Get one of the best data-driven crypto insights and evaluation each week:

By: Victor Ramirez, Uriel Morone

Key Takeaways:

Buying and selling exercise reached historic ranges throughout and after the election as Bitcoin surged to all-time highs.

Elevated ranges of open curiosity weighted in the direction of name choices at excessive value ranges sign robust bullish sentiment.

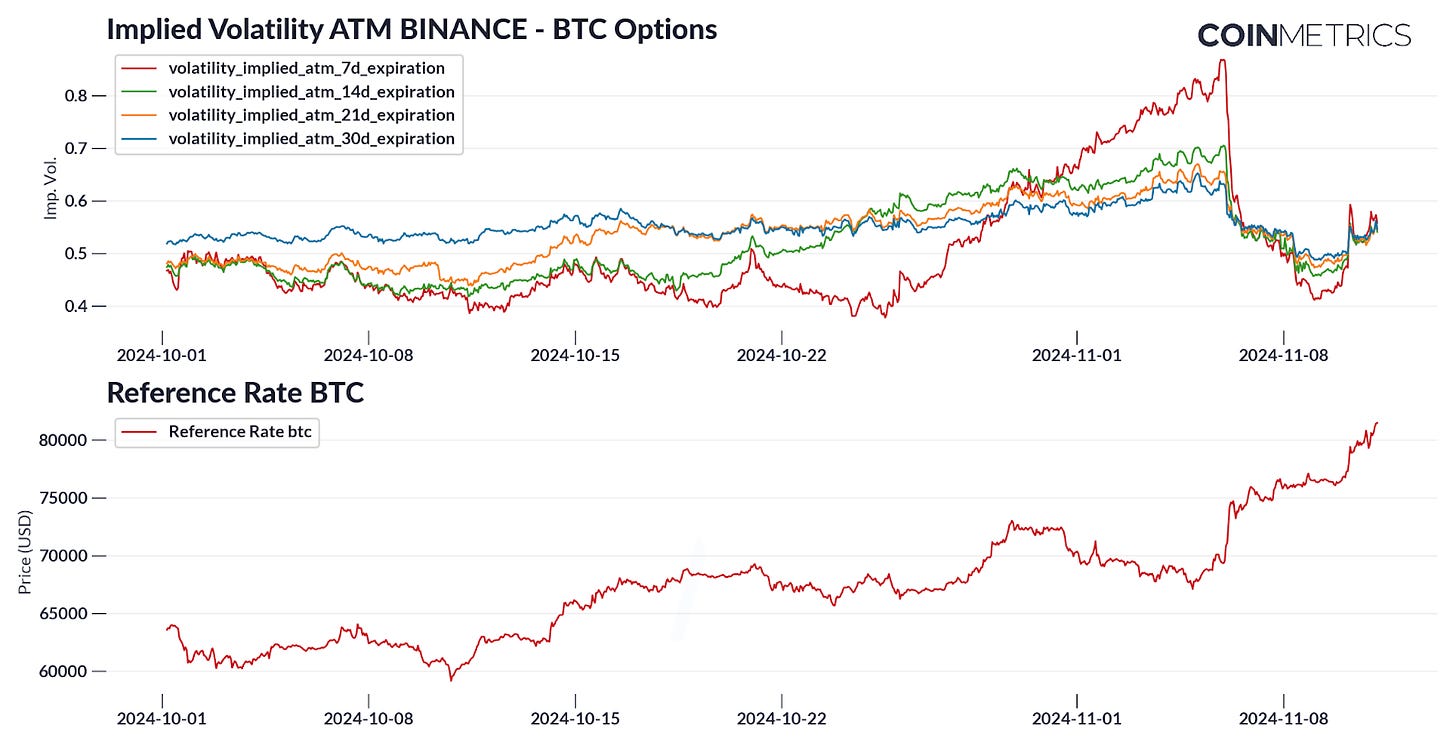

Implied volatility can reveal common sentiments of uncertainty forward of main occasions. IV was excessive heading into the election and sharply dropped after its decision.

The 2024 US Election was a cathartic occasion for the crypto trade. Now two years because the FTX collapse, the trade has been focused with intense scrutiny from monetary regulators choking off entry to banking for crypto companies to regulatory companies partaking in lawsuits that value the trade practically half a billion {dollars} to date to litigate. Dubbed the primary “crypto election,” the 2024 cycle featured the primary crypto foyer deploying greater than $100 million in capital in a number of electoral races within the hopes of paving guidelines of the highway for the trade. Extra candidates—together with the presidential race—have adopted express stances in the direction of crypto than any election earlier than. Market members have lengthy awaited the decision of this election to evaluate the regulatory dangers of doing crypto within the US for 2024 and past.

The hype didn’t disappoint. Bitcoin broke new all-time-highs on the again of historic buying and selling exercise. For the reason that election final week, Bitcoin has gained about $400 billion in market capitalization in its ascent from $67k to virtually $90k on the time of writing. However is that this optimism the beginning of a brand new market regime or only a fleeting euphoria?

On this week’s situation of Coin Metrics’ State of the Community, we’ll break down what went down within the markets across the election. We’ll additionally take a particular look into how choices markets are shaping up amidst a interval of excessive ranges of exercise and uncertainty.

