Get the perfect data-driven crypto insights and evaluation each week:

By: Tanay Ved & Matías Andrade

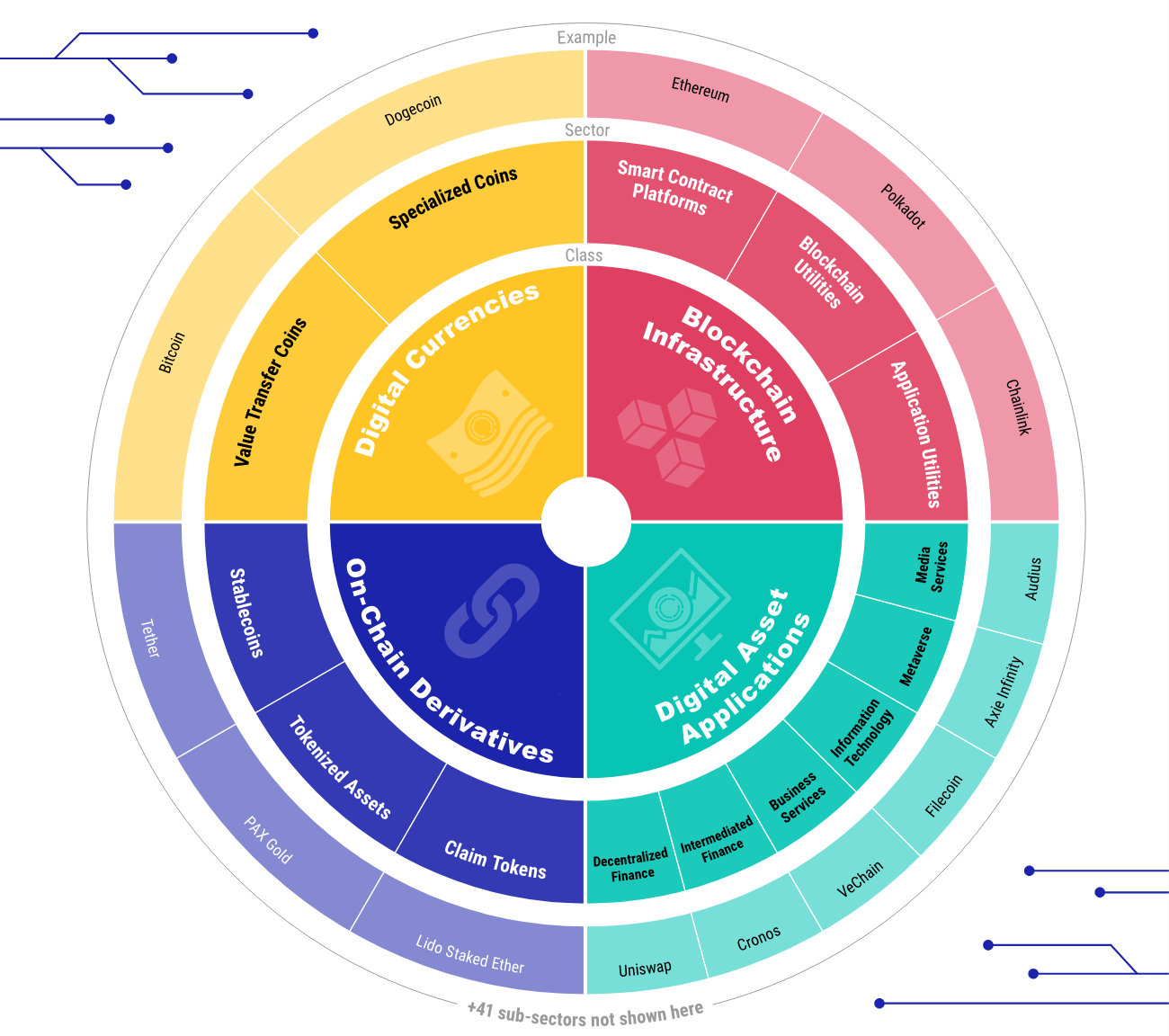

The crypto universe has expanded from a single asset in 2009 to an enormous ecosystem of 4 asset lessons, 14 sectors and 41 subsectors as coated by datonomy™.

