institutional and retail sentiment, additionally evident in spot buying and selling volumes. Whereas altcoins at giant have struggled to maintain tempo, memecoins emerged as the popular automobile for retail hypothesis. Nonetheless, a current cooldown within the sector has additional dampened retail sentiment.

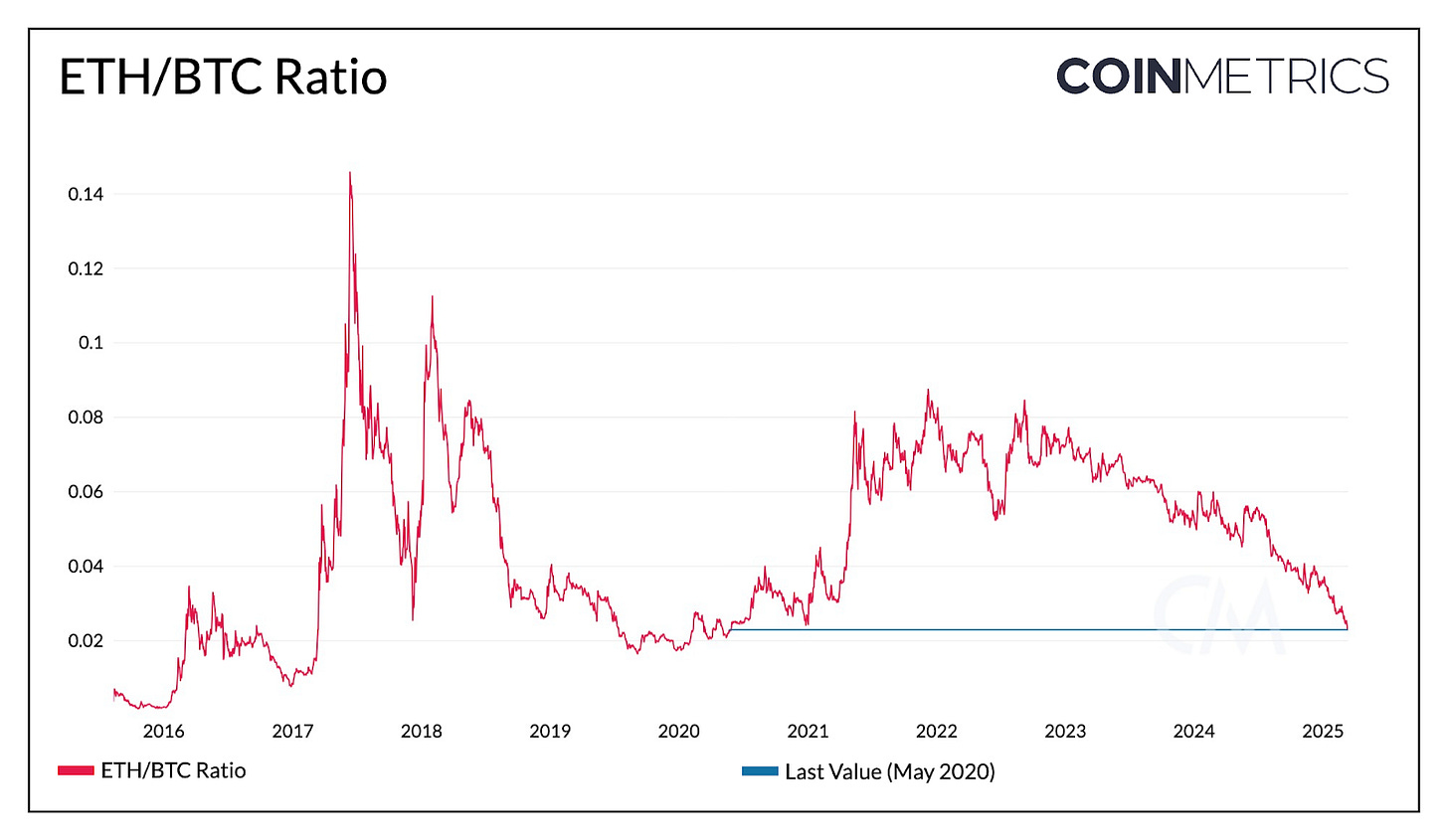

Supply: Coin Metrics Reference Charges

One other issue at play is the continued underperformance of Ethereum (ETH) relative to Bitcoin (BTC). Traditionally, shifts in ETH/BTC have been correlated to actions in altcoin dominance, rising when ETH/BTC weak point reversed in 2017, 2018 and 2021. At present at 0.022, the ETH/BTC ratio is at ranges final seen in Could 2020.