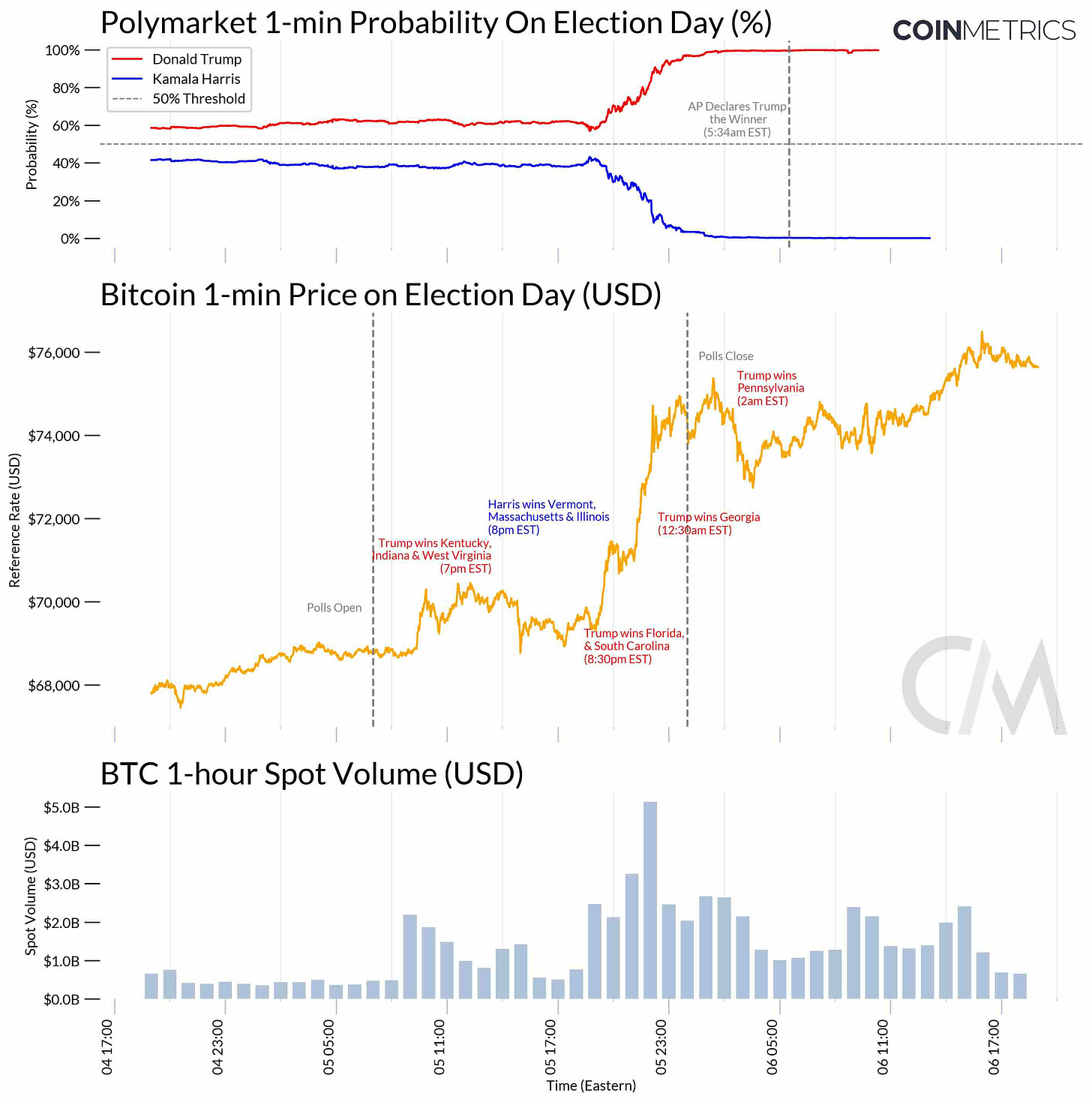

For many of Election Day, markets have been uneven, hovering between $68-70k as little was identified in regards to the consequence of the election. As night dawned, election outcomes began trickling in and a consensus started to type. Polymarket odds shifted for Donald Trump via many of the night time and Bitcoin costs reflexively reacted to real-time info. By the next morning at 5:34am, the Related Press had known as the election for Trump, over 6 hours after Polymarket. Quickly after the election was known as, Bitcoin reached a then-all-time-high of $76,497. The ability of 24/7 markets have been on full show because the election unfolded.

Supply: https://x.com/coinmetrics/standing/1854290564826468601

In a uncommon incidence, volumes spiked significantly throughout US off-market hours, peaking at 10:00pm Japanese Time. For perspective, this was the ninth largest hourly spot quantity and 26th largest hourly reported futures quantity we’ve recorded thus far.

The charts on the underside present how latest buying and selling quantity for Bitcoin compares traditionally. Buying and selling exercise on daily basis because the election has been nothing in need of extraordinary.