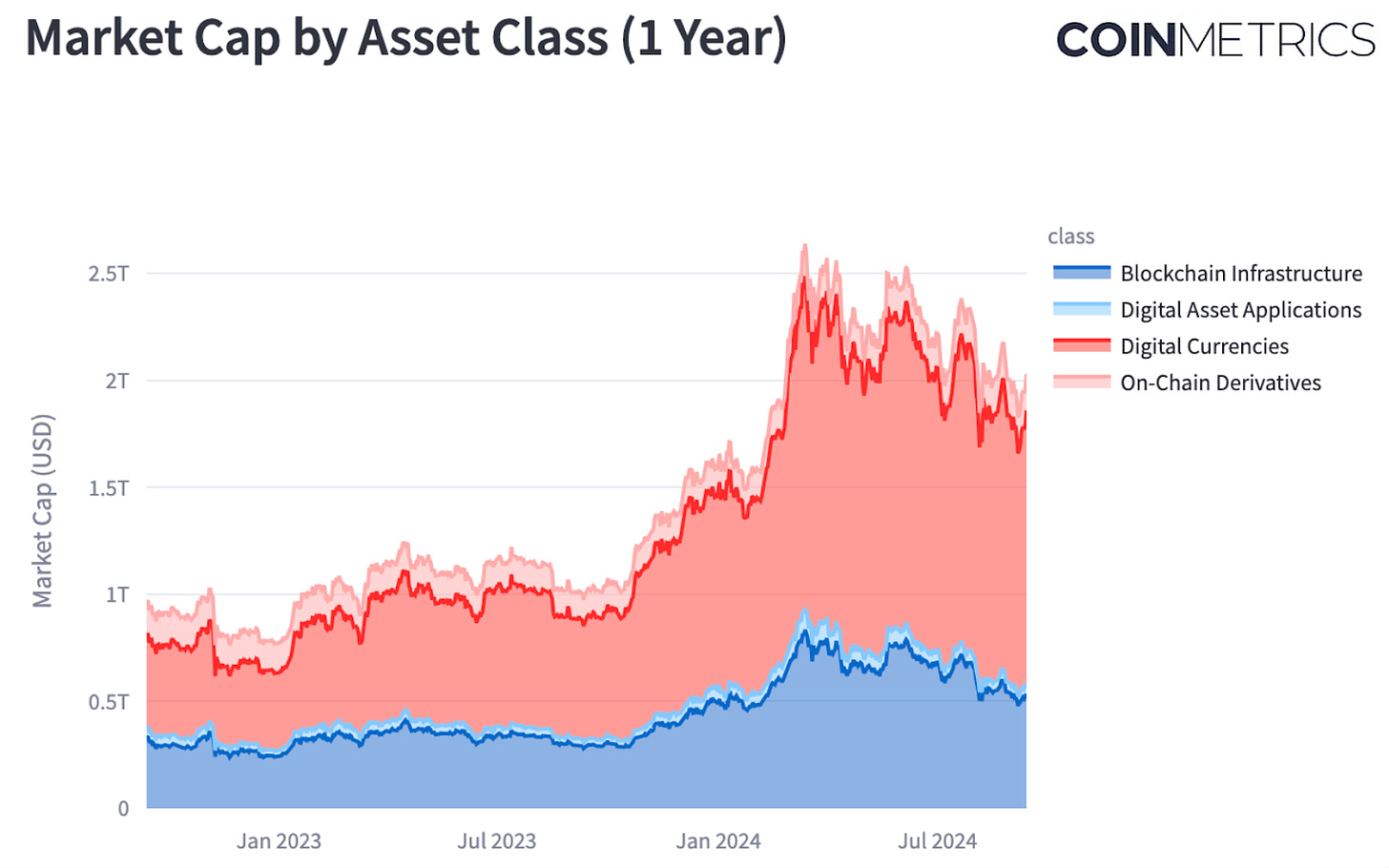

The combination market capitalization of property within the datonomy™ universe stands at $2T in the present day, 2x larger than a 12 months in the past.

Combining on-chain metrics with datonomy™ can present helpful insights into the evolving relationship between basic value-drivers and sector returns.