Whereas this underperformance might be attributed to Ethereum’s personal challenges, similar to diminished Layer-1 exercise, worth accrual from L2s and competitors from various L1s, it has additionally weighed on broader altcoin sentiment. A reversal in ETH/BTC, alongside an bettering macro outlook and larger regulatory readability, may function a possible catalyst for altcoins, notably these with extra established fundamentals and clearer funding theses in sectors positioned for structural development.

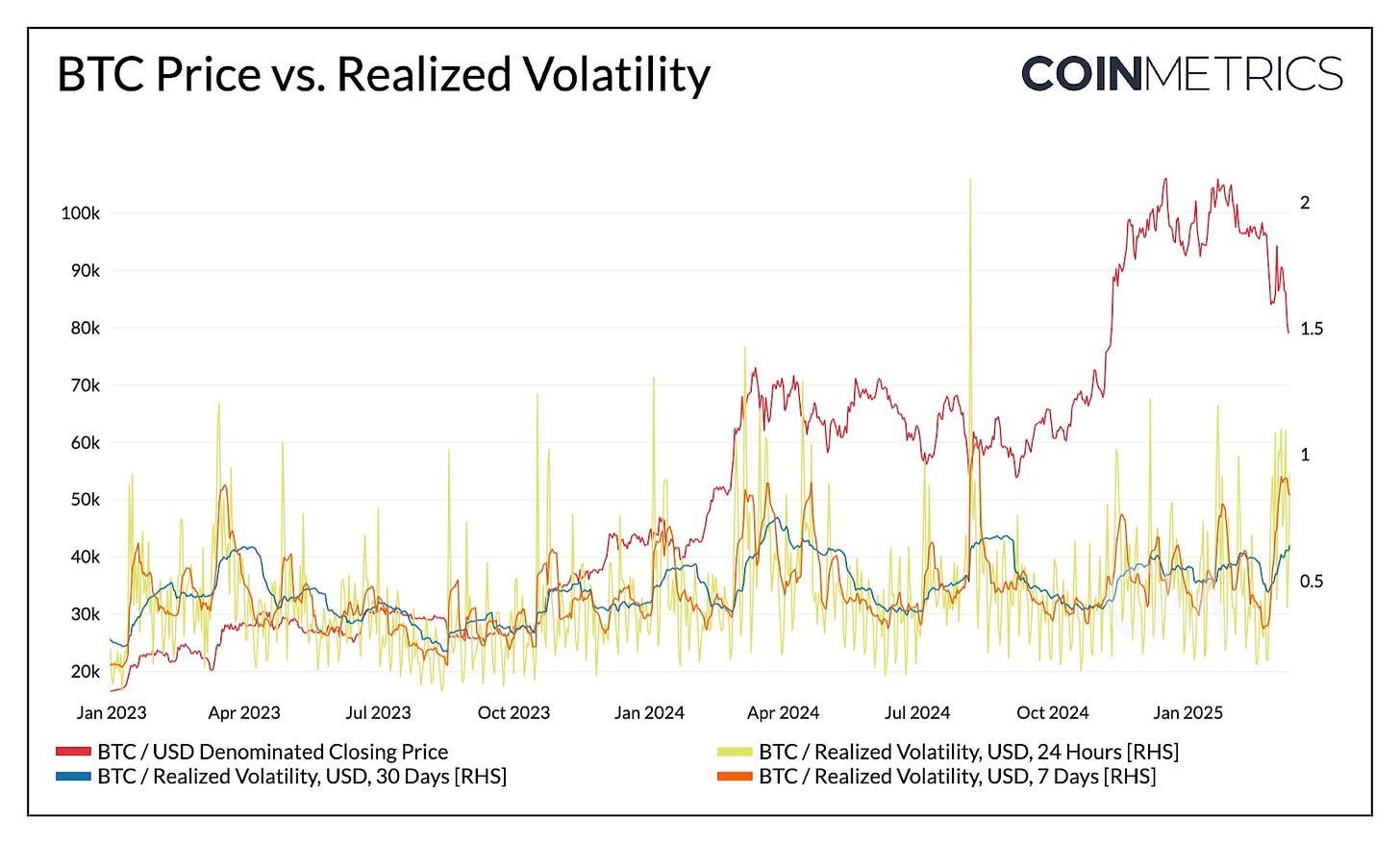

A attribute trait of Bitcoin (BTC) is its volatility. Whereas BTC’s volatility has dampened over time, it’s nonetheless vulnerable to giant drawdowns and swings in value. Most lately, we are able to see day by day volatility on the rise, with BTC’s 7-day realized volatility reaching 0.9 amid a ~25% drawdown.