Supply: Coin Metrics Market Information Feed

Finding out choices market exercise might help us gauge market sentiment and expectations for future value actions. Choices are advanced derivatives, which can be utilized to get a way of what the market collectively expects when it comes to value actions. Choices are contracts which give the proprietor of a contract the fitting to buy (name) or promote (put) the underlying asset on the expiration date for a given strike value. This implies the choice’s proprietor will make a revenue if the underlying asset’s market value is larger than the strike value on the expiration date if the choice is a name choice, or they may make a revenue if the asset’s market value is decrease than the strike value within the case of a put choice. Every choice contract is outlined by these three parameters: kind (name/put), strike value, and expiration date. For a fast refresher on derivatives, try our Mastering Derivatives piece and our choices market tutorial.

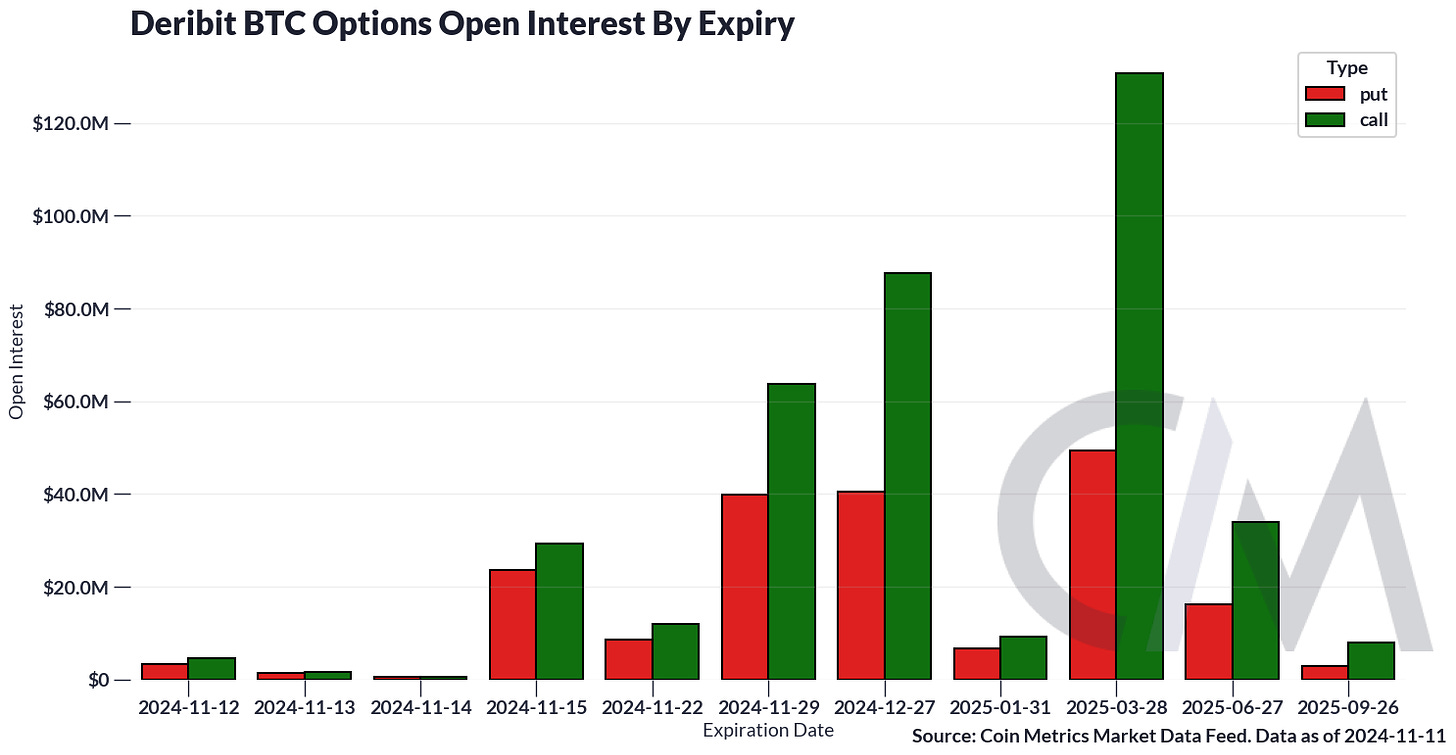

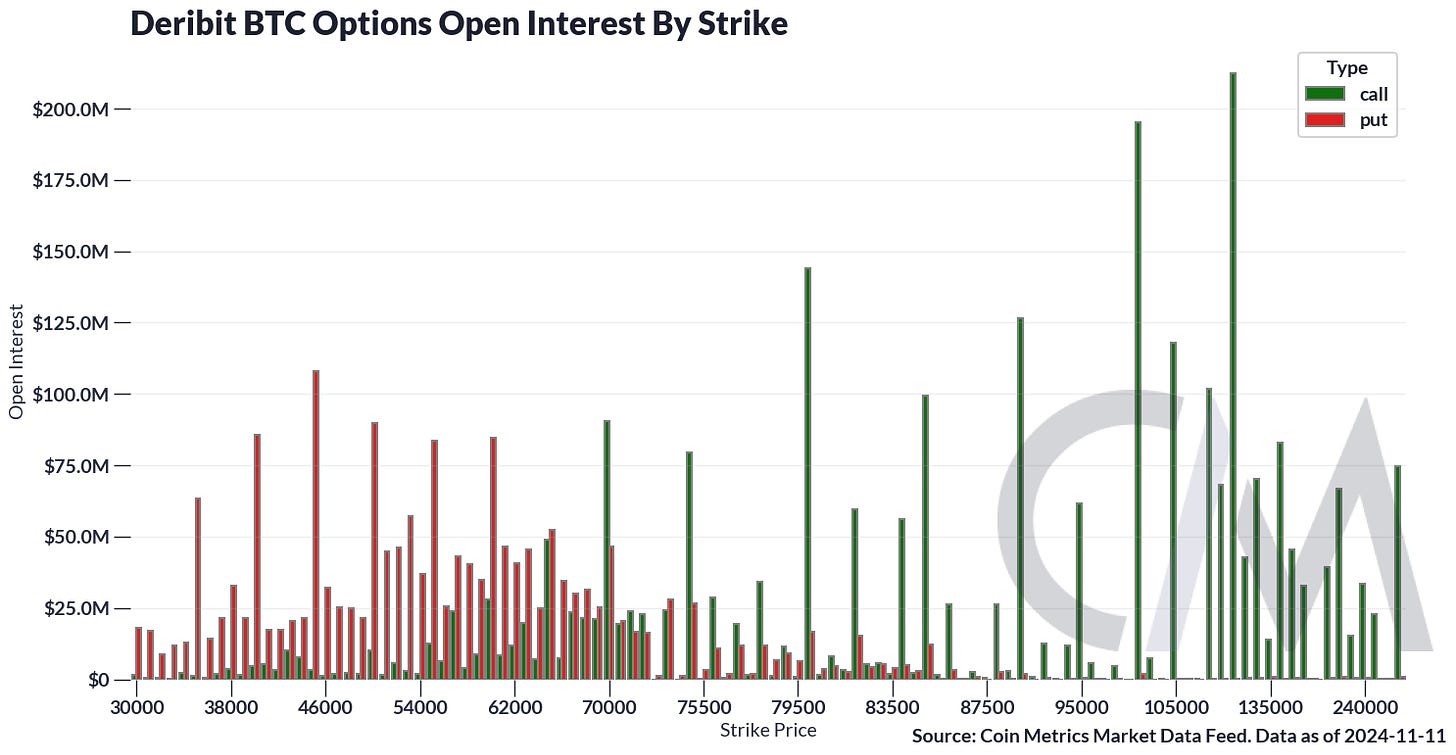

One of many important metrics utilized in choices markets is open curiosity. Open curiosity, or the variety of excellent derivatives contracts, is a measure of market liquidity and sentiment. When each open curiosity and value are rising, extra merchants are coming into the market and signaling a powerful conviction in regards to the value motion of the market.