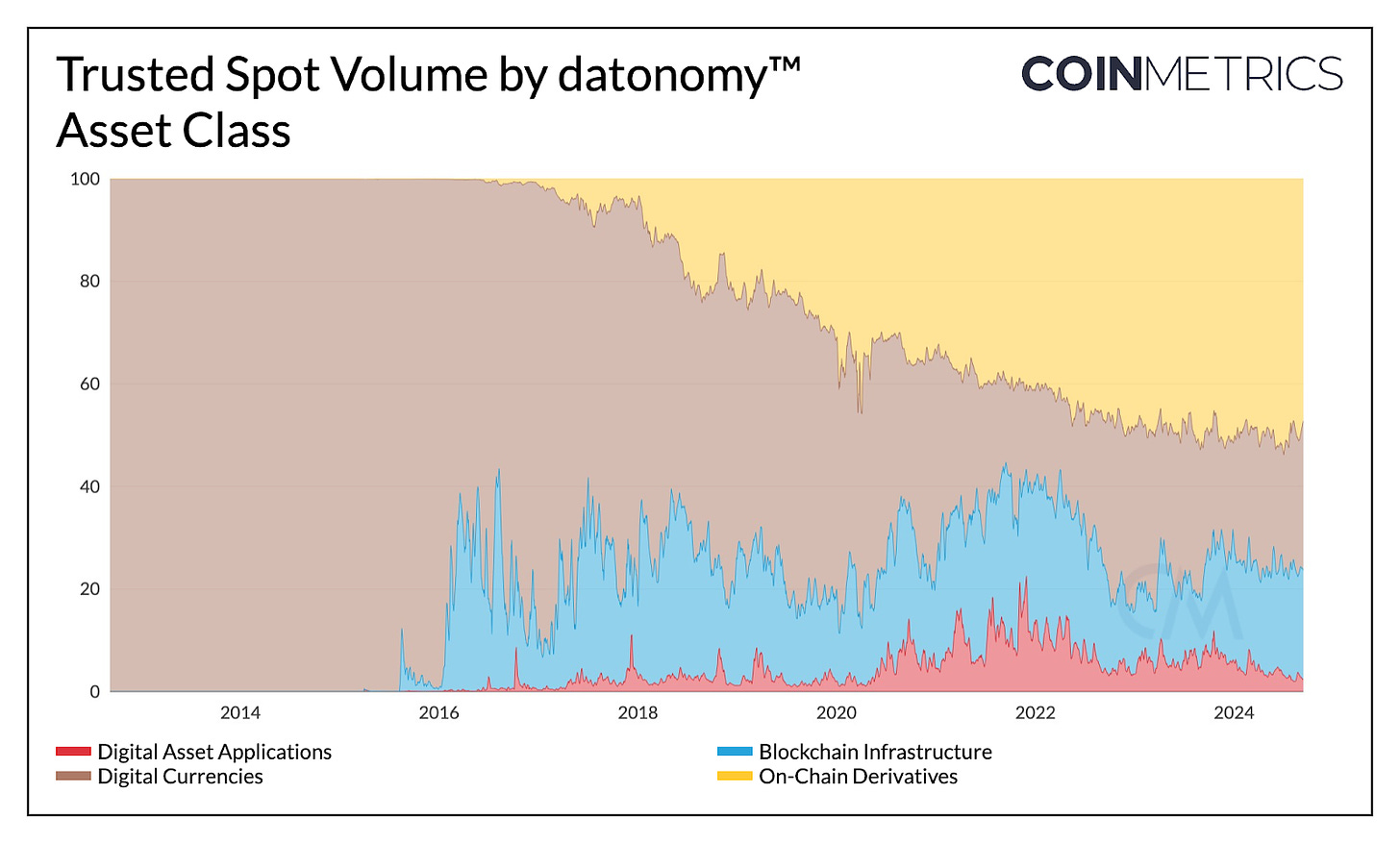

The On-Chain Derivatives asset class, comprising stablecoins and tokenized property, represents 50% of trusted spot quantity throughout all sectors.

Be sure you take a look at our datonomy™ dashboard, serving to illuminate the huge digital asset universe.

In 2008, the world was launched to Bitcoin—the primary decentralized digital foreign money and peer-to-peer digital money system. Following its then meteoric rise got here altcoins like Litecoin, the “silver” to Bitcoin’s “gold”; Dogecoin, impressed by the favored “Doge” meme and Ripple, every providing distinctive capabilities influenced by Bitcoin’s basis.

Nevertheless, there existed a void within the capacity to help extra versatile and programmable transactions. This hole was bridged with the launch of Ethereum, broadening the scope of what blockchains might obtain through smart-contracts and on-chain functions. A number of different Layer-1s emerged, every with its personal optimizations and tradeoffs—from high-throughput chains like Solana to customizable architectures like Cosmos and Avalanche. Since then, we’ve witnessed an explosion of use-cases and tokens within the ecosystem, from tokenized property and Layer-2 scalability options to oracle and application-based governance tokens and quite a few extra. The inception of a single idea has now flourished into an enormous and complicated universe.

However how do traders, operators or market-watchers make sense of this quickly evolving panorama? On this problem of Coin Metrics’ State of the Community, we offer an replace on crypto-asset valuations, sector efficiency and volumes leveraging datonomy™, a classification system for the digital asset ecosystem.

An ecosystem with continuously rising complexity requires simplification. That is the place datonomy™ is available in, bringing great worth by classifying property into 4 lessons, 14 sectors and 41 subsectors primarily based on their financial context of use. This permits traders to discern “Sensible Contract Platforms” from “Digital Currencies”, and “Tokenized Property” from “Decentralized Finance” offering a clear framework to construct portfolios, handle danger or perceive developments shaping the market.

As an illustration, dividing the digital asset ecosystem into 4 main asset lessons permits a greater understanding of the relative market measurement of the trade and the way it has developed over time. As one of many first-use instances, the Digital Currencies class stays the most important, comprising 57% of complete market capitalization, whereas Blockchain Infrastructure, composed of sensible contract platforms, and utilities like scalability and interoperability options has been steadily rising, holding a 31% market share. With a ~4% share Digital Asset Purposes nonetheless stay comparatively small in measurement, presenting an amazing alternative for the subsequent wave of progress underpinned by public blockchain infrastructure and tokenized property.

In combination, the market capitalization of property coated within the datonomy™ universe at present stands at $2T, rising by 100% since September 2023.

Supply: Coin Metrics datonomy™ Dashboard

Breaking the cryptocurrency market into sectors permits individuals to establish developments, optimize portfolios, and assess danger throughout various segments of the trade. Very like how conventional fairness traders analyze “Client Discretionary” or “Financials” sectors, cryptocurrency traders can gauge the efficiency of particular sectors equivalent to Decentralized Finance and evaluate it to the broader market. This sectoral strategy gives helpful insights into market dynamics and the power of prevalent narratives, enabling focused funding methods, knowledgeable across the nuanced dangers and alternatives throughout the cryptocurrency ecosystem.