Supply: Coin Metrics Market Knowledge Professional

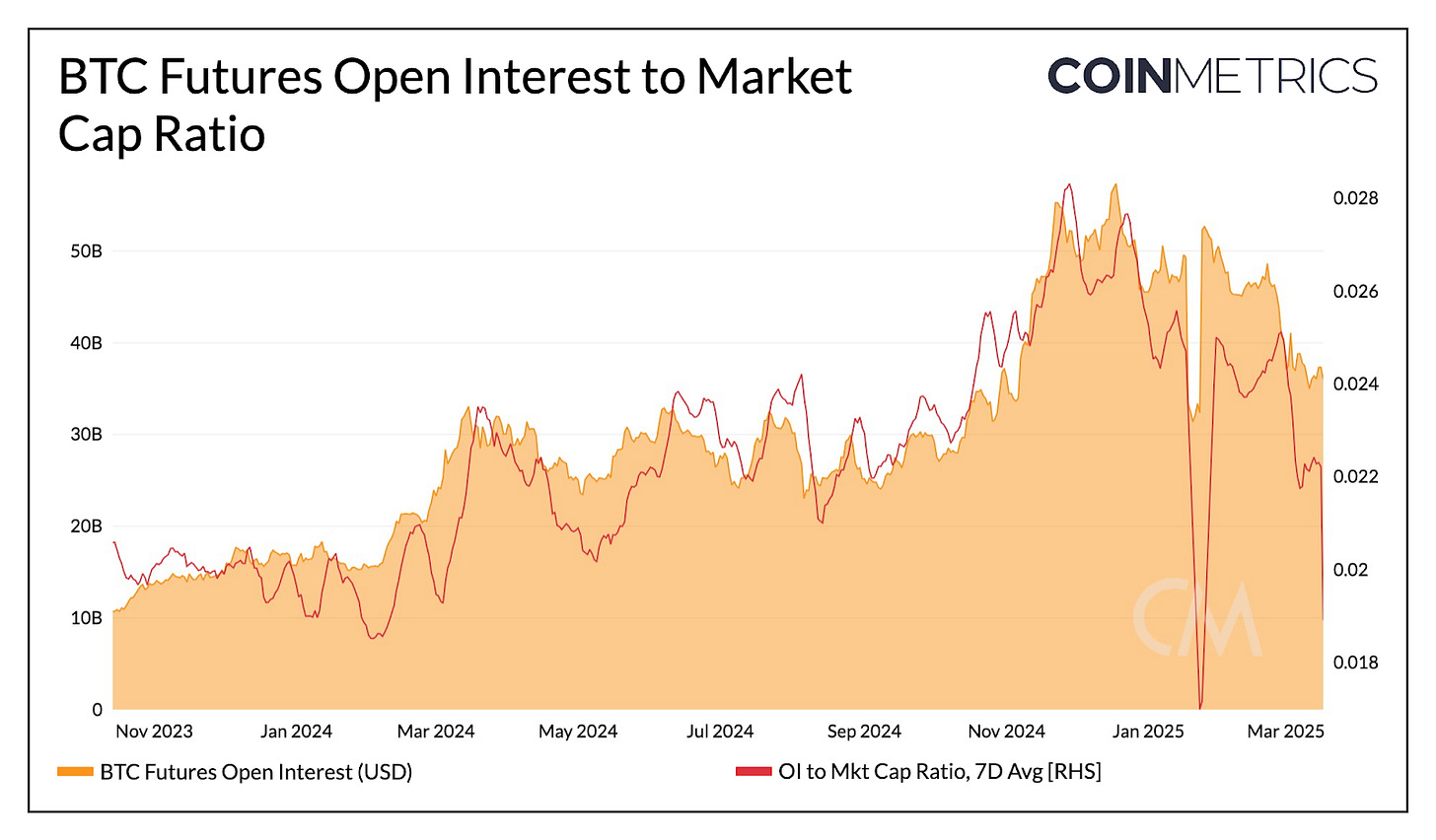

This volatility has spurred a wave of liquidations in spot and by-product markets of late. Nonetheless, Bitcoins futures market suggests a more healthy positioning in contrast to some months in the past. Futures open curiosity has dropped to ranges seen earlier than the November elections, indicating that extra leverage has been flushed out. Futures open curiosity relative to its market cap has additionally declined, suggesting that speculative positioning has reset. This offers a extra secure basis for the subsequent leg of development.