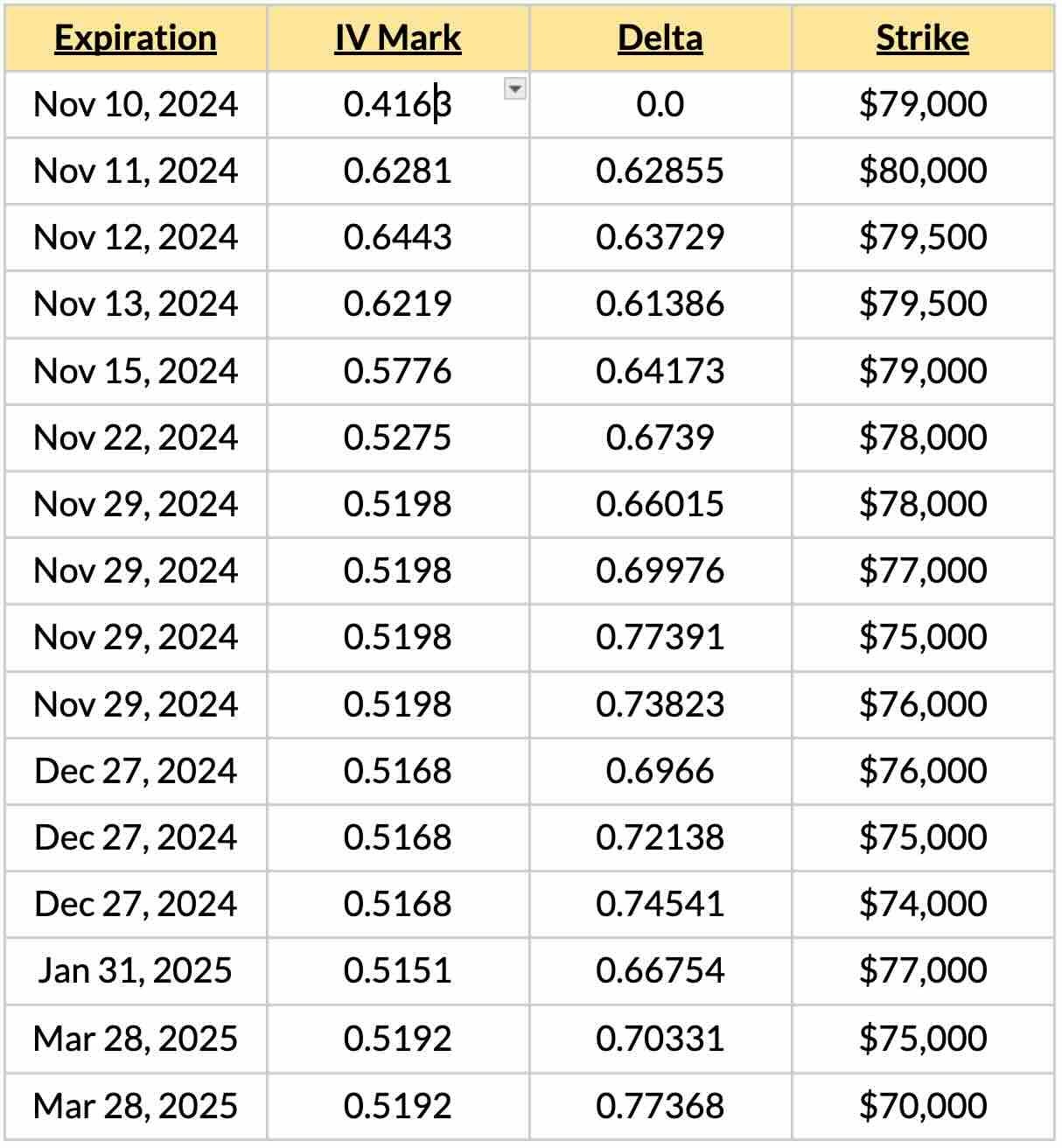

The charts beneath present a breakdown of choices market open curiosity by contract kind.

Supply: Coin Metrics Market Information Feed

Choices open curiosity is skewed to have extra name choices than put choices for contracts expiring from November 2024 and displaying vital open curiosity on the $90-120k value degree. This means that choices merchants consider that bitcoin is prone to improve to that degree within the medium time period and are positioning themselves to make the most of potential value appreciation.

Supply: Coin Metrics Market Information Feed

Along with a contract’s market value, choices merchants examine its implied volatility (IV). Implied volatility is the % of the present market value equal to 1 normal deviation within the value one 12 months from now. IV is beneficial as a result of along with being mappable to the contract’s value, it incorporates statistical details about the asset’s actions. If the open curiosity is the market’s expectation of the vacation spot, volatility can inform us how we might get there.

The worth of the choice is inherently probabilistic, that means it’s based mostly on the chance the asset value will transfer by a certain quantity in a sure time. Thus, it may be represented by a statistical parameter that captures the chance of this value motion. Merchants will usually assume a sure mannequin the place the likelihood of the asset’s future value is dependent upon its volatility (along with the kind, strike, and time till expiration). The IV is that this variance of the asset’s potential value which is implied by the value the choice is buying and selling for on the present market.

For instance an IV=0.5 implies roughly a 68% chance the value in 1 12 months can be between 50–150% of at present’s value. The larger the IV, the larger uncertainty there may be in regards to the value of the underlying asset. Decrease IV values translate to larger confidence that the asset value can be close to the strike come the expiration date.

Implied Volatility of Bitcoin Choices Approaching and Continuing the U.S. Election

Markets exhibited excessive ranges of short-term volatility main up the election. We will think about the IV of “short-term”[1] choices expiring 1, 2, 3, and seven days sooner or later, together with “medium-term” choices expiring 7, 14, 21, and 30 days sooner or later.

Supply: Coin Metrics Market Information Feed

We see clearly the influence of the election in a couple of other ways. First, the 1-day expiration choice’s IV began to extend quickly a couple of day and a half earlier than the election was resolved on November 6th at 1:00am. The 7d IV began ramping up on Nov. 25th, the 14d IV on Nov. 19th, and the 21d IV on Nov. 12th. In every case the IV will increase dramatically when the hypothetical expiration date of the choices approaches the election day.

This isn’t stunning if we think about what the IV represents: the quantity of volatility or uncertainty within the BTC value. It stands to purpose that the market expects a a lot wider vary of potential costs after a serious occasion. This vary of potential outcomes is precisely what’s represented by the IV, and what’s going to decide the value of the choice contracts.

The influence of the election is much more apparent in each the drop and the consolidation of IV throughout all expiration dates instantly following Nov. 6th. The general drop displays a dramatic lower in uncertainty. Equally, the consolidation of the IV exhibits that the distinction between an choice that expires in 1 week and versus in 2 weeks, with out an apparent catalyst, is much less dramatic.

Put up-election we noticed a sudden bull run round Nov. 10th. The IV jumps throughout this era, because it tends to do throughout vital value actions. Nevertheless, it’s also attention-grabbing to notice the interval from Nov. 9–10th when—after falling because the election—the IV started creeping up once more. That is notable as a result of the value remained flat on this interval. It seems the market started to get a way that massive strikes have been coming, regardless of the buying and selling being sideways for a number of extra hours.

[1] In an effort to correctly outline “short-term” choices, we should standardize the IV throughout time and value. As a result of the IV is a perform of the time remaining till expiration, we’d be interested by evaluating a hard and fast time till expiration choice over time, say choices expiring in 7 days. Nevertheless, if an change publishes choices contracts expiring each Sunday, for instance, we don’t all the time have a 7-day window to think about. On Monday the contract will expire in 6 days, on Tuesday in 5 days, and so forth. Equally, the strike value issues primarily in relation to the present market value of the asset, not absolutely the greenback quantity. If BTC was at $60,000 yesterday and $63,000 at present, an choice with a strike value of $60,000 will imply one thing very totally different than it did yesterday; it might be extra correct to match at present’s strike value of $63,000 to yesterday’s $60,000 choice.