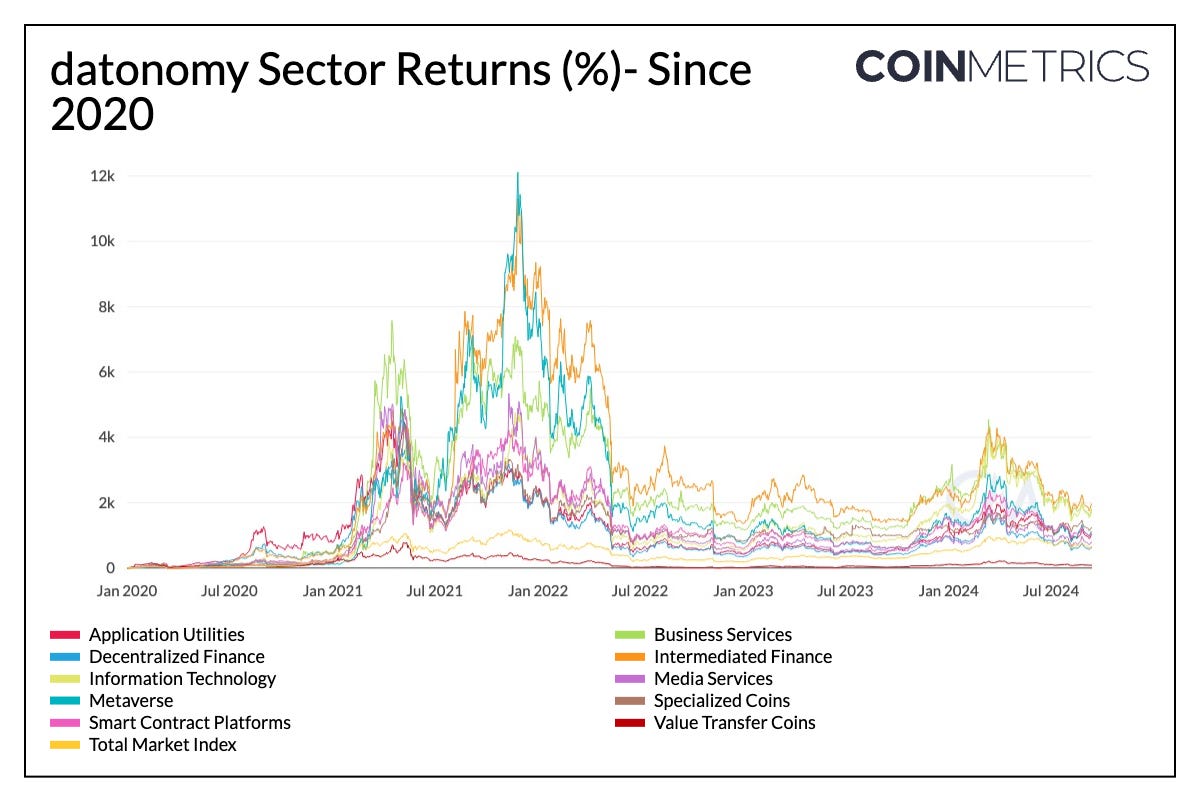

Over an extended time-horizon, regardless of giant swings and variability in efficiency throughout sectors, the Coin Metrics Complete Market Index (CMBITM) has offered 690% in cumulative returns. Amongst this, the Intermediated Finance (+1948%), Enterprise Companies (+1734%) and Data Know-how (+1681%) sectors of the Digital Asset Purposes asset class have outperformed the remaining market. Pushed by the surge in curiosity across the “Metaverse” theme 2021 on the again of Fb’s rebrand to Meta, the Metaverse sector (tokens related to digital ecosystems) displayed the strongest efficiency. Nevertheless, this was short-lived as lackluster adoption and Meta’s battle to translate its efforts into substantial revenues led to waning investor enthusiasm.