Supply: Coin Metrics Market Knowledge Professional

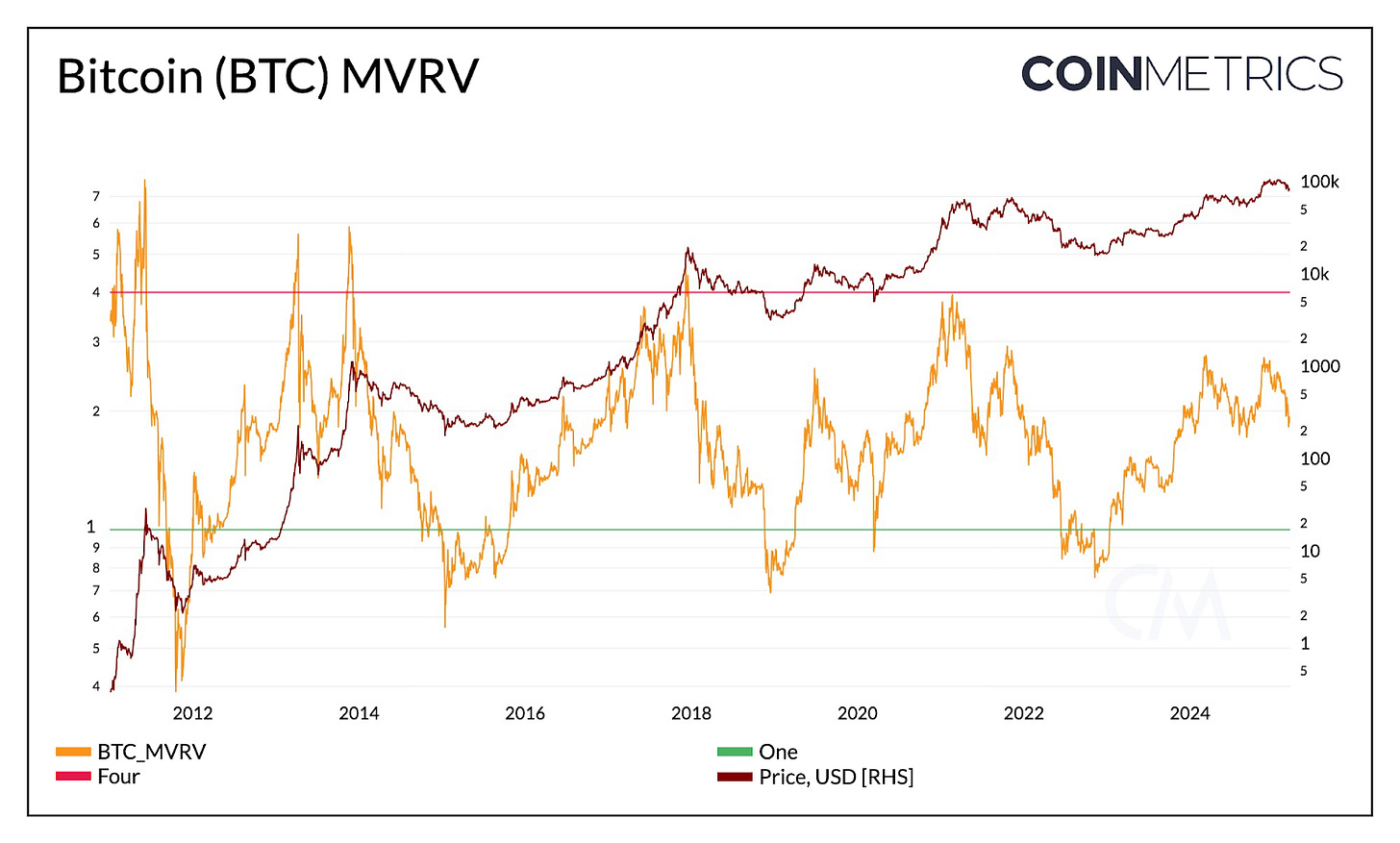

Given the present setting, the place can we stand relative to prior “cycles”? Amongst different metrics, Bitcoin’s MVRV ratio, measuring the ratio of Bitcoin’s market worth to its realized worth (combination worth of the worth at which cash final moved on-chain), can function a helpful indicator of cycle positioning. Traditionally a excessive ratio (>3.5) has signaled an overheated market, whereas a low ratio (1) signifies enticing accumulation zones.