We cope with this normalization downside through the use of Coin Metrics’ Implied Volatility ATM Fastened Time period metrics. These metrics interpolate between real-world choices to estimate the IV of an At-the-Cash (ATM) choice with a hard and fast time till expiration. ATM means the metric is derived from the IV of whichever choice has a strike closest to the market value on the calculation time. Fastened-Time period signifies that each time a price is calculated it considers a goal expiration a hard and fast variety of days forward, and calculates a weighted common of IV of the choices expiring closest to the goal date earlier than and after. This permits us to match the IV on choices over time in an apples-to-apples means.

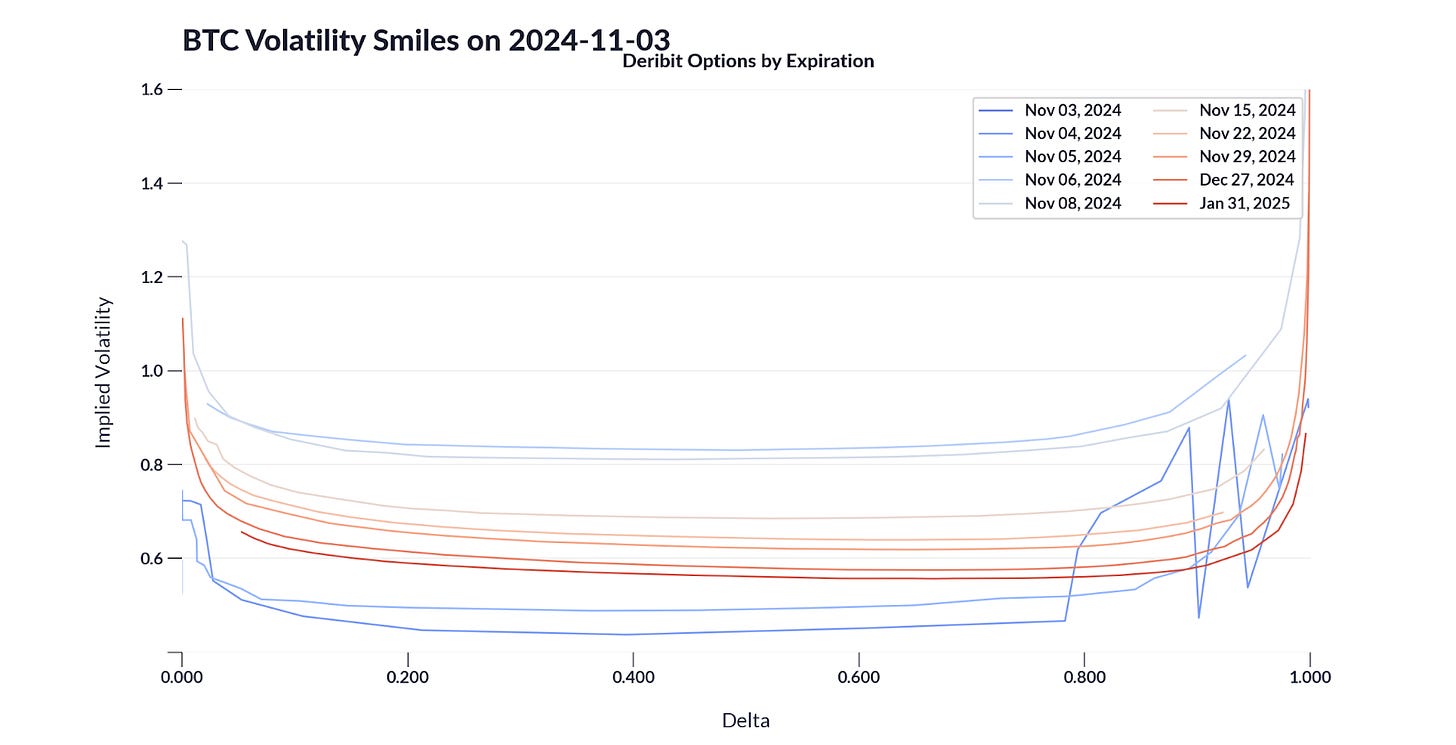

The curve beneath is known as the IV Smile, as a result of IV tends to extend for strike costs removed from the cash (i.e., asset’s market value). Nevertheless, the asymmetry or skew on this curve can present market sentiment in regards to the expectation of a rise vs lower in value.

Though we will plot IV vs the Strike Worth, it can provide a clearer image to take a look at the IV vs. delta of various choices. Just like the fixed-term choices above, taking a look at delta on this means helps management for a way far sooner or later the expiration date is. Delta is a “greek,” or derived worth of the Black-Scholes choice pricing mannequin, which particularly says how a lot the choice’s value adjustments relative to the underlying asset’s change in value. Delta could be seen as a means of wanting on the strike value after controlling for the asset’s market value and the way far sooner or later the choice will expire. For name choices a delta of 0.5 is normally at-the-money (strike = asset’s present value), a delta larger than 0.5 usually has a strike lower than the asset value (ITM), and a delta lower than 0.5 usually has a strike larger than the asset value (OOTM).