Supply: Coin Metrics datonomy™

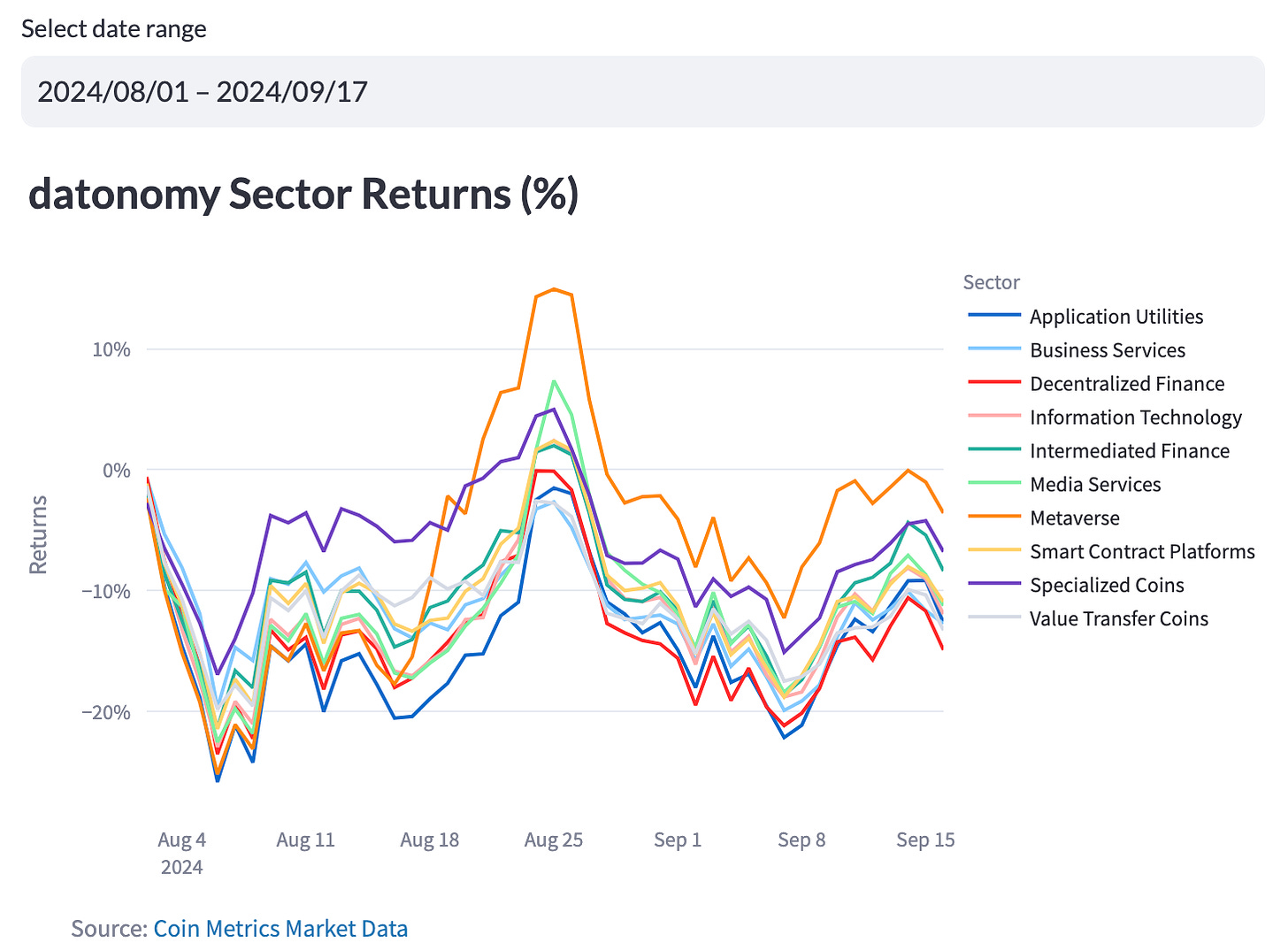

It’s additionally helpful to decipher pockets of the market that present instant power submit sudden market downturns or sectors that present weak spot as market rallies quiet down, when considered from a short-term lens. The market volatility across the August 5th market crash resulted in a steep decline throughout all sectors. The Specialised Cash sector skilled the quickest rebound, and stays the perfect performing sector YTD with a 6% acquire. The Metaverse theme rebounded to fifteen%, the very best amongst all sectors earlier than receding alongside the market.

Supply: Coin Metrics datonomy™ Dashboard

It’s additionally essential to grasp the distinctive volatility profiles and correlations in sector efficiency as they assist inform traders round portfolio building, lowering total danger.