At present, Bitcoin’s MVRV ratio sits at 1.9, peaking close to 2.65 earlier this yr. This locations it above the bear market lows however under the euphoria of previous cycle peaks, suggesting that we’re in a mid-cycle reset. Whereas historic tendencies present a helpful framework, structural shifts similar to ETF pushed demand, evolving investor profiles and regulatory readability, all of which didn’t exist beforehand, may reshape how this cycle unfolds and the way we interpret it relative to previous ones.

Supply: Coin Metrics Community Knowledge

Trying forward, the medium to long-term outlook stays optimistic. Expectations of a supportive administration and SEC are coming to fruition. Regulatory readability in areas like custody and financial institution participation, stablecoins and tokenization of actual world belongings (RWAs), amongst many others, may unlock a big wave of adoption. Whereas the macroeconomic panorama stays unsure, the muse is in place, and as structural shifts take maintain, the onset of price cuts and renewed liquidity may assist drive the subsequent part of market development.

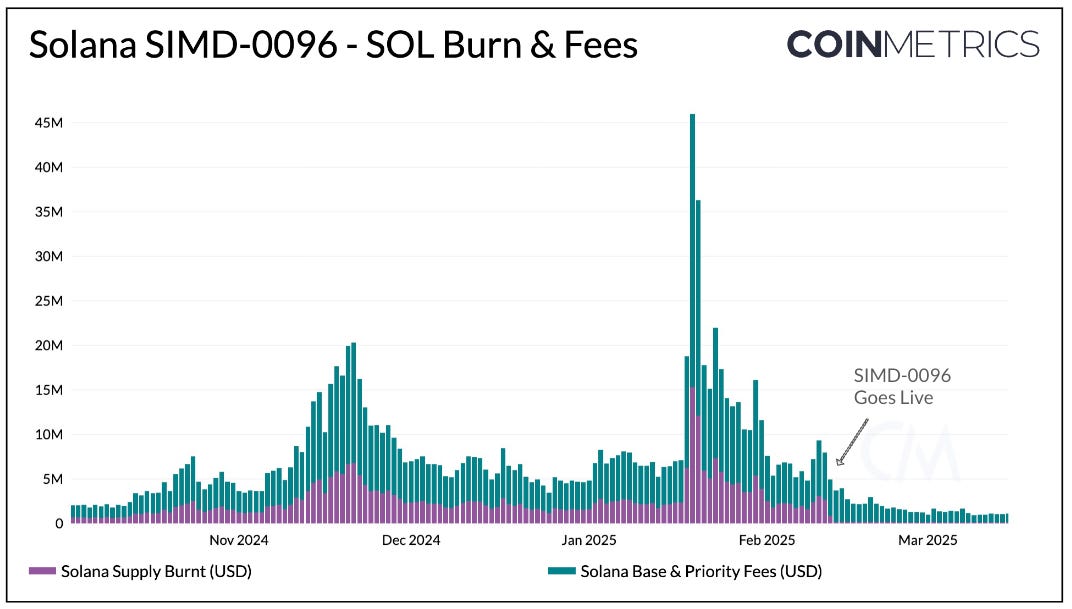

Solana SIMD-0096 went dwell on February twelfth, redirecting 100% of precedence charges to validators. This alters the the earlier break up, the place 50% was burned and 50% was collected by validators. Earlier than the replace, 16,000 SOL was burned on common per day, now decreasing to ~960. Moreover, SIMD-0123, which introduces on-chain revenue-sharing between validators and stakers, handed with 75% approval, enhancing staking incentives and transparency.

Supply: Coin Metrics Community Knowledge Professional

This week, Solana’s proposal to implement a dynamic SOL issuance mannequin primarily based on staking participation (SIMD-228) didn’t move. This retains the present mounted inflation schedule intact, lowering yearly from ~4.6% to 1.5% over time. For extra on Solana, take a look at our Analyst Highlight Solana Overview report.

-

Comply with Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As all the time, when you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You possibly can see earlier problems with State of the Community right here.