Earlier than Election (2024-10-03):

Supply: Coin Metrics Market Information Feed

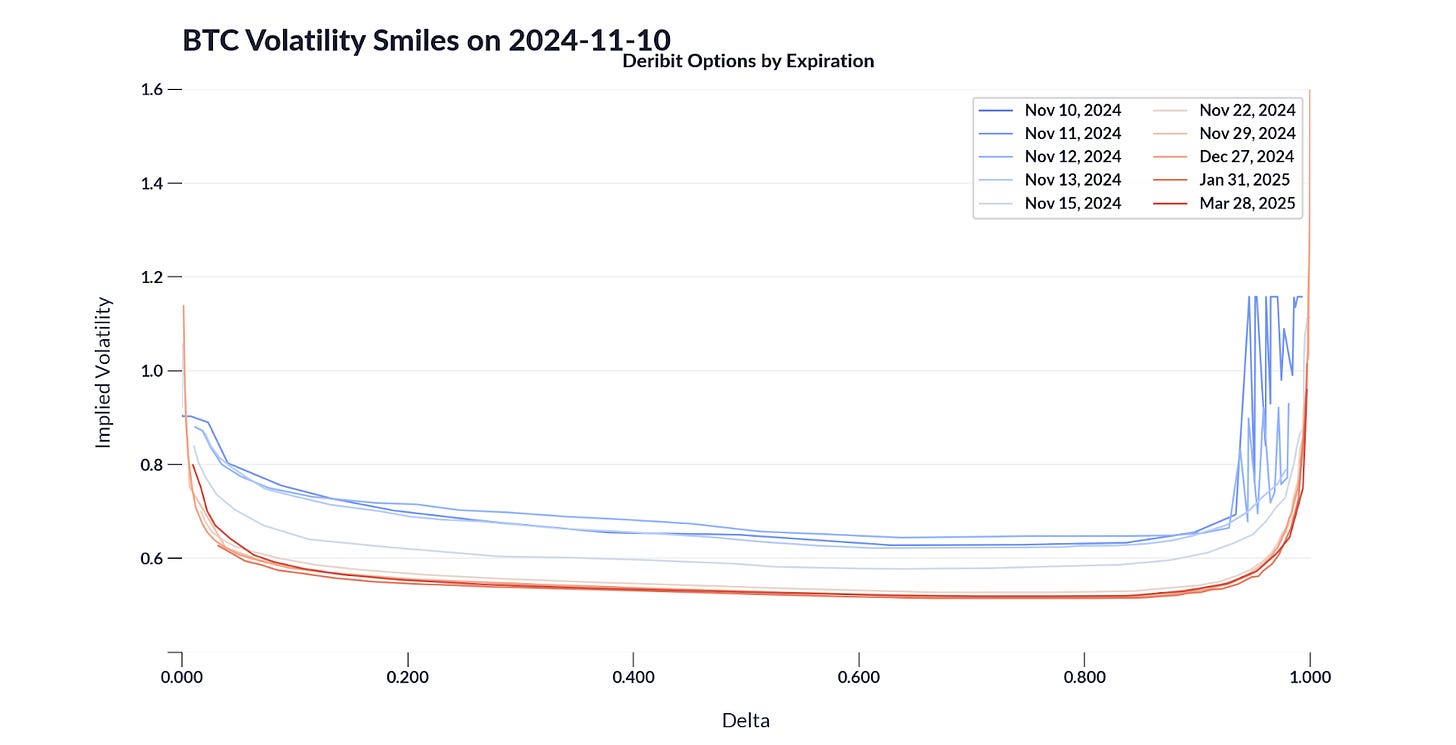

After Election (2024-10-10):

Supply: Coin Metrics Market Information Feed

Initially, we see a notable sample within the pre-election choices, the place the bottom implied volatilities (darkish blue) have been held by choices expiring earlier than the election, the second lowest by choices expiring after sooner or later (darkish purple), and the biggest volatility was in choices expiring shortly after the election. It’s attention-grabbing to watch that the market expects the value influence in the long run to considerably steadiness out, nonetheless the interval instantly following the election has the best uncertainty.