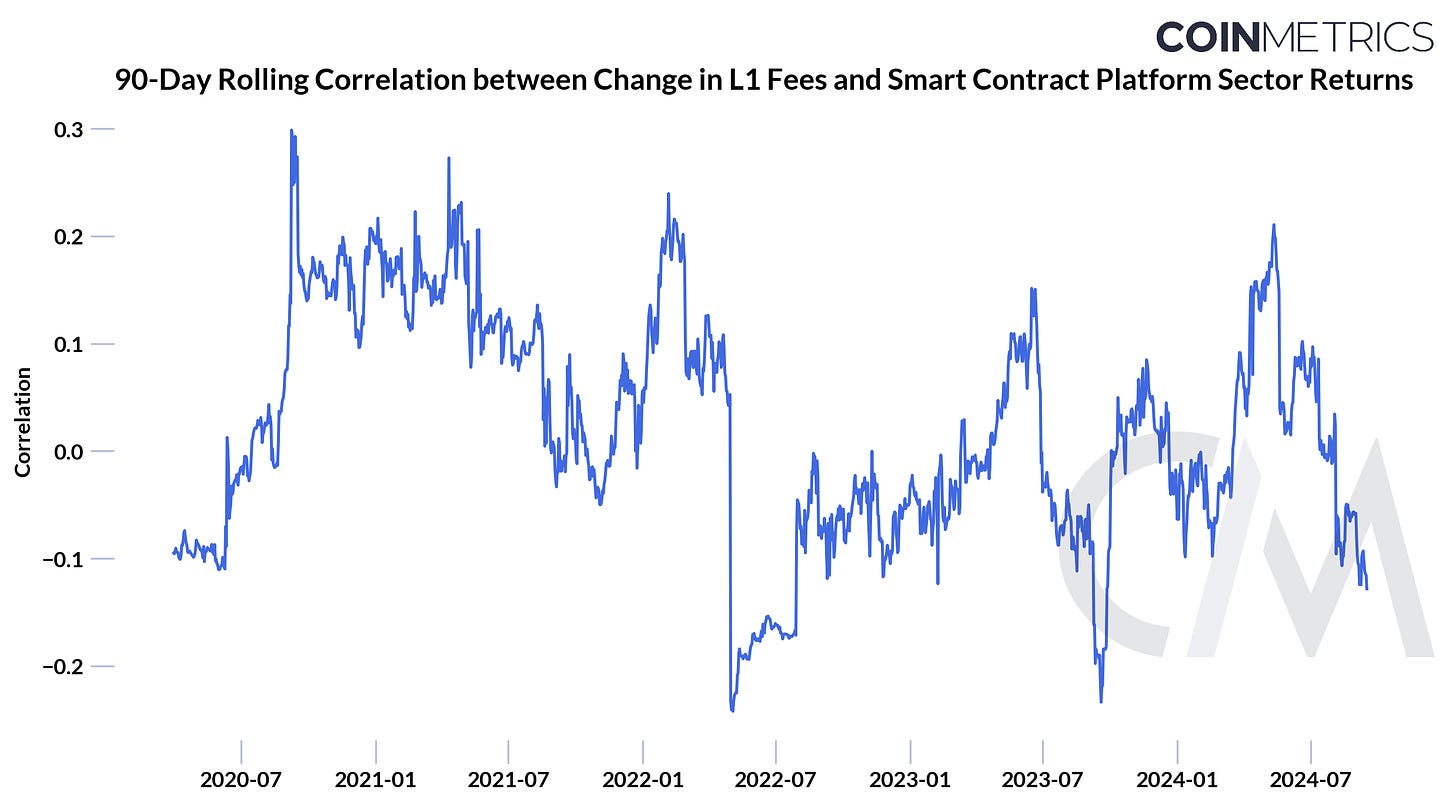

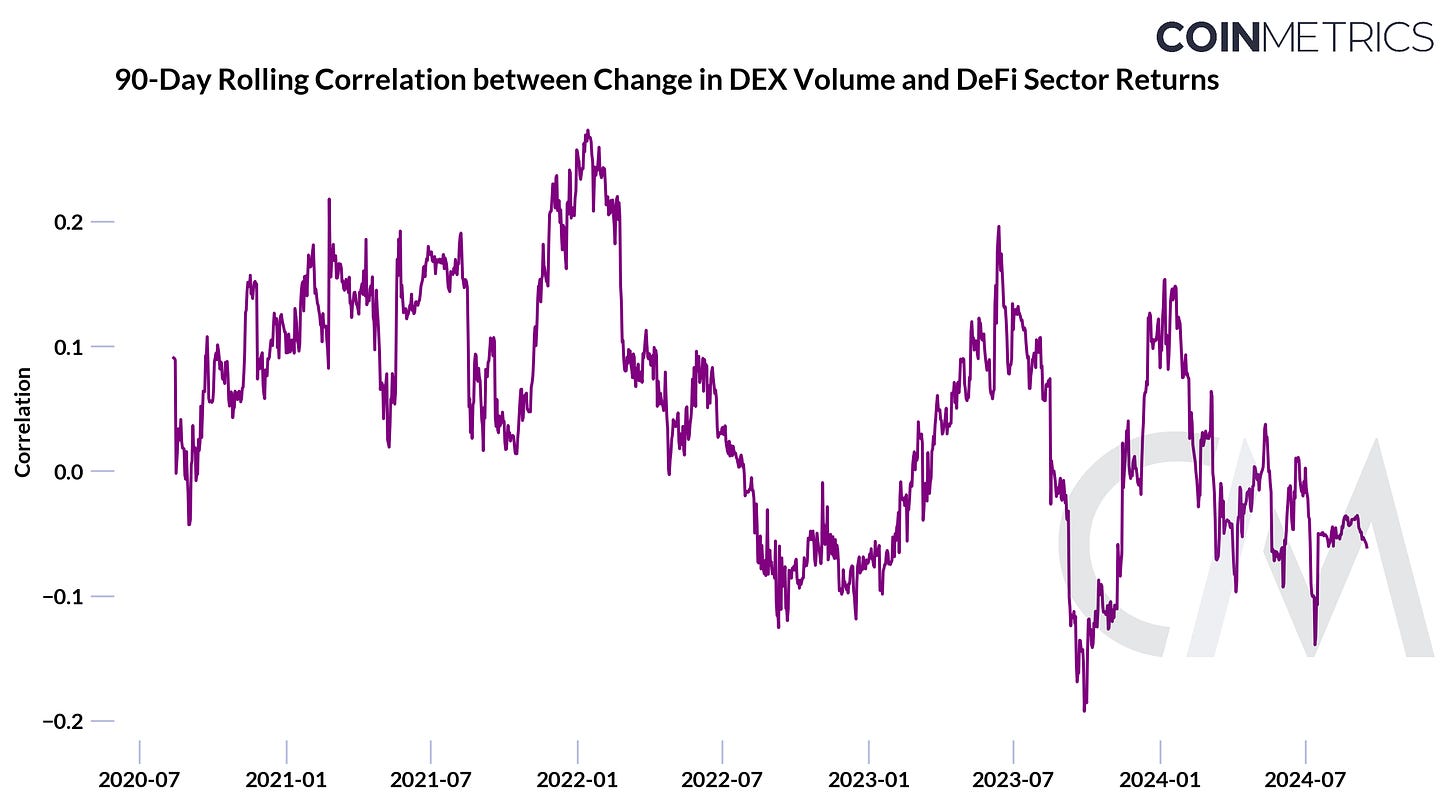

We will additionally discern the evolving relationship between on-chain basic metrics equivalent to adjustments in charges on Layer-1 networks or volumes on decentralized exchanges (DEXs) compared to the Sensible Contract Platform or DeFi sectors’ returns.

Supply: Coin Metrics Community Information Professional, datonomy™

The 90D rolling correlation between change in L1 charges and Sensible Contract Platform sector returns exhibits substantial cyclicality throughout completely different phases of the market, ranging between -0.25 to 0.3. Reasonably optimistic correlations in periods recommend that rising community charges are probably an indication of elevated demand for blockspace and transaction execution which aligns with rising costs within the sensible contract sector (or vice versa). Boosts in price markets have been noticed prior to now, with some occurring alongside broader market rises whereas others happen in isolation attributable to community particular occasions, just like the launch of Runes, for instance.

Supply: Coin Metrics Community Information Professional, datonomy™

Adjustments in buying and selling quantity throughout main DEXs like Uniswap and Curve exhibit a dynamic relationship with DeFi sector returns. Durations of optimistic correlation (~0.25) typically point out elevated person participation and speculative exercise coinciding with rising DeFi costs. This was evident in October 2023 when correlations rose from -0.25 to over 0.1, pushed by altcoin and memecoin exercise amid a broader market uptrend.

Nevertheless, DEX quantity spikes may also happen throughout market stress, such because the Silicon Valley Financial institution collapse, resulting in fast correlation shifts as traders handle danger. Over time, the declining development in correlation could also be attributed to the sector’s progress past simply on-chain exchanges to stablecoin issuers like Maker and cash markets like Aave, reflecting a extra diversified ecosystem.