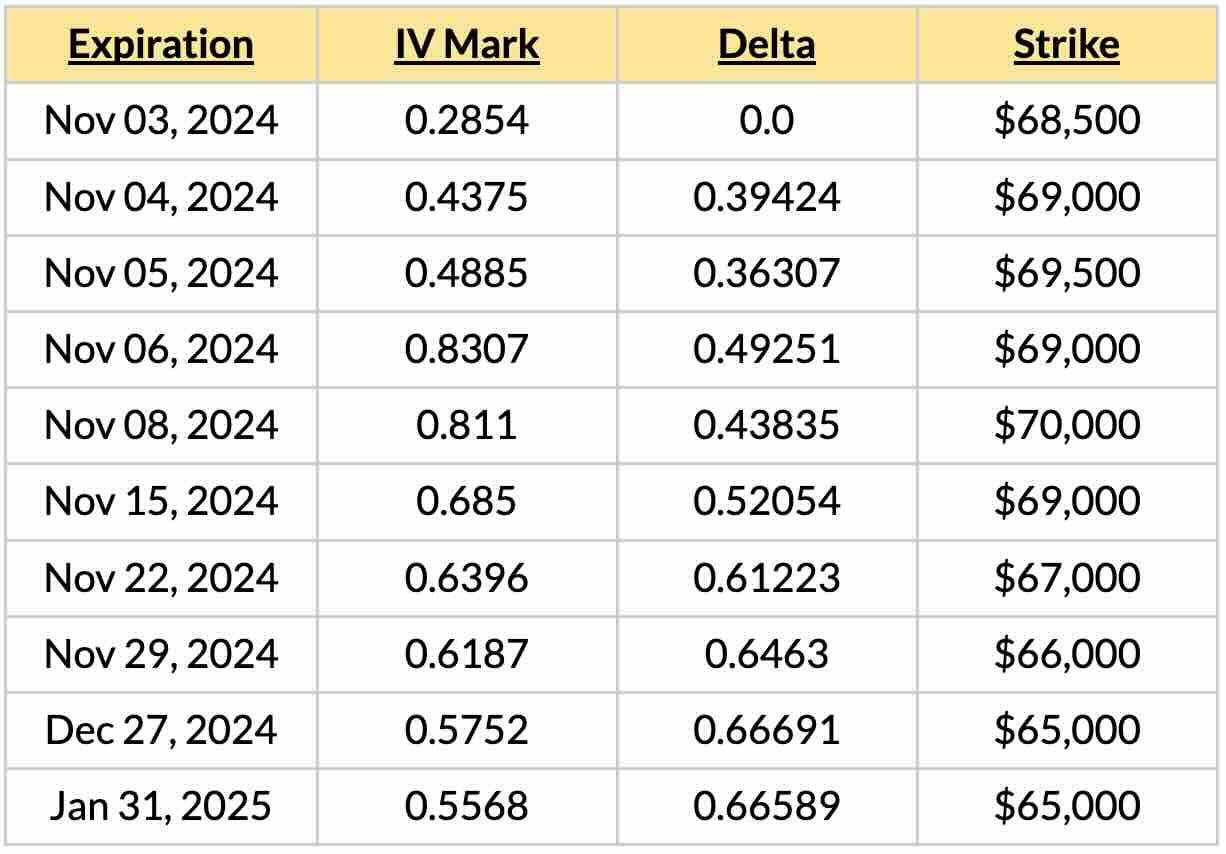

The ultimate notice is troublesome to watch instantly within the graph, however utilizing the info factors we will determine which delta/strike represents the minimal of IV in for every expiration. The minimal IV is attention-grabbing, as a result of we will say the market expects this value to be the “probably”. This can be a crude assertion as a result of a number of elements will affect the IV, not least provide and demand from merchants hedging different positions that aren’t identified. Nevertheless, we will say holistically the market is pricing choices as if there may be the smallest uncertainty round this mixture of value & expiration date. We’ll shortly notice that the IV is relatively flat, so “probably” additionally does not imply “far and away probably the most possible.”

The minimal IV values beneath have been taken from the curves on Nov 3rd:

We see that the choices expiring earlier than the election with probably the most stability have deltas lower than 0.5. In different phrases, strike costs larger than the present market value of bitcoin. In the meantime, the choices expiring on the election (Nov. 6th) have a minimal IV when delta is nearly precisely equal to 0.5, which could be seen as additional affirmation this timeframe is the one driving Bitcoin asset’s market value. Lastly, the choices expiring sooner or later had a lowest IV at a a lot bigger worth of delta, which can have been a sign the BTC value was anticipated to drop post-election.

If we take a look at the more moderen curves on Nov. 10th we see a unique sample within the minima:

Notice that some expirations have a number of minima, as a consequence of how flat the IV curve is. Now that the election has resolved, the IV throughout strikes are way more constant. All of the expiration dates have a minimal larger than 0.5, largely clustered round 0.7. Once more we see the market expects the least volatility at costs decrease than the present market value (on the time). In actual fact, as we go additional into the long run we see that the minima of the IV shifts steadily to larger delta/decrease strike value. Though we reiterate IV is sort of shut at totally different strike costs.

Amidst durations of excessive uncertainty, learning choices markets can uncover how the market is weighing the chance of every consequence. With the US election lastly within the rearview mirror, markets have responded with explosive optimism over the previous week. In some ways, the latest market actions mirror the market pricing within the chance for a good regulatory setting for the US crypto trade within the foreseeable future.

No matter who’s in command of any authorities on the planet, blockchains stay a globally accessible, credibly impartial, and permissionless platform that anybody can use. Time will inform whether or not the market’s exuberance is simply an irrational post-election honeymoon or the start of a brand new paradigm. But when the vibes now are certainly proper, we may even see greener pastures forward for our fledgling trade.

This week’s updates from the Coin Metrics workforce:

Observe Coin Metrics’ State of the Market e-newsletter which contextualizes the week’s crypto market actions with concise commentary, wealthy visuals, and well timed information.