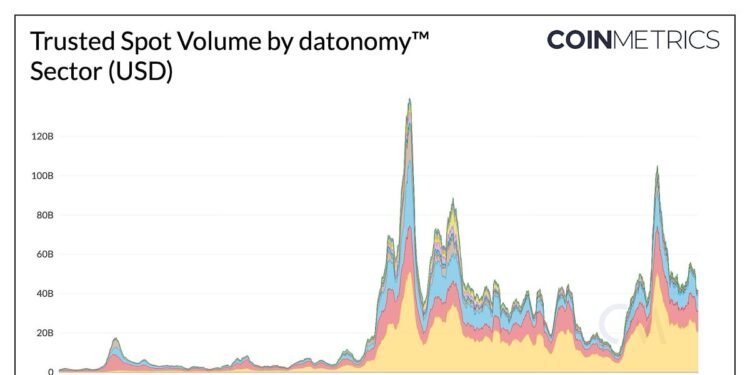

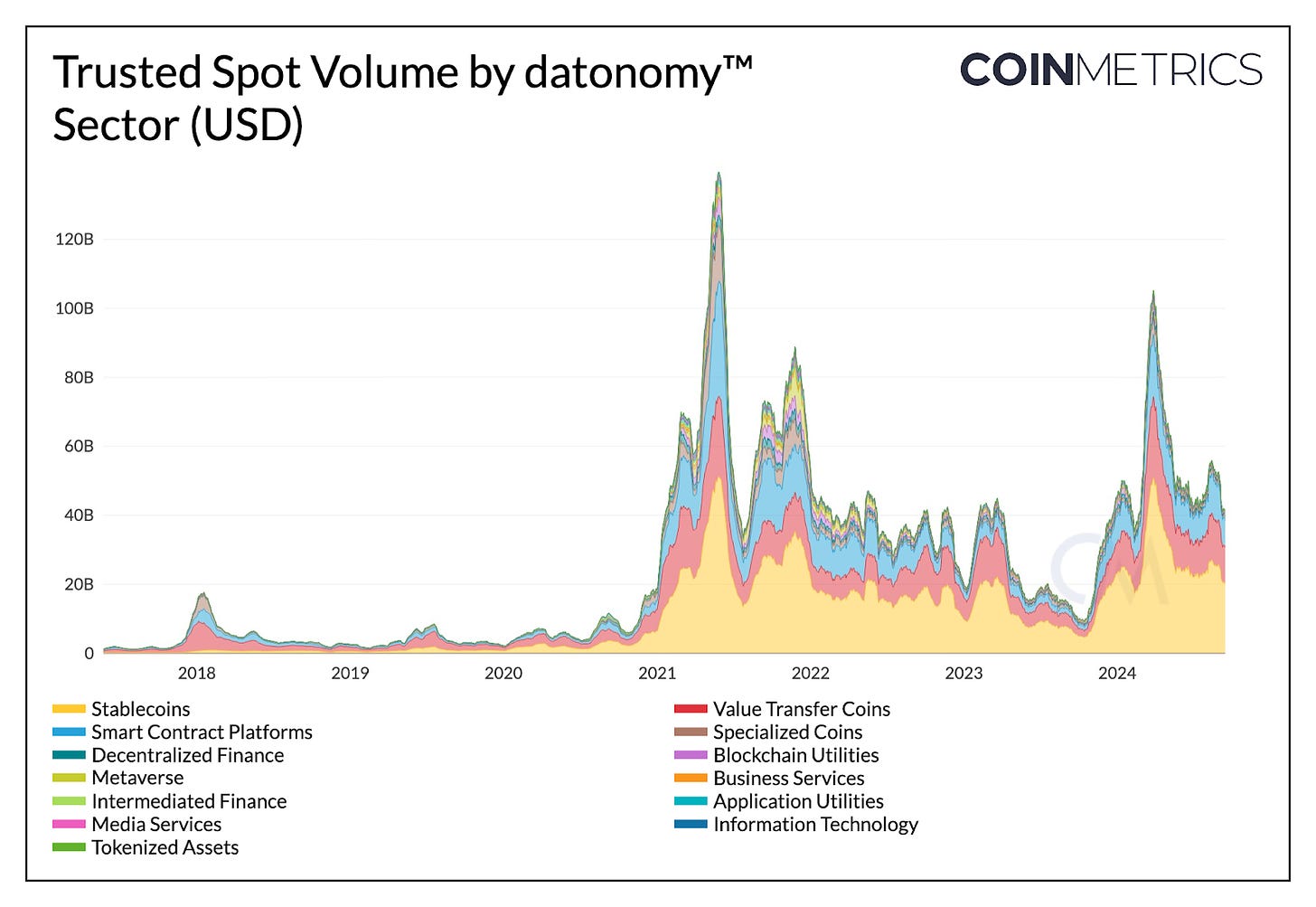

The evolution of spot buying and selling quantity displays market exercise and liquidity throughout asset lessons of the ecosystem. Pushed by the adoption and nature of early initiatives, the Digital Currencies sector dominated volumes. Nevertheless, the following rise of Blockchain Infrastructure underpinning Digital Asset Purposes is clear—at present making up 20% and at instances, 40% of complete spot quantity.

Supply: Coin Metrics datonomy™, Market Information Feed

In parallel, the On-Chain Derivatives sector has grown considerably to characterize a 50% market share of spot quantity amongst all asset lessons. This progress stems particularly from the Stablecoins sector, contributing $25B, or half of the 30D common spot quantity which stands at $50B throughout all sectors. Worth Switch Cash and Sensible Contract Platforms have maintained their significance, representing a mixed 45% market share of spot quantity throughout trusted exchanges.

Supply: Coin Metrics datonomy™, Market Information Feed

Whereas volumes have tapered off just lately, they continue to be at ranges noticed through the bear market section of 2022 and considerably larger than the summer time of 2023, when a number of market makers retreated their operations.

What as soon as was a single utility has now flourished right into a multi-faceted trade encompassing sensible contract platforms, scalability and interoperability options, on-chain monetary, data expertise and media infrastructure in addition to a plethora of tokenized property, from stablecoins to off-chain monetary devices. Because the constructing blocks of the digital asset ecosystem proceed to develop, it’s probably that the ecosystem will improve in breadth and complexity, owing to the necessity for standardized classification frameworks equivalent to datonomy™.

To discover datonomy™ additional, take a look at our new dashboard which gives an interactive view into market sizes, sector efficiency, correlations and volatility throughout sectors of the crypto universe.

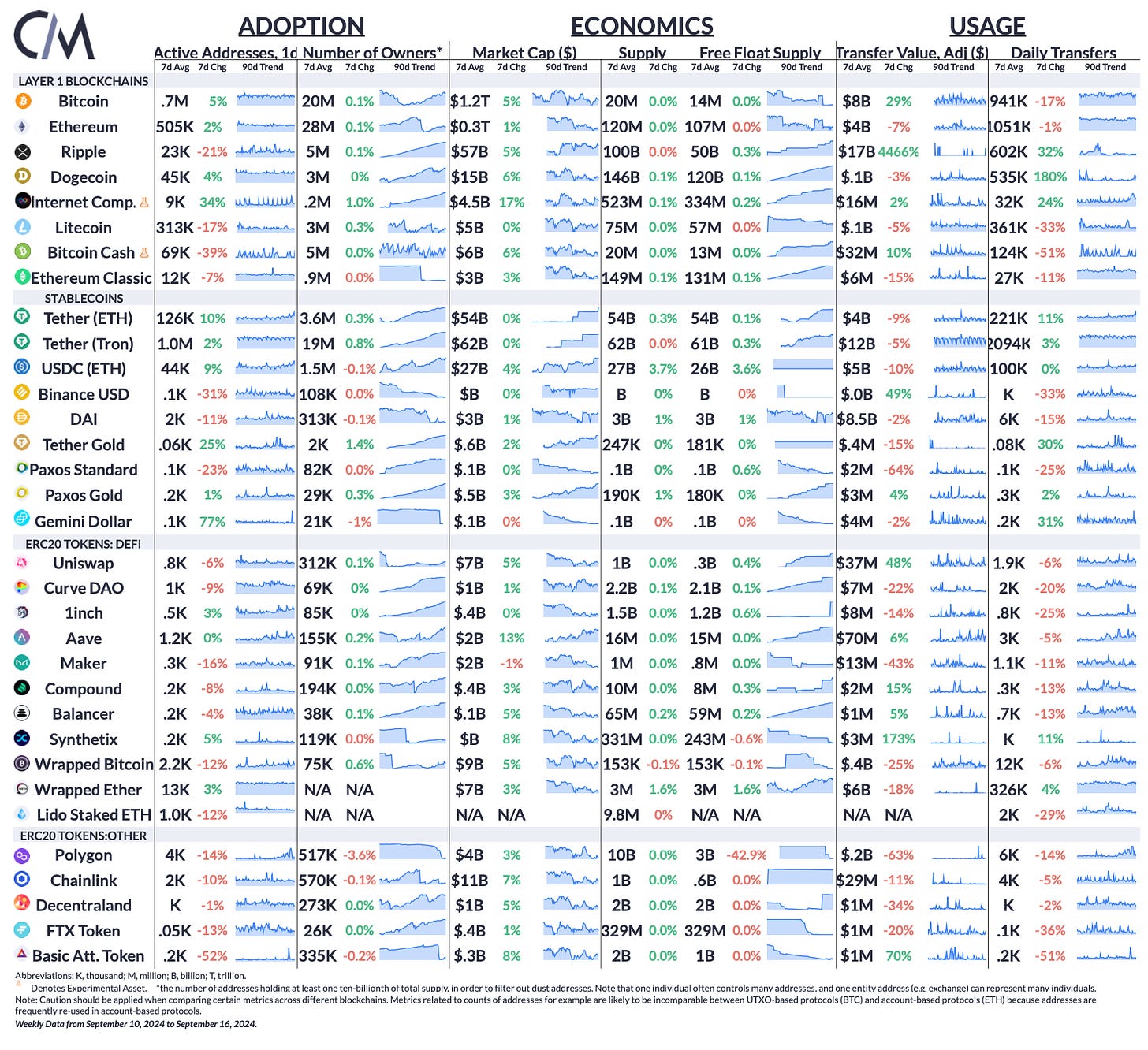

Supply: Coin Metrics Community Information Professional

Day by day energetic addresses elevated by 5% for Bitcoin and a pair of% for Ethereum over the week respectively. Adjusted switch worth (USD) for Ripple surged by 4466%, reaching $17B on the again of an announcement of the Grayscale XRP Belief.

This week’s updates from the Coin Metrics group:

Observe Coin Metrics’ State of the Market publication which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed knowledge.

As at all times, when you have any suggestions or requests please tell us right here.

Coin Metrics’ State of the Community, is an unbiased, weekly view of the crypto market knowledgeable by our personal community (on-chain) and market knowledge.

If you would like to get State of the Community in your inbox, please subscribe right here. You’ll be able to see earlier problems with State of the Community right